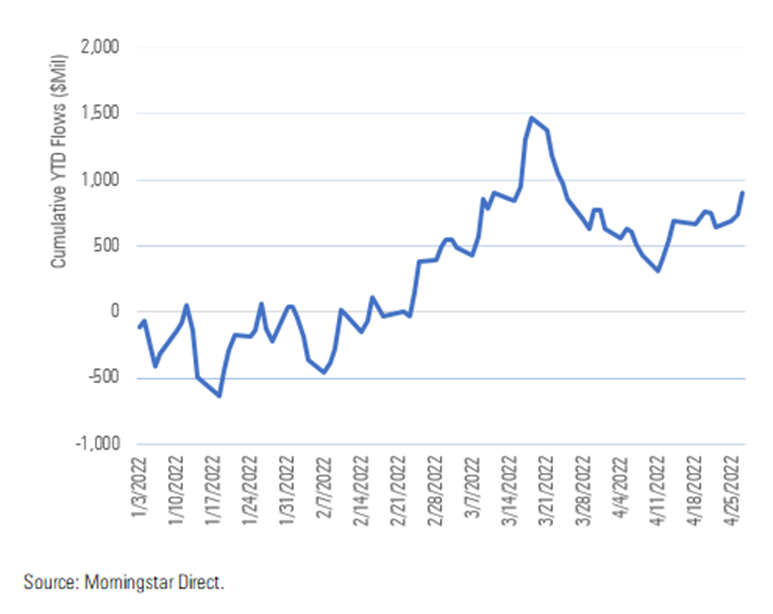

1. ARKK Fund -50% YTD…But $900m in Inflows???

I’m still trying to wrap my mind around the fact that $ARKK is down ~50% YTD but has pulled in $908 million in net new money.

