1.The 60/40-60% Stock and 40% Bond Portfolio Down -20% for Only the 4th Time in 75 Years.

Michael Santoli@MICHAELSANTOLI

The traditional retirement portfolio of stocks and bonds is down 20% for only the fourth time since WWII Michael Santoli@MICHAELSANTOLI

VBINX-Vanguard 60/40 Index…Above 2018 Sell-Off Lows

2.Good News…Insiders are Buying Stocks

“The ratio of companies with insider buying compared to insider selling is at 1.75 for March, its highest level since March of 2009”

“Insiders have a 35+ year track record of buying on the type of extreme weakness experienced in Q1′20,” InsiderScore director of research Ben Silverman said in a note. “A dramatic increase in insider buying volume combined with dampened levels of insider selling has resulted in the generation of industry buy inflections – our strongest, quantitative macro signal – for the entire market.”

3.Baltic Dry Index Dropped -83% From High 2400

Baltic Dry Index

The Baltic Dry Index (BDI) is an assessment of the average price to ship raw materials (such as coal, iron ore, cement, and grains) on a number of shipping routes (about 50) and by ship size. It is thus an indicator of the cost paid to ship raw materials on global markets and an important component of input costs

Above 10,000 in 2007

4.Commodity Index -35%

Jefferies Commodity Index

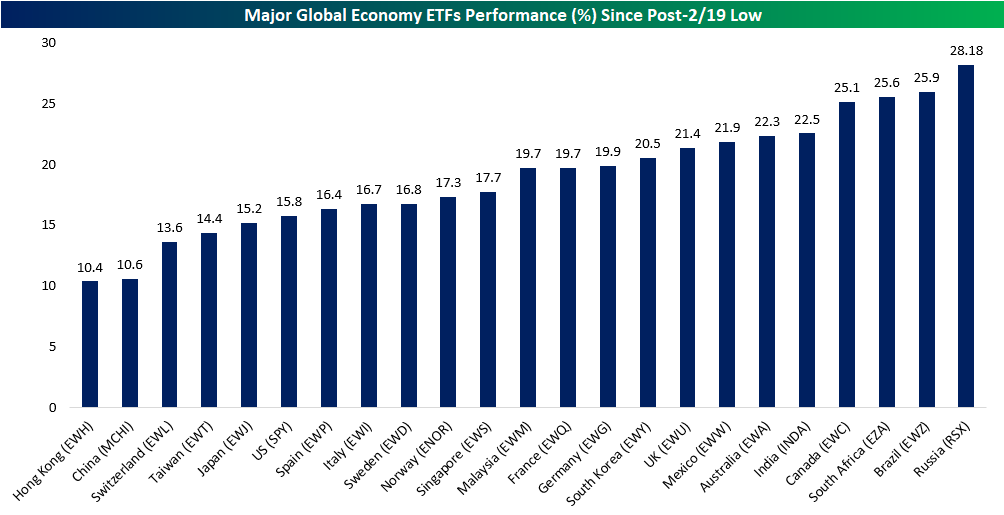

5.Country ETFs’ Drawdowns and Rebounds

Thu, Mar 26, 2020

The COVID-19 pandemic has impacted equity markets around the globe. As shown in the table below, the equity markets of all the major global economies tracked in our Global Macro Dashboard (using each country’s ETF as a proxy) are all well off their 52-week highs with only four—Taiwan (EWT), Switzerland (EWL), Japan (EWJ), and China (MCHI)—less than 20% away from the past year’s high. While not as close as those four, the US is actually one of the countries that is closest to its recent high; down ‘just’ 23.2% after this week’s rally. Brazil (EWZ), on the other hand, is currently the furthest below its 52-week high at 45.8%.

The S&P 500 (SPY) peaked on February 19th and was down 34.1% from there at Monday’s close. Including SPY, that Monday close has marked at least a temporary bottom for a number, though not all, of these country ETFs. Since then, SPY has risen over 15% and that is actually on the lower end of these countries’ performance. The chart below shows how much each country’s ETF has rallied off of their respective lows since the global sell-off began on 2/19. Russia has seen the biggest rebound having risen 28.18%. Granted, it also bottomed ahead of other countries putting in its low on March 18th. Even though it is down the most off of its 52-week high, Brazil is also one of the best performers since its low on Monday. South Africa and Canada have also risen more than 25% since their lows on Monday. Start a two-week free trial to Bespoke Institutional to access our Global Macro Dashboard and our full range of research and interactive tools.

