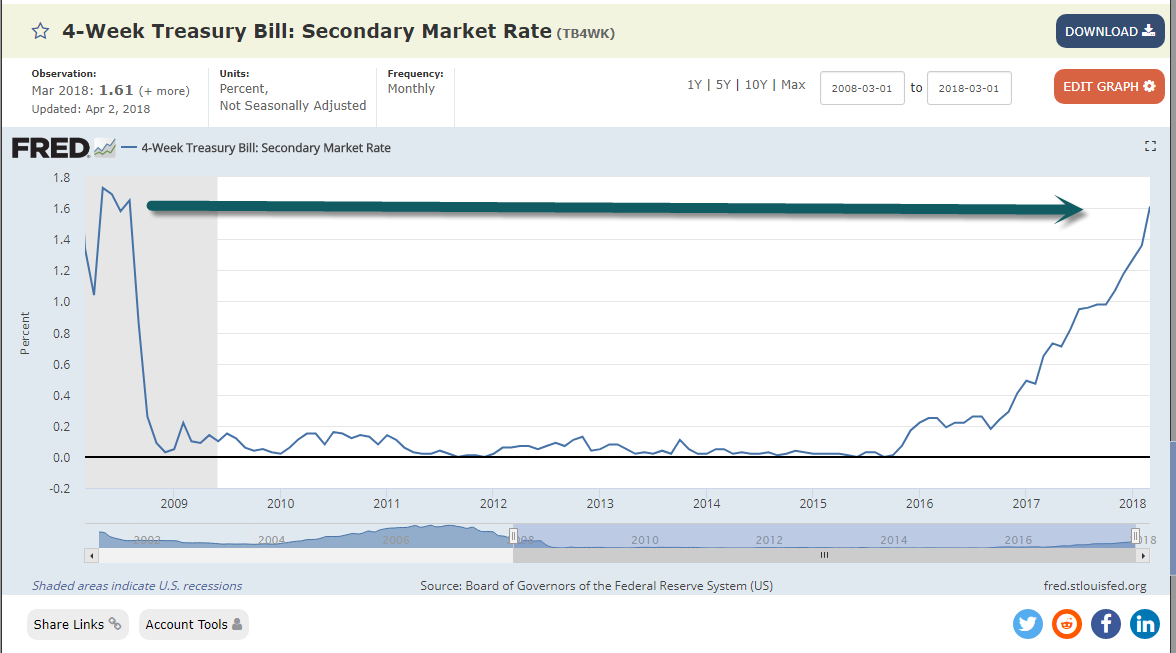

1.4-Week Treasury Bill 10 Year Chart…Sideways for 8 Years then Hockey Stick.

https://fred.stlouisfed.org/series/TB4WK

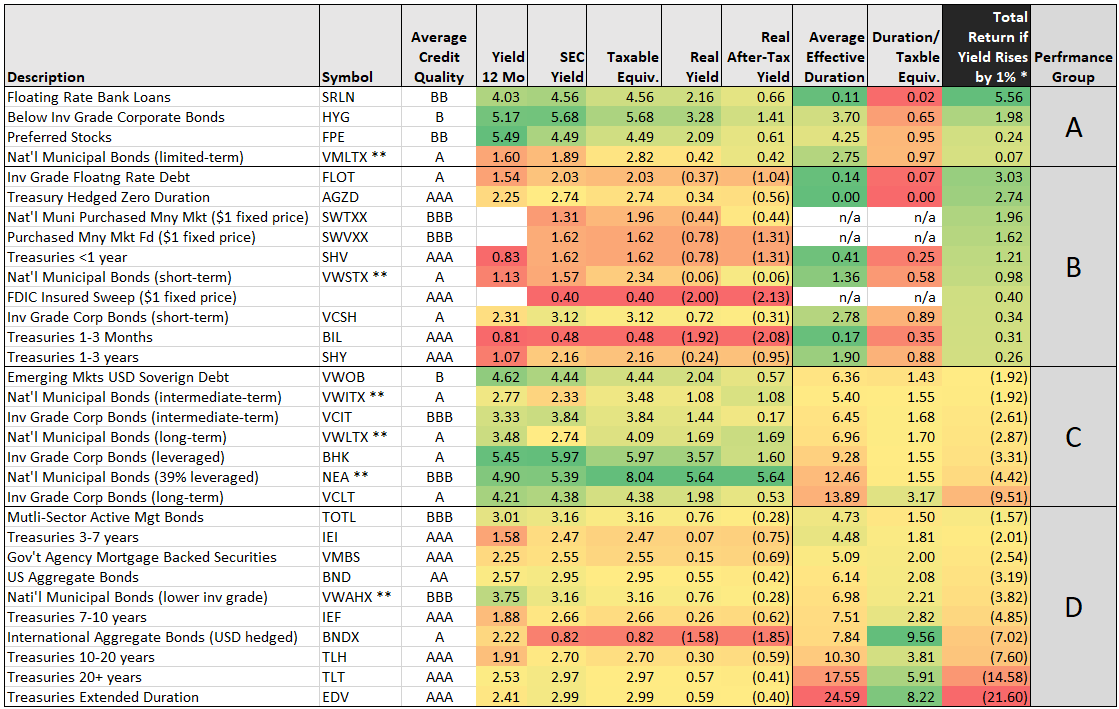

2.Grid-Rates Rise 1%…What will your bonds do?

