1.Gold ETFs Take in More Money Than 2009 Crisis…$14.5B in Less Than 5 Months.

Gold ETFs Luring Record Amounts of Cash Despite Risk-Asset RallyBy Claire Ballentine and Justina Vasquez

Funds take in $14.5 billion on inflation, stock pullback fears

· Money continues to pour in as equities regain 30% from lows

2.$4.8 Trillion in Cash on the Sidelines.

CNBC noted “The assets sitting in money market mutual funds now totals $4.8 trillion, which equates to around 16% of market cap. On a percentage basis it’s not as big as 2008, but it’s still a meaningful amount of dry powder earning little & suffering from increasing FOMO.”

Dave Lutz at Jones Trading

3.M2 Money Supply Up 22%

KEY TAKEAWAYS

- M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money.

- M2 is a broader measure of the money supply that M1, which just include cash and checking deposits.

- M2 is a closely watched as an indicator of money supply and future inflation, and as a target of central bank monetary policy.

https://www.investopedia.com/terms/m/m2.asp

https://fred.stlouisfed.org/series/M2

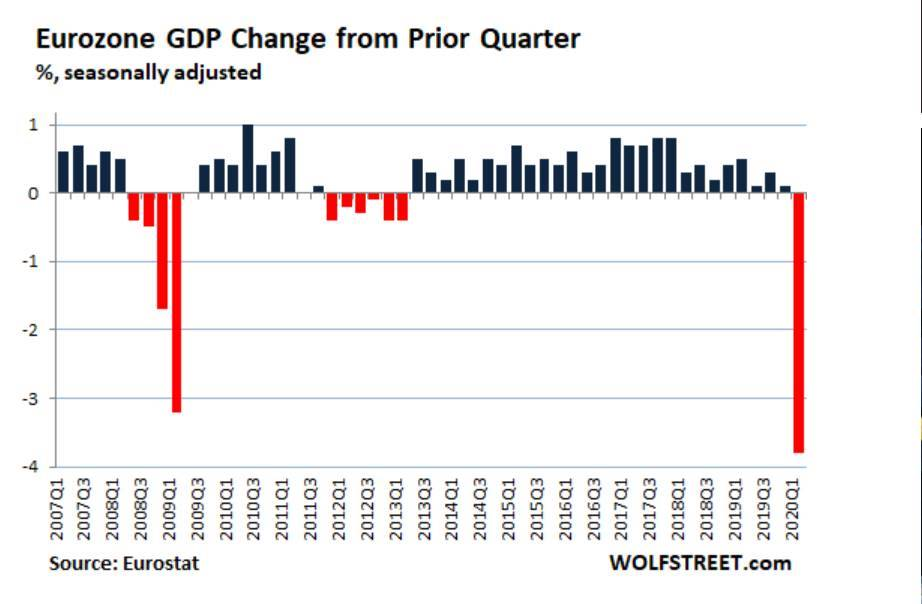

4.Third Crisis in 12 Years for Eurozone…Only 21 Years of Existence.

In its 21 years of official existence, the Eurozone has already been through two brutal crises — the Global Financial Crisis and one of its own doing, the Euro Debt Crisis — that nearly tore the bloc apart. Now, it is in the grip of another one that is already exacting a larger toll than the first two, despite having barely begun.

The preliminary GDP in the first quarter for the Eurozone fell by 3.8%, according to Eurostat’s flash estimates (for the entire EU, it fell by 3.5%), “the sharpest declines observed since the time series started in 1995,” Eurostat said. This is despite the fact that most of the region’s lockdowns did not begin until mid-March:

Third Mega-Crisis in 12 Years: Eurozone Economy Plunges at Fastest Rate on Record

by Nick Corbishley Wolf Street

5.Coronavirus: Merkel and Macron propose €500bn EU recovery fund

Jill Petzinger, Germany Correspondent, Yahoo Finance UK

German chancellor Angela Merkel and French president Emmanuel Macron have outlined a joint initiative to help drive the European Union’s recovery from the economic damage of the coronavirus crisis.

Merkel and Macron jointly proposed a €500bn (£445bn, $543bn) economic recovery fund that could offer grants to the hardest-hit regions and sectors, the leaders announced at a joint virtual press conference on Monday (18 May).

They proposed that the European Commission would be authorised to borrow the money on the financial markets. All 27 EU member countries would have to approve the fund.

“Such a crisis demands a corresponding response,” Merkel said, adding that the goal was to ensure that the European Union comes out of this crisis in solidarity.

The leaders of the EU’s two largest economies met via video conference between Berlin and Paris to try and find a common position on a recovery fund, which would come out the European Union’s 2021 to 2027 budget.

The “ambitious, targeted and temporary” recovery fund would finance the relaunch of the EU economy. The eurozone economy is predicted to shrink by 7.7% overall this year.

Since the coronavirus crisis hit, France has sided with Spain and Italy to demand that the EU issue joint debt, in the form of “corona bonds,” to raise money for EU member states whose economies have been devastated by the coronavirus pandemic.

Germany, Austria, and the Netherlands opposed debt mutualisation for the bloc, although Germany has said it is ready to commit to much more aid for EU countries.

Spain, France, and Italy have been the worst-hit EU countries in terms of both coronavirus cases and deaths from COVID-19.

Germany, although it is now in recession and expects a significant drop in GDP in 2020, has seen comparatively fewer deaths — currently still under 8,000 according to Johns Hopkins University data.

EU spokesperson Arianna Podesta said today that Berlin’s state aid to support its economy accounts for more than half the €1.95tn in state aid approved by regulators for the whole EU.

The coronavirus pandemic pushed Europe’s largest economy to abandon its long-held ‘black zero’ rule against taking on new debt, and it has mobilised billions in grants, state-backed loans for companies, and short-term work programs.

