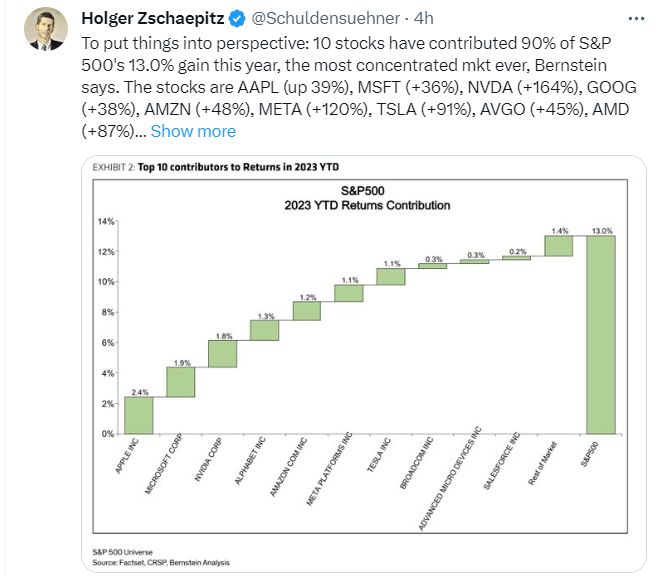

1. 10 Stocks 90% of S&P Returns

2. Nasdaq Up 7 Weeks in a Row

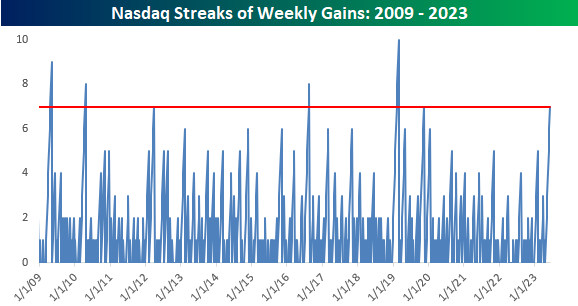

Lucky Seven for the Nasdaq-It wasn’t by much, but the Nasdaq rallied 0.14% last week and extended its streak of weekly gains to seven. That’s the longest streak of weekly gains for the index since November 2019. To find a longer streak, you have to go back to February 2018 when the Nasdaq had ten straight weeks of gains. As shown in the chart below, since the Financial Crisis lows in May 2019, there have now been seven different periods where the Nasdaq rallied for at least seven weeks in the row.

Looking at forward performance after a seven-week winning streak in more detail, the chart below shows the maximum drawdown for the S&P 500 in the three months after seven straight weeks of gains in the Nasdaq. Here again, it’s easy to see the large declines that followed the 2010 and 2012 streaks, but in the four other streaks, the S&P 500 never even pulled back 4%. In two of those periods, the maximum decline never exceeded 0.41%. For reference, the average ‘max drawdown’ over any three-month period for the Nasdaq since the start of 2009 has been 5.33%

https://www.bespokepremium.com/interactive/posts/think-big-blog/lucky-seven-for-the-nasdaq

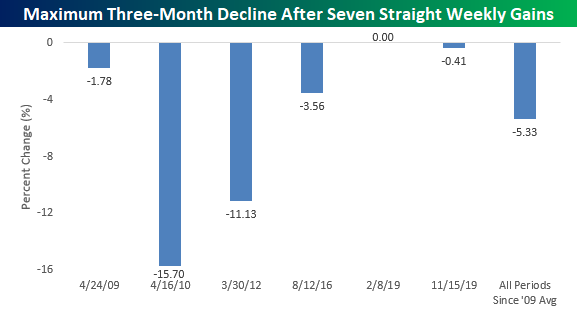

3. Average Stock Dispersion Significant Jump 2020-2023-Blackrock

Source: BlackRock Investment Institute, with data from Refinitiv, June 2023. Notes: The chart shows the dispersion in Russell 1000 stock returns based on a 21-day moving average (dark orange line), average dispersion from July 2009 after the global financial crisis through 2019 (yellow line), and average dispersion from 2020 through June 8, 2023 (green line).

The average range of individual stock returns versus broad index returns, or dispersion, since 2020 (green line in chart) has jumped about 10 percentage points above the average from 2009 to 2019 (yellow line). We think that reflects the new macro regime and structural changes shaping returns. Forum attendees agreed the new regime of heightened volatility is playing out. We see supply constraints driving higher inflation in the new regime. Persistent inflation makes it unlikely developed market (DM) central banks will cut interest rates this year. The new regime presents central banks with a sharp trade-off between living with some inflation and crushing activity, as we’ve argued. That shift is in sharp contrast with the four-decade period of steady activity before 2020 known as the Great Moderation. Today’s environment offers new opportunities, in our view, thanks to market divergences and structural changes playing a bigger role.