https://seekingalpha.com/article/4163529-types-bonds-attractive-rising-rate-environment

Richard Shaw

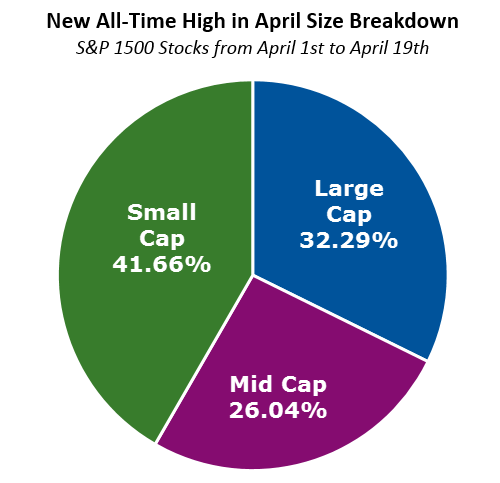

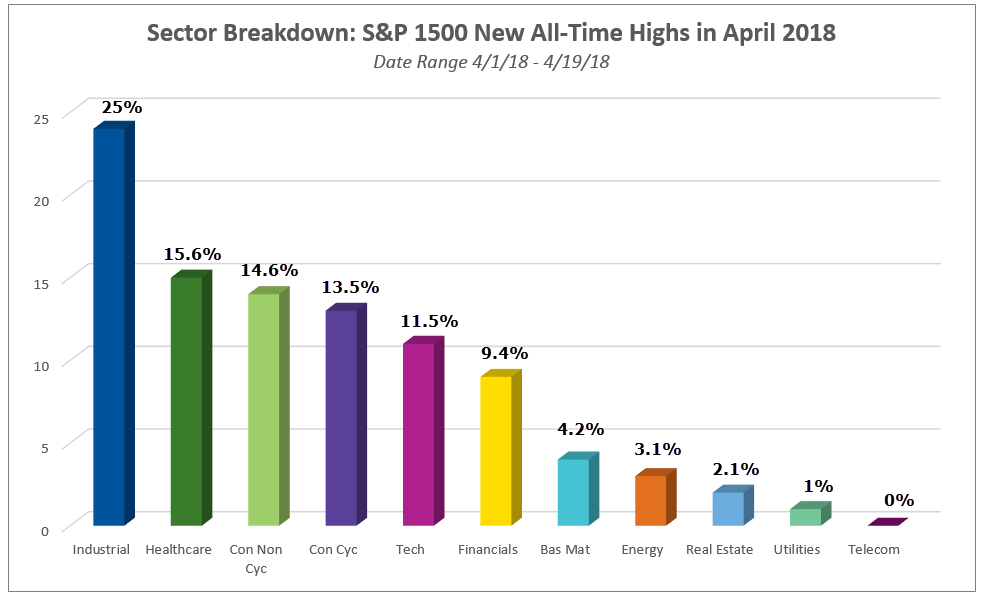

3.Small Caps and Industrials Making the Most New Highs Since April 1st.

While the S&P 500 Index SPX and the S&P Equal Dollar Weighted Index SPXEWI are still sitting roughly 6% off of their all-time highs from late January, we have witnessed some areas of the market move higher over the past few weeks. Since the beginning of the month, the SPX has gained 4.31% while the S&P 400 Midcap Index MID has gained 4.27% (through 4/19). However, Small Caps have been the clear winner as the S&P 600 Small Cap Index SML has gained 5.51% over the same time frame. In fact, since April 1st, we have seen 96 stocks within the S&P 1500 move to new all-time highs. When we take a closer look at these new highs, we can see that some areas of the market are participating more in this rally than others. Small Caps have led the way, not only by performance, but also by headcount, accounting for 40 of the 96 stocks (41.66%) moving to new highs. Large Caps are next in line with 31 stocks (32.29%), followed by Mid Caps with 25 stocks (26.04%).

As we lift the hood and take a closer look at the individual names, we are able to pinpoint sector participation. The image below shows the number of stocks within each sector that have hit a new high between April 1st and April 19th (with the percentage of the 96 new highs the sector accounts for shown above each of the bars).

