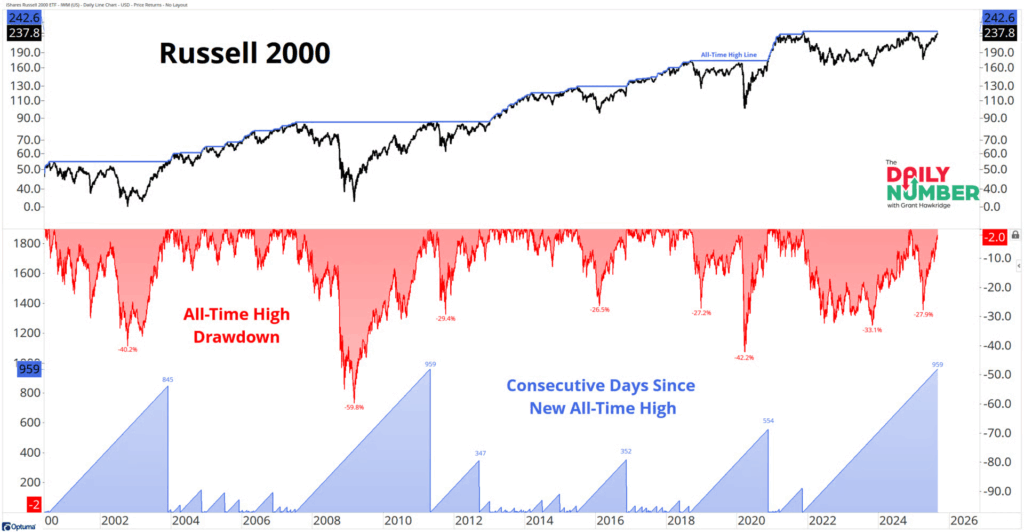

1. Small Cap Hits Record 960 Days Without Reaching All-Time Highs

DC Lite Blog R2K vs. ATHs. The Russell 2000 has now gone a record 960 days without reaching a new all-time high, surpassing the streak that followed the GFC.

DAILY CHARTBOOK

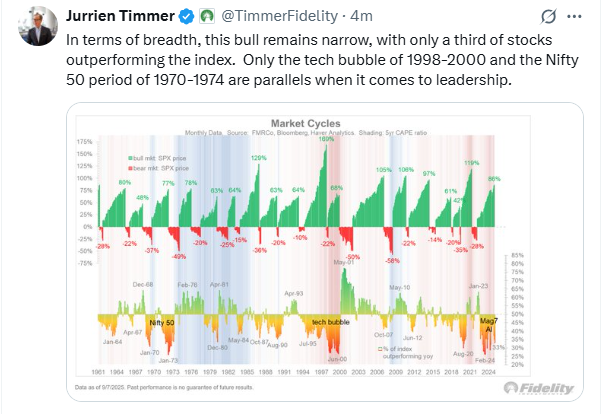

2. Only 1/3 of Stocks Outperforming Index

Jurrien Timmer

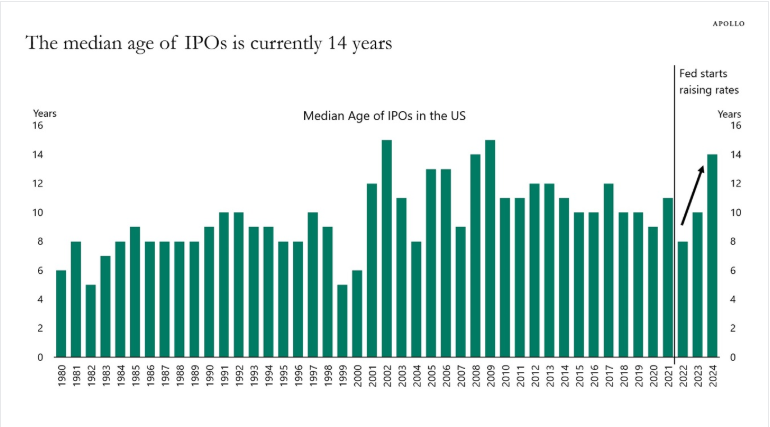

3. IPO Market Picking Up…Average Age of Firms 14 Years

Torsten Slok Apollo There are fewer public companies to invest in, and firms that decide to do an IPO are getting older and older. In 1999, the median age of IPOs was five years. In 2022, it was eight years, and today, the median age of IPOs has increased to 14 years, see chart below. The rise in the age of companies going public is not only a result of the Fed raising interest rates in 2022, but also the consequence of more companies wanting to stay private for longer to avoid the burdens of being public. Combined with the domination of passive investing, failure of active managers and high correlation in public markets, and high concentration in a few stocks, the reality is that there is no alpha left in public markets.

