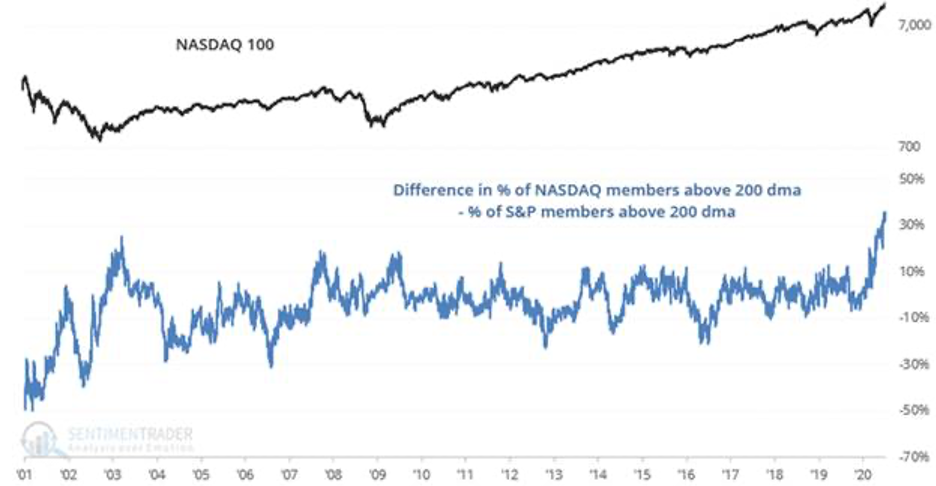

1. The Difference in Tech Companies Over 200 Day Moving Average and S&P Companies Over 200 Day Moving Average at All-Time Highs

SentimenTrader notes This rally is ALL tech. While 76% of NASDAQ 100 members are above their 200 dma, less than 40% of S&P members are above their 200 dma. Tech is trying to lift up the index, other stocks aren’t participating. This has pushed the gap in breadth to an all-time high

Dave Lutz at Jones Trading.

2. We Don’t Have 1999 Zero Revenue IPOs Yet But Tech Outperformance is About to Hit Internet Bubble Levels

3.But….IPO ETF +30% Over Previous Highs

MorningBrew

Tech IPOs Emerge From Quarantine

Francis Scialabba

COVID-19 threw markets a curveball, but 2020 may yet meet some big IPO expectations.

1. Alibaba’s fintech arm Ant Group is planning a Hong Kong IPO this year that could value it at $200+ billion, Reuters reports. As the world’s most valuable tech unicorn, it’ll be one of 2020’s biggest debuts.

2. In the U.S., crypto exchange Coinbase is looking to go public in a direct listing, again per Reuters. With more than 35 million users and a 2018 valuation of $8 billion, Coinbase is the U.S.’ biggest exchange…but still needs SEC blessing before putting an opening bell ring on it.

- Coinbase has recently wriggled into mainstream finance: In February, Visa made Coinbase its first pure-play crypto principal member. And in May, JPMorgan took it on as a client.

3. Palantir Technologies said on Monday it confidentially filed paperwork to go public, which is the only way we’d expect Peter Thiel’s secretive big data company to do so. It boasts an estimated $26 billion valuation, but its data-mining practices and government contracts (particularly with immigration authorities) have elicited controversy in recent years.

