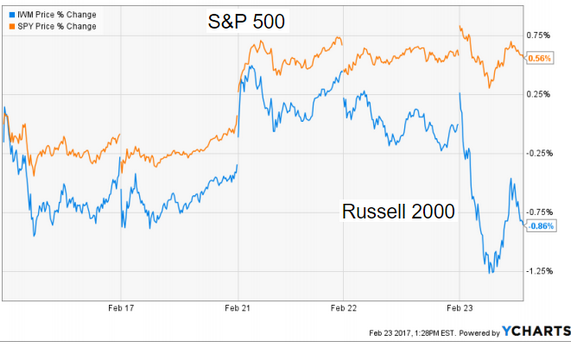

1.Small Caps Lag in Feb….Tax Cuts Delayed Until Late Summer.

S&P vs. IWM (Small Cap Index) Feb.

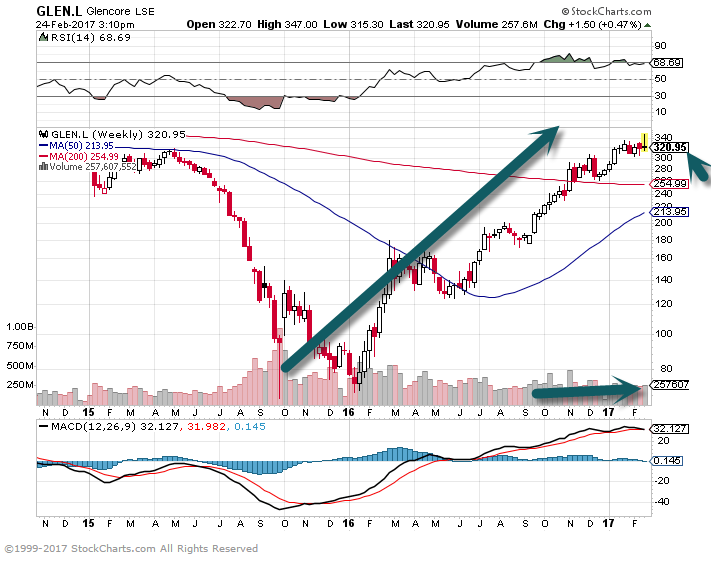

2.Glencore—Another Commodities Name Up From the Ashes….+76% Since Ja. 2016 Pullback.

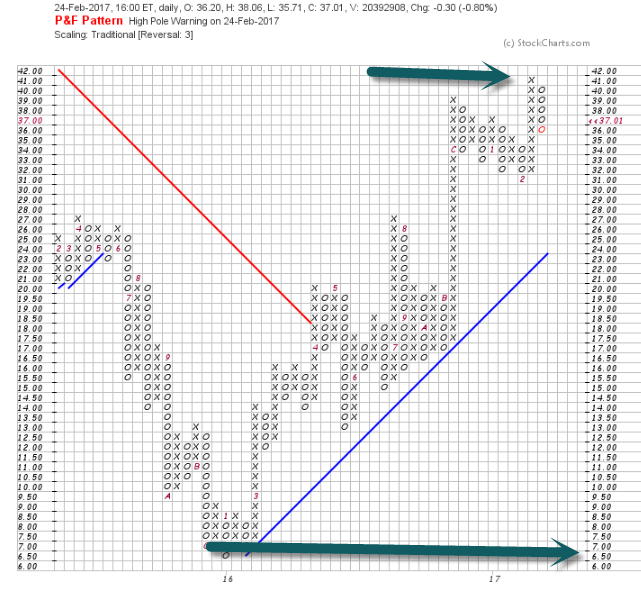

3.Another Name Up from Death March…Who had the U.S. Steel Trade? $6.50 to $41

U.S. Steel +530% Off Bottom…50day thru 200day to Upside on Weekly Chart.

