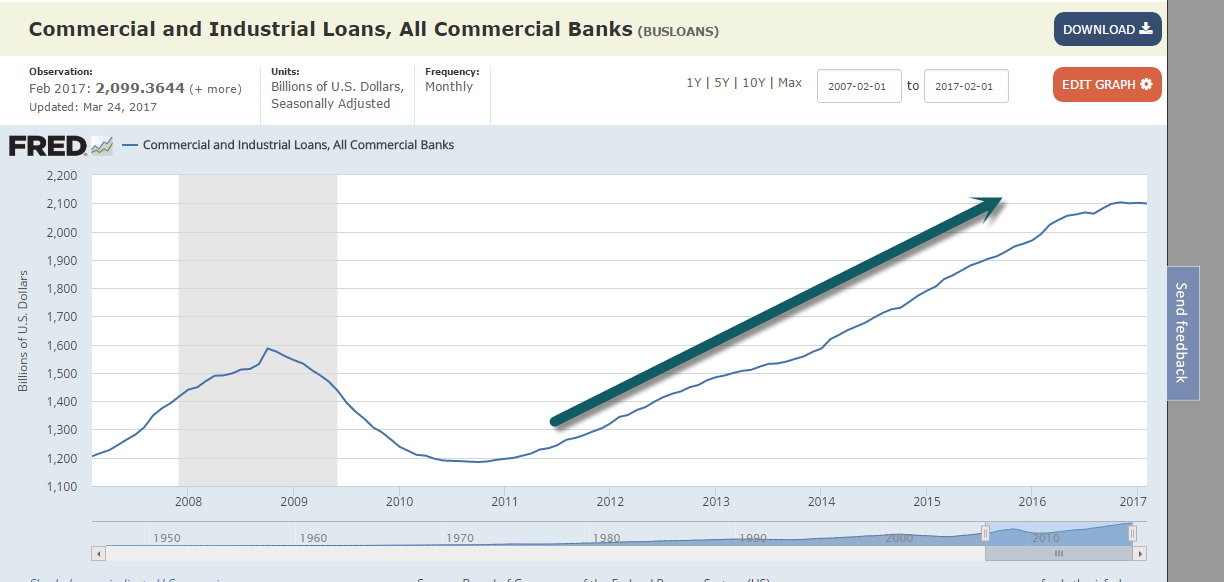

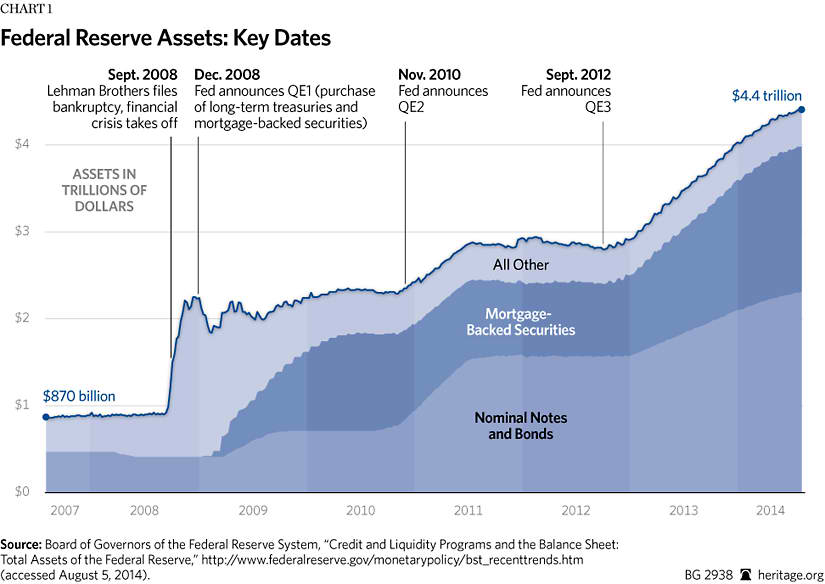

1. The Big Question? How does the FED Shrink the Balance Sheet? Less than $1 Trillion in 2008 to $4.5 Trillion Today. Now 23%of GDP from Around 6% Before Crisis.

https://fred.stlouisfed.org/series/WALCL

2.Q1 Summary…Tech and Consumer Discretionary Lead…AMZN Responsible for a Full 1/3 of Consumer Sector Gains.

