1. The Percentage of S&P 500 Stocks Trading Above 200-day Moving Average

The Daily Shot Brief Equities: This chart shows the percentage of S&P 500 stocks that are above their 200-day moving average.

Source: barchart.com

2. IWM Small Cap Russell 2000 …50day thru 200day to Upside

Bullish cross in early July for small cap stocks.

©1999-2023 StockCharts.com All Rights Reserved

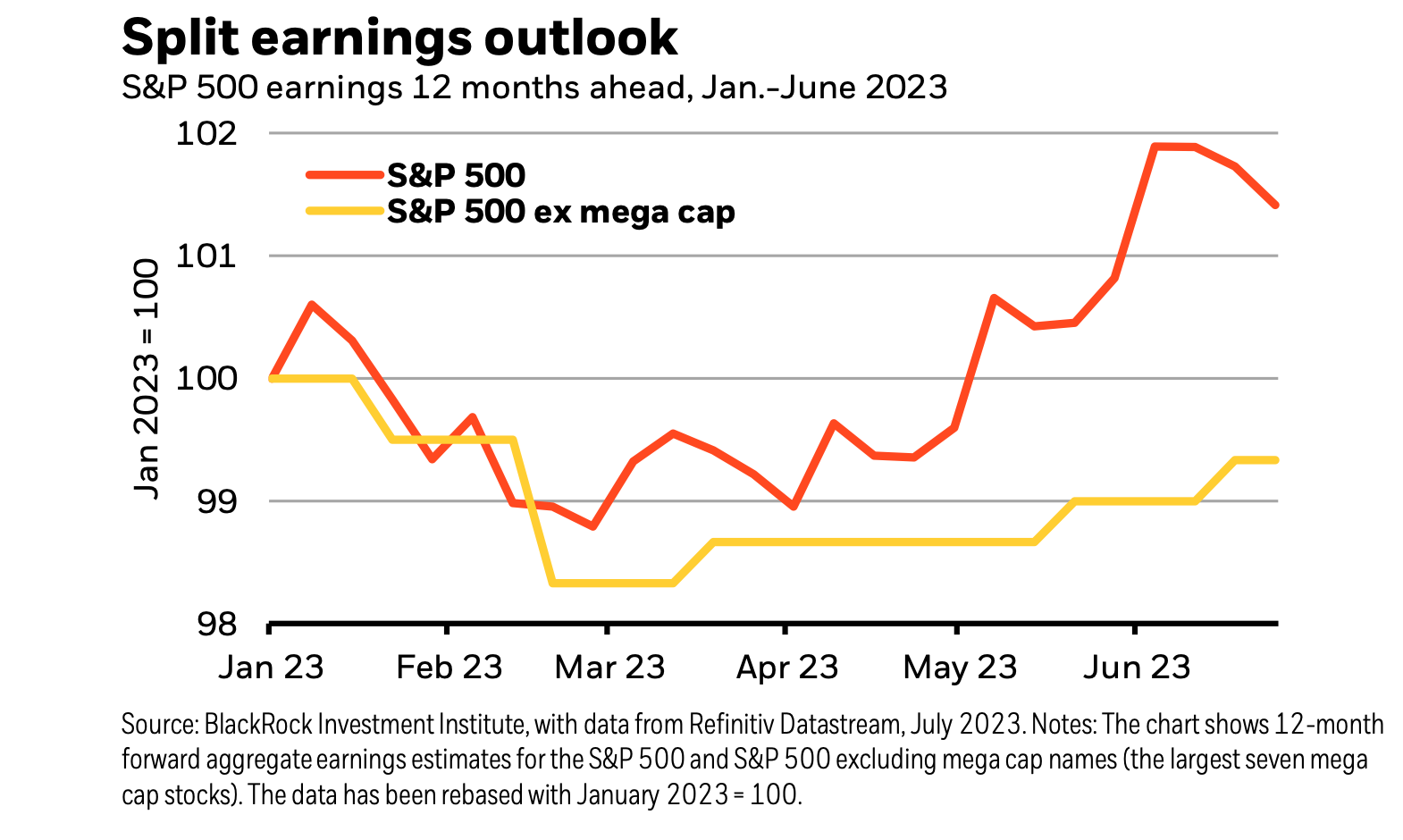

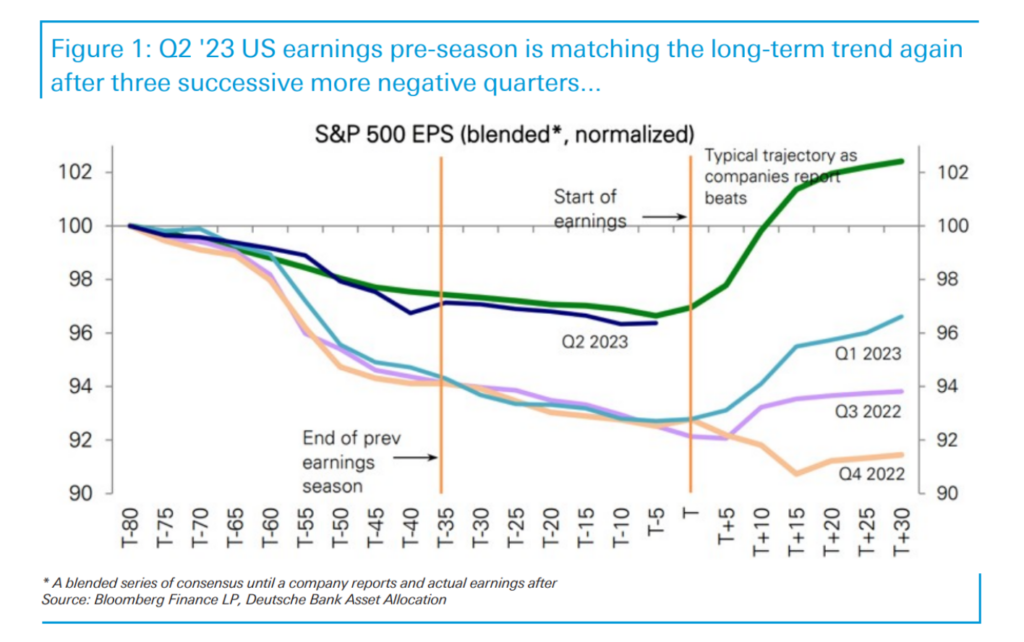

3. Earnings Season Normalizing

Jim Reid Deutsche Bank

4. FANG + Index Blows Thru All-Time Highs

