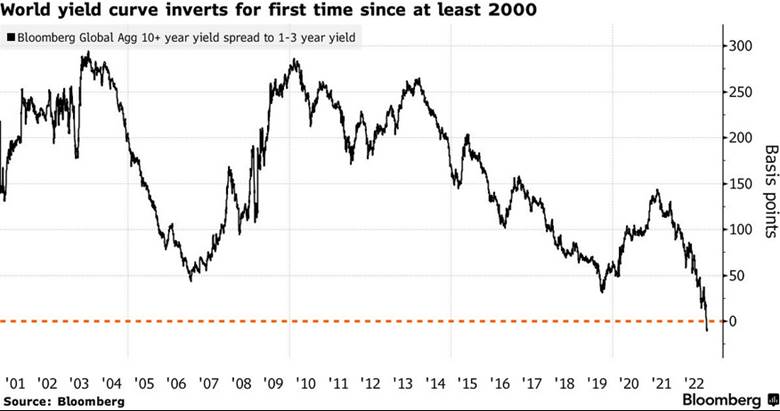

1. World Yield Curve Inverts

I am not familiar with this yield curve but first time in 22 years From Dave Lutz at Jones Trading The average yield on sovereign debt maturing in 10 years or more has fallen below that of securities due in one-to-three years, according to Bloomberg Global Aggregate bond sub-indexes. That has never happened before based on data going back to the beginning of the millennium.

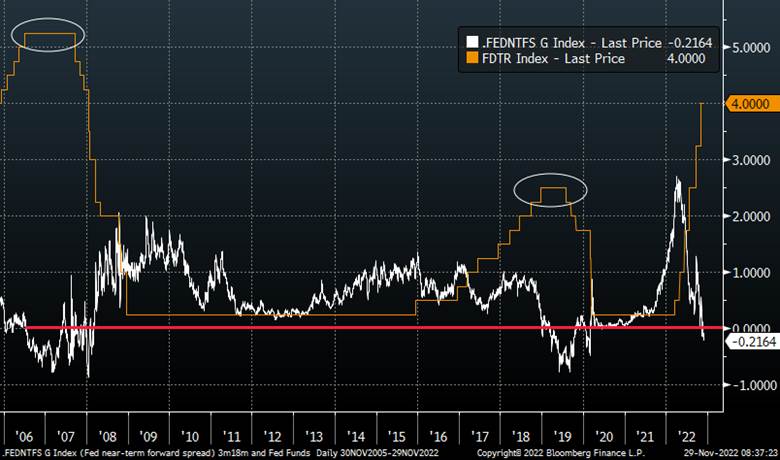

The Most Important Curve as we await Powell tomorrow? He loves the 3m18m Curve – The last 2 times it inverted like it is now, the Fed has paused it’s hiking campaign.