Bottom 2016 $6.50

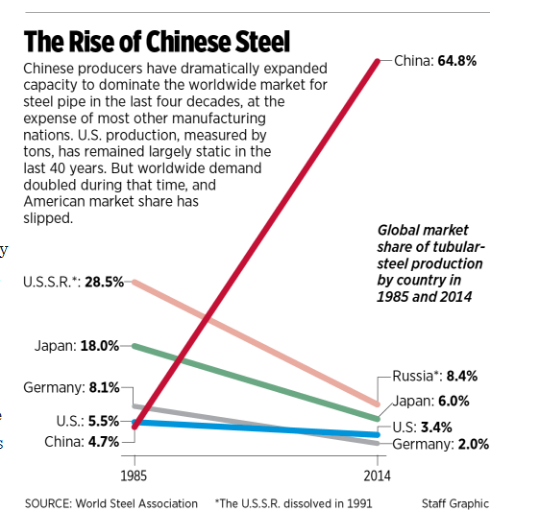

4.The Rise of Chinese Steel and Collapse of Price.

http://www.philly.com/philly/business/American-steel-pipes-Trump-Pennsylvania-Durabond.html

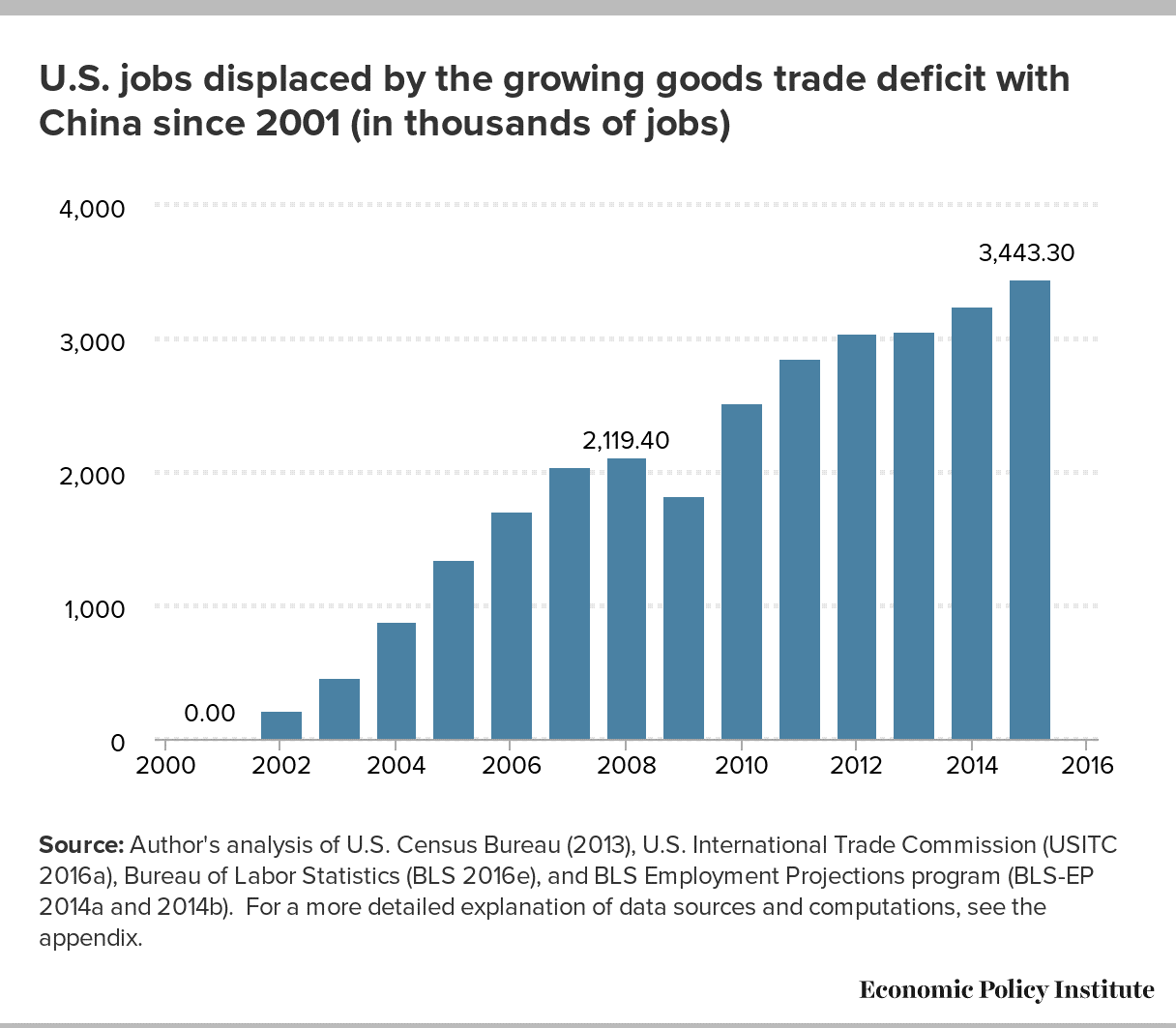

5.That’s a Ton of Displaced Jobs in 15 Years….Populism?