That’s a Wrap: Q1 Performance

Mar 31, 2017

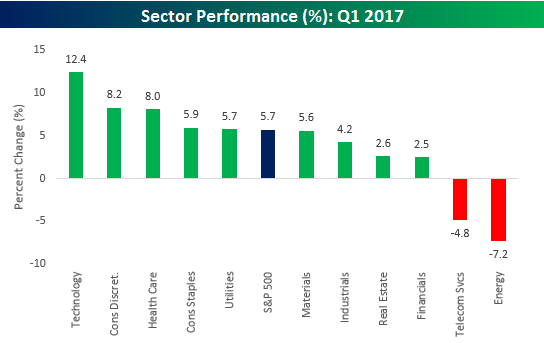

Not a bad quarter for the bulls. With Q1 now officially in the books, 2017 has gotten off to a great start with the S&P 500 rallying 5.7% through late Friday afternoon. As shown in the sector performance chart below, Technology did most of the heavy lifting this quarter with a rally of 12.4%, or more than double the S&P 500’s gains. Behind Technology, Consumer Discretionary rallied 8.2%, while Health Care gained 8%. On the downside, the only two sectors that were down on the quarter were Energy (-7.2%) and Telecom Services (-4.8%). Besides these two sectors, others that underperformed during Q1 were Financials, Real Estate, Industrials, and Materials.

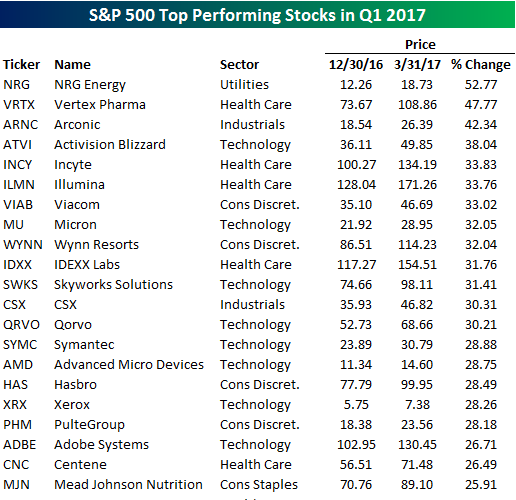

The tables below list the best and worst performing stocks during the quarter. Of the 21 stocks that gained more than 25%, shares of NRG Energy (NRG) rallied more than 50%, while Vertex Pharma gained 48%. With Technology leading the market higher, it shouldn’t come as too much of a surprise that eight of the top performing stocks in the index were from that sector, led by Activision Blizzard (ATVI) and Micron (MU) which both added more than 30%. How good a year has 2017 been for equities and Tech in general? Even Xerox (XRX) is up over 25%!

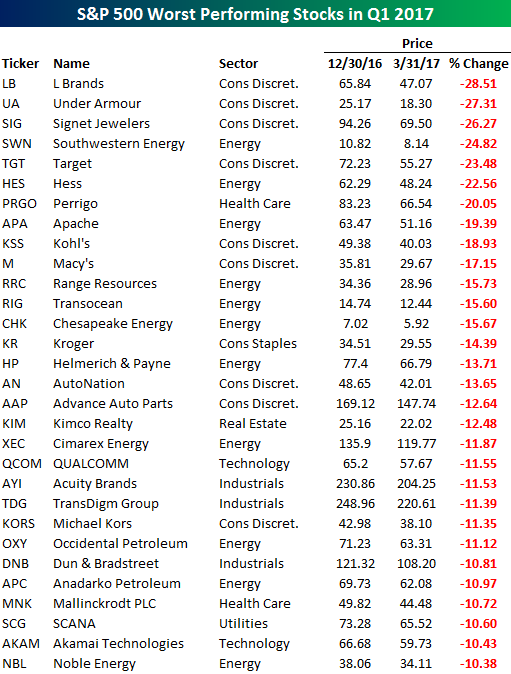

To the downside, the table below lists the 30 stocks in the S&P 500 that traded down more than 10% this quarter. Leading the way lower, L Brands (LB), Under Armour (UA), and Signet (SIG) all lost more than a quarter of their market value during Q1. Along with those three names, another six stocks from the Consumer Discretionary sector made the list. The only sector with more stocks on the list of losers was Energy. Given that it was the worst performing sector during the quarter, Energy makes sense, but Consumer Discretionary was the second best performing sector. The reason Consumer Discretionary fared so well even with so many stocks in the sector declining sharply is due in large part to Amazon.com (AMZN). With a gain of 18% and a market cap of around $425 billion, AMZN was responsible for one-third of the Consumer Discretionary sector’s gain in Q1.

