1.U.S. Stocks Trading at 52 Week Lows Increasing.

From Dave Lutz at Jones Trading

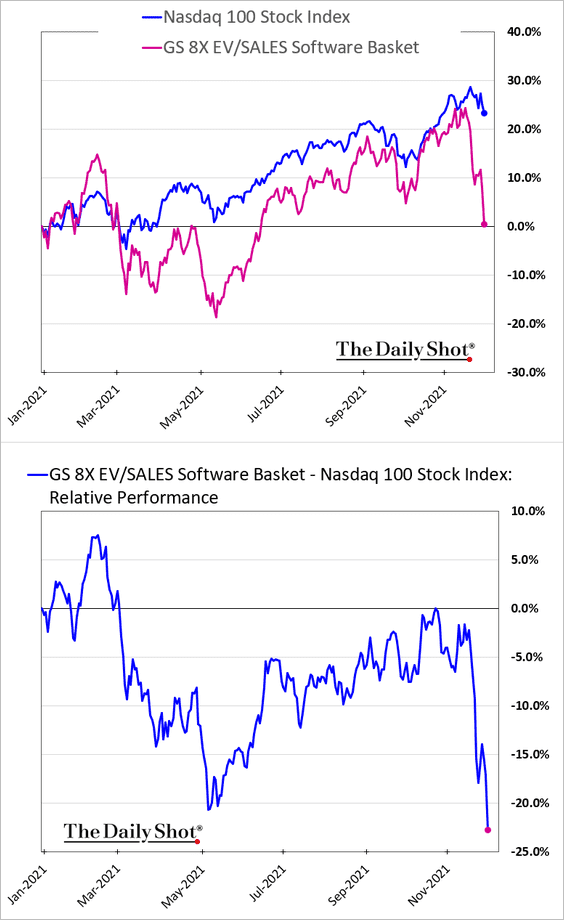

2.Funds are Dumping Most Expensive Stocks.

Equities: Funds have been dumping the most expensive tech shares..

The Daily Shot Blog https://dailyshotbrief.com/

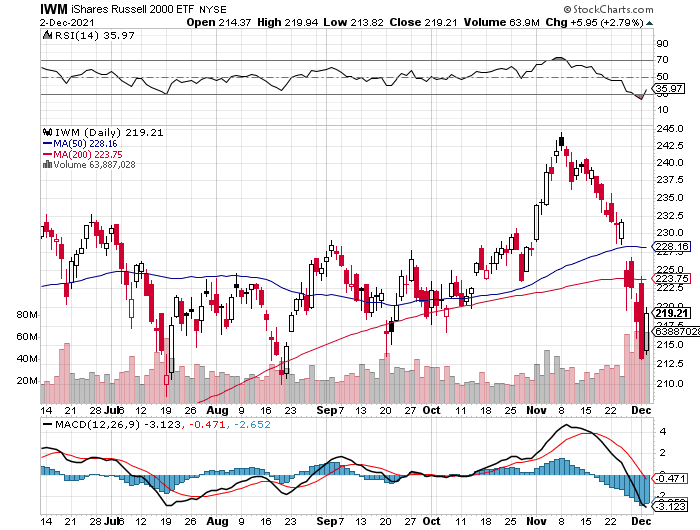

3.IWM Small Cap Quick -10% Correction

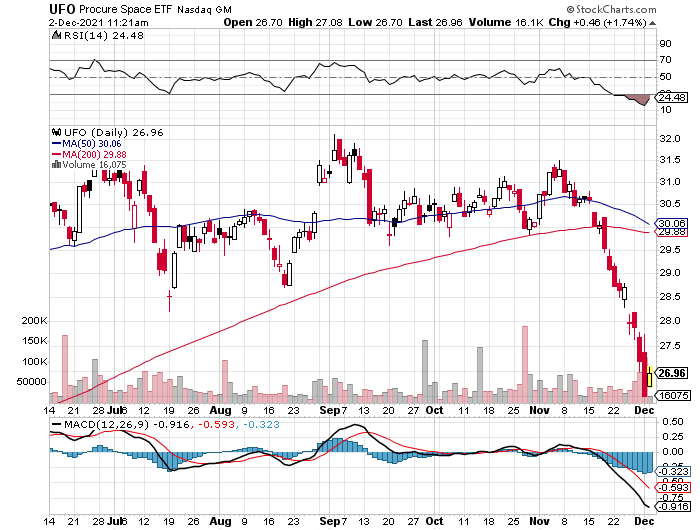

4.Following up on my Theme this Week of Speculative Bets Breaking Down.