2. This is Where We Got the August Sell Off

S&P Trades Back to 200day Moving Average

3. MegaCap Tech ETF Still Holding Above 200 Week Moving Average.

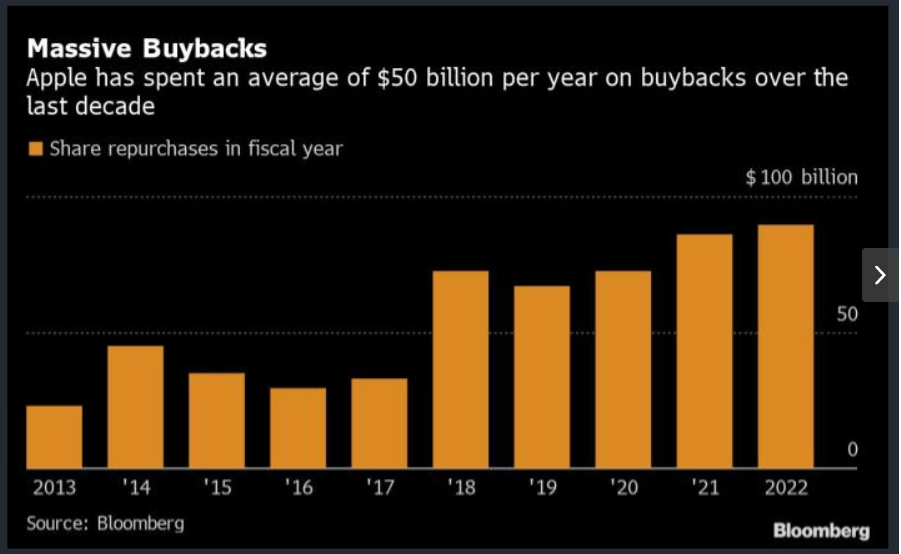

4. The Largest Holding in MegaCap Tech is AAPL….$550B in Buybacks Last 10 years

(Bloomberg) — Apple Inc. has shelled out more than $550 billion buying back its own shares over the past decade, more than any other US company, and the technology juggernaut shows no signs of slowing down.

“This is an aggressive bet that they made, something that Steve Jobs would have never done, and it’s paid off nicely for the company and its investors in part because the stock has done well during that period,” Munster said of the share repurchases.

Apple, the world’s largest company with a market value of almost $2.3 trillion, also is in a league of its own when it comes to share buybacks.

In two of the last five years, it has outspent the second-highest repurchaser by least $50 billion. It spent almost $90 billion last year, about equal to the market value of Citigroup Inc.

