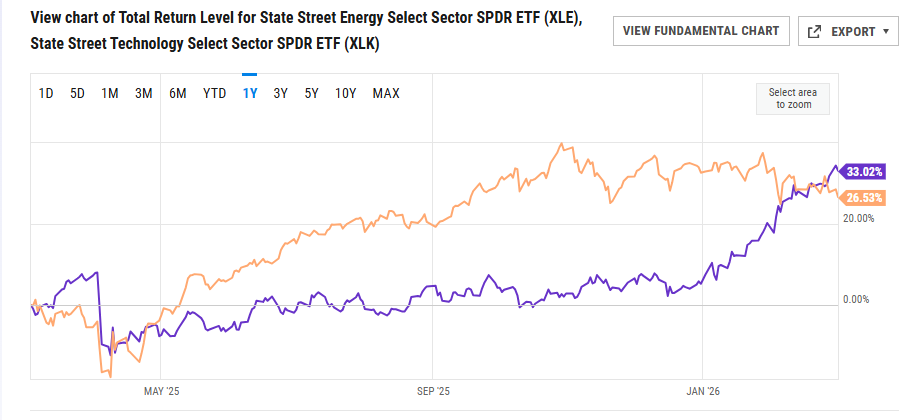

1. Energy ETF XLE Beating XLK Tech ETF on One-Year Basis

Ycharts

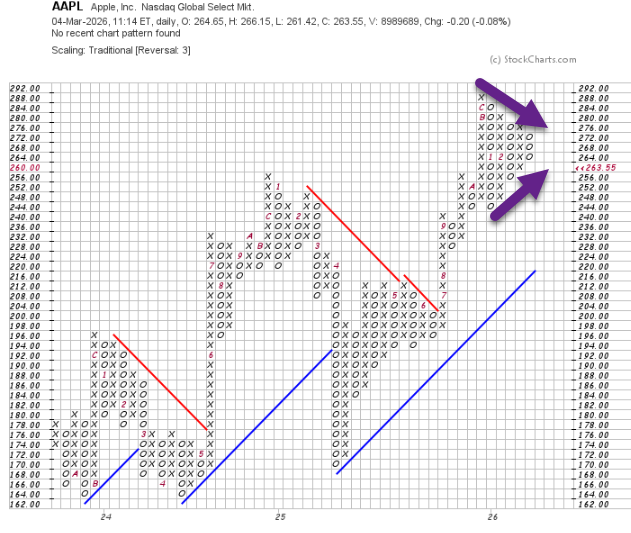

2. AAPL Triangle Pattern on Chart -Important for Tech/Mag 7 to Break Higher.

3. VHT Vanguard Healthcare ETF Breaks Out of Long Sideways Pattern-4 Years.

StockCharts

4. XLE Energy ETF Same Pattern…Breakout of 4-Years Sideways.

StockCharts

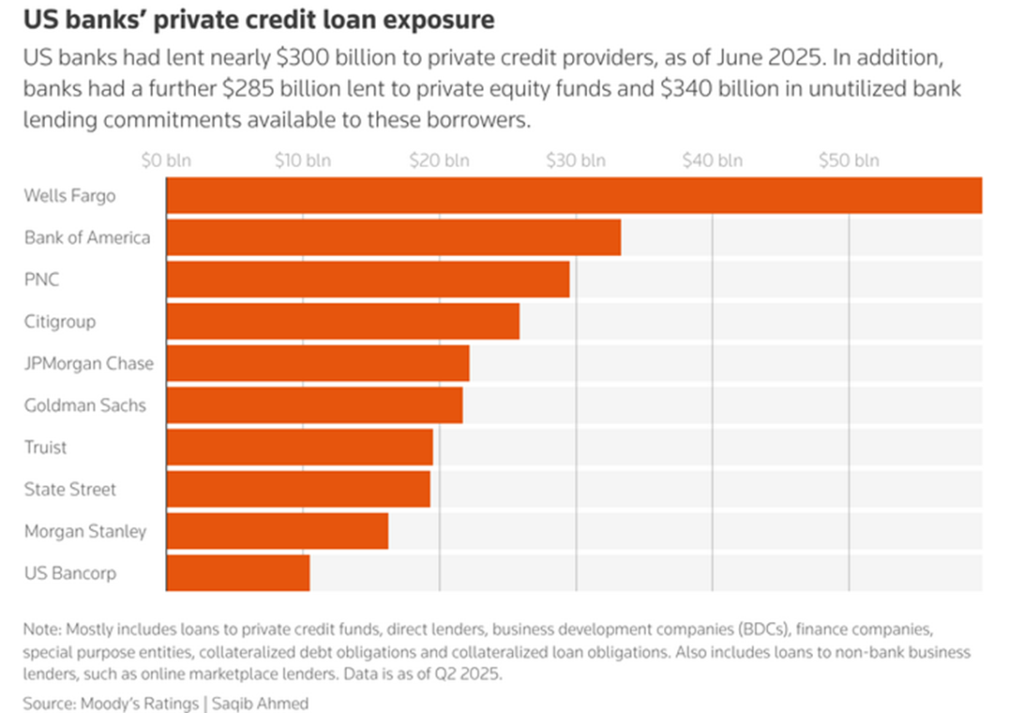

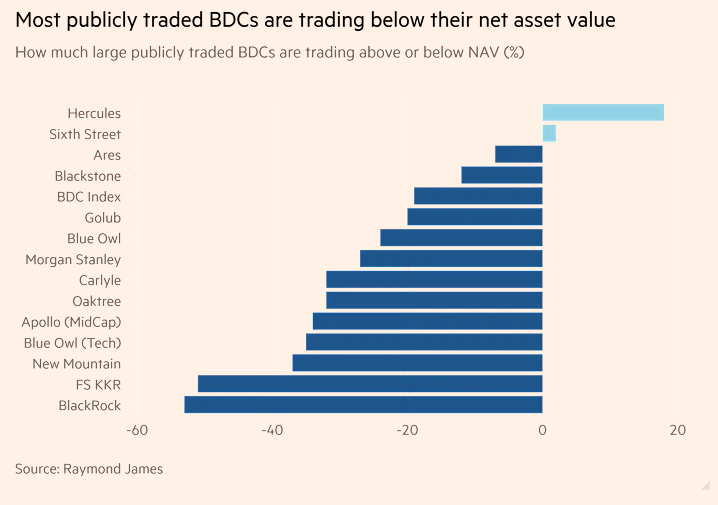