23 Million People Remain Outside Confines of Labor Force-David Rosenberg.

How would you advise President Trump?

We have 23½ million Americans age 25 to 54 who reside outside the confines of the labor force. It is not that they’re unemployed. They by definition have disengaged from the entire economy, and that number has never been that high. The irony is that we have a record level of job openings. There is a skills mismatch.

So we need a WPA-type program, except with education?

Yes—education, training, skills development, apprenticeship programs. We have to find a way to retool these disenfranchised prime working age folks. Enrollment in universities and colleges is going down, and we do not have nearly enough engineers, scientists, and mathematicians. The No. 1 priority should be redressing the single biggest constraint on the economy outside of the fact that we have excessive debt loads.

Read Full Interview.

http://www.barrons.com/articles/david-rosenberg-cautious-on-the-trump-rally-1488000316

6.China MCHI Index +11.6% YTD…$815m in Outflows 2017

-$9B Outflows 2016

-$21B Outflows 2015

7.U.S. and China Infrastructure Boom…Cui bono

Commodity Rebound Would Be Boon for Russia, Indonesia

The two would benefit more than other developing economies if the U.S. and China spend heavily on infrastructure projects.

By

As commodity prices stabilize, two developing countries should be winners: Russia and Indonesia.

Among major emerging markets, commodities as a percentage of exports are greatest in Russia, at roughly 70%, followed by Brazil (51%), India (35%), and Indonesia (35%), according to World Trade Organization data provided by Pavilion Global Markets. But India imports half of its commodities and food needs, and the rise in oil prices may weigh on its economy, as will the lingering negative of last fall’s rupee demonetization. And Brazil is still struggling with high interest rates and debt, as it recovers from a deep recession.

But stronger commodity prices should benefit Russia and Indonesia. Driving demand are two factors: The first is China, which could spend close to $800 billion over the next three years on transportation improvements alone. The second is the U.S,, which also is likely to undertake infrastructure projects that will drive commodity consumption.

Exports from emerging markets have risen over the past six months, helping to boost foreign currency reserves in half of them, says François Boutin-Dufresne, a global strategist at Pavilion, an independent research and brokerage firm in Montreal. He’s bullish on buying the MSCI Emerging Markets Index over the next three to six months. The iShares MSCI Emerging Markets exchange-traded fund (ticker: EEM) is up 11% this year.

http://www.barrons.com/articles/commodity-rebound-would-be-boon-for-russia-indonesia-1488000350

RSX-Russian Market Doubled Off Bottom

Indonesia Rally then Sideways.

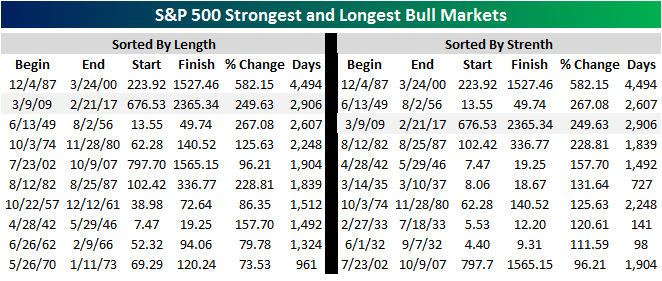

8.5% Rally From Here Would Make Us Second Strongest Bull of All Time

Feb 24, 2017

When it comes to rankings, a “ten” is typically considered as good as it gets. In many sports, a “ten” is considered the best possible score. In 1976, Nadia Comaneci was the first gymnast to ever score a perfect ten when she was flawless on the uneven bars. Then, in 1979, Bo Derek also taught us that a ten was perfect.

In 1984, the “perfect ten” was one-upped when ‘guitarist’ Nigel Tufnel from Spinal Tap introduced the world to amps that had a volume control that topped out at eleven. His reasoning was that every once in awhile there are those times where you have the volume up to ten and everything is going great but there is nowhere else to go from there. To solve the problem Tufnel tells the interviewer (played by Rob Reiner) that his amps go to eleven for those times when the band needs the “extra push off the cliff.”

This week, the DJIA was more than perfect, and like the amps from Spinal Tap, it pulled an eleven. And it did so in dramatic fashion, as the only time that the DJIA traded in positive territory was in the final seconds of the trading day. So where do we go from here?

