1.Index Funds $10 Trillion.

Index Funds Power through $10 trillion in assets

Source: Financial Times

From Barry Ritholtz The Big Picture https://ritholtz.com/

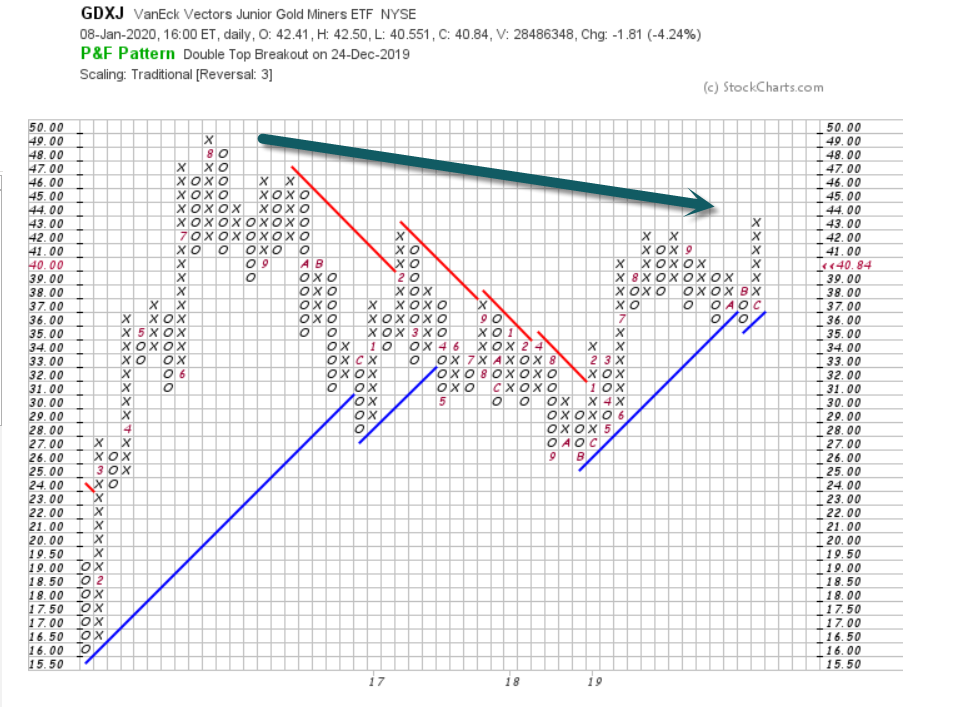

2.With Iran Situation and Impeachment…Junior Gold Miners +46% from Summer 2019 Lows

GDXJ Junior Gold miners the most aggressive risk on play for gold

Group has not broken out above 2016 highs yet

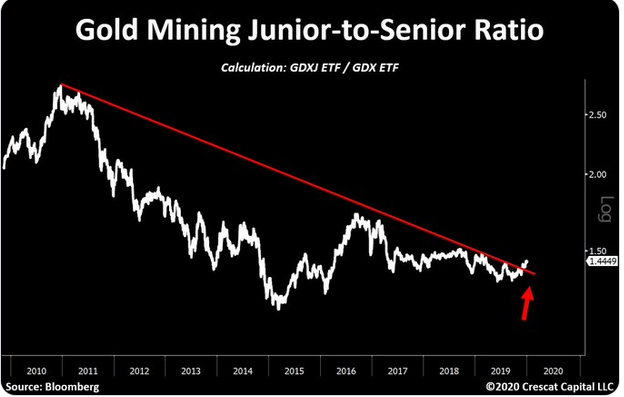

3.Junior Gold Miners vs. Large Gold Miners Breaking Out…Signal of Bigger Rally?

Twits note Gold mining junior-to-senior ratio now breaking out from a decade-long resistance – “A perfect prelude for a precious metals bull market”

From Dave Lutz at Jones Trading.