Apollo

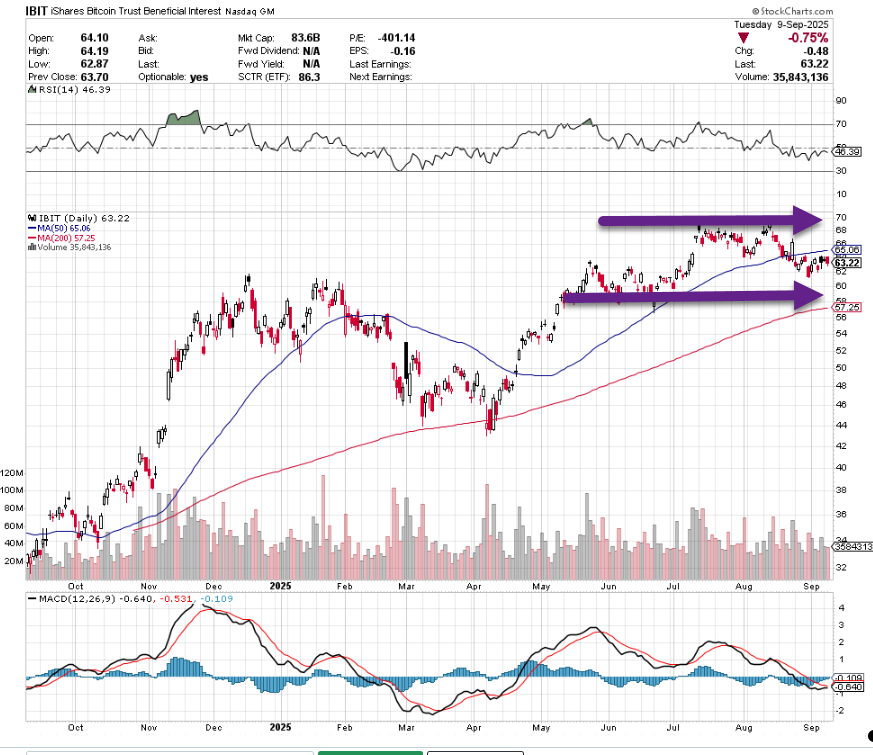

4. Robinhood Going All-In on Tokenization

Crypto Advisor–Robinhood is also making a major push. At its Cannes event Robinhood Presents: To Catch a Token, the firm unveiled products targeting 400 million users across 30 EU and EEA countries, including stock and ETF tokens. These moves reflect a broader push to make investing simpler and more accessible on a global scale. https://thecryptoadvisor.substack.com/

StockCharts

5. Who Owns Bitcoin?

Crypto Advisor Blog Here’s the breakdown of who owns what:

- ETFs – 1.472M BTC

- Public Companies – 1M BTC

- Governments – 526K BTC

- Private Companies – 300K BTC

- The Rest – 400K BTC

https://thecryptoadvisor.substack.com

IBIT Sideways Pattern Here

StockCharts

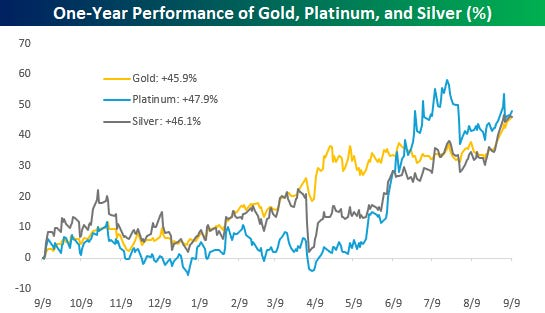

6. Platinum and Silver Catch Up to Gold

Over the last year, gold has gained 45.9% while platinum and silver have rallied 47.9% and 46.1%, respectively. Their paths haven’t necessarily been identical, but they’ve ended up at the same place.

