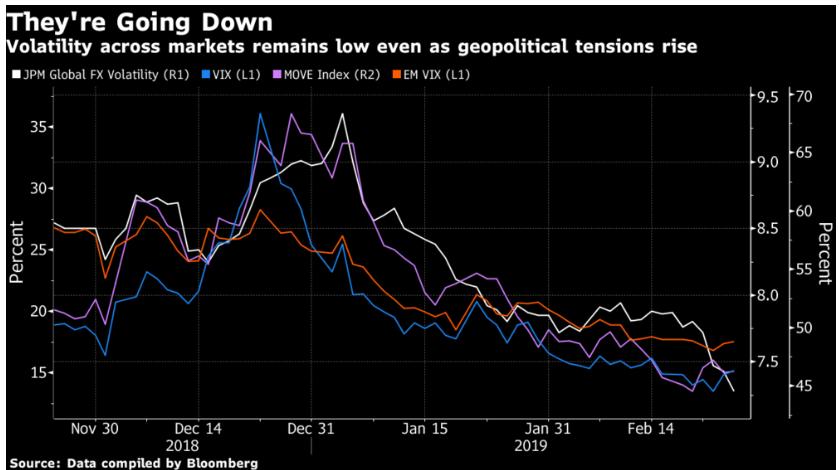

1.Volatility Across Markets Big Drop.

Five Things You Need to Know to Start Your Day Get caught up on what’s moving markets. By Lorcan Roche Kellyhttps://www.bloomberg.com/news/articles/2019-02-27/five-things-you-need-to-know-to-start-your-day-jsn4mcso?srnd=premium

2.Another Risk On Measure…IPO Market.

A Fair Amount of Unicorns Lining Up for IPOs—ETF Close to Breaking Out.

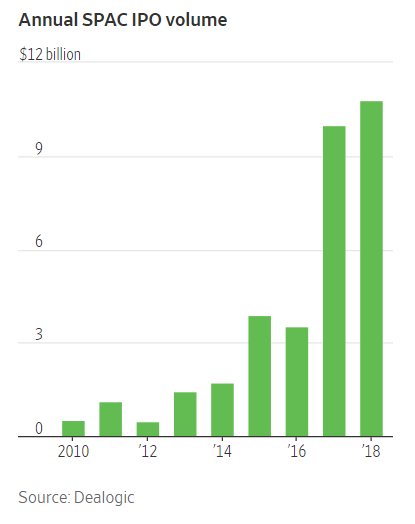

3.Blank Check SPAC IPO Volume Hit New Highs.

Blank-check companies—initial public offerings for special-purpose companies, or SPACs, that raise cash for acquisition—are enjoying their highest popularity in more than a decade, raising more than $10 billion in new listings last year.

Such firms don’t have assets or any operating histories. They are largely bets on their executives, who seek to do a deal within a specified time, typically two years.

But investors should still be cautious about the structure, according to a review of the companies’ performance by The Wall Street Journal.

Blank-Check Companies, a Hot IPO Fad, Contain Pitfalls for Investors

More than half of SPACs that went public in 2015 and 2016 are now trading below their offering price

By

Alexander Osipovich

4.Buybacks Below Highs.

Stock buybacks ETF watching to see if it makes new highs before the S&P

5.Japan vs. German 10 Yr.

Good Morning from #Germany where #Japanification narrative prevails. 10y German Bund yields hover around 0.1%, lowest since 2016. All the money printing failed to push Inflation and Bund yields higher, so they continue mimicking JGB’s yields of the 1990s.

Holger Zschaepitz @Schuldensuehner 6h6 hours ago

https://twitter.com/Schuldensuehner

6.Housing Starts and Recessions

Urban Carmel

https://twitter.com/ukarlewitz/status/1100426433824837639

7.Slowest Pace of Home Growth in 4 Years.

The numbers: The S&P CoreLogic Case-Shiller 20-city index rose a seasonally adjusted 0.2% in December compared to November and was 4.2% higher compared to a year ago. That was the slowest pace of annual growth since November 2014.

What happened: Home price growth is screeching to a halt, and yet prices are still increasing much faster than wages. Price growth as measured by the broader national Case-Shiller index for the three months ending in December was 4.7%. The gain in the popular 20-city index missed the Econoday forecast of a 4.8% increase.

Home prices slump to a fresh 4-year low, Case-Shiller says By Andrea Riquier

8.U.S. is not Building Enough Housing.

