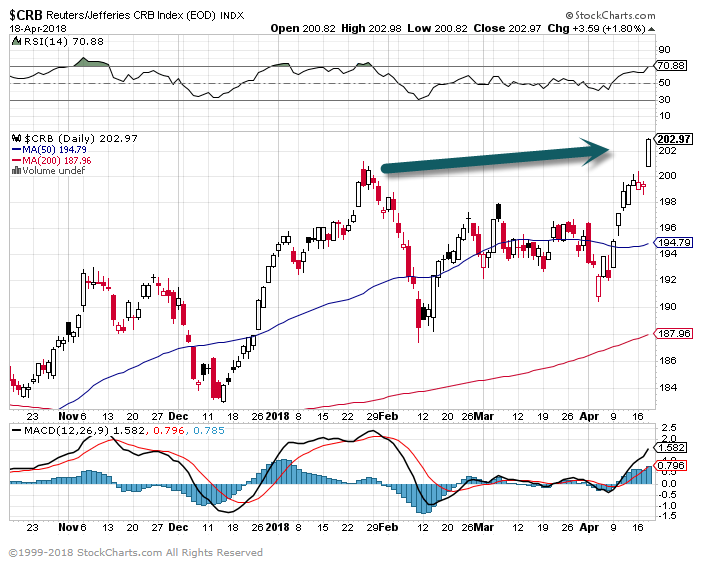

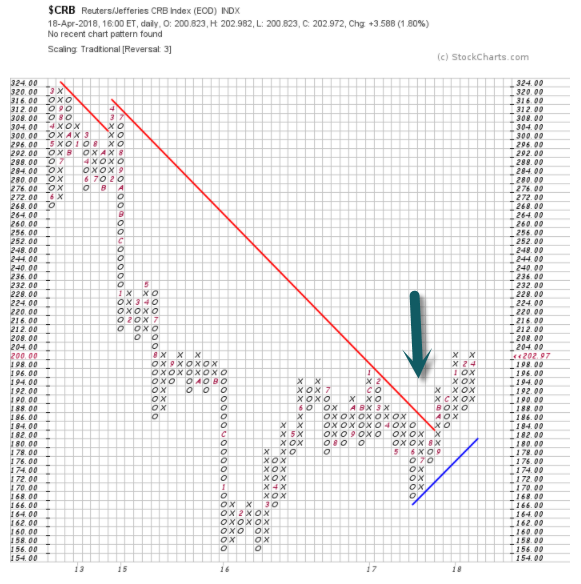

1.Commodities Break Out to New Highs YTD.

CRB-Jefferies Commodity Index

Showed this chart a number of times on Top 10…..Red downtrend line goes back to 2012…Break above it happened at end of 2017

2.Small Caps 5% of the S&P YTD.

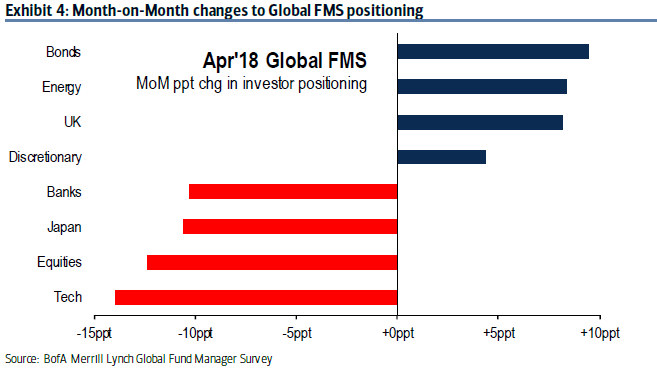

3.More Contra Indicators to Go with Retail Sentiment Charts from Earlier in Week.

