1. Its Always Something

Peter Mallouk

2. One Stock that Held Its Post-Election Rally…Fannie Mae: +400% over 6 Months

StockCharts

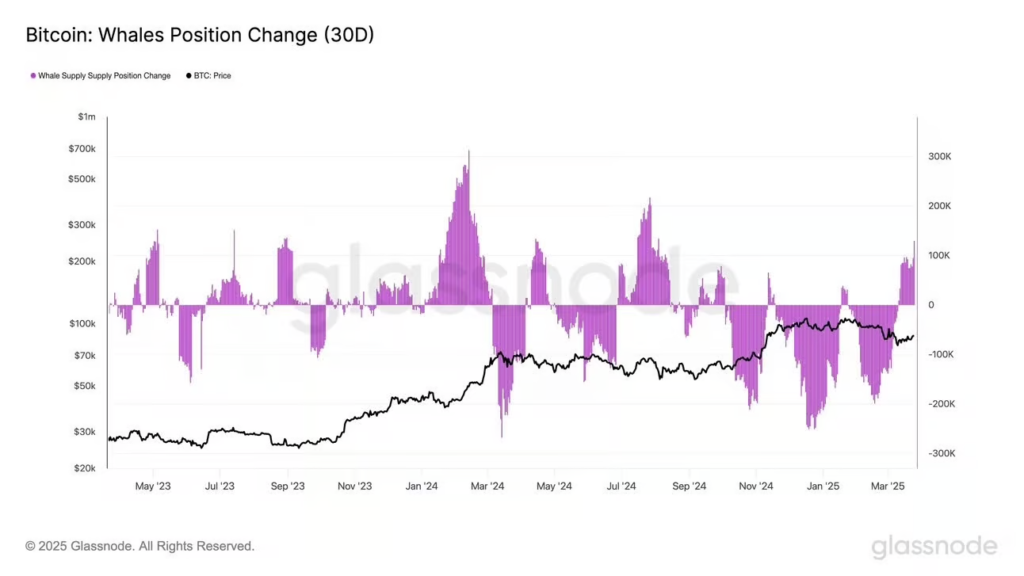

3. Large Bitcoin Traders are Buying

Bitcoin whales. “The 30D position change for whales shows they’ve added +129K BTC since March 11 – with momentum picking up sharply over the past 2 days. That’s the largest accumulation rate since late August 2024, signaling growing confidence from large players.”

Glassnode via DailyChartBook

4. Put Software on Long List of Growth Sub-Sector Charts that Mirror below, pulled back to 2+ Year Trendline

StockCharts

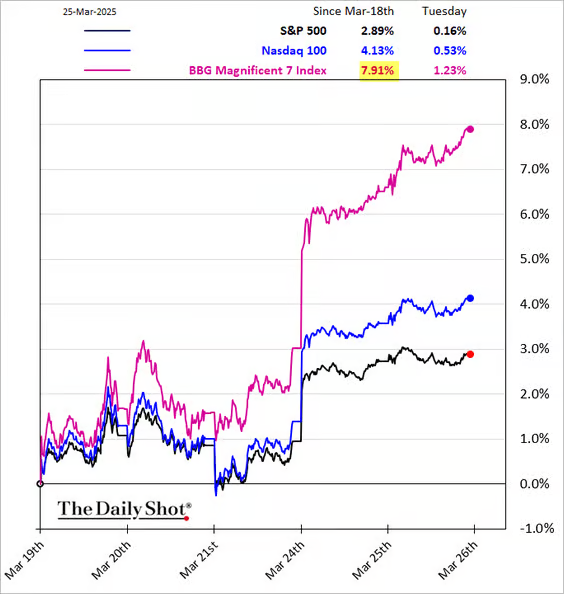

5. Before Yesterday Mag 7 Big Bounce

It’s been a good couple of days for the Magnificent 7 stocks.