4. And There is a Record Amount of Cash Still Waiting to be Deployed

Blackrock-Record Amount in Money Market Funds

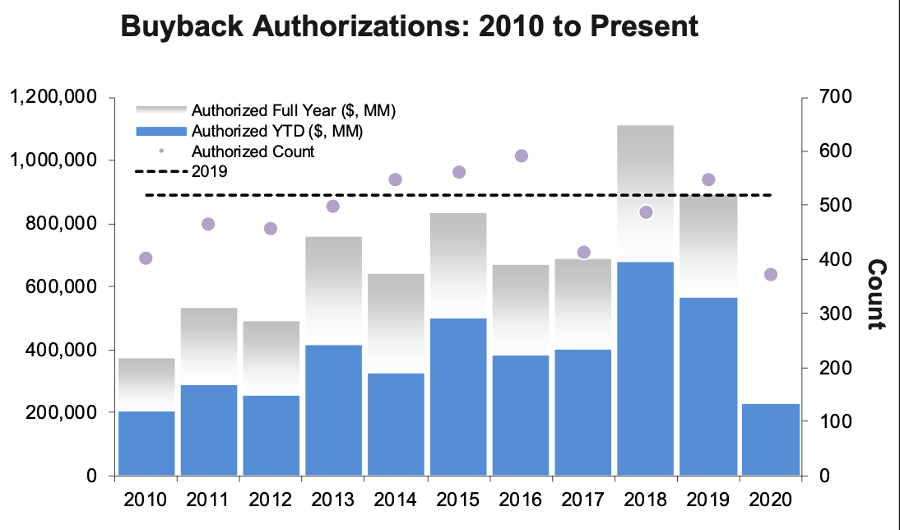

5. And Stock Buybacks Could Bounce Back as we Normalize…

June 2020 Stock Buybacks Down 98%

July 8, 2020 12:00pm by Barry Ritholtz

Source: Birinyi Associates

I really enjoy the regular updates the crew at Birinyi do on stock buybacks. In the most recent note, Chris Costelloe observes that “There were 25 new authorizations announced during June for a total of $2.51 billion, 98% lower than June 2019 and the lowest total value of authorizations since May 2009.”

That is quite a huge drop! Buybacks are way down this year; it makes one wonder how accurate the claims have been that share buybacks are what have been driving stocks higher.

6. YTD Results by Company Size—Bigger Dominates 2020

YCHARTS

https://ycharts.com/

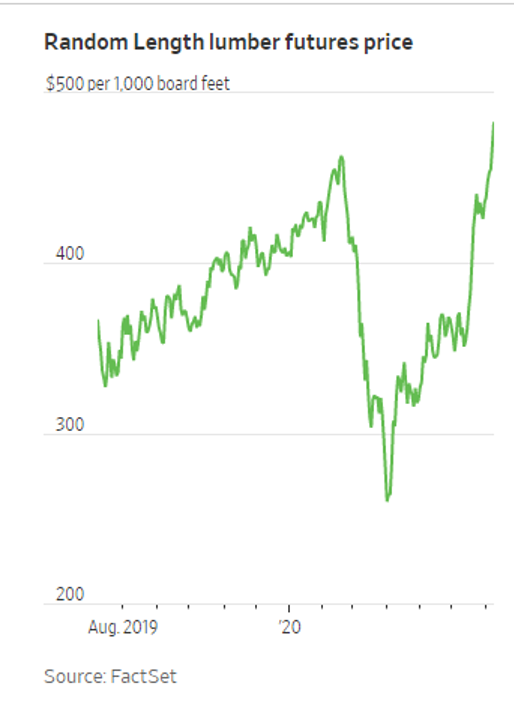

7. Lumber Futures +85% Since April……Lumber ETFs Still -35-40% From Highs?

WSJ-By Ryan Dezember—Prices for forest products like lumber and plywood have soared because of booming demand from home builders making up for lost time, a DIY explosion sparked by stay-at-home orders and a race among restaurants and bars to install outdoor seating areas.Lumber futures are up more than 85% since April 1. Lumber for July delivery settled Thursday at $499 per thousand board feet while the more heavily traded September futures ended at $481.90. Both are above the pre-pandemic high of $463.00, set during the hottest home-building market since 2006. Lumber futures seldom trade above $4

America Is on a Lumber Binge–Lumber futures are up more than 85% since April 1

https://www.wsj.com/articles/america-is-on-a-lumber-binge-11594305886?mod=itp_wsj&ru=yahoo

WOOD-Lumber ETF Well 2018 Highs

www.stockcharts.com

8. China Stock Market Bubble Talk…But Market Still Below Highs and Remain in 5 Year Plus Trading Band

FXI-China Large Cap—Below Highs

ECNS-China Small Cap Below Highs

www.stockcharts.com

9. This former Knicks center ditched the NBA to lead an Army infantry platoon

BY STEFAN BONDY, NEW YORK DAILY NEWS , JUN 27, 2020 9:52 AM EDT

Lt. Marshall Plumlee graduated from the Army Ranger School on August 30, 2019.