- Cash jumps from 4.6% to 5.0%

- Equity hedging levels @ 18-month highs

- 18-month lows in equity allocation – tech allocation lowest since Feb’13

- #1 “tail risk” = trade war (China, Germany markets most vulnerable)

- April rotation into commodities (8-year high), UK (biggest post-Brexit)

From Dave Lutz at Jones Trading

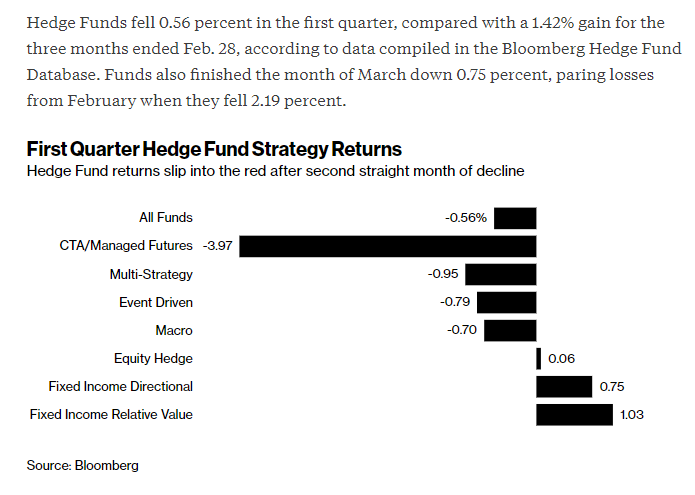

4.First Quarter Hedge Funds Returns Lag

Hedge Funds Suffer First Back-to-Back Loss in Two Years

5.I Mentioned Earnings Multiple Times in Last 2 Weeks…Good Fundamentals Summary Below.

Don’t lose sight of the fundamentals

- Published on April 17, 2018

Global Chief Investment Officer at UBS

Politics rather than economic fundamentals have been driving equity markets of late.

February’s equity correction was prompted by fears of higher inflation leading to faster rate hikes, but over the last month political risks have taken center stage. Concerns that the tit-for-tat trade dispute between the US and China may escalate and materially weaken global growth have weighed on stocks.

More recently, the deteriorating geopolitical situation between the US and Russia over Syria has added to investor concerns. Further volatility related to trade and geopolitics is likely. But with the US first quarter earnings season now underway, the fundamentals should start to come back into focus and, in our view, are supportive for equities.

- Corporate earnings growth is robust.

For full-year 2018 we expect earnings per share (EPS) growth of 16%, roughly half of which represents the boost from tax reform enacted in late December. For the first quarter, earnings growth is likely to reach 20%, the fastest pace since the end of 2010. Even without tax reform benefits, we estimate EPS growth will be a very healthy 12%. We expect revenue growth, which is not distorted by corporate tax changes, to grow by 7% in 1Q, one of the strongest growth rates in the last six years.

- The two largest sectors, tech and financials – accounting for more than 40% of earnings – both look poised to report growth of 20% or more.

Most of the growth for tech reflects very positive enterprise spending trends and continued growth in secular drivers such as cloud and online advertising. Financials are one of the main beneficiaries of tax reform, but are also benefiting from higher interest rates, improving economic growth, and a pickup in trading revenues.

- Corporate earnings growth reflects strong economic momentum.

US growth remains solid. Healthy business confidence and still-low financing costs are boosting business spending on investments and labor. In turn, this is boosting consumer confidence and driving consumer spending. The tax cut package only strengthens the near-term growth outlook. As a result, we forecast real US GDP growth of 2.8% in 2018 and 3.0% in 2019, the strongest two-year period since 2005–2006.

- US equity valuations have become more attractive during 2018 given the combination of sharply positive forward-looking earnings revisions and flattish stock prices.

The S&P 500 price/earnings ratio (on forward 12-month EPS) now stands at 16.4x – the lowest level in 18 months – and down from 18.3x at the beginning of the year.

Recent sources of market volatility may persist in the near term. We believe the best way to protect portfolios against these tail risks is to hold a diversified set of countercyclical positions and to hold downside protection through derivatives, rather than to exit equities. We expect inflation to be at the Fed’s target this year and next, but the market may need more confidence that inflation is not accelerating beyond the central bank’s expectations. Ultimately we expect solid economic growth and robust earnings trends to push stock prices higher. We remain overweight global equities, of which the US comprises about 50% of the global benchmark.

Bottom line

Politics, not economic fundamentals, have been driving equity markets over the last month. But with the US first quarter earnings season underway the fundamentals should come back into focus. US growth is solid and this economic momentum is supporting robust corporate earnings growth, which we expect to reach 20% in the first quarter. The trend in earnings has helped make US equities more attractively valued and we remain overweight global equities.