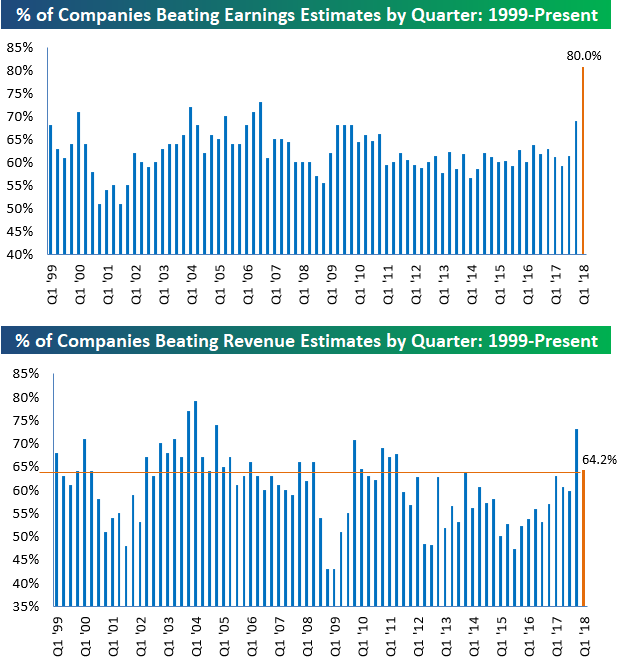

4.Earnings Better ….Revenues Not So Much.

Bottom Line Beat Rates Strong, But Top Line A Different Story

Apr 23, 2018

In last Friday’s Bespoke Report newsletter, we provided our first rundown of this season’s earnings results. While only 10-15% of companies have reported so far, it’s still enough to give us an early read on how companies performed in Q1. Below are two charts we thought we’d share more broadly with Think B.I.G. readers. In the first chart, we show the percentage of companies that have beaten consensus analyst EPS estimates on a quarterly basis going back to 1999. So far this season, 80% of companies that have reported have beaten EPS estimates. If that reading were to stand — and note that we don’t expect it to stand — it would be the strongest earnings beat rate seen in at least 19 years. Needless to say, companies have been beating EPS estimates at a historic clip so far this season.

In the second chart below, we show the percentage of companies that have exceeded consensus top-line revenue estimates on a quarterly basis. In terms of revenues, the beat rate looks much different this season compared to earnings. Only 64.2% of companies have beaten revenue estimates, which is nearly 16 percentage points below the EPS beat rate. If we had to choose, we’d prefer the top-line beat rate to be stronger than the bottom-line beat rate, because sales are harder for companies to manipulate. Last earnings season we actually saw a stronger revenue beat rate than earnings beat rate, but the opposite has been the case so far this season.

https://www.bespokepremium.com/think-big-blog/

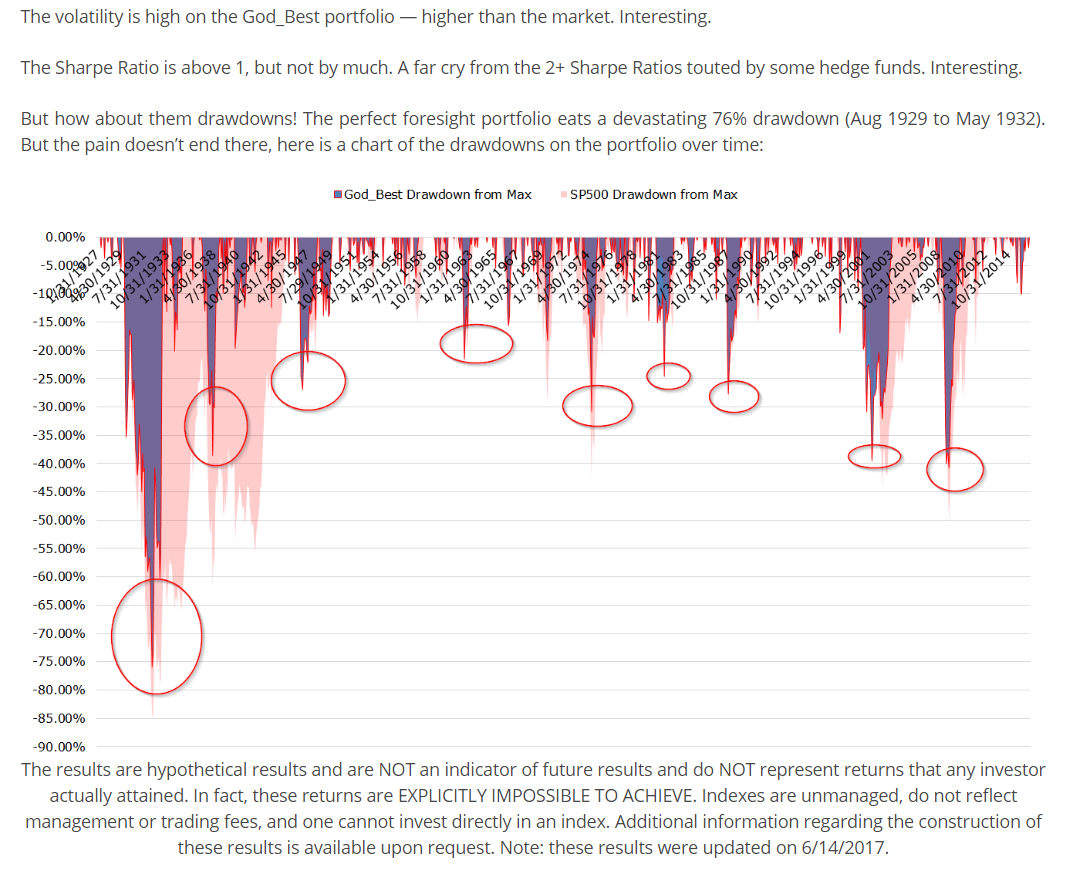

5.Great Read from Wes Gray…Even If God Were Picking Stocks, It Would Be Tough to Ride Out Drawdowns.

