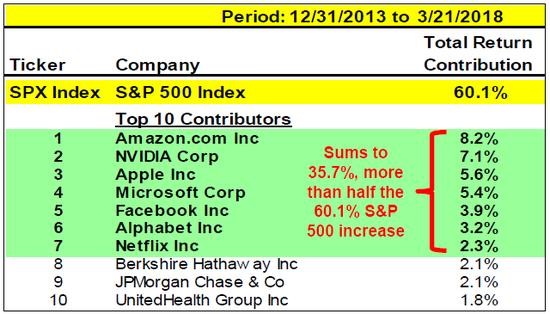

1.60% of the Money Made in S&P During the Last 4 Years Came From Only Seven Stocks.

Look at the chart below; 60% of the money made in the S&P 500 during the last four-plus years came from only seven common stocks.

Guru Focus

https://www.gurufocus.com/news/666219/the-good-shepherd-investor

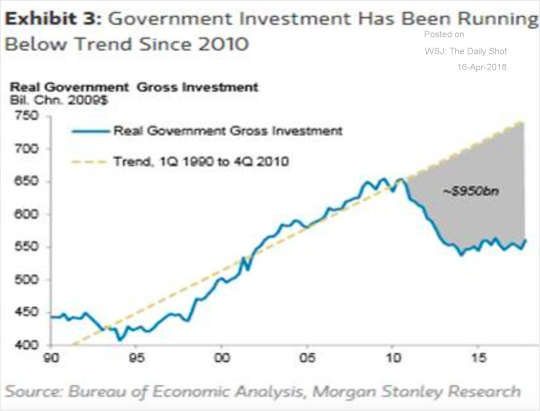

2.Nine Years into Bull..The U.S. Still Has Massive Infrastructure Spending Gap.

The United States: The massive US underinvestment in infrastructure continues.

Source: @acemaxx, @MorganStanley

https://blogs.wsj.com/dailyshot/

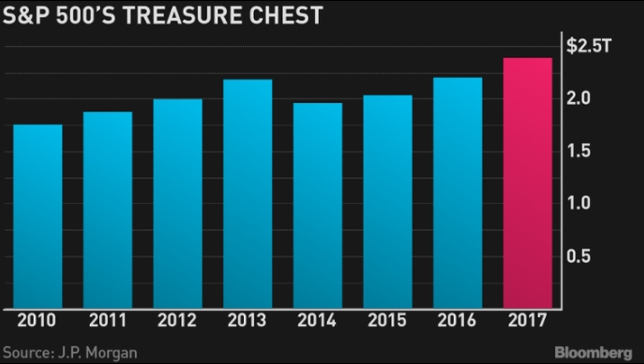

3.Cash Hits $2.5 Trillion for S&P Companies…Dividends and Buybacks?

Companies are going into earnings season with record liquidity, according to JPM. Cash and investments totaled $2.39 trillion at the end of last year for non-financials in the S&P 500. The potential to use these funds for dividends, repurchases and dealmaking is “a compelling argument” that stocks are attractive

From Dave Lutz at Jones

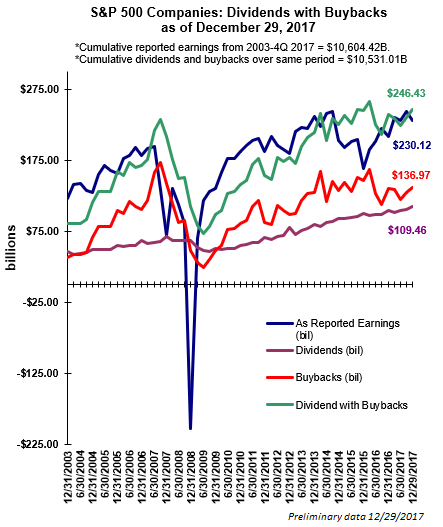

4.Dividends and Buybacks Expected to Accelerate 2018

Dividend And Stock Buyback Growth Potentially Accelerate In 2018

Near the end of last month S&P Dow Jones Indices reported preliminary dividend and buyback activity for the S&P 500 Index for the fourth quarter of last year. For the quarter the dollar amount of dividends paid increased 5.4% versus the same quarter in the prior year. Additionally, for the quarter, dividends combined with buybacks increased 3.1% year over year. It is not uncommon for the combined dividends with buybacks to exceed as reported earnings in the quarter and that was the case for Q4 2017 as seen in the below chart.

