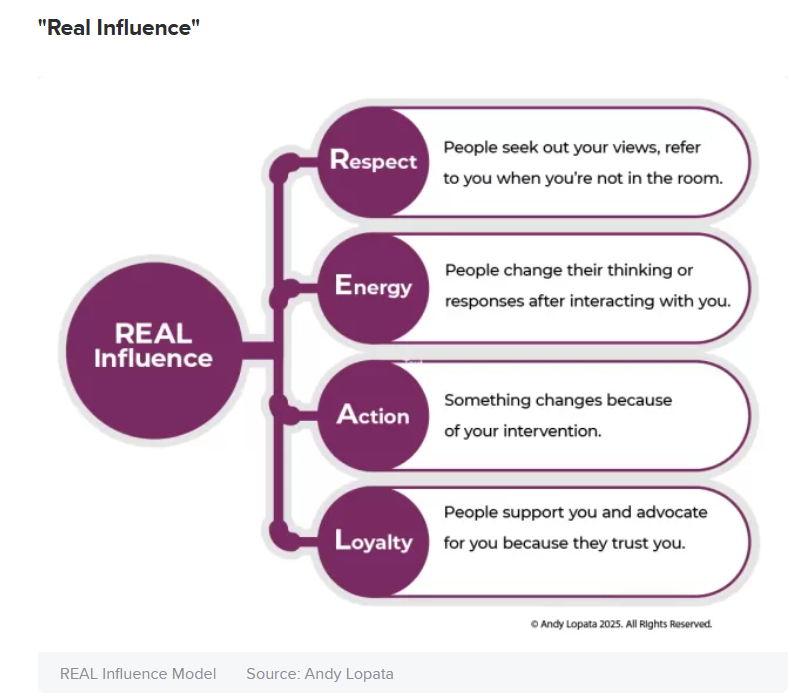

1.International Stock Breakout?

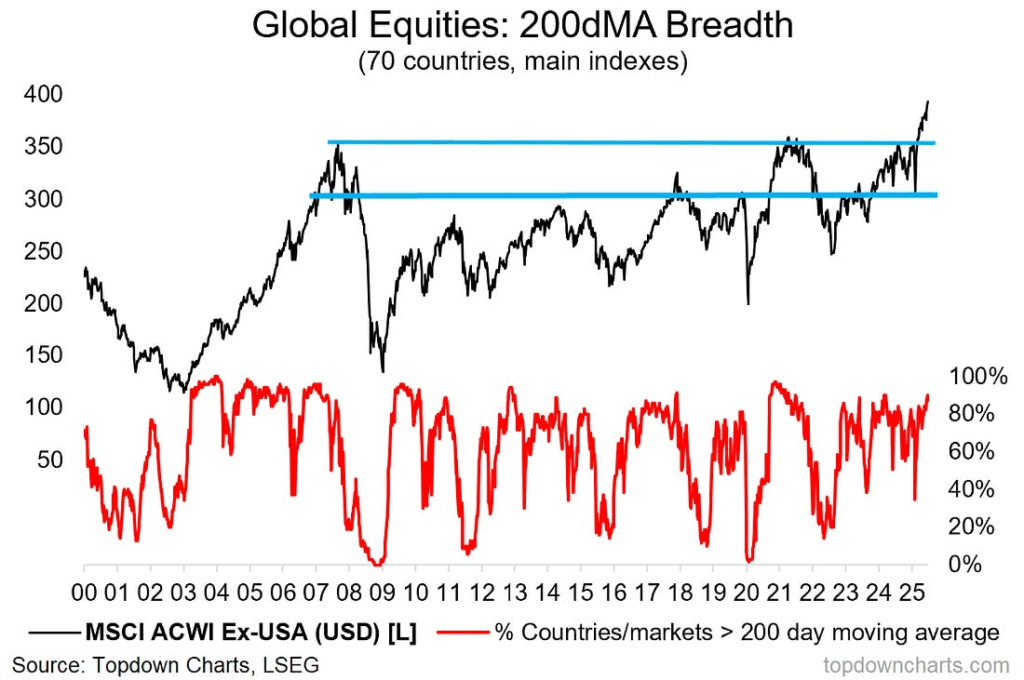

2.US M2 Money Supply No Slowdown in Growth

Zach Goldberg Jefferies …. The US M2 money supply surged +4.8% YoY in July, to a record $22.12 trillion. This also marks the 21st consecutive monthly increase.

