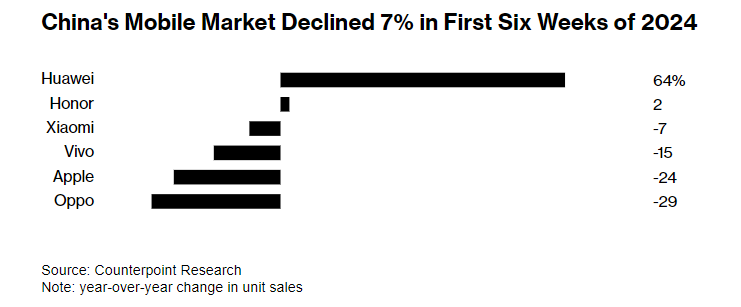

1. EU Apple Fine Followed by China IPhone Sales -24%

Apple’s iPhone Woes in China Deepen With a 24% Sales Plunge-Bloomberg By Vlad Savov

Apple Inc.’s iPhone sales in China fell by a surprising 24% over the first six weeks of this year, according to independent research that may stoke fears about worsening demand for the marquee but aging device.

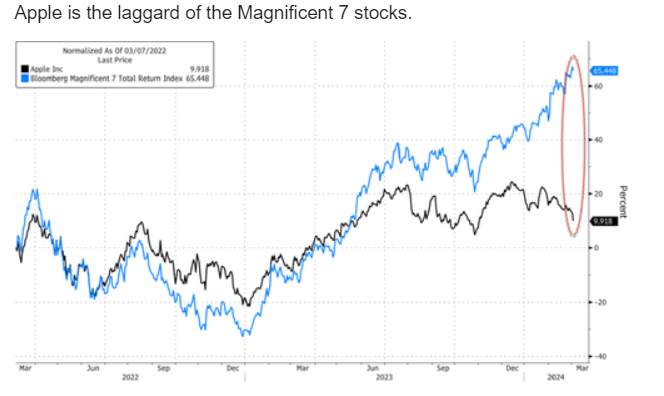

2. AAPL Chart

Watch for 50day to go thru 200day to downside…Approaching November 2023 Lows….RSI 23 short-term oversold.

3. AAPL vs. Mag 7

Zerohedge

https://www.zerohedge.com/markets/gloom-doom-apples-iphone-sales-china-plunge-24

4. Nasdaq has gone more than 300 days without a major pullback

The tech-heavy Nasdaq has gone 303 trading days without a major pullback.

The tech-heavy Nasdaq-100 has gone 303 trading sessions without a pullback of 2.5% or more, the third-longest stretch since 1990, according to Jonathan Krinsky, chief market technician at BTIG.

While this doesn’t necessarily mean the artificial-intelligence-driven boom in U.S. stocks is ripe for a selloff, Krinsky thinks the market is overdue for a bout of volatility.

“Some sort of shakeout is likely coming, in our view,” Krinsky said.

The Invesco QQQ Trust Series ETF QQQ, which tracks the Nasdaq-100 and is one of the most popular U.S.-traded ETFs, has marched to 14 straight record highs in 2024. It’s most recent record arrived on Friday, when the ETF rose 1.5% to finish at $445.61.

According to FactSet data, the most recent pullback of 2.5% or more occurred on Dec. 15, 2022, when QQQ fell 3.4%.

Notably, the Nasdaq-100 has been achieving these records without the help of Apple Inc., AAPL, -2.54% once considered an indispensable constituent of the index. While Apple was down 9.1% so far this year, the Nasdaq-100 was up 8.3%, according to FactSet. Divergence in the performance of a popular group of megacap technology stocks has been growing since the beginning of 2024, while all of the so-called Magnificent Seven tech stocks helped drive gains for the S&P 500 in 2023.

Take Monday’s session for example: Nvidia Corp. NVDA, +3.60% is up 3.6% on Monday, while Tesla Inc. TSLA, -7.16% was down 7.2%. Alphabet Inc. GOOGL, -2.76% was down 2.8%. And Apple AAPL, -2.54% was down 2.5%.

“… [T]he dispersion under the surface shouldn’t be ignored. Yes, it’s encouraging to see some broadening beyond the ‘AI’ trade, but the continued one-way move in many momentum names is ultimately going to have some ramifications, even if only short-term in nature,” Krinsky said.

The weakness in several megacap names weighed on the Nasdaq on Monday.

Both the Nasdaq-100 NDX, which includes the 100 largest nonfinancial stocks trading on the Nasdaq, and the Nasdaq Composite COMP, which includes more than 3,000 stocks listed on the exchange, finished 0.4% lower. The S&P 500 SPX also eked out a loss after briefly turning positive. The Dow Jones Industrial Average DJIA finished lower as well.