As noted earlier, S&P’s press release mentions the benefits of lower corporate taxes and repatriation may serve as a tailwind for 2018.

- “Dividends, which are on track to set a seventh consecutive record annual payment for 2018, may return to double-digit gains last seen in 2015; 2016 posted a 5.4% gain and 2017 had a 7.0% gain.”

- “S&P 500 issues have increased the size of their dividends hikes this year an average of 14.04%, versus 11.36% for 2017 and 10.51% for 2016. No issues have lowered their rate and there are 128 increases so far for 2018.”

Lastly, on April 3 S&P Dow Jones Indices Dividend Activity report press release for Q1 2018 Howard Silverblatt noted,

“within the S&P 500, the average dividend increase during Q1 2018 was 13.9%, up from 10.4% during Q4 2017 and 10.2% during Q1 2017. The median increase was 10.3%, up from 8.2% during Q4 2017 and 7.9% during Q1 2017. Supporting the depth of increases are fewer dividend cuts and a resurgence of payments from Energy issues.”

Lower corporate taxes and repatriation may be already favoring investors.

Source: S&P Dow Jones Indices

http://disciplinedinvesting.blogspot.com/2018/04/dividend-and-stock-buyback-growth.html

From Abnormal Returns BLog

https://abnormalreturns.com/

5.By PEG Ratio..Stocks are not Expensive

FULL DISCLOSURE…I DO NOT FOLLOW PEG…INFORMATION PURPOSES ONLY

Are U.S. stocks expensive? Depends on how you measure them

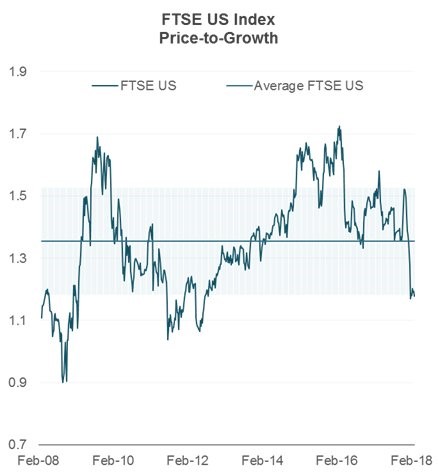

FTSE Russell also provided the following chart to MarketWatch, which looks at the market in terms of its PEG, or a P/E ratio that accounts for earnings growth. Based on this metric, stocks have a PEG of 1.2, which means they’re not only trading one standard deviation below their long-term average of a little more than 1.3, but also at their cheapest level since 2012.

Courtesy FTSE Russell

“If you just look at P/E, then you might be able to say that the market looks expensive. But if you look at PEG, the U.S. doesn’t look as extended as people perceive it to be,” said Philip Lawlor, managing director of global markets research at FTSE Russell, who emphasized that he was simply analyzing the data, and not making a market prediction.

