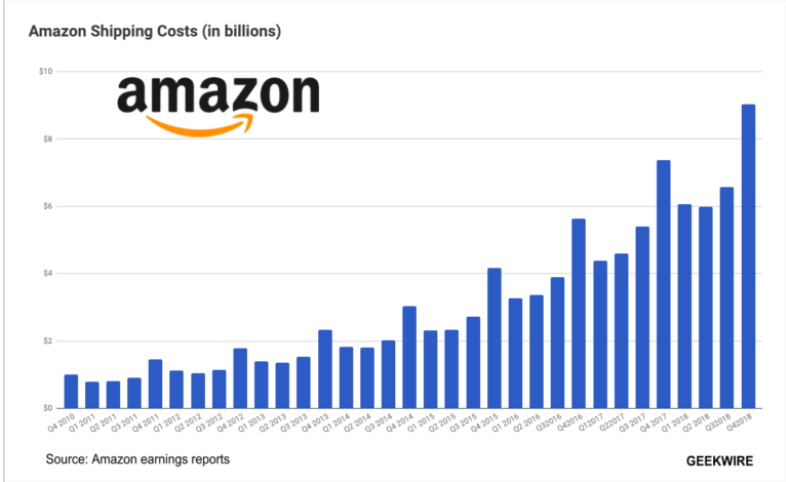

1. Amazon Stock..Cost of Shipping Jumps 46% Year Over Year….Stock Never Made New Highs From 2018

Amazon earnings fall for first time in more than two years, stock drops in late trading

Amazon’s spending on one-day delivery and other initiatives sends profit down year-over-year for first time since 2017, forecast calls for even more spending in holiday quarter

Johannes Eisele/AFP/Getty Images

Amazon.com Inc. has spent more than $1 billion this year to reduce the amount of time it takes to deliver packages to Prime customers, and expects a $1.5 billion hit in the holiday season.

Amazon prepped investors and analysts for the spending increase and resulting profit decline, projecting an $800 million charge in the second quarter for the one-day delivery change. Amazon ended up spending more than that in the second quarter, however, and Chief Financial Officer Brian Olsavsky said in July that Amazon would spend even more in the third quarter.

Olsavsky said in the call that the fourth quarter will see even larger costs from one-day delivery efforts.

“So, as we head into Q4 we’ve added what’s just nearly $1.5 billion penalty in Q4 year-over-year for the cost of shipping, which essentially is transportation costs, the cost of expanding our transportation capacity, things like adding additional roles and shifts in our warehouses,” the Amazon CFO said.

Amazon’s worldwide spending on shipping jumped 46% year-over-year in the third quarter to a record $9.6 billion, more than a half-billion dollars over what Amazon spent in the busier holiday season a year ago. The company, which cut back on hiring a year ago after absorbing the Whole Foods workforce and hiring quickly in 2017, also increased its total employee count by 22% to 750,000 people. Amazon added nearly 100,000 employees just in the third quarter, according to Thursday’s release, which Baird analyst Sebastian deemed the “most surprising metric” in the report.

2. Amazon Historical 2010-2018 Shipping Cost Growth.

Amazon shipping costs hit record $9B in latest quarter, total nearly $28B for 2018 BY NAT LEVY on February 1, 2019 at 10:33 am