5. Sometimes Chart Tells the Entire Story….NYCB -70%

6. KRE-Regional Bank ETF…

Failed twice at 200-day

7. Microstrategy Going Up with Bitcoin…Breaks Above 5-Year Highs

50week thru 200week to the upside on long-term chart

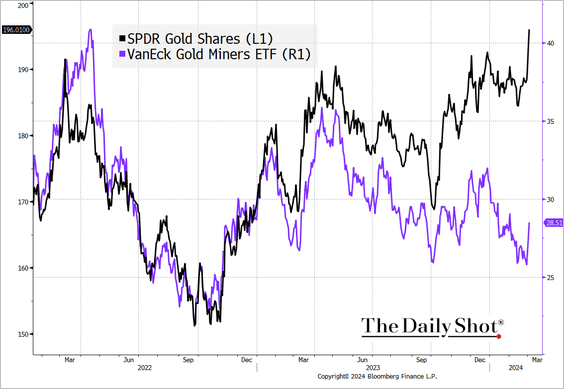

8. Top 10 Showed Gold Breakout Yesterday….Gold Miners Large Lag

The Daily Shot Brief-Commodities: Gold is diverging from gold miners.

Source: @TheTerminal, Bloomberg Finance L.P.

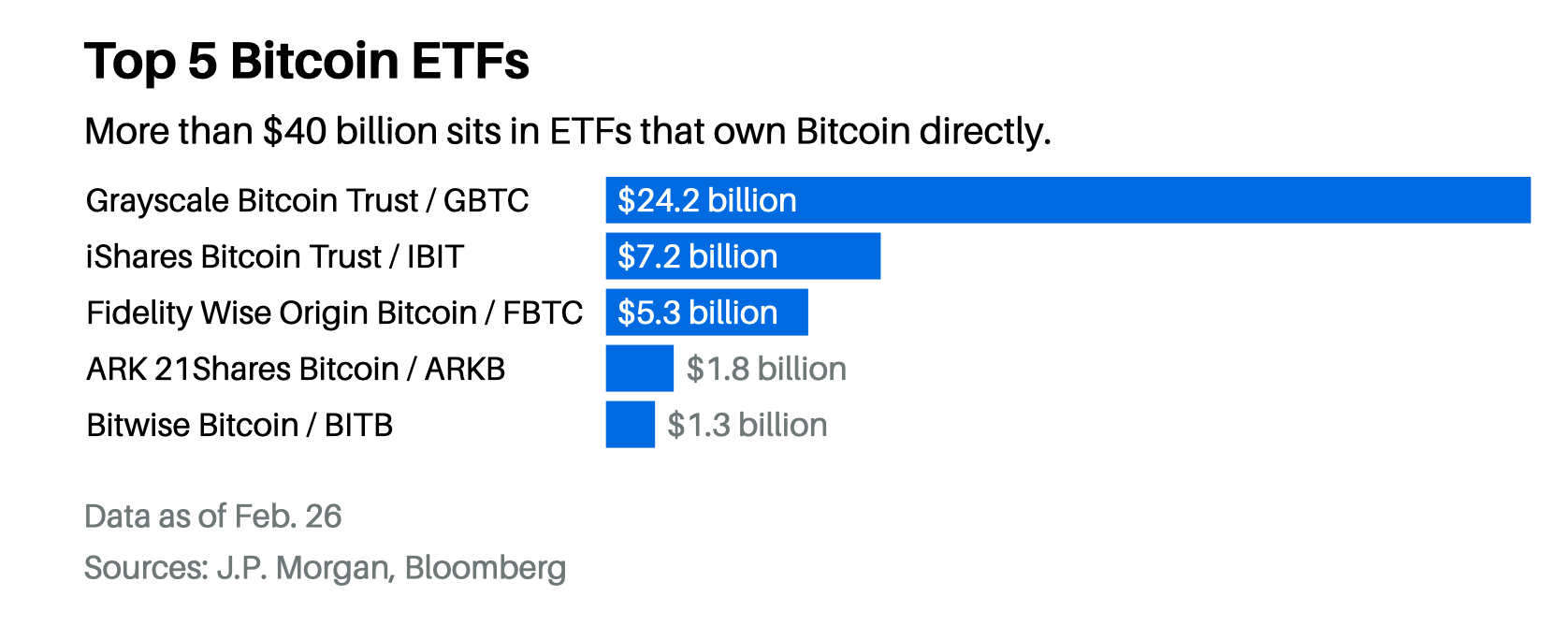

9. Bitcoin ETF AUM Update

10. Why You’re Scared of Investing (and how to overcome it)-

My heart is racing. My hands are so wet from my sweat that I can’t even get a good grip on the computer mouse.

After hearing many stories from people who lost money, I feared investing. But I still to get in on the game. I wanted to get rich badly.

But my stomach felt like it was inside out. I collected all the courage inside me. Then, I finally did it. Boom! I bought my first stocks.

This was in 2007, and I STILL remember how I felt. That’s how scary investing is. Over the years, I started to control my emotions to a degree that I don’t even feel the slightest itch when I invest my money.