4.2020 Earnings Estimates.

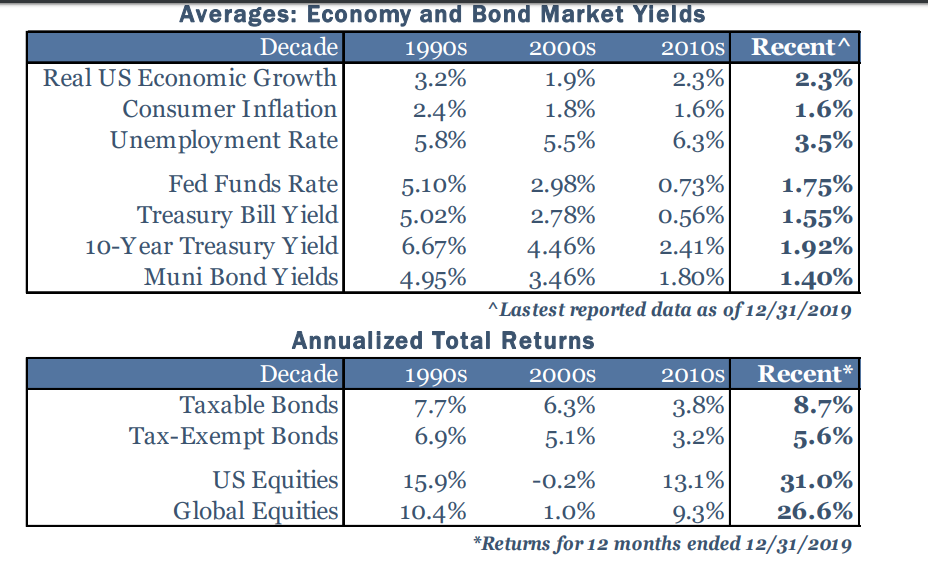

5.Grid of Economy for Last 3 Decades.

Mill Creek

Mill Creek Capital

6.The Market Definitely Does Not Need “Investor Confidence to Go Higher.”

(1 Feb 2019) “As you can see with the chart, the global (investor confidence) index dropped to a record low which indicates massive de-risking”

Cal Thomas Top Down Charts

https://www.linkedin.com/pulse/my-favorite-charts-2019-callum-thomas/

7. Follow up From Yesterday’s Article on the Drop in Cancer Rates.

Cancer Drugs Market All Set To Reach USD 161.30 Billion By 2021

https://www.zionmarketresearch.com/news/global-cancer-drugs-market

8-9.10 Key Tax Breaks Thru 2020

A recent spending package signed into law by President Trump on December 20 retroactively resurrects and/or extends several key tax breaks through 2020. It also provides tax relief for victims of federally declared disasters. Here are ten breaks that can benefit eligible individuals.

