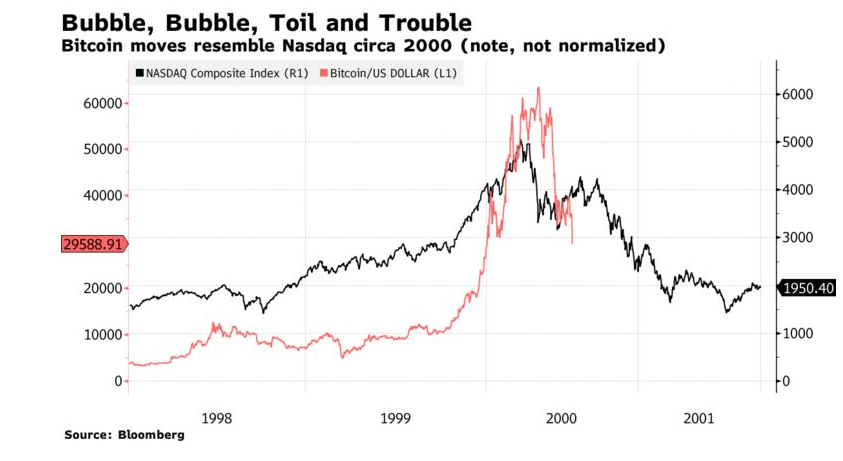

1. Bitcoin vs. Nasdaq 2000 Bubble

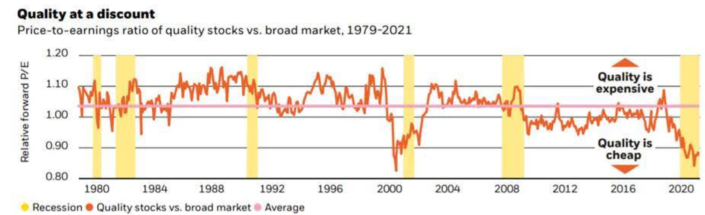

2. Quality Stocks P/E Cheapest vs. Broad Market Since 2000

Interestingly, despite the impressive fundamental features of high quality companies the stocks themselves have sucked wind going on nine months.

Quality stocks look to be on sale, BlackRock contends.

DeSpirito’s research shows that quality stocks have underperformed since COVID-19 vaccine announcements came to fore back in November 2020, sending their valuations lower. Instead of paying up to own quality companies amidst a global economic recovery (ones that could lift their dividends and share repurchase plans because of the macro rebound), investors have largely avoided or sold these stocks in favor of riskier bets that produced strong gains early in the recovery.

Quality stocks haven’t been this cheap in more than 20 years-Brian Sozzi https://finance.yahoo.com/news/quality-stocks-havent-been-this-cheap-in-more-than-20-years-184255120.html

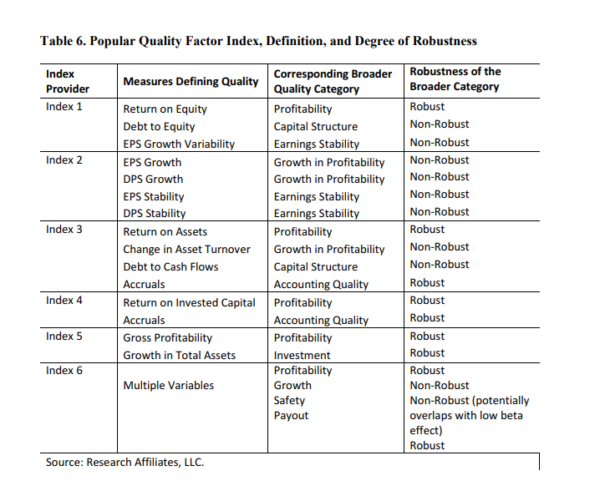

Alpha Architects Discuss Quality Factor https://alphaarchitect.com/2019/10/22/the-quality-factor-what-exactly-is-it/

3. That Did Not Take Long…..Delta Hiring 1000 Pilots.

Delta looks to hire more than 1,000 pilots by next summer: reportsBy Mike Murphy

Delta Air Lines Inc. plans to hire more than 1,000 pilots by next summer, according to multiple reports Monday. Citing an internal memo, Reuters and Bloomberg News separately reported Delta DAL, -0.69% is looking to increase its number of pilots by about 8%, anticipating a recovery in air travel over the next year as international travel restrictions ease.