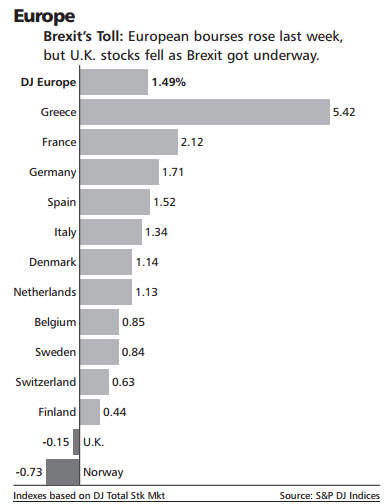

3.Advisors are Moving Money to Europe…I am Watching Two Names from Past Collapse Lists.

Deutsche Bank…Gundlach once said it was over if DB broke $10…Hit $11 then Rallied 81%

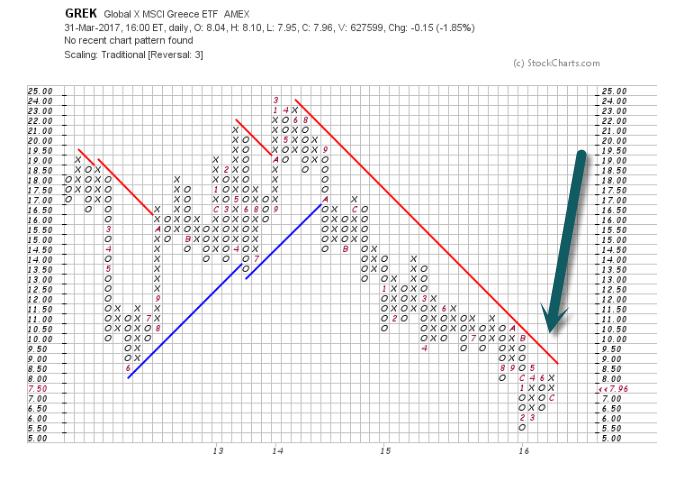

Greece ETF approaching red downtrend line going back to 2013

www.stockcharts.com

Greece Leads in 1st Qt.

DIGBY LARNER, based in Paris, is a Wall Street Journal editor for Europe, the Middle East, and Africa.

http://www.barrons.com/articles/outlook-brightening-for-euro-zone-banks-1491020996

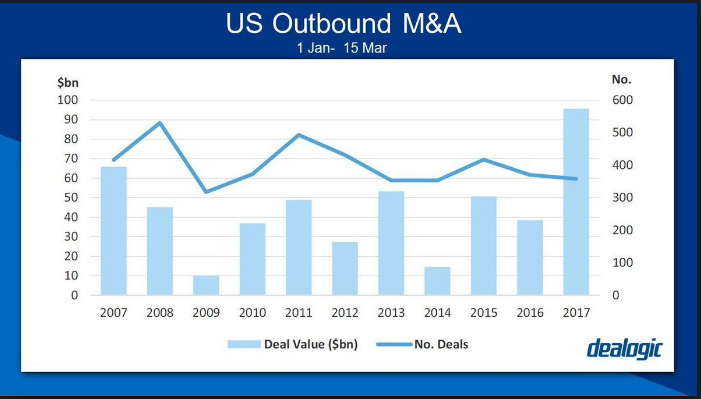

4. Global M&A Surpasses 2007

March 21, 2017

Written by Olga Tarabrina

Global M&A reaches $705.0bn

Global M&A volume has reached $705.0bn in 2017 YTD, surpassing $700bn in a YTD period for the first time since 2007 ($903.5bn). Of this, a total of 125 $1bn+ deals, worth $454.9bn, have been announced so far this year, compared to only 94 deals (totaling $260.3bn) 5 years ago. $10bn+ deals account for $167.2bn of the total this year.

