1. Chart of the Week

Michael Batnick

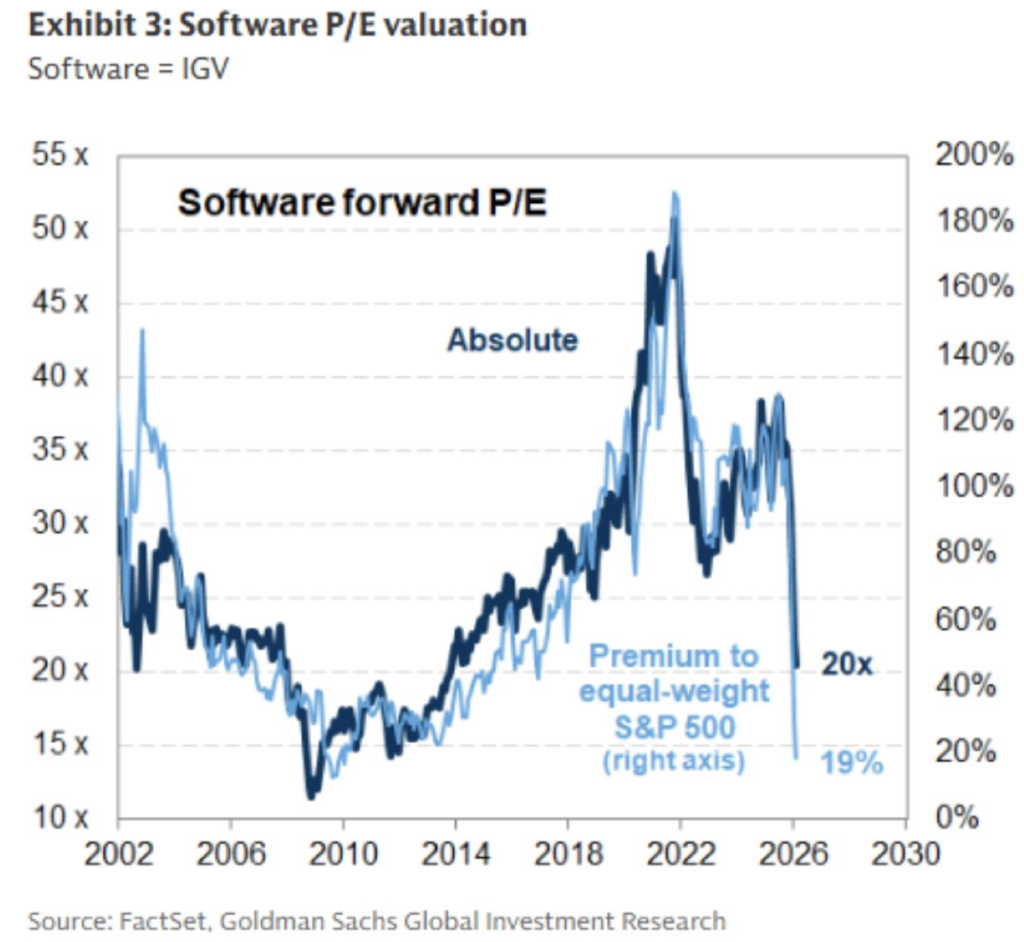

2. Software Stocks Premium in P/E Valuation vs. Rest of Market Drops to Even

3. Software ETF Right on Its 200 Week Moving Average

StockCharts

4. BETZ Sports and Gaming ETF Falls Back to Liberation Day Levels …Polymarket and Kalshi Competition?

StockCharts

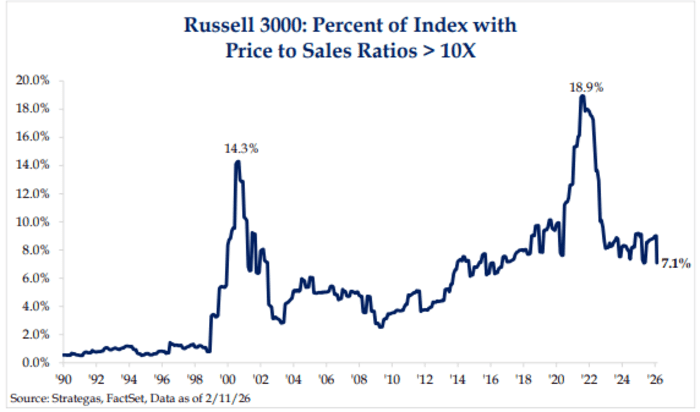

5. Number of Small Cap Stocks Trading at 10x Sales Back to Normal Levels

The chart-“Despite broader concerns around market valuations, our data on the percentage of Russell 3000 companies trading at 10x price-to-sales does not currently raise red flags,” say Ryan Grabinsky and Jon Byrne at Strategas Securities. “At 7.1%, the reading is among the lowest levels observed in the post-COVID period. That said, it is worth noting that this metric offered limited signal in the run-up to the financial crisis, so we remain mindful of its limitations,” they add.