| A recent spending package signed into law by President Trump on December 20 retroactively resurrects and/or extends several key tax breaks through 2020. It also provides tax relief for victims of federally declared disasters. Here are ten breaks that can benefit eligible individuals. 1. Reduced Threshold for Medical Expense Deductions The Tax Cuts and Jobs Act (TCJA) set the threshold for itemized medical expense deductions at 7.5% of adjusted gross income (AGI) for 2017 and 2018. The threshold was scheduled to increase to 10% of AGI starting in 2019. Luckily, the Taxpayer Certainty and Disaster Tax Relief Act extends the 7.5%-of-AGI threshold through 2020. To take advantage of the reduced threshold, you might need to “bunch” discretionary medical expenditures — such as dermatology treatments, orthodontics, dentures and eyeglasses — along with other itemized deductions, in alternating tax years. 2. Deduction for College Tuition Costs The federal income tax deduction for college tuition costs expired at the end of 2017. However, the Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects the deduction for 2018 and extends it for 2019 and 2020. That means, depending on your income level, you can deduct up to $2,000 or up to $4,000 of annual eligible college costs incurred in 2018, 2019 and 2020. The following modified gross income (MAGI) limits apply: Taxpayers with MAGI up to $65,000 ($130,000 if married filing jointly) can claim a maximum $4,000 deduction. Taxpayers with MAGI between $65,001 and $80,000 ($130,001 and $160,000 if married filing jointly) can claim a maximum $2,000 deduction. The allowable deduction goes to zero if your MAGI exceeds $80,000 ($160,000 if married filing jointly). Qualifying taxpayers can claim this break, regardless of whether they itemize deductions or take the standard deduction. Important: You may qualify for other education tax breaks, which weren’t affected by the new law, that could be more valuable, depending on your situation. 3. Tax Break for Forgiven Principal Residence Mortgage Debt For federal income tax purposes, a forgiven debt generally counts as taxable cancellation of debt (COD) income. However, a temporary exception applied to COD income from canceled mortgage debt that was used to acquire a principal residence. Under the temporary rule, up to $2 million of COD income from principal residence acquisition debt that was canceled in 2007 through 2017 was treated as a tax-free item ($1 million for married individuals who file separately). The Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this break to cover eligible debt cancellations that occurred in 2018. It’s also been extended to cover eligible debt cancellations that occur in 2019 and 2020. This break also applies to an eligible debt cancellation that happens after 2020 under a binding written agreement that was entered into before January 1, 2021. 4. Deduction for Mortgage Insurance Premiums The deduction for mortgage insurance premiums expired at the end of 2017. However, the Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this deduction for 2018 and extends it for 2019 and 2020. Specifically, premiums for qualified mortgage insurance on debt to acquire, construct or improve a first or second residence can potentially be treated as deductible qualified residence interest. However, the deduction is available only for premiums for qualifying policies issued after December 31, 2006, and premium amounts allocable to periods before 2021. And it’s phased out for higher-income individuals. 5. Credit for Energy-Efficient Home Improvements In recent years, individuals could claim a federal income tax credit of up to $500 for the installation of certain energy-saving improvements to a principal residence. This break expired at the end of 2017. Fortunately, the Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this credit for 2018 and extends it for 2019 and 2020. Important: The $500 maximum allowance must be reduced by any credits claimed in earlier years. In other words, the $500 amount is a lifetime limitation. So, many taxpayers who claimed the credit before 2018 will be ineligible for any further credits for 2018 through 2020. 6. Credit for Fuel Cell Vehicles The federal tax income credit for fuel cell vehicles also expired at the end of 2017. But the Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this credit to cover qualified vehicles purchased in 2018 and extends it to cover qualified vehicles purchased in 2019 and 2020. Under current law, taxpayers can claim a federal income tax credit for vehicles propelled by chemically combining oxygen with hydrogen to create electricity. The base credit is $4,000 for vehicles weighing 8,500 pounds or less. Heavier vehicles can qualify for credits of up to $40,000. An additional $1,000 to $4,000 credit is available to cars and light trucks to the extent their fuel economy specified fuel economy standards. 7. Credit for 2-Wheeled Plug-In Electric Vehicles The federal income tax credit for electric-powered motorcycles expired at the end of 2017. But the Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this credit to cover qualified vehicles purchased in 2018 and extends it to cover qualified vehicles purchased in 2019 and 2020. This credit is for 10% of the cost of qualifying electric-powered 2-wheeled vehicles manufactured primarily for use on public thoroughfares and capable of at least 45 miles per hour. It can be worth up to $2,500. 8. Credit for Alternative Fuel Vehicle Refueling Equipment Another green tax break that expired at the end of 2017 was the federal income tax credit for alternative fuel vehicle refueling equipment. The Taxpayer Certainty and Disaster Tax Relief Act retroactively resurrects this credit to cover property placed in service in 2018 and extends it for 2019 and 2020. The credit equals up to 30% of the cost of installing nonhydrogen alternative fuel vehicle refueling property. 9. Credit for Health Insurance Costs The health coverage tax credit (HCTC) was scheduled to expire at the end of 2019. However, the Taxpayer Certainty and Disaster Tax Relief Act extends it through 2020. This credit equals 72.5% of the premiums for qualified health insurance coverage paid by eligible individuals. Unfortunately, this credit is highly restricted and applies only to certain narrowly defined individuals. 10. Tax Breaks for Federally Declared Disasters The TCJA generally eliminates itemized deductions for personal casualty losses incurred in 2018 through 2025, unless they occur in a federally declared disaster. If you’re the victim of a federally declared disaster you also might qualify for additional relief under the Taxpayer Certainty and Disaster Tax Relief Act, including: Exceptions to the 10% early-withdrawal penalty for qualified disaster relief distributions from retirement plans and IRAs, Recontribution privileges for IRA withdrawals intended for home purchases that were canceled due to an eligible disaster, Flexible rules for retirement plan loans in qualified hurricane relief situations, Temporary suspension of limitations on charitable contribution deductions for donations related to qualified disaster relief efforts, and Liberalized rules for qualified disaster-related deductions for personal casualty losses. These relief measures apply to individuals and businesses in areas affected by federally declared disasters occurring between January 1, 2018, and 30 days after December 20, 2019. We’ll cover them in more detail in a future article. For More Information Consult your tax advisor for more information about the recent “extenders” legislation, including the new disaster relief provisions. In addition to explaining the relevant rules and restrictions, he or she can help you file an amended 2018 return in some cases to take advantage of breaks that were retroactively resurrected for 2018. |

