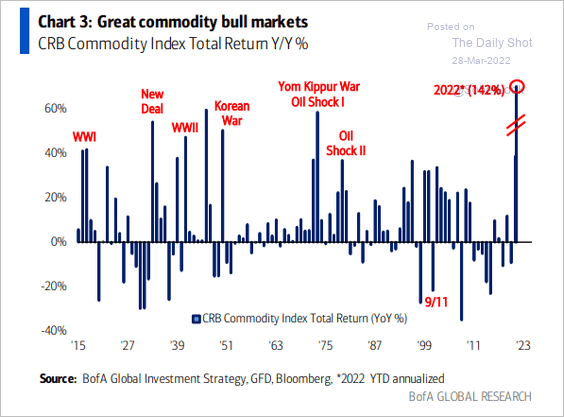

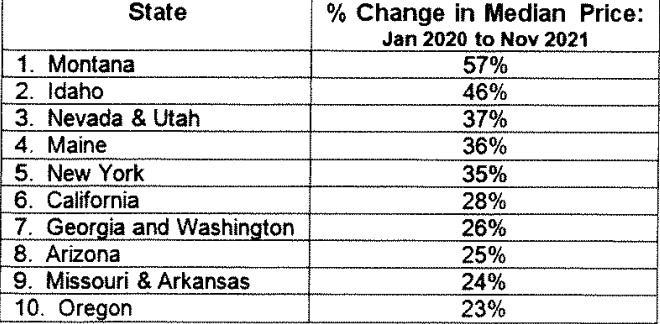

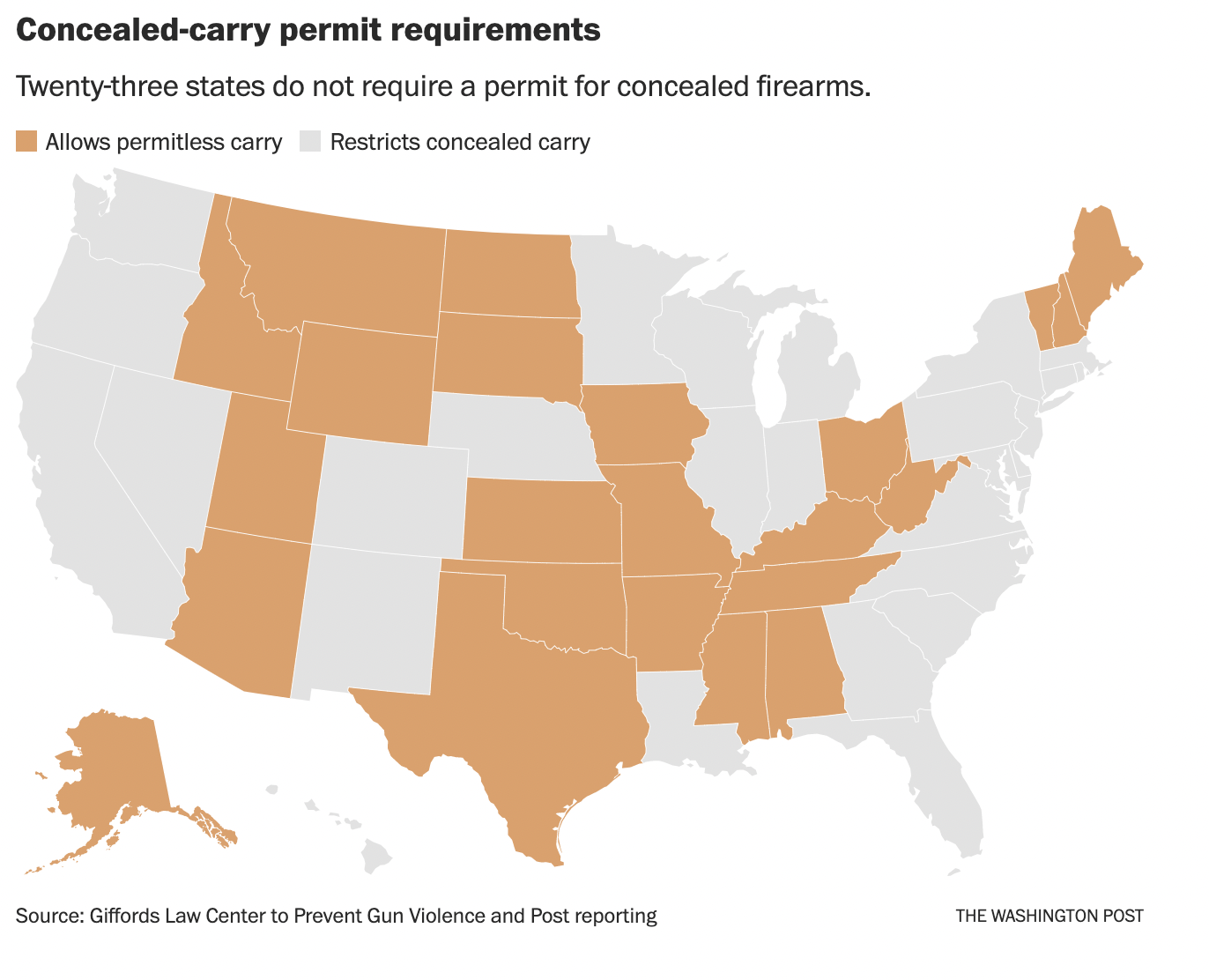

1. Commodities Historical vs. S&P

Capital Group

https://www.capitalgroup.com/advisor/insights/articles/is-spike-commodity-prices-sustainable.html?sfid=1988901890&cid=80693875&et_cid=80693875&cgsrc=SFMC&alias=D-btn-LP-6-A1cta-Advisor