https://twitter.com/MsartETFUS

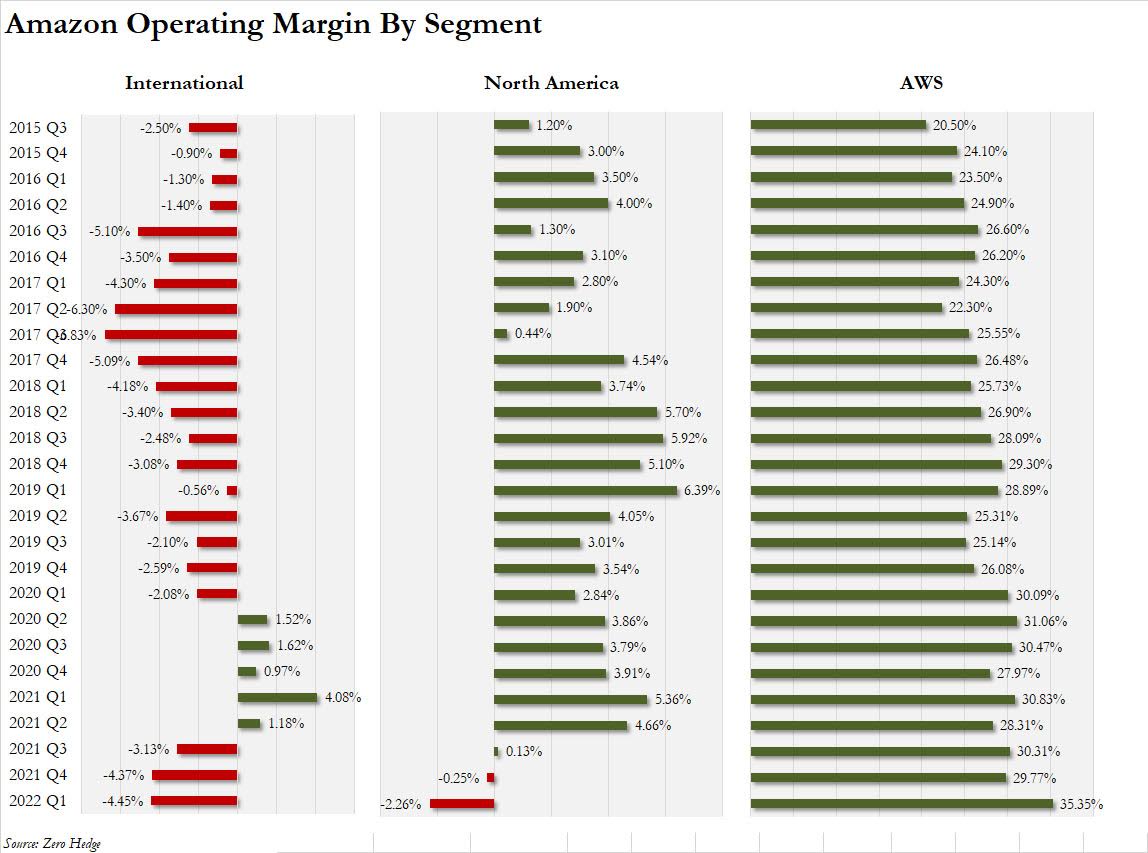

2. Amazon Operating Margin by Segment-Zerohedge Chart

North American and Europe Negative

3. 200day Moving Average on AMZN Long-Term Weekly Chart $2530

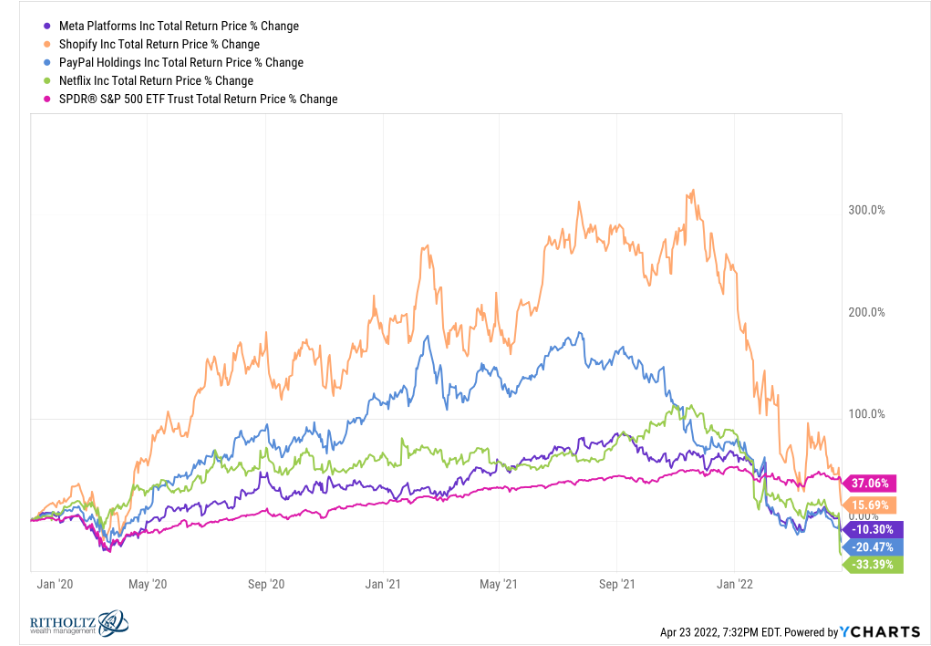

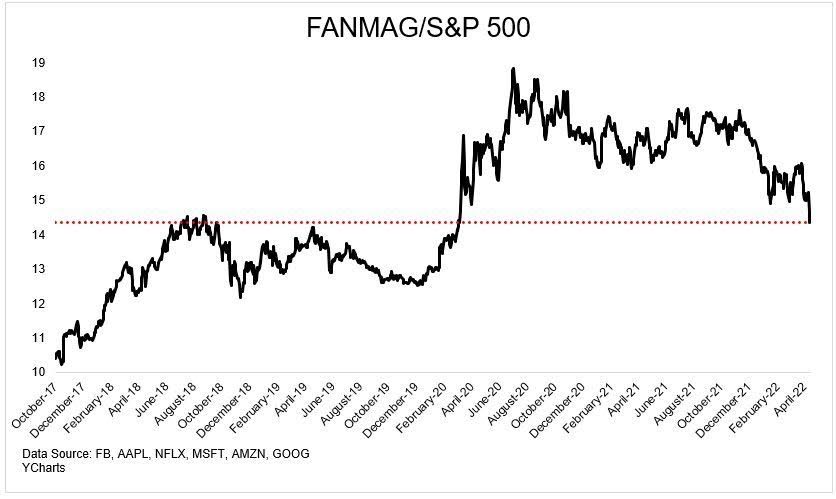

4. FANMAG Now Even with the S&P for Last 5 Years

Josh Brown Blog Reformed Broker

https://www.linkedin.com/in/joshua-brown-96a5569b/

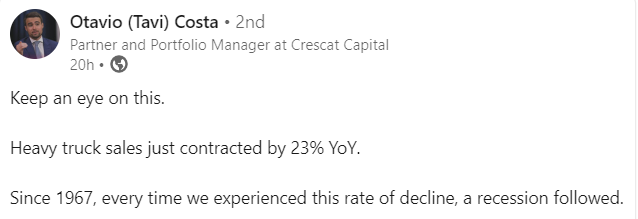

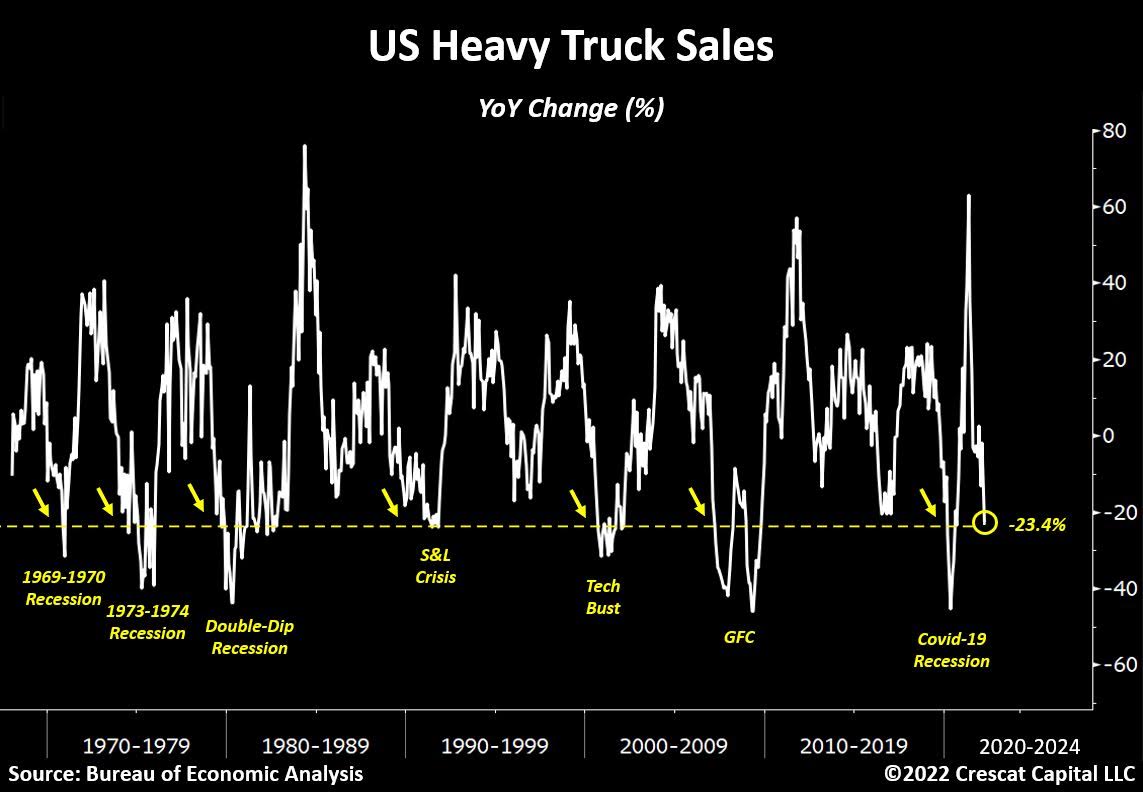

5. Heavy Trucks Sales -23%

