1.History of Stocks Trading at 10x Sales

GMO Research

While there is no particular magic about 10x sales being the unique true sign of overvaluation, it has gained a certain amount of fame from a statement that Scott McNealy, co-founder and CEO of Sun Microsystems, made to Bloomberg in 2002:

…2 years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?9

It is not strictly impossible for a stock trading at 10x sales or more to give a good return. Amazon was trading at well over 10x sales in the fall of 1999, and the return from then has been a very healthy 18% annualized, or 38x total gain over 22 years.10 On the other hand, Amazon did fall by almost 93% from that peak to the low 2 years later, and an investor who had held off and only bought when its price/sales fell below 10 in late 2000 would have made 89x his initial investment and saved himself a good deal of initial pain.11

But the more important point is that the odds are strongly against companies trading at over 10x sales. Exhibit 8 shows the long-term real returns to a portfolio of stocks trading at 10x sales or more against the overall stock market.

From The Big Picture Blog https://ritholtz.com/2021/09/10-monday-am-reads-325/

2. U.S. Savings Deposits Take Another Gap Up….

Ben Carlson Twitter.

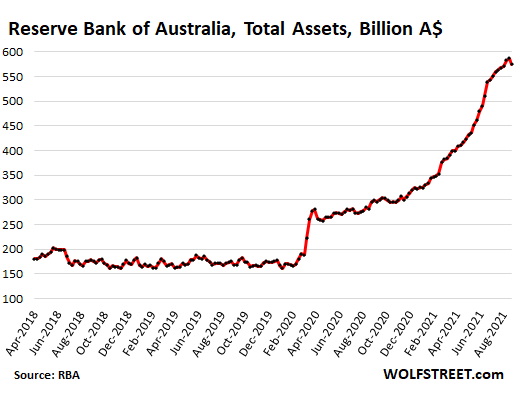

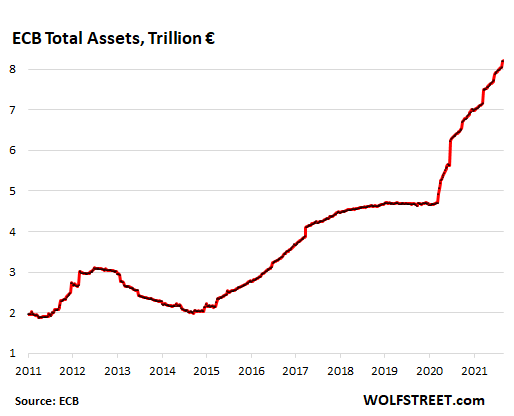

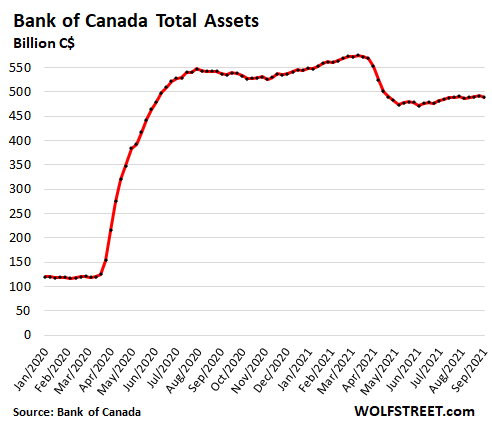

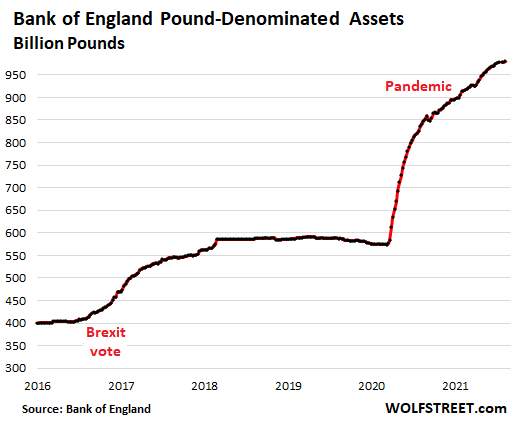

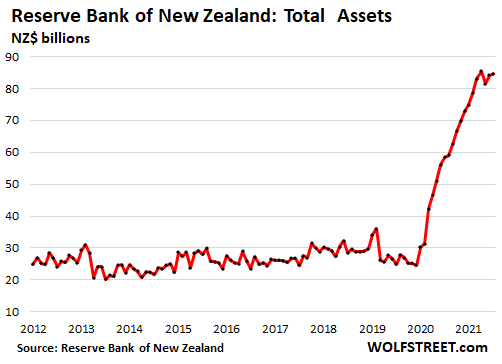

3. A Picture of How Massive and Global Covid QE is from Central BANKS

Wolf Street

The Bank of Canada started tapering its purchases of Government of Canada bonds last October, ended its purchases of mortgage-backed securities, and shed its repos and Canada Treasury bills, with the effect of cutting is total assets by 15% since the peak in March:

The Bank of England announced its decision to taper its asset purchases in May, and has since cut its weekly bond purchases, on net, from about £4 billion a week to close to £2 billion a week through the summer:

Reserve Bank of New Zealand ended its asset purchases cold turkey in May without tapering to pull the plug on the #1 housing bubble in the world:

The Reserve Bank of Australia announced in July that it would start tapering its asset purchases from A$5 billion a week to A$4 billion a week. Total assets on its balance sheet declined last week for the first time all year:

4. Europe Seeing Record High Gas and Electric Prices.

Europe’s record-high gas and electricity prices are a taste of what’s in store for global commodity markets, Goldman Sachs says

- Europe’s soaring energy prices are a glimpse of what’s next for a range of commodities, Goldman Sachs said.