Even God Would Get Fired as an Active Investor

By Wes Gray| February 2nd, 2016

https://alphaarchitect.com/2016/02/02/even-god-would-get-fired-as-an-active-investor/

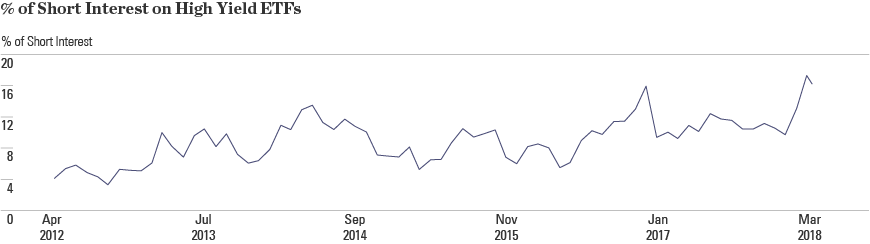

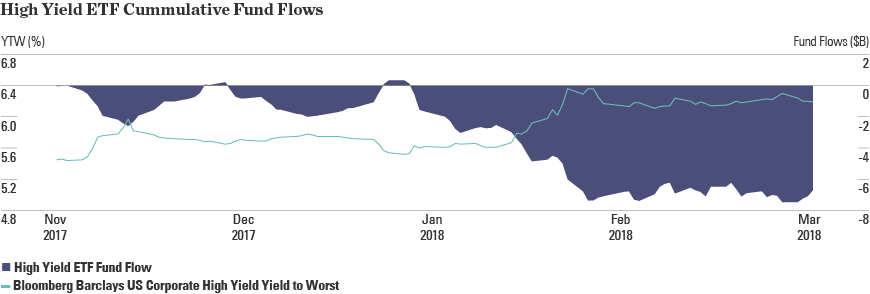

6.High Yield—Highest Short Interest in 5 Years and Heavy Outflows.

SPDR BLOG

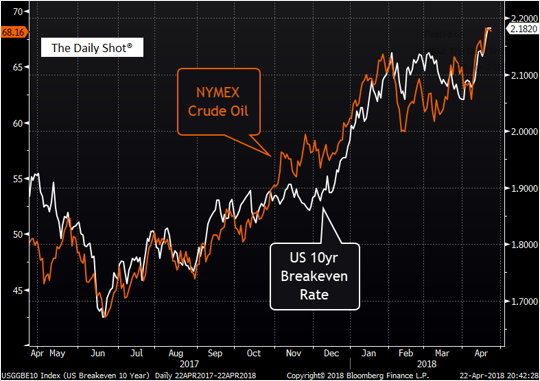

7.Rates: Oil prices have been driving inflation expectations higher.

Source: @Insider_FX, Bloomberg

Oil Beneficiary…Petrobras Rumored for Dead in 2016-PBR +480% Return Since 2016 Lows.