The Daily Shot

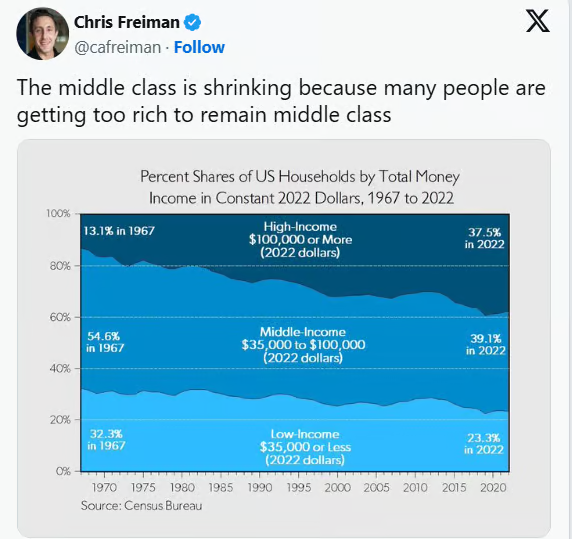

6. Interesting…Middle Class Shrink Due to More High Class Earners?

The Irrelevant Investor

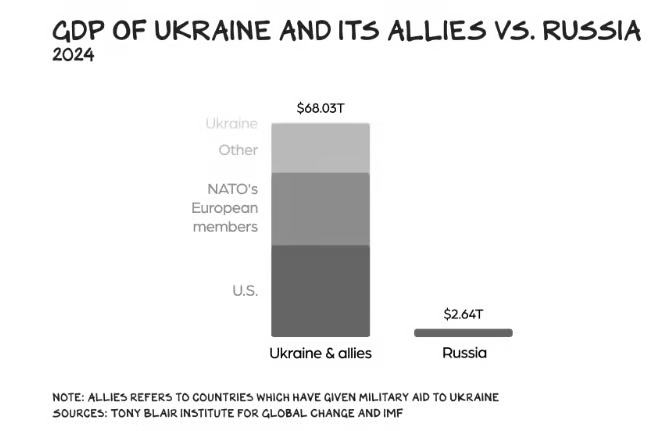

7. GDP of Ukraine and Its Allies Vs. Russia

Professor Galloway

8. 700 Basketball Players Entered Transfer Portal Day 1…Private Lending Coming to College Sports

Via PitchBooK: Pitch Book Private credit lenders, usually known for financing loans to companies, may be recruited for a new role: funding athletic programs as the NCAA changes rules on compensating players.

Until now, US colleges have enjoyed an unusual advantage in their business models by not having to pay athletes.

That’s set to change. Final approval of a $2.8 billion antitrust lawsuit is imminent, paving the way for college athletics programs to share revenue with their players. The rule change could mean up to $20.5 million of direct payments to student-athletes per school, per year, starting in the 2025-2026 academic year.

Early in the quarter

College athletics programs have historically spent more than they have brought in. The new balance sheet line item on the sports programs’ balance sheets will dramatically increase capital needs that tuition increases and alumni donations can’t solve.

According to lenders, advisors, and law firms to whom LCD spoke, banks will not be able to meet the additional financing needs. What’s more, a dearth of sponsor-backed M&A and buyouts makes these opportunities more enticing for lenders with capital to put to work.

Several private credit providers told LCD they’ve already begun holding early conversations with universities and conferences about forming new lending relationships.

It’s likely that schools will need to demonstrate additional revenue streams to support any potential incoming capital infusions to offset normal operational deficits.

Randall Boe, senior counsel at Akin Gump and former commissioner of Arena Football League, says that private credit will prioritize transactions that fund projects and renovations that will generate new streams of revenue and help schools transition to the new business models necessitated by changes in the college sports landscape.

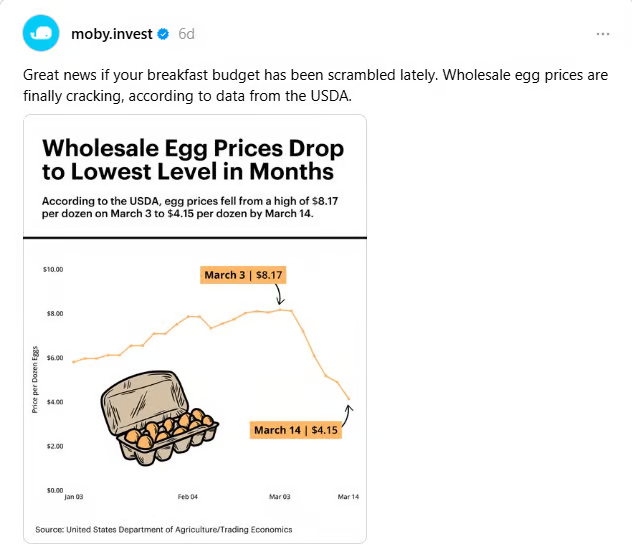

9. Egg Prices -66%

Moby.Invest

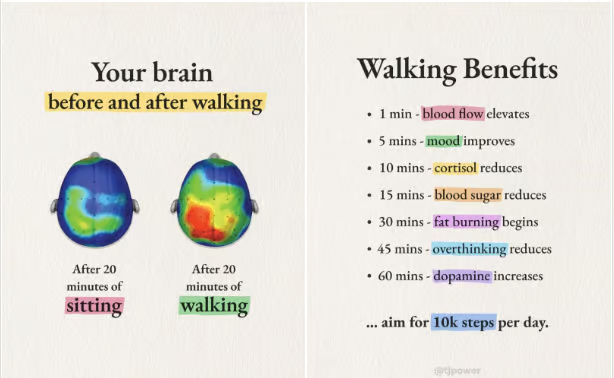

10. Brain Benefits of Walking

Dr. Hyman