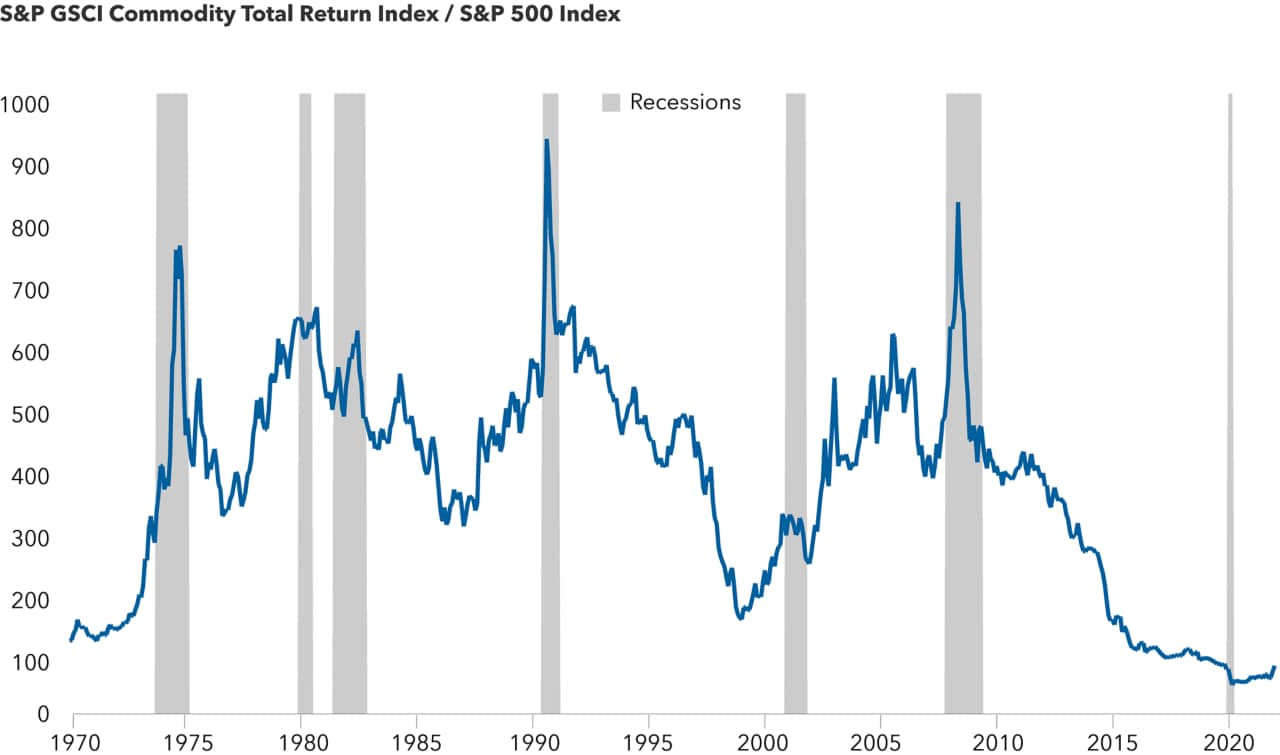

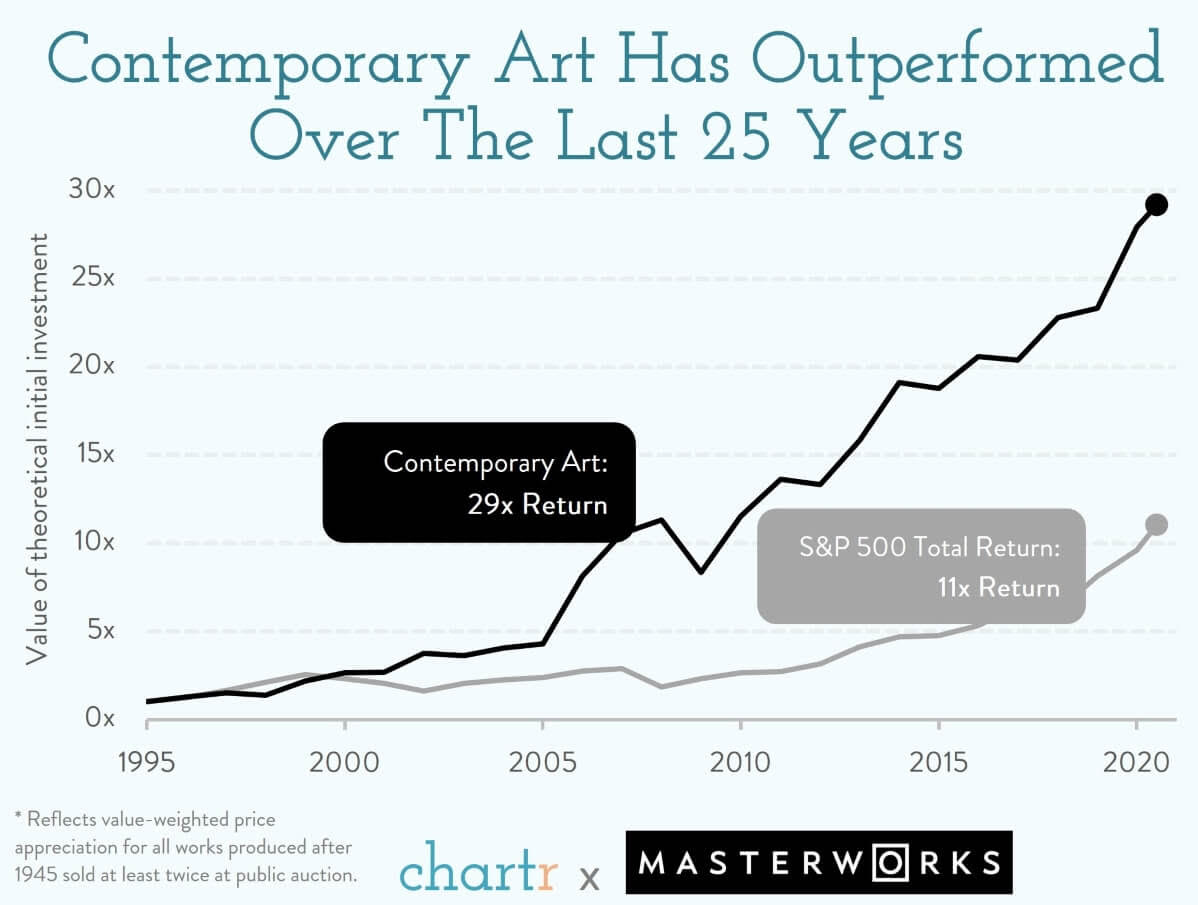

2. Where to Allocate in Case of Stagflation

Living with Stagflation: So you’ve decided to move on with your life and just “live with stagflation”. Here’s what history says about where to allocate…(n.b. past performance does not necessarily = future, etc)

Source: @AndreasSteno

From Callum Thomas Topdown Charts

https://www.topdowncharts.com/chartstorm

3. Household Allocation to Equities Historically Points to Tops in S&P

From Steve Blumenthal CMG Wealth https://www.cmgwealth.com/ri-category/on-my-radar/

