1. Amazon Capex Crushes Other S&P 500 Names.

https://twitter.com/edwards_deming WE Deming

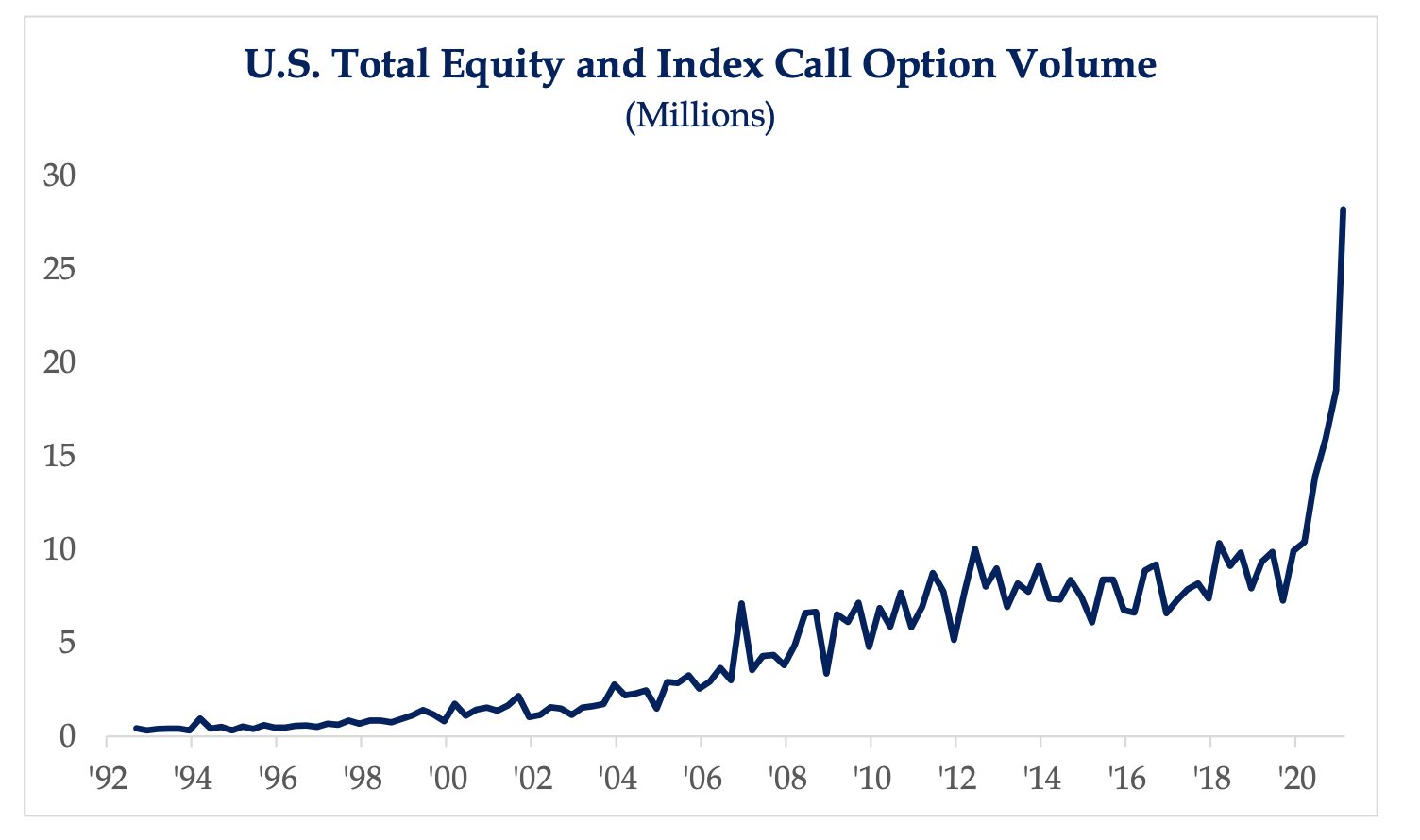

2. Long-Term Chart on Call Option Buying

One of the Most Speculative Charts I have Ever Seen

Holger Zschaepitz, @Schuldensuehner

https://twitter.com/Schuldensuehner/status/1360531158493130755/photo/1

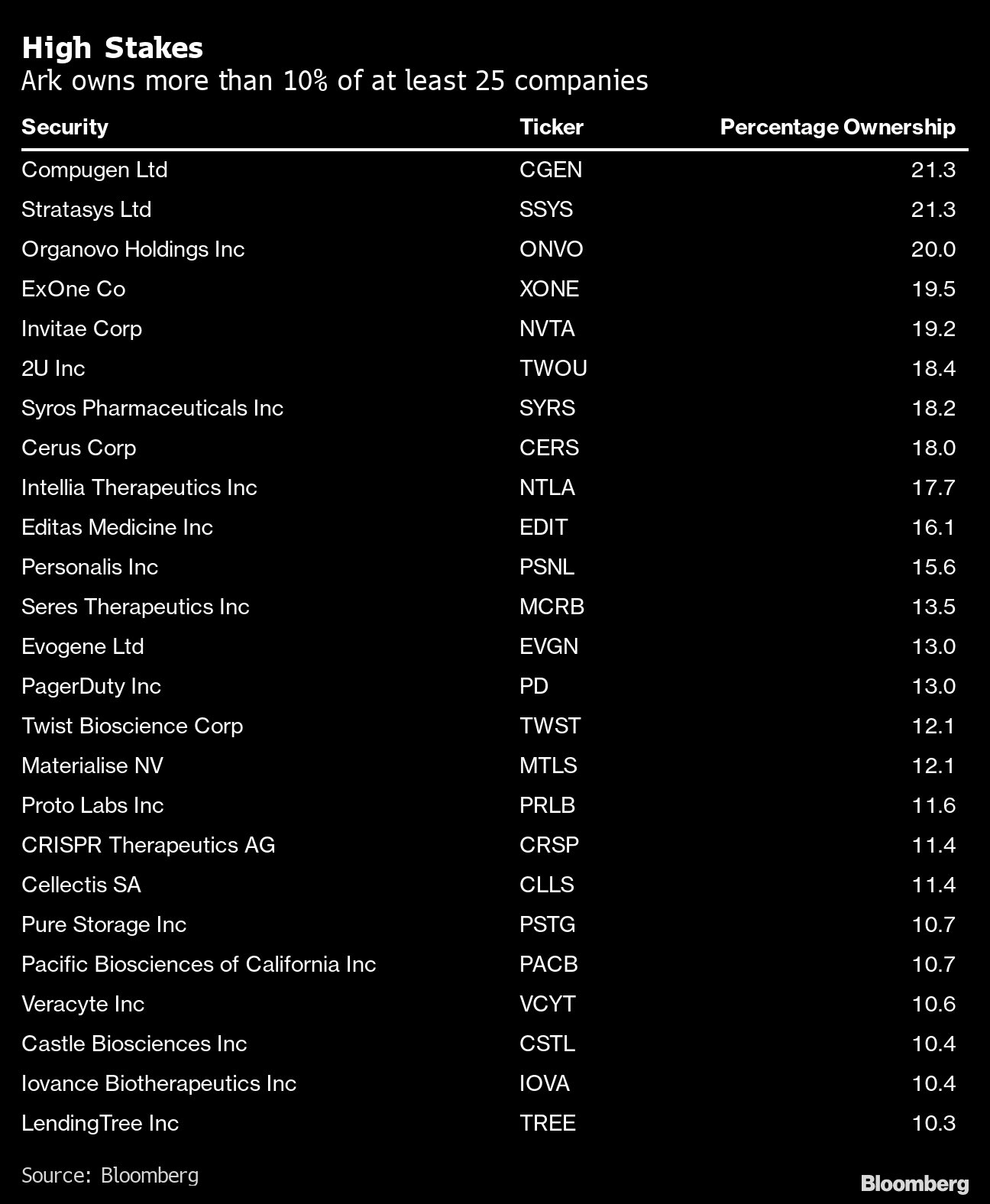

3. Ark Funds Owns 10% Stake in at Least 25 Companies

https://twitter.com/Schuldensuehner/status/1360531158493130755/photo/1

4. New Speculation…First Day Spike in SPAC IPOs

Unusual first-day rallies in SPACs raise bubble concern: ‘Every single one of them has gone up’

5. Under the Hood of SPAC ETF

ETF.COM- Cinthia Murphy

Index Choice: SPAK

The first-to-market ETF, the Defiance Next Gen SPAC Derived ETF (SPAK), is an index-tracking fund that invests in both U.S.-listed SPACs and SPAC-merged companies.