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary

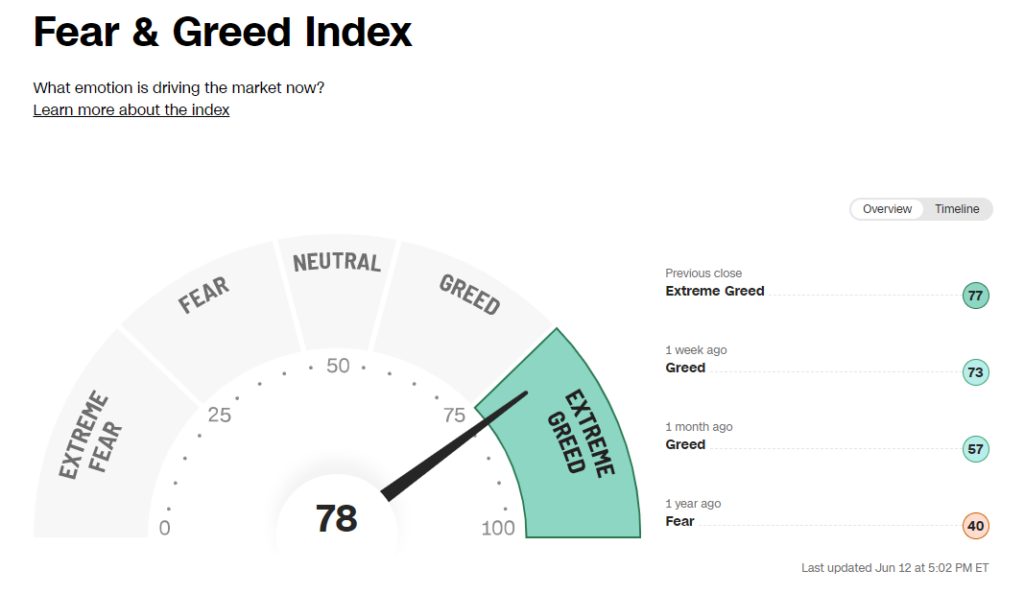

4. Fear and Greed Index

https://www.cnn.com/markets/fear-and-greed

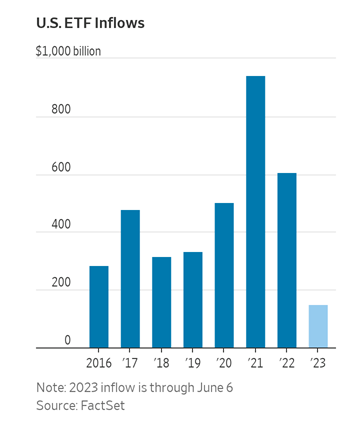

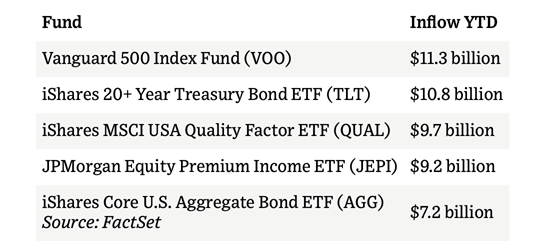

5. ETF Flows Not Greedy

WSJ By Jack Pitcher ETF Flows Weak and Going to Defensive Names.

ETF Flows Lean Defensive After S&P 500

6. WisdomTree Jeremy Siegel Comments

Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania.

While last week was quiet for economic data releases, the S&P 500 entered into a bull market phase on Thursday, defined as 20% move from its low. Saying we are in a bull market makes it seem like the markets are going up. And indeed, once you experience a 20% move, the following year has been above average. But it is also very important to remember in two of the last three bear markets, we had 20% bounces similar to the one we just had, but then hit new lows.

During the great financial crisis in 2008-2009, the market rallied 20% off the low in November 2008 and then plunged to new lows in March of 2009. Similarly, after the dot-com bust in 2000, we rallied about 25% off the lows and then went to a new low right after that. This recent bull market move is no guarantee we are out of the woods from the downturn.

With that caveat, my feeling is that the October low will hold, but I remain cautious and do not think we have the start of a major up move here.

This week we have the important inflation data and the Fed decision. For someone who focuses a lot on the Fed, you’d think the combination of inflation, the Fed decision, and the Fed dot plot would be my prime focus this week. Rather, much more interestingly I will be watching Thursday’s initial jobless claims. Last week we had a considerable move higher in jobless claims—and it does not look like it was caused by similarly fraudulent claims from Massachusetts as the last spike was a few weeks back. Jobless claims are a notoriously volatile indicator. And seasonal adjustments could be responsible for some of the increase this week. It is critical to see how serious of a move we have in this series and if this turns into the downturn everyone has been waiting for.

