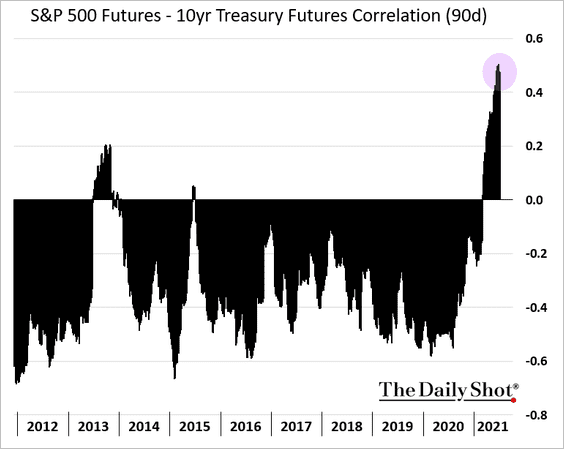

1.The Correlation Between Stocks and Bonds Most Elevated Since 2013

Equities: The correlation between stocks and bonds remains elevated (nowhere to hide).

Source: The Daily Post

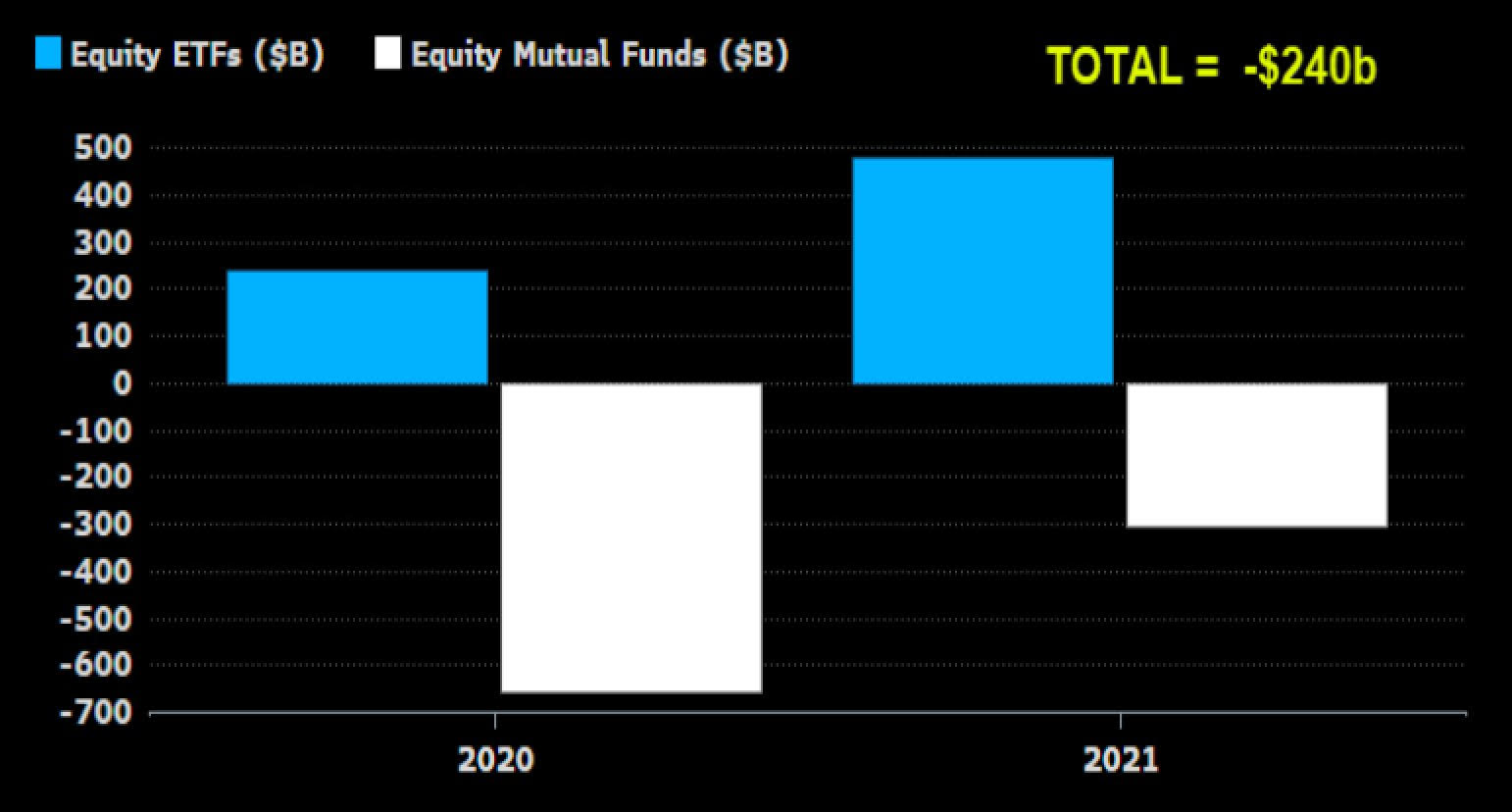

2.Add Up Net Outflows from Mutual Funds vs. Net Inflows from ETFs……Equities have Negative Flows 2020-2021

Little thing out today on how the equity ETF flow-a-thon gets a little less dramatic as a sentiment indicator when context provided, namely the $304b out of equity MFs and the $415b net outflows in 2020. Add it up and equity fund flows over past 20mo are negative $240b.

@EricBalchunas

https://twitter.com/

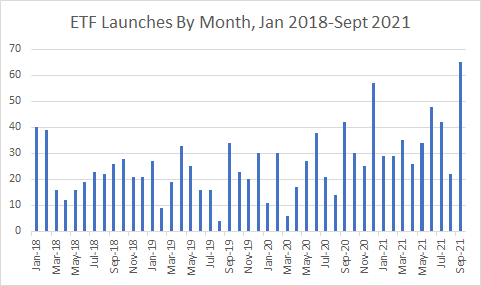

3.Record Amount of ETF Launches….59% of New ETFS are Actively Managed.

ETF.COM This year has been just as dizzying, but in a different way. At the quarter’s close, we had a total of 332 launches, breaking 2021’s record-setting number in just nine months. Since that number averages out to roughly 110 launches per quarter, we could easily see 400 launches by the end of the year.