https://finance.yahoo.com/news/apple-stock-buyback-bonanza-helps-113849830.html

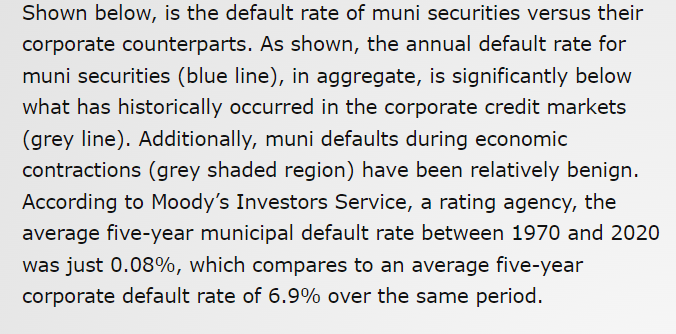

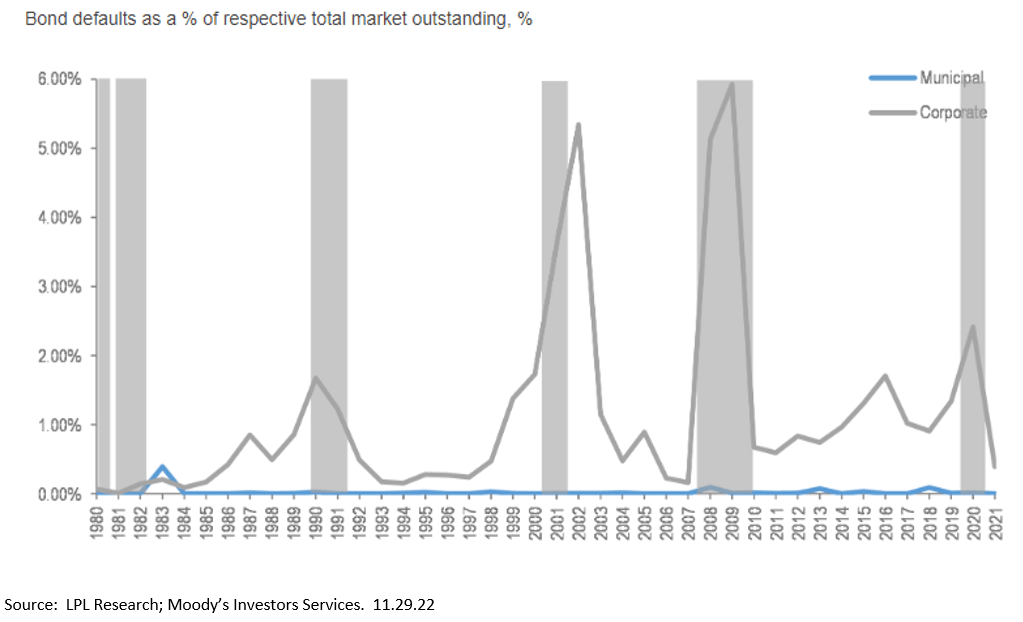

5. Munis Just Had Best Month Since 1986

LPL Research

https://iplresearch.com/2022/11/29/munis-a-historically-defensive-asset-class-during-economic-downturns/

6. S&P Price to Sales Update…Not Sure What it Looks Like Minis FANG+

Liz Ann Sonders Schwab S&P 500’s price/sales ratio has come down significantly from peak … orange circles highlight where ratio was at major market lows in 2020, 2018, 2009, and 2002

www.linkedin.com/in/liz-ann-sonders-57a65619/

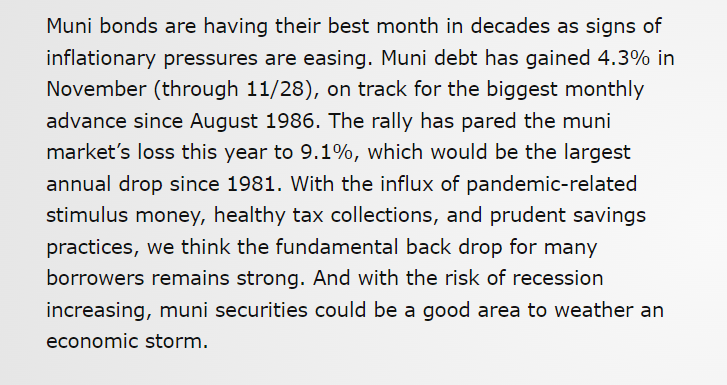

7. U.S. Household Debt to Service Ratio

Irrelevant Investor Blog

https://theirrelevantinvestor.com/2022/11/23/animal-spirits-a-confusing-year/

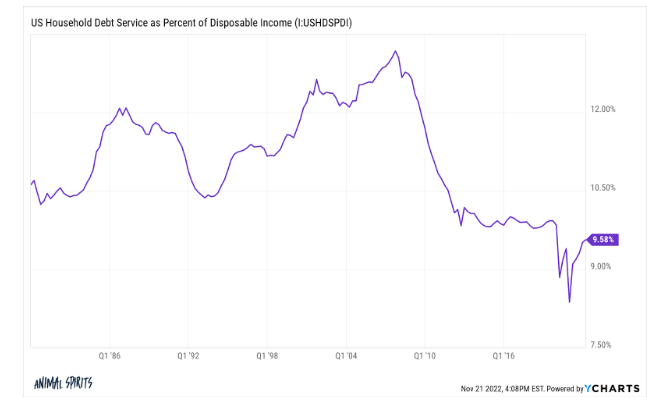

8. Forclosures Non-Existant Right Now

Wolf Street Blog-Foreclosures dipped in the third quarter and have been at ultra-historic lows since the mortgage forbearance programs, where delinquent mortgages were put on ice, and no longer counted as delinquent. Most of the borrowers have now exited the forbearance programs, either by having the mortgage modified in some way, or by having sold the home and paid off the mortgage, which was easily possible amid the pandemic spike of home prices. The free pandemic money also helped.