UFO ETF -19% from Highs.

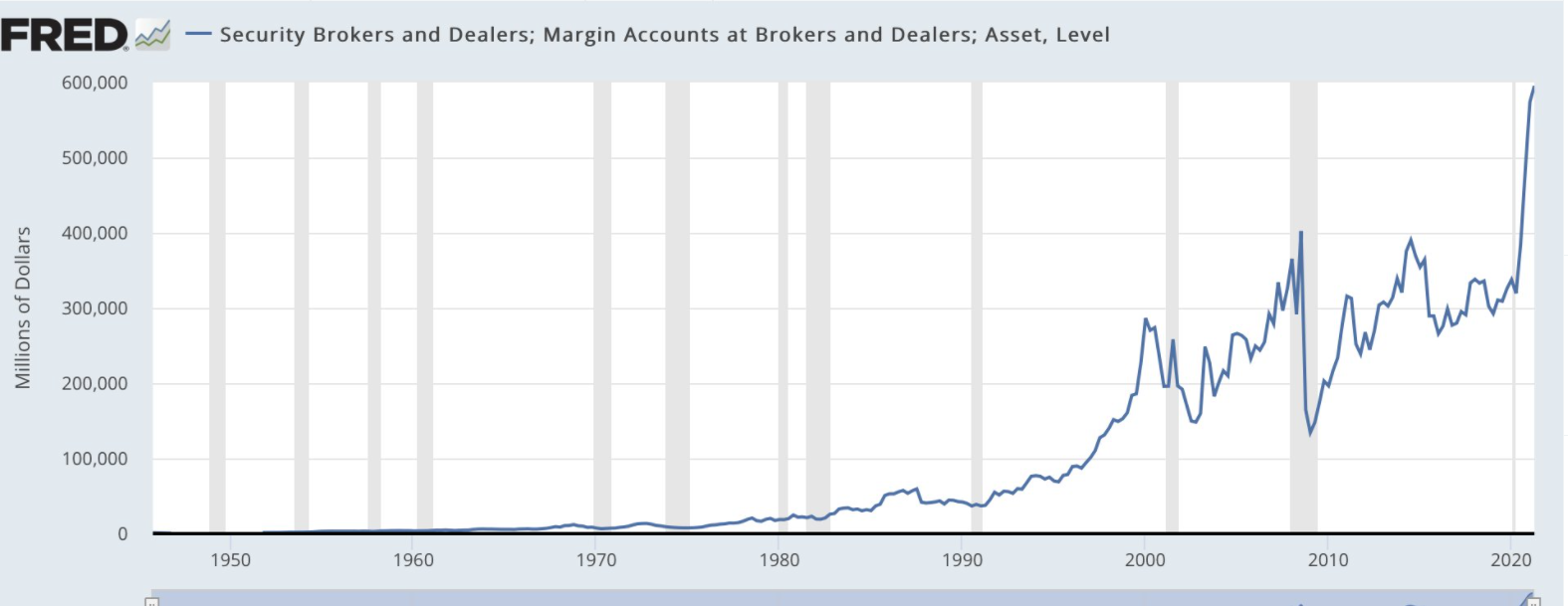

5.Margin Accounts at Brokers and Dealers….Hockey Stick

Herb Greenberg

https://twitter.com/herbgreenberg

6.Record selling by insiders is setting up stocks for a big fall, says contrarian investor

After a year of record stock buying on Wall Street, the message from forecasters for 2022 has largely been “keep at it.” This week, we heard from Goldman Sachs, which sees households and corporate buying driving the S&P 500 to a 5,100 finish by the end of next year, and Sanford Bernstein, who said buy stocks even if real yields normalize, which it says justifies high valuations.