©1999-2023 StockCharts.com All Rights Reserved

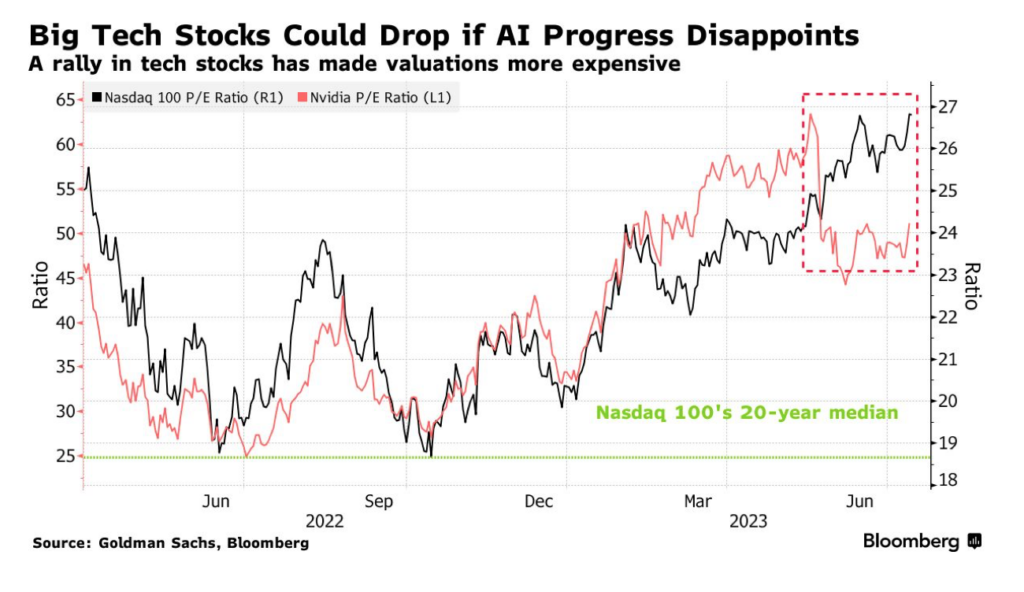

5. Earnings Season Will Be Key to Maintaining High Valuations….QQQ 27x

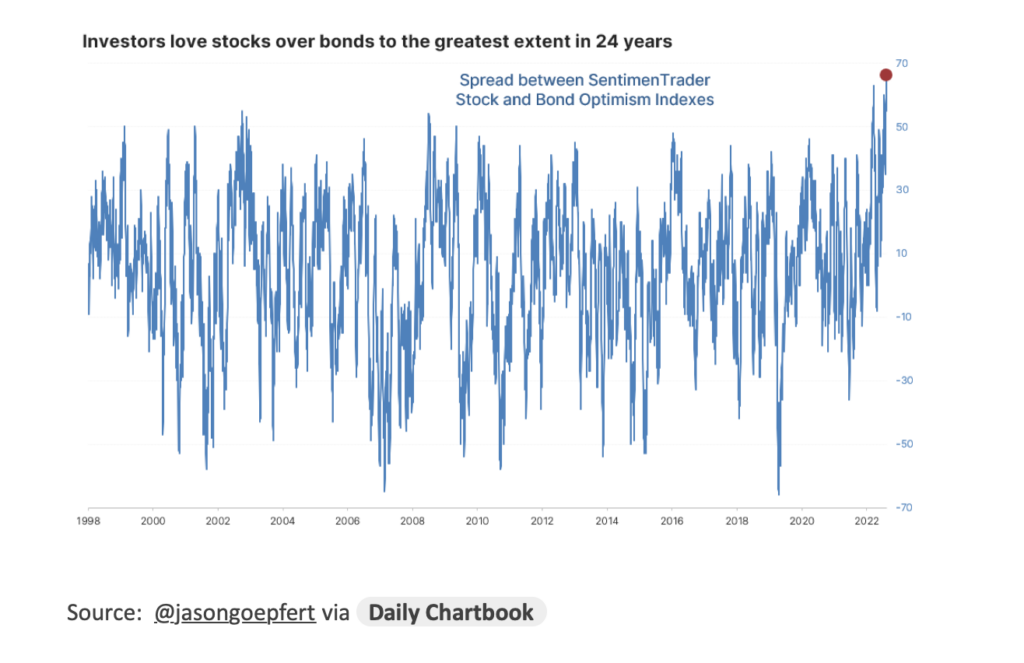

6. Investors Love Stocks Over Bonds to the Greatest Extent in 24 Years

From Callum Thomas Chart Storm.

