1. S&P Gains Last Week are Historically Bullish Going Forward

From Dave Lutz at Jones Trading

History was made last week, LPL notes – For only the 5th time ever, the S&P 500 gained at least 1% for 4 consecutive days. This rare occurrence is also quite bullish, as a year later it has been up more than 20% every single time with an average gain of 28.0%.

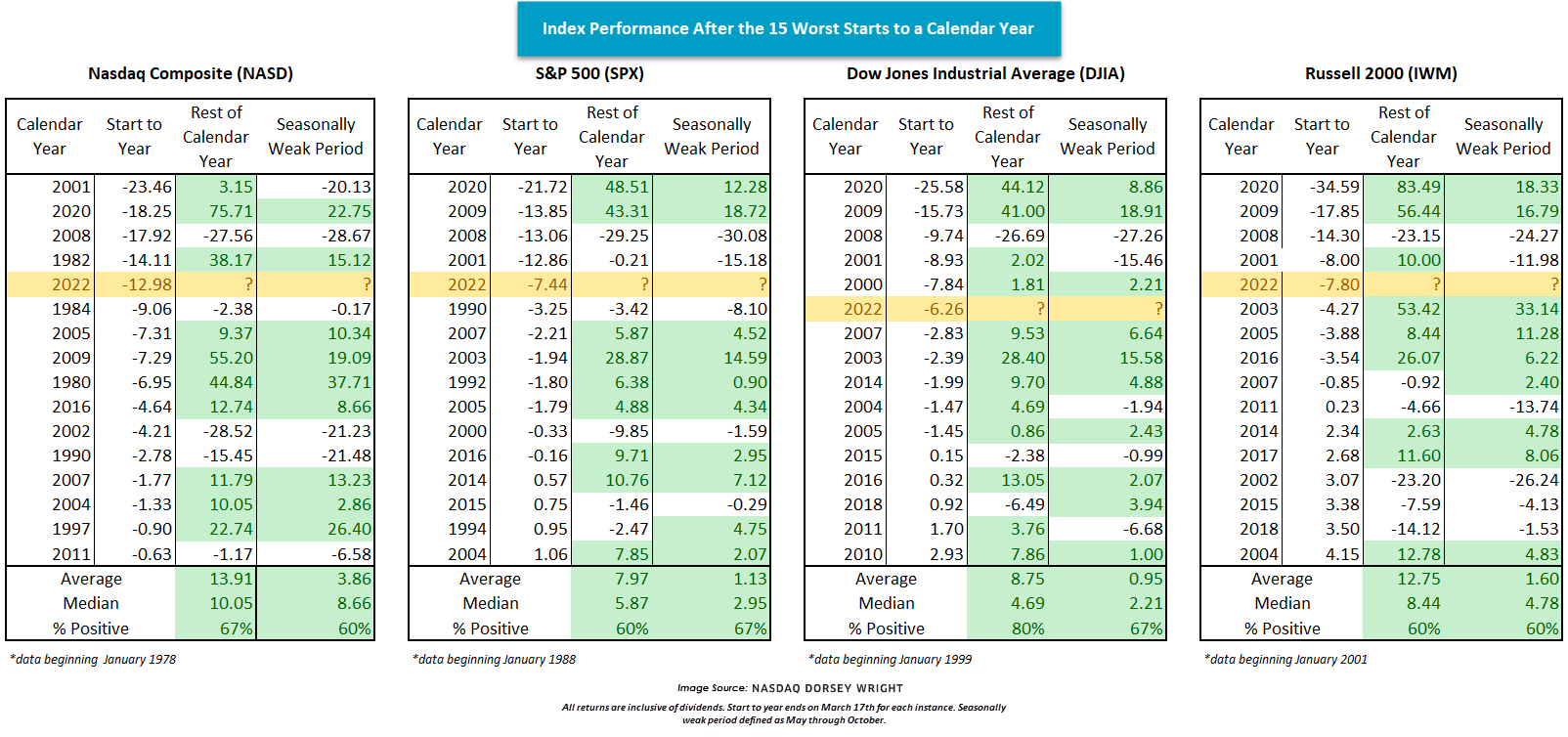

2. Index Performance After 15 Worst Starts to Calendar Year

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

