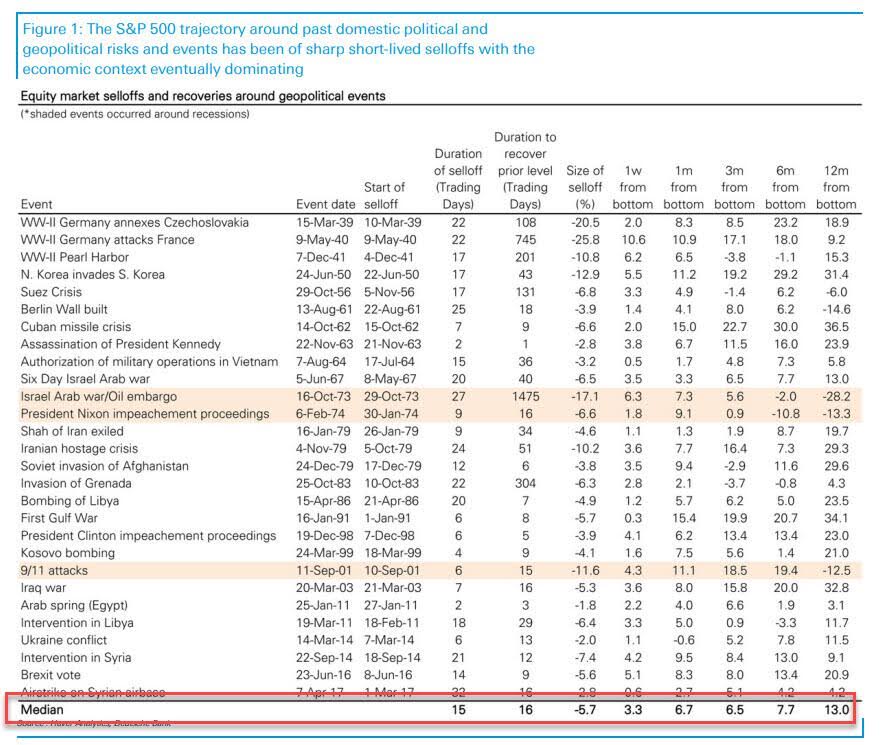

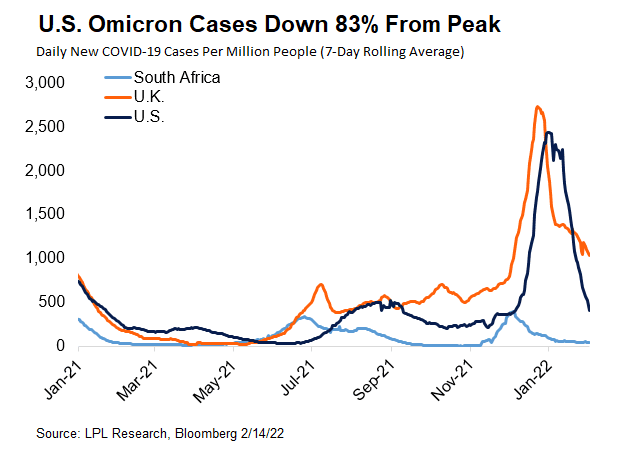

1. Political and Geopolitical Events Impact on S&P 500

Zerohedge

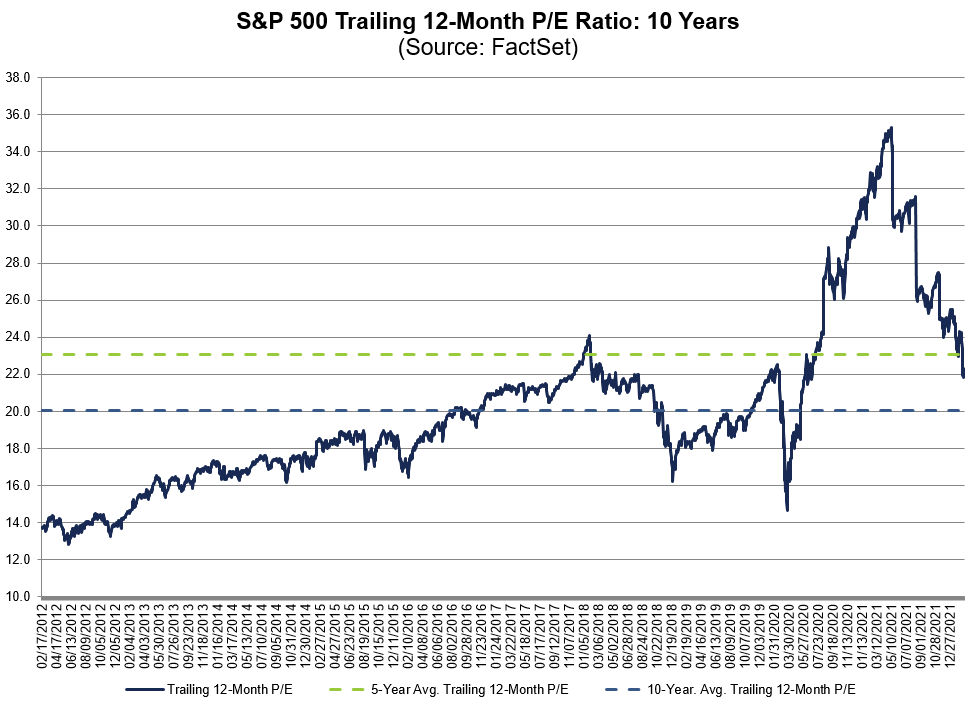

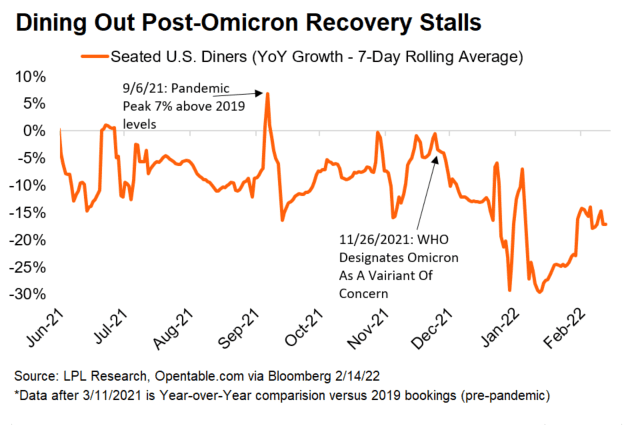

2. Updated Trailing and Forward Price to Earnings Ratios

FactSet

The trailing 12-month P/E ratio for $SPX of 21.8 is below the 5-year average (23.1) and above the 10-year average (20.0). https://bit.ly/3sQM7aR

The forward 12-month P/E ratio for $SPX of 19.2 is above the 5-year average (18.6) and the 10-year average (16.7). https://bit.ly/3sQM7aR