https://www.topdowncharts.com/blog

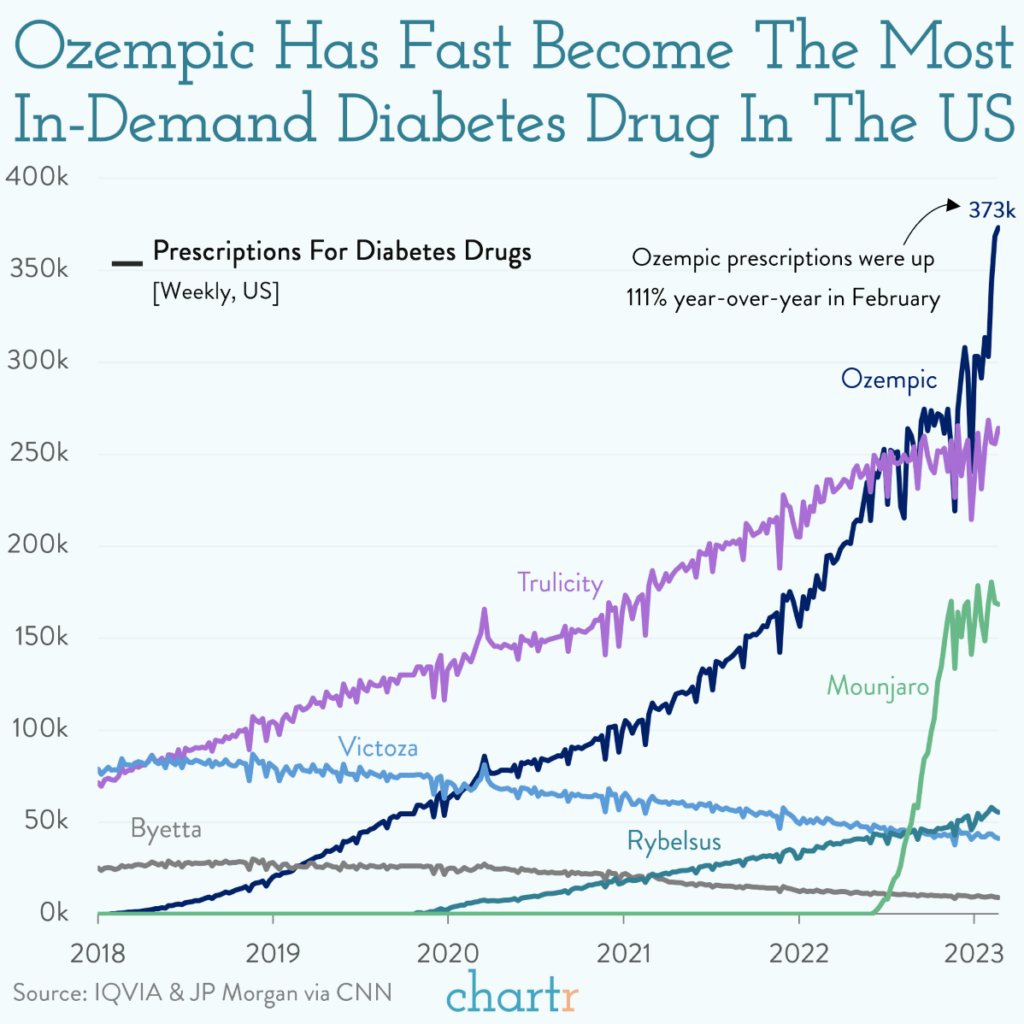

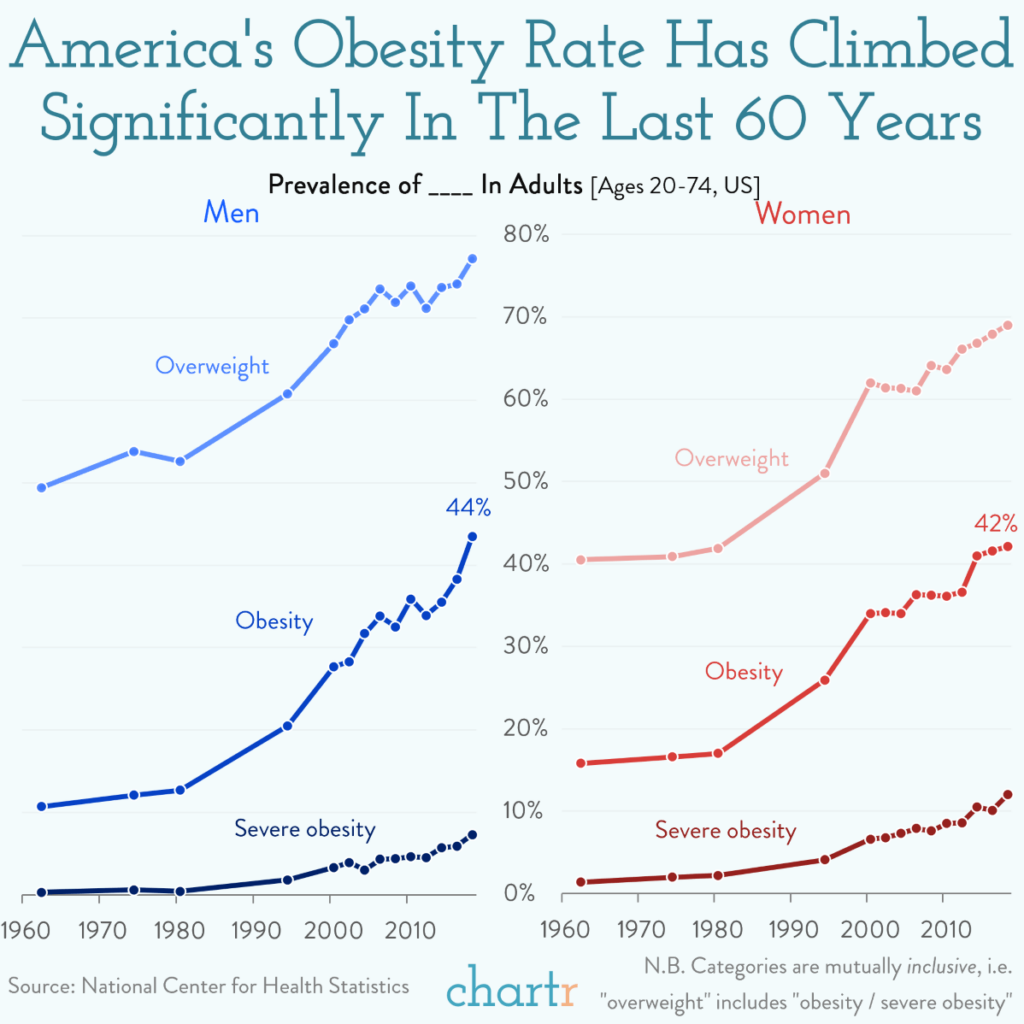

7. Qzempic Sales +110% in February

Chartr.com Scaling up Prescriptions for Ozempic, which is still technically only approved as a treatment for type 2 diabetes, have soared in recent years as word continues to spread about the drug and its reported pound-shifting properties. Indeed, at the start of 2018, US Ozempic prescriptions weren’t even breaking the 100 mark — by 2020, there were over 100,000 a week. That figure has risen even higher since, making it the most prescribed diabetes drug in America by some distance, with doctors increasingly prescribing Ozempic “off-label” — that is for a different purpose from what the medication is explicitly intended for.