I believe CPI will come in relatively tame, within +\- one tenth of a percentage point of expectations. We have had a drop in oil prices so headline inflation will look better than core inflation.

I expect the Fed to pause or skip hikes at this week’s meeting, but the headlines are likely to read that there was a hawkish dot plot. During the press conference, Chair Powell will make every effort to say the skip in hikes at this meeting does not mean the Fed is claiming mission accomplished. Hawkish narratives at the conference and dot plot should appease the hawks on his committee who would prefer continued hikes.

Despite Fed funds futures now pricing in near certainty of a hike in July–and no matter what the dot plot reads out or Powell insinuates, I would bet against any future hikes. We’re entering political season and there is already a ton of pressure not to create a deep recession. I expect a shallow recession that the market has arguably already positioned for. The NASDAQ is now selling for 30-times earnings, and the S&P 500 is selling for 20-times earnings. We have small and mid-cap equities selling for 14- and 15-times earnings, with value stocks at heavy discounts, pricing in and largely anticipating a mild recession.

We might not see much of a decline in the stock market even as the labor market deteriorates. The labor market weakening has political implications and would put a lot of pressure on the Fed, which does have a dual mandate to consider employment as well as inflation. That is why I am so focused on jobless claims this week. Is forcing 2 to 3 million workers out of a job worth an additional tick down in inflation? The Federal Reserve will have to keep re-evaluating this tradeoff.

After inflation normalizes, I expect the Fed to consider an increase its inflation target from 2% to 3%. During the heat of the inflation battle itself, it would be politically impossible to give up on its 2% target right now. But there is good theoretical motivation to move the target up from 2 to 3%. A decade ago, the normal and neutral Fed Funds Rate was over 4%, with 2% real economic growth and 2% inflation. A 4% neutral rate gave the Fed ample room to stimulate the economy into a downturn by cutting rates. But with demographic and productivity trends leading to slower growth, a lower neutral rate is warranted, and I think the neutral rate is heading to 2-2.5% or close to zero real. A 3% inflation target gives the Fed more room to cut rates when they need to stimulate the economy.

https://resources.wisdomtree.com/weekly-siegel-commentary/

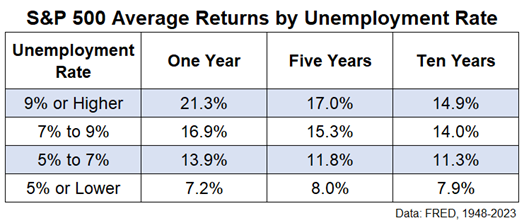

7. History of Unemployment Rate and Bull Markets Starting

Could be turned on its head due to Covid and shortage of labor??

Ben Carlson Blog Many historical market relationships have been turned on their head since the pandemic but there has been a clear correlation between stock market returns and the unemployment rate over the past 75 years or so.

These are the ensuing 1, 5 and 10 year average returns from starting unemployment rates since 1948:

https://awealthofcommonsense.com/2023/06/can-we-have-a-new-bull-market-with-3-unemployment/

8. Global X Robotics $450m Inflows 2023

BOTZ still well off highs

9. As American Rallies…China Small Cap Making Run at New Lows

©1999-2023 StockCharts.com All Rights Reserved

10. How Great Coaches Ask, Listen, and Empathize

by Ed Batista Historically, leaders achieved their position by virtue of experience on the job and in-depth knowledge. They were expected to have answers and to readily provide them when employees were unsure about what to do or how to do it. The leader was the person who knew the most, and that was the basis of their authority.

Leaders today still have to understand their business thoroughly, but it’s unrealistic and ill-advised to expect them to have all the answers. Organizations are simply too complex for leaders to govern on that basis. One way for leaders to adjust to this shift is to adopt a new role: that of coach. By using coaching methods and techniques in the right situations, leaders can still be effective without knowing all the answers and without telling employees what to do.

Coaching is about connecting with people, inspiring them to do their best, and helping them to grow. It’s also about challenging people to come up with the answers they require on their own. Coaching is far from an exact science, and all leaders have to develop their own style, but we can break down the process into practices that any manager will need to explore and understand. Here are the three most important:

Ask

Coaching begins by creating space to be filled by the employee, and typically you start this process by asking an open-ended question. After some initial small talk with my clients and students, I usually signal the beginning of our coaching conversation by asking, “So, where would you like to start?” The key is to establish receptivity to whatever the other person needs to discuss, and to avoid presumptions that unnecessarily limit the conversation. As a manager you may well want to set some limits to the conversation (“I’m not prepared to talk about the budget today.”) or at least ensure that the agenda reflects your needs (“I’d like to discuss last week’s meeting, in addition to what’s on your list.”), but it’s important to do only as much of this as necessary and to leave room for your employee to raise concerns and issues that are important to them. It’s all too easy for leaders to inadvertantly send signals that prevent employees from raising issues, so make it clear that their agenda matters.

