1.TSLA Closes on 50 Day Moving Average.

Tesla Chart-2 lower tops then closes at 50day

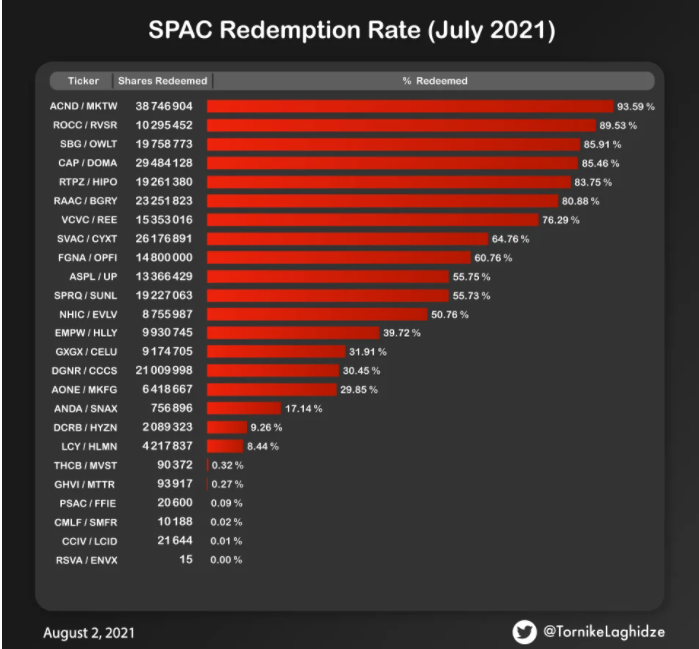

2.Average SPAC Redemption Rate Q3 52% vs. 10% Q1

Morning Brew

|

https://www.morningbrew.com/

https://news.bloomberglaw.com/securities-law/redemptions-soar-as-spac-values-drop-below-10-a-share-chart

See the number of 90%+ Redemptions

https://www.reddit.com/r/SPACs/comments/owg9um/spac_redemption_rate_July_2021/

3.Technology Sub-Sectors Breaking Down.

CLOU-Cloud Computing ETF quick -20% correction

Tech Sub-Sectors Big Spreads in Performance….Cloud sub-sector -6% YTD vs. Semiconductors +37%

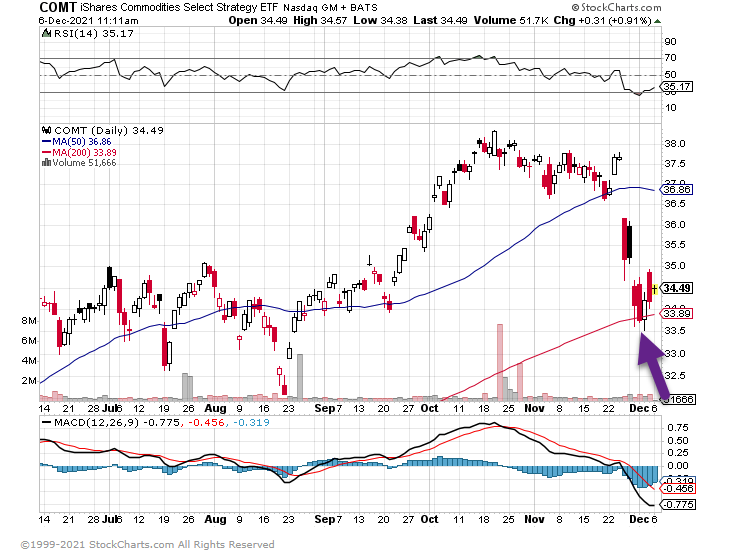

4.Commodity ETF Holds 200day Moving Average

COMT-holding at 200day right now

5.COINBASE -32% from High

6.Crypto Miner MARA -56% from Highs.