A lot of those launches have come from the active side of things. Consider that in 2018, before the ETF Rule and when defined outcome ETFs were just getting started, there were 67 active launches. That’s out of a total of 267 launches for the whole year. That represents a quarter of all launches in 2018.

Now consider that out of the 332 launches in the first three quarters of 2021, there were 197 active ETFs in the mix, or 59% of all launches year-to-date. That’s a huge difference in just a few years. And it shows that the shape of the ETF industry is changing before our eyes.

ETFs Up The Ante Again In 2021-Heather Bell https://www.etf.com/sections/

4.Onshore Chinese Investors Calm During Evergrande Collapse

https://dailyshotbrief.com/the-daily-shot-brief-september-30th-2021/

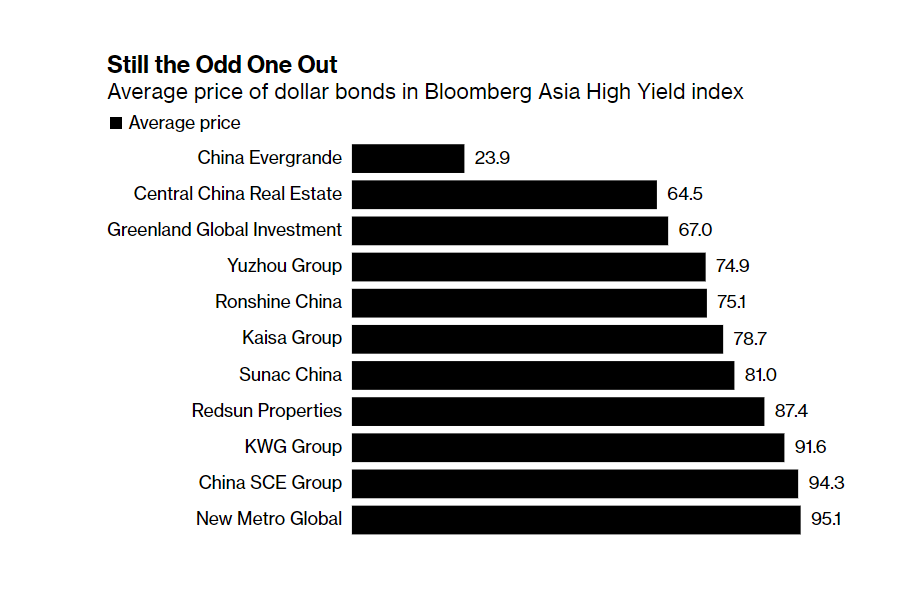

5.China Ring Fencing Evergrande.