Along with the DJIA this week, all of the major averages hit new bull market and all-time highs, as one of the most unloved bull markets of all time continues to chug along. For the S&P 500, the current bull ranks as the second longest and third strongest of all time. While it will be some time before the current bull makes a run for the top spot in either category, in strength terms, a gain of 5% from here will put the current bull into second all-time as well.

https://www.bespokepremium.com/think-big-blog/

9.Read of the Day…FED Watching VIX.

After reading Alan Greenspan’s book, I was shocked how much the FED monitored the financial press, but I am even more surprised that they are watching the VIX.

The Fed is worried about a key measure in the stock market

- Frank ChaparroJanet L. Yellen, Chair, Board of Governors of the Federal Reserve System, looks over her notes as she testifies before the United States Senate Committee on Banking, Housing, & Urban Affairs on “The Semiannual Monetary Policy Report to the Congress” on Capitol Hill in Washington, DC on Tuesday, February 14, 2017.AP

- The Federal Reserve said January 22 it is worried about the “low level of implied volatility in equity markets”

- The VIX, a gauge of market fearfulness, has been bouncing around at historic lows

- That seems at odds with the “considerable uncertainty” the Fed expects in US policy

The Federal Reserve is worried that the stock market might be showing signs of complacency.

The central bank’s most recent communication — the Fed minutes for the January/February meeting — released on January 22 shows that members are split on whether President Trump’s agenda will spur economic growth.

That uncertainty doesn’t seem to be showing up in the stock market, however. The Chicago Board Options Exchange volatility index, which gauges investor anxiety (technically, implied expectations for volatility in the stock market) and is widely known as the VIX index, has been trending down.

The Fed minutes said: “They also expressed concern that the low level of implied volatility in equity markets appeared inconsistent with the considerable uncertainty attending the outlook for such policy initiatives.”

What is implied volatility, and why is it so low?

The VIX is commonly read as a gauge of market fearfulness, and measures the market’s expectation of volatility implicit in the price of options on the Standard & Poor’s 500.

One way to think of it is like the cost of an insurance policy. When the market is expected to be volatile, there are more buyers of insurance, and so the cost of that insurance rises. When the market is relaxed, nobody’s interested in buying insurance against a wild swing, so the protection offered by options is inexpensive.

Lately, the VIX has barely been moving, only breaking 20 on a handful of occasions, and generally trending below 13.

10.Mark Cuban…Next Job Growth will be About Interpreting the Data.

After Job Skill

The billionaire investor predicts one crushing reality of automation.

When Mark Cuban speaks, people listen. The billionaire investor and Shark Tank personality has a slew of wildly successful businesses under his belt. Whether he’s commenting on the recent Time Warner and AT&T merger, recommending books for entrepreneurs, or sounding off about the 45th president, the internet hangs on Cuban’s every last word.

Now his latest prediction about the future of jobs is picking up steam. In a recent interview with Cory Johnson on Bloomberg TV, Cuban presented an interesting argument against people pursuing so-hot-right-now computer science degrees or attending learn-to-code bootcamps.

“What looks like a great job graduating from college today may be not be a great job graduating from college five years or 10 years from now,” Cuban said.

He predicts the next wave of innovation will be “the automation of automation.” By that, Cuban means software will soon begin writing itself, which will ultimately eliminate those lucrative software development jobs. About writing software, Cuban said: “It’s just math, right?” Humans will no longer be needed.

Though it’s ironic, Cuban believes technology will eventually kill tech jobs themselves. “There are no manufacturing jobs coming back. There are no coal mining jobs coming back,” Cuban said. He thinks software development jobs are next on the chopping block.

The next most in-demand job skill

If Cuban’s prediction does indeed come true, with the need for coders, developers, and engineers eventually evaporating, what sort of workers will be in demand? Those who can make sense of the data that automation is spitting out. No, not data scientists. Cuban believes employers will soon be on the hunt for candidates who excel at creative and critical thinking.

“I personally think there’s going to be a greater demand in 10 years for liberal arts majors than for programming majors and maybe even engineering,” Cuban said. He cited degrees such as English, philosophy, and foreign languages as being the most valuable. “Maybe not now,” Cuban acquiesced. “They’re gonna starve for awhile.” Their day, though, is likely coming, he says.

Cuban went on to voice his support for programs such as AmeriCorps, which engage young people in public service work across the United States. “Having people come in and have a social impact and making it a real job is what we’re gonna need.”