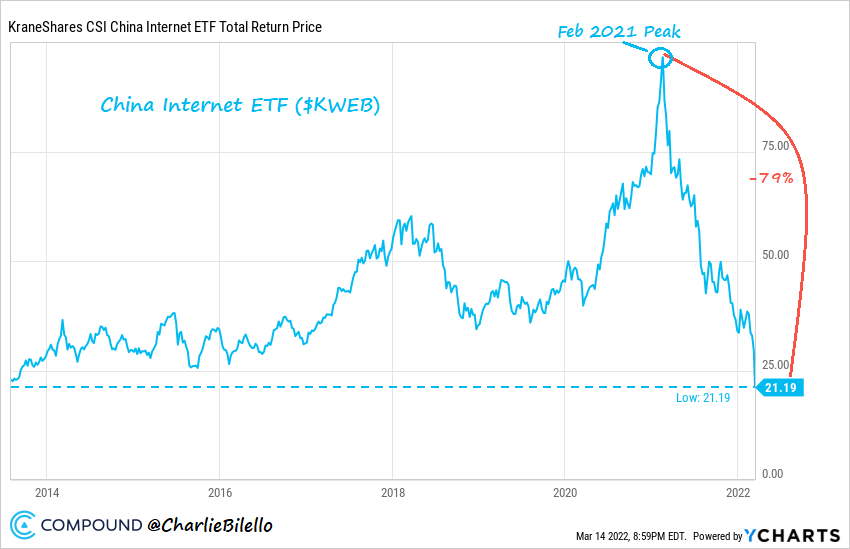

3. China Internet Stock Crash 3x Faster than 1999 U.S. Tech Bubble

@Charlie Bilello After its peak in March 2000, the Nasdaq composite fell 78% to its low in October 2002. That took 31 months. From its high in February 2021 to its low last week, the China Internet ETF $KWEB fell 79% in just 13 months.

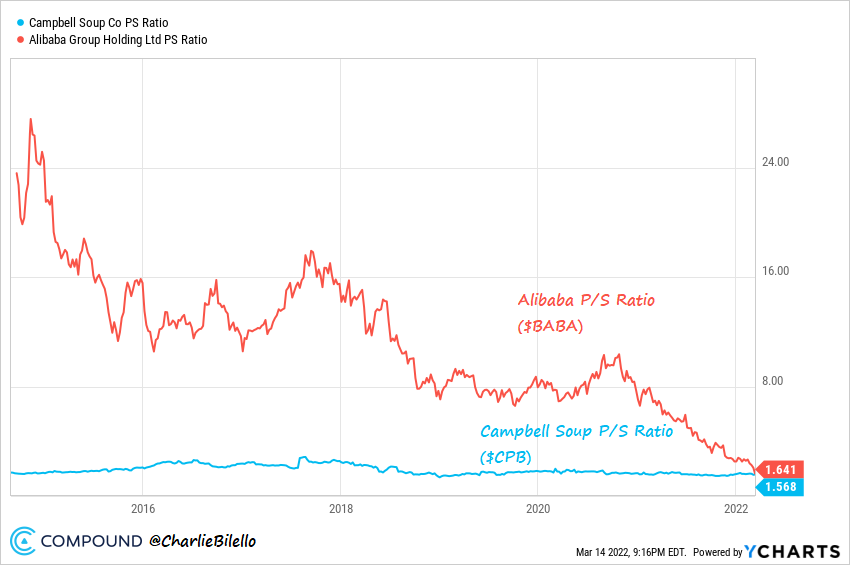

The rapid decline pushed valuation multiples down across the board, with Alibaba ($BABA) trading at the same price to sales ratio (1.6x) as Campbell Soup ($CPB).