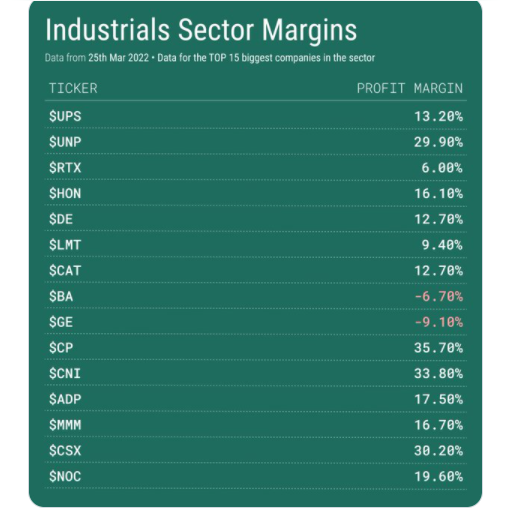

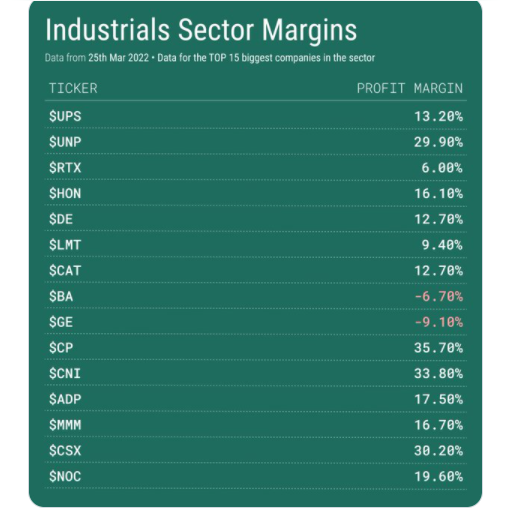

4. Industrial Sector Margins ..Rails Highest

(20) Stef ⚡️ (@dyankov91) / Twitter

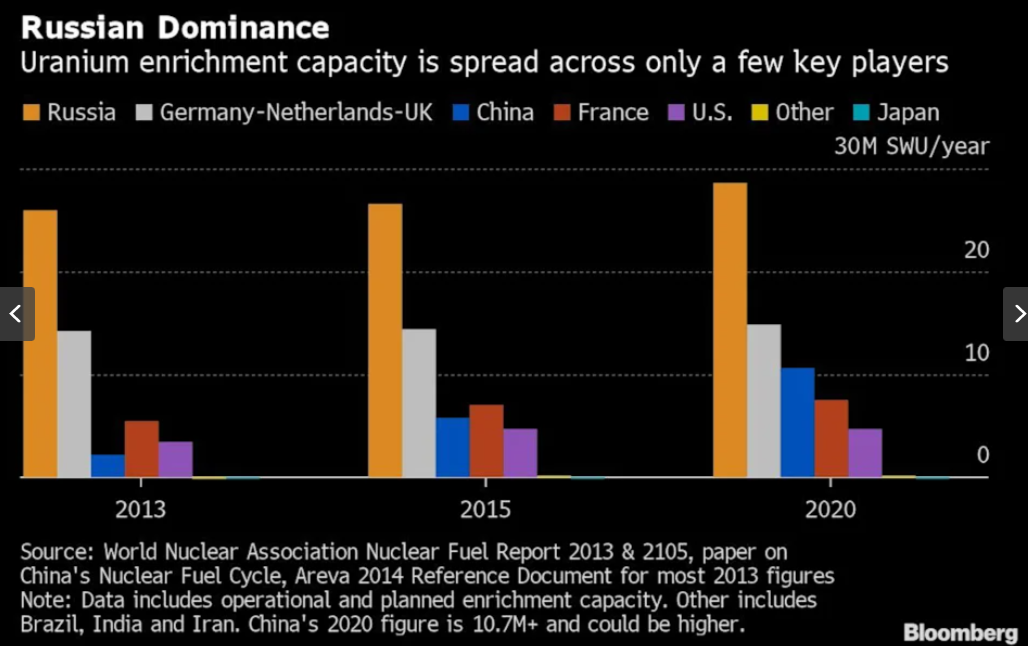

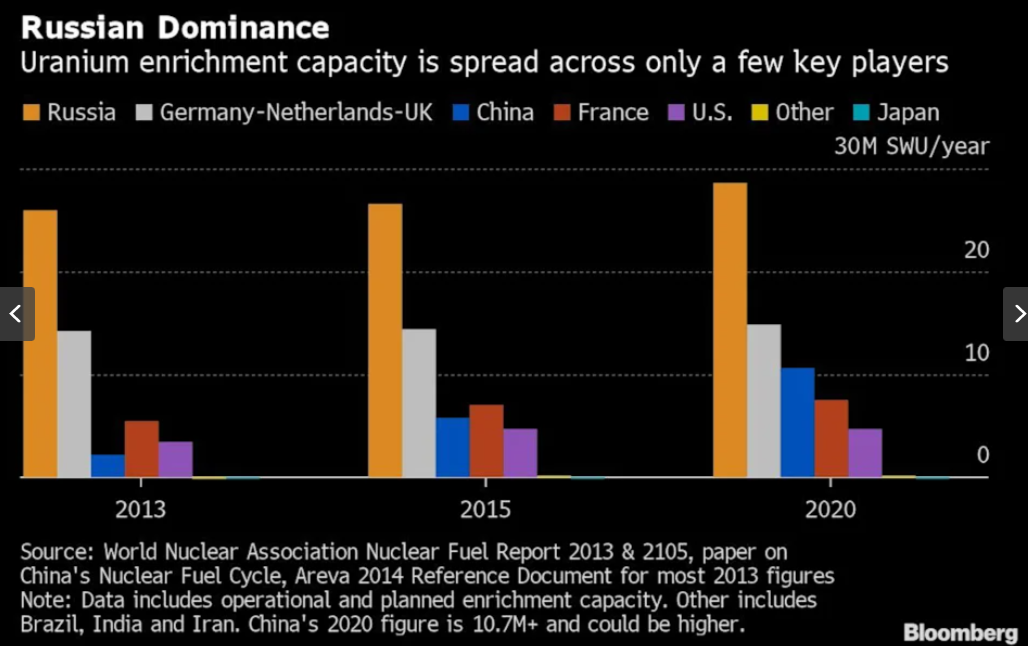

5. Russia 35% of World Uranium

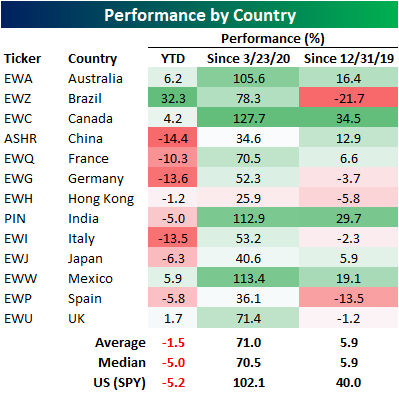

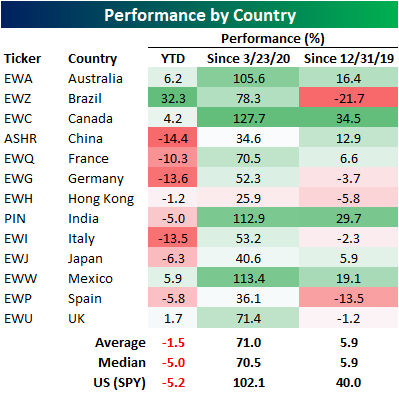

6. Country Performance Since Covid Low

https://www.bespokepremium.com/interactive/posts/think-big-blog/country-performance-since-covid-low

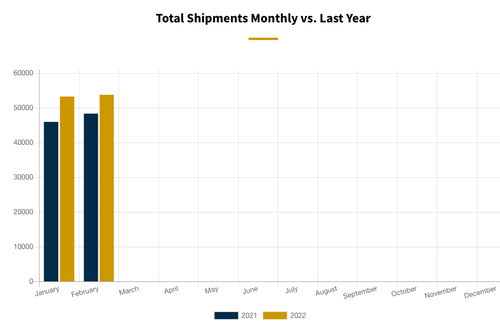

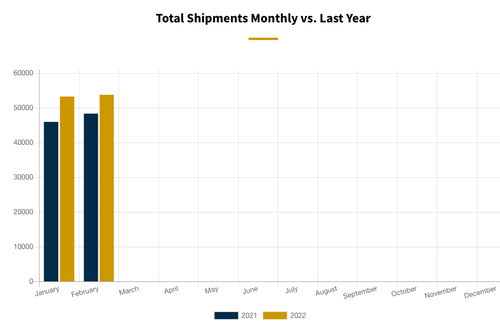

7. RV Shipment Data Highest Ever

Zerohedge-New RV shipment data from the RV Industry Association’s (RVIA) February 2022 survey of manufacturers revealed demand for this time of year is at some of the highest levels ever.

RVIA said total RV shipments last month topped 53,722 units, an increase of 11.3% compared to the 48,286 units shipped during the same month last year. RV shipments jumped 13.6% through February versus the same point last year with 107,012 wholesale shipments.