Please visit ubs.com/cio-disclaimer

https://www.linkedin.com/pulse/dont-lose-sight-fundamentals-mark-haefele/

6.Latest Fed Minutes…The Word “Inflation” Appeared 106 Times.

Fed Still on Gradual Normalization Course

- Published on April 17, 2018 Ed Yardeni

The word “inflation” appears 106 times in the minutes of the latest FOMC meeting, held March 20-21 and released on April 11. By contrast, the word “unemployment” appears 45 times. Does this suggest that Fed officials are increasingly concerned about a rebound in inflationary pressures given that the jobless rate was at a cyclical low of 4.1% during March? There were still 6.6 million unemployed workers, according to the Bureau of Labor Statistics (BLS). However, the latest data, also from the BLS, showed that there were 6.1 million job openings during February. That implies that virtually all the remaining unemployment can be described as “frictional,” resulting from geographic and skills mismatches.

If inflation should rise much faster than expected and stay consistently above 2.0%, however, then the FOMC might decide to raise rates at a “slightly” faster pace over the next few years. One risk to inflation discussed in the minutes could come from fiscal stimulus. Depending on the timing and magnitude of the effects of fiscal stimulus, it could push output above its potential and further tighten resource utilization.

The key will be inflation. While Fed officials continue to believe that it is a monetary phenomenon, they may come around to recognize, and even to appreciate, that there are other forces such as global competition and technological innovations keeping a lid on inflation. If so, then the Fed’s current game plan will be realized. (For more on the Fed and inflation, see Chapter 9 in my new book, Predicting the Markets: A Professional Autobiography.)

https://www.linkedin.com/pulse/fed-still-gradual-normalization-course-edward-yardeni/

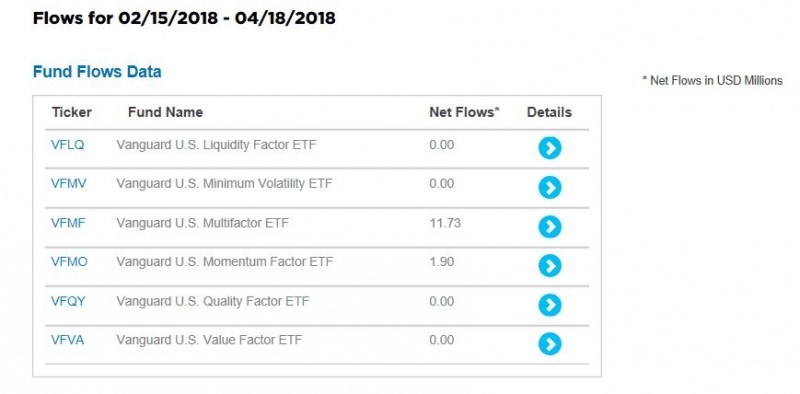

7.Interesting…Vanguard Factor Based ETFs Not Taking Off Yet.

Vanguard Active ETFs Slow To Grow

April 19, 2018

Cinthia Murphy

The lineup of Vanguard actively managed factor ETFs is off to a very slow start in the asset-gathering race, at least relative to other Vanguard products.

Two months since inception, four of the six active factor funds have seen zero net asset inflows. Zero. They are the Vanguard U.S. Liquidity Factor ETF (VFLQ), the Vanguard U.S. Minimum Volatility ETF (VFMV), the Vanguard U.S. Quality Factor ETF (VFQY) and the Vanguard U.S. Value Factor ETF (VFVA).

One of the funds—the Vanguard U.S. Momentum Factor ETF (VFMO)—has attracted less than $2 million in net assets, probably benefiting from the fact that momentum is doing well this year.

Only one ETF—the Vanguard U.S. Multifactor ETF (VFMF)—has seen a decent $11 million in net creations since mid-February.

According to Vanguard’s head of global product management Matt Jiannino, the main reason that uptake of these strategies has been slow is due to the fact that getting advisors onboard with a new fund—and a new active manager—takes time. The Vanguard brand name is strong, but the company has to spend time and effort on advisor education.

