1. 10-Year Treasury Closes Below 4% First Time in 12 Months

CNBC

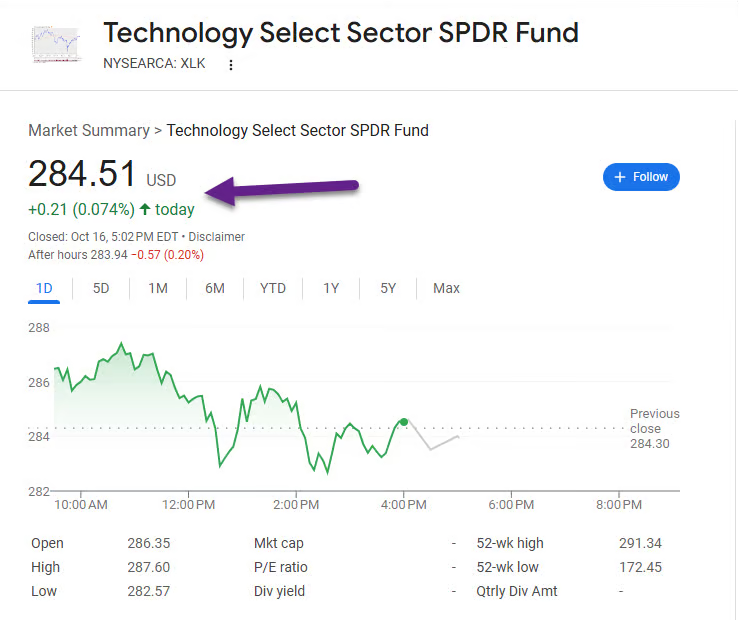

2. Tech Doesn’t Care About More Credit Cockroaches?? XLK Closed Higher Yesterday

Google Finance

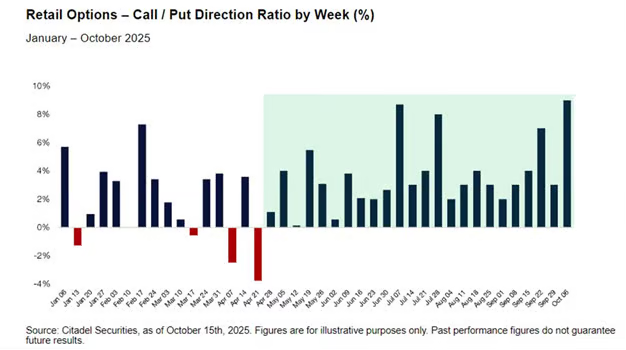

3. Retail Options Trading

Retail traders’ demand for call options has outpaced puts for 24 consecutive weeks, which ties with November 2023 for the longest streak ever, said Citadel Securities’ Scott Rubner, citing data going back to 2020. Retail traders’ conviction in the stock market “remains extraordinary” he says.

