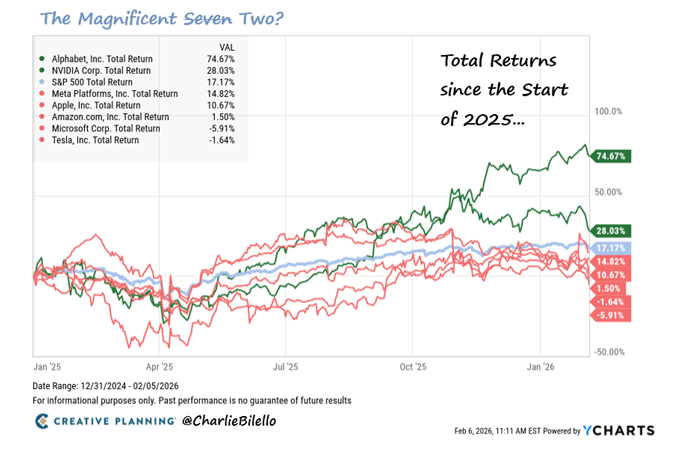

1. The Magnificent 2

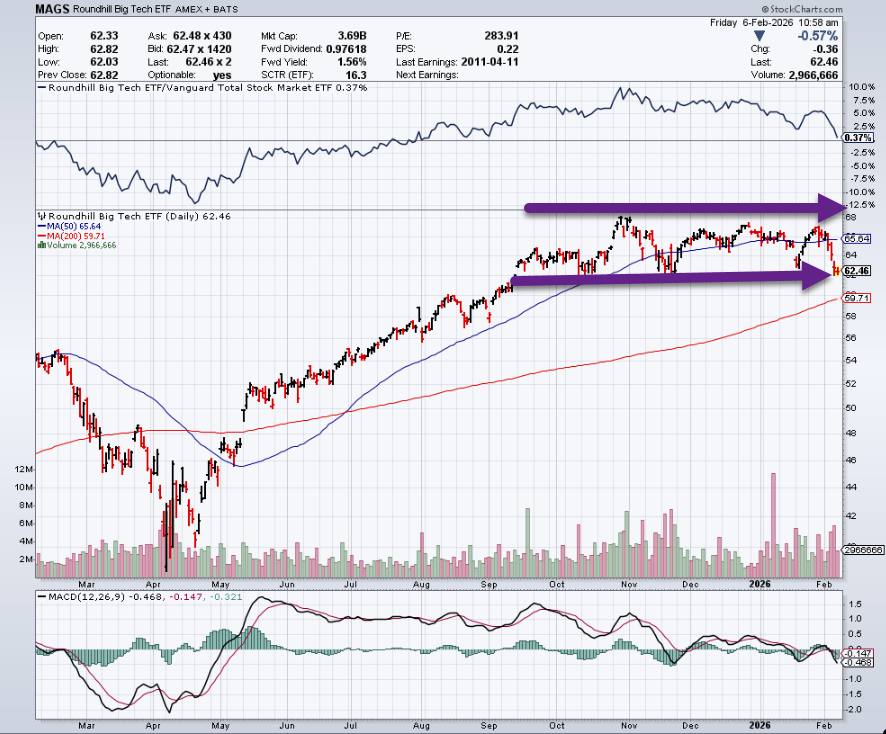

2. MAGS Mag 7 ETF Chart …Sideways Since Sept 2025

StockCharts

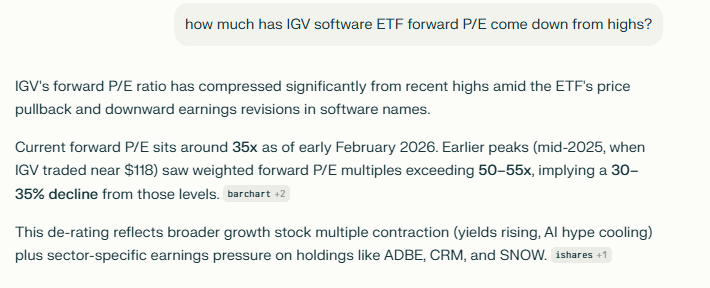

3. Software Forward PE Drop ….Forward P/E of Software ETF 55x to 35x

Perplexity

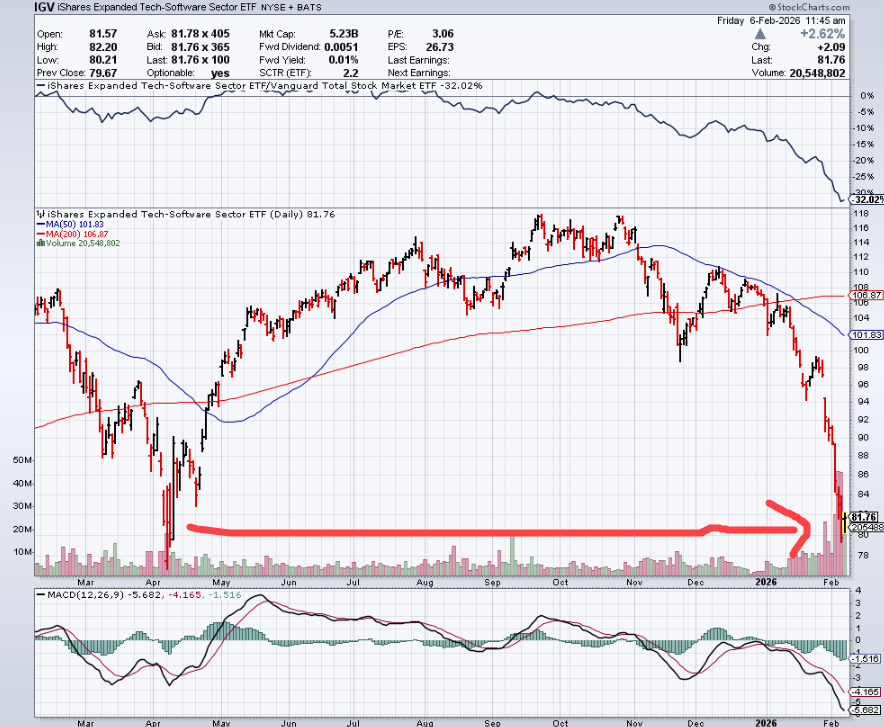

4. IGV Software ETF Right on Liberation Day Lows

StockCharts

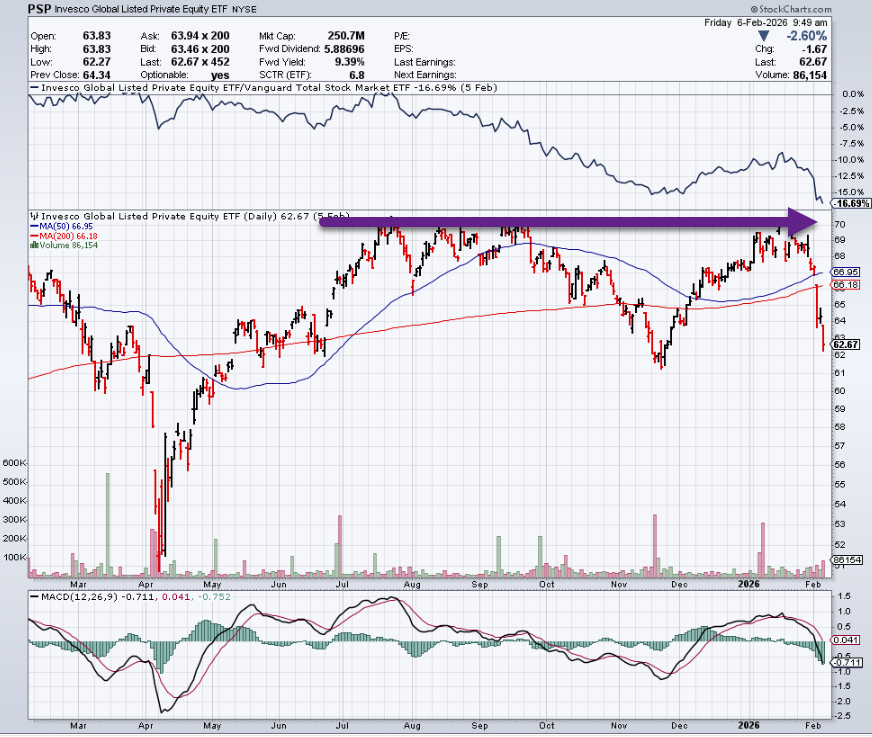

5. Private Equity ETF PSP Failed 4x at New Highs

StockCharts

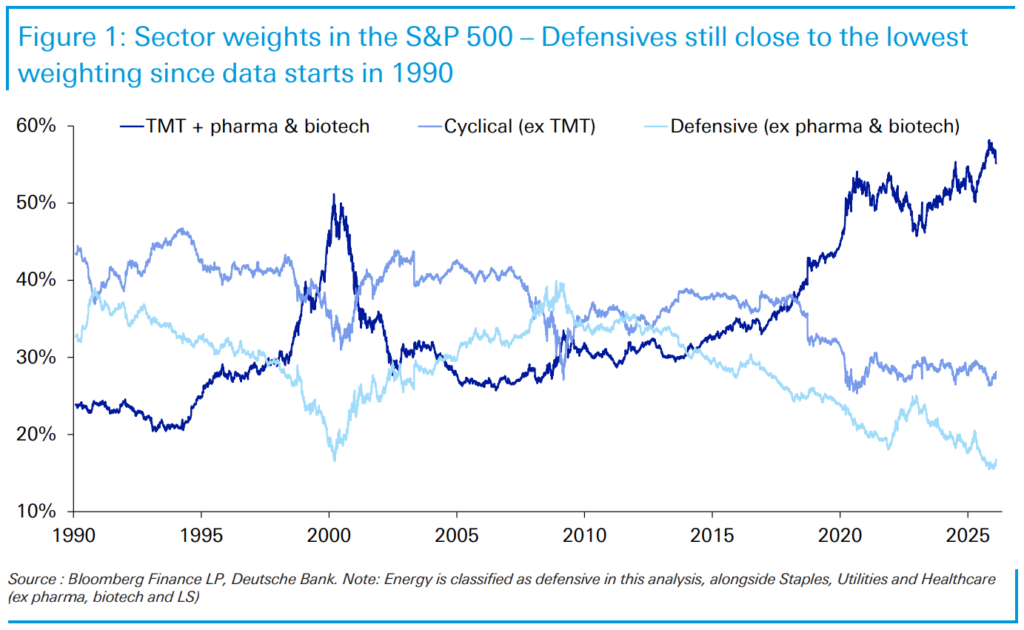

6. Defensives Still Close to Lowest Weighting in S&P 500 Since 1990

After a fascinating week in markets, today’s CoTD —updated from last week’s pack (link here)—shows that US defensive stocks remain close to the “cheapest” levels we’ve seen since our dataset begins in 1990. In other words, even with the recent rotation out of tech, the broader picture still shows limited impact when you zoom out.

For more colour on positioning and flows behind the recent equity move, see Parag Thatte’s latest weekly report (link here). Two themes stand out:

- Tech bounced on Friday from the bottom of its 10-year relative channel versus the S&P 500. Notably, it was sitting at the top of that channel back in October when the rotation began.

- The rotation away from tech began around the time Q3 earnings revealed a broadening of earnings growth—from a narrow set of sectors (mainly tech) to most sectors.

This second point is particularly interesting: improving earnings elsewhere may have helped create the conditions for the tech sell-off just as much as anything happening within tech itself. And while tech still shows the strongest earnings growth, today’s chart suggests that as other sectors improve, relative valuations become compelling enough for investors to reallocate.