And Ozempic isn’t the only diabetes drug that’s seen a surge in demand. Novo-produced Rybelsushas also soared, as has Mounjaro, which is one of the fastest-rising diabetes treatments, and being tipped by some doctors as the most powerful on the market in terms of weight loss credentials. Developers Eli Lillyare looking to get FDA approval of the drug for that purpose by the end of 2023.

8. JP Morgan 15% from Previous Highs After Record Revenues

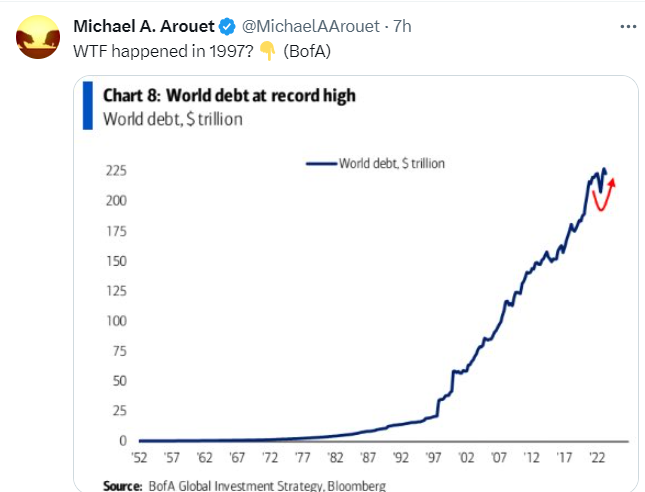

9. Government Spent $1 Trillion Since Lifting Debt Ceiling

An Insult to Drunken Sailors

It’s been a little over a month since the “Debt Ceiling” was suspended. What has transpired since? A borrowing binge for the ages, with National Debt increasing by over $1 trillion.