Just as important is establishing a live performance track record, particularly in the active space, Jiannino says. Due diligence desks require sometimes as much as three years of track record for actively managed ETFs before they consider adopting them.

http://www.etf.com/sections/features-and-news/vanguard-active-etfs-slow-grow

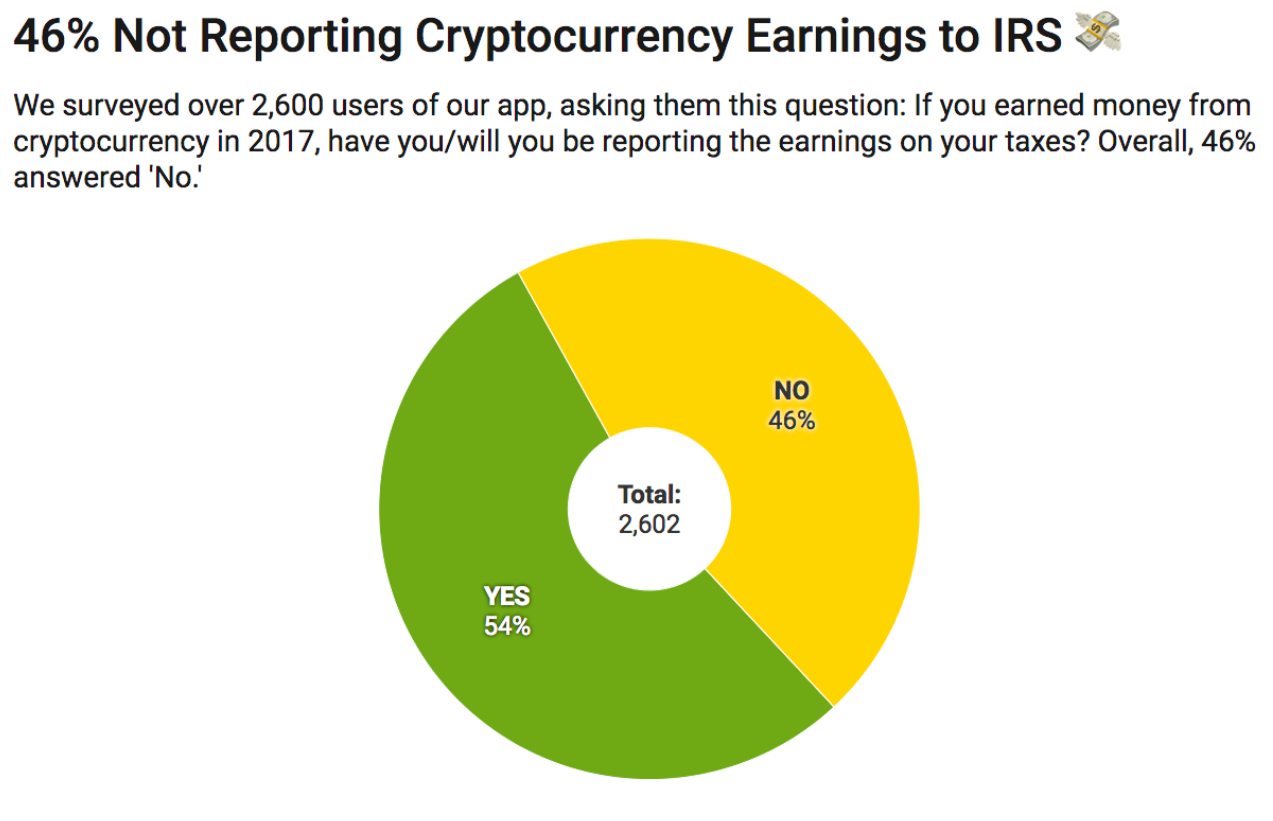

8.More Reasons that Crypto Will See Increased Regulation…Half of Traders Dodging IRS

Nearly half of crypto traders refuse to pay taxes, survey finds

By Aaron Hankin

Many crypto traders are gambling that the tax man will turn a blind eye to 2017 gains

Tax day is here, and a significant number of investors have decided not to report gains from digital currency trading.

According to a recent survey from TeamBlind, an anonymous social app for tech employees, 46% of people who made money trading cryptocurrencies in 2017 will attempt to dodge the tax man.

“We surveyed more than 2,600 users who said they earned money from cryptocurrency in 2017, and we asked them if they are reporting their earnings on their taxes this year. Nearly half said ‘No,’” according to TeamBlind.