Bloomberg -Beijing nudges banks to ease credit, support real estate firms

-Moves show China will put homebuyers ahead of bond creditors

The moves underscore that China will do everything it can to ring-fence Evergrande, while showing little interest in a direct bailout of the developer that has roiled global markets for weeks. That doesn’t bode well for bondholders — both onshore and abroad — looking for some kind of rescue from the Chinese government.

“The first obligation is going to make sure that homeowners who bought those homes take delivery and are made whole,” said Marathon Asset Management Chief Executive Officer Bruce Richards, who started buying Evergrande debt last week. “At the very end of the pecking order are offshore bondholders.”

Asia High Yield Index Not Collapsing

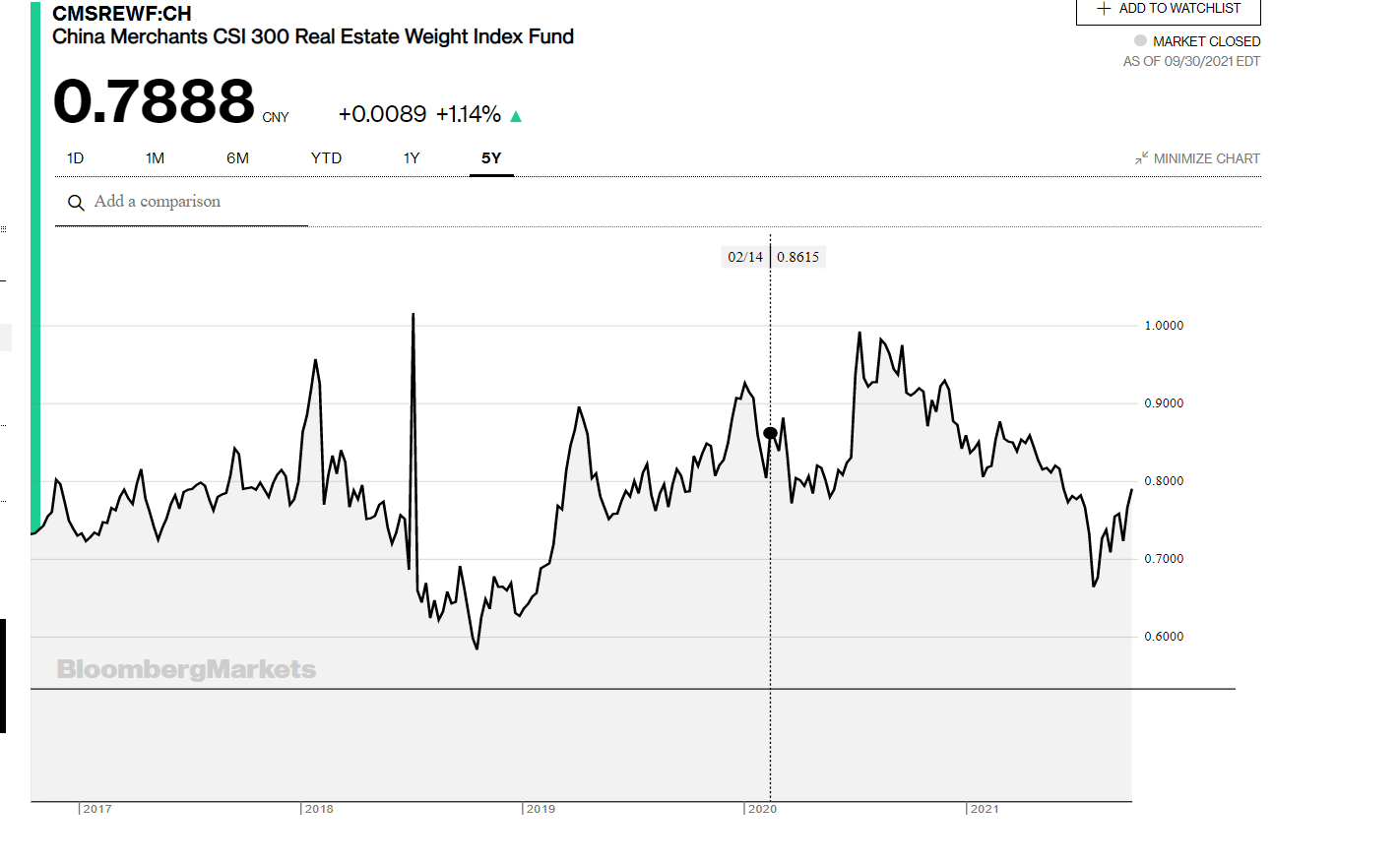

China Real Estate Index 5 Year Chart—No Collapse

China Steps Up Efforts to Ring-Fence Evergrande, Not Save It https://www.bloomberg.com/