https://www.statista.com/chart/12893/amazon-fulfillment-and-shipping-costs/

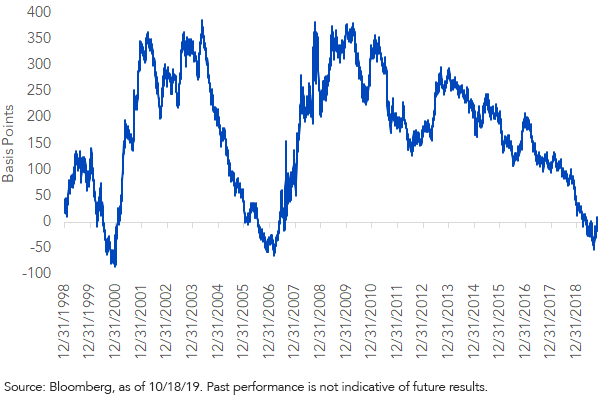

3. The Yield Curve Un-Inverts.

Wisdom Tree

Head of Fixed Income Strategy

Without much fanfare, an interesting development has occurred in the bond market in October: the Treasury yield curve “un-inverted.” I can’t help but to think back to May of this year when the U.S. Treasury (UST) 3-month/10-year note spread fell into negative territory for the first time since 2007 and the news took center stage. Arguably, the heightened news coverage was warranted, given the inverted yield curve’s prior history of forewarning of potential recessions. This raises the question—does the un-inverted curve now flash the all-clear signal for the U.S. economy?

Technically, an un-inverted yield curve simply means the spread between the two aforementioned Treasury securities has moved back into positive area. As of writing, the UST 3mo/10yr spread was registering at +8 basis points (bps), and it has been in plus territory now for the last week or so. This is in stark contrast to just a couple of months ago, when this differential plunged to a low of -51 bps in late August.

U.S. Treasury 3-Mo/10-Year Spread

So, what has happened within the last two months to create such a turnaround? This steepening of the curve has been a function of the yields of both the 3-month t-bill and the 10-year note moving in almost equal, but more importantly, opposite directions. Specifically, since the peak inversion was printed on August 27, the 3-month t-bill yield has fallen about 30 bps, while the 10-year note has seen a roughly 30-bps increase in its yield level.

Let’s take the 10-year first. The yield increase here has been the result of improved U.S.-China trade news as well as economic data that continues to suggest that the labor market setting and consumer spending patterns are more than offsetting weaker readings for manufacturing and investment. For the 3-month t-bill, the current yield reflects that the market is pricing in an additional rate cut at next week’s FOMC meeting and the recent news that the Fed will be buying $60 billion in Treasury Bills to provide sufficient reserves for the funding markets.

Conclusion

Back to the question I posed earlier: is the U.S. economy out of harm’s way? Our base case is for a slowdown in growth, not an outright contraction. The N.Y. Fed’s indicator of a probable recession in the next 12 months stood at 34.8% as of September, a slight decline from the prior month. This latest development from the yield curve will more than likely reduce those odds a bit more for the October reading if the un-inverted status is maintained (the UST 3mo/10yr spread is the key leading indicator for this series). I think a good rule of thumb going forward is a two-thirds chance of avoiding a recession and a one-third chance for one occurring.

https://www.wisdomtree.com/blog/2019-10-23/the-yield-curve-un-inverts

4. Yield Curve Uninverts – Now What?

Less than six months ago, the market was buzzing with the information that the yield curve inverted. As we all know, when the curve inverts there will be a recession. The time between inversions and recession is variable, but it will happen. It is a lock. Unfortunately, there can be false positives or more precisely, changes in the likelihood of a recession.

So, what do we do now? The curve has moved from inverted to being positive. This positive yield curve however is slight. The 3-month Treasury bill versus 10-year treasury bond yield is now positive 12 bps. The combination of Fed rates cuts and the announcement of Treasury bill buying to increase the Fed balance sheet is pushing rates lower. The Fed seems to be successfully offsetting fu twnd tightness on the front-end of the curve, and some positive tariff news has pushed up yields on the long-end of the curve.

We can say is that the threat of a recession has been lowered. Most of the work on yield curve inversion and recessions has used logistic regressions to measure the probability of a recession event. The last reading from the New York Fed was slightly above 30 percent for September 2020, but that was with data from July. This likelihood measured while the curve was still inverted. That number will go down.

We are left with a measured response. The probability of a recession has declined. The Fed action and forward guidance has been enough to reduced the threat. Recession fears have diminished so holding a riskier portfolio is appropriate.