Cross-border transactions drive volume

The increase in M&A volume has been driven by cross-border acquisitions, which have doubled in the last 5 years to $288.4bn in 2017 YTD ($144.9bn in 2012 YTD), and is the highest YTD level in a decade ($324.7bn in 2007 YTD). The US is the top acquiring nation for cross-border M&A with $95.8bn, the highest YTD level on record. Domestic M&A stands at $413.7bn, also up 4% year-on-year, with the US representing a 47% share ($192.9bn) of all domestic M&A this year.

Johnson & Johnson’s pending $31.4bn bid for Actelion is expecting to complete on April 26, and is the largest M&A deal announced in 2017 YTD. It is also the third largest Europe-targeted acquisition by a US-based company, and the second largest Swiss inbound M&A deal on record.

Oil & gas, healthcare, and technology

Oil & gas is the top targeted sector in 2017 YTD with volume totaling $96.7bn, the highest YTD level on record. Domestic activity in the US and Canada helped to boost volume, with deals worth $52.8bn (62% share) and $9.4bn (10% share), respectively. Both countries are also the top targeted nations for cross-border oil & gas M&A in 2017 YTD, with a combined share of 40% of volume.

The healthcare ($95.9bn) and technology ($87.1bn) sectors follow. Intel’s $15.4bn pending bid for Mobileye, announced on March 13, is the largest technology M&A transaction in 2017 YTD and the largest Israel-targeted M&A deal on record.

The top advisor for global M&A

Morgan Stanley leads the global M&A ranking in 2017 YTD with $142.7bn, followed by Bank of America Merrill Lynch with $130.3bn and Citi with $123.9bn.

Data source: Dealogic, as of March 21, 2017

http://www.dealogic.com/insights/global-ma-breaks-700bn-mark/

Interesting…Last Year had the Highest Withdrawn Deal Volume

Last year had already seen the highest withdrawn deal volume since 2008, in total 769 deals for $842 billion, “partly reflecting heightened regulatory pressure,” as J.P. Morgen put it.

And J.P. Morgan had an additional explanation for the merger boom, beyond the crazy stock market valuations: “Buyers capitalize on low cost of funding.”

Cash deals – funded by borrowing money, rather than issuing shares – accounted for 62% of the deals in 2016, up from 54% in 2015. And this year, despite rising rates, “the cost of capital is unlikely to be substantially impacted (emphasis added), and we do not think any increases will impede M&A activity.”

Read full story at BI

http://www.businessinsider.com/mergers-and-acquisitions-are-starting-to-look-a-lot-like-they-did-just-before-the-financial-crisis-2017-3

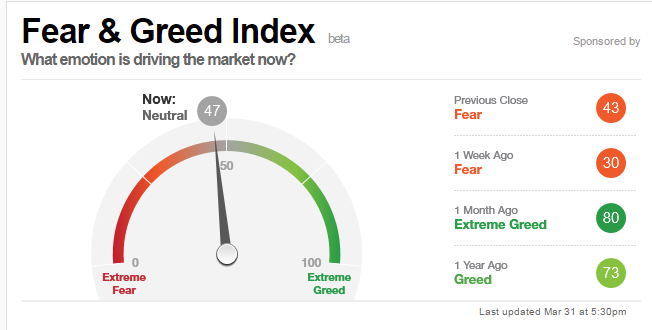

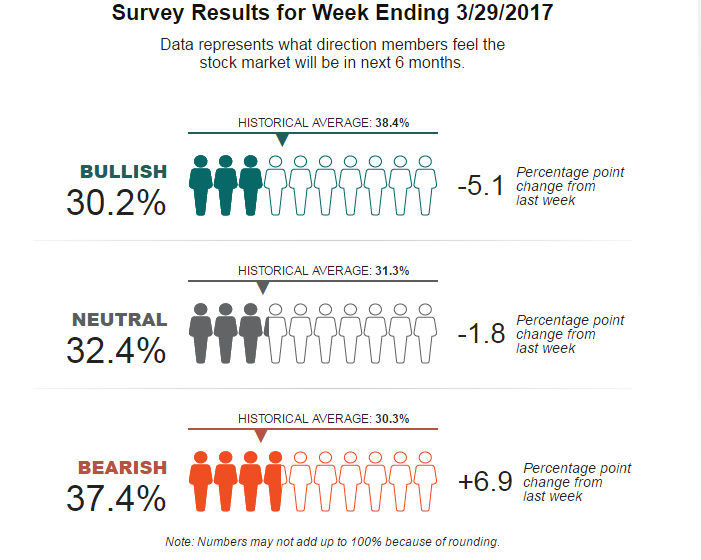

5.Lack of Euphoria…Fear and Greed Index Neutral After Big First Quarter for S&P….AAII Bullish Sentiment Retreating.