3.Micro-Cap Stocks Approaching All-Time Highs.

https://www.google.com/finance/quote/IWC:NYSEARCA

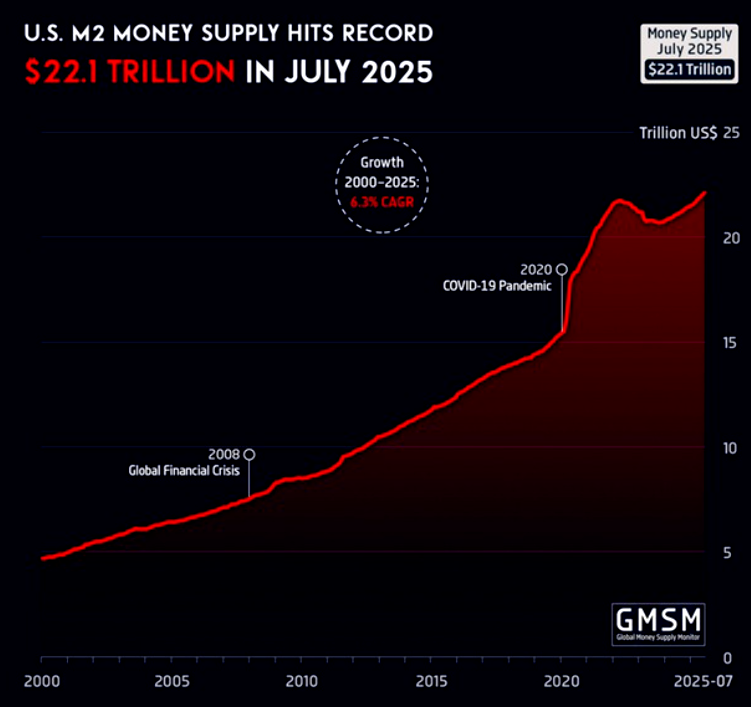

4.U.S. Dollar Chart of Year 2025—Hits Support Going Back to Early 2024

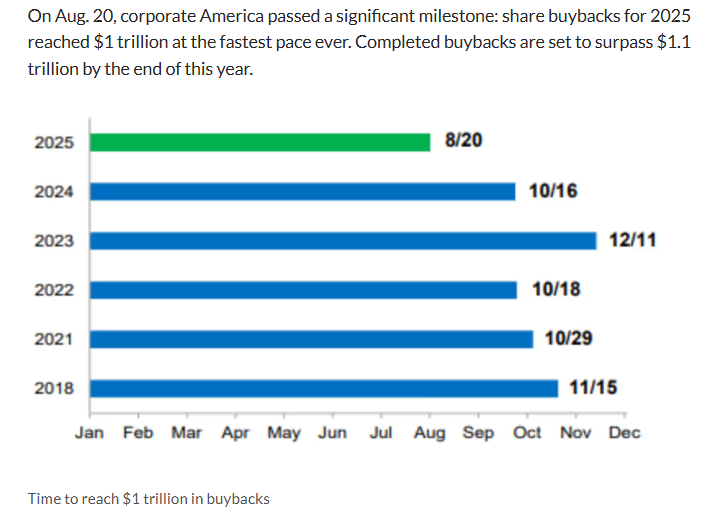

5.Stock Buybacks Pass $1 Trillion in 2025

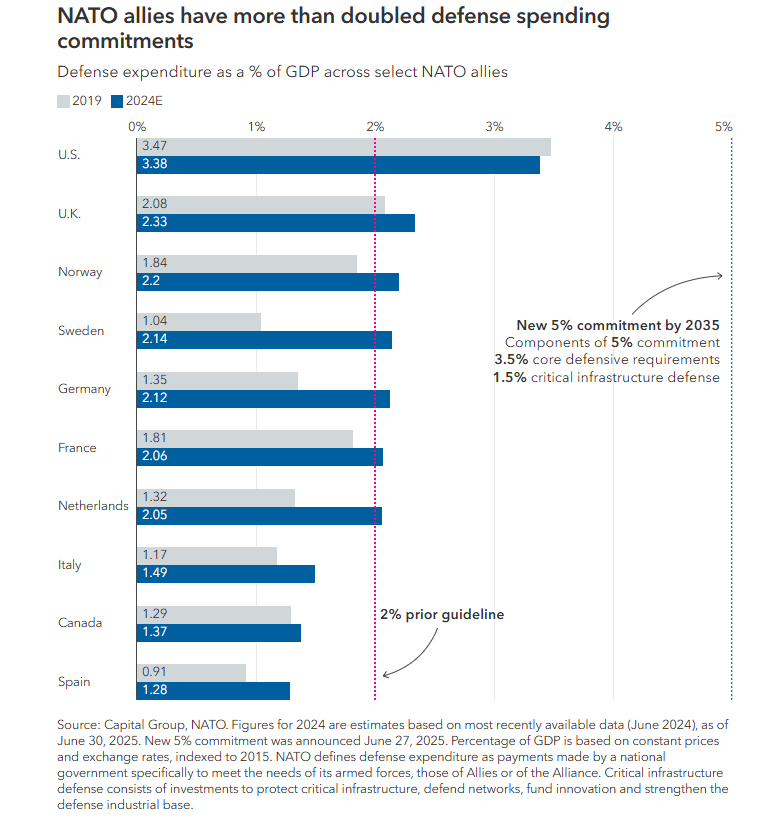

6.NATO Doubles Defense Spend.