|

© Copyright 2020. All rights reserved. |

From Don Riley Wealth Enhancement Group

https://www.linkedin.com/in/donriley1/

10.How to Keep Meetings Focused, Efficient, and Productive

Getting back into “work mode” after a break isn’t always easy, but with a few creative strategies, you can optimize the use of your team’s time.

By

- Marina Khidekel, Editorial Director at Thrive Global

After a long stretch of holiday celebrations and vacation time, it’s not always easy to get back into “work mode.” When you haven’t sat in a meeting for a week or two, regaining focus and getting back in the groove can feel like a challenge. That’s why it’s important to start with small, realistic Microsteps to protect and prioritize your time.

We asked our Thrive community for the innovative strategies they use to keep their own meetings productive and efficient — and their suggestions are inspiring. Which of these tips will you implement?

Establish a 30-minute cap

“We have a few guidelines that help optimize our time together as a team. We try to keep meetings to 30 minutes or less. It helps regulate debates, and challenges the group to end early. We also find that meetings are most effective when everyone is standing, and team members high five or clap to celebrate decisions made. It’s an instant motivator!”

—Kareen Walsh, CEO and managing consultant, Greenwich, CT

Designate one day for internal meetings

“We have a slightly different approach than most companies when it comes to meetings and it’s called: less meetings. You gain productivity by cutting away the time you and your team spend on unnecessary meetings. If your entire team is in a meeting, then no one is being productive. We have set up our internal business meetings to Tuesdays only, and every meeting have a short agenda with at least two to three action points per attendee, which we follow up on during the week by email, and finally at next week’s meeting on Tuesday.”

—Brian Snedvig, CEO at Jofibo.com, Aalborg, Denmark

Use a “minutes remaining” reminder

“We use ‘minutes remaining’ reminders in our meetings. It helps us ensure that topics being discussed are aligned with what we’d like to spend our time on, so that we can end meetings on time with clear next steps.”

—Alyssa Swantkoski, executive assistant, Denver, CO

Send out the agenda in advance

“I provide all the relevant content for the meeting a few days in advance. I also provide the reason for the meeting, and state what needs to be accomplished beforehand, so everyone can come prepared before we start.”

—Valerie Nifora, Global 500 marketing and communications leader, West Sayville, NY

Turn lunch meetings into walking meetings

“I’m constantly asked to sit down for a quick lunch or coffee meeting, but I travel a lot, so my time in the office is something I need to protect. I try to keep the ‘meet and eats’ to a ‘meet and move’ instead. For me, it allows me to get a workout in, and for the person who wants my time, moving and meeting means they’ll get to see me sooner than if they waited for a spot on my workday calendar. There are even studies that show that moving while meeting allows the brain to solve problems more creatively!”

—Laura Gassner Otting, author, Boston, MA

Send out pre-meeting thought starters

“The best action I take to maintain maximum productivity is putting aside a few minutes to send out a pre-meeting note of what we’re going to review during the session. This way, everyone shows up knowing what we’re going to cover, along with the estimated time it’s going to take. The idea is to have everyone show up ready to go with their thoughts and suggestions.”