TeamBlind

The survey mirrors early findings from Credit Karma that found of the first 250,000 tax filings, less than 100, or 0.04%, reported any cryptocurrency gains.

Read: Warning, crypto investors: You must pay taxes on your bitcoin

The No. 1 digital currency rose by more than 1000% in 2017, making many small-time investors rich, but unbeknown to some, a 2014 ruling from the IRS meant cryptocurrencies would be taxed as property.

“For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency,” the IRS said.

While traders who dabbled in small volumes of bitcoin BTCUSD, -0.11% and other cryptocurrency may get away without disclosing gains, Coinbase users who made more than $20,000 in transactions with other Coinbase users may want to think again. A Feb. 23 ruling meant the largest U.S.-based digital-currency exchange would hand over 13,000 users’ data to the IRS.

Read: Bitcoin exchange Coinbase is handing over user information to the IRS

Tax day has been built as an important day for bitcoin enthusiasts, with some bulls arguing the reason behind the underperformance of the No. 1 digital currency is tax payments: owners are selling bitcoin to fiat to pay their taxes.

Now April 17 is here, the answer shouldn’t be too far away.

New York attorney general investigating 13 cryptocurrency exchanges

New York’s Attorney General, Eric Schneiderman, has sent letters of inquiry to 13 popular cryptocurrency exchanges, including Coinbase’s GDAX and Gemini, about their operations and tools to protect customers.

Why it matters: Exchanges have been an area of concern and skepticism for regulators. Even the Securities and Exchange Commission and its chairman, Jay Clayton, have repeatedly warned that cryptocurrency exchanges aren’t regulated like stock exchanges and shouldn’t be trusted to operate with as much integrity.

Be smart: The state of New York already has some of its own regulations over cryptocurrency-related businesses. A Bitlicense, which only a handful of companies have been able to obtain, is required to operate in the state.

9.Read of the Day…Tech Geneva Accord.

Tech Firms Sign ‘Digital Geneva Accord’ Not to Aid Governments in Cyberwar

By DAVID E. SANGERAPRIL 17, 2018

“This has become a much bigger problem, and I think what we have learned in the past few years is that we need to work together in much bigger ways,” said Brad Smith, the president of Microsoft, who was largely behind the effort to create a “Cybersecurity Tech Accord.” Credit Jason Redmond/Agence France-Presse — Getty Images

WASHINGTON — More than 30 high-tech companies, led by Microsoft and Facebook, announced a set of principles on Tuesday that included a declaration that they would not help any government — including that of the United States — mount cyberattacks against “innocent civilians and enterprises from anywhere,” reflecting Silicon Valley’s effort to separate itself from government cyberwarfare.

The principles, which have been circulating among senior executives in the tech industry for weeks, also commit the companies to come to the aid of any nation on the receiving end of such attacks, whether the motive for the attack is “criminal or geopolitical.” Although the list of firms agreeing to the accord is lengthy, several companies have declined to sign on at least for now, including Google, Apple and Amazon.

Perhaps as important, none of the signers come from the countries viewed as most responsible for what Brad Smith, Microsoft’s president, called in an interview “the devastating attacks of the past year.” Those came chiefly from Russia, North Korea, Iran and, to a lesser degree, China.

On Monday, American and British officials issued a first-of-its-kind joint warning about years of cyberattacks emanating from Russia, aimed not only at businesses and utilities but, in some cases, individuals and small enterprises. The warning was only the latest in a series about Russian threats to elections and electoral systems.

The impetus for the effort came largely from Mr. Smith, who has been arguing for several years that the world needs a “digital Geneva Convention” that sets norms of behavior for cyberspace just as the Geneva Conventions set rules for the conduct of war in the physical world. Although there was some progress in setting basic norms of behavior in cyberspace through a United Nations-organized group of experts several years ago, the movement has since faltered.

https://www.nytimes.com/2018/04/17/us/politics/tech-companies-cybersecurity-accord.html

10. Want to Be a Great Leader? Become a Great Identifier

If you want to lead a great team, stop worrying so much about managing and focus a lot more on identifying.

Once upon a time, I was a member of the most productive crew in the department, which meant we were considered to be the best crew, because numbers were everything. But we didn’t need a Jobs or Bezos or Sandberg or [pick your personal epitome of effective leadership] to get us there.