©2020 Bespoke Investment Group

https://www.bespokepremium.com/interactive/posts/think-big-blog/country-etfs-drawdowns-and-rebounds

6.Warren Buffett Cash Pile—Berkshire Could Buy 11 of the Dow 30 Stocks.

Elephant Hunting – Warren Buffett’s Berkshire Hathaway boasted $125 billion in cash, cash equivalents, and short-term investments in US Treasuries at the end of December. Assuming that figure hasn’t changed, and looking purely at market caps — ignoring whether a purchase would be feasible, sensible, or even legal — Berkshire could buy one of more than 450 companies in the S&P 500, more than 80 in the Nasdaq 100, and 11 in the Dow 30 without needing a loan, as of the close of trading on March 27.

Dave Lutz Jones Trading

Berskshire Hathaway Falls Well Below 2018 Lows.

7.Following Prior Announcements of Quantitative Easing Yields Actually Rise.

As shown in the LPL Chart of the Day, following prior announcements of quantitative easing (Fed securities purchases), yields have actually risen. Part of that story is the market pricing in higher inflation expectations as a result of the “money printing.” Another piece is the market becoming more confident in economic recovery. “The massive injection of liquidity into the bond market by the Federal Reserve—in concert with fiscal stimulus—surely helps shore up the economy and credit marekts for an eventual recovery,” noted LPL Financial Sr. Market Strategist Ryan Detrick.

8.Read of the Day…The Mystery of the Profitable Energy Marks

PSCE-small cap energy ETF -80% but private equity energy deals not showing sell-off

THE MYSTERY OF PROFITABLE ENERGY MARKS….GREAT FULL READ

An industry gadfly questions the value private-

equity firms are applying to energy holdings.By Christine Idzelis

After Dan Rasmussen, founder of Verdad Advisers, pored over the performance of private-equity energy investments, a discrepancy nagged at him: Private funds focused on energy had fared strikingly well compared to small, publicly traded companies in the sector. Maybe a little too well, to his mind.

It seemed improbable to Rasmussen that most energy funds from vintage years 2012 to 2015 were profitable in 2019. Oil has not recovered from its 2014 plunge — it’s now trading below $30 a barrel, more than 70 percent lower than levels in early 2012 — and energy stocks have sunk over the past six years.

“It’s a mismatch that’s really kind of bizarre,” he recently said by phone. “Either these guys are all geniuses,” or “whatever methodology they’re using to value their portfolio is not comparable to how markets value public companies.”

Private-equity managers typically mark their portfolio performance quarterly, avoiding the daily swings and scrutiny of the public market. Fund valuations can influence a “whole chain of decisions” by end investors, said Rasmussen, from manager selection to spending levels to how much of their portfolios to allocate to an asset class.

Using data from private-markets tracker Cobalt, Rasmussen analyzed the performance of 41 energy funds from vintage years 2012 to 2015, including multiples of investment cost and internal rates of return. (The vintages are determined by when the funds first began investing, he explained, with their marks being as recent as the end of June or September.)

Rasmussen found 83 percent of the funds were marked as profitable — remarkable performance considering the S&P SmallCap 600 Energy Index lost 78 percent from the end of 2012 through September 2019.

“Those two worlds are so far off,” he said.

This year, things have gotten even worse for energy stocks. Investors have fled oil and gas companies on fears that the coronavirus pandemic is sapping energy demand, and that lower crude prices will dent cash flows.

The question, said Rasmussen, is whether private-equity holdings would actually be worth what managers say they are if they tried to sell their energy assets right now. The discrepancy in private-equity energy performance is “egregious,” he said. “What does that say to investors in this asset class — and how they should think about the value of their portfolios?”

But another opaque and niche part of the private-equity world seems to have caught on.

This niche area of trading, known as the secondary market, reveals investors were signaling pain in energy even before this month’s turmoil, shunning some portfolios in the sector while demanding deep discounts for others.

The price they’re willing to pay for stakes in funds focused on energy has declined significantly in secondary trading, according to Michael Dean, a managing director at HarbourVest Partners.

“Most energy secondaries trade at meaningful discounts to net asset value,” he said by phone. By comparison, stakes in private-equity funds across strategies traded at an average 101 percent of NAV in the last half of 2019, according to a survey by Palico, which runs an online marketplace. There, investors can buy and sell interests in funds that lock up capital for years.