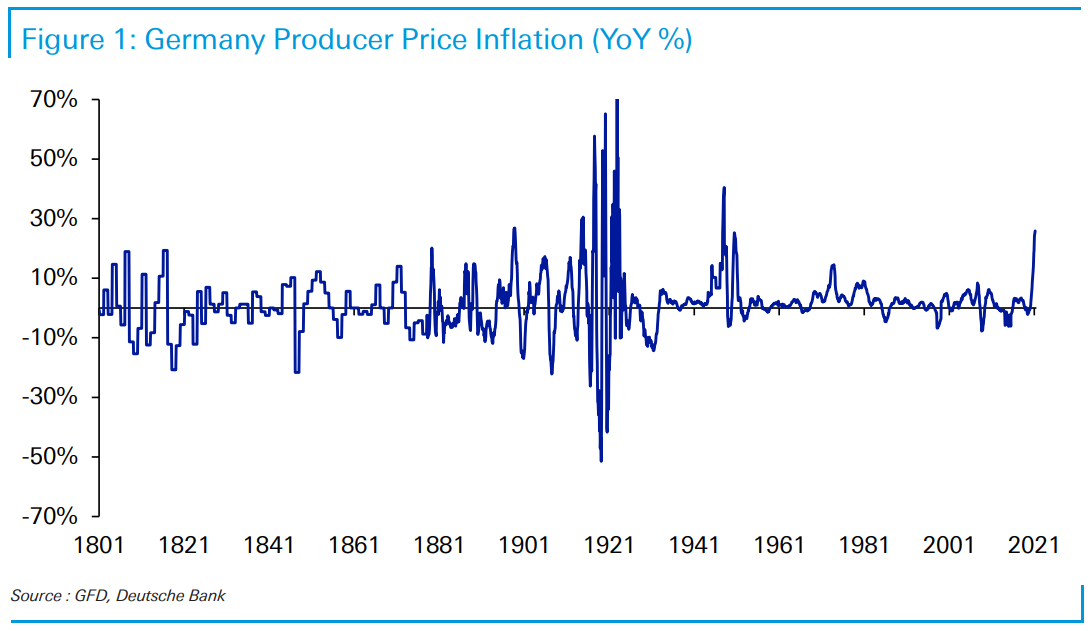

4. German PPI (inflation) 26.5%

Jim Reid-Deutsche Bank

German PPI came out this morning at a 25.9% YoY level. Using long-term data spliced from various sources, this is the highest since the aftermath of WWII and on par with the highest peacetime levels on record. This time last year it was still just under 2%!

Although energy makes up just over the half of the total, even PPI ex-Energy is now at 12.4% YoY. For context in the 1970s, overall PPI didn’t get above 15% YoY.

One of the most fascinating accounts of the 1970s I read around this time last year was that of the Fed by ex-staffer and famous economist Stephen Roach. When energy spiked, the Chair Arthur Burns asked his staffers to devise an ex-energy inflation series and was comforted that this measure showed inflation was more contained. His view was that this energy spike had nothing to do with monetary policy. But soon he had to ask for another basket to be created ex food and energy. Again he was relatively calm at the lack of inflation elsewhere and believed food price rises were more to do with an El Nino. This stripping out continued until less than a third of the basket was left and eventually the Fed had to admit that inflation was broad based as even this stripped-out inflation series was in double digits.

So maybe there is little the Fed and the ECB can do about energy costs, but it’s worth remembering that the real central bank rates in both regions are massively negative and at their lowest post-WWII in the former, and clearly the lowest (by a long, long way) on record for the ECB. So are they pouring fuel on a fire?

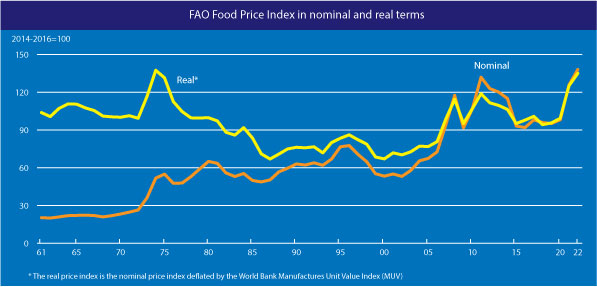

5. Food Price Index hit record high in February, UN agency reports

Nominal and Real Terms New Highs

Global food prices reached an all-time high in February, the Food and Agriculture Organization (FAO) reported on Friday.

The Food Price Index, which tracks the international prices of a items such as vegetable oils and dairy products, averaged 140.7 points last month, or nearly four per cent up from January.

This is also 24.1 per cent over the level a year earlier and 3.1 points higher than in February 2011.

Factors behind food inflation

“Concerns over crop conditions and adequate export availabilities explain only a part of the current global food price increases. A much bigger push for food price inflation comes from outside food production, particularly the energy, fertilizer and feed sectors,” said FAO economist Upali Galketi Aratchilage.

“All these factors tend to squeeze profit margins of food producers, discouraging them from investing and expanding production.”

As the Food Price Index measures average prices over the month, the February reading only partly incorporates market effects stemming from the conflict in Ukraine.

Rise in demand

The overall rise last month was driven by an 8.5 per cent increase in the FAO Vegetable Oils Price Index, a new record high.

This was mostly due to sustained global import demand, which coincided with a few supply-side factors, such as lower soybean production prospects in South America.

The Dairy Price Index averaged 6.4 per cent higher in February than January, supported by lower-than-expected milk supplies in Western Europe and Oceania, as well as persistent import demand, especially from North Asia and the Middle East.

