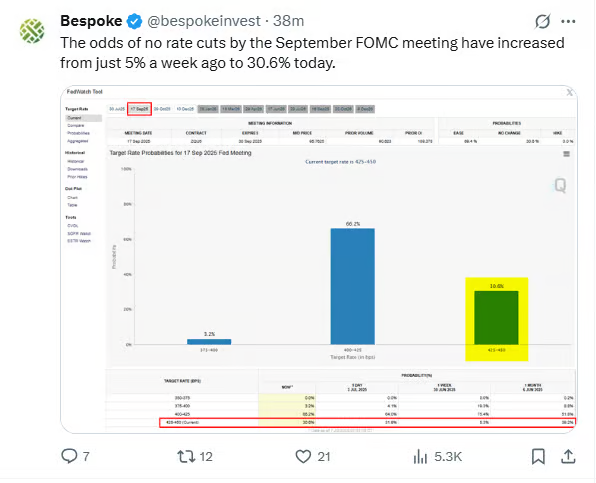

1. Odds of No Rate Cut by September Jump to 30%

Bespoke

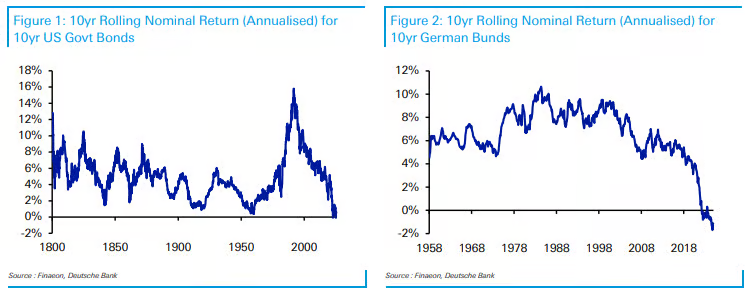

2. Worst Decade for Government Bonds Ever

One section of the pack shows how this has been the worst decade for government bonds across the globe on record, at least in nominal terms, although in real terms it’s still one of the worst. In today’s CoTD we show this for 10yr US govt bonds (or equivalents) back over 200 years, and for 10yr Bunds over the last 70 years. In the pack we also show the real adjusted graphs and also include the same for 30yr USTs, 10yr JGBs, 10yr Gilts and 10yr OATs.

Jim Reid Deutsche Bank

3. New Highs are Not Bearish

Ryan Detrick

4. XLF Financial Sector ETF Hits New Highs…Deregulation and Bet on Lower Rates?

StockCharts

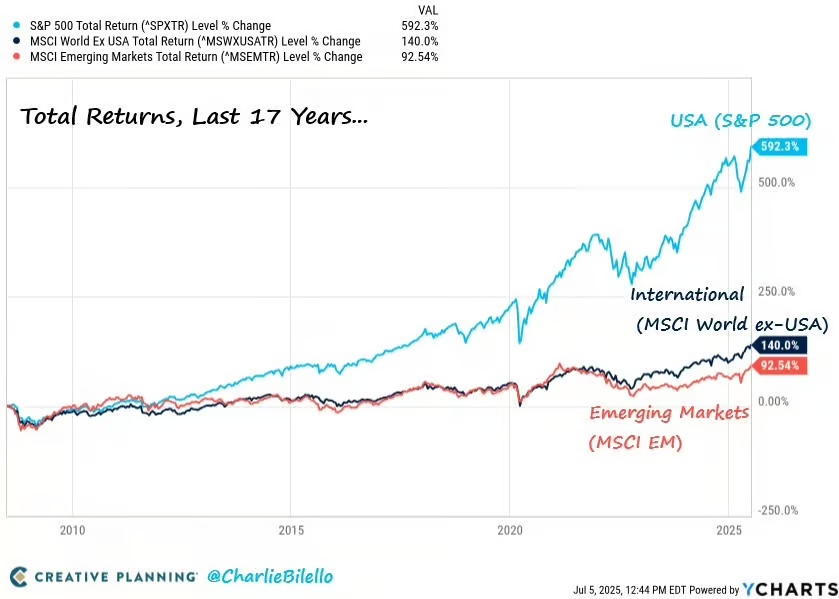

5. International Stocks Over 17 Years

Over the last 17 years, US stocks have gained 592% versus 140% for International stocks and 93% for Emerging Markets.