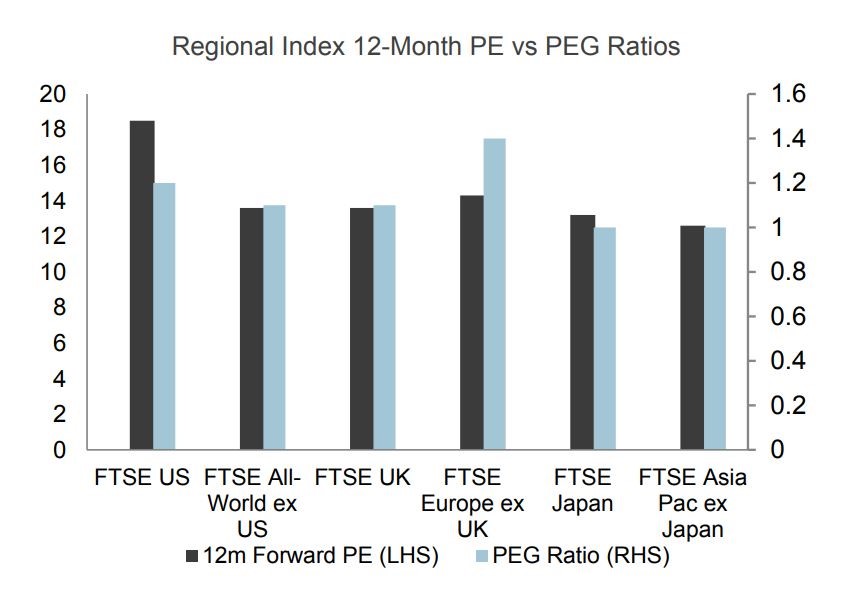

One thing boosting earnings growth, and the PEG along with it, is the recently passed tax-reform bill, which cut corporate tax rates, delivering an immediate boost to profitability. Compared with the growth rate of 17.3% that is currently expected, analysts were looking for growth of 11.4% at the end of December, back when the bill was passed, according to FactSet.

Analyzing the market through a P/E or a PEG lens makes U.S. stocks look markedly differently, including in comparison with other countries. While the U.S. forward P/E is the highest of any region, it doesn’t rank that lofty on a PEG basis. By that metric, an index for Europe that excludes the UK is the most expensive major market, even though that region’s P/E is lower than the U.S. This occurs because the Europe ex-UK region has lower earnings growth than the U.S.

Courtesy FTSE Russell

Lawlor also played down the apparent high reading of the CAPE ratio, which compares stock prices with corporate earnings over the past 10 years. He noted that the past 10 years includes the financial crisis, and the massive drop in profits that were seen in 2008. Next year, the rolling 10-year period will begin in 2009, when markets bottomed in the crisis and profits started to recover.

“Once 2008 is excluded,” he said, “the CAPE will automatically drop” without any change to current economic conditions or fundamentals. Lawlor added that while the CAPE provided a reasonable predictor of future returns over the coming decade, it shouldn’t be used as a short-term market-timing tool.

Ryan Vlastelica

https://www.marketwatch.com/story/stock-valuations-are-at-multiyear-highs-and-multiyear-lows-2018-04-13