https://twitter.com/FactSet

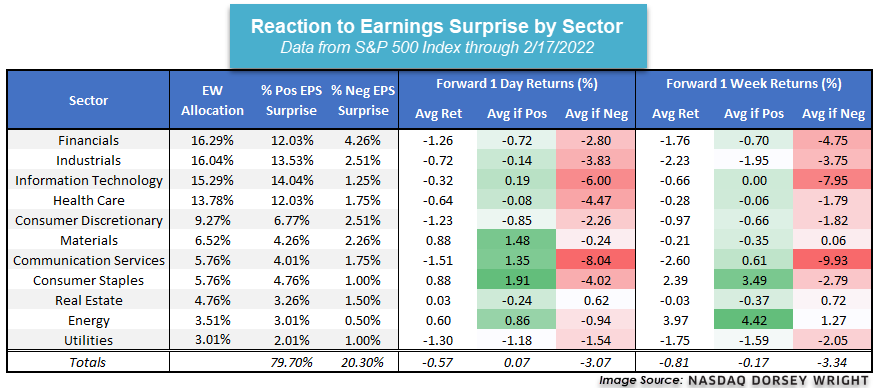

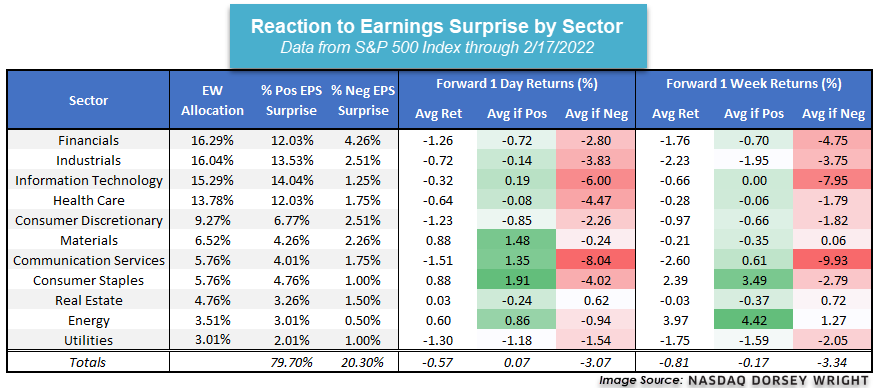

3. Reaction to Earnings Surprise by Sector Thru Friday

Nasdaq Dorsey Wright https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

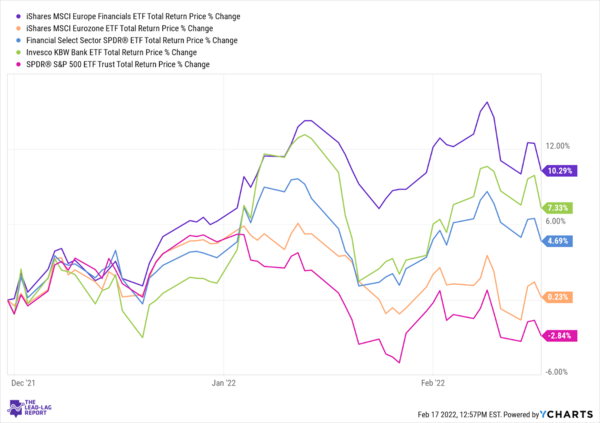

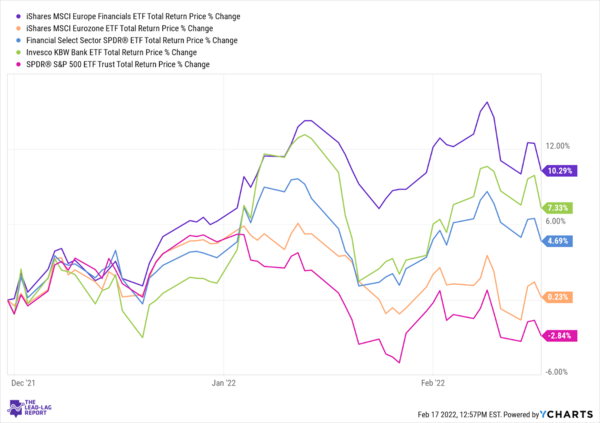

4. European Financials Outperforming

Michael Gayed Lead Lag Report ….Banks in U.S. have Outperformed since last year….Euro financials also adding sizeable alpha this year

https://www.leadlagreport.com/

EUFN Ishares Euro Financials close to breaking out of 11 year sideways move

www.stockcharts.com

5. Russia Stock ETF -30% Correction from Highs.

Russian ETF Hit $14 during Covid then rallied to $33 as energy prices rose…$23 last

www.stockcharts.com

6. Top 10 Companies with Exposure to Russia/Ukraine

The Daily Shot Blog

7. Emerging Markets After Sucking Wind for Years…Start 2022 Beating U.S. Stocks and Bonds.

LPL Research-Asset Class Returns Thru Friday

https://lplresearch.com/2022/02/18/weekly-market-performance-the-fed-and-ukraine-influence-this-weeks-markets/