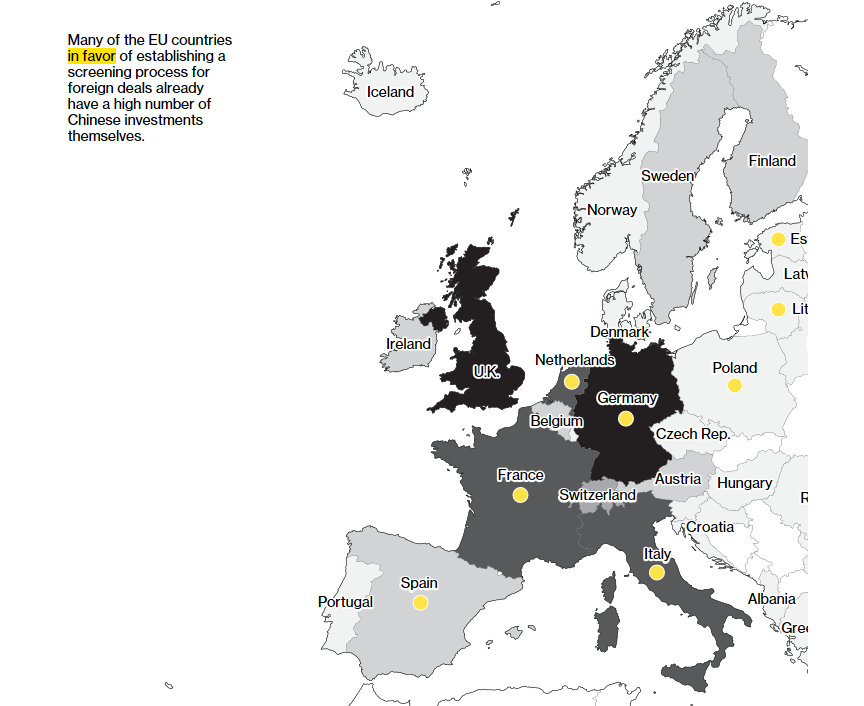

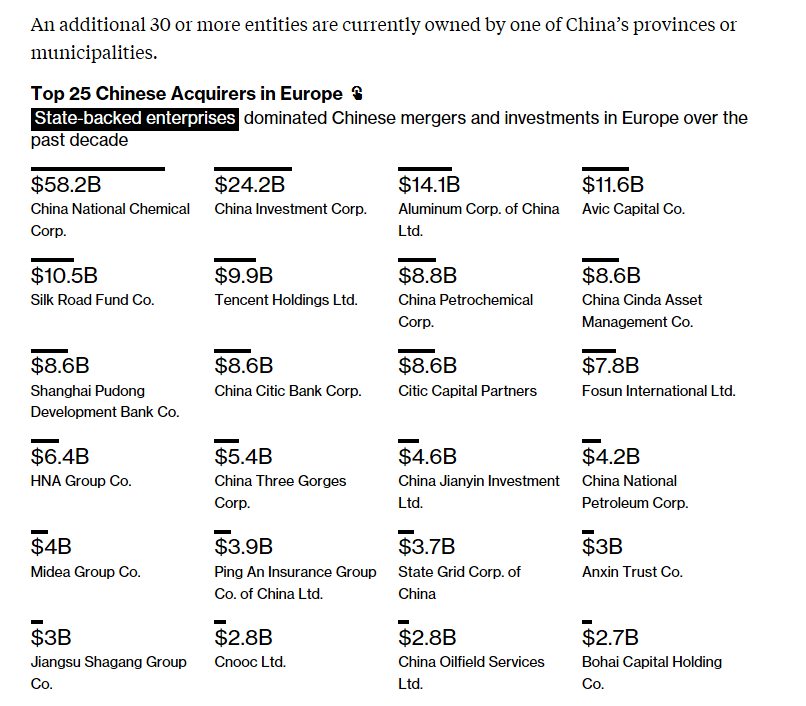

8.Last Week We Mentioned China Rivaling the U.S. in Venture Capital….See Below as China Buys Up Europe.

How China Is Buying Its Way Into Europe

For more than a decade, Chinese political and corporate leaders have been scouring the globe with seemingly bottomless wallets in hand. From Asia to Africa, the U.S. and Latin America, the results are hard to ignore as China has asserted itself as an emerging world power. Less well known is China’s diffuse but expanding footprint in Europe.

Bloomberg has crunched the numbers to compile the most comprehensive audit to date of China’s presence in Europe. It shows that China has bought or invested in assets amounting to at least $318 billion over the past 10 years. The ontinent saw roughly 45 percent more China-related activity than the U.S. during this period, in dollar terms, according to available data.

The volume and nature of some of these investments, from critical infrastructure in eastern and southern Europe to high-tech companies in the west, have raised a red flag at the European Union level. Leaders that include German Chancellor Angela Merkel and French President Emmanuel Macron are pressing for a common strategy to handle China’s relentless advance into Europe, with some opposition from the EU’s periphery.

https://www.bloomberg.com/graphics/2018-china-business-in-europe/

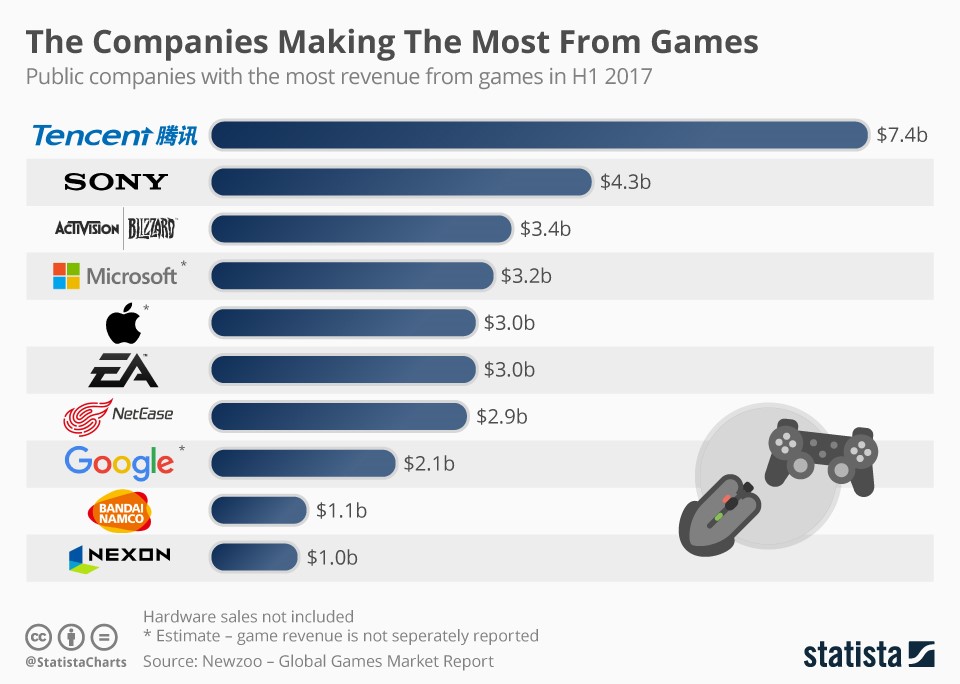

9.Chinese Tencent Preparing Biggest IPO of the Year.