Disciplined Systematic Global Macro Views

spot.com/2019/10/yield-curve-uninverts-now-what.html

Found at www.abnormalreturns.com

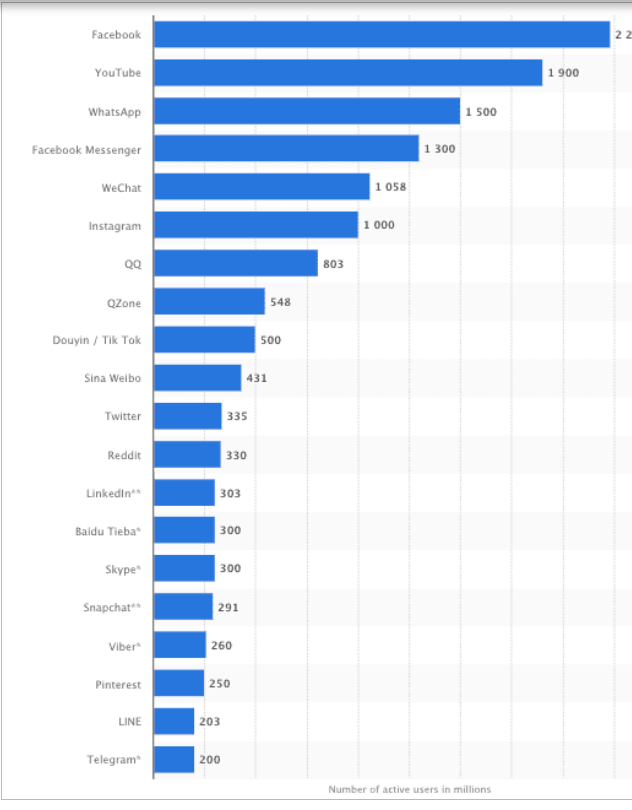

5. Twitter Did Not Make It Above 2018 Highs

This compilation of the most popular social networks worldwide by active users (October 2018) prepared by Statista using data from the Global Web Index panel gives a clear picture of the number of active users (in millions) with Facebook ruling supreme. This won’t be a shock to anyone! With over 2 billion active users it holds the majority market share. Google’s YouTube is second with Facebook-owned, WhatsApp and Messenger not far behind. Facebook’s Instagram platform has fewer than half of the visits of Facebook…

Global social media research summary 2019 By Dave Chaffey

6. Big Name Shorts Get Slammed in Tesla.

Short sellers slammed as Tesla shares surge the most in 6 years

By Kevin Dugan

October 24, 2019 | 5:25pm | Updated

Tesla’s Elon Musk (bottom right) got a charge on Thursday as shares of his e-car company surged 18% after it reported an unexpected quarterly profit. Short sellers Jim Chanos (right) and David Einhorn (left).Alamy photos; NY Post photo composite

Tesla shares are surging — and short sellers are hurting.

Wall Street investors betting against Tesla’s stock got clobbered to the tune of nearly $1.5 billion on Thursday after Elon Musk’s electric-car maker reported a surprise profit, giving the company’s shares their biggest boost in six years.

Tesla bears — which include big-name money managers like Jim Chanos and David Einhorn — got caught after Tesla reported a third-quarter profit of $1.86 a share on improved efficiencies at its factory. Tesla also said it expects deliver as many as 400,000 cars this year and that it was ahead of schedule on a new car plant in China.

The news lifted Tesla shares nearly 18% to $299.68, giving the company a market capitalization of $53 billion — edging past General Motors to become the nation’s most valuable car company.

It was a miserable day for short sellers, who lately had been booking healthy gains on bets that the stock would fall, according to S3 Analytics.

The research firm calculated that short sellers’ collective, year-to-date gains got slashed on Thursday to $525 million, or about 6%, from a high of $2 billion earlier this year.

“This was the worst loss that we’ve seen” for Tesla’s short sellers, S3’s managing director, Ihor Dusaniwsky, told The Post.

Investors that have placed short bets against Tesla more recently were the ones who had the most to lose, he noted, while long-term bears were more likely to still be in the black.