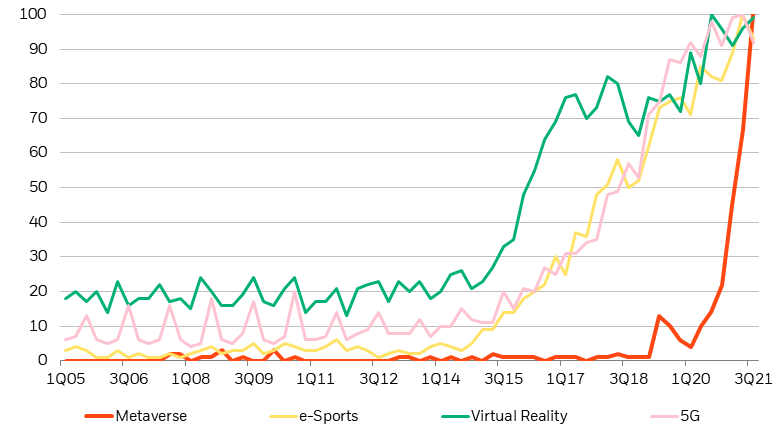

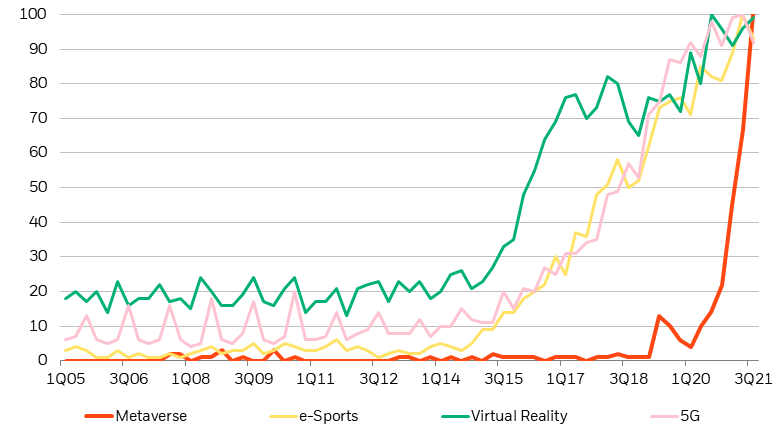

8. Metaverse Jump in Mentions on Corporate Transcripts

Blackrock Blog-A giant leap into the metaverse

Momentum of ‘metaverse’ mentions in company transcripts vs. other themes

Reid Menge https://www.blackrock.com/us/individual/insights/metaverse-investing-in-the-future

9. The Economics of Food Delivery

CHARTR -Indeed, many of the restaurants on aggregator platforms may actually be losing money (70c) on an average order. Drivers are making ~$9 per order including tip before considering their own expenses, and the platforms are generally squeezing out just a 3-4% contribution margin.

Some of these numbers come from the National Restaurant Association and may tell a slightly different story to DoorDash’s own analysis, but the fact remains that despite ~10 years of rapid growth, food delivery profits are hard to find. Add to the mix the new and fiercely competitive ultra-fast grocery delivery market, and things get even murkier still.

Please sir, I want some more

With trends like larger average orders, more users to optimize multi-order trips, better technology, more in-app advertising and higher market concentration, these numbers are going to keep evolving — but how any improvement in economics is shared between stakeholders remains to be seen.

If there’s a local spot you’d like to support (it is Friday after all), your best bet is probably still to go to the restaurant direct.

Move fast and break even

US delivery behemoth DoorDash reported their full year 2021 results on Wednesday, shaking off some doubts that food delivery demand would slow amidst re-opening with 369 million orders coming through the platform in the final quarter of last year.

That number was ahead of expectations, and sent DoorDash’s share price higher, but it still wasn’t enough for the company to make a net profit, instead notching a $155m loss.

That’s not a surprise to anyone familiar with the industry. Some great research from our friends at McKinsey suggests the economics of food delivery are still challenging for everyone involved – delivery companies, drivers and restaurants.

www.chartr.com

10. 34 Things You Need to Give Up to Be Successful

INC…BY BENJAMIN HARDY, PH.D., CONTRIBUTOR, INC.COM@BENJAMINPHARDY

1. Wasting five minutes.

When you have five minutes of down time, how do you spend that time? Most people use it as an excuse to rest or laze.

By lazing for five five-minute breaks each day, we waste 25 minutes daily. That’s 9,125 minutes per year (25 X 365). Sadly, my guess is we’re wasting far more time than that.

I was once told by my ninth-grade English teacher that if I read every time I had a break?–?even if the break was just for a minute or two?–?that I’d get a lot more reading done than expected. She was right. Every time I finished my work early, or had a spare moment, I’d pick up a book and read.

How 4 Top Performers Maintain Their Mental and Physical Wellbeing How we spend our periodic five-minute breaks is a determining factor in what we achieve in our lives. Every little bit adds up.Why can we justify wasting so much time?

2. Not valuing one dollar.

I was recently in Wal-Mart with my mother-in-law buying a few groceries. While we were in the check-out line, I pointed an item out to her I thought was interesting (I honestly can’t remember what it was anymore).

What stuck out to me is that she said, “One dollar. That’s a lot of money!”