Dave Lutz Jones Trading

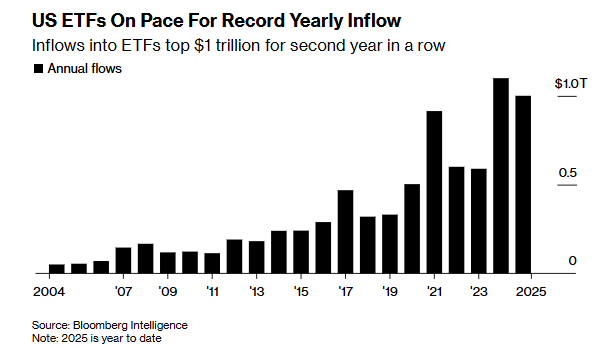

4. U.S. ETFs Monthly Flows 3.5x the Usual Seasonal Average

Bloomberg

5. MicroStrategy -38% from Highs…50day thru 200day to Downside in October

StochCharts

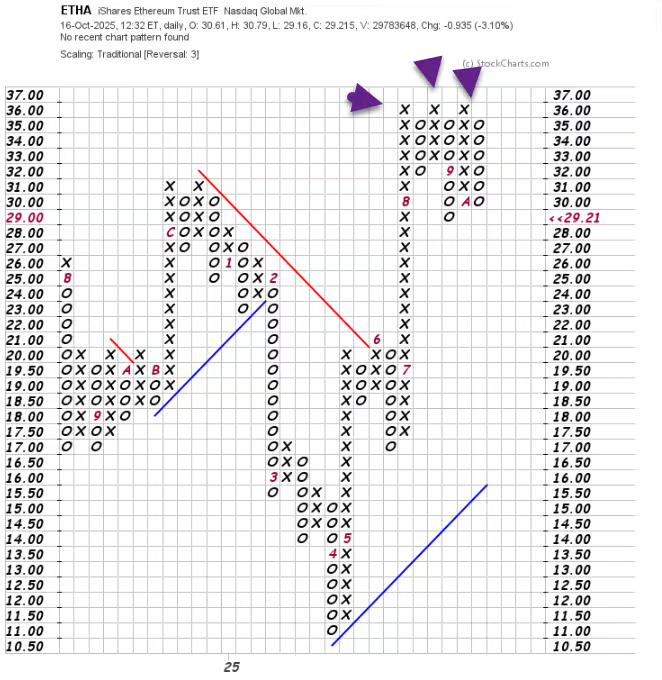

6. Ethereum ETF-A Couple Attempts to Break-Out to New Highs Failed

Stock Charts

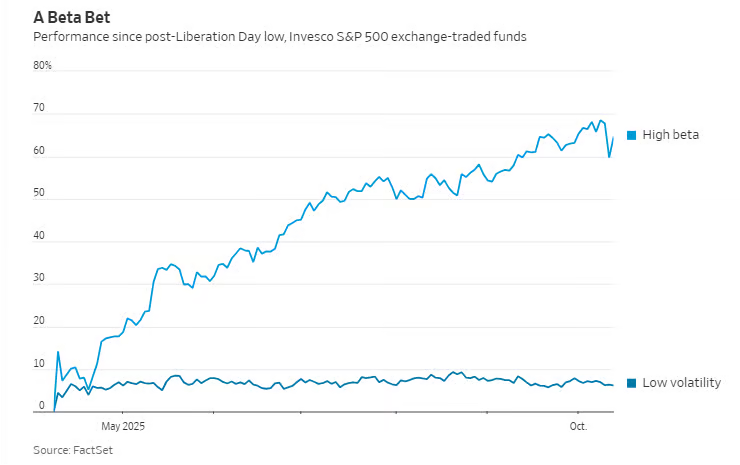

7. Massive Spread in Just 11 Month Period High Beta vs. Low Volatility…..At Highs +68% vs. +7%

WSJ

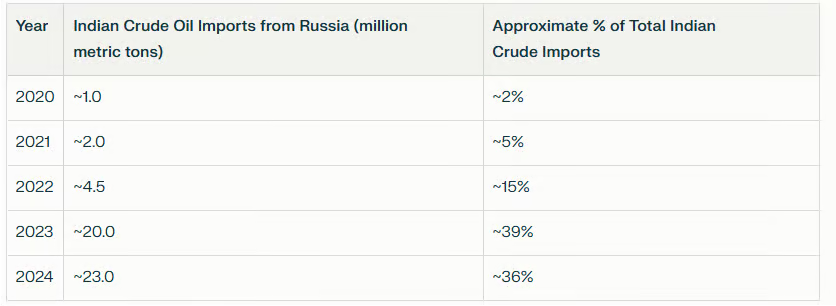

8. India Pre-Ukraine Invasion Bought $1B of Russian Oil Imports….2024 India Imported $52.7B of Russian Oil 36% Of Total

Perplexity

Zerohedge- “Within a short period of time, they will not be buying oil from Russia,” Trump told reporters in the Oval Office during a press conference.

Before Russia invaded Ukraine, India’s annual crude oil imports from Russia hovered at about $1 billion. But since the war began, imports have skyrocketed, reaching $25.5 billion in 2022, $48.6 billion in 2023, and $52.7 billion in 2024, according to the U.N. Comtrade database.