- Benchmark gas and electricity prices in Europe have exploded as supply struggles to keep up with surging demand.

- Goldman Sachs said the S&P GSCI commodities index is likely to rise 11% over the next 12 months.

- See more stories on Insider’s business page.

The sky-high prices in Europe’s energy markets could well materialize in a range of commodities markets around the world as their inventories are depleted, Goldman Sachs has said.

Wholesale natural gas and electricity costs have surged to record highs in Europe, as a rise in demand from the reopening of pandemic-hit economies coincides with supply getting snarled up by a number of factors.

The price of European natural gas futures traded in the Netherlands has risen more than 450% over the last year, to stand at a record high of 60.63 euros ($71.39) per megawatt hour, according to Bloomberg data. UK gas prices have also soared to a record high, as have German and French electricity prices.

The price crunches could soon become more widespread, Goldman analysts said in a note Monday.

“European energy pricing dynamics offer a glimpse of what is in store for other commodity markets,” the analysts, including head of commodities research Jeffrey Currie, wrote.

They said the combination of falling inventories and the reopening of the global economy is likely to boost price volatility as “markets struggle to balance strong demand with sticky supply.”

Goldman said it expects the S&P GSCI commodities index to return 11% or more over the next 12 months. The index is dominated by oil, and it includes a heavy weighting of gold and agricultural products such as corn.

The US has also seen natural gas prices rise sharply, and the benchmark Henry Hub price is at its highest level since 2014. WTI crude oil breached $70 on Monday as supply struggled to rebound from Hurricane Ida.

Goldman’s analysts said inventories in nearly all physical goods, from US cars to Chinese copper cathodes, are declining sharply as pandemic restrictions lift, and people go out and spend.

“These markets are becoming increasingly exposed to any type of supply disruption (like Russian gas exports) or unexpected demand increase (like hot weather),” they wrote.

Limits to how much of a commodity can be supplied – due to labor shortages or bad weather, for instance – mean that demand will have to drop for markets to balance themselves out.

“As commodity markets are now unable to react to the first leg higher in prices through greater supply, once inventories are exhausted like in European gas, then demand destruction via sharply higher prices is the only option to rebalance markets,” they said.