To say that the government is spending money like a “drunken sailor” would be an insult to drunken sailors who at least a) were spending their own money and b) quit when they ran out of funds.

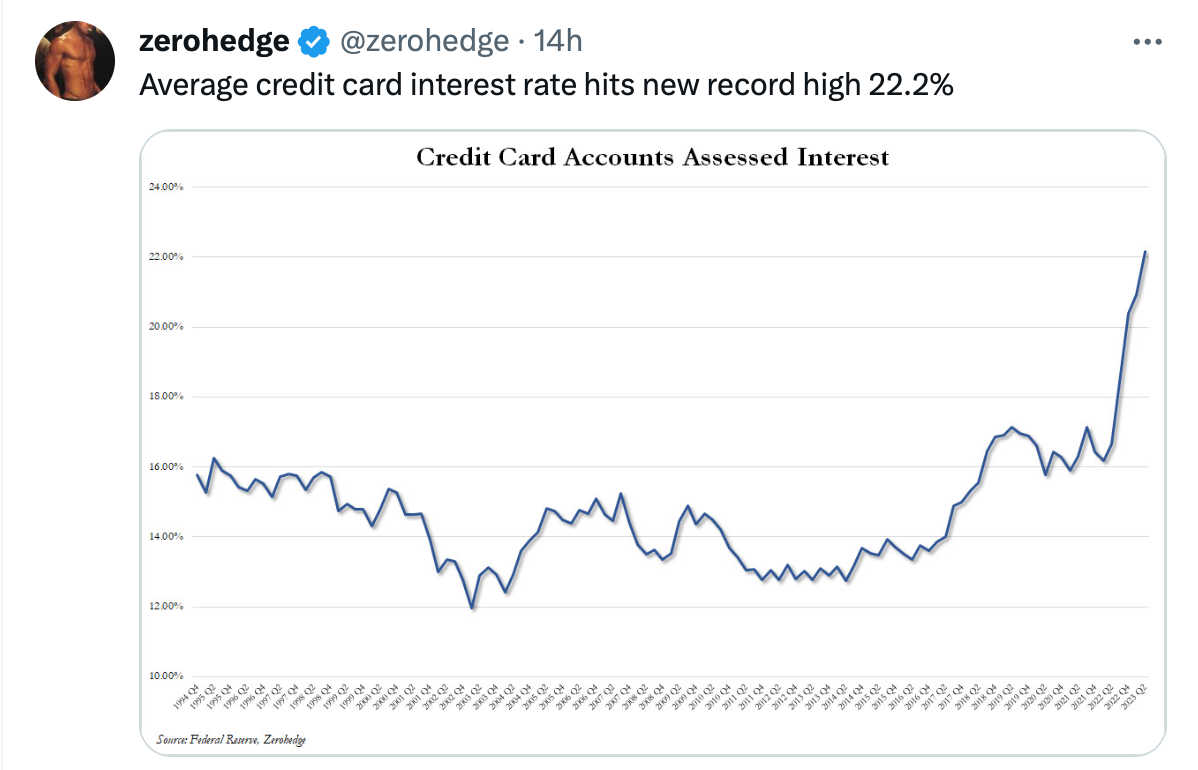

Not so for the US government, which continues to borrow from the future to spend more money today. In June, federal budget deficit rose to $2.25 trillion, its highest level since 17 months.