https://www.linkedin.com/in/otavio-tavi-costa-76368628/

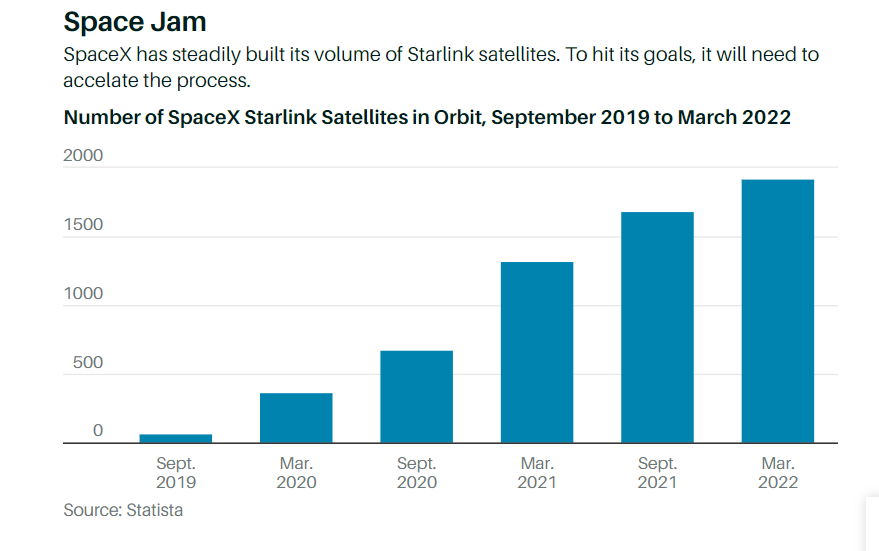

6. CNBC-Elon Musk will be the most indebted CEO in America if the Twitter deal goes through

KEY POINTS

· Two-thirds of Elon Musk’s financing for the $44 billion deal to take Twitter private will have to come out of his own pocket. He has a net worth of about $250 billion.

· Yet because much of his wealth is tied up in Tesla stock, Musk will have to sell millions of his shares and pledge millions more to raise the necessary cash.

· According to research firm Audit Analytics, Musk has more than $90 billion of shares pledged for loans.

· That makes him the largest stock-debtor in dollar terms among executives and directors, far surpassing second-ranked Larry Ellison, according to ISS Corporate Solutions.

The world’s richest person could soon add another title to his name – America’s most leveraged CEO.

Two-thirds of Elon Musk’s financing for the $44 billion deal to take Twitter private will have to come out of his own pocket. That pocket is deep. He has a net worth of about $250 billion.