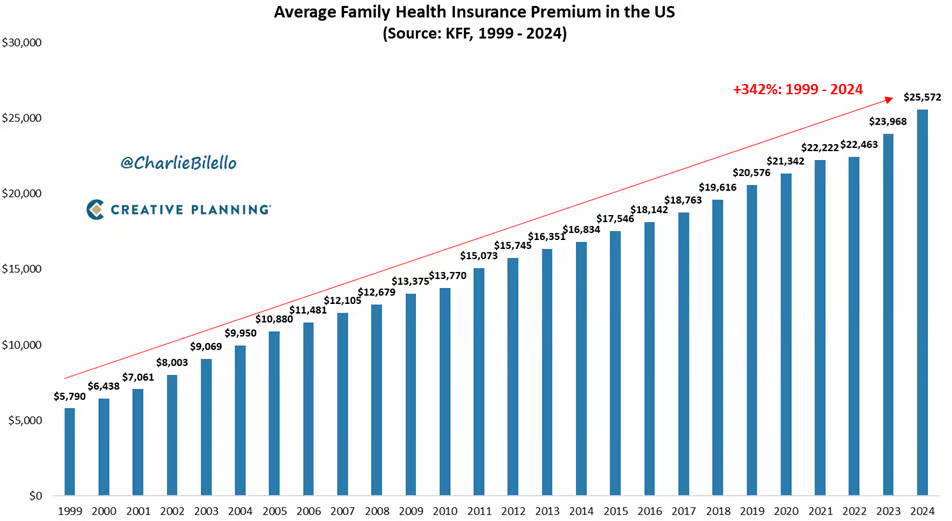

7.Average American Family Health Insurance Premiums

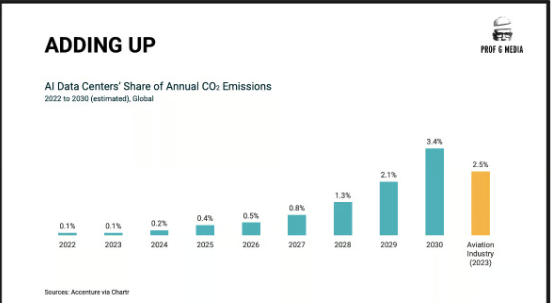

8.AI Data Center CO2 Emissions More Than Aviation Industry-Prof G

9.Revenue of Internet vs. Revenue of AI

In 2000, at the height of the dot-com bubble, revenue from internet subscriptions, e-commerce and PCs (which many bought to access the internet) was about $1.5 trillion (in 2024 dollars), which is orders of magnitude larger than the $20 to $30 billion in revenue likely to be generated this year for AI software. It is hard to imagine AI users paying more for services that can’t be used, in situations where the costs of mistakes are substantial.

Jeffrey Funk is a retired professor, tech consultant and the author of “Unicorns, Hype and Bubbles: A guide to spotting, avoiding, and exploiting investment bubbles in tech.”

Gary Smith is the author of more than 100 academic papers and 20 books, including “Standard Deviations: The truth about flawed statistics, AI and big data” (Duckworth, 2024) and (co-authored with Margaret Smith): “The Power of Modern Value Investing: Beyond Indexing, Algos and Alpha” (PalgraveMacmillan, 2024).

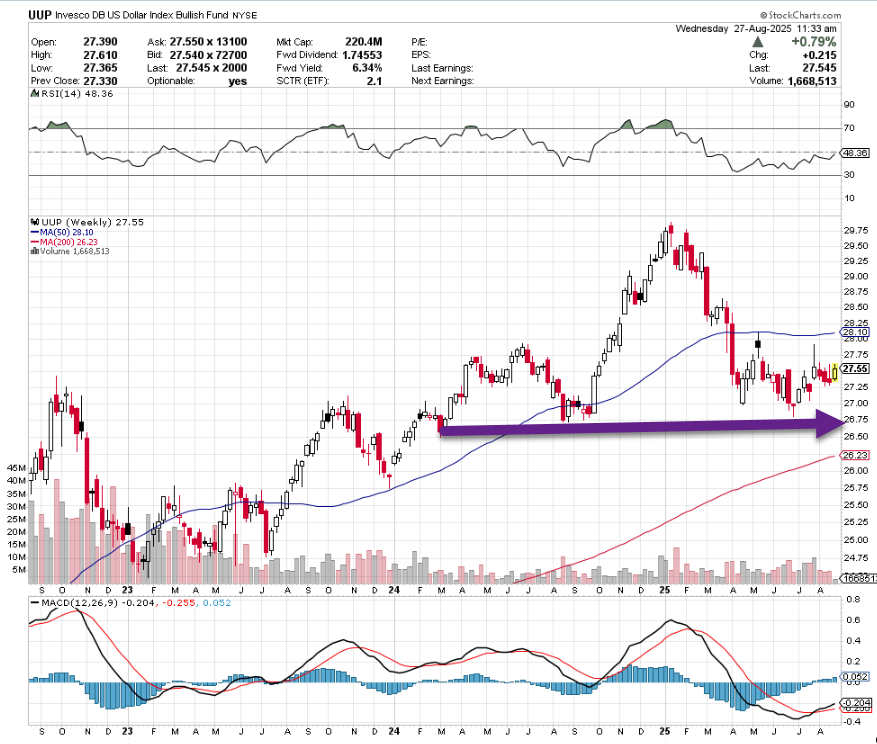

10.Real Influence.

Andy Lopata-Psychology Today