MARA-3rd attempt since July to hold its 200day moving average

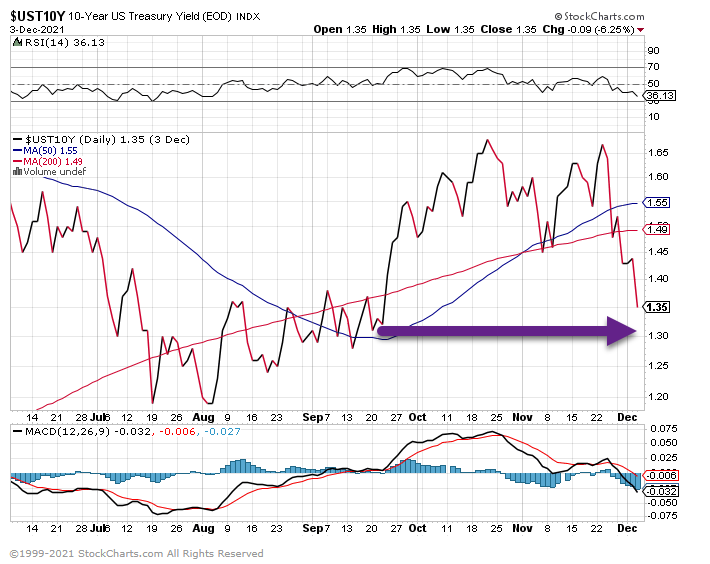

7.The 10-year Treasury yield, which was 1.67% as recently as the week of Thanksgiving, was yielding 1.35% at the close on Friday

Inflation? 10 Year rates plummet

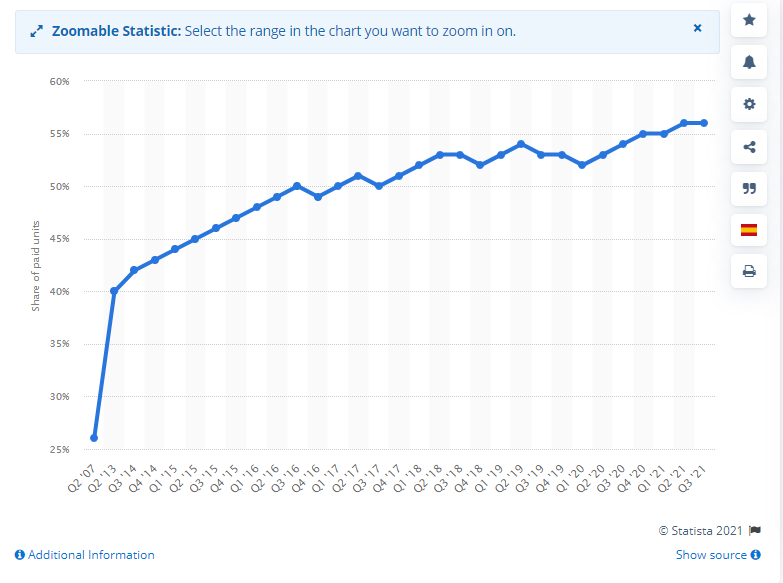

8.Share of paid units sold by third-party sellers on Amazon platform as of 3rd quarter 2021…+50% Year Over Year

Statista–Amazon seller revenues

This magic formula has ultimately cashed in for Amazon, which has seen its net revenues multiply in recent years. In 2020, the e-commerce giant generated approximately 80.5 billion dollars in third-party seller services, an increase of nearly 50 percent over the previous year. While these figures are the product of orders throughout the year, a significant chunk is attributable to special offer and discount days. According to a survey, Black Friday is the shopping event driving the largest sales increase for Amazon sellers, followed by two of the company’s own events, Prime Day and Amazon Summer Sale. In the context of the coronavirus pandemic, Amazon Prime Day played a particularly decisive role for small and medium-sized businesses around the world, many of which had to turn to online sales overnight in order to survive.

https://www.statista.com/statistics/259782/third-party-seller-share-of-amazon-platform/