Deutsche Bank

7. Murder Rate Per 100,000 People

Semafor

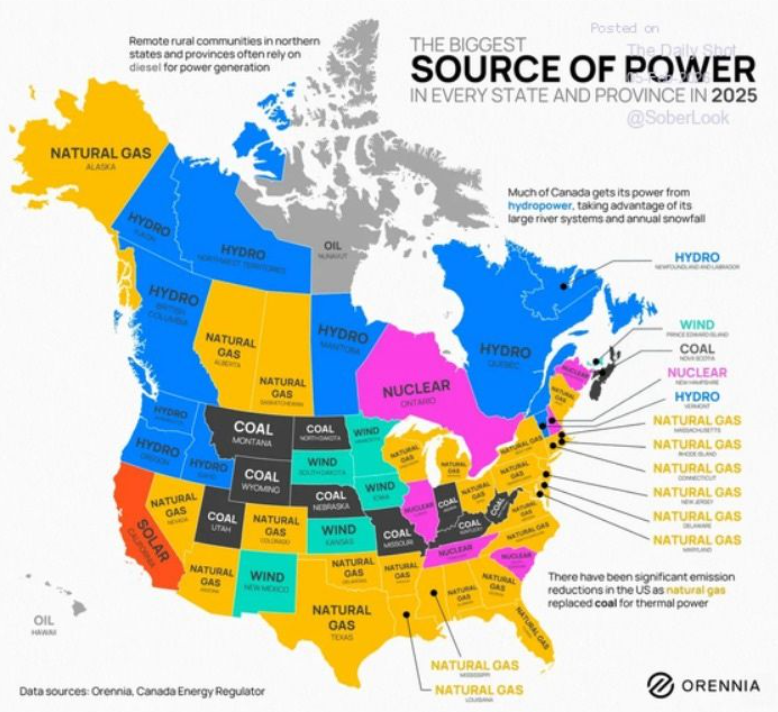

8. Source of Power by State 2025

Orennia

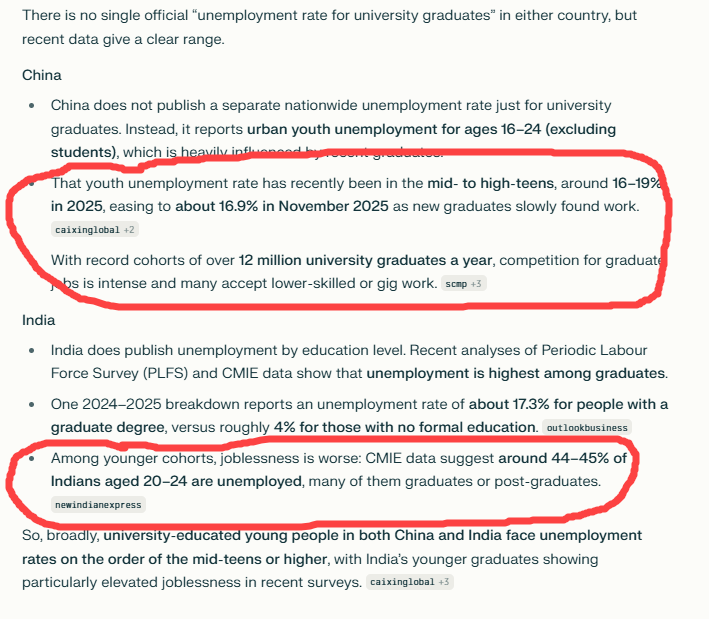

9. Unemployment Rate for College Grads in U.S. 2.5%-2.8%….Vs. China/India

Perlpexity

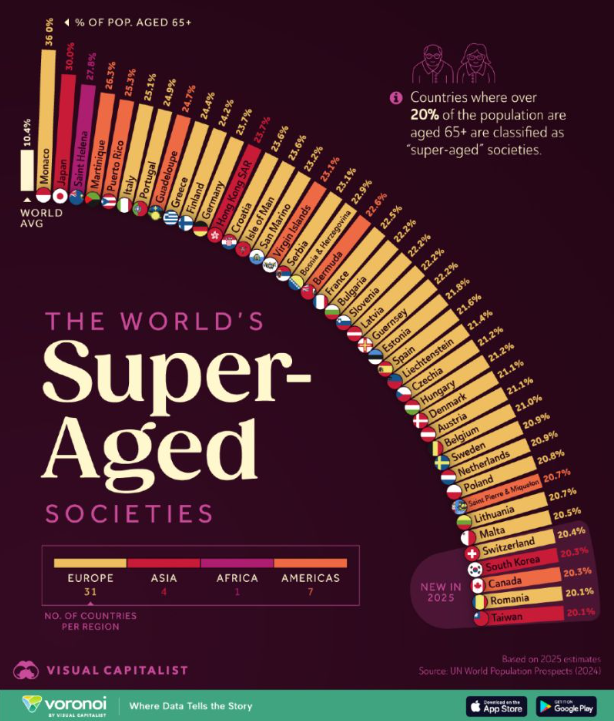

10. Super-Aged Societies-Demographics is Destiny

Visual Capitalist