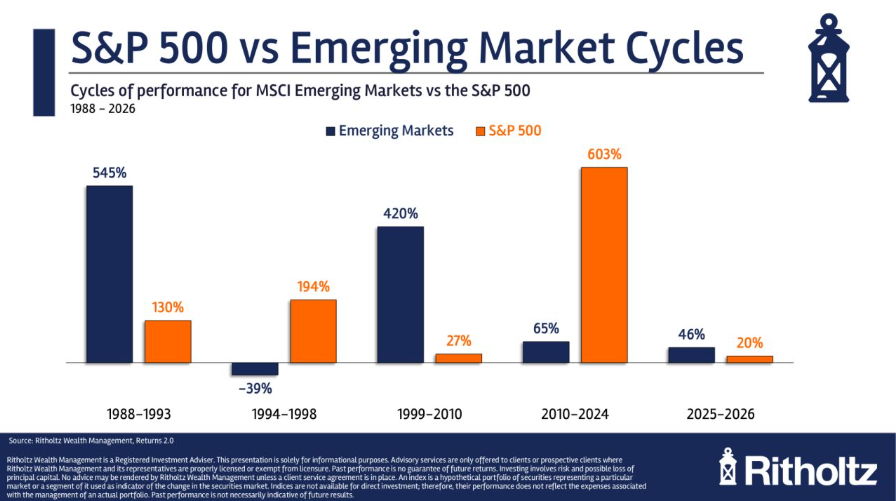

1. History of Emerging Market vs. S&P Cycle

Ben Carlson

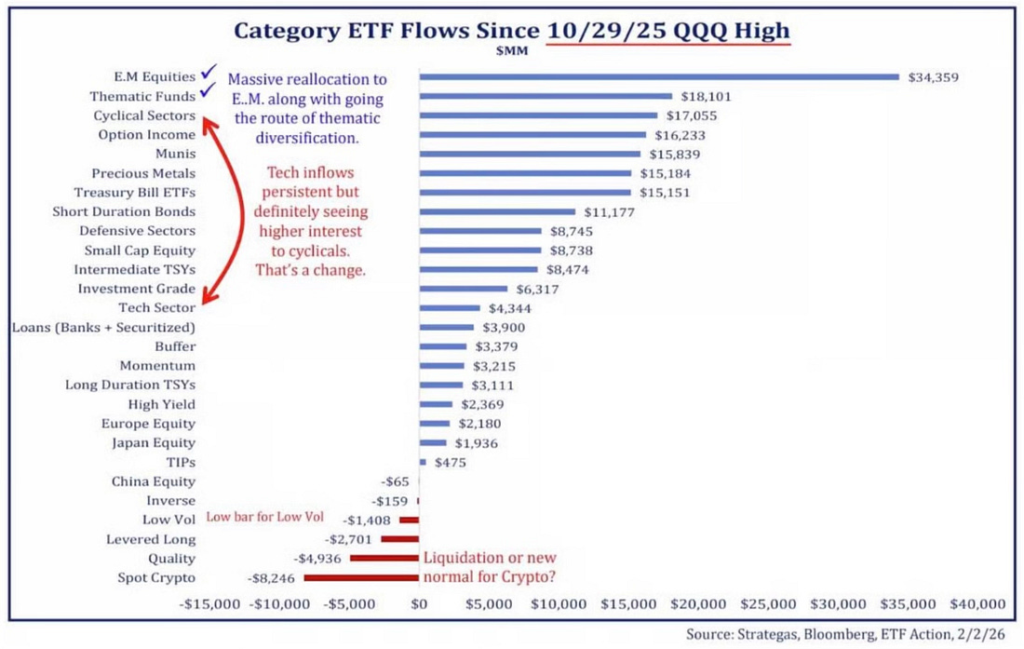

2. Fund Flows Post October Nasdaq Peak

Since the Nasdaq peaked on October 29th, the money has been flooding into emerging markets, thematic funds, and cyclicals. ETF flow data shows a clear exodus from mega-cap tech into overlooked corners of the market.