SPAK is the only index-based SPAC ETF in the market. The mix, which takes into account market cap, free float and liquidity requirements in its selection process, is a 40/60 mix: 40% of the portfolio are SPACs and 60% are post-deal companies.

SPAK is a market-cap-weighted portfolio, so you’ll find the biggest deals at the top.

The index rebalances annually, but the methodology allows for SPACs and post-deal companies to be added with more frequency if needed.

You could argue that one of the benefits of SPAK being an index fund is that it removes manager risk from the equation. It offers broad access to the space with a rules-based approach. No surprises.

The fund, which launched last fall, has $78 million in assets under management and costs 0.45% in expense ratio, or $45 per $10,000 invested. Since inception, SPAK has gained almost 30%.

https://www.etf.com/sections/features-and-news/battle-3-spac-etfs-0?nopaging=1

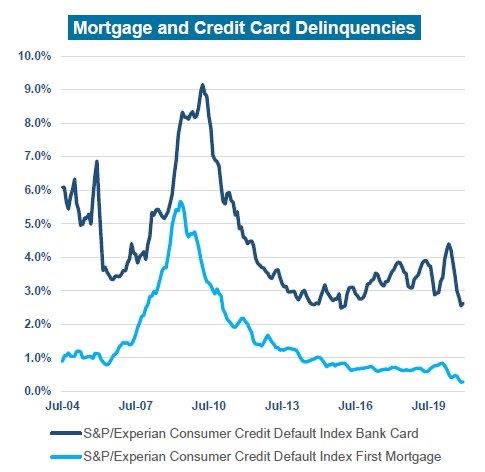

6. Mortgage and Credit Card Delinquencies

Peter Mallouk

https://twitter.com/PeterMallouk

7. 10 Year Treasury Yield Doubled in 6 Months…Now Approaching S&P Dividend Yield 1.57%

Chart to watch

©1999-2021 StockCharts.com All Rights Reserved

8. MSOS ETF–$2m AUM to $1B Since Sept.

MSOS-AdvisorShares Pure U.S. Cannabis

©1999-2021 StockCharts.com All Rights Reserved

MSOS Fund Description

MSOS is an actively managed narrow portfolio of US stocks or swap contracts related to the domestic cannabis and hemp industry.

MSOS Factset Analytics Insight

MSOS is the first US-listed actively managed ETF to provide exposure solely to American cannabis and hemp companies, including multi-state operators (MSOs). This is the second fund from AdvisorShares dedicated to the cannabis investment strategy. MSOS seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. Stocks may be of mid- and small-cap companies. In addition, the fund will use total return swap contracts to create such exposure. The fund advisor uses a variety of tools and ratings sources to select securities. Companies must be registered with the DEA specifically for the purpose of handling marijuana for lawful research and development of cannabis or cannabinoid-related products. Stocks selected may focus on areas such as REITs, health care, cannabidiol (CBD), pharmaceutical and hydroponics. In addition to investment risks, investors need to be aware of the ongoing regulatory risks.