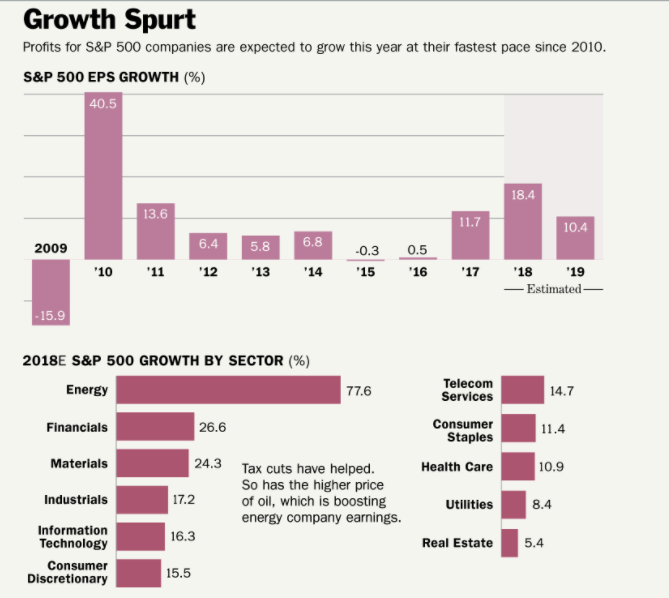

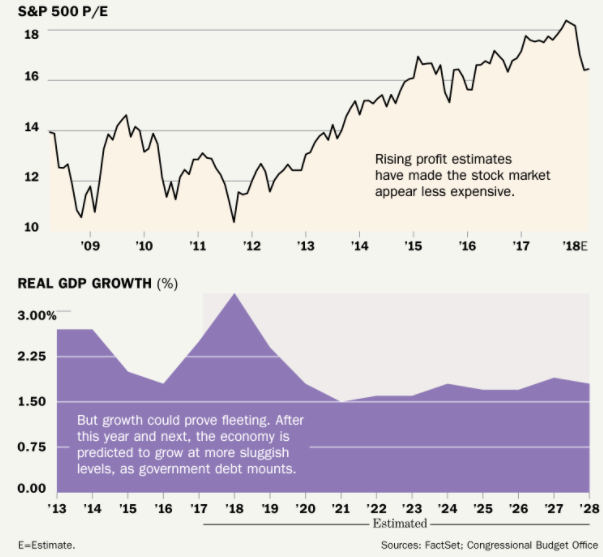

6.Here it is in a Nutshell…Earnings.

https://www.barrons.com/articles/will-booming-earningssave-the-bull-market-1523664002

Found at Barry Ritholtz Big Picture Blog

http://ritholtz.com/2018/04/10-monday-reads-180-42/

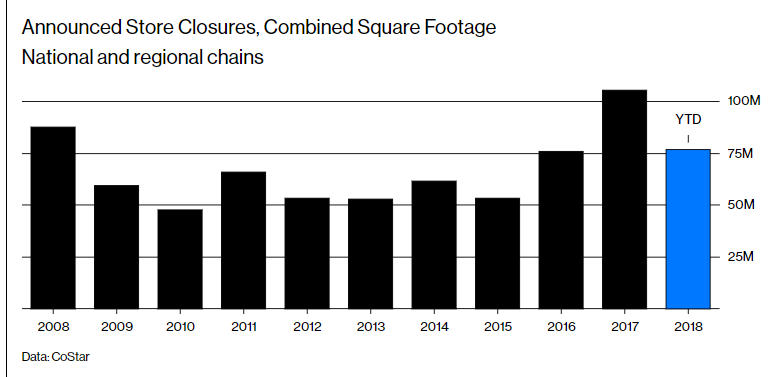

7.Retail Real Estate—77 Million Square Feet Open Already This Year.

The Retail Real Estate Glut Is Getting Worse

Stores have announced the closing of 77 million square feet of shopping space so far this year.

The fall of the Toys “R” Us chain, with more than 700 U.S. stores, shows how much retail real estate has changed in just the last decade. When KKR & Co., Bain Capital, and Vornado Realty Trust took over the company in 2005, the buyers justified the $7.5 billion price, in part, because of the supposedly valuable properties that came with the deal.

8.4 Questions Every Great Leader Should Be Able to Answer

By documenting what they expect from employees–and what employees can expect from them–CEOs diminish confusion and create a culture of continuous improvement.

Editor-at-large, Inc. magazine@LeighEBuchanan

Most entrepreneurs–especially new ones–charge into leadership with a cloud of aspirational adjectives (“inspiring,” “benevolent,” “collaborative”) roiling their brains but no clear idea what those things look like in practice. The result is confusion, as employees try to deduce the boss’s intent (“Am I supposed to take initiative here, or wait for the white flag?”) and grapple with leadership that is situational rather than consistent.

Ed Ruggero is a former Army officer, military historian, and business writer who teaches organizations about leadership, including in programs held at the sites of the Battle of Gettysburg and the Normandy Invasion. Among other things, he helps CEOs and their teams craft personal statements–or what he calls “leadership philosophies”–that codify their beliefs about good leadership and document their commitment to pursue it. The exercise “is meant to get past fuzzy thinking,” Ruggero says. “Writing it down gives you clarity.”