Todd Sohn via Daily Chartbook

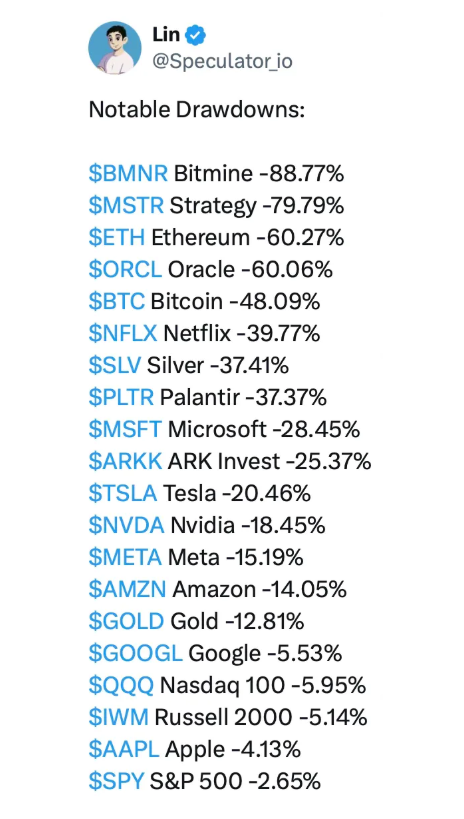

3. Notable Drawdowns

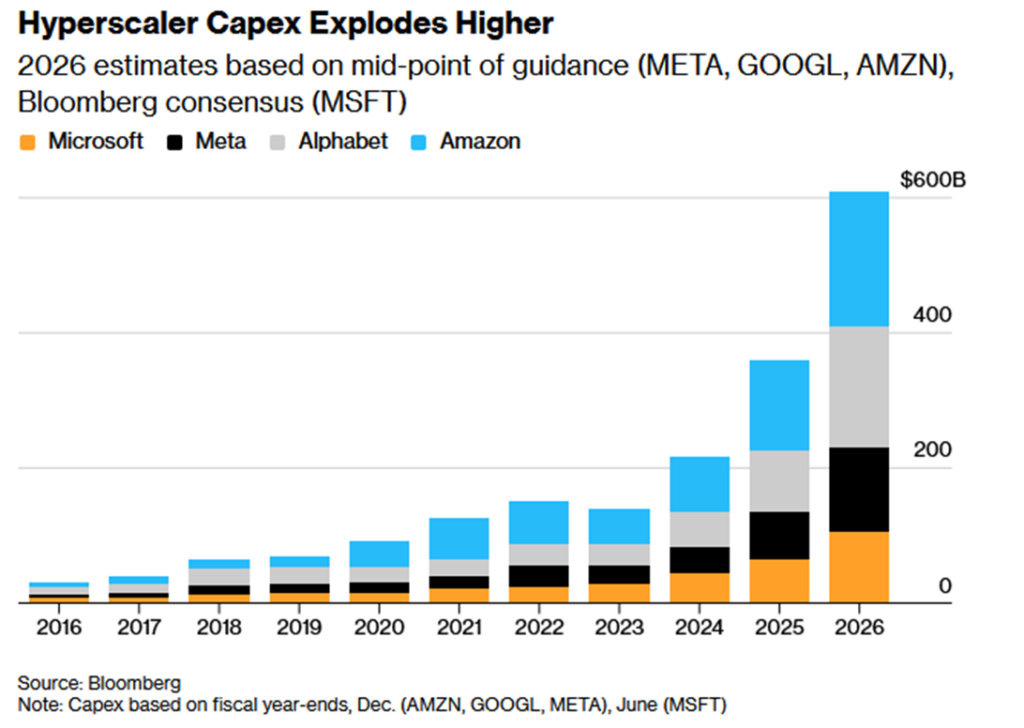

4. Big 4 Companies Spending $650 Billion 2026 on Capex

Dave Lutz Jones Trading ROTATION WATCH– Four of the biggest US technology companies together have forecast capital expenditures that will reach about $650 billion in 2026 — a mind-boggling tide of cash earmarked for new data centers and the long list of equipment needed to make them tick, including artificial intelligence chips, networking cables and backup generators.

The four companies “see the race to provide AI compute as the next winner-take-all or winner-takes-most market,” said Gil Luria, an analyst at DA Davidson. “And none of them is willing to lose.”