COMT-Commodity ETF 50 day thru 200day on longer-term weekly chart

5. Metal Prices have Jumped on Demand Boom

“Physical goods demand has reached such high levels — above pre-pandemic trends in all but oil — that the system is becoming increasingly constrained in its ability to supply these goods,” Goldman analysts including Jeff Currie said in a note on Monday. “Markets are becoming increasingly exposed to any type of supply disruption or unexpected demand increase.”

https://finance.yahoo.com/news/commodities-prices-surging-again-121532911.html

6. The history of new technologies shows that apps beget infrastructure

Not Boring-Packy McCormick

The Interface Phase–First we shape our interfaces; thereafter, they shape us. The Apps-Infrastructure Cycle

A common narrative in the Web 3.0 community is that we are in an infrastructure phase and the right thing to be working on right now is building out that infrastructure: better base chains, better interchain interoperability, better clients, wallets and browsers. The rationale is: first we need tools that make it easy to build and use apps that run on blockchains, and once we have those tools, then we can get started building those apps.

– Dani Grant & Nick Grossman, The Myth of the Infrastructure Phase, USV, 2018

In 2018, Union Square Ventures’ Nick Grossman and Dani Grant wrote an essay called The Myth of the Infrastructure Phase. During 2018’s crypto winter, they kept hearing that crypto needed better infrastructure, and once that happened, then people would be able to build those killer apps. People building infrastructure, though, said that they were building the infrastructure, but that no one was building apps on top! Why the disconnect?

Instead of the commonly-accepted “infrastructure phase,” Grossman and Grant argued, crypto was in another turn of the apps-infrastructure-cycle. “The history of new technologies shows that apps beget infrastructure,” they wrote, “not the other way around.”

First, builders build apps, then other builders build the infrastructure to support those apps, then that infrastructure supports new apps, which in turn requires new supporting infrastructure, and so on. That’s how it worked historically, from the lightbulb to the airplane to the iPhone, and it’s exactly what was happening in web3.

Grant and Grossman’s 2018 classic has re-entered the conversation recently, as an explosion of new web3 apps has caused challenges:

- Gas prices are too high!

- DAOs coordinated across a mishmash of tools.

- Delayed Eth2 and L2 confusion.

- Scams abound.

- Speculation reigns and the rich get richer.

Last week, Paxos Global and 6th Man Ventures’ Mike Dudas tweeted that the piece was very relevant to the current crypto environment. Blockchain Capital’s Kinjal Shah tweeted, “we’re in an app frenzy, about to enter a major infrastructure phase.”

The apps-infrastructure cycle is playing out in real-time. For example, Grant and Grossman mentioned ERC721 as the last piece of infrastructure built when they wrote the piece. The 2018 invention of ERC721, the non-fungible token standard (infrastructure), has powered the 2021 NFT craze (app). From February to July, $950 million worth of NFTs changed hands on OpenSea. In August and the first 12 days of September alone, $4.8 billion has passed through OpenSea.

7. Walmart joins the green bond party with $2 billion deal

Illustration: Sarah Grillo/Axios

Walmart just raised the largest green bond ever in the U.S. corporate bond market.

Why it matters: The $2 billion bond deal illustrates that U.S. investors’ interest in green bonds is not going anywhere. Companies are tapping into that demand, and putting money behind efforts to battle climate change.

- Funds raised from green bonds are meant to be used for environmental projects. But they can run the risk of “greenwashing” as there are no real penalties for not following through on commitments.

Driving the news: Walmart said it would put the funds toward projects including renewable energy, high-performance buildings, sustainable transportation and zero waste/circular economy initiatives.

State of play: Though the potential for greenwashing is always a concern, Walmart has a concrete sustainability plan, including being carbon neutral by 2040 and reducing emissions in its supply chain, Shawn Keegan, credit portfolio manager at AllianceBernstein, tells Axios.

- “Walmart has a lot of influence and control over its supply chain. That’s important, and it gets other retailers to think about their supply chains,” Keegan says.

The intrigue: Walmart’s green capital didn’t come any cheaper than the rest of its bonds, based on their maturity and comparable Treasury benchmark.

- Nowadays green bonds save investors an estimated 0.04% annually on average compared with their regular bonds, down from about 0.10% for green bonds placed at the beginning of the year, notes Matt Lawton, portfolio manager at T. Rowe Price. Some green bonds, like Walmart’s, don’t have a discernible pricing advantage.

Be smart: Besides the potential for savings, the rationale for issuing green bonds is just as much about companies signaling to the market and investors that they’re taking sustainability seriously, says Keegan.

The big picture: Walmart’s deal is important for the green bond sector because until now, most deals have largely been concentrated in just three industries: real estate, utilities and autos, Lawton says.