Ideally, everyone working for the leader gets clarity too. A leadership philosophy is, in essence, your operating manual. This is how I think, act, and react. This is how we will work together.

Leadership philosophies typically top out at about 750 words. But length is not important. What matters, Ruggero says, is that leaders give the process of writing one sufficient time and approach it with honest introspection, ideally in collaboration with colleagues.

The documents they produce comprise four sections. Here’s an overview.

- What I believe about leadership

Principles precede promises. Leaders begin by laying out bedrock beliefs about the role of leadership in general, which can range from “leaders serve others” to “discipline is the bridge between goals and accomplishment” to “good leaders have followers who do things because they want to, not because they have to.” The beliefs are the outline. What follows colors them in.

- What you can expect of me

The simple acknowledgment that leadership is a two-way street will surprise and impress many employees. For this part of the exercise, Ruggero asks people to consider other leaders they’ve worked with or heard about whose practices and behavior they most admire. Participants then digest those practices and behaviors into brief statements that they incorporate into their personal credos by adding the words “I am” or “I will.” So, for example, “I will participate fully in every team effort, but will make every effort to delegate responsibility and authority to those who are capable. I will give credit for the accomplishments of each and every team member.”

Leaders can also use this section to lay out aspects of their leadership that remain works in progress. For example, “I am impatient. I know that is both a flaw, when others try to explain things to me, and a strength, in my ability to bring quick closure to issues. I work on this daily.” Such disclosures are reassuring to employees, allowing them to tell themselves “It’s not me. That’s just how she is.” They also create opportunities for employees to safely point out to the leader when she is falling short of her own aspirations.

- What I expect of you

This section in particular benefits from brainstorming among the leadership team, Ruggero says. Many leaders will agree on the basics: They want employees to display honesty, hard work, respect, promptness, and accountability. But there may also be genuine disagreements. For example, is it OK to present the leader with a problem for which the employee has no proposed solution? How long should employees wrestle with a challenge before seeking help? Philosophies can differ, but by crafting the statements together, leaders at all levels can discuss why one approach or another might be preferable.

One common expectation is that employees speak up when they disagree with their bosses. As with feedback to the leader, this creates a safe space for candor and reduces the likelihood of going down wrong paths. “At McKinsey & Company, one of their expectations is that you have an obligation to dissent,” Ruggero says. “I love that they chose that word.”

- What attracts negative attention

This final section may not dramatically improve a company’s performance. But it reduces day-to-day stress. Essentially, these are the leader’s pet peeves. Interrupting others. Self-aggrandizement. Gossip. Whining. “Someone who lives with you probably can fill this out on your behalf,” Ruggero says.

The creation and dissemination of a CEO’s leadership philosophy, along with the attendant philosophies of lower-level leaders, “engages people in an ongoing conversation about how we can be a better team,” Ruggero says. If leaders start to deviate from their commitments, then peers or employees can help them correct course. Perhaps a commitment made in the startup phase no longer makes sense as the business scales. For example, it may not be feasible for the CEO of a 500-person company to maintain an open-door policy. The CEO may recognize that when revisiting his philosophy. Then he can remove the expectation from his own document and perhaps ask lower-level managers to add it to theirs.

On the grand level, leadership philosophies keep companies on course and forge healthy cultures. On the granular level, they reduce the time employees waste trying to guess whether the boss will be appreciative or annoyed when they come to her with problems. And they eliminate friction in relationships. Ruggero cites one state government official whose leadership philosophy included a heads-up that “when I get excited, I talk really fast,” he says. “She said, ‘It is OK to ask me to slow down.'”

https://www.inc.com/leigh-buchanan/how-will-you-lead-write-it-all-down.html