China’s largest music streaming company, Tencent Music Entertainment Group, is preparing an IPO that could be one of the biggest ever recorded for a tech company, reports the Wall Street Journal.

Why it matters: The group’s listing shows that public offerings are continuing to build steam in the tech world and it could be one of the largest deals of 2018, potentially raising as much as $25 billion.

Show less

- “The initial public offering, potentially coming in the second half of 2018, would be one of the largest deals of the year and is expected to raise billions.”

- “Tencent Music is expected to list in the U.S., but it is unlikely to make a final venue decision for several months.”

- “Tencent Music’s offering could value the business in excess of $25 billion … Should investors give it that valuation in its IPO pricing, it would be the fourth-biggest U.S.-listed tech IPO on record.”

10.Buffett’s Edge

“Defining what your game is, where you are going to have an edge is enormously important” Warren Buffett

Every successful investor has an edge. And when I say ‘edge’, I’m referring to the difference we have that gives us an advantage in a situation. In investing, this could be a structural edge such as access to better information or low-cost permanent capital, or it may be an intellectual edge derived from creativity or lateral thinking or a psychological edge like emotional rigor or temperament. It could also mean having a longer time horizon than other investors, or even a better reputation. Outperformance as we know it is usually derived from a combination of more than one edge.

“First answer the question, ‘What’s your edge?” Seth Klarman

“You have to figure out where you have an edge.” Charlie Munger

I’ve long thought about the edges Warren Buffett has. These are his differences that he has utilized to allow him to deliver returns far in excess of the market indices; you don’t compound capital at nearly 20%pa for over 50 years without some sort of serious edge.

I’ve outlined the multitude of Buffett’s edges below. There are probably others however these tend to define the key differences for me…

Reads & Thinks

“I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business.” Warren Buffett

Discipline

“An investor cannot obtain superior profits from stocks by simply committing to a specific investment category or style. He can earn them only by carefully evaluating facts and continuously exercising discipline.” Warren Buffett

Unemotional

“If you’re emotional about investment you’re not going to do well.” Warren Buffett

Loves Investing

“I get to do what I love to do every day.” Warren Buffett

No Distractions

“The best CEO’s love operating their companies and don’t prefer going to Business Round Table meetings or playing golf at Augusta National.”

No Ulterior Motives

“There’s nothing material I want very much.” Warren Buffett

Humility

“You gotta hit a few in the woods.” Warren Buffett

“You have to put mistakes behind you and not look back. Tomorrow is another day. Just go on to the next thing and strive to do your best.” Warren Buffett

Learns from Mistakes

“One of the reason Warren’s so successful is that he is brutal in appraising his own past. He wants to identify mis-thinkings and avoid them in the future” Charlie Munger

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” Warren Buffett

Independent Thinker

“You will not be right simply because a large number of people momentarily agree with you. You will not be right simply because important people agree with you. You will be right over the course of many transactions, if your hypothesis are correct, your facts are correct, and your reasoning is correct.” Warren Buffett

Contrarian in Nature

“We have usually made our best purchases when apprehension about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist.” Warren Buffett

“Berkshire buys when the lemmings are heading the other way.” Warren Buffett

Age

“It’s hard to believe that he’s getting better with each passing year. It won’t go on forever, but Warren is actually improving. It’s remarkable: Most seventy-two-year-old men are not improving, but Warren is.” Charlie Munger

Communication Skills

“We also believe candor benefits us as managers: The CEO who misleads others in public may eventually mislead himself in private.” Warren Buffett

“By our policies and communications, we can encourage informed, rational behavior by owners that, in turn, will tend to produce a stock price that is also rational. Our it’s-as-bad-to-be- overvalued-as-to-be-undervalued approach may disappoint some shareholders. We believe, however, that it affords Berkshire the best prospect of attracting long-term investors who seek to profit from the progress of the company rather than from the investment mistakes of their partners.” Warren Buffett

[Buffett’s skill in writing has helped him develop a rapport with Berkshire’s shareholders. He’s under no pressure to buy or sell assets or keep up with an index. He doesn’t have to worry investors will pull their money. Unlike most managers, it has allowed him to maintain a long term focus].

Away from Wall Street

“If I was on Wall Street I’d probably be a lot poorer. You get overstimulated on Wall Street. You hear lots of things. You may shorten your focus and a short focus is not conducive to long profits. Here I can just focus on what businesses are worth. I don’t need to be in Washington to figure out what the Washington Post is worth, or be in New York to figure out what some other company is worth. Here I can just focus on what businesses are worth.” Warren Buffett

Value Approach

“As far as I can observe and speak to with statistics, there has only been one style which has reliably and safely brought investors exceptional long term returns: value investing. Today, Buffett has a 57-year track record.” Li Lu

Generalist / Opportunistic

“Our rule is pure opportunism. If there is a masterplan somewhere in Berkshire, they’re hiding it from me. Not only do we not have a master plan, we don’t have a master planner.” Charlie Munger

[Buffett doesn’t have constraints such as benchmarks, indexes, asset types, time horizon, etc. There is no pressure to keep up with an index. As a private business owner, Buffett doesn’t have to invest in any business if the return profile is unattractive. Furthermore, with a fortress balance sheet, Buffett is often sought out for transactions at times when others are constrained.]