https://www.zerohedge.com/markets/rv-shipments-soar-record-time-year

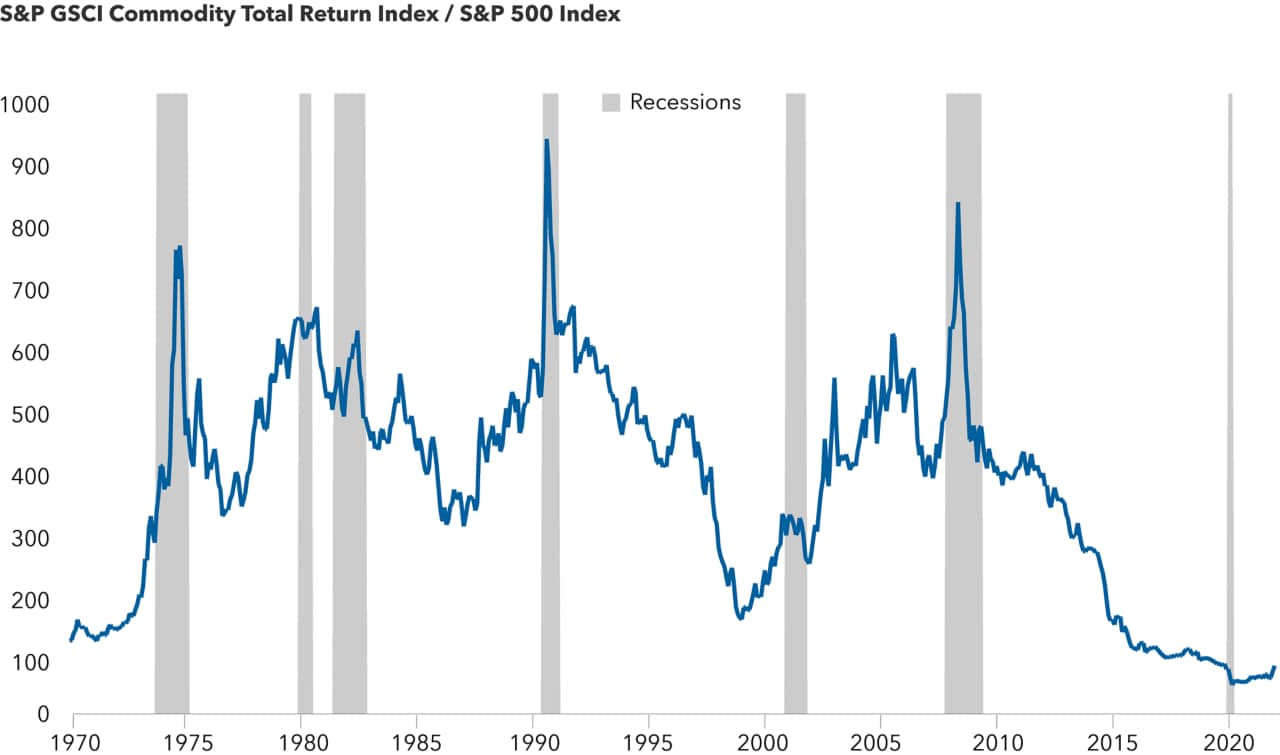

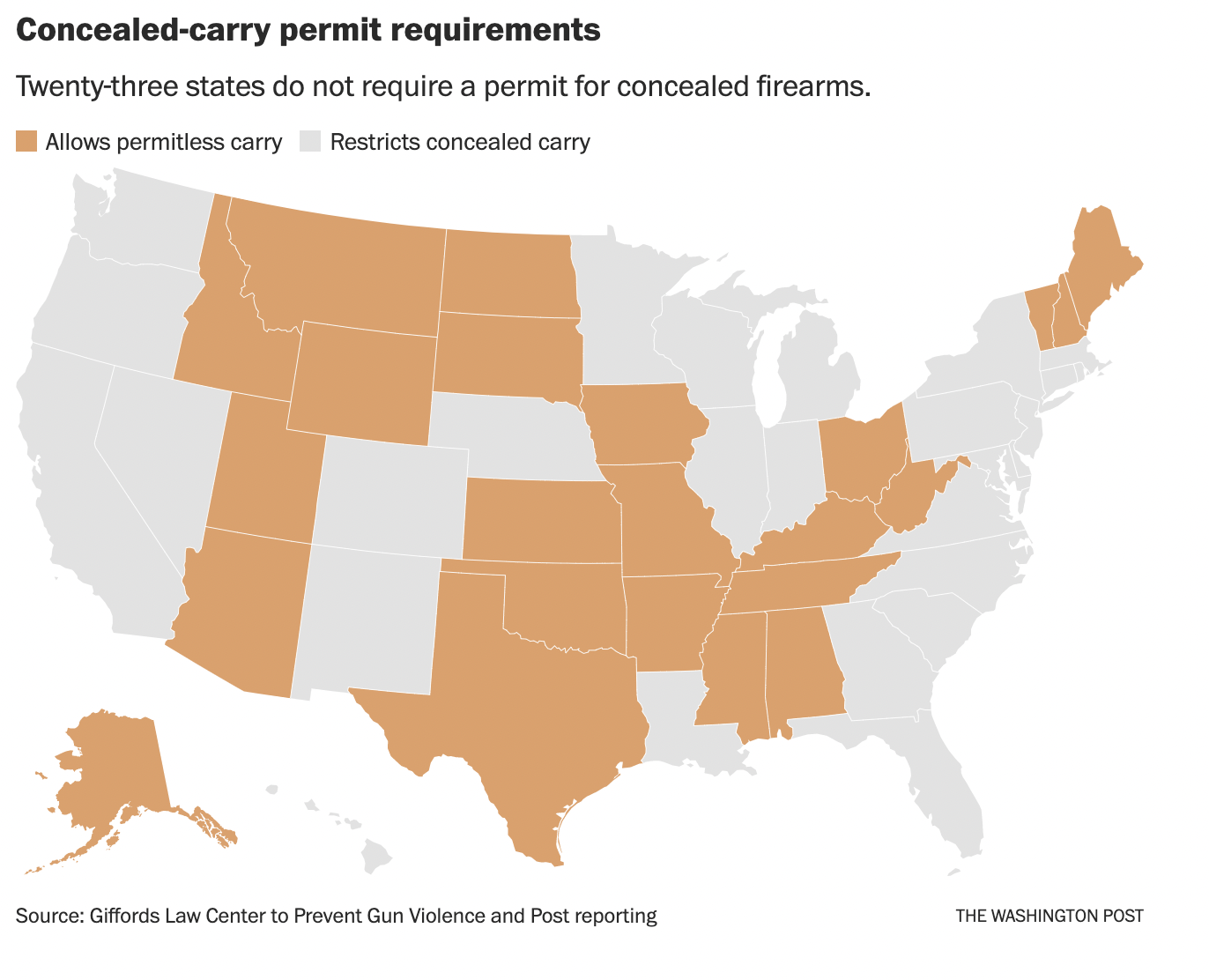

8. Nearly half the country requires no permit to carry a concealed weapon — and it’s a growing trend

Source: Washington Post From Barry Ritholtz Blog https://ritholtz.com/2022/03/sunday-reads-266/