Leonard Kiefer @lenkiefer 20h20 hours ago

U.S. not building enough #housing If you look over the 40 years from 1968 to 2007 there were only two years when the U.S. added fewer gross units (homes/apartments/manufactured housing) than it did in 2018

9.Confidence in Press

9.Confidence in Press

Trust In Media Hits Rock Bottom: 60% Of Americans Think Journalists Pay Their Sources

by Tyler Durden

https://www.zerohedge.com/news/2019-02-26/trust-media-hits-rock-bottom-60-americans-think-journalists-pay-their-sources

10.Psychlogy Behind Smart People Saying Dumb Things

Smart people usually don’t say dumb things for no reason. Here’s what a prominent psychologist who has studied this phenomenon has to say about it.

The following is from Travis Bradberry, PhD.

- Smart people are often overconfident. A lifetime of praise and pats on the back leads smart people to develop an unflappable faith in their intelligence and abilities. When you rack up accomplishments while people stroke your ego, it’s easy to expect that things will always go your way. But this is a dangerous expectation. Smart people often fail to recognize when they need help, and when they do recognize it, they tend to believe that no one else is capable of providing it.

How this applies to the realm of investing.

Of all the biases and faulty thinking investors can have, overconfidence is quite possibly the most destructive. It usually leads to mistakes, and even worse, an overconfident investor is often in denial about the fact that they made a mistake. To admit a mistake would be to admit that perhaps they aren’t as smart as they once thought. A bitter pill for a smart person to swallow.

- They have a strong need to be right. It’s hard for anyone to graciously accept the fact that they’re wrong. It’s even harder for smart people because they grow so used to being right all the time that it becomes a part of their identity. For smart people, being wrong can feel like a personal attack, and being right, a necessity.

How this applies to the realm of investing.

If you always need to be right, you will not be able to recognize your mistakes, and therefore you won’t be able to learn from them and improve your skills.

- They sometimes lack emotional intelligence. While intelligence (IQ) and emotional intelligence (EQ) don’t occur together in any meaningful way (Smart people, on average, have just as much EQ as everyone else), when a smart person lacks EQ, it’s painfully obvious. These high-IQ, low-EQ individuals see the world as a meritocracy. Achievements are all that matter, and people and emotions just get in the way. Which is a shame because TalentSmart research with more than a million people shows that—even among the upper echelons of IQ—the top performers are those with the highest EQs.

How this applies to the realm of investing.

An investor who lacks emotional intelligence is unable to grasp the “sentiment” aspect of the stock market. The market is driven by the emotions of investors, and failure to take this into account will doom an investor to below-average outcomes.

- They have difficulty developing grit. When things come really easy to you, it’s easy to see hard work as a negative (a sign that you don’t have what it takes). When smart people can’t complete something without a tremendous amount of effort, they tend to feel frustrated and embarrassed. This leads them to make the false assumption that if they can’t do something easily, there’s something wrong with them. As a result, smart people tend to move on to something else that affirms their sense of worth before they’ve put in the time to develop the grit they need to succeed at the highest possible level.

How this applies to the realm of investing.

For a smart person, grit often means stubbornness. In the investment realm, grit means determination, focus, resiliency, and adaptability to changing market environments. These are characteristics that are lacking in many smart people.

- They multitask. Smart people think really quickly, which can make them impatient. They like to get several things going at once so that there isn’t any downtime. They think so quickly that, when they multitask, it feels like it’s working and they’re getting more done, but Stanford research shows that this isn’t the case. Not only does multitasking make you less productive, but people who multitask often because they think they’re good at it are actually worse at multitasking than people who prefer to do one thing at a time.

How this applies to the realm of investing.

Impatience is another performance killer when it comes to making investment decisions. Master investors tend to be very patient because they understand that the ebb and flow of security prices take a long time to play out.

- They have a hard time accepting feedback. Smart people tend to undervalue the opinions of others, which means they have trouble believing that anyone is qualified to give them useful feedback. Not only does this tendency hinder their growth and performance, it can lead to toxic relationships, both personally and professionally.

How this applies to the realm of investing.

Without the willingness to accept feedback, especially critical feedback, an overconfident investors is much more likely to repeat mistakes and miscalculations in their decision making.

https://www.zeninvestor.org/psychology-behind-smart-people-saying-dumb-things/