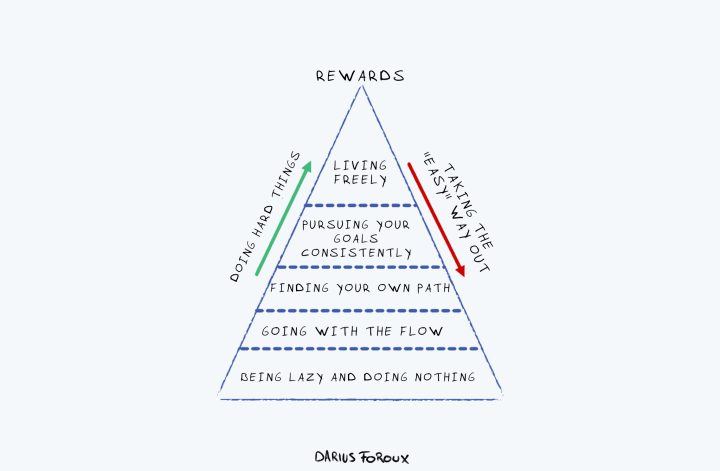

10. Do Hard Things if You Want an Easy Life-Darius Foroux

The other day my mom told me about a family member who had a flat tire on her bike. This relative doesn’t live an easy life.

She had a doctor’s appointment and when she pulled out her bike to go there, she discovered the flat. She doesn’t have a car. So she ended up walking to the doctor’s office. To make it worse, it also started to rain after a few minutes into her walk.

She barely made it. I thought, “Man, I’m lucky. I have an easy life.” But then I also thought, “I did a lot of hard things to get here.”

I remember the days of not having much. When I was 17, I had a full-time job during the entire summer at a call center. One day I was cycling to work and a massive downpour started about halfway through.

If I stopped to get shelter from the rain, I would’ve been late. I also couldn’t return to get the bus. I had to keep cycling.

Man, I still remember how I felt when I showed up at work, completely SOAKED in water, from my socks to my underwear. I sat down, at 9 AM and started making my calls.

During my breaks, I went to the bathroom and tried to dry my clothes piece by piece with the electric hand dryer. That whole day I sat in my chair with wet clothes, cursing at everything in my mind.

I was livid. I didn’t want a hard life like that.

A hard life versus doing hard things

Looking back, I’m grateful for experiences like that when I was in my teens and early twenties. It taught me that a hard life can be like a black hole that you can’t get out from.

My luck was that after the summer, I went to college. My parents, who never went to college, forced me to study. I really wanted to keep working because I thought that having my own money would make my life easy.

They knew better. Having a salary and nothing else is the road to a hard life. The path to an easier life is to get educated.

- Getting educated is hard.

- Learning new skills is hard.

- Exercising regularly is hard.

- Eating healthy is hard.

- Sleeping at the same time every day is hard.

- Seeing your friends having fun and going out is hard.

But the truth is that these things are only hard during the moment. Because what’s the alternative? I bet you have family members or friends who also have hard lives. What makes your life hard?

- A dead-end job.

- Bad health.

- No free time.

- Feeling caged by responsibilities.

Ultimately, it’s a lack of freedom that makes a hard life. To obtain freedom, we must do the “other” hard things.

We must sweat, study, focus, sacrifice, and strive for betterment every single day. And yes, that will always stay hard.

The real prize: An easy life

I had such a limited life that I wanted to do whatever it took to get an abundant life. This is why I never shied away from doing hard things.

Now that I have the freedom to do work I like and live my life on my terms, I feel my life is easy compared to the past.

As Theodore Roosevelt once said:

”Nothing worth having comes easy.”

Remember this as you go through life. If you run into challenges and think it’s too hard, remember why you do what you do.

You might be doing hard things, but you do it because you don’t want to have a hard life.

Having the freedom to do what you want and being comfortable doesn’t come easy. We must work hard for that privilege every single day. And we will never reach an end state where our lives will always be easy.

It’s something we keep working for. Day in and day out. But it’s all worth it.