That’s because I found ways to overcome my fear of investing.

What follows is a list of 5 common reasons most people fear investing and a practical way of overcoming the fear.

1. Fear of losing money

The fear of losing money is a primal instinct, deeply ingrained in our psyche. It’s tied to our survival instincts. After all, for much of human history, losing resources could mean life or death.

This is reflected in the concept of loss aversion:1 The pain of losing is psychologically twice as powerful as the pleasure of gaining.

This means we’re more likely to avoid investing because we fear the potential losses more than we value the potential gains.

Overcoming it: The founder of modern-day investing, Benjamin Graham, famously said:

”The investor’s chief problem—and his worst enemy—is likely to be himself.”

To overcome this fear, we need to change our mindset. First, understand that investing isn’t gambling.

It’s about making calculated decisions based on research and analysis. Second, diversify your portfolio.

As the saying goes, don’t put all your eggs in one basket when you start. While many successful investors got rich by concentrating on their portfolios, I don’t think it’s wise to start picking individual stocks. This is also why many people get scared of investing.

You’re much better off buying a broad index like the S&P 500 when you start. You can concentrate on your individual investments later.

2. Lack of knowledge

Investing can seem intimidating if you don’t understand how it works. This fear stems from the Dunning-Kruger effect, a cognitive bias where people with low ability at a task overestimate their ability.

This leads to a paradox: the less you know about investing, the more confident you might feel, leading to risky decisions.

But as you learn more, you realize how much you don’t know, which can lead to fear and hesitation.

Overcoming it: Knowledge is power. Start by educating yourself about the basics of investing.

Read books, listen to podcasts, take online courses. As legendary investor Warren Buffett said:

”Risk comes from not knowing what you’re doing.”

The more you understand investing, the more confident you’ll become. Just remember you also don’t need to have a PhD in Finance to be a good investor. Basic knowledge is enough.

3. Fear of falling behind

The fear of falling behind, also known as FOMO (fear of missing out), often prevents people from building wealth in the stock market.

Humans seem to be naturally competitive. Social media makes this even more visible, as people feel unsatisfied when they watch other folks live a “better” life. We tend to define our worth based on how we stack up against others.

This behavior sometimes translates to our investing strategy. Which leads to risky behavior, such as jumping on an investment bandwagon without doing your research.

Overcoming it: Remember that investing is a long-term game, not a get-rich-quick scheme.

As Peter Lynch, one of the most successful investors of all time, said:

”The real key to making money in stocks is not to get scared out of them.”

Focus on your financial goals and stick to your investment plan, regardless of what others are doing.

4. Reacting to market volatility

Market volatility can be scary. When the market takes a downturn, our natural instinct is to panic and sell.

This reaction is linked to the fight-or-flight response. I experienced that feeling when I lost around 60% of the money I first invested in the stock market.

Overcoming it: It’s crucial to stay calm and stick to your long-term investment plan during market volatility.

The economist Paul Samuelson said it well:

”Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

What do you do when you paint your walls? You leave it alone and simply get on with your life. Do the same with your investments.

5. Fear of commitment

Investing often means locking away your money for a significant period, which can feel daunting.

There is always the fear of uncertainty. What if the market suddenly crashes and you need to use that money after all? What if you suddenly need to take a one-month vacation, but don’t have the money for it? These fears keep many people scared of investing.

When you get down to it, there are two main goals that every investor aims for: Liquidity and growth. Liquidity is about how easily you can turn an investment into cash without losing its value.

It’s important because having liquid assets means you can quickly access funds for emergencies or unexpected expenses. On the flip side, growth is all about increasing value over time. This is crucial for building wealth and reaching financial goals like retirement or buying a house.

But when it comes to investing, you can’t have total liquidity and maximum growth simultaneously; there’s always a trade-off. The key is finding the right balance between the two.

Overcoming it: Maintain an emergency fund that covers 3-6 months of living expenses.

This will give you the peace of mind to invest your other funds without worrying about accessing them in an emergency.

Embrace the future: Conquer your fears today

Always remember this as you’re investing: The regret of not taking action today could be far greater than any fear you’re experiencing now. Think about that whenever you find yourself scared of investing.

Imagine yourself 10, 20, or even 30 years from now. You look back on your life and realize you let fear dictate your financial decisions.

You missed out on opportunities to grow your wealth, to secure your future, to provide for your loved ones. That regret can be a heavy burden to bear.

We’re more likely to regret the things we didn’t do than the things we did. And when it comes to investing, the cost of inaction can be high.

Yes, there will be risks. There is always risk in every part of life. But as long as you invest sustainably and consistently, you will grow your wealth in the long term.

As American entrepreneur and motivational speaker, Jim Rohn, said:

“We must all suffer one of two things: the pain of discipline or the pain of regret.”

Choose wisely.