(Screenshot via Army video)

NEW YORK — Marshall Plumlee had been training his platoon for a week through combat scenarios with live ammunition, stumbling and learning until they completed the mission by blowing up a mine-wire obstacle with C-4 explosives.

Plumlee, the former Knicks center, suddenly was hit with the same adrenaline rush he remembered at Duke, or the G League, or the NBA.

“When I was able to help my squad leaders blow up that obstacle, in that moment, it was like the same as dunking on somebody in a basketball game,” Plumlee tells the Daily News. “It was a pretty surreal experience.”

Lt. Plumlee is still only 27, the youngest of three brothers who all played (or still play) in the NBA. But he ditched his basketball career almost two years ago for the U.S. Army, and is already the leader of a roughly 40-person rifle platoon stationed at Fort Lewis in Washington.

It was an opportunity Plumlee knew was coming, having declared his intentions to join the U.S. Military before the NBA draft. He then juggled his duties with the New York National Guard while playing with the Knicks, driving up to its facility in Troy, N.Y., for drills whenever the schedule allowed. Carmelo Anthony called him “Captain America.”

Related: 10 Years After His Death, Here’s What Pat Tillman Means To Me

Although Plumlee might’ve never elevated to anything more than a fringe NBA player, he still had opportunities to continue his pro career. Back in October of 2018, he was traded to the Nets’ G-League affiliate in Long Island. But Plumlee never played for the Nets, and doesn’t plan to ever play professional basketball again.

“I enjoyed basketball, I loved playing it at the highest level,” Plumlee says. “But there was still an itch I wanted to scratch on the army side of things. I wanted to do it on a larger capacity. I feel like I learned all these great lessons in teamwork and leadership from some of the teams I’ve been a part of in the NBA, and I felt obligated to share that with the army team. The basketball is going to stop bouncing at some point. And for me, I figured I’d get a jump on it. I know I have something outside of basketball that I’m passionate about, something I love, let’s give this a real shot here and see how far I can go.”

Plumlee, who is from Indiana, is physically unique to the army at 7-feet tall. It has its pluses and minuses. As Plumlee noted, he is easily spotted by his soldiers (although that could also work against him if it’s the enemy who is searching).

“Even in the middle of the night under night vision goggles, my soldiers can always find me,” he says. “They can see which one of the dark blurs is Lt. Plumlee because I’m about twice as big as the other guys.”

But getting inside vehicles or jumping out of planes can be challenging.

“Each jump has been an adventure,” Plumlee says. “To put it mildly.”

Three years ago, Plumlee had just finished up his rookie season with the Knicks. Now he’s on a different team.

“It was a really tough decision to leave basketball and I’ll say people often ask me if I miss it on the army side of things, but I tell them what I loved about basketball was the locker room environment,” Plumlee says. “I loved being part of a team, being part of something bigger than yourself. And in that sense, I haven’t left anything.

“If anything, I’m getting to do that on an even bigger level where the stakes are higher.”

©2020 New York Daily News – Distributed by Tribune Content Agency, LLC.https://www.nydailynews.com/sports/basketball/knicks/ny-marshall-plumlee-20200626-ax6b4soqvze6xbvvs2ivlqd7qu-story.html

10. Lots of Things Happening at Once

Morgan Housel

“Steve [Jobs] and I will always get more credit than we deserve, because otherwise the story gets too complicated,” Bill Gates once said.

It’s a simple sentence, but there’s a lot of important stuff packed in there:

- Stories are more powerful than statistics because they’re memorable and easy to contextualize.