MarketWatch

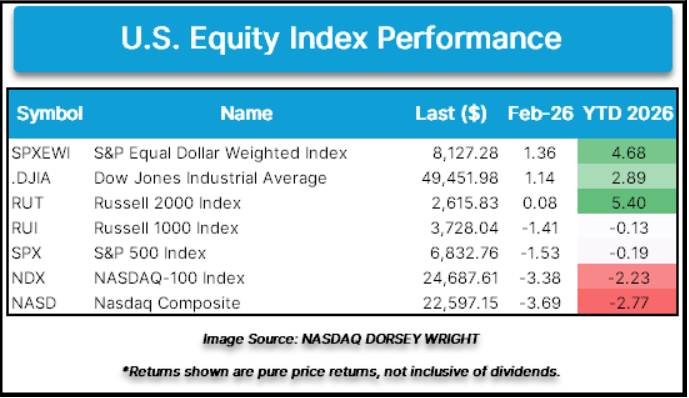

6. 2026 Returns S&P Equal Weight +7.5% Above QQQ

Nasdaq Dorsey Wright

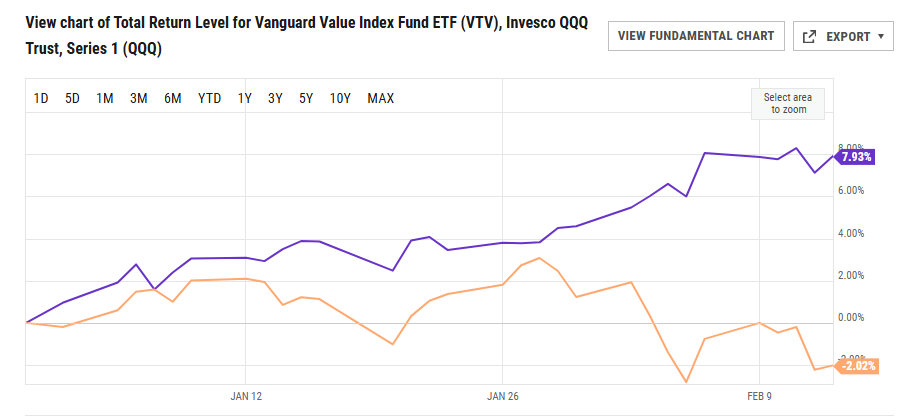

7. Vanguard Value VTV +8% vs. QQQ -2% 2026

Ycharts

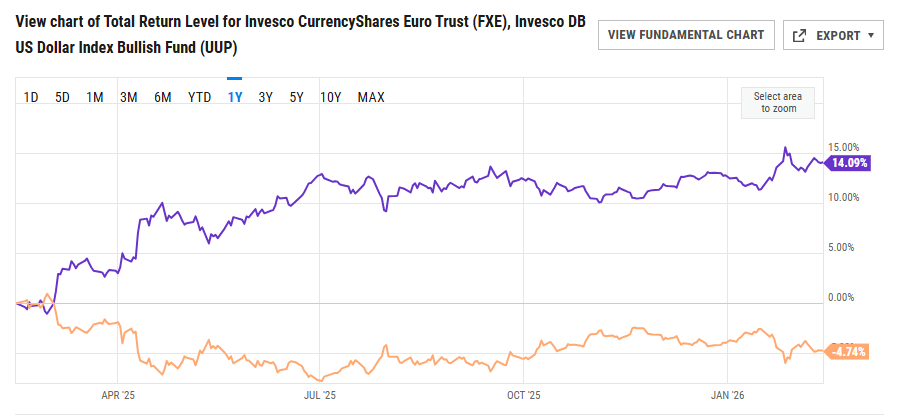