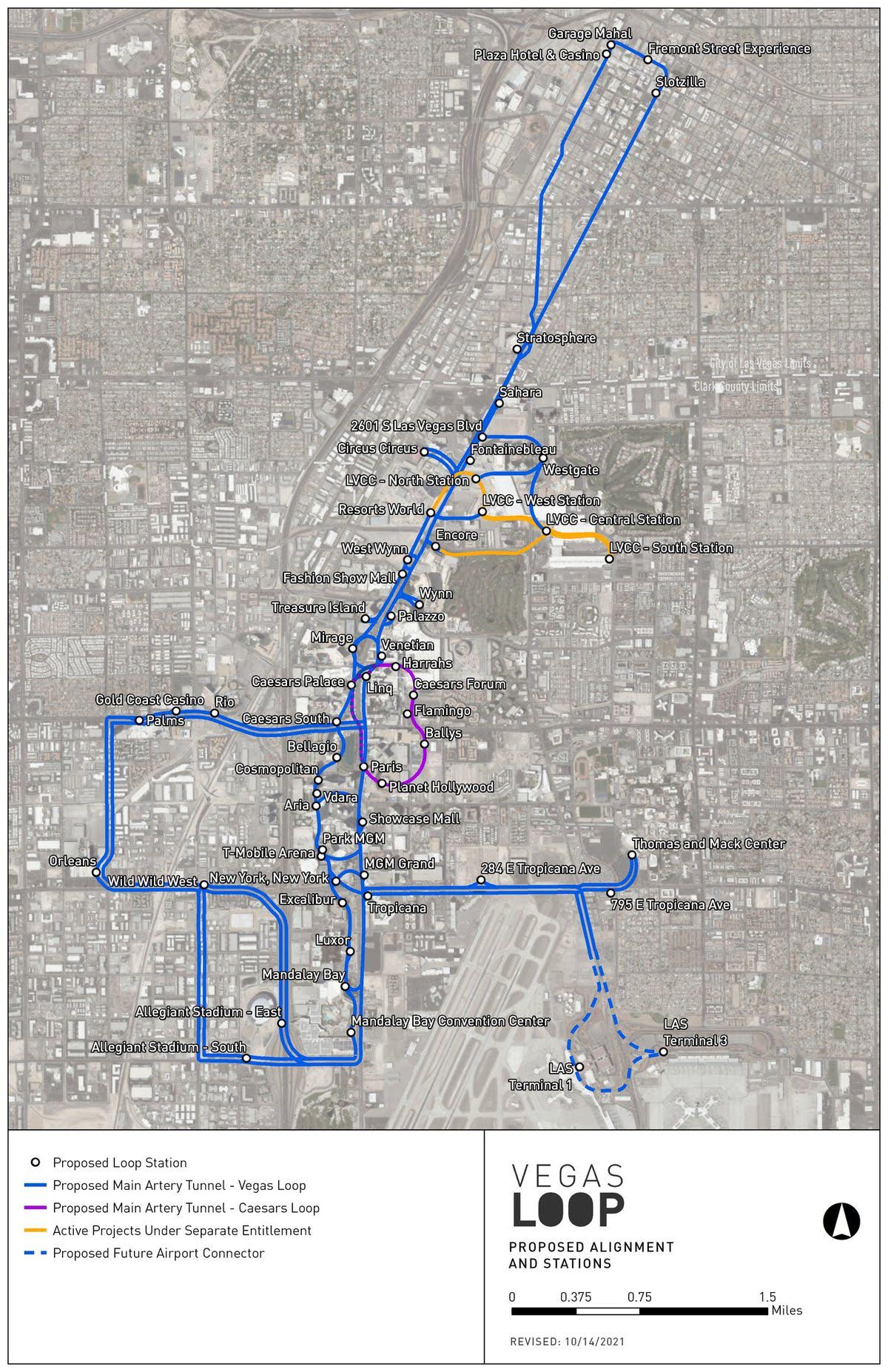

Yet because his wealth is tied up in Tesla stock, along with equity in his SpaceX and The Boring Co., Musk will have to sell millions of his shares and pledge millions more to raise the necessary cash.