Last month, the Cereal Price Index increased 3.0 per cent over January. Contributing factors included rising quotations for maize and other coarse grains, caused by continued concerns over crop conditions in South America, uncertainty about maize exports from Ukraine, and rising wheat export prices.

Strong global import demand contributed to the 1.1 per cent rise in the Meat Price Index. Other factors included tight supplies of slaughter-ready cattle in Brazil and a high demand for herd rebuilding in Australia.

The FAO Sugar Price Index declined by nearly two per cent amid favourable production prospects in India, Thailand and other major exporters, as well as improved growing conditions in Brazil.

Cereal forecast

FAO has also published a preliminary forecast that shows worldwide cereal output is on course to increase to 790 million tonnes this year.

Anticipated high yields and extensive planting in North America and Asia, should offset a likely slight decrease in the European Union and the adverse impact of drought conditions on crops in some of the North African countries.

The agency has updated its forecast for world cereal production in 2021, which is now pegged at 2,796 million tonnes, a 0.7 percent increase from the year before.

The forecast for world trade in cereals was also raised to 484 million tonnes, up nearly one per cent from the 2020/2021 level. The forecast does not assume potential impacts from the conflict in Ukraine, and FAO is closely monitoring the developments and will assess impacts in due course.

Fears for food security

Relatedly, the head of the International Fund for Agricultural Development (IFAD) has highlighted how the crisis in Ukraine could impact global food security.

IFAD President Gilbert F. Houngbo said continuation of the conflict, which is already a tragedy for those directly involved, will be catastrophic for the entire world, particularly for people already struggling to feed their families.

He warned that the fighting could limit the world’s supply of staple crops like wheat, corn and sunflower oil, resulting in skyrocketing food prices and hunger. This could jeopardize global food security and heighten geopolitical tensions.

“This area of the Black Sea plays a major role in the global food system, exporting at least 12 percent of the food calories traded in the world,” said Mr. Houngbo.

“Forty percent of wheat and corn exports from Ukraine go to the Middle East and Africa, which are already grappling with hunger issues, and where further food shortages or price increases could stoke social unrest.”

6. Corn and Wheat ETFs

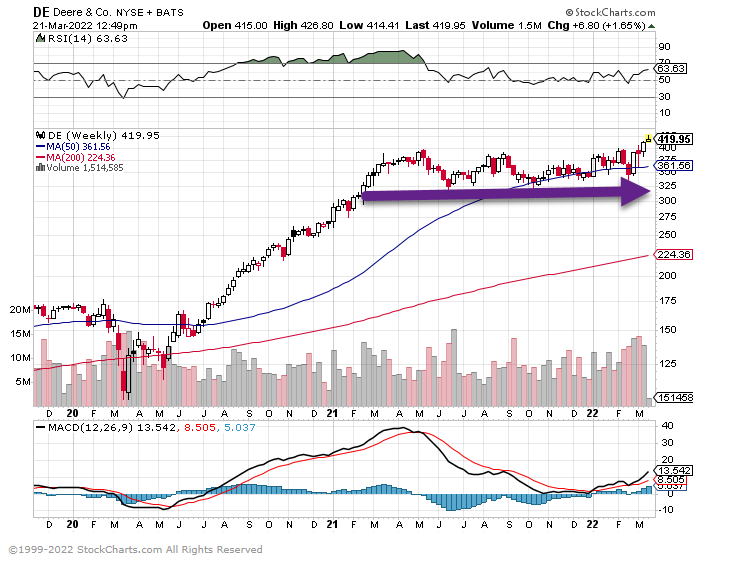

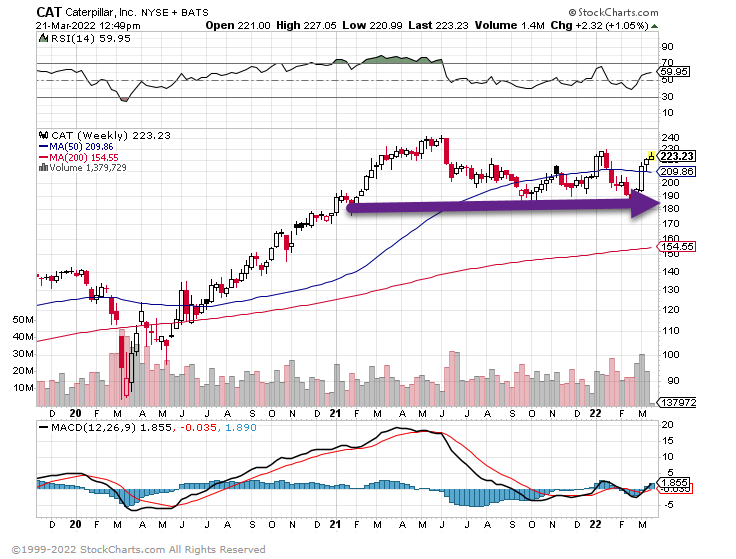

7. Farm Equipment Stocks

Deere New Highs after 1 year sideways

CAT still below May 21 highs

8. Utilities Stocks Break Out to New Highs

This chart shows strength of utilities vs. AGG (bond index)