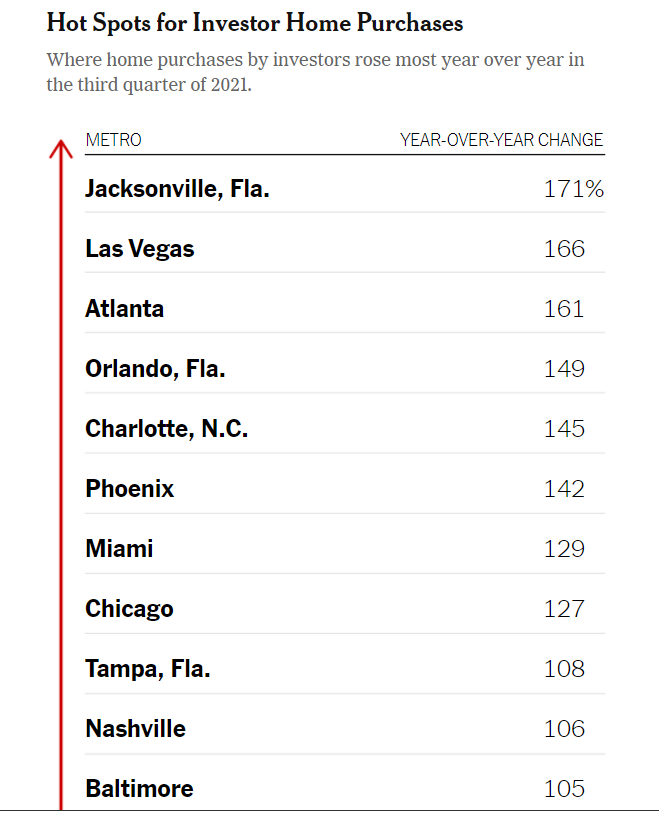

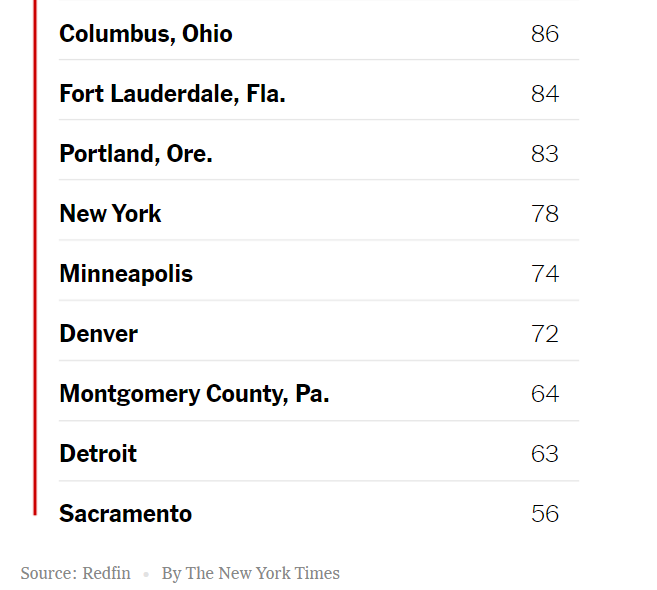

9.Q3 2021-Investors Bought 18% of Homes for Sale in the United States.

Your Future Landlord Just Outbid You for That House-In a tough home-sales market, investors are winning more often.

Dec. 2, 2021

It’s no secret that rising prices and shrinking inventory have made it difficult to bid successfully on a home. The news that investors are increasingly winning those bids should offer no solace to frustrated home shoppers.

During the third quarter of 2021, investors bought more than 18 percent of the homes sold in the United States — about 90,000 homes in all, for a total of about $64 billion. That’s the highest share and the largest number in any quarter on record, according to a new report by Redfin.

“Investors have the advantage because they usually come with cash,” said Daryl Fairweather, chief economist at Redfin. “They are usually willing to waive inspections. An investor is able to offer terms that are more favorable than an owner occupant.”

The study also found that investors were buying more expensive homes than in the past; the average investor home purchase in the third quarter cost $438,770, about 5 percent more than the average a year earlier. That means investors are profiting from higher rents paid by middle-class earners who in another era may have had an easier time buying themselves.

“The people who own homes these days have very good credit. They’re putting a lot of money down, and people who don’t have that are being shut out,” noted Ms. Fairweather. “That creates an opportunity for investors to buy homes and rent them back to the very people that would have wanted to buy them.”

Rising investor share is nothing new. In Q3 2000, investors bought only about 6 percent of available homes; by the beginning of 2020, just before the pandemic, their share peaked at 16.6 percent. After taking a pandemic dive, the share roared back to the current record 18.2 percent, essentially catching up with the prior trajectory of investor purchases.