The Atlanta-based airline has said it expects domestic leisure travel to return to pre-pandemic levels this month, and that it expects a pre-tax profit for the second half of the year as the industry recovers.

Airlines are still figuring out how to adjust to travel as the pandemic eases, at least in the U.S. On Sunday, the Wall Street Journal reported American Airlines AAL, -1.51% is cutting about 950 flights over the next month in order to avoid straining its operations.

Delta shares are up about 14% year to date and up 56% over the past year, compared to the S&P 500’s SPX, 0.59% 12% gain this year and 36% gain over the past 12 months.

JETS Airline ETF sideways on 200day moving average for 4 months

4. Short U.S. Treasury ETF Rolls Back Over.

5. Platinum -23% Correction from 2021 Highs.

One of traders favorite commodity plays closes below 200day moving average.

6. MSTR-Hit a High of $1300 Off Bitcoin Bet…..$553 Last.

MSTR owns $3B in Bitcoin

7. Existing Home Sales Decline for 4th Month in a Row

High Prices and Low Inventory Slow Sales

D-Line Minutes Twitter

https://twitter.com/DLineMinutes

8. One Restaurant Group that Dramatically Increased Traffic 2021

Valuewalk Blog –Pizza restaurants have seen an increase in foot traffic of 49% nationwide since the beginning of 2021 according to the data scientists at brick-and-mortar marketing expert Zenreach.

https://www.valuewalk.com/pizza-restaurants-visit-up-49-since-january-nationwide/

9. Birth Rate in U.S. Lowest Since 1979

The number of babies born in America last year was the lowest in more than four decades, according to federal figures released Wednesday that show a continuing U.S. fertility slump.

WSJ By Janet Adamy https://www.wsj.com/articles/births-in-u-s-drop-to-levels-not-seen-since-1979-11620187260?mod=hp_lead_pos11

10. A Better Way to Prepare for Meetings

ByDan SolinApril 27, 2021

When I start a new relationship with a coaching client, I engage in my own form of “discovery.” It’s important for me to understand how you currently approach the process of trying to convert a prospect into a client.

One of the questions I always ask is, How do you prepare for a meeting with a prospect? The same principles discussed below would apply to a meeting with anyone in any setting, including presentations to groups or committees and even to conversations you have with yourself!

What’s typical

The details vary, but there’s one fact that’s immutable. The focus of your preparation is on you: what you say, how you say it, your process, what you are trying to achieve in the meeting…and the list goes on.

Recently, an initial coaching session coincided with an upcoming meeting my client was going to have with a large prospect. The advisor explained the “six step process” he discusses at these meetings, which he illustrates with nicely designed PowerPoint slides. He told me how he “led” the prospect through his process, which took “about an hour.”

A better way

Instead of following his process, I told him to prepare a list of ten questions he would ask the prospect, with the goal of trying to get to know him as a person – not as a source of AUM. If he didn’t have enough information about the prospect, I suggested he check social media to see what he could find out.

I advised him to listen carefully to the answers to his questions, and to ask suitable, open-ended follow up questions.

That’s it. No agenda. No notes. No PowerPoint. No discussion of process.

He was skeptical, but agreed to try.

A good outcome

After the meeting, he wrote me this note: I asked a lot of questions. We never discussed my background or anything about how I would invest his money. Two days after the meeting, he called and hired me. He told me there was a huge difference in the meeting he had with me and those with the other firms he interviewed.

An effective strategy

Asking the right questions is so powerful, it’s even recommended for dealing with the constant stream of self-talk we experience throughout our day. According to writer Spencer Sekulin, the key to changing the impact of your self-talk from negative to positive is whether it’s phased as a statement or a question.

Questions permit you to thrive. Statements often result in stagnation – or worse. Instead of self-talk that states: I don’t have enough time, make it a question, like How can I make the time for this?

Sekulin believes you can improve your relationship with yourself by asking better questions. Doing so will [I]nspire your subconscious mind to action.

Asking questions, showing a sincere interest in others, and shifting the focus from conveying information to eliciting it, is critical to establishing more meaningful relationships.

Start by changing the way you prepare for meetings.

Formulate the questions you want to ask. Don’t focus on the information you wish to impart.

https://danielsolin.com/a-better-way-to-prepare-for-meetings/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.