Chanos and Einhorn, who haven’t disclosed the size of their Tesla short bets, didn’t respond to requests for comment. But on Thursday Chanos struck a defiant tone on Twitter, claiming that Tesla was “fundamentally unprofitable.”

Previously, Einhorn had bashed Tesla cars for being less safe than the company claims as a rationale for his short bet. “The wheels are falling off — literally,” he said earlier this year in an investor letter, according to CNBC.

While Einhorn got pummeled Thursday, critics note that Musk also has a spotty track record when it comes to delivering on his bold promises. Analysts at JPMorgan said they are “unsure that this is really the breakout quarter that is likely to be claimed by the bulls,” according to a Thursday analyst note.

To be sure, Tesla still has plenty of lost ground to recover. Even after Thursday’s surge, its shares are 22% lower than its all-time high of $383.45 reached in June 2017. Since then, the shares have gotten battered on a slew of flubs by Musk, including his misleading tweet in August 2018 that he had “funding secured” to take the company private.

After Apple, Tesla is the second-most shorted stock in the US, with about $8.3 billion — or 20% — of its shares shorted by investors, according to S3.

Nevertheless, that percentage is down from 24 percent in June and a whopping 60% in 2012.

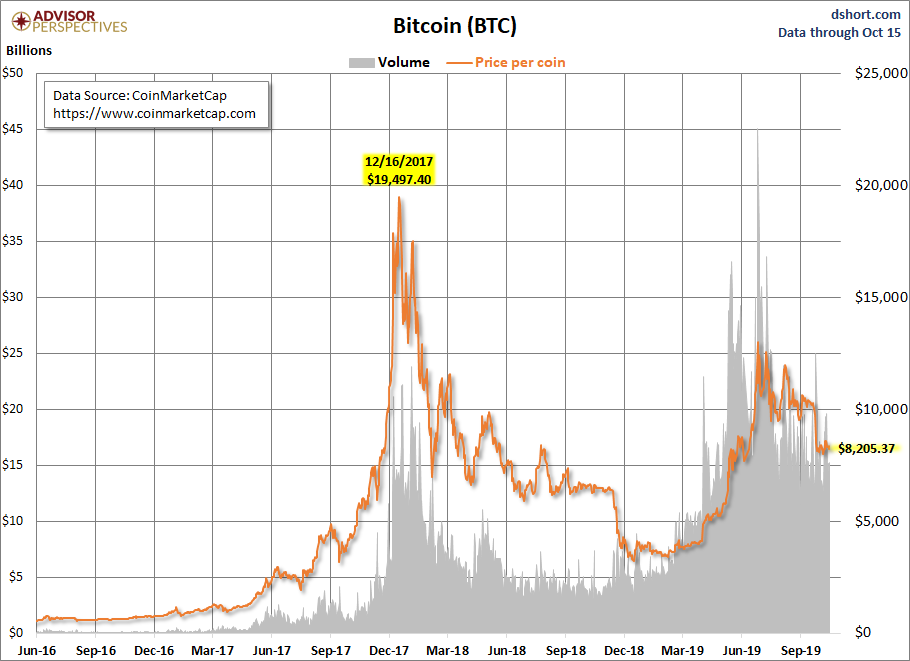

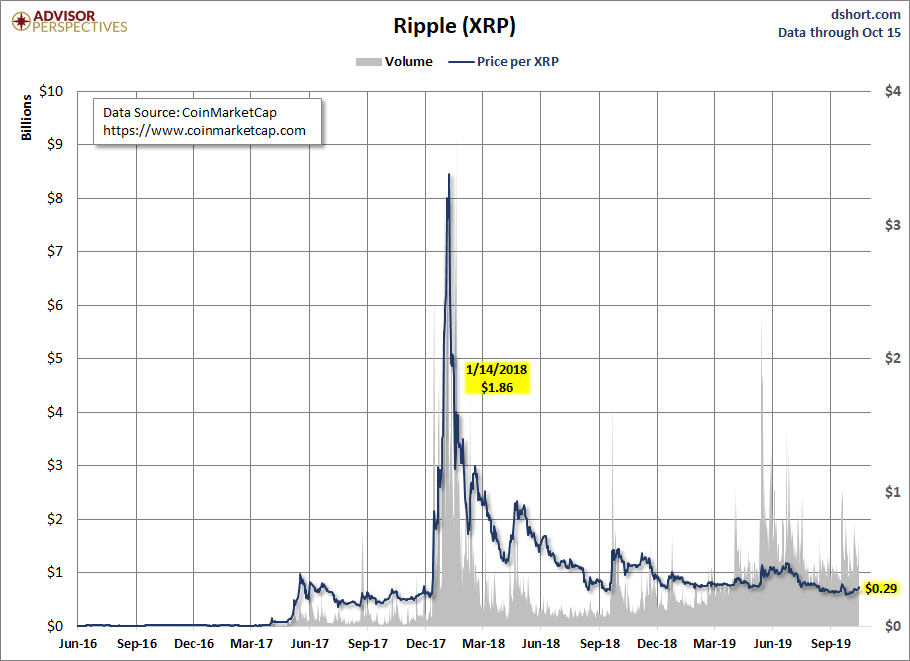

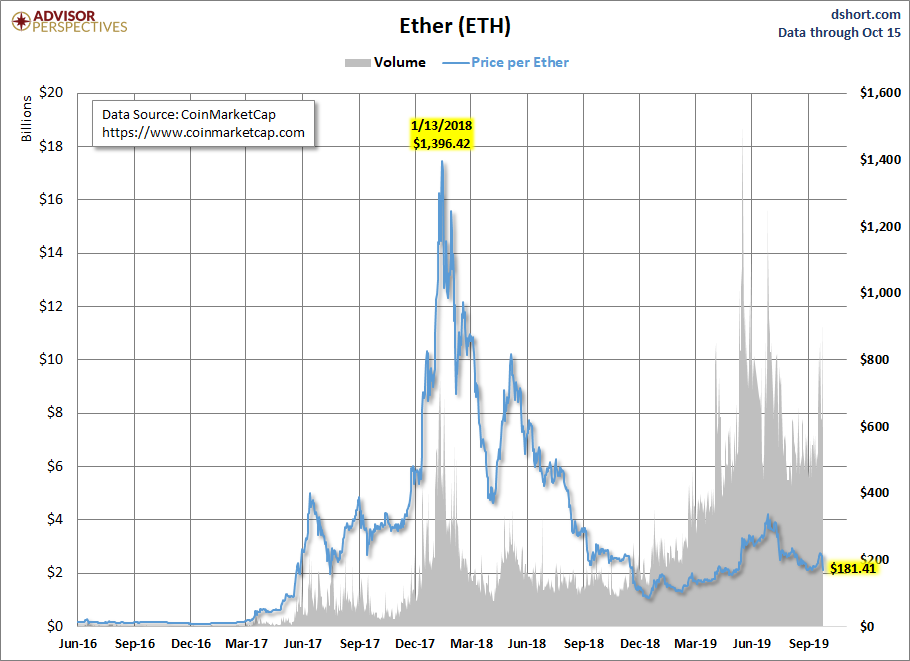

7. Three Largest Crypto Currencies Charts.

The Three Largest Cryptocurrencies

by Jill Mislinski, 10/16/19 https://www.advisorperspectives.com/dshort/updates/2019/10/16/the-three-largest-cryptocurrencies