To reach their conclusions, Redfin analysts searched sales records and deeds for telling keywords in the names of purchasers, such as “LLC,” “Inc,” “Trust, ” “association,” company” and “corporate trustee.” The study covered the 50 largest metropolitan areas in the United States, though only 40 could be used because of laws prohibiting records access. This week’s chart shows the 20 metropolitan areas in which investor home purchases increased the most over a year, according to the report.

https://www.nytimes.com/2021/12/02/realestate/your-future-landlord-just-outbid-you-for-that-hourse.html

10.Reexamining Productivity with Mindfulness

Mindfulness can challenge our glorification of productivity toward wiser being

KEY POINTS

- We can all get stuck in compulsive, automatic, and mindless productivity.

- This can easily leave us in a spiral of anxiety, exhaustion, and depletion.

- We can take the power back by mindfully and purposely practicing letting things be as they are, instead of engaging in automatic productivity.

- The more we’re OK with things as they are, the better we’ll be at completing our tasks—saving more time and energy overall.

We all want to live with more calm and ease, yet unfortunately, many of our ingrained habits can produce the opposite. Mindfulness is the practice of observing, discovering, and letting things be as they are; it’s actually doing less than this all-too-usual default mode of being busy and constantly productive.

I’m one of those people that loves self-distraction, getting things done and crossing them off my to-do list, seemingly so I can relax after. Maybe you can relate? A long to-do list can make me anxious, especially if I’m not mindful and attentive to my inner state. At least that’s one of my main default mindsets.

The unfortunate truth is that I don’t usually get to relax after unless I’m conscious, purposeful, and intentional. By default, my mind will usually want to focus on the next thing that will need to be completed or done. This leaves me in a never-ending loop of obsessive productivity that can all too easily burn me out and deprive me of joy after a while.

I know I’m not alone because I see similar patterns in others. This pattern is in fact all too rampant in the U.S. and many other Western nations. Here, we worship productivity. We have chased “productivity hacks”; many productivity gurus have millions of views on their videos.

Big tech companies have been profiting handsomely off our obsession with productivity, as I noted last year when I wrote about compulsive phone use. How do you feel when you know you know you have unread emails, texts, comments, and messages waiting for you? If you’re like most people, you probably feel uneasy. Ever wonder why there’s no “mark unread” feature on your iMessage app? Apple may want us to answer each other quickly—and may not mind that we feel anxious if we don’t. The more “plugged in” we are, feeling “productive” by answering people quickly, the more we’ll purchase hardware and software, and the more data they’ll collect to understand us and profit off us.

This post, then, is about bucking trends in tech, materialism, and other cultural norms and default emotional patterns that weigh on us, and taking the power of our minds, attention, well-being, and mental health back. So how do we do this?

An Ancient Un-Productivity Hack: Mindfulness

Well, we can start by stepping off the train of mindless, obsessive, and compulsive productivity, and let things be as they are more frequently, when possible. To do this, of course, we can use mindfulness. In this sense, mindfulness is more about unlearning than learning. You aren’t adding anything to your experience, just noticing what the mind is like when you aren’t lost in thought.

article continues after advertisement

Paradoxically, mindfulness meditation is essentially dropping everything to just notice what is already here. You’re actually doing less during meditation because no action is needed. As you realize and feel into this truth, you can protect yourself from compulsive productivity. In meditation, productivity-based obsessive thoughts reveal themselves as mere and transient appearances in consciousness.

Mindfulness is not about being peaceful or understanding concepts, it is about experiencing pre-conceptually more accurately and deeply. It’s knowledge by experiencing. It is an underused form of intelligence that can promote psychological freedom instead of the automatic productivity and burnout we’ve often promoted instead. After all, what’s the point of productivity if we’re not present and intentional in our being, and don’t live with sufficient simplicity, ease, joy, and patience?

The more we practice, the more we’re in charge of our productivity, and the less it is of us. This way, you can learn to only prioritize the tasks that are urgent, not the ones that you want to mindlessly cross off your to-do list, thus enhancing the quality and efficiency of everything you do and the joy it brings you. It’s ultimately about wise action and choosing what is best for us instead of automatic habits running our lives. Who and what do you want in charge of your life?