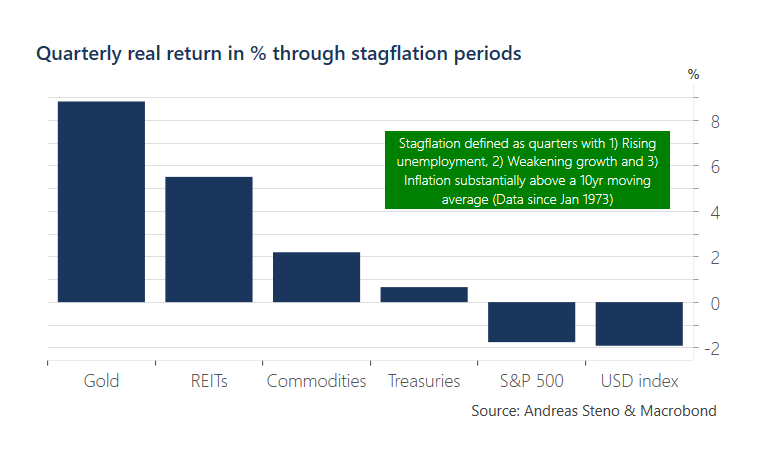

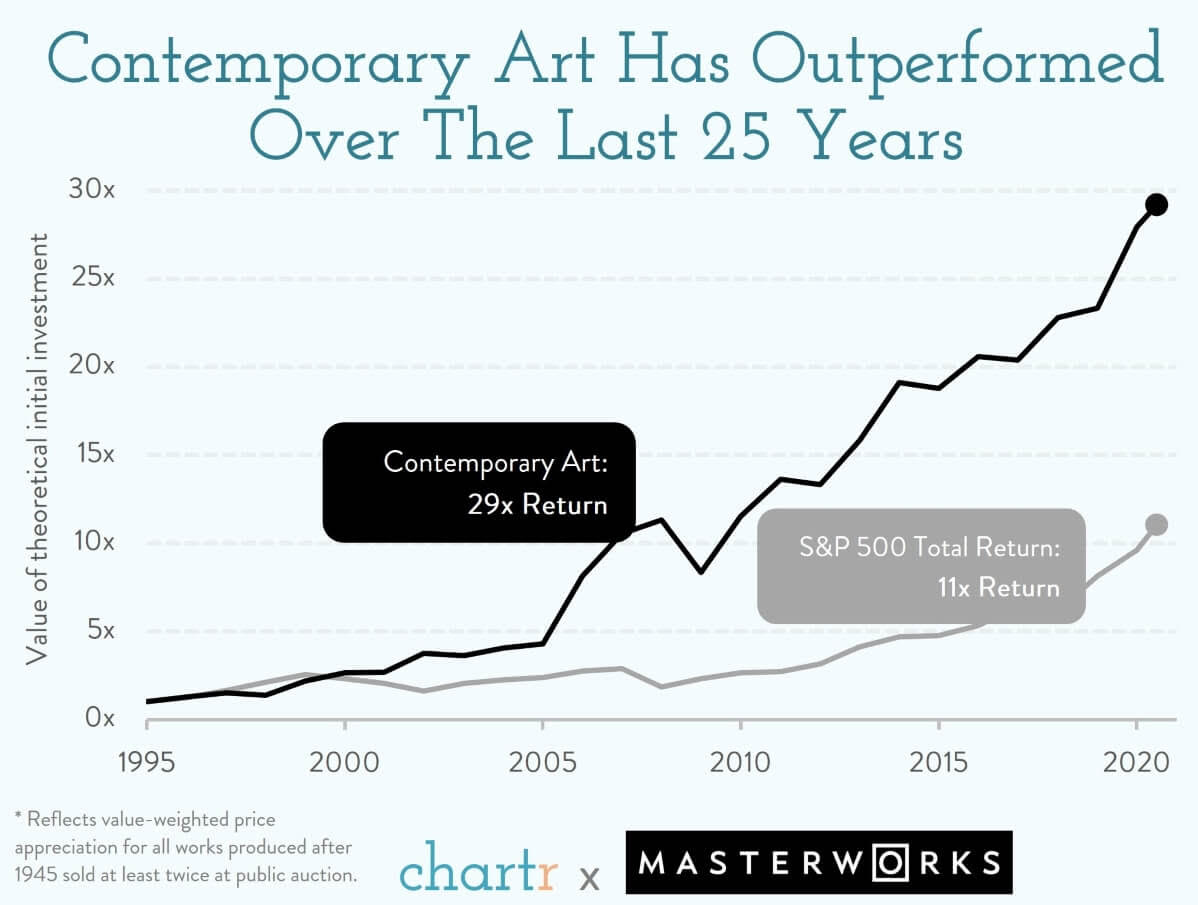

9. Contemporary Art Has Outperformed Stocks for 25 Years

| In the 993 days since starting this newsletter, we’ve seen thousands of charts about investing. But few struck us like this one above.

When you see numbers like this, it’s easy to see why billionaires and hedge fund managers battle for paintings in auction houses across the globe.

Going once, going twice…

The heavyweights might duke it out for $100 million+ pieces, but you can harness the compounding magic of art with Masterworks for much less. This revolutionary platform lets you invest in art by legends like Picasso, Warhol, and Rothko—even if your last name isn’t Bezos.

Here’s their track record since 2019:

- George Condo’s “Staring into Space”: +31.7% net IRR (2020-22)

- Banksy’s “Mona Lisa”: +32% net IRR (2019-20)

- Albert Oehlen’s “Doppelbild”: +33.8% net IRR (2020-21)

No wonder JP Morgan called art a “powerful financial asset.” With over 375,000 investors already signed up, demand is high — but Chartr Subscribers skip the waitlist.* |

www.chartr.com

10. How to Become Truly Confident

By Jordan Harbinger | October 13, 2020 | 4

Confidence is one of those game-changing qualities—like rapport, empathy and courage—that is both incredibly valuable and highly elusive. As soon as we “try” to be confident, we’ve already failed. As soon as we “act” more confident, we’re already pretending. Telling someone to “be more confident” is like telling someone to be taller. That’d be nice, but how?

The answer to that question requires a new approach to confidence—one that goes beyond the “fake it till you make it!” mentality, and moves toward something more authentic, more grounded and more holistic.

We need to get clear on what true confidence really looks like, so we can understand how it works, how to cultivate it and how to rediscover it when it wanes.

Most importantly, we need to approach confidence not as a fixed quality to be attained, but as a dynamic process to be engaged in throughout our lives—a process my team and I have been developing for more than 15 years, most recently through our live-training company, Six-Minute Networking.

So let’s start at the beginning and get a good handle on what confidence really is.

What Is Confidence, Exactly?

We might not always have a firm grasp of textbook confidence, but we know it when we see it. We know it because we feel it, and we know what it feels like to be around it. Which is one reason the definition of confidence can be so hard to pin down. Confidence is really an experience—both of ourselves and of other people.

We also know when we don’t feel it. In the presence of an insecure person—or, even more telling, a person pretending to be confident—we not only notice their lack of confidence, but also their shaky attempts to compensate for it.

Interestingly, when we’re in the company of an unconfident person, we often tend to feel unconfident ourselves. We struggle to organically connect, we begin second-guessing our words and choices, and we notice ourselves feeling uneasy, uncertain and unengaged.

Which is pretty fascinating if you think about it.

Confidence—and a lack of it—is one of those rare characteristics that is infectious. Lead with true confidence, and you’ll inspire it in other people. Betray a lack of confidence, however, and you’ll expose a similar lack in them. If you’ve ever spent time with a confident stranger at a cocktail party, or tried to bond with an insecure manager in a job interview, then you know how radically different these two qualities can make you feel.

But as we know, confidence is also a quality that can be affected, projected or faked. Deep insecurity can masquerade as confidence, as we often see with embattled politicians and troubled CEOs, struggling loved ones and nervous first dates. And experts continue to tell us that confidence can be “hacked,” “acquired” and “learned” if we just commit to talking, acting or looking a certain way.

Our confidence can also appear quite strong, only to crumble in the face of struggle, criticism or failure. In those moments, it seems like confidence is nothing more than a fleeting feeling, a passing belief in our own power, a temporary reprieve between periods of self-doubt.

So what is true confidence, really?

To put it simply, true confidence is a feeling of self-assurance that is grounded in an authentic experience of our own ability, perspective and sufficiency.

It’s a stable connection to the fact that we can do what we want to do, feel how we want to feel, and be who we want to be in this world.

It’s also a sense that we are enough—that we aren’t lacking in some fundamental sense that prevents us from navigating the world in a healthy, positive, productive way.

All of which, of course, are qualities we aspire to have. Confidence is an integral part of human psychology. With it, we feel engaged, purposeful, inspired. Without it, we feel rudderless, wary, fearful. Consciously or unconsciously, we know how important confidence really is.

Still, you probably know relatively unconfident people who manage to get ahead in life. You might believe that your own confidence is secondary to the quality of your work, your relationships and your overall personality. You might even suspect that confidence isn’t a quality to be trusted, given that it can be affected, inherited or “turned on” at a moment’s notice.

So it’s worth asking…

Why Does Confidence Matter?

It’s an excellent question. And while it might seem painfully obvious to those who are already interested in working at it, confidence actually does matter—for four key reasons.