Steve was our Bobby Hurley (yep, old school college basketball reference): always pushing, always encouraging, always making assists. Lee was solid: never making mistakes, helping out the entry-level workers, quick to make repairs and get things running again. Jeff was our glue, coaxing surprising uptime out of the least reliable machines on the line while also serving as our quality conscience. Doug was easily rattled, but his nervous energy helped him catch up when he got behind and keep the end of line workers straight.

I was definitely the weak link, but because I hated to be seen as the weak link, I tried to be useful in as many other ways as I possibly could.

So what about our supervisor? We had one, but we didn’t need him.

He didn’t have to drive our performance; we were already (almost too) competitive. He didn’t need to find ways for us to run better; we were constantly looking for improvements on our own. He didn’t have to deal with weak links, or mentor newer employees, or do any of the stuff supervisors claimed they did; we were already doing all those things.

We only turned to him when we required immediate assistance from another department and our clout in an extremely hierarchical organization was insufficient to get results.

Yet he was seen as the best supervisor in the department. (More on that in a moment.)

I know what you’re thinking: If you’re in a leadership position, you probably see our results as an anomaly. A great team starts with a great leader, right?

Not really — at least not in the way you might think.

Take sports. A team with great players and a decent coach will almost always beat a team with decent players and a great coach. (That’s why the best college coaches are, first and foremost, great recruiters.)

Force Mike Krzyzewski, the winning-est Division I coach in college basketball, to take over a struggling D-II program and the first thing he does will not be to talk about culture or group dynamics or team building.

Instead he’ll say, “We need great players. We’re going to spend every waking moment recruiting the best players we possibly can.” No matter how inspirational, transformational, or exceptional, leadership can only produce incremental improvements. Even a guy like Coach K can’t turn a struggling program into a winning program without incredibly talented players.

Where teams are concerned, the impact ratio is 80 or 90 percent players, 10 to 20 percent the leader.

Fine, you might say, but what about Bill Belichick, the Patriots coach who for years has been able to plug seemingly any players into his winning system?

You’re right — at least where the second half of that sentence is concerned. The Patriots put a tremendous amount of effort into plugging in players who are able to fit into their system. Talent is important, but if you can’t put team goals first, the Patriots don’t want you.

First, they put incredible effort into finding the right players. Then Belichick and his staff coach them up.

And the same can be true in any field.

Put together a team of awesome salespeople, and you can basically leave them alone. Put together a team of awesome engineers, and you can basically leave them alone.

Put my humble little production team together, and you could basically leave us alone.

Yet if you ask most leaders to describe their jobs, they’ll talk about leading the people they have.

Maybe you do too. Maybe you only think about finding great people for your team when you have an opening.

Ninety-nine percent of the time, you focus on leadership: developing people, building team cohesion, creating an innovative culture, driving performance, focusing on results — all the things leaders rightly value.

But what if you changed your ratio? What if you spent 20 percent, 30 percent, or even more of your time focused on building your team? What if you constantly worked to identify, recruit, and even develop your next generation of talent?

What if, instead of “just” being a leader, you became an identifier?

It’s not hard. Imagine you’ll someday need to replace Mary. Start looking now. Look closely at lower levels of your organization to see who might be perfect. Ask friends if they know someone who would be perfect.

Instead of having a list made for you — of the people who someday apply for Mary’s job — identify the right people now and create your own list.

And then keep identifying.

Spend a significant chunk of your time focused on how you’ll add the perfect people to your team. Make it a daily part of your job to identify. Make it a daily part of your job to recruit.

Spend a chunk of your time developing the people you currently lead, and spend the other chunk identifying people who won’t really need to be led — which then gives you the opportunity to identify and add someone even better.

Build a great team and you’ll need to spend less time managing that team, which will allow you to spend even more time identifying even better people to add when the occasion arises, which makes it even easier to attract great people. (Success attracts success. Great people love to work with great people.)

Become an identifier and you create the most virtuous of cycles — one that helps your team perform at ever-higher levels.

And isn’t that what the job of a leader really is?

https://www.inc.com/jeff-haden/want-to-be-a-great-leader-become-a-great-identifier.html