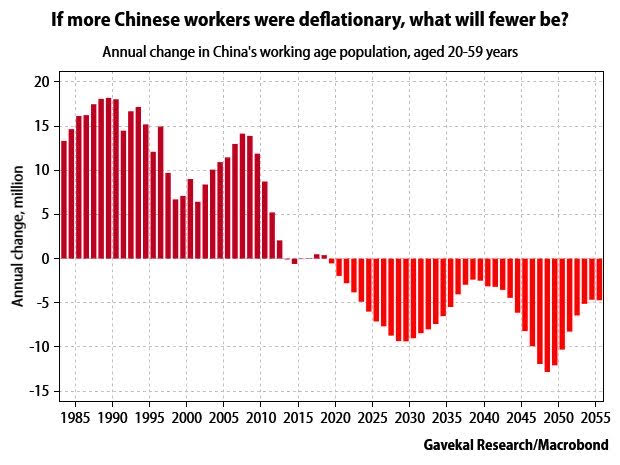

6.Clear Picture of Chinese Worker Demographic Cliff…Inflationary?

Annual Change in China Working Age Population, Aged 20-59

From Liz Ann Sonders Schwab

https://twitter.com/LisAnnSonders

7.S&P -4.6% September vs. Commodities Up

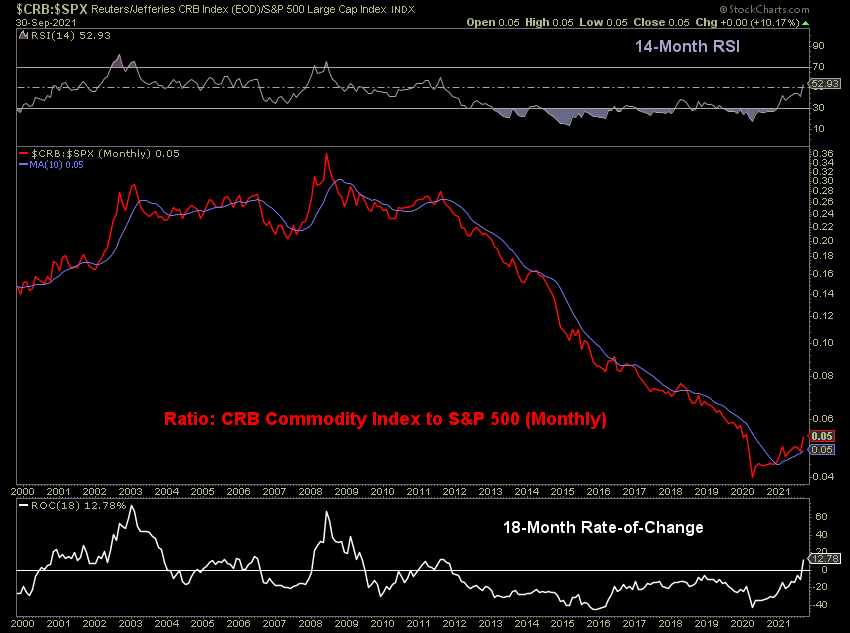

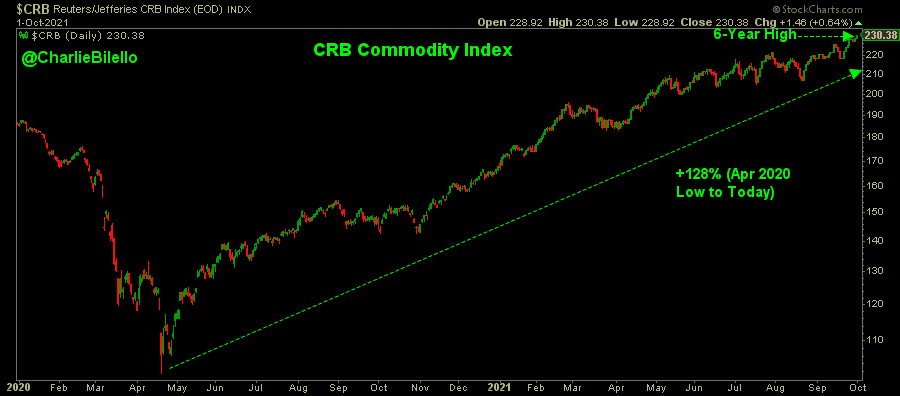

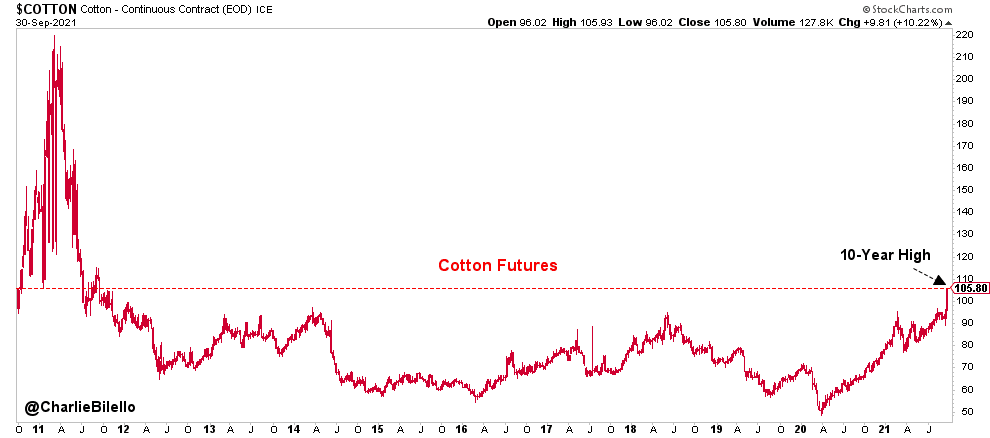

Charlie Bilello-Hot Commodities–While US equities had their worst month of the year in September (S&P 500: -4.8%), Commodities continued their steady advance. In an interesting change of leadership, Commodities have bested equities over the past 18 months. The last time that happened was back in 2011.

The CRB Index ended the week at a 6-year high, up 128% from the lows last April.

Cotton is the latest commodity to spike, surging to levels we haven’t seen in over 10 years. This will likely mean higher prices to come for clothing.

https://twitter.com/charliebilello?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

8.Seasonality….There has been Crashes in October…But Overall the Month is Positive for Stocks.

Keep in mind these are average numbers…no adjustment from valuation standpoint.