1. Confidence is an amplifier of quality and success.

Contrary to the view of many self-help experts, confidence is not a proxy for quality, depth or character. It should not be an end in and of itself, and it will never compensate for good old-fashioned hard work. Even the most confident people need to be confident about something—themselves, their work, their identities—and confidence divorced from content will always fall apart sooner or later.

Instead, we think about true confidence as an essential part of our character and work.

It’s a layer to everything we do, say and put out into the world, from our work to our relationships, our opinions to our decisions. Confidence acts as fuel on the fire of whatever we touch. We still need a good fire—we will always need to do the work—but without the fuel, the fire can only grow so large. Look at any massive and consistent success—from Jay-Z to the iPad, Honey Nut Cheerios to Tesla, Michael Jordan to Walmart—and you’ll find a sense of confidence at its core.

Interestingly, many high performers resist this view of confidence. They believe that if their work is strong enough, if their skills are advanced enough, or if their personalities are likable enough, they won’t need confidence. They believe, in other words, that their strengths will speak for themselves. Which is true, of course. The question is: how well?

Ironically, it’s some of the most talented people in the world who dismiss the importance of confidence. In my experience—based on hundreds of interviews with top performers and years of coaching clients, corporations and the military—it’s precisely their talent that makes them so skeptical. How impressive would their work really be if it depended on something as vague as self-assurance? How would they feel about their talent if their success ultimately depended on personality?

These are worrying questions for people who have been trained their whole lives to value their skills and performance above all else.

But it’s not the case that these people completely lack confidence. What they have is contextual confidence. Within the narrow context of their specialty or world—coding, writing, statistical analysis, business development, team meetings—they actually do enjoy a certain degree of confidence. It’s a critical type of confidence that comes with time, dedication and expertise.

Outside of that context, however, they waver. They don’t have the kind of generalized confidence that infuses everything they do, in and around their work: the way they present their deliverables, the way they engage with different types of colleagues and partners, the way they navigate their careers in the bigger picture, and so on.

That lack of generalized confidence tends to make them double down on the areas in which they do feel confident. And so they remain in their secure confidence bubbles, focusing on the silos and tasks and roles where they feel most competent, which guarantees that they won’t tackle new skills and situations that would expose their lack of generalized confidence.

Nate, an immensely talented network architect at a cloud security company, recently attended our live training program. After years of exceptional work with little recognition and no major promotions, he decided it was finally time to seek some additional help.

Once he completed the training on relationship building, self-analysis and practical exercises, he told me why he had been dreading the process so much. He knew, subconsciously, that he had a profound weakness in his general confidence and that the better he became in his technical role, the less he wanted to work through any perceived deficiencies in his personality.

But the transformation was worth it. He entered the program as a quiet, self-effacing, generally avoidant personality with a gift for engineering. He left the program as an excited, gregarious, curious personality with a demonstrable passion for it.

A few months later, I received an email from Nate with a life update. After six weeks back at the office, his managers began visibly responding to his work in team meetings. Though it was always strong, they suddenly seemed to take notice of his contributions—no doubt because of the way he was now presenting it. Soon after, his colleagues also mentioned a change—not just in his technical role, but in his personal style, his excitement and his approachability. He was promoted to manager of his team ahead of a major rollout, which also helped secure two other job offers from competing companies.

As if by magic, Nate’s professional life had completely turned around. But it wasn’t magic. Just a couple months earlier, he had plateaued professionally by focusing exclusively on his deliverables. The moment he began working on himself, he created the exciting opportunities he always wanted. He had invested in confidence, which amplified his excellent work.

Stories like Nate’s are a reminder that confidence can be consciously cultivated. More importantly, they’re evidence that confidence matters. And it matters most when it’s developed in conjunction with hard work and meaningful substance.

Whether we like it or not, the quality of our work alone will never get us where we want to go. But when that quality links up with true confidence, our work takes on a new caliber and begins to resonate with people in a much more powerful way.

2. Confidence is essential to influence and leadership.

As we just saw, the success of our professional lives depends on both what we do and how we do it.

What we do is a matter of technical skill. How we do it is a function of confidence.

One of the most important aspects of that how is our degree of influence and the quality of our leadership. The impact we have on our work products, the control we exert in our organizations and the influence we have on our partners all require true confidence. These confidence-based skills are what separate technicians from managers, employees from leaders, and artisans from artists.

Selby, a producer at a major radio station, recently came to our program to work specifically on these skills. As she told us on her first day, she was a deeply shy person who was remarkable at her job. She spent her days booking celebrity guests, only to experience crippling anxiety when they arrived at the station. She loved her colleagues, but was devastated to learn that they regularly farmed out work to her knowing that she was incapable of saying no. And she hadn’t risen up through the ranks of the station, despite four years of consistently great work behind the scenes.

After graduating from the program, Selby went back to work. She continued the exercises we gave her and used them to improve her interactions with the high-profile people she met. With a handle on her fear of setting boundaries, she began telling her colleagues what she would and wouldn’t do and watched as the station’s productivity skyrocketed. As a result of these (and many other) tools and mindsets, she was promoted to manager of the entire station six months later. A year after that, she was given her own show.

The difference in Selby’s performance was not a function of talent or discipline. She didn’t become smarter, more skilled or more committed. She became connected to her confidence. And that confidence opened a window into a suite of skills—from delegation to politics, leadership to conversational banter—that had eluded her for years.

3. Confidence isn’t just about style. It’s also about substance.

Selby’s story is also a reminder that confidence and substance are intimately connected. While a lack of confidence in a typical person is always challenging, a lack of confidence in a truly capable person can be crippling.

Why?

Because an incongruence between the quality of your work and your level of confidence can actually amplify the deficiency.

Your work might perform well, but by succeeding, it will end up highlighting your insecurity even further. At the same time, your partners and colleagues will expect a degree of confidence that reflects how strong your work is and will be all the more disappointed when they find it missing.

Once people sense that gap, they’ll often begin to doubt whether the work is as strong as it first seemed. That, in turn, can make you doubt your judgment about your own work, creating a dangerous feedback loop. Insecurity will give rise to new feelings of doubt, fear and confusion, which will eventually creep into your choices. Your strong contextual confidence will begin to erode, and your weaker generalized confidence will start to infect it.

So these two types of confidence are actually closely related. As much as we want to believe otherwise, we can’t succeed without having both types of confidence, which are essential to creating and capitalizing on your work.

4. Confidence protects us.

In an increasingly complex and competitive world, confidence is one of the greatest weapons we can develop. At the same time, a lack of confidence is also one of our greatest vulnerabilities because it broadcasts to the world how susceptible we really are.

As we’re about to explore in more depth, confidence manifests in a number of highly visible ways: our body language, vocal tonality, verbal cues and micro-decisions. No matter how hard we try, we can’t really hide how we feel about ourselves. We broadcast our weaknesses wherever we go.

We wear our lack of confidence like a badge, and that badge unconsciously tells the world how to treat us.

Unfortunately, there will always be a segment of the population ready to capitalize on those weaknesses. In some cases, that vulnerability will invite trouble in relatively minor ways: a shifty cab driver offering us a ride off the meter, a gifted insurance salesman upselling us to a higher premium, a narcissistic friend dominating our time and energy. In other cases, that weakness will get us into deeper trouble: a predatory lender locking us into a dangerous loan, a manipulative family member controlling our happiness and resources, a power-hungry manager exploiting us in the workplace. Of course, the possibilities can get even more troubling.

If you take a moment to think back, you can probably remember a time you were taken advantage of in a moment of low confidence. That wasn’t an accident. It was your degree of confidence at the time that exposed you to that situation, and it was your relationship to your confidence that determined how well you handled it.

The outcome of that experience might have taught you a lesson and increased your confidence in the future. Or it might have confirmed what you subconsciously believe about yourself and left you vulnerable to a similar scenario down the road.