8. Last 12 Months….Euro Trust Currency ETF +14% vs. UUP U.S. Dollar Chart -5%

Ycharts

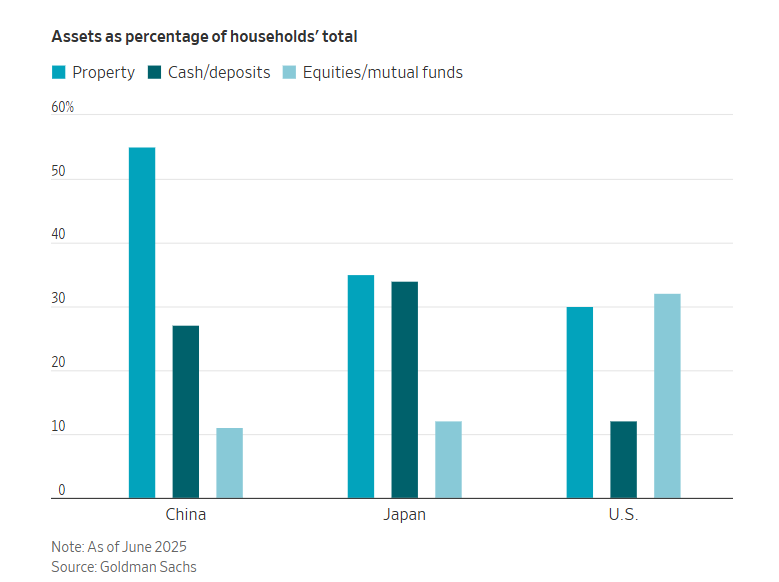

9. Americans are Stock Nation vs. Rest of World…Double Percentage of Holdings Versus China/Europe

WSJ

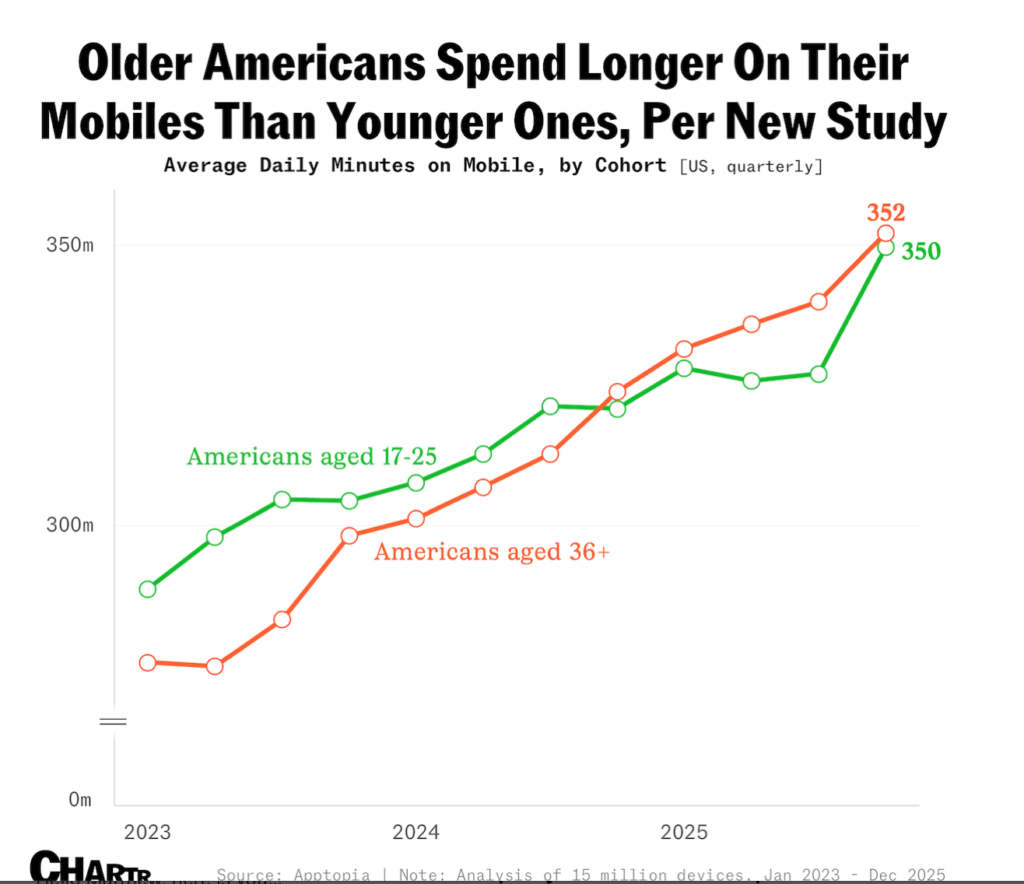

10. Older Americans on Phones as Much as Kids

Chartr