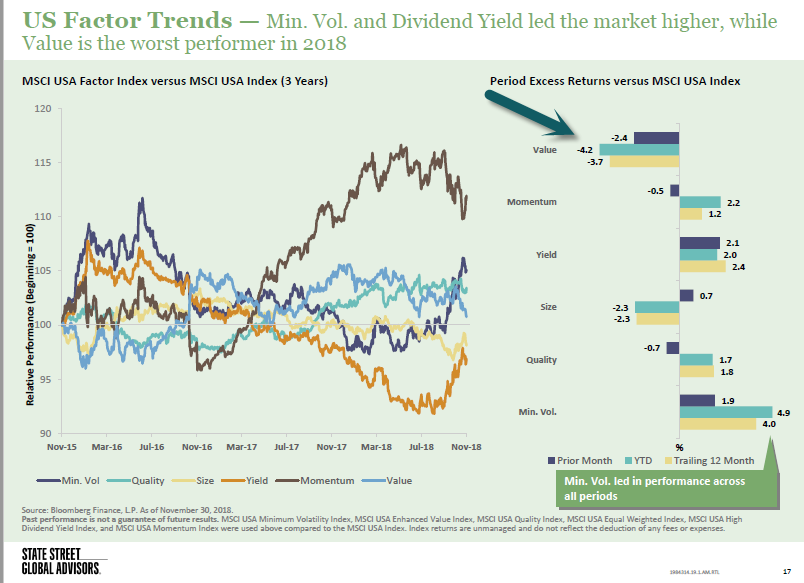

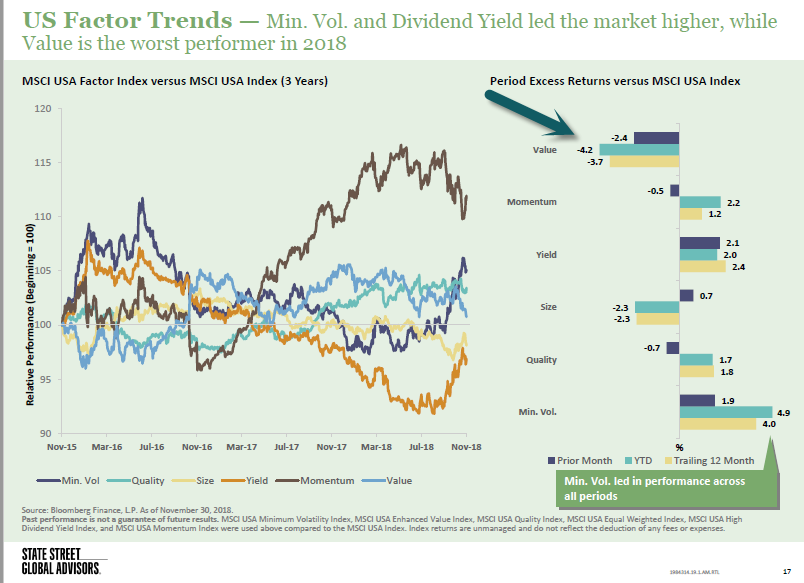

1.Factor Trends…Value Worst Performer in 2018.

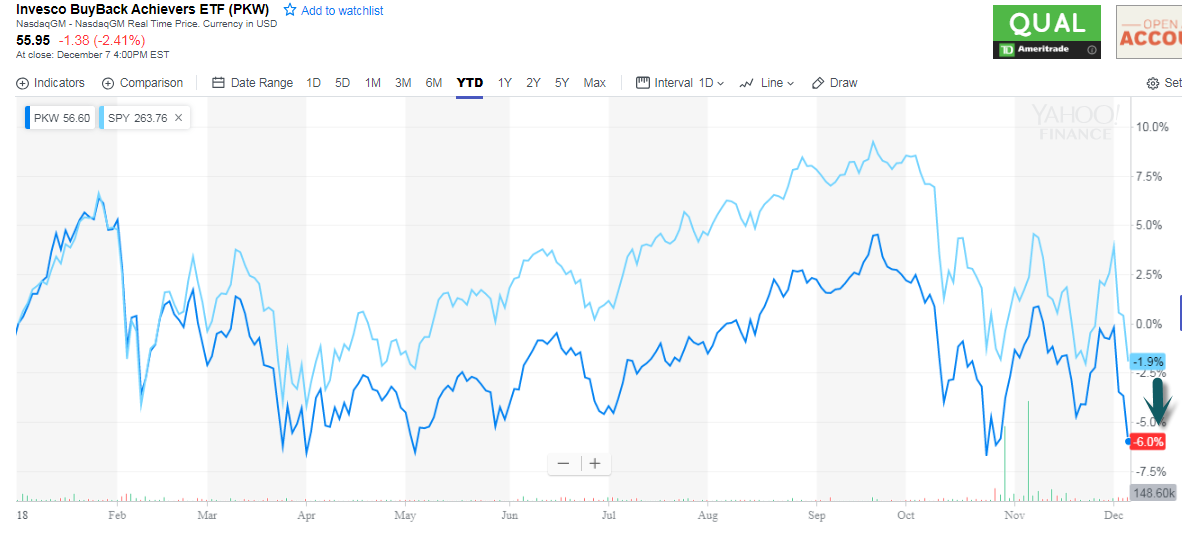

After Trailing Growth This Entire Bull Market…Value Dead Last Again This Year.

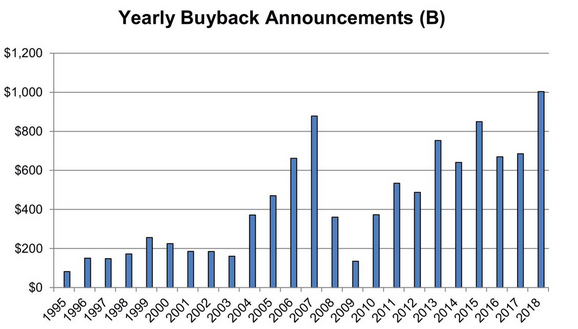

Buybacks certainly helped in the afternoon – With today’s buyback announcements, value announced so far this year now above $1 trillion, highest yearly figure ever … even backing out Apple’s $100 billion announcement this year, 2018 is still the highest on record

From Dave Lutz at Jones Trading.