READ FULL STORY

Found at Barry Ritholtz blog https://ritholtz.com/

9.FDA authorizes 15-minute coronavirus test

By Arman Azad, CNN

Doctors answer your coronavirus questions

(CNN)Federal health officials on Friday approved a coronavirus test that can provide results in less than 15 minutes, using the same technology that powers some rapid flu tests.

Teased by Vice President Mike Pence in a Thursday press briefing, the new diagnostic test could accelerate testing in the United States, allowing for rapid results in doctors’ offices. But shortages of critical equipment used to collect patient specimens, like masks and swabs, could blunt its impact.

The US Food and Drug Administration authorized the test for emergency use, signaling that federal regulators were satisfied with the test’s validation data and believe its benefits outweigh any risks, such as false positives or negatives.

The test’s maker, Abbott Laboratories, said it expects to deliver 50,000 tests per day beginning next week. The technology behind the test looks for genes that are present in the virus, similar to PCR (polymerase chain reaction) tests already on the market.

Coronavirus symptoms: A list and when to seek help

The platform used to run the test weighs less than 7 pounds, according to Abbott, and could be deployed “where testing is needed most.”

Last week, the FDA authorized another rapid test from molecular diagnostics company Cepheid, which provides results in about 45 minutes. Most laboratory tests for the coronavirus take anywhere from a few hours to days to receive results.

All FDA-authorized tests, however, require samples from patients and health care facilities say they’re facing shortages of critical supplies needed to collect specimens.

The US Centers for Disease Control and Prevention on Tuesday issued guidance allowing some patients to collect their own nasal swabs in health care facilities, which could reduce the amount of protective equipment needed for health care workers.

But in some places, like New York City, health officials have said that patients with a coronavirus-like illness should stay home, saying that is “safer for the patients and health care workers” and doesn’t change the treatment patients receive.

https://www.cnn.com/2020/03/27/us/15-minute-coronavirus-test/index.html

10.Only 8% of People Stick to Their Goals.

HOW TO SET GOALS AND ACTUALLY ACHIEVE THEMBy: TEAM ASPREY

· Only eight percent of people stick to their goals; the other 92 percent give up. There’s a key difference between the two groups: the people who succeed know how to set good goals.

· A good goal has to have several things: a deep purpose behind it, clear-cut parameters for success, and diversified meaning that makes it easier to handle failure.

· This article covers how to set goals for yourself that you’ll actually keep.

Here’s a little money-saving hack: if you want a good deal on a gym membership, join in January.

Any gym owner will tell you that January is their most lucrative month of the year. Gyms offer discounts and run marketing campaigns, and pretty soon new members come flooding in, all intent on sticking to their New Year’s resolution: to get in shape.

Getting fit is a worthwhile resolution. But that same gym owner will tell you that by February, every year, the newcomers have stopped showing up. Only eight percent of people stick to their New Year’s resolutions.[1] For the rest, excitement wanes, motivation runs out, and it’s back to the couch instead of the gym.

REACHING YOUR GOALS TAKES WORK

What sets the successful people apart? What does it take to be in the eight percent of people who succeed at their goals, instead of in the 92 percent who don’t?

It’s a good question. There are a few reasons people fail at their goals. In his recent Bulletproof Radio podcast episode [iTunes], high performance coach Brendon Burchard talks about what it takes to set your mind to something and actually achieve it.

“You have to ask, ‘who do I have to become to achieve the purpose I want?’” Burchard says.

Burchard acknowledges what a lot of motivational coaches don’t: reaching your goals is hard work. It requires doing things you don’t want to do. That’s why 92 percent of people who set New Year’s resolutions fail — your motivation runs out sooner or later, and when it does, you have to dig deep to stay committed to your goals.

Most people give up when faced with hard work, or they overcommit and burn themselves out because they don’t think long-term. It’s a shame, because research shows that working hard (and sustainably) toward a goal that truly matters to you is one of the best ways to enrich your life.

With a little guidance and the right mindset, you can set meaningful goals and actually achieve them. Here’s how to set good goals, pursue them properly, and make it into the eight percent of people who stick to their New Year’s resolutions.

CREATE PURPOSE, DON’T SEARCH FOR IT

If a goal is worthwhile, it’s going to be difficult to reach it. You’re going to struggle, fail, learn, and work hard, and by the time you achieve your goal, you’ll be a quantifiably stronger person than you were when you started.