In his book Helping, former MIT professor Edgar Schein identifies different modes of inquiry that we employ when we’re offering help, and they map particularly well to coaching conversations. The initial process of information gathering I described above is what Schein calls “pure inquiry.” The next step is “diagnostic inquiry,” which consists of focusing the other person’s attention on specific aspects of their story, such as feelings and reactions, underlying causes or motives, or actions taken or contemplated. (“You seem frustrated with Chris. How’s that relationship going?” or “It sounds like there’s been some tension on your team. What do you think is happening?” or “That’s an ambitious goal for that project. How are you planning to get there?”)

The next step in the process is what Schein somewhat confusingly calls “confrontational inquiry”. He doesn’t mean that we literally confront the person, but, rather, that we challenge aspects of their story by introducing new ideas and hypotheses, substituting our understanding of the situation for the other person’s. (“You’ve been talking about Chris’s shortcomings. How might you be contributing to the problem?” or “I understand that your team’s been under a lot of stress. How has turnover affected their ability to collaborate?” or “That’s an exciting plan, but it has a lot of moving parts. What happens if you’re behind schedule?”)

In coaching conversations it’s crucial to spend as much time as needed in the initial stages and resist the urge to jump ahead, where the process shifts from asking open-ended questions to using your authority as a leader to spotlight certain issues. The more time you can spend in pure inquiry, the more likely the conversation will challenge your employee to come up with their own creative solutions, surfacing the unique knowledge that they’ve gained from their proximity to the problem.

Listen

It’s important to understand the difference between hearing and listening. Hearing is a cognitive process that happens internally — we absorb sound, interpret it, and understand it. But listening is a whole-body process that happens between two people that makes the other person truly feel heard.

Listening in a coaching context requires significant eye contact, not to the point of awkwardness, but more than you typically devote in a casual conversation. This ensures that you capture as much data about the other person as possible — facial expressions, gestures, tics — and conveys a strong sense of interest and engagement.

Effective listening also requires our focused attention. Coaching is fundamentally incompatible with multitasking, because while you may be able to hear what another person is saying while working on something else, it’s impossible to listen in a way that makes the other person feel heard. It’s critical to eliminate distractions. Turn off your phone, close your laptop, and find a dedicated space where you won’t be interrupted.

Coaching conversations can take place over the phone, of course, and in that medium it’s even more important to refrain from multitasking so that in the absence of visual data, you can pick up on subtle cues in someone’s speech.

In my experience taking brief, sporadic notes in a coaching conversation helps me to stay focused and lessens the burden of maintaining information in my working memory (which holds just five to seven items for most people.) But note-taking itself can become a distraction, causing you to worry more about accurately capturing the other person’s comments than about truly listening. Coaching conversations aren’t depositions, so don’t play stenographer. If you feel the need to take notes, try writing one word or phrase at a time, just enough to jog your memory later.

Empathize

Empathy is the ability not only to comprehend another person’s point of view, but also to vicariously experience their emotions. Without empathy other people remain alien and opaque to us. When present it establishes the interpersonal connection that makes coaching possible.

A key to the importance of empathy can be found in the work of Brené Brown, a research professor at the University of Houston whose work focuses on the topics of vulnerability, courage, worthiness and shame. Brown defines shame as “the intensely painful feeling or experience of believing that we are flawed and therefore unworthy of love and belonging.” Empathy, Brown notes, is “the antidote to shame.” When employees need your help they are likely experiencing some form of shame, even if it’s just mild embarrassment — and the more serious the problem, the deeper the shame. Feeling and expressing empathy is critical to helping the other person defuse their embarrassment and begin thinking creatively about solutions.

But note that our habitual expressions of empathy can sometimes be counterproductive. Michael Sahota, a coach in Toronto who works with groups of software developers and product managers, explains some of the traps we fall into when trying to express empathy: We compare our issues to theirs (“My problem’s bigger.”), try to be overly positive (“Look on the bright side.”), or leap to problem-solving while ignoring what they’re feeling in the moment.

Finally, be aware that expressing empathy need not prevent you from holding people to high standards. You may fear that empathizing is equivalent to excusing poor performance but this is a false dichotomy. Empathizing with the difficulties your employees face is an important step in the process of helping them build resilience and learn from setbacks. After you’ve acknowledged an employee’s struggles and feelings, they’re more likely to respond to your efforts to motivate improved performance.

When you coach as a leader you don’t need to be the expert. You don’t need to be the smartest or most experienced person in the room. And you don’t need to have all the solutions. But you do need to be able to connect with people, to inspire them to do their best, and to help them search inside and discover their own answers.