Why this surprised me is that my in-laws are not short of money. Actually, this happened while we were on a family trip (30-plus people) at Disney World?–?the whole thing being paid for by them.

Understanding the value of one dollar is the same as coming to appreciate the value of time. To thoughtlessly spend one dollar may not seem like a big deal, but it actually is. That frivolous spending compounded over a long enough time could be millions. It also reflects a lack of care about the details, which is where the true art and value lies.

Additionally, most millionaires are self-made, 80 percent being first-generation rich, and 75 percent being self-employed. Not getting paid hourly challenges you to take more responsibility for every minute and every dollar. Consequently, a great majority of millionaires are extremely frugal with?–?or at least highly mindful? of–?their money.

3. Believing success will make you happy.

“One of the enemies of happiness is adaptation,” says Thomas Gilovich, a Cornell psychologist who has studied the relationship between money and happiness for more than two decades.

“We buy things to make us happy, and we succeed. But only for a while. New things are exciting to us at first, but then we adapt to them,” Gilovich further states.

Actually, savoring the anticipation or idea of a desired outcome is generally more satisfying than the outcome itself. Once we get what we want?–?whether that’s wealth, health, or excellent relationships?–?we adapt and the excitement fades. Often, the experiences we’re seeking end up being underwhelming and even disappointing.

I love watching this phenomenon in our foster kids. They feel like they need a certain toy or the universe will explode. Their whole world revolves around getting this one thing. Yet once we buy the toy for them, it’s not long before the joy fades and they want something else.

Until you appreciate what you currently have, more won’t make your life better.

4. Believing you’re not up for the challenge.

Just as we deceive ourselves into believing something will make us happier than it will, we also deceive ourselves into believing something will be harder than it will.

The longer you procrastinate or avoid doing something, the more painful (in your head) it becomes. However, once you take action, the discomfort is far less severe than you imagined. Even to extremely difficult things, humans adapt.

I recently sat on a plane with a lady who has 17 kids. Yes, you read that correctly. After having eight of her own, she and her husband felt inspired to foster four siblings, whom they later adopted. A few years later, they took on another five foster siblings, whom they also adopted.

Of course, the initial shock to the system impacted her entire family. But they’re handling it. And believe it or not, you could handle it too, if you had to.

The problem with dread and fear is that it holds people back from taking on big challenges. What you will find, no matter how big or small the challenge, is that you will adapt to it.

When you consciously adapt to enormous stress, you evolve.

5. Pursuing “happiness.”

There is no way to happiness?–?happiness is the way. ?–?Thich Nhat Hanh

Most people believe they must:

- first have something (e.g., money, time, or love)

- before they can do something (e.g., travel the world, write a book, start a business, or have a romantic relationship),

- that will ultimately allow them to be something (e.g., happy, peaceful, content, motivated, or in love).

Paradoxically, this “have?-?do?-?be” paradigm must actually be reversed for you to experience happiness, success, or anything else you desire:

- First, be whatever it is you want to be (e.g., happy, compassionate, peaceful, wise, or loving);

- then, you can start doing things from this space of being; and

- almost immediately, what you are doing will bring you the things you want to have.

You attract what you are. If you want the things happy people have, you must be happy to get those things. If you want things wealthy people have, you must be and live wealthy to have those things.

Results translate from attitudes and behaviors. Not the other ways around.

6. Undervaluing what you have.

In an interview at the annual Genius Network Event in 2013, Tim Ferriss was asked, “With all of your various roles, do you ever get stressed out? Do you ever feel like you’ve taken on too much?”

Ferriss responded:

Of course I get stressed out. If anyone says they don’t get stressed out, they’re lying. But one thing that mitigates that is taking time each morning to declare and focus on the fact that “I have enough.” I have enough. I don’t need to worry about responding to every email each day. If they get mad, that’s their problem.

Ferriss was later asked during the same interview:

Having read The 4-Hour Workweek, I got the impression that Tim Ferriss doesn’t care about money. You talked about how you travel the world without spending any money. Talk about the balance and ability to let go of caring about making money.

Ferriss responded:

It’s totally OK to have lots of nice things. If it is addiction to wealth, like in Fight Club, “the things you own end up owning you,” and it becomes a surrogate for things like long-term health and happiness?–?connection?–?then it becomes a disease state. But if you can have nice things, and not fear having them taken away, then it’s a good thing. Because money is a really valuable tool.