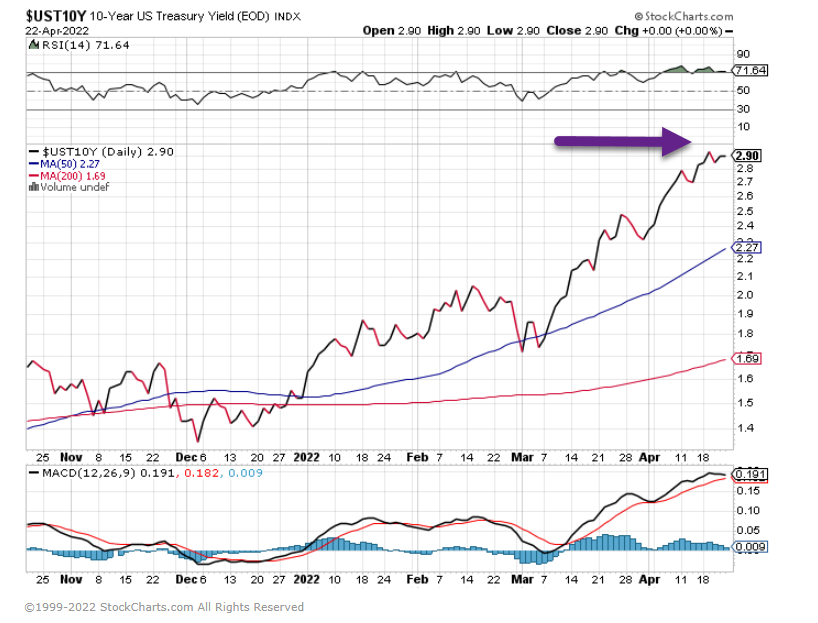

Tesla closes below 200 day moving average for 3rd time since February

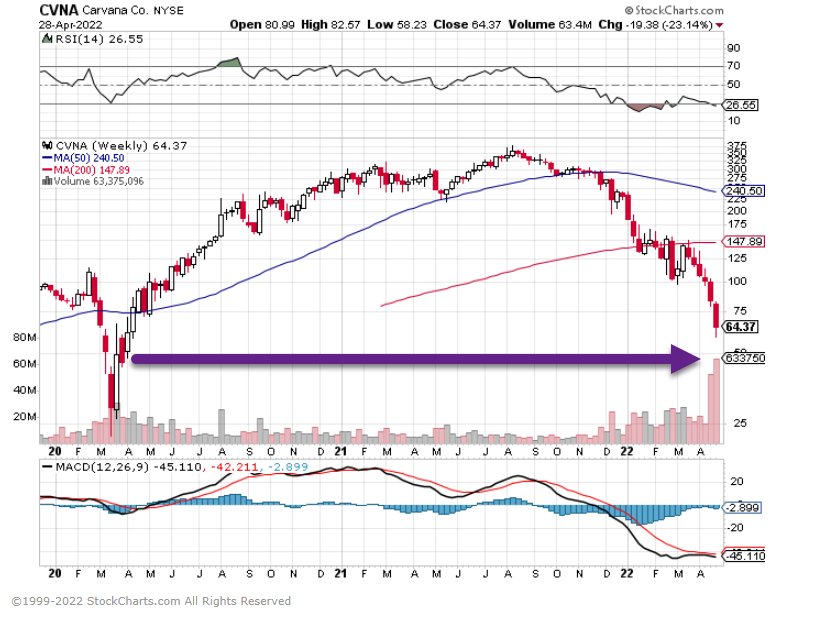

7. Another Covid Superstar Stock Close to Full Round Trip….CVNA-Carvana.

8. Metaverse ETFs Up to Six

ETF.com Overview Of Metaverse Themed ETFs In The US –Aniket Ullal

There are currently six ETFs that provide exposure to the Metaverse theme. There is also an ETF that focuses on console gaming (ETMG Video Game Tech ETF) as well as multiple decentralized finance (DeFi)- and blockchain-focused ETFs. Since those are more specialized or have a slightly different investment objective than the metaverse-themed ETFs, they have been excluded from this analysis.

The first metaverse ETF (METV) in the U.S. launched in mid-2021. Since then, five other similarly themed ETFs have launched in the U.S. They range in expense ratio from 0.39% to 0.75%. Table 1 summarizes these six metaverse-themed ETFs:

https://www.etf.com/sections/blog/metaverse-etfs-rapidly-growing-universe

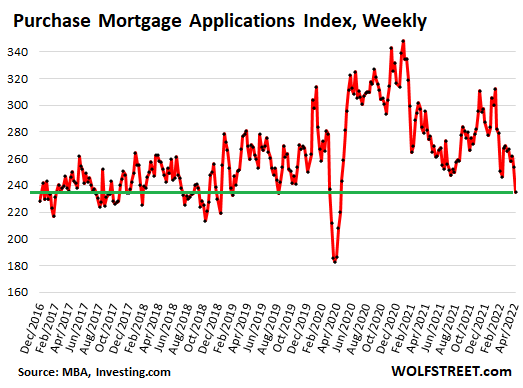

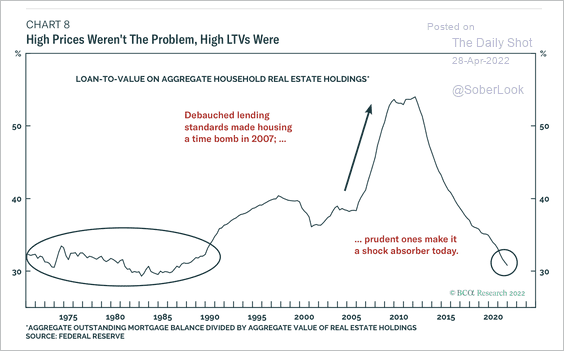

9. Loan to Value in Residential Housing is at Record Lows….The Opposite of 2008 Crisis

Looking towards the housing market, the current loan-to-value ratio is relatively low, unlike during the subprime housing crisis.

Source: BCA Research

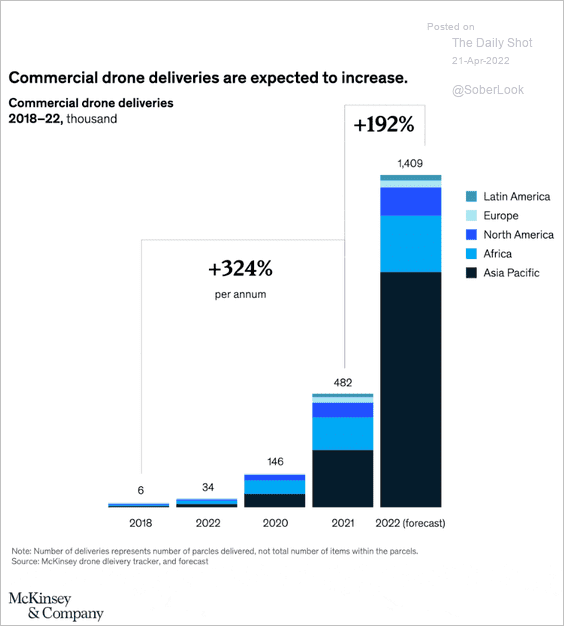

The Daily Shot Blog https://dailyshotbrief.com/

10. 13 Things the Most Confident People Don’t Do

Self-confident people know what they value and what they want. They share common habits and thought patterns that help them achieve their goals. Here are 13 things self-confident people don’t do, so you can be one of them.