So in addition to enhancing our work and character, confidence also helps protect us, physically and emotionally. That’s why working on it matters so much. We aren’t just talking about style and appearances. We’re talking fundamentally about who we are, how we present ourselves in the world, and how the world will treat us in return.

Now that we have a handle on why confidence matters, let’s explore some practical principles and techniques for achieving it.

How Do I Become More Confident?

As we’ve discussed, confidence is a tough quality to pin down. Because it’s more of a dynamic experience than a static trait, it can be a difficult concept to teach.

In our experience, the best way to build confidence is to isolate the elements that comprise it—the behaviors, characteristics and mindsets that create true self-assurance. Then, we can put those pieces together in a way that creates true, lasting, generalized confidence.

Starting with…

1. Nonverbal communication.

As we just touched upon, confidence is expressed most profoundly through our bodies. No matter how well we speak, the way we feel about ourselves will always manifest in our posture, our gait, our hand movements and our facial features.

And because these cues are nonverbal—bypassing the more intellectual language centers in our brains—other people pick up on them viscerally and quickly. They receive a vivid snapshot of our inner confidence the moment we walk into a room.

If we enter a room standing up straight with our shoulders back, chins up and eyes engaged, then others will viscerally perceive us as confident. If we enter with our shoulders hunched, brows furrowed, and eyes shifty or staring at the floor, then they’ll viscerally perceive us as unconfident (if they notice us at all). And they make this judgment in microseconds—just as we do of them.

That’s why body language is such an important part of strong first impressions. We have to remember that people’s impressions are made when they see us, not when we first interact with them. Since we can’t control when that happens, we can’t just turn our confidence on when we think we need it. We need to internalize and embody it at every moment, so it becomes part of our observable presence wherever we go.

To do that, we recommend the doorway drill, a simple technique that will force you to check your body language whenever you walk through a door. The exercise is simple: Every time you approach a doorway, take a moment to stand up straight, pull your shoulders back, uncross your arms, and look up and ahead. These are the signals of positive body language, and they both reflect and reinforce confidence.

To help form that habit, we often tell our students to place post-it notes at eye level in their doorways at home and in the office. Every time they see a post-it, they remember that it’s a reminder to check their body language. After a week or two, the post-its become unnecessary. The visual cue creates a habit that lives in their bodies, and they automatically begin checking their body language whenever they walk through any doorway out in the world.

While body language might seem superficial—it is, after all, about how confidence appears on the “outside”—it’s actually very profound. Because while confidence informs body language, body language also has a powerful effect on building confidence. If we carry ourselves confidently, we teach our bodies to experience confidence. And the more confident we become, the more we reinforce the behavior to carry ourselves that way out in the world.

This is one of the beauties of body language work: Addressing the symptoms of confidence can actually influence the causes of it.

So commit to strong, positive body language and make a conscious effort to form habits that make your nonverbal communication automatic. Notice the body language that signals confidence in people you meet and consider internalizing those choices in yourself.

Most importantly, notice how your nonverbal communication changes the way you feel in social situations and how it changes the way other people feel about you. You’d be amazed how much of confidence depends on the things we don’t say.

2. Vocal tonality.

After body language, our voice is the most powerful organ of our confidence. Vocal tonality—which includes not just the physical quality of our voice, but our pitch, articulation, syntax, volume and intention—expresses and reinforces our innermost sense of self.

Vocal tonality is notoriously difficult to teach in an article, but we can touch on some key techniques for improving this dimension of confidence so that we can use it to enhance our self-assurance.

Speak in statements, not questions.

While you’re probably no stranger to the high rising terminal—also known as “upspeak,” or the tendency to end sentences with a rising pitch intonation, as if asking a question—you might not know how much of a role intonation plays in our confidence, both perceived and actual.

When we express statements as questions (“Hi, my name is Steven?”; “I’m applying for the content manager role in marketing?”; “I’ve been working here three years?”), we subtly communicate the doubt, uncertainty and informational disparity implied by a question. As a growing body of research now shows, upspeak can significantly diminish our hireability, compromise our chances for promotion, and affect the way people perceive our power and authority—which is unfortunate, since many of us adopt it out of politeness and a desire to be understood.

One of the best ways to smooth out the high rising terminal is to do a simple visualization exercise. Imagine a sentence as a hill, rising from the earth, peaking and then sloping back down. When we engage in upspeak, we stop at the top of that hill, leaving ourselves and the audience in a subtle state of uncertainty. As you speak, impose the image of the hill on your sentence and commit to coming back down the other side of the slope. That will help your audience rest in the declarative finish that communicates confidence and further increase your confidence the more you speak.

Articulate and enunciate.

The way we treat our words—literally, as they form in our mouth—is a signal and a function of confidence. To increase our confidence in conversation, we should also commit to articulating and enunciating our words more emphatically. When we do, we communicate confidence to the people around us. We also teach our bodies to become more confident the more we speak.

A helpful exercise here is to take a champagne cork (which is larger than a standard cork), place it in your mouth, and read a passage from a book with strong dramatic flair. Because you’ll be forced to work overtime as the cork resists your efforts, your mouth will become super articulate. On an emotional level, enunciating strongly will force you to commit to your words—to take them more seriously—which is, of course, a hallmark of confidence.

Avoid the use of filler words.

Filler words such as “like,” “um” and “so” also play a major role in confidence. And while we don’t believe you need to remove them entirely in order to be taken seriously—these words can actually make your speech friendlier, more colloquial and more organic if used properly—filler words tend to undermine our authority when they become a crutch.

In many cases, we use filler words to patch silences in conversation. (“So… yeah, I mean, what do think about the new, uh… the new project?”) We often do this because we’re subconsciously afraid that if we hand the reins over to the person we’re speaking with, we’ll lose control of the conversation or be responsible for any gaps. But as we know, confidence means trusting that our words and presence are enough to be compelling. It also means trusting that the other person can and should help carry a conversation. When we remove these types of filler words in conversation, we stop subtly buttressing our unconfident speech, and we signal to the other person that we trust in their confidence, too.

Of course, we also use filler words to qualify our speech. (“Well, I just feel that, like, there’s a better way to, you know, present this, uh, deliverable, so…”) Sometimes we do this strategically, but more often we do this subconsciously, which has a similar effect on our confidence—and the way people perceive it—as upspeak does. In a professional setting, filler words can have major implications in team meetings, salary negotiations and conflict resolution.

A helpful exercise to weed out filler words is to record yourself in conversation. You can use the voice memo app on your phone (or any old-school recording device) to record a meeting or your side of a conversation on the phone. Listen to the recording for a few minutes every day for a week and notice how often filler words creep into your everyday speech.

I then recommend going a step further and exporting the file to an audio editor (Audacity is an excellent free app) and editing out all of the filler words that pop up. While it might seem a bit obsessive, it’s actually one of the greatest ways to analyze your speech. I only noticed my own dependence on filler words after spending hours editing out the “ums” and “so’s” on my podcast, The Jordan Harbinger Show. Once I realized how much of a crutch these words had become, I caught myself before I used them and found my confidence growing exponentially.

With body language and vocal tonality under our belts, let’s turn now to the more profound psychological underpinnings of confidence.

3. Authentic vulnerability.

As much as experts argue that confidence can be affected, that kind of superficial confidence—built on acquired body language, forced vocal tonality, rehearsed social scripts, and so on—will never create true confidence because it will never be authentic.

Authenticity, at its core, is the quality of being fully yourself. Being authentic means being emotionally honest, clear about your experience of the world and free of pretense. It means responding organically to every moment of life—the positive and the negative—and not feeling the need to unnecessarily “pretend” about your feelings, beliefs or experiences in any way.