9. Manhattan’s Third-Largest Hotel To Sell At Staggering Loss

ZEROHEDGE BY TYLER DURDEN By Ciara Long of BisNow.com,

One of the largest hotels in New York City will trade at a massive loss, an ominous sign for the owners of Manhattan’s big hospitality properties.

Sheraton New York Times Square Hotel

Host Hotels & Resorts has agreed to sell its Sheraton New York Times Square hotel for $365M, Real Estate Alert reported, less than half the $738M it paid for the 1,780-room property in 2006.

Host, the largest U.S. hotel real estate investment trust, is under contract to sell the property to MCR Hotels, one of the most active buyers of New York City hotel properties since the onset of the pandemic. The sale is the city’s largest hospitality trade in over two years. The 51-story hotel is New York City’s third-largest by room count.

Host was struggling to sell the property at the price it purchased the hotel for long before the pandemic, asking for $550M in 2018, according to REA. In 2020, Host admitted that the Times Square Sheraton’s value had sunk even lower, to $495M.

The Times Square Sheraton sale adds Host to the list of several NYC hotel owners to sell their properties at a discount. Hotels in the city have yet to return to their pre-coronavirus occupancy rates, and the omicron wave in December and January suppressed tourism’s nascent return to NYC.

The hotel’s new owner, MCR, is the fourth-largest hotel owner-operator in the U.S. and has been making aggressive purchases in major cities over the past year, including Marriott, Hilton

But MCR also made two notable NYC purchases in 2021, The Real Deal reports. It joined with Island Capital and Three Wall Capital to acquire the Lexington Hotel at 511 Lexington Ave. for $185M, and it bought the Royalton Hotel at 60 West 37th St. for $42M. Both sales were below the price paid by previous owners.

MCR is also the owner of the Ink 48 Hotel and the High Line Hotel, which were ranked among NYC’s top 20 hotel choices by Condé Nast Traveler’s Readers Choice Awards last year.

= https://www.zerohedge.com/

10. The 3 Elements of Trust

by Jack Zenger and Joseph Folkman

Summary. As a leader, you want the people in your organization to trust you. And with good reason. In our coaching with leaders, we often see that trust is a leading indicator of whether others evaluate them positively or negatively. But how to create that trust, or perhaps…more

As a leader, you want the people in your organization to trust you. And with good reason. In our coaching with leaders, we often see that trust is a leading indicator of whether others evaluate them positively or negatively. But creating that trust or, perhaps more importantly, reestablishing it when you’ve lost it isn’t always that straightforward.

Fortunately, by looking at data from the 360 assessments of 87,000 leaders, we were able to identify three key clusters of items that are often the foundation for trust. We looked for correlations between the trust rating and all other items in the assessment and after selecting the 15 highest correlations, we performed a factor analysis that revealed these three elements. Further analysis showed that the majority of the variability in trust ratings could be explained by these three elements.

The Three Elements of Trust

By understanding the behaviors that underlie trust, leaders are better able to elevate the level of trust that others feel toward them. Here are the three elements.

Positive Relationships. Trust is in part based on the extent to which a leader is able to create positive relationships with other people and groups. To instill trust a leader must:

- Stay in touch on the issues and concerns of others.

- Balance results with concern for others.

- Generate cooperation between others.

- Resolve conflict with others.

- Give honest feedback in a helpful way.

Good Judgement/Expertise. Another factor in whether people trust a leader is the extent to which a leader is well-informed and knowledgeable. They must understand the technical aspects of the work as well as have a depth of experience. This means:

- They use good judgement when making decisions.

- Others trust their ideas and opinions.

- Others seek after their opinions.

- Their knowledge and expertise make an important contribution to achieving results.

- Can anticipate and respond quickly to problems.

Consistency. The final element of trust is the extent to which leaders walk their talk and do what they say they will do. People rate a leader high in trust if they:

- Are a role model and set a good example.