- Good stories usually have just one hero or one villain because if there are more the plot is hard to follow.

But think of how complex the world is. Then think about how strong our desire is to explain how the world works with simple, single-cause stories.

It’s a problem.

“This happened because of that.”

“This causes that.”

“To get more of this, we need more of that.”

It’s not that these things are always wrong. It’s that, when used to describe something as complex as a business or an economy, they’re usually like the Bill Gates and Steve Jobs explanations: true but incomplete, yet persuasive because they make a good story. And something that’s true but incomplete might be more dangerous than something that’s wrong, because a little truth is fuel for a lot of overconfidence.

In his documentary on American history, Oliver Stone says, “Real history is the story of lots of things happening at the same time.” Big trends rarely have one cause.

Let me give you two recent examples.

Story: College tuition has surged because of a proliferation of government-backed student loans that let schools easily jack up prices.

Of course that’s true.

Many other things are also true:

- The share of tuition paid by students at state colleges has surged as state governments reduce the portion they cover in an attempt to deal with their budget shortfalls.

- Published tuition isn’t a good measure of what people actually pay due to a surge in financial aid designed to make students feel like they’re getting a deal.

- Demand for college has increased as the economy shifts from labor-intensive to knowledge jobs.

- As where you went to college becomes a growing part of a generation’s social identity, students have become less price-sensitive because they think they’re buying more than an education.

Lots of things happening at once.

Story: Interest rates are low because central banks are keeping them low.

Of course that’s true.

What’s also true:

- Horrendous global demographics are a headwind to growth and inflation, which would keep rates low on their own.

- Two of the worst recessions of modern times (2008, 2020) happening within about a decade of each other pushes investors toward perceived safety.

- There hasn’t been serious inflation in the developed world for 30 years. So even seasoned veteran investors have to strain to imagine what inflation would feel like in theory, rather than drawing on painful experience.

There are lots of things happening at once.

And you can, I believe, do this for almost any business or investing topic.

Even a flagrantly obvious statement like, “The economy is weak because of Covid-19” has all kinds of nuance, from government stimulus offsets to the politicization of lockdowns and reopenings. When America’s unemployment rate was 14.7% in April, Germany’s was 5.5% and Japan’s was 2.9%. Lots of different things were happening at once.

“It’s complicated” isn’t a good story. You won’t persuade many people with it, including yourself.

But a few things happen when you attribute trends to single-issue stories.

Your ability to predict how long a trend can and will last is a mess, wrecked by overconfidence in a clean narrative without appreciating how many little, subtle factors can influence a trend – especially in aggregate. An investor or CEO overestimating their odds of future success based on past success is a big one. “I, and I alone, am responsible for this success” is a captivating story that’s often smashed to pieces during its second take.

You’re pushed to the extreme ends of worship and cynicism, led to believe that the good and bad things in life are caused by a few people who look like they have superhuman skills or cruel intentions. The majority of the time it’s more complicated than that – great and terrible things usually occur because several unrelated forces collide at once.

Your ability to change your mind is limited, because simple stories are so persuasive. And part of the benefit of simple stories is that they’re easy to share with others. But once you share a persuasive story about how things work it’s hard to backtrack or update your view, since changing your mind is hard to distinguish from not knowing what you were talking about – especially when your original story was so clear and compelling. This helps explain the stubbornness and inaccuracies of many pundits.

There’s a theory in medicine called diagnostic parsimony. It says doctors should make as few assumptions as possible when diagnosing, settling on the simplest explanation as the most likely.

Doctor John Hickamn once pointed out its limitations. “Patients can have as many diseases as they damn well please,” he said.

A patient is statistically more likely to have a few common ailments than a single big one. Lots of things tend to happen at once, so the push to find one underlying cause to a patient’s ills can lead to false precision at best, misdiagnosis at worst.

It became known as Hickamn’s Dictum, and it’s a useful rule of thumb in many areas of life.

https://www.collaborativefund.com/blog/lots-of-things-happening-at-once/

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only