1. They don’t believe they are worth less than others.

One of the fundamental beliefs underlying confidence is, “My worth as a person is equal to everyone else’s.” That doesn’t mean you don’t have to work for what you want, and it certainly doesn’t mean that life divides up its rewards evenly. But it does mean you have the same right as anyone else to stand up for yourself, pursue your dreams, enjoy your life, and make a difference in the way that’s most meaningful to you.

2. They don’t fear self-doubt.

Confident people realize that not all self-doubt is a bad thing. Sometimes fear is a signal that you haven’t prepared enough for the big presentation, the recital, or the interview. Practicing what you plan to say and do will give your mind something to fall back on when the pressure is high. The voice of self-doubt may also be saying you need to get more information, move in a different direction, or take a break.

3. They don’t hesitate too much.

The flip side of #2 is that once you’ve put in the hours of practice, you should be able to take action without obsessing over what might go wrong.

4. They don’t wait for the “big” move.

When you envision a confident person, you might think of someone who takes big, bold actions, like running for office or making a marriage proposal on the Jumbotron. But there can be boldness and bravery in small steps. Those incremental changes build on themselves, both through your own feelings of accomplishment and reinforcement from others.

5. They don’t confuse confidence with arrogance.

Some people fear confidence, because they don’t want to start stepping on other people’s toes, taking up too much space, or just plain being a jerk. But confidence isn’t the same as arrogance or narcissism. In fact, when you feel confident in yourself, you often become less self-absorbed. When you stop worrying so much about how you’re coming across, you can pay more attention to those around you.

6. They don’t fear feedback or conflict.

A confident person can accept helpful feedback and act on it without getting defensive. When your sense of self-worth is no longer on the table, you can handle criticism or even outright rejection without allowing it to break you. By the same token, confidence doesn’t mean you mow other people down when a conflict arises. It’s possible to speak your mind with conviction and still make room to listen to someone else’s point of view and even reach a compromise.

article continues after advertisement

7. They don’t fear failure.

Confidence doesn’t mean you won’t fail. It doesn’t mean you’re always smiling or that you never experience anxiety or self-doubt (see #2). Instead, it means you know you can handle those feelings and push through them to conquer the next challenge.

8. They don’t have to make things perfect.

Perfectionism is a form of faulty thinking that contributes to low self-confidence. If you believe you have to have something all figured out before you take action, those thoughts can keep you from doing the things you value.

9. They don’t believe everything they see in ads.

Many advertisements are designed to make you feel lacking. Companies that want to sell you products usually start by making you feel bad about yourself, often by introducing a “problem” with your body that you would never have noticed otherwise.

10. They don’t believe everything they see on social media.

This point is closely tied to #9. It’s easy to believe that everyone around you has the perfect marriage, a dream career, and supermodel looks to boot. But remember that what people post online is heavily curated and edited. Everyone has bad days, self-doubt, and physical imperfections. They just don’t trot them out on Facebook!

11. They don’t avoid trying new things.

As you keep pushing yourself to try new things, you’ll start to truly understand how failure and mistakes lead to growth. An acceptance that failure is part of life will start to take root. Paradoxically, by being more willing to fail, you’ll actually succeed more — because you’re not waiting for everything to be 100 percent perfect before you act. Taking more shots will mean making more of them.

12. They don’t focus on themselves.

It might seem counterintuitive, but when you have more self-confidence, you’re less focused on yourself. We’ve all been guilty of walking into a room and thinking, “They’re all looking at me. They all think I look dumpy and that every word I say is incredibly stupid!” The truth is, people are wrapped up in their own thoughts and worries. When you get out of your own head, you’ll be able to genuinely engage with others.

article continues after advertisement

13. They don’t let others determine their goals.

No one can tell you what is most important to you. Sure, our culture will say that having a better job, a bigger house, and a fancier car is what we need to make us happy. It takes a lot of strength and conviction to not just go along with societal expectations. Self-confidence doesn’t always look like the “big” move. It can be the confidence to say, “No, this opportunity is not right for me at this time.”

Adapted from The Self-Confidence Workbook: A Guide to Overcoming Self-Doubt and Improving Self-Esteem. Copyright © 2018 by Barbara Markway and Celia Ampel.