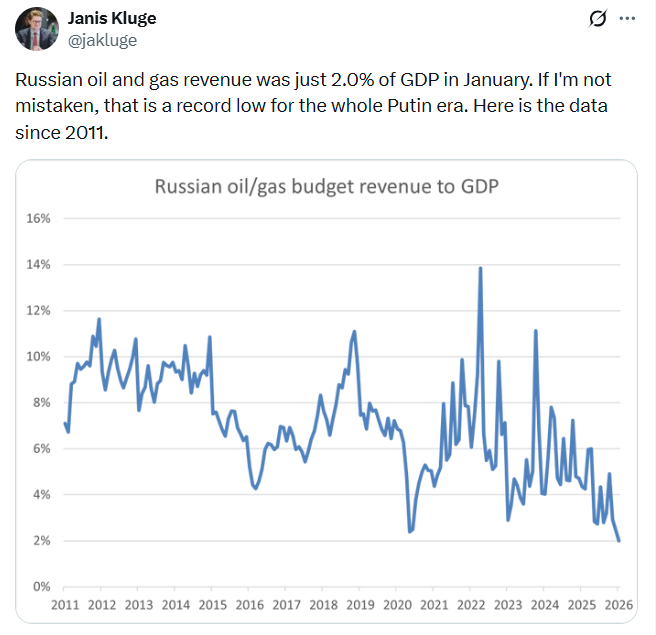

5. Russian Oil and Gas Revenue -50% in January

Janis Kluge

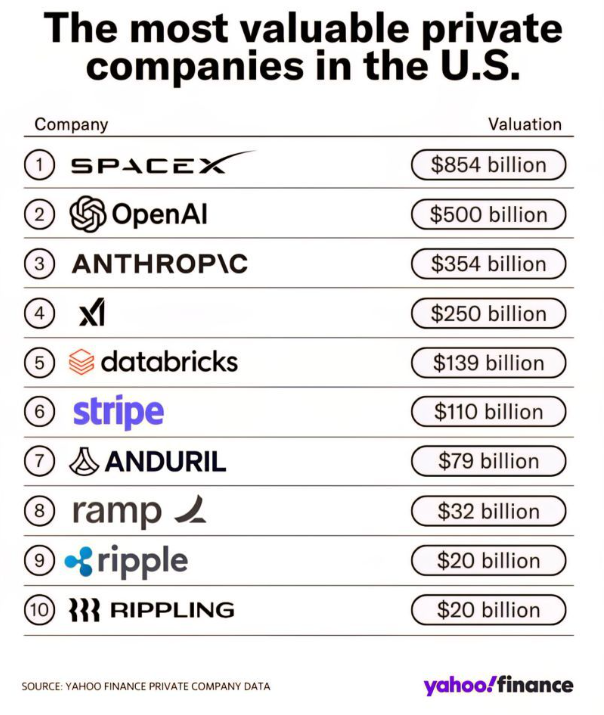

6. The Most Valuable Private Companies

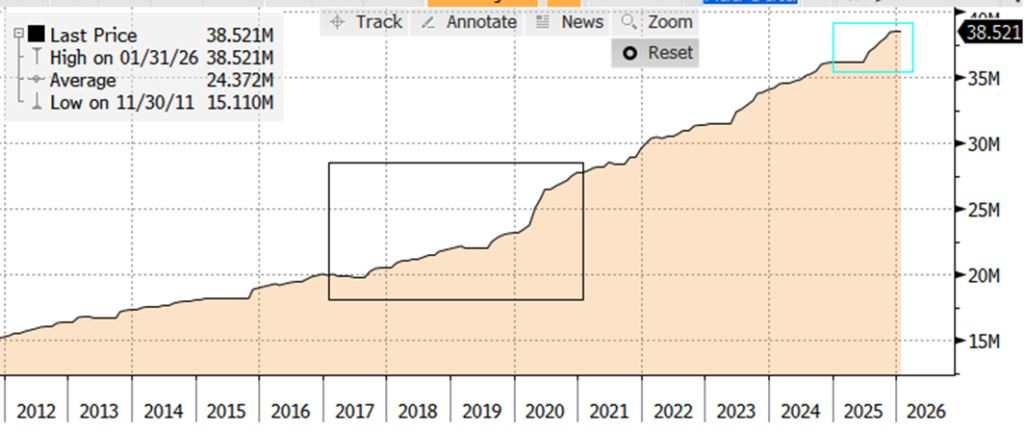

7. The $20 Trillion Increase in U.S. Debt

King Report-US debt under Trump soared $8 Trillion or 40% from his January 2017 inauguration until Biden’s January 2021 inauguration. US debt soared $8 Trillion during Biden’s term, or 28.77%. US debt during Trump’s 2nd term has jumped $2.32 Trillion in ONE YEAR!

The King Report

8. Bitcoin ETF Hits 2024 Levels of Support

StockCharts

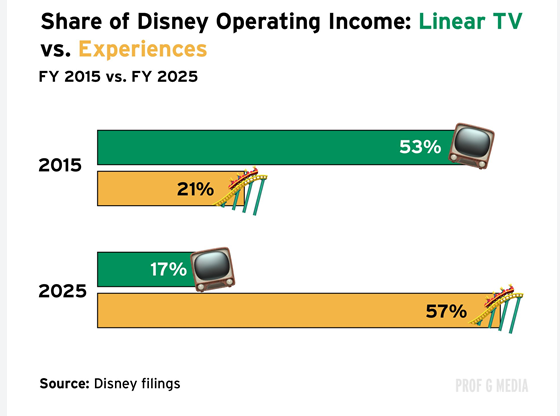

9. Disney Flip in Operation Income Over 10 Years-Prog G

Prof G Markets

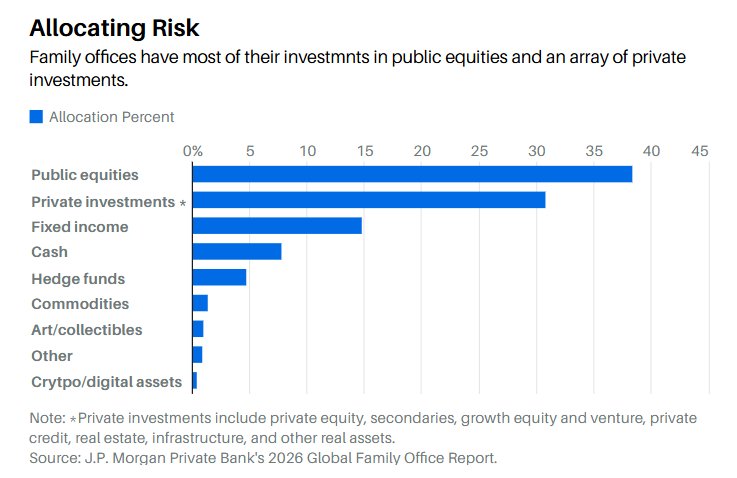

10. How Do Family Offices Allocate-Barrons

Barron’s