LPL Research

https://lplresearch.com/2021/09/30/could-there-be-an-october-crash/

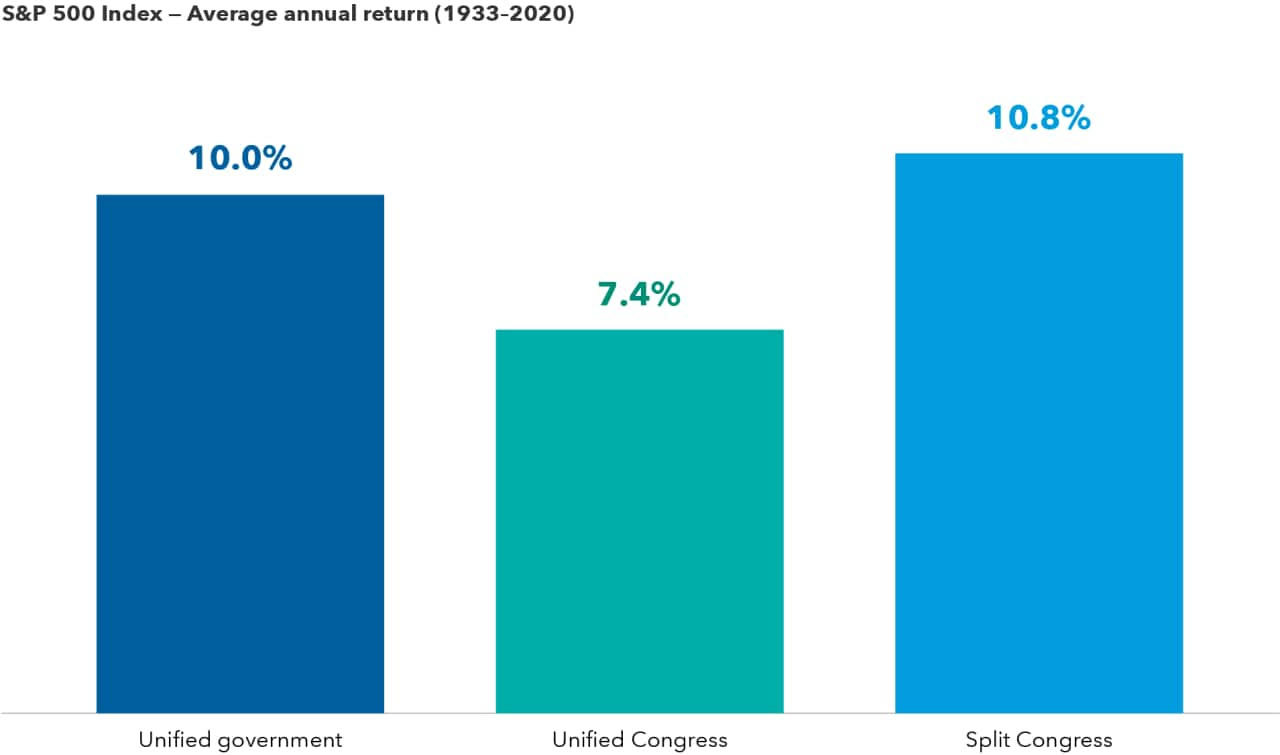

9.Mid-Term Elections One Year Away

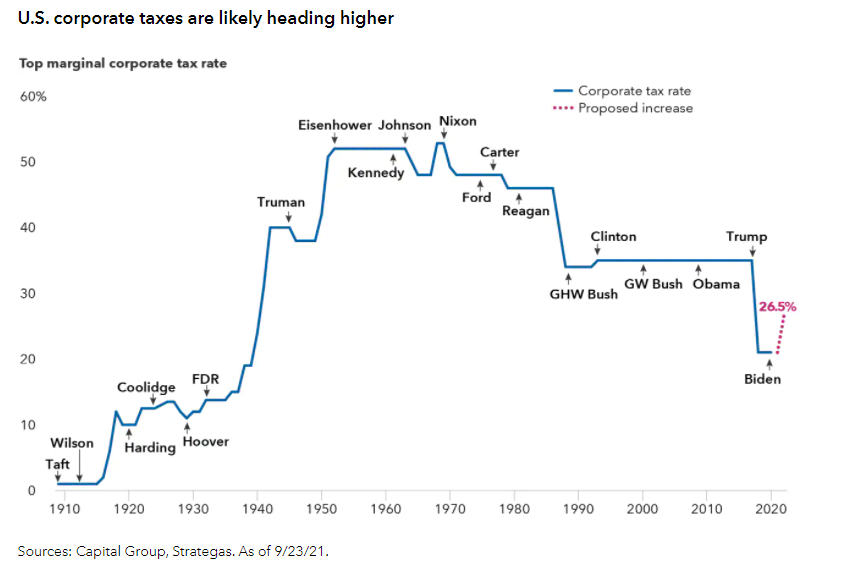

Capital Group-Midterm elections will produce a divided Congress–All these momentous events are happening against a backdrop of what could be one of the more consequential midterm elections in U.S. history. Make no mistake, every move in Washington right now is being carefully calculated with the midterms in mind. While the election is still more than a year away — and that’s a lifetime in politics — history suggests we will see a backlash against the party in power that will result in Republicans taking back control of the House and potentially the Senate.

Democrats are certainly worried about this outcome, which is why they feel the urgent need to pass their ambitious agenda now. Assuming history repeats itself, Republican control of the House or the Senate will end the affirmative phase of Joe Biden’s presidency and the Democratic Party’s lofty legislative ambitions.

https://www.capitalgroup.com/advisor/insights/articles/3-predictions-Congress-tax-budget-plans.html

10.Tasks or initiatives?

Seth’s Blog

For the longest time, just about all jobs were task jobs.

Factory work.

Inbox then outbox.

The assembly line, the ticket taker, the cook…

We learned how to hire for these jobs, measure them, manage the work to be done. Over time, we’ve figured out how to outsource them, mechanize them and pay as little as possible for them.

But in many pockets of our economy, the new jobs and the best jobs aren’t task jobs. They are jobs of initiative. Work that’s taken, not simply assigned. Work that can’t be easily forecast, and work that thrives with a different sort of teamwork.

These jobs often have a lot of task work mixed in, which is really confusing for everyone involved. Because reverting to task work feels safe and hiring for task work is easier. Apparently, people are supposed to learn how to do initiative work on their own and do it in their spare time.

Most organizations do an astonishingly bad job at creating, initiating and dancing with the next thing. And so they struggle and eventually become Yahoo.

First step: announce what the jobs around here are like. Hire for them and measure and reward appropriately.

https://seths.blog/2021/10/

Found at Abnormal Returns www.abnormalreturns.com