Experts at the Observer Research Foundation think tank estimate that India accounts for more than one-third of Russia’s crude exports, behind China’s 50 percent share.

“Indian refiners have temporarily ramped up Russian crude imports, without any visible signs of concern emerging from the political leadership,” the foundation wrote in a report.

The United States has accused India of reselling Russian oil on the open market, allegedly further benefiting Russia.

“India’s subsequent reselling of this oil on the open market, often at significant profit, further enables the Russian Federation’s economy to fund its aggression,” Trump’s executive order reads.

In December 2021, Russian President Vladimir Putin and Modi signed a flurry of trade and arms deals. Putin and Modi also signed nine agreements related to trade, research, and climate action in July 2024.

According to the U.S. Trade Representative’s Office, the U.S. goods trade deficit with India was almost $46 billion in 2024, representing a 5.9 percent increase from 2023.

https://www.zerohedge.com/geopolitical/trump-says-india-agreed-stop-buying-oil-russia

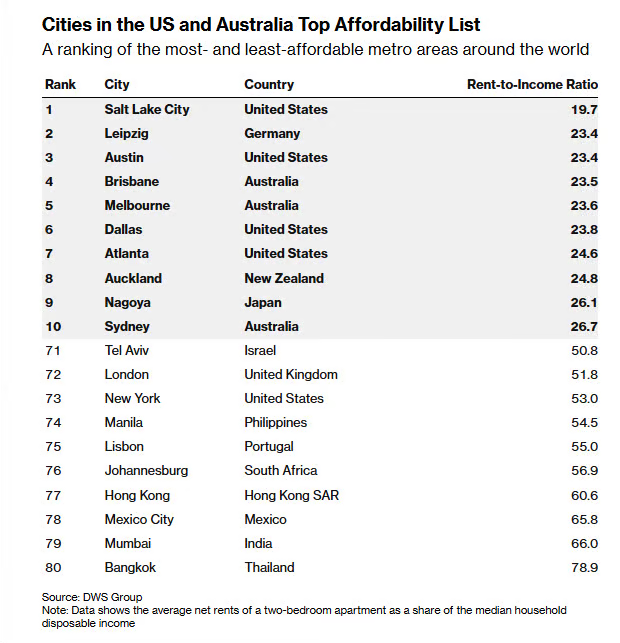

9. Most Affordable Global Cities…Salt Lake, Austin, Dallas, Atlanta

Bloomberg

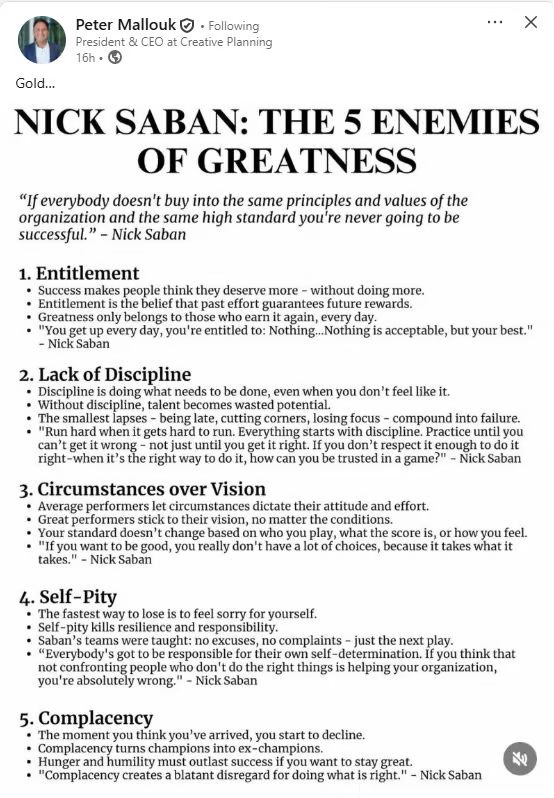

10. Nick Saban-The 5 Enemies of Greatness

Peter Mallouk