5. Most Publicly Traded BDCs are Trading Below their Net Asset Value.

Financial Times

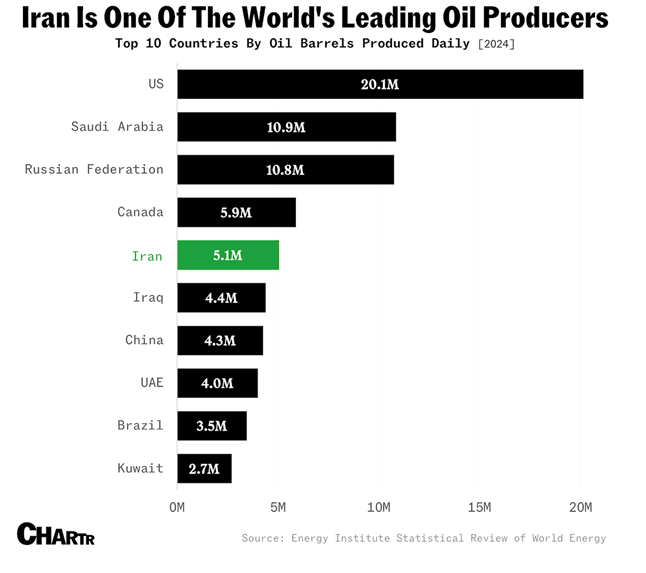

6. Iran Top 5 World Oil Producer

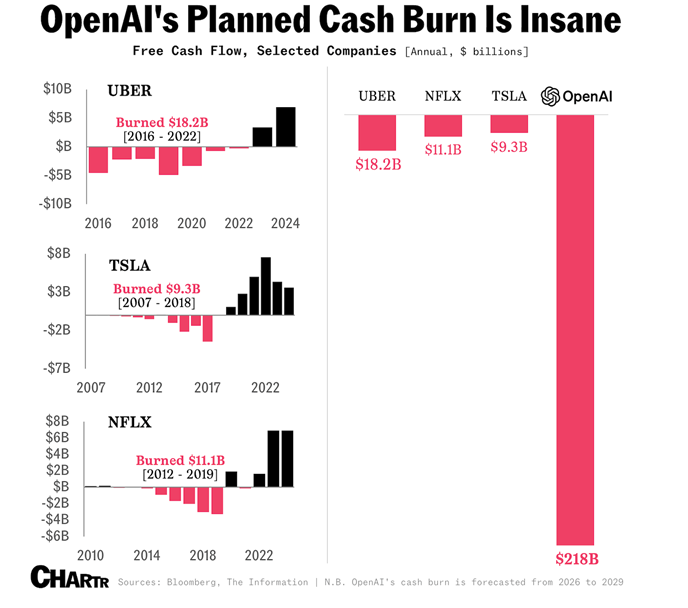

Chartr

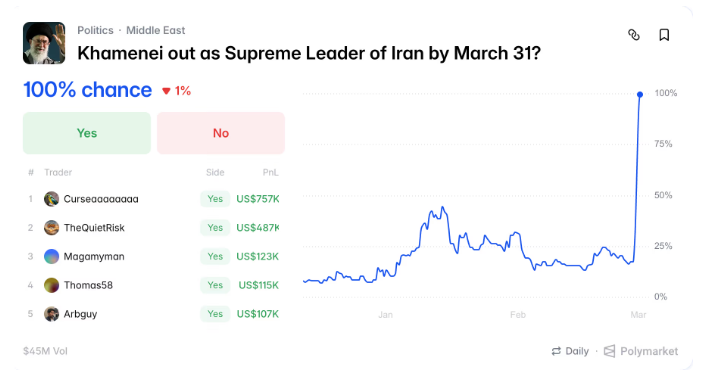

7. Polymarket attracts record trading ‘world’ volumes as U.S.-Iran bets top $529 million

A prediction market about military strikes on a sovereign nation now sits alongside presidential election bets as one of the most-traded contracts the platform has ever hosted.