6.Value Valuation Spreads vs. Growth at Max Percentile

Small Cap Value ETFs were +7% Yesterday….

AQR

Even when removing tech sector growth vs. value record spreads in valuation.

Is (Systematic) Value Investing Dead? Cliff Asness AQR

https://www.aqr.com/Insights/Perspectives

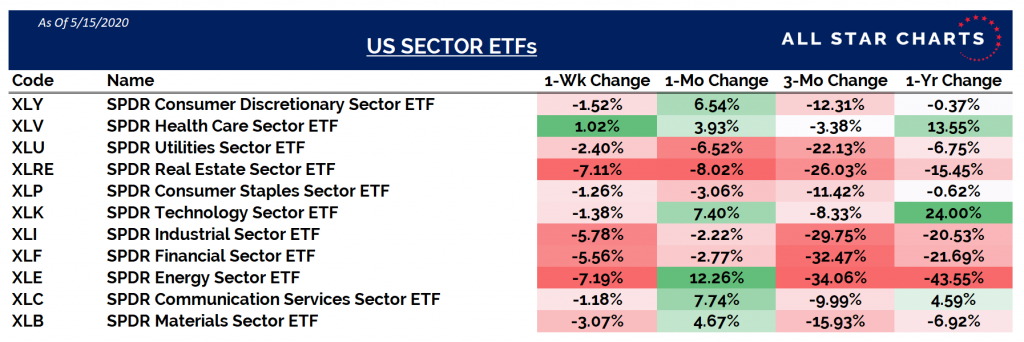

7.Spreads Between Sectors 2020

All-Star Charts

This week’s main theme is that the strong continue to get stronger and vice versa, which we’ll highlight in our Industry and Sector ETF tables, below.

Notice how the top three performers this week also happen to be the only Industry ETFs that are positive over the trailing 3-month period?

Gold Miners (GDX), Biotech (IBB), and Internet (FDN) posting positive 3-month returns may not sound like much but is actually quite impressive as it means these areas have already taken out their highs from just before the broader market peaked and collapsed in February.

https://allstarcharts.com/wp-content/uploads/2020/05/05.17.20Returrnsusindtry-1.png

Found at Abnormal Returns www.abnormalreturns.com

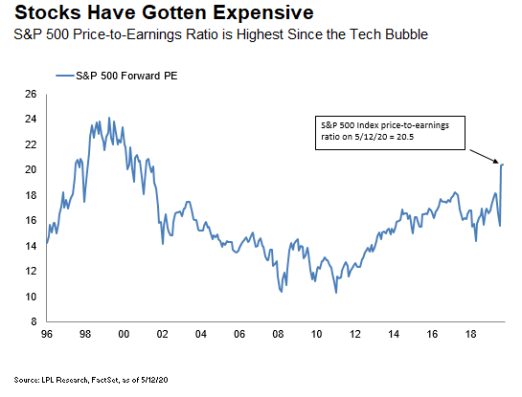

8.Historical Look at Forward P/E Getting Back Above 20

As shown in the LPL Chart of the Day, the forward (next 12 months) price-to-earnings (PE) multiple for the S&P 500 Index recently eclipsed 20, which is overvalued based on historical averages and at the highest level since the tech bubble in the late 1990s.

9. These Asian economies seem to have contained the coronavirus outbreak. Here’s how they did it-

Yen Nee Lee-CNBC

Asian economies such as Taiwan and Hong Kong appear to have contained the spread of the coronavirus within their borders, with the number of daily new cases slowing to a trickle in the last few weeks.

· That’s a feat that few globally have achieved even as an increasing number of countries and territories started winding down containment measures to get their economies going again.

· Those economies arrived at that stage via different routes, but experts pointed out that their governments were generally quick to enact containment measures and appeared to have learned from their experience handling the SARS outbreak nearly 20 years ago.

https://www.cnbc.com/2020/05/19/how-taiwan-hong-kong-vietnam-contain-the-coronavirus-outbreak.html

10.The Daily Stoic.

It’s easy to look at history and learn the wrong lesson. You see Alexander the Great or Julius Caesar and can’t help but connect their enormous ego to their incredible successes. Or you watch Elizabeth Holmes escape consequences for her frauds and Adam Neumann, the founder of WeWork, get rewarded with a golden parachute and think: the upside of ego is enormous and the downside is pretty minimal. You look at a Steve Jobs or a Kanye West and it’s understandable to think that ego is an asset.

This is a mistake. Correlation and causation are not the same thing.

As William Manchester would write of Douglas MacArthur, it’s not that MacArthur’s ego contributed to his success, it’s that “his gifts were so great that he repeatedly triumphed in spite of himself.” Kyrie Irving is not a great athlete because he has an ego. It’s that his talent as a basketball player was great enough for three teams to absorb his ego in order to utilize those talents… and even then this turned out to be a costlier bargain than they thought.

The Stoics believed that ego was the enemy of real greatness. When Marcus Aurelius looked back at the emperors who preceded him, he didn’t think: “Oh, Tiberius and Hadrian got away with big egos, so can I.” Instead, what he saw was what could have been. How much more they could have accomplished, how much grander and more meaningful their legacy would have been had it been infused with more temperance, wisdom, justice, and courage. And that’s how we should look at an Adam Neumann or a Steve Jobs or a Kanye West, too—not as rationalizations for our own egos, but as cautionary tales. They could have done more, been better people, and avoided many of their most painful failures.

Remember today that ego is not making you better. At best, it is a drag on your talents—a tax people are only willing to pay for a short time. At worst, it is a ticking time bomb that will take you and the people who work with you down in flames.

Beware.