If you appreciate what you already have, then more will be a good thing in your life. If you feel the need to have more to compensate for something missing in your life, you’ll always be left wanting no matter how much you acquire or achieve.

7. Downplaying your current position.

It’s easy to talk about how hard our lives are. It’s easy to talk about how unfair life is, and to believe that we got the short-end of the stick.

But does this kind of talking really help anyone?

When we judge our situation as worse than someone else’s, we are ignorantly and incorrectly saying, “You’ve got it easy. You’re not like me. Success should come easy to you, because you haven’t had to deal with what I’ve gone through.”

This paradigm has formally become known as the victim mentality, and it generally leads to feelings of entitlement.

The world owes you nothing. Life isn’t meant to be fair. However, the world has also given you everything you need. The truth is, you have every advantage in the world to succeed. And by believing this in your bones, you’ll feel an enormous weight of responsibility to yourself and the world.

You’ve been put in a perfect position to succeed. Everything in the universe has brought you to this point so you can now shine and change the world. The world is your oyster. Your natural state is to thrive. All you have to do is show up.

8. Compartmentalizing your life.

Human beings are holistic. When you change a part of any system you simultaneously change the whole. You can’t change a part without fundamentally changing everything.

Every pebble of thought?–?no matter how inconsequential?–?creates endless ripples of consequence. This idea, coined the butterfly effect by Edward Lorenz, came from the metaphorical example of a hurricane being influenced by minor signals, such as the flapping of the wings of a distant butterfly, several weeks earlier. Little things become big things.

When one area of your life is out of alignment, every area of your life suffers. You can’t compartmentalize a working system. Although it’s easy to push certain areas?–?like your health and relationships?–?to the side, you unwittingly infect your whole life. Eventually and always, the essentials you avoid will catch up to your detriment.

Conversely, when you improve one area of your life, all other areas are positively influenced. As James Allen wrote in As a Man Thinketh, “When a man makes his thoughts pure, he no longer desires impure food.”

We are holistic systems.

Humanity as a whole is the same way. Everything you do effects the whole world, for better or worse. So I invite you to ask:

Am I part of the cure? Or am I part of the disease? ?–?Coldplay

9. Competing with other people.

All failed companies are the same: They failed to escape competition. ?–?Peter Thiel

Competition is extremely costly to maximum product reach and wealth creation. It becomes a battle of who can slightly out-do the other for cheaper and cheaper. It’s a race to the bottom for all parties involved.

Instead of trying to compete with other people or businesses, it’s better to do something completely novel or to focus on a tightly defined niche. Once you’ve established yourself as an authority on something, you can set your own terms rather than reactively responding to the competition. Thus, you want to monopolize the space in which you create value.

Competing with others leads people to spend every day of their lives pursuing goals that aren’t really their own, but rather what society has deemed important. You could spend your whole life trying to keep up, but will probably have a shallow life. Or, you can define success for yourself based on your own values and detach yourself from the noise.

10. Trying to have it all.

Every decision has opportunity cost. When you choose one thing, you simultaneously don’t choose several others. When people say you can have it all, they are lying. They are almost certainly not practicing what they preach and are trying to sell you on something.

The truth is, you don’t want it all. And even if you did, reality simply doesn’t work that way. For example, I’ve come to terms with the fact that I want my family to be the center of my life. Spending time with my wife and three foster kids is my top priority. As a result, I can’t spend 12 or 15 hours a day working, as some people do. And that’s OK. I’ve made my choice.

And that’s the point. We all need to choose what matters most to us, and own that. If we attempt to be everything, we’ll end up being nothing. Internal conflict is hell.

Although the traditional view of creativity is that it is unstructured and doesn’t follow rules, creativity usually occurs by when you think inside the proverbial box, not outside of it. People flex their creative muscles when they constrain their options rather than broaden them. Hence, the more clearly defined and constraining your life’s objectives, the better, because it allows you to sever everything outside those objectives.

https://www.inc.com/benjamin-p-hardy/34-things-you-need-to-give-up-to-be-successful.html?cid=sf01003&sr_share=facebook

By 1939, parts of Czechoslovakia had already been carved off and taken over by Nazi Germany, which claimed that millions of ethnic Germans were being persecuted there.