—Brandon Schaefer, big data specialist, Philadelphia, PA

End with three takeaway questions

“I find the most frustrating part of meetings is the feeling that everyone is wasting their time. To keep things moving forward and increase productivity, I find it helpful to ask three specific questions at the end of each meeting: ‘What did we just agree to?’ ‘Who is going to do it?’ And ‘When will it be done by?’ This way, everyone can leave with a sense of accomplishment and direction.”

—Al Roehl, executive leadership consultant, Lexington, KY

Start with a “mindful minute” exercise

“I spent many years of my military career feeling that certain meetings were a waste of time, and I vowed I’d flip the dialogue when I led my own team. As a commander, I introduced the ‘Mindful Minute.’ It’s a way to cognitively prepare and strengthen the attention systems of everyone in the room during the first 60 seconds of the meeting. We start with six deep breaths to improve focus and clarity, and they act as an anchor for mental push-ups. The whole meeting afterward becomes more calm and action-oriented.”

—Jannell MacAulay, Ph.D., keynote speaker and consultant, Salt Lake City, UT

Review last week’s action items

“We begin each meeting by reviewing action items that were assigned last week for a progress check. This strategy sets the tone for the meeting by allowing us to dive in right away, and celebrate any achievements that have been made in the last week.”

—Alyssa Swantkoski, executive assistant, Denver, CO

Try emailing first

“Before I set an agenda for a meeting, I check to see what can be accomplished with email first, and then what still needs to be discussed in person. This ensures I’m not wasting anyone’s time. It also helps to have someone in the meeting keep track of time so I can be diligent about getting through each item.”

—Marla A. Parker, Ph.D., educator and consultant, Los Angeles, CA

Break down tasks into actionable goals

“A good exercise to cut away any unnecessary and boring meeting content is to ask yourself, ‘Can we break down a complex task into one actionable goal, and then follow up on it at the next meeting, next week?’ Asking this question helps keep the meeting concise and actionable.”

—Brian Snedvig, CEO at Jofibo.com, Aalborg, Denmark

Open with gratitude

“Starting a meeting with a pause for gratitude keeps meetings human-centered, and demonstrates to attendees that leaders see more than to-do lists and agenda items. Gratitude is shown to reduce unproductive, unpleasant, or toxic emotions. Therefore, by starting with gratitude, we are creating the conditions that allow our meetings to be more conducive to learning, growth, productivity, efficiency, and focus.”

—Marissa Badgley, M.S.W., founder, trainer, and consultant, New York, NY

Try a breakfast meeting

“Getting back into the routine of working can be a monotonous task, which is why it’s important for companies to ease employees in. I find that holding breakfast meetings, or offering any form of beverage and delicious little bites can help, even if it is simply having lunch together to make individuals feel a part of a team and the organization. Food is a good way of socializing, and it allows team members to ease back in, and improve focus.”

—Belynder Walia, psychotherapist, RTT™ practitioner and mindfulness coach, London, UK

Keep the room tech-free

“To keep meetings focused, ban phones, iPads, and laptops. Also, state the duration of the meeting beforehand and stick to it. As the chairperson, keep to time; ideally, you should have a timetable and stick to it!”

—Susan Heaton-Wright, impact presence and speaking trainer, Hertfordshire, UK

Select attendees mindfully

“To ensure a great meeting, it’s important to have the right people in the room. As Jim Collins wrote in his seminal book on Leadership, From Good To Great, it’s all about getting the right people on the bus. So whoever is calling the meeting needs to ensure that the right people are at the meeting. Talk with them beforehand to make sure they can attend, and state the agenda beforehand.”

—Paul Adam Mudd, executive director and company secretary, UK

Do you have a tip that keeps your team meetings focused and productive? Share it with us in the comments!

Follow us here and subscribe here for all the latest news on how you can keep Thriving.

Stay up to date or catch-up on all our podcasts with Arianna Huffington here.

— Published on January 6, 2020

https://thriveglobal.com/stories/how-to-keep-meetings-focused-productive-work-tips/