But in order to weather all the hard work and failure along the way, your goal has to really mean something to you.

The good news is that you get to decide on that meaning. The second law of success in Bulletproof Founder Dave Asprey’s new book “Game Changers: What Leaders, Innovators, and Mavericks Do to Win at Life” is “Never Discover Who You Are.” Instead of trying to discover who you are, decide on who you want to be, and actively create that person. If you let others tell you who you should be, you’ll never have a real sense of meaning in life, and you’ll struggle with feelings of mediocrity and creeping misery.

Meaning in life isn’t something you find, it’s something you create, and if your goals aren’t imbued with meaning, you won’t want them badly enough to stick with them through hard times.

If you want to lose 40 pounds to get abs, for example, you probably won’t make it. How you look is superficial. But if you want to lose 40 pounds so you can be fit enough to play with your kids and be alive when they’re in their twenties, you’re much more likely to stay committed to that fat loss.

Identify a purpose that drives your goals. Make it something that really matters to you at a deep level. Get as specific as possible, and write it down somewhere. Purpose is what will keep you going on the path to success.

You’ll also be happier when you’re working toward something that really matters. Overcoming obstacles in pursuit of something valuable gives your life meaning, which leads to a deep sense of fulfillment.[2] Figuring out challenges also shows you that you’re stronger than you thought, which builds resilience.[3]

So pick something you really want and that carries deep importance to you. That’s what you’ll structure your goals around.

HOW TO SET GOOD GOALS FOR YOURSELF (AND ACTUALLY ACHIEVE THEM)

Once you’ve chosen a purpose-driven goal, it’s time to figure out how to achieve it on a practical level. You want to set clear parameters for success when it comes to your goal. That way you’ll know exactly when you succeed and exactly when you fail, and you can figure out where you’re falling short and correct it.

A lot of people don’t get specific with their goals. It’s understandable — if you don’t define failure, you’ll never have to acknowledge when you’re failing. But being able to identify your shortcomings is crucial to success, and in order to do that, you have to be practical and specific with your goals.

Let’s continue with the example from before. You want to be a better parent to your kids, and right now you’re too overweight to run around with them without getting winded. What would success look like? Write out the parameters:

· Lose 10 percent body fat

· Play ball with your kids for an hour, four times a week

· Be able to run a mile in under eight minutes

You’ll notice that all these parameters for success are quantifiable. There’s no room for interpretation; either you run a mile in eight minutes or you don’t. Either you’re fit enough to play with your kids for an hour, or you aren’t.

Set specific, practical goals with clear parameters for success. You have to know, unambiguously, when you’re succeeding and when you’re failing.

The next step is to set a timeline for your goals. Maybe you aim to lose one percent body fat per week, or start by playing ball with your kids once a week and work up to four times a week in the next six months. Set a clear schedule, and make it challenging enough that you fail 20-40 percent of the time. That failure means you’re pushing your limits. Aim to reduce the amount that you fail, week by week.

To summarize, your goals should have:

· A purpose driving theme

· Practical, quantifiable criteria for success

· A timeline that challenges you so you fail 20-40 percent of the time

Keep track of your progress in a journal or a free habit tracking app like Way Of Life. You want to have data that shows you how you’re doing.

DON’T PUT ALL YOUR EGGS IN ONE BASKET

You’re going to fail on the way to your goals. It’s an inevitable part of growth. Failure is important feedback. It tells you when you’re falling short and offers an opportunity to examine yourself, figure out what you’re not doing well, and correct it.

Failure also sucks. It’s painful to find out that you’re not good at something, and it takes humility to accept your shortcomings and work to correct them. Most people try to avoid failure, which is a fool’s errand; instead, make yourself more resilient to failure by having several goals at once.

Having multiple goals diversifies the meaning in your life. Maybe you fall short on goal A one day, but you do a great job at goals B and C. That makes goal A’s failure less devastating, and allows you to figure out why you fell short and correct it instead of being overwhelmed by your failure.

Set three or four goals for yourself at a time. More than four can be overwhelming and decreases the value of each goal. Fewer than three means you’re too invested in each goal, and when you inevitably fail, you’re more likely to feel crushed and give up.

Use these tools to set good goals for yourself. Get clear on what you really want, and why, and how you’re going go get it. Instill a sense of purpose in your life, then work hard to achieve it. You might be surprised by what you can do.