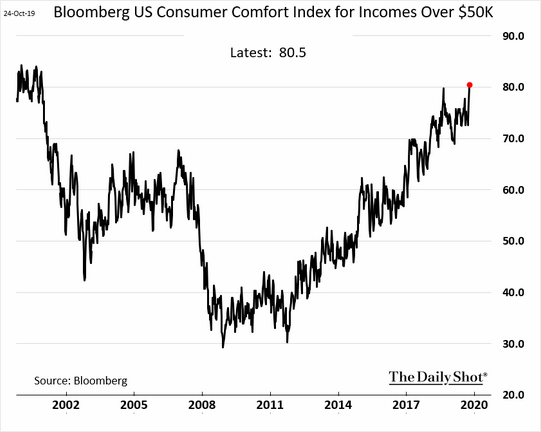

8. Households making over $50k/year:

9. World Series Game 2 Falls to All-Time Low TV Audience

After narrowly avoiding rock bottom in Game 1, Fox wasn’t as lucky with Wednesday blowout

Tim Baysinger | October 24, 2019 @ 1:31 PM Last Updated: October 24, 2019 @ 1:57 PM

Elsa/Getty Images

Fox narrowly avoided setting the wrong kind of record for Game 1 of the 2019 World Series between the Washington Nationals and Houston Astros. The network wasn’t as lucky for Game 2.

Wednesday night’s game, in which the Nationals soundly won 12-3 to take a 2-0 lead, drew 11.93 million viewers, the smallest audience ever for a Game 2. That was down 3% from the previous record set in 2012 (12.34 million), when the San Francisco Giants swept away the Detroit Tigers to win their second title in three years. Fox avoided the same distinction for Game 1 on Tuesday by just 3,000 viewers.

In the adults 18-49 demo, Game 2 drew a 2.9 rating, which was down 6% from Tuesday’s Game 1. In total viewers, Fox shed 2% of its Game 1 audience.

Also Read:World Series Game 1 Misses All-Time Low TV Audience by Just 3,000 Viewers

Factoring in streaming platforms, Fox added another 480,000 viewers to bring that total to 12.41 million. In the Washington, D.C. market, Game 2 was the highest-rated MLB telecast since the 2001 World Series.

Wednesday’s game looked like it would come down to the wire, being knotted at 2-2 through the first six innings. Then the Nationals’ bats exploded against the Astros’ bullpen, scoring 10 runs in the last three innings. But now Fox is looking at the ratings-unfriendly possibility of an upset sweep by the Nats.

The series takes a break Thursday — Fox has the “Thursday Night Football” game between the Washington Redskins and the Minnesota Vikings tonight — before picking up back Friday, when the nation’s capital will play host to its first World Series game since 1933. That will also push “Friday Night SmackDown” to cable network Fox Sports 1.

https://www.thewrap.com/world-series-game-2-tv-ratings/

10. The Hidden Costs of Stress on Your Memory

New research shows how the experience of stress can erode your memory.

When you’re stressed, it can be difficult to focus on the task at hand. All you can think about is how far behind you are in your work, how poorly your relationship is going, or whether you’ll be able to pay your utility bill or not. You spend your days preoccupied with the feeling of being overwhelmed by the challenges that face you. Stress begets stress as your inability to concentrate means that you’re more likely to make mistakes, further worsening the actual situation in which you find yourself.

Theories of stress and coping emphasize the cognitive components of the negative emotions that can stymie you in overcoming the challenges you face. Stress, in this view, is in the mind of the beholder. It’s that belief in your inability to conquer challenges that leads to the negative emotions of anxiety and worry. If you can perceive the threatening situation as a challenge (“I’ll be able to pay that bill by cutting expenses elsewhere”) then the stress will dissipate and positive emotions will replace it.

All of this takes a great deal of mental effort, which theoretically can detract from your ability to perform cognitively challenging tasks. However, according to University of Greifswald (Germany) psychologist Janine Wirker and colleagues (2019), there may be ways in which your memory can actually be enhanced in tasks that tap your ability to recall emotionally-arousing stimuli. Frightening events trigger a rise in the activity of the amygdala, the fear-sensing part of the brain. The amygdala, Wirker and co-authors note, is “the center of a widespread salience network”—meaning that once fired up, it promotes “hypervigilance towards potentially threatening stimuli” (p. 93). Your increased attention to these emotionally arousing events leads to enhanced memory in the all-important encoding stage that registers new information.