Long Term Focus

“One factor that has caused some reluctance on my part to write semi-annual letters is the fear that partners may begin to think in terms of short-term performance which can be most misleading. My own thinking is much more geared to five year performance, preferably with tests of relative results in both strong and weak markets.” Warren Buffett

[Having a long term focus allows Buffett to allocate capital to businesses which may depress short term earnings at the expense of long term gains. When investing, he can focus on what a business will be earning and likely worth many years into the future without the pressure of short term performance.]

Sticks with What he Knows / Defined Filters

“I don’t need to make money in every game. I don’t know what coca beans are going to do. There are all kinds of things I don’t know about. That maybe too bad but why should I know all about them, I haven’t worked that hard on them.” Warren Buffett

“We do have filters. And sometimes those filters are very irritating to people who check in with us about businesses – because we really can say “no” in 10 seconds or so to 90%+ of all of the things that come along simply because we have these filters.” Warren Buffett

Thinks as a Businessman

“When we buy a stock, we always think in terms of buying the whole enterprise because it enables us to think as businessmen rather than stock speculators.” Warren Buffett

“I did a lot of work in the earlier years just getting familiar with businesses and the way I would do that is use what Phil Fisher would call, the ―Scuttlebutt Approach – I would go out and talk to customers, suppliers, and maybe ex-employees in some cases. Everybody.”

Buys Simple Businesses He Understands

“We try to stick to businesses we believe we understand. That means they must be relatively simple and stable in character” Warren Buffett

Insists on Good Management

“In making both control purchases and stock purchases, we try to buy not only good businesses, but ones run by high-grade, talented and likable managers.” Warren Buffett

Conservative assumptions

“.. take all of the variables and calculate ‘em reasonably conservatively .. don’t focus too much on extreme conservatism on each variable in terms of the discount rate and the growth rate and so on; but try to be as realistic as you can on these numbers, with any errors being on the conservative side. And then when you get all through, you apply the margin of safety.” Warren Buffett

Access to Information

“We have dozens and dozens and dozens of businesses. I’ve always said I’m a better investor because I’ve had experience in business and better businessman because I’ve had experience in investments. Berkshire is about as good a place as you can find to really understand competitive dynamics and all that.” Warren Buffett

“There is almost no industry Berkshire doesn’t touch in one form or another. I can’t count the number of times when I’m looking at something and pick up the phone and talk to [one of our CEOs] and if it’s in any one of their adjacent industries, they know more about it in 15 minutes than an investor can learn in a lifetime.” Todd Combs

Looks at Price Last

“I always like to look at investments without knowing the price – because if you see the price, it automatically has some influence on you.” Warren Buffett

Doesn’t Disclose Positions

“We cannot talk about our current investment operations. Such an “open mouth” policy could never improve our results and in some situations could seriously hurt us. For this reason, should anyone, including partners, ask us whether we are interested in any security, we must plead the “5th Amendment”. Warren Buffett

Buys Established, Predictable, Quality Businesses

“Experience indicates that the best business returns are usually achieved by companies that are doing something quite similar today to what they were doing five or ten years ago.“

“At Berkshire we will stick with businesses whose profit picture for decades to come seems reasonably predictable.” Warren Buffett

“It must be noted that your Chairman, always a quick study, required only 20 years to recognize how important it was to buy good businesses. In the interim, I searched for “bargains” – and had the misfortune to find some. My punishment was an education in the economics of short-line farm implement manufacturers, third-place department stores, and New England textile manufacturers.” Warren Buffett

No Committees / Groupthink

“As your company gets larger and larger and you have larger groups making decisions, the decisions get more homogenised. I don’t think you will ever get brilliant investment decisions out of a large committee.” Warren Buffett

Aligned Shareholders

“Boredom is a problem with most professional money managers. If they sit out an inning or two, not only do they get somewhat antsy, but their clients start yelling ‘swing you bum’ from the stands.” Warren Buffett

“We do not view Berkshire shareholders as faceless members of an ever-shifting crowd, but rather as co-venturers who have entrusted their funds to us for what may well turn out to be the remainder of their lives.” Warren Buffett

Avoids Leverage

“Borrowed money has no place in the investor’s tool kit: Anything can happen anytime in markets.” Warren Buffett

Maintains Significant Cash

“There will be some incident, it could be tomorrow. At that time, you need cash. Cash at that time is like oxygen. When you don’t need it, you don’t notice it. When you do need it, it’s the only thing you need. We operate from a level of liquidity that no one else does.” Warren Buffett

No Guidance to Hit

“We do not follow the usual practice of giving earnings ‘guidance.’” Warren Buffett

Zero Cost Permanent Capital

“Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and “float,” the funds of others that our insurance business holds because it receives premiums before needing to pay out losses”