Charlie Bilello

6. America’s Prison Population About to Fall Off Cliff

The Atlantic

7. GEO Big Rally on Trump Election…-35% Correction from High

StockCharts

8. Internal Divisions at BRICS Summit…Half the Group’s Leaders Did Not Attend

Semafor

This weekend’s BRICS summit in Brazil put a spotlight on the growing internal divisions within the bloc of developing nations. About half of the group’s leaders, including China’s Xi Jinping and Russia’s Vladimir Putin, didn’t attend the gathering. While BRICS has expanded from five members — Brazil, Russia, India, China, and South Africa — to 11 in the last two years, the additions have brought fresh points of contention, and perhaps diluted its clout. Delegates avoided any controversial subjects that might trigger Washington’s ire, analysts said: A joint declaration condemning tariffs refrained from naming US President Donald Trump, and mentioned Ukraine only once. It marked a contrast from last year’s gathering in Russia, where the Kremlin pushed for alternatives to US-dominated financial systems.

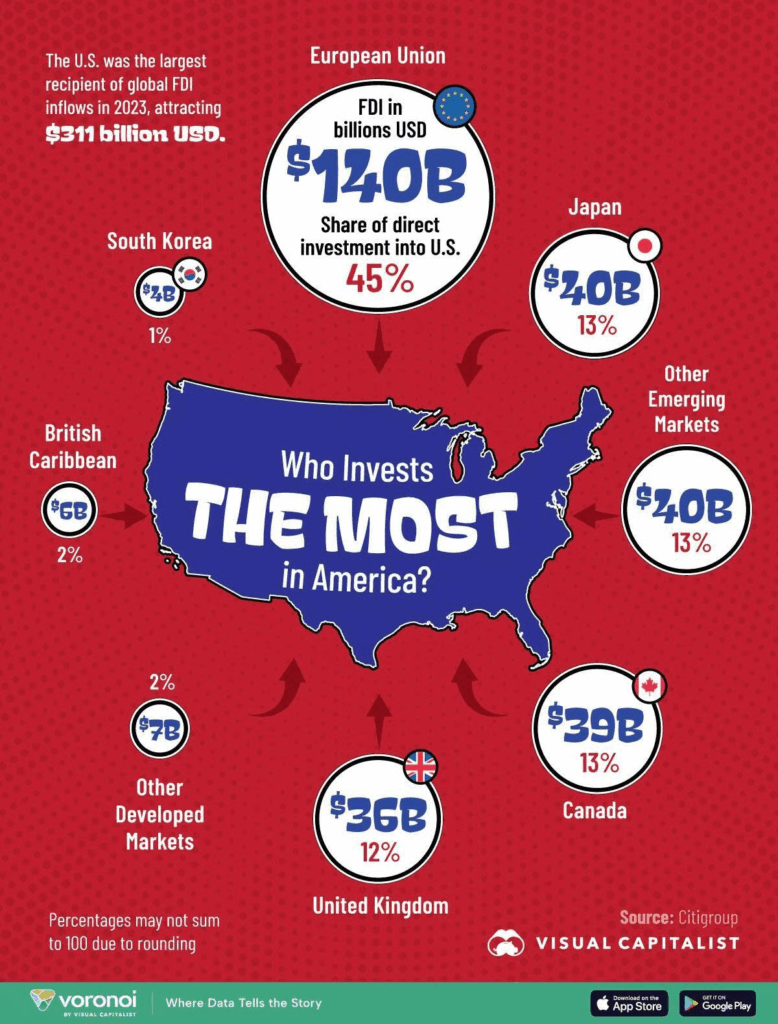

9. Foreign Direct Investment into U.S. by Country/Region

This graphic, via Visual Capitalist’s Kayla Zhu, visualizes foreign direct investment (FDI) into the U.S. by country or region of origin in 2023.

ZeroHedge

10. Not smart vs. stupid

Via Seth’s Blog: Not smart is a passive act, remedied with learning, experience and thought.

Stupid is active, the work of someone who should have or could have known better and decided to do something selfish, impulsive or dangerous anyway.

The more experience, assets and privilege we have, the less excusable it is to do stupid things. And at the same time, the more useful it is to announce that we’re not smart (yet).