If, perhaps, acute stress helps your memory for emotionally arousing stimuli, what happens when the stress is constant? You might notice, and therefore remember, emotionally jolting events, but can your preoccupation with the problems in your life drain your mental resources for the ordinary details required for performing more mundane everyday tasks?

Wirker et al. note that the findings are not clear-cut with regard to the effects of chronic stress on memory in humans. Lab studies with rats clearly show that there are detrimental long-term effects of being placed under experimentally-induced chronic stress. These effects include actual degeneration of neurons in the brain region responsible for memory and a slower rate of recovery from that damage. Researchers who study stress and long-term memory in humans assume that there are similar effects, but as Wirker et al. note, the results are less consistent.

Rather than induce chronic stress in their human participants, the German researchers measured levels of existing stress by examining the amount of cortisol in the hair, a hormone that lodges in your follicles, registering exposure to stress over the past six months. Wirker and her colleagues then exposed their participants to photographs found in previous research to evoke strong emotional reactions. The positively arousing pictures included erotic couples and adventure; negatively arousing photos showed scenes involving attack and mutilation. As control, other photos of a neutral emotional quality included images of nature and objects.

The authors predicted that participants with high levels of cortisol in their hair would be more likely to attend to the emotionally-laden pictures due to their heightened state of alertness to any potential threats. The sample consisted of 20 healthy women with an average age of 21, screened for history of psychological disorders, current or chronic medical conditions, and familiarity with the actual stimulus materials. In addition to testing their memory for the pictures, the research team also took electrophysiological measurements consisting of what is called a “late positive potential (LPP),” which provides an indication of attentiveness and is tied to functioning of that fear-sensing amygdala.

In evaluating memory, the authors used a measure of recognition memory, in which participants stated whether they had seen the photograph or not (i.e. “Yes-No”). Recognition memory tests offer the distinct advantage for this type of study by providing researchers with an indication of whether participants are trying to improve their scores with “false alarm” responses in which they hedge their bets on getting the answer right by saying “yes” even when a stimulus was not actually shown to them. This rate, when compared with the “hit” rate (a “yes” response to an actual stimulus) allows researchers to test memory accuracy, or ability to discriminate the photos in the actual stimulus set. You can imagine that people primed to over-react to emotion-arousing pictures would probably have a high false alarm rate because they are just not that good at attending to details when their internal stress signals become triggered.

article continues after advertisement

As the authors expected, those with high cortisol levels were especially likely to show greater LPP’s, hence brain activation, when confronted with emotional stimuli compared to neutral controls. Thus, people under chronic stress become hypervigilant to any new stimulus that has emotional significance.

You can probably relate to this experience if you’ve ever felt particularly stressed for a period of time and have become chronically edgy. You’re sitting outside in the fresh air trying to relax and get your mind off of work. All of a sudden, you catch sight of a car going down the street at what you think is an excessive rate of speed. You feel your blood pressure rise as you worry that the car is going to hit a pedestrian. As it turns out, the car just goes by, but you remain quite rattled.

Turning now to memory, you might think that the heightened attention the stressed participants paid to emotional stimuli would actually help them solidify their memory for the stimuli they saw in the lab. However, supporting animal models of stress and memory, the participants with higher stress levels performed less accurately when tested on emotional stimuli. They also had higher false alarm rates.

Thus, people under chronic stress may pay undue attention to new stimuli but then become primed to believe they saw images that were never presented to them. The anxiety that can accompany these constant shocks to the system could contribute, as the authors suggest, to the development of the stress-related psychological disorders involving alterations in mood and anxiety as well as to poorer memory overall.

To sum up, the German study shows the value of recognizing the potential for constantly high stress levels to impair not only your mental health but also your ability to function cognitively in the world. Working that cortisol out of your hair as well as your body’s inner functioning can help you retain both your memory and your peace of mind.