http://money.cnn.com/data/fear-and-greed/

And it isn’t just stocks that have been doused with a bucket of cold water. The latest American Association of Individual Investors survey shows the percentage of bullish respondents fell to 30.2%, 16 points lower than the start of the year, while bearish sentiment rose to 37.4%, 12.2 points higher. “The market got ahead of itself and was due for a pause,” says SunTrust strategist Keith Lerner. “The good news is that a lot of the sentiment measures have cooled off.”

http://www.barrons.com/articles/dow-rises-4-6-in-sixth-straight-up-quarter-1491020979

http://www.aaii.com/o/sentimentsurvey

http://www.aaii.com/o/sentimentsurvey

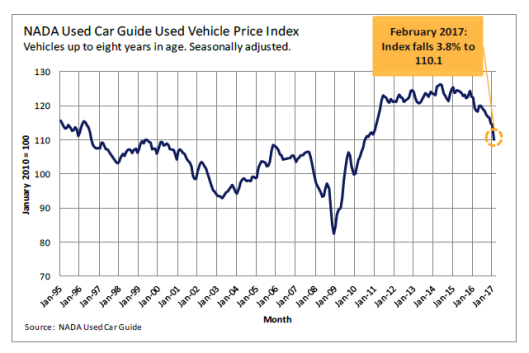

6.The National Automobile Dealers Association Used Vehicle Price Index plunged 8%, year over year, in February—the sharpest annual drop in almost a decade.

The supply of cars coming off-lease is expected to grow 25% in the next couple of year

“After inflating like crazy, the auto-loan bubble has at last gone bust,” MacroMavens’ Stephanie Pomboy writes. Lenders provided lengthy deals, seven years and more, to get buyers into pricey sport-utility vehicles and pickups, while keeping the monthly nut affordable. The loans can be securitized into ABS, which investors gobble up in the low-interest-rate world.

“These practices are bearing their inevitable fruit,” she continues. Auto inventories are bulging, resulting in stepped-up incentives for new cars, which is driving down used-car prices.

The ripple effects are apt to spread far beyond the manufacturers, as they will have to pare payrolls and hours, resulting in lower spending by their workers, reduced tax revenue, and higher outlays by state and local governments. This, at a time when defaults on credit cards and home-equity loans are at three-year highs, Steph notes.

Barrons article on Carmax

Barrons article on Carmax

http://www.barrons.com/articles/carmax-could-stall-as-risky-loans-rise-1491021003

http://www.barrons.com/articles/dr-dooms-diagnosis-of-the-banks-the-fed-and-the-economy-1491020967

7.Hedge Funds See Positive Net Flows in First Quarter….Assets Over $3 Trillion.

eVestment: February Hedge Fund Inflows Make for Cautious Optimism

The January to February period is typically one that defines the industry outlook for the year in terms of industry flows. In the six-year period of 2010 through 2015, January and February typically made up at least 30% of the industry’s total annual net inflows. “While it is good that sentiment toward the industry is more positive than negative now, and inflows are outpacing redemptions, unless 2017 is unlike any of the prior eight years, inflows will not likely be significant,” according to Peter Laurelli, an eVestment vice president. Thus, eVestment is “cautiously optimistic” about the February inflows.