- More sector representation means more diversification for investors.

- “My hope is that others will follow their lead, and we’ll see a more diverse set of issuers coming to the market. I think that’s ultimately what we need to see for [the green bond market] to be successful,” Lawton adds.

Zoom out: Global issuance of sustainable debt, which includes green, social and sustainability bonds, reached $1.7 trillion as of the end of 2020, according to the Climate Bonds Initiative, which helps certify these types of bonds.

- Green bonds specifically reached $1.1 trillion in 2020, which is a fraction of the overall fixed income market.

What to watch: Walmart says this is just the beginning of its foray into green bonds.

Go deeper: Amazon’s climate goals take root in Brazil

https://www.axios.com/walmart-2-billion-green-bond-deal-d5eba2fc-5c5a-421a-ac14-bb8c5780361d.html

8. Top 10 Metro Areas with the Highest Year Over Year Increase Home Prices.

Barrons

Remote Workers Are on the Move. What It Means for the Housing Market.—by Shaina Mishkin https://www.barrons.com/articles/housing-market-remote-workers-outlook-51631239674?mod=past_editions

9. How U.S. Veterans View Afghan Withdrawal.

The Daily Shot Blog

10. Billionaire investor Howard Marks compares the current market to the mid-2000s bubble, touts bitcoin’s staying power, and offers several tips in a new interview. Here are the 12 best quotes.

Howard Marks.

- Oaktree’s Howard Marks discussed stocks and bitcoin, and shared several tips for investors.

- The investor highlighted similarities between the current market and the mid-2000s bubble.

- Marks underlined the importance of managing risks, not panic-selling, and staying skeptical.

- See more stories on Insider’s business page.

Howard Marks drew parallels between the current market and the asset bubble that preceded the global financial crisis, highlighted bitcoin’s longevity, and argued rock-bottom interest rates may justify higher stock valuations, speaking during the latest episode of the “We Study Billionaires” podcast.

The billionaire cofounder and co-chairman of Oaktree Capital Management advised investors to carefully manage their portfolio risk, resist the urge to buy high and sell low, and be skeptical of grand claims.

Here are Marks’ 12 best quotes, lightly edited and condensed for clarity:

1. “The pandemic was like a meteor hitting the Earth from outer space. The market decline was not born out of excess optimism. The recovery was not merely a bounce back from excess pessimism, it was the result of the greatest economic rescue effort in history.” – arguing the past 18 months shouldn’t be viewed as a traditional market cycle.

2. “There certainly are similarities that cause Jeremy Grantham and others to say ‘bubble territory’ and to blow the whistle of caution.” – comparing the hype around several assets in 2006 to the current market boom.

3. “If investors can think of an asset class and say, ‘Oh, for that, there’s no price too high’ – that’s one of the greatest indications of a bubble.”

4. “We have the lowest interest rates in history. That would simplistically argue for the highest asset valuations in history.”

5. “I came out very strongly against bitcoin in 2017. I was extremely negative, I was extremely outspoken. I had a knee-jerk reaction to something new. Now I prefer to say, ‘I don’t know enough about it to have a strong opinion.’

6. “Bitcoin has been around now for a dozen years. If it’s a flash in the pan, it’s an awful long pan.”

7. “One of the most important aspects of being a good investor is you try to set things up so that if things go your way, you do great. But if things don’t go your way, you still do okay.”

8. “Good investing is not a matter of buying good things but buying things well. And if you don’t know the difference, then you shouldn’t be doing much investing.”

9. “Don’t get in the way of the compounding machine. Just get out of the way. Don’t screw it up.”

10. “When you’re in an area which is beset with uncertainty, variability, unpredictability, randomness, things like that – it just strikes me as folly to be confident that you know the future.”

11. “Active investors are in this business to buy low and sell high. But everything in our nature conspires to make us buy high and sell low. It is essential to combat those instincts.”

12. “Somebody comes into your office and says, ‘I’ve been managing money for 30 years, I’ve made 11% a year, and I’ve never had a down month.” Your job is to say, ‘That’s too good to be true, Mr. Madoff.'” – urging investors to always be skeptical of fantastic claims and promises.