Foreclosures, after ticking up for two quarters, ticked down again in Q3 to just 28,500 mortgages with foreclosures, thereby nixing the beginnings of a trend that had been forming. During the Good Times before the pandemic, there were about 70,000 mortgages with foreclosures, more than double the current number:

https://wolfstreet.com/2022/11/25/consumer-bankruptcies-foreclosures-delinquencies-and-collections-free-money-still-doing-the-job/

9. Gaslighting Word of Year

MorningBrew Gaslighting “psychological manipulation over an extended period of time that causes the victim to question the validity of their own thoughts,”

YEAR IN REVIEW

‘Gaslighting’ is in everyone’s head

Photo Illustration: Dianna “Mick” McDougall, Source: Gyrgy Halmos/EyeEm/Getty Images

|

https://www.morningbrew.com/

10. Brett Arends’s ROI-These are the top 5 ‘financial regrets’ of Americans over 50 Marketwatch Brett Arends

There’s an old joke about a man in the Wild West who’s about to be hanged for some crime he had committed. As he is standing on the scaffold, and the hangman is placing the noose around his neck, the criminal tells the crowd, “this is going to be a real lesson for me!”

One of the great problems with retirement planning is that by the time we realize the big mistakes we’ve made it’s usually too late to do anything else. Those who have (for example) spent too much while young, and who then end up old and broke, can always say in their dotage “this has been a real lesson to me,” but how exactly is that going to help?

Which brings us to the question of what we can do to try to prevent those financial regrets, by taking the right decisions when we still have time to change our actions. This isn’t simply a challenge for each of us individually, but also one of public policy. How can we do more to encourage more and better retirement planning?

Economists Abigail Hurwitz of the Hebrew University of Jerusalem and Olivia Mitchell of the University of Pennsylvania’s Wharton business school recently conducted a survey of older Americans on the subject of financial regret. They polled 1,764 Americans over the age of 50 through the University of Michigan’s ongoing Health and Retirement Survey. In the survey the average age was around 72.

What they found was interesting and useful.

Older Americans have five major financial regrets. One or two are quite surprising.

And those regrets increase, dramatically, when people are encouraged to think more about how long they are likely to live.

Let’s start with the regrets. In the survey, the No. 1 financial regret of older Americans, shared by a thumping 57%, was not having saved more for their retirement during their working years. And while you can’t save more if you don’t earn more, those looking back with regret also blamed themselves for “not planning ahead” and “living day to day.”

Second on the list, surprisingly: Not buying long-term-care insurance, to pay for a nursing home or similar. This was a regret by 40% of those polled. There is a widespread misapprehension, especially among non-retirees, that Medicare will pay for your stay in a nursing home. It won’t (except in narrow and quite brief exceptions). You’ll have to pay for it yourself. Medicaid will step in, but only when you have run out of money.

Third on the list, 37% of older Americans regret not working longer, while 23% regret claiming Social Security too early—that is fifth on the list.

You can start claiming at 62, and many do. But if you wait you will get more each month. Someone waiting till they are 70 to start claiming will end up getting checks that are nearly 80% bigger.

The two most powerful levers you can pull to improve your retirement prospects, even as late as your 60s, is to keep working for longer and to delay taking Social Security as long as possible.

Meanwhile at No. 4, a remarkable 33% of older Americans regretted not investing more in a lifetime annuity or similar product that would produce a guaranteed income for life.

As part of the survey, the researchers also gave some of the subjects objective information about longevity, showing them mathematically the chances that they would live to a ripe old age. The result? Financial regrets went up. In some cases, they went up a lot. “Healthy people given objective longevity information were 43% more likely to express regret about not having saved more,” Hurwitz and Mitchell report. Those given the objective data about survival probabilities “expressed twice as much regret about not having purchased LTC insurance, and 2.4 times greater regret for not having purchased lifetime income payments,” they write.

So if a key to preventing financial regret in old age is to think more, and earlier, about how long we’re likely to live, reflect on this: According to CDC data, among those who make it to 65, half can expect to live into their mid 80s and a quarter into their 90s. About 10% can expect to live to their mid-90s. And those numbers are rising. Which is great news — unless you run out of money.