In everyday language, we call this quality being “real.” And when we meet someone “real,” we feel that we’re in the presence of something exceptional. The reason, of course, is that we’re in the presence of true confidence. We feel that we’re meeting ourselves—that is, our best selves.

Authenticity transforms normal insecurity into grounded confidence. While faked confidence hides insecurity, weakness and self-doubt, true authenticity owns and acknowledges these less pleasant experiences in a way that ultimately enhances our sense of self.

It’s a strange paradox. It’s also a very useful one.

But to acknowledge these parts of ourselves requires more than just authenticity. It requires vulnerability. It requires us to open up and be exposed—to be seen—as the people we really are.

When authenticity and vulnerability link up—when we become organically and honestly open to sharing our true experiences, even when those experiences make us seem insecure—they actually create true confidence.

Why?

In short, because honesty and openness are the raw stuff of true confidence.

By allowing people to see who we really are, we stop offering a proxy version of ourselves to hide the aspects of our personalities we’d rather not show. And by embracing who we really are, we also relinquish control over how other people might perceive us—which, if you think about it, is a classic hallmark of insecurity.

In other words, we don’t become confident by never feeling insecure. We become confident by dropping the need to hide our insecurity in the first place.

It took me years to realize that we don’t need to always feel confident to be confident. And we don’t need to act confident to appear confident. All we need to do is respond authentically to our experiences, and share those experiences—in the appropriate amounts, in appropriate ways, in appropriate contexts—even (and, ironically enough, especially!) when they reveal our lack of confidence. Despite what we’ve been told, vulnerability isn’t weakness—it’s true strength.

This is a principle that the world’s greatest athletes, most successful entrepreneurs and most prolific artists understand: the alchemical power of authentic vulnerability. As Kobe Bryant famously said, “I have self-doubt. I have insecurity. I have fear of failure … We all have self-doubt. You don’t deny it, but you also don’t capitulate to it. You embrace it.”

By embracing it, Bryant managed to authentically acknowledge and vulnerably admit to his insecurity, self-doubt and fear of failure, which only enhanced his grounded sense of self.

That possibility is open to every single one of us.

A few weeks ago, I was invited to a dinner party for a bunch of broadcasters and media folks. The room was filled with smart, talented, ambitious people, and none of us knew one another. At dinner, I was seated next to a quiet guy who didn’t say much at first. As we often do in these cases, I assumed that he either wasn’t very friendly or was struggling with his social confidence. After a few minutes of conversation, however, he said something that took me by surprise.

“I’m kind of nervous to be around all these new people,” he confessed with a shy smile. “I’m used to producing my show alone in my house, and I really didn’t feel like going out tonight, but I forced myself to come and make some new friends.”

In an instant, my entire perception of this person had changed.

He was still exhibiting the same unconfident behaviors, but by unabashedly owning and sharing them, he shifted my perception from “unfriendly” to “human,” from “nervously unconfident” to “authentically vulnerable.” What he did, really, was offer me a window into his experience, and that experience was deeply honest.

That gave me permission to tell him that that I was a little overwhelmed, too, and just like that, we were bonding over our shared experience of the evening. He ended up being my favorite person at that dinner party, and we’re still good friends to this day.

So as you move through your life, make a conscious effort to commit to authentic vulnerability. At the same time, avoid the trap of inauthentic vulnerability—such as oversharing, strategic revelations and inappropriately personal stories—which are really just another way of simulating confidence.

Notice what this mindset does to your sense of self. Notice how confidence and insecurity are totally compatible, as long as you drop the impulse to self-protect.

Most importantly, notice that you cannot be confident without acknowledging your true experience moment to moment. That is a profound inner shift that goes deeper than superficial behaviors. It’s precisely the raw stuff of trust, rapport and relationship building—key skills that thrive on authentic confidence.

4. A process-oriented mindset.

By now you might have noticed an underlying theme in our approach to confidence.

Whereas popular self-help usually treats confidence as a static, goal-oriented, binary quality—basically, you either have it or you don’t—true confidence is, in fact, a process. It ebbs and flows. It accelerates and decelerates. It takes hits and has to recover. And it’s always evolving over the course of our lives as we take on new situations, challenges and goals.

Thinking about confidence as a process, rather than an end in and of itself, opens us up to a much healthier relationship to our own self-esteem.

We no longer believe that we must be confident one hundred percent of the time in order to be effective. We stop beating ourselves up for having moments of confusion, insecurity or self-doubt, which are perfectly normal parts of a healthy ego. And we don’t buy into the notion that if we just look or act or behave a certain way, confidence will magically appear.

Most importantly, we avoid falling into the trap of thinking we can develop “unshakable confidence.”

Unshakable confidence is a myth, and when you see it, you can bet that there’s some insecurity being protected beneath the surface. Confidence that can be shaken isn’t insecurity or weakness; it’s a sign that you can work through setbacks, criticism and growth. Which, if you think about it, is the whole point of having confidence in the first place!

Process-oriented confidence is the opposite of the “fake it till you make it” philosophy.

While the “fake it till you make it” approach suggests we should pretend our way toward true confidence, the process-oriented approach suggests we should become our way toward true confidence.

And while “faking it” does play a small role in confidence—for example, inviting confidence into your body using the nonverbal communication and vocal tonality exercises we mentioned earlier—it will never build true confidence. One way or another, simulating confidence will always create new problems.

It’s worth discussing a few of the most common, so we understand the risks of inauthentic confidence.

For one thing, faking it till we make it creates an inauthentic self—the supposedly “confident” person— which creates a division between the person you really are and the person you’re pretending to be. At best, we become two insecure people: the true self desperate for confidence, and the false self grasping at confidence in order to hide the true self.

As a result, that false self creates new feelings of fraudulence and self-doubt that will, sooner or later, betray you when you need your confidence the most. (This, in a nutshell, is impostor syndrome.) Eventually, one of two things will happen. Either your false self will break down, revealing the unaddressed insecurities lurking beneath. Or it will grow stronger and stronger, moving you further and further away from a healthy and secure sense of self.

The entire act of faking confidence will also become exhausting, confusing and alienating, as keeping up appearances becomes your primary objective. The fear of being exposed as less than confident will only grow. That in turn will make you double down on faking it in order to protect the false self, which will further increase the cost of being exposed—a truly vicious cycle.

For all these reasons, we at Six-Minute Networking don’t advocate for the “fake it till you make it” approach. Instead of acquiring confidence by building a new self, we prefer to work with our students to develop confidence by being their true selves. We then give them exercises, principles and mindsets that help them develop more and more authentic confidence. Anything else is a short-term fix, an unreliable hack and a recipe for even deeper insecurity.

A process-oriented approach means letting go of the impulse to pretend that we’re confident when we’re not. It also means accepting that our confidence will take hits from time to time. If we authentically acknowledge when our confidence takes a hit, then we put ourselves in a position to rediscover it—not by faking our way back into confidence, but by doing the work required to rebuild it. In practical terms, that means putting time into our craft, investing in new skills, repairing relationships, sticking with difficult goals, and—most importantly—being patient as our confidence steadily evolves.

That’s the stuff of true and authentic confidence. That’s how we can work on confidence without compromising our identities and values. That’s how we survive when our confidence takes a hit, and how we can actually enhance our self-assurance when we struggle. That’s how we become truly confident, by committing to the life-changing process of simply being ourselves.

https://www.success.com/the-art-of-true-confidence/

Articles

Jordan Harbinger hosts The Jordan Harbinger Show, where he deconstructs the playbooks of the most successful people on earth and shares their strategies, perspectives and insights with the rest of us. He’s also the co-founder of Six-Minute Networking, a training company that offers workshops on nonverbal communication, persuasion and influence to corporate and military organizations.