Investors are showing interest in macro strategies, considering that the 10 largest macro strategy funds “significantly outperformed their peers” in 2016. Funds with quantitative strategies are also favored, and quantitative strategies have benefited long equity and short equity funds. In the absence of quantitative strategies, in fact, flows to equity long and equity short funds in February would have actually been negative.

http://www.ai-cio.com/channel/ASSET-ALLOCATION/eVestment-February-Hedge-Fund-Inflows-Make-for-Cautious-Optimism/

https://www.google.com/search?q=hedge+fund+assets+hit+3+trillion&espv=2&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiKhqXck4jTAhVE8CYKHcm6AgkQ_AUIBygC&biw=1366&bih=638#imgrc=PIsZvDvb-N7nMM:

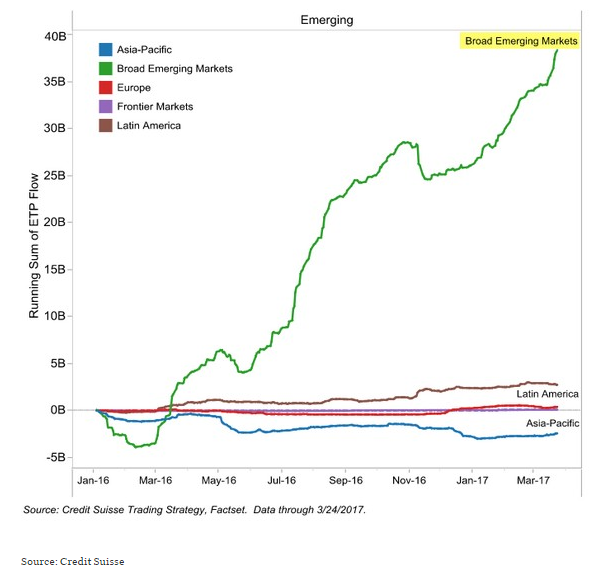

8.Money is Pouring into Emerging Markets.

We’ve continued to see strong price momentum in emerging market ETFs. Look at the flow of capital in this next chart. More buyers than sellers.

http://www.valuewalk.com/2017/04/causes-consequences-fewer-u-s-equities-emerging-market-etfs-surge-investors-bullish/?all=1

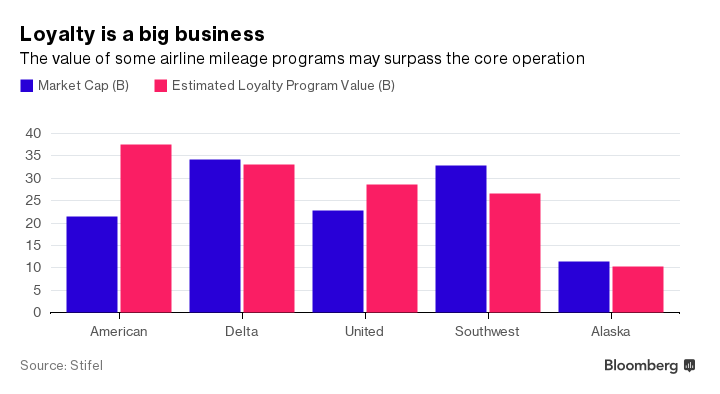

9.Read of the Day….Miles Cards Account for Half the Profits at Some Airlines

Airlines Make More Money Selling Miles Than Seats

The golden goose isn’t your ticket or bag fee—it’s the credit card you use to collect frequent flier miles.

by

Justin Bachman

For carriers such as American Airlines riding Citigroup Inc. plastic, or Delta on American Express Co., these programs are a cash cow, a golden goose, or any other fiscal livestock you care to conjure. Each mile fetches an airline anywhere from 1.5 cents to 2.5 cents 1 , and the big banks amass those miles by the billions, doling them out to cardholders each month.

For the banks, people who pay annual fees for those cards to accumulate miles are the closest thing to a sure bet. These consumers typically have higher-than-average incomes and spend more on their cards, which generates merchant fees for the banks. They also tend to maintain high credit scores, which means they pay their bills on time and banks experience fewer defaults.

Full Bloomberg Story

https://www.bloomberg.com/news/articles/2017-03-31/airlines-make-more-money-selling-miles-than-seats

10.One of my Favorite Bloggers Ben Carlson…Great Stuff! Highlighted some of my favorites.

Some Things I Wish I Would Have Learned in College

Posted March 16, 2017 by Ben Carlson

I’ve gotten the opportunity to speak with a number of college students over the past few years. I’m always impressed at how far ahead of the game most of these students are from where I was at their age. At these talks, I mostly try to share my story and tell them some of the stuff I wish someone had told me about when I was in school.