Bespoke

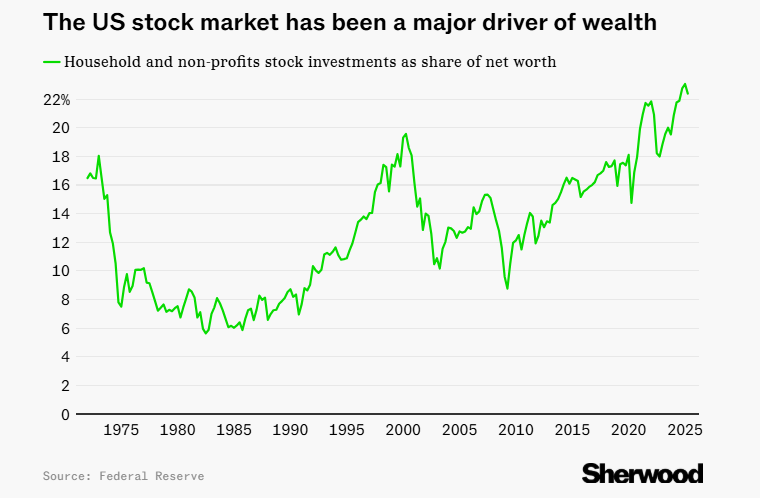

7. Stock Market Record Share of American Net-Worth

SherwoodNews

8. Open AI Projects $20B in Annualized Revenue

OpenAI Raises $8.3 billion, Projects $20 Billion in Annualized Revenue By Year-End By Sri Muppidi

OpenAI has secured $8.3 billion of new commitments from investors such as hedge funds Dragoneer, Altimeter Capital and D1 Capital Partners, exceeding its earlier goal of $7.5 billion, according to a person with knowledge of the fundraise, confirming earlier reporting from The Information about the round.

The fundraise comes as ChatGPT continues to anchor OpenAI’s business, which is generating $12 billion in annualized revenue, roughly doubling from the start of the year. OpenAI expects to hit $20 billion in annualized revenue by the end of the year, meaning it would be generating about $1.7 billion in revenue per month, according to the same person, up from practically no revenue three years earlier. The company has over 700 million ChatGPT users across both consumer and business customers.

The new capital is part of an unprecedented $40 billion funding round that values the ChatGPT maker at $260 billion before the investment. OpenAI received $10 billion of that amount in June, and the new commitments means that the $40 billion round will increase by about $1 billion. SoftBank, which is leading the fundraise, has committed to funding $22.5 billion of the round, provided that OpenAI successfully reorganizes its corporate structure this year or early next year.

Dragoneer committed $2.8 billion to OpenAI, and other investors in the round include existing shareholders Sequoia Capital, Andreessen Horowitz, Founders Fund, Fidelity Management, Tiger Global Management and Thrive Capital. New OpenAI investors in the round include TPG, T. Rowe Price and Blackstone.

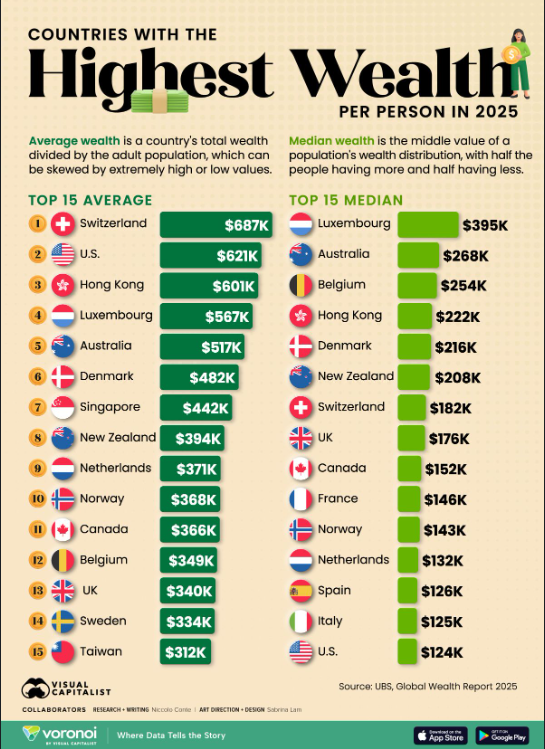

9. Countries with Highest Wealth Per Person

Visual Capitalist

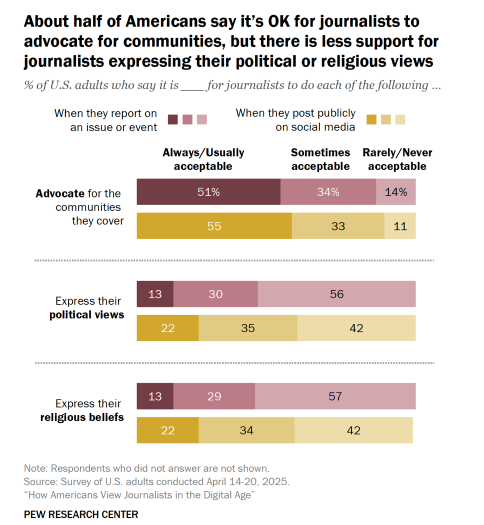

10. Americans Opinion on Journalists

Pew Research Center