https://www.etf.com/MSOS#overview

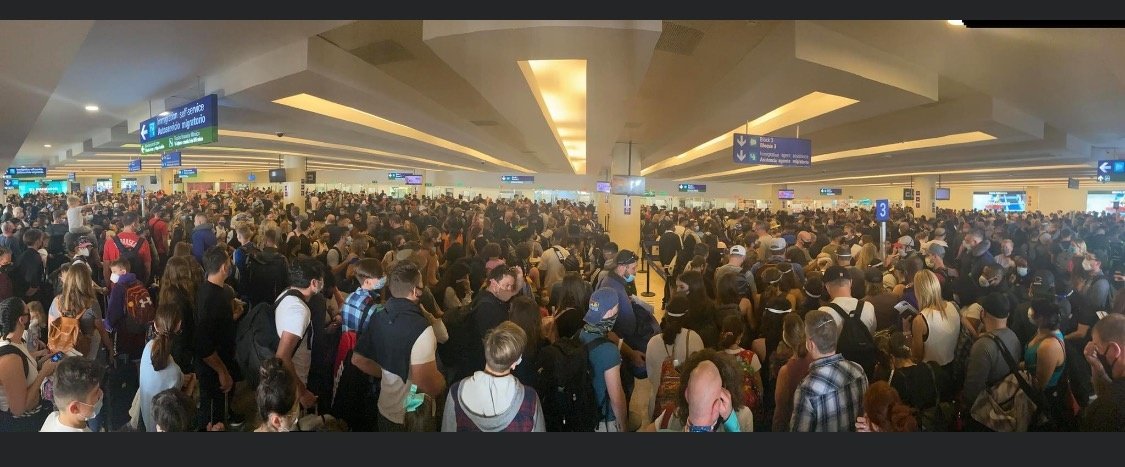

9. The Airport in Cancun

This is the airport in Cancun right now. Good luck with your bonds at 1%

https://twitter.com/OJRenick/status/1360375507880206340/photo/1

10. The Difference Between Amateurs and Professionals

READING TIME: 2 MINUTES

Why is it that some people seem to be hugely successful and do so much, while the vast majority of us struggle to tread water?

The answer is complicated and likely multifaceted.

One aspect is mindset—specifically, the difference between amateurs and professionals.

Most of us are just amateurs.

What’s the difference? Actually, there are many differences:

- Amateurs stop when they achieve something. Professionals understand that the initial achievement is just the beginning.

- Amateurs have a goal. Professionals have a process.

- Amateurs think they are good at everything. Professionals understand their circles of competence.

- Amateurs see feedback and coaching as someone criticizing them as a person. Professionals know they have weak spots and seek out thoughtful criticism.

- Amateurs value isolated performance. Think about the receiver who catches the ball once on a difficult throw. Professionals value consistency. Can I catch the ball in the same situation 9 times out of 10?

- Amateurs give up at the first sign of trouble and assume they’re failures. Professionals see failure as part of the path to growth and mastery.

- Amateurs don’t have any idea what improves the odds of achieving good outcomes. Professionals do.

- Amateurs show up to practice to have fun. Professionals realize that what happens in practice happens in games.

- Amateurs focus on identifying their weaknesses and improving them. Professionals focus on their strengths and on finding people who are strong where they are weak.

- Amateurs think knowledge is power. Professionals pass on wisdom and advice.

- Amateurs focus on being right. Professionals focus on getting the best outcome.

- Amateurs focus on first-level thinking. Professionals focus on second-order thinking.

- Amateurs think good outcomes are the result of their brilliance. Professionals understand when good outcomes are the result of luck.

- Amateurs focus on the short term. Professionals focus on the long term.

- Amateurs focus on tearing other people down. Professionals focus on making everyone better.

- Amateurs make decisions in committees so there is no one person responsible if things go wrong. Professionals make decisions as individuals and accept responsibility.

- Amateurs blame others. Professionals accept responsibility.

- Amateurs show up inconsistently. Professionals show up every day.

- Amateurs go faster. Professionals go further.

- Amateurs go with the first idea that comes into their head. Professionals realize the first idea is rarely the best idea.

- Amateurs think in ways that can’t be invalidated. Professionals don’t.

- Amateurs think in absolutes. Professionals think in probabilities.

- Amateurs think the probability of them having the best idea is high. Professionals know the probability of that is low.

- Amateurs think reality is what they want to see. Professionals know reality is what’s true.

- Amateurs think disagreements are threats. Professionals see them as an opportunity to learn.

There are a host of other differences, but they can effectively be boiled down to two things: fear and reality.

Amateurs believe that the world should work the way they want it to. Professionals realize that they have to work with the world as they find it. Amateurs are scared — scared to be vulnerable and honest with themselves. Professionals feel like they are capable of handling almost anything.

Luck aside, which approach do you think is going to yield better results?

Food for Thought:

- In what circumstances do you find yourself behaving like an amateur instead of as a professional?

- What’s holding you back? Are you hanging around people who are amateurs when you should be hanging around professionals?

TAGGED: DELIBERATE PRACTICE, HABITS, PERFORMANCE

FOOTNOTES

Ideas in this article from Ryan Holiday, Ramit Sethi, Seth Godin and others.

https://fs.blog/2017/08/amateurs-professionals/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.