This week I talked to a business class at Grand Valley State University. I wrote down a few notes beforehand and expanded on some of those thoughts here with some advice I wish I would have gotten in college:

Passion is overrated. People always say “go into something you’re passionate about” but I’ve found it’s more effective to experiment and figure out what you’re good at first. I wasn’t one of those people who was reading the Wall Street Journal at age 10. I grew into my love of investing and the markets and only became passionate about it after spending some time doing the work. The same thing happened with writing for me.

Learn about behavioral psychology and human nature. You have to understand how humans generally function and how things like incentives, blind spots, and cognitive dissonance guide our actions. Human nature is a fascinating subject matter that far too few people ever take the time to study. Understanding your own biases and how other people are hardwired will help you understand much of how the world works.

Don’t just send out a bunch of resumes. Sending out hundreds of resumes to every open position on the Internet is a terrible strategy for finding a job. You’ll never get noticed that way. It’s a much better strategy to personalize your resume and cover letter to a select few companies that you take your time to get to know first. You can also reach out to people in your chosen industry to pick their brain about how to work your way into certain companies. People love talking about themselves so figure out how to invite people to coffee to help you understand how the working world really works. Building these networks can help you find open positions that never get posted, as well.

Avoid defeatism at all costs. Don’t let people tell you the horrible job market is holding you back. Or student loans are crushing our young people. Or things were better in the 90s. The headlines don’t run your life or make decisions for you. Don’t worry about what everyone else is doing. Focus on getting better and avoid negative people like the plague.

Think in terms of systems over goals. A goal would be: How do I accumulate $1 million? A system would be: How do I put processes in place to become wealthier over time? If you’re only focused on the end goal it can make you feel like a letdown if you fall short. You can’t control life and all of its unpredictable outcomes so it’s more important to implement good systems you can follow over and over again in hopes of putting the probabilities in your favor. That way, if and when you do fail, you’re not completely devastated and can move on to your next challenge with a plan already in place.

Avoid lifestyle creep. It’s not a bad idea to live like a college student for a couple of years right out of school until you get a handle on how to deal with money in the real world. At the very least, don’t turn into a lavish spender right when you get your first big paycheck. That’s a tough habit to kick. And make sure to read a few personal finance books. It’s one of the most important, yet ignored topics on becoming a functioning adult.

Start those 401k contributions right away. Saving money is the most important investment decision you can make, especially at a young age when you have the wind at your back in terms of human capital and compound interest. Increase how much you save a little each year, make it automatic and your future self will thank you.

Become a lifelong learner. One of the best ways to become smarter is to read as much as possible on a wide range of subjects. Being well-read can help level the playing field when you’re young and inexperienced. I’ve found that people who are well-read do far better than those who were born with a high intellect.

Understand the difference between being productive and being busy. The majority of the people I talk to who work 70-80 hour weeks are typically really busy but not really productive. Some jobs force you to do busy work but figuring out how to manage your time productively is essential if you ever want a life outside the office or a fulfilling career.

Ask questions. You feel like an idiot at times, but one of the ways I learned on the job was simply by asking questions every time I didn’t understand something. Not only does this help you figure out what’s going on faster but it shows you’re interested. From there it’s up to you to become a fast learner so you can help solve other people’s problems.

Take care of your health. When I was in college I could eat fast food all the time and party until 2-3am and get up and turn it around easily the next day. That doesn’t work when you get older. You have to eat right, exercise and get enough sleep. This gives you more energy, you’ll feel better about yourself and hopefully live a longer life because of it.

Learn how to sell. Everyone is in some form of sales whether they understand it or not. You have to be able to sell yourself, your message, your product, your firm or your philosophy.

Take some risks. Move to a new city. Take a flier on a risky job. Don’t stay put in a company you hate working for. You don’t need your whole life mapped out right out of college. Take your risks when you have plenty of time to make up for them if something doesn’t work out. Everyone will tell you to play it safe but don’t follow that path just because it’s the easy thing to do.

And finally, have fun and don’t take yourself too seriously. Life is all about balance. I’m glad I traveled for a few years before settling down with all of the responsibilities that come along with being an adult. Enjoy yourself when you’re young and energetic.

http://awealthofcommonsense.com/2017/03/some-things-i-wish-i-would-have-learned-in-college/