- Walk the talk.

- Honor commitments and keep promises.

- Follow through on commitments.

- Are willing to go above and beyond what needs to be done.

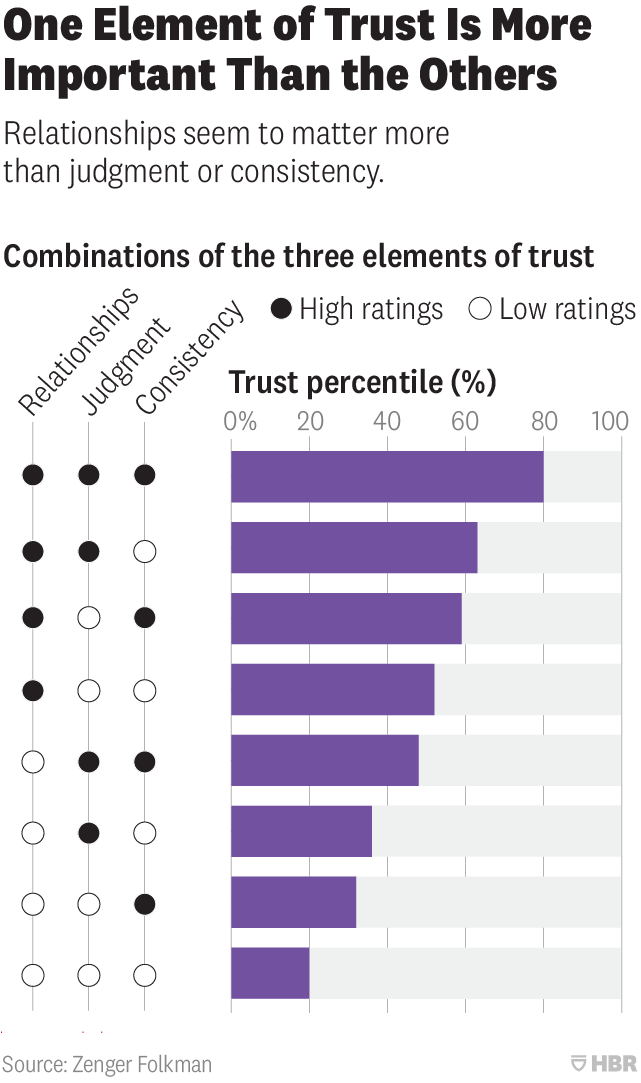

We wanted to understand how these three elements interacted to create the likelihood that people would trust a leader. We created three indices for each element and since we had such a large dataset, we experimented with how performance on each of the dimensions impacted the overall trust score. In our study we found that if a leader scored at or above the 60th percentile on all three factors, their overall trust score was at the 80th percentile.

We compared high scores (above 60th percentile) and low scores (below the 40th percentile) to examine the impact these had on the three elements that enabled trust. Note that these levels are not extremely high or low. Basically, they are 10 percentile points above and below the norm. This is important because it means that being just above average on these skills can have a profound positive effect and, conversely, just being below average can destroy trust.

We also found that level of trust is highly correlated with how people rate a leader’s overall leadership effectiveness. It has the strongest impact on the direct reports’ and peer overall ratings. The manager’s ratings and the engagement ratings were not as highly correlated, but all the differences are statistically significant.

Do You Need All Three Elements of Trust?

We were also curious to know if leaders needed to be skilled in all three elements to generate a high level of trust and whether any one element had the most significant impact on the trust rating. To gauge this, we created an experiment where we separated leaders into high and low levels on each of the three pillars and then measured the level of trust.

Intuitively we thought that consistency would be the most important element. Saying one thing and doing another seems like it would hurt trust the most. While our analysis showed that inconsistency does have a negative impact (trust went down 17 points), it was relationships that had the most substantial impact. When relationships were low and both judgment and consistency were high, trust went down 33 points. This may be because many leaders are seen as occasionally inconsistent. We all intend to do things that don’t get done, but once a relationship is damaged or if it was never formed in the first place, it’s difficult for people to trust.

We often tell people that they don’t need to be perfect to be an excellent leader but when it comes to trust, all three of these elements need to be above average. Remember that, in our analysis, we set the bar fairly low: at the 60th percentile. This is not a brilliant level of performance, barely above average.

We have regularly found in our research that if a leader has a preference for a particular skill, they are more likely to perform better at it. Think about which of these elements of trust you have a stronger preference for – and which you prefer least. Because you need to be above average on each, it is probably worth your time to focus on improving the latter.