By Shaurya Malwa|Edited by Nikhilesh De

What to know:

- Polymarket has rapidly become a hub for betting on the U.S.-Iran conflict, with traders wagering on ceasefire dates, regime change and potential U.S. ground involvement.

- A contract on Ayatollah Ali Khamenei leaving power by March 31 drew $45 million in volume, while a long-running market on whether the U.S. would strike Iran has amassed $529 million, making it one of Polymarket’s largest ever.

- Onchain analysts have flagged six wallets that made about $1.2 million by correctly betting on a Feb. 28 U.S. strike on Iran, intensifying scrutiny of potential insider trading as Polymarket promotes its markets as a source of real-time geopolitical insight.

CoinDesk

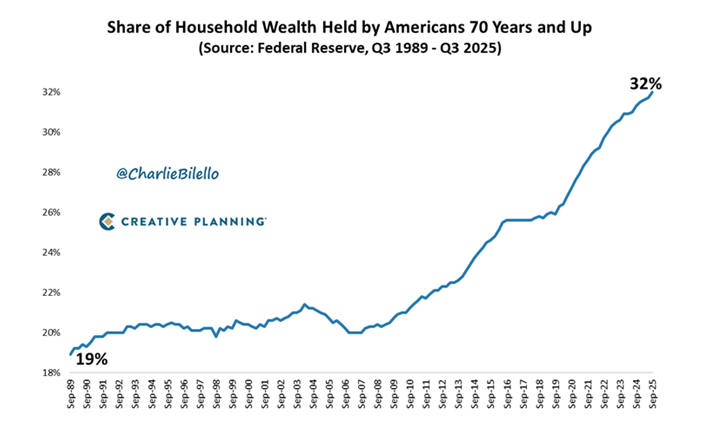

8. Aging Population, Booming Real Estate and Equity Markets for Boomers.

9. How Can Cuba Build So Many Hotels When Occupancy So Low? Military Owns the Real Estate in Case of Democracy. (You can’t make it up)

With Fuel Running Out, Cuba’s Tourism Is Collapsing-NYT

By Frances Robles and Vjosa Isai The Trump administration’s decision to cut off foreign oil to the island is devastating its tourism industry, a key source of income for a government being pushed to the edge. Cuba’s state-run hotels are managed by Gaviota, a subsidiary of the military-run conglomerate GAESA, which controls the Cuban economy. That means Cuba’s best hotels and prime real estate are in the hands of military officials, Mr. Spadoni said.

“One key misconception is: How can Cuba build so many hotels when the occupancy rate is so low?” Mr. Spadoni said. “One thing people miss is that to the Cuban military, these are real estate investments more than tourism.”

Military officials are likely taking the “long view” by wanting to be in control of valuable properties should the Communist government transition to democracy, he said.

Some new luxury hotels, like the iconic Torre K in Havana, are largely empty.

In the past 15 years, the Cuban government invested about $24 billion in hotels, said Emilio Morales, a Miami-based former marketing official for Cimex, Cuba’s retail conglomerate, who now studies Cuba’s tourism industry and is a harsh critic of its government.

“There were many hotels, and in two or three and a half years, everything shut down or kept deteriorating,” Mr. Morales said. “They didn’t invest in the other sectors that support tourism, such as the energy grid itself.”

https://www.nytimes.com/2026/03/04/world/americas/cuba-tourism-travel-canada-trump.html

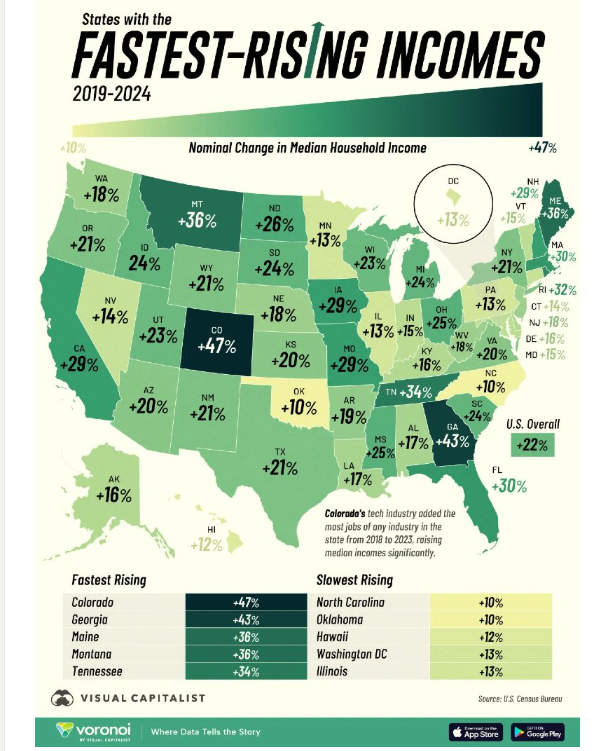

10. States with Fastest Rising Incomes 2019-2024