Better yet, this funding to date has been cost-free. Deferred tax liabilities bear no interest. And as long as we can break even in our insurance underwriting – which we have done, on the average, during our 32 years in the business – the cost of the float developed from that operation is zero. Neither item, of course, is equity; these are real liabilities. But they are liabilities without covenants or due dates attached to them. In effect, they give us the benefit of debt – an ability to have more assets working for us – but saddle us with none of its drawbacks.“

[Berkshire’s insurance operations have their own significant edges versus competitors, including the absence of pressure to grow premiums if/when pricing is unattractive, the ability to write premiums no other insurer has the balance sheet to write, speed of response time, lack of bureaucracy, lowest costs (Geico) etc]

No Mark to Market on Wholly Owned Businesses

“Our equity holdings have fallen considerably as a percentage of our net worth, from an average of 114% in the 1980’s, for example, to less than 50% in recent years. Therefore, yearly movements in the stock market now affect a much smaller percentage of our net worth than was once the case, a fact that will normally cause us to underperform in years when stocks rise substantially and over perform in years when they fall.” Warren Buffett 2004

[While Berkshire owns marketable securities that fluctuate with markets, wholly owned subsidiaries are not marked to market. On a short term basis this limits exposure to large stock market declines. Over the long term, it’s the business performance that drives returns. Buffett focuses on the earnings of the businesses he owns not the share prices]

Avoids Potential Blow-Ups / Focuses on Downside

“If we can’t tolerate a possible consequence, remote though it may be, we steer clear of plantings its seeds.” Warren Buffett

Avoids Turnarounds, Start-Ups and IPO’s

“Start-ups are not our game.” Warren Buffett

“After 25 years of buying and supervising a great variety of businesses, Charlie and I have not learned how to solve difficult business problems. What we have learned is to avoid them.” Warren Buffett

“It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller (company insiders) to a less-knowledgeable buyer (investors).” Warren Buffett

Ethical

“Both of us [Warren] know that we’ve done better by having ethics” Charlie Munger

Seeks Win-Win Outcomes

“He [Buffett] wanted win/win results everywhere – in gaining loyalty by giving it, for instance.” Charlie Munger

Good Home for Businesses

“I won’t close down businesses of sub-normal profitability merely to add a fraction of a point to our corporate rate of return. However, I also feel it inappropriate for even an exceptionally profitable company to fund an operation once it appears to have unending losses in prospect. Adam Smith would disagree with my first proposition, and Karl Marx would disagree with my second; the middle ground is the only position that leaves me comfortable.” Warren Buffett

“We are also very reluctant to sell sub-par businesses as long as we expect them to generate at least some cash and as long as we feel good about their managers and labor relations. We hope not to repeat the capital-allocation mistakes that led us into such sub- par businesses.” Warren Buffett

“You can sell it to Berkshire, and we’ll put it in the Metropolitan Museum; it’ll have a wing all by itself; it’ll be there forever. Or you can sell it to some porn shop operator, and he’ll take the painting and he’ll make the boobs a little bigger and he’ll stick it up in the window, and some other guy will come along in a raincoat, and he’ll buy it.” Warren Buffett

“Financial profit was not the key to ISCAR’s sale. We wanted to ensure that ISCAR could continue to grow, and we saw Warren Buffett as the person who would help achieve that.. In truth, the money – $4b for 80% of ISCAR – was not the most important consideration for us in this deal .. I liked the fact that Buffett does not operate in the stock market as a speculator but as an investor. He does not look for a rapid profit but instead for stability and growth potential in the companies he acquires. He has said that he buys businesses, not stocks, they are businesses he wants to own forever. For us, the deal was more than a tribute to the unique value of the company I had founded fifty-four years earlier with an old lathe in our two-room apartment in Nahariya” Stef Werthheimer

[Over time Buffett has attracted more and more quality businesses to join Berkshire. Business founders often prioritize legacy, staff morale, business continuity and management independence above financial gain. Buffett has developed an enviable track record and a reputation as an ethical, discreet, and timely buyer who will maintain a business for the long term. Buffett doesn’t participate in auctions (another edge!) and is often the only party to be offered the businesses he buys. The counter to this is that negotiated private asset sales are rarely done at knock-down prices as they occasionally are in the stock market]

Summary

While the list of Buffett’s edges is long and I’m sure you can think of others, he does have some headwinds. One of those is size. Another is the fact he doesn’t close under-performing businesses – that’s the likely cost of seeing more private opportunities. He’s also conservative. Carrying more debt would have generated even more returns, but it could also have led to the permanent loss of capital. And that would have broken Buffett’s first rule: Don’t lose money.

Many of Buffett’s edges are available to all investors. He certainly doesn’t hide them; he’s been writing about them for the last 50 years. But there’s one other edge I haven’t mentioned, and it could be the most important of all – Charlie Munger. And what an edge that is. Buffet has given us much in the way of learning over those 50 years, and Charlie has as much and more to teach. And if you’re looking for more, you could certainly start with him.

http://mastersinvest.com/newblog/2018/4/16/buffetts-edge

Found at www.abnormalreturns.com