A contrarian voice has been Morgan Stanley, who is telling clients to resist buying U.S. stocks. From that same neck of the woods, our call of the day from the True Contrarian blog and newsletter’s chief executive, Steven Jon Kaplan, has a warning for investors who have been piling into this market.

“People are really underappreciating the degree of risk that they’re taking because now that we have — especially for the really big megacap names — even greater overvaluation than we’ve had before, the downside risk is extremely high,” Kaplan told MarketWatch in an interview on Wednesday.

While a year ago Kaplan predicted a big selloff that didn’t really materialize, he notes 2021 was “unusual” with stock inflows not seen in 20 to 50 years, depending on whom you ask, that kept markets propped up. So the biggest and strongest companies kept rising and the rest went sideways.

For 2022, he sees those highflying stocks falling hard and possibly panicking inexperienced investors. That is because “anybody who’s 30 years old or younger, the last time we had a bear market, they were in high school or even earlier grades so they don’t even have the experience of knowing what it’s like to invest in a bear market,” Kaplan said.

Among the warning signs, he highlights a favorite indicator of his — selling and buying by company insiders, which he tracks via J3 Information Services Group.

“We’ve had all-time record levels of insider selling meaning that the top executives, the people that are the most experienced investors in the world, have been pretty much spending all year getting rid of their stakes in some cases and unloading huge amounts of shares they have accumulated for decades,” said Kaplan.

For example, the chairman of broker Charles Schwab SCHW, +4.69% who has been selling all year — the stock is up 50% — and of course Tesla TSLA, -0.95% CEO Elon Musk has dumped over $8.8 billion — shares are still up 54%. Billions have been sold by the heads of Apple AAPL, -0.61%, Facebook parent Meta META, +1.79% and Amazon AMZN, -0.18% this year.

“So I think that the people that have the most knowledge are the most worried about a drop and people that have the least experience in some cases, maybe just started trading in the past year or so, consistently, are the most aggressive and the most optimistic about what’s going to happen,” Kaplan said.

“History has shown us that when you have that big a difference in opinion from the most experienced to the least experienced people that the most experienced ones always come out on top,” he said, adding that the opposite has also held true with big insiders buying at crucial moments, such as in March 2009.

One sign that those investors are trying to position more conservatively could be driving dollar DXY, +0.11% gains this year, he added.

As for what it will take to normalize price earnings ratios that are on average about “triple where they need to be,” Kaplan said most stocks would need to drop two-thirds. But “when things are either above or below fair value, and they come back to fair value, they rarely stay at fair value. They normally keep going because when people start to see things dropping a lot, they start to panic,” he said.

For where to park some cash for the coming storm, Kaplan suggests investors look at I-Bond or Series I savings bonds that can be bought directly from the government and are currently offering a return of 7%.

“You can put up to $65,000 a year into those and for 30 years, you can just keep them in there and just let them keep collecting whatever interest that they pay, which keeps changing every six months,” he said.

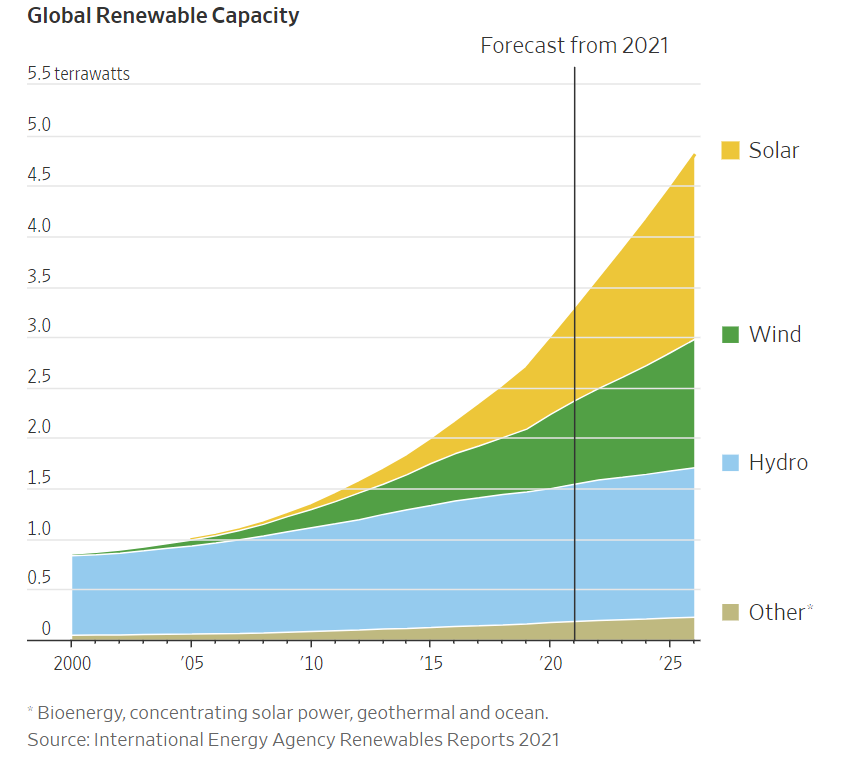

7.Record Year for Building Wind and Solar Farms….Costs Up Exponentially.

WSJ-Higher energy prices are a worry for consumers and central bankers this winter, but they have the odd benefit. Case in point: fueling the renewable-energy revolution.

This will be another record year for building wind and solar farms, according to a report published Wednesday by the International Energy Agency. About 290 gigawatts of generating capacity is expected to be installed, up 3% on an exceptionally strong 2020. The trend should continue with an average of 305 GW forecast annually through 2026.

The investment comes despite much higher costs. In the past two years, freight rates have risen nearly sixfold, the cost of polysilicon used in solar panels has more than quadrupled, and prices of steel, copper and aluminum—big inputs for panels, turbines and electrical connections—are up by half or more.

By Rochelle Toplensky

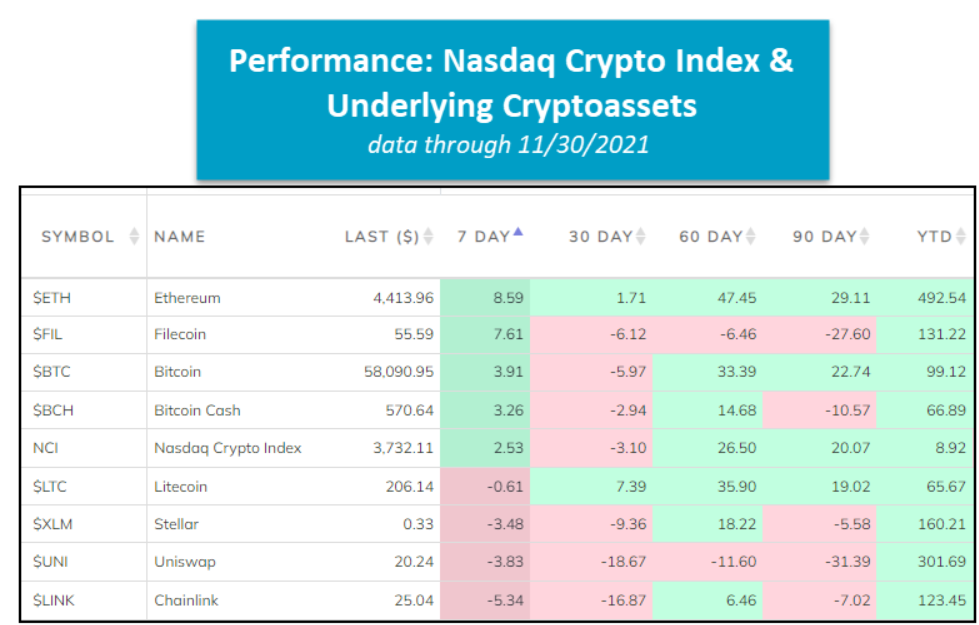

8.Nasdaq Crypto Index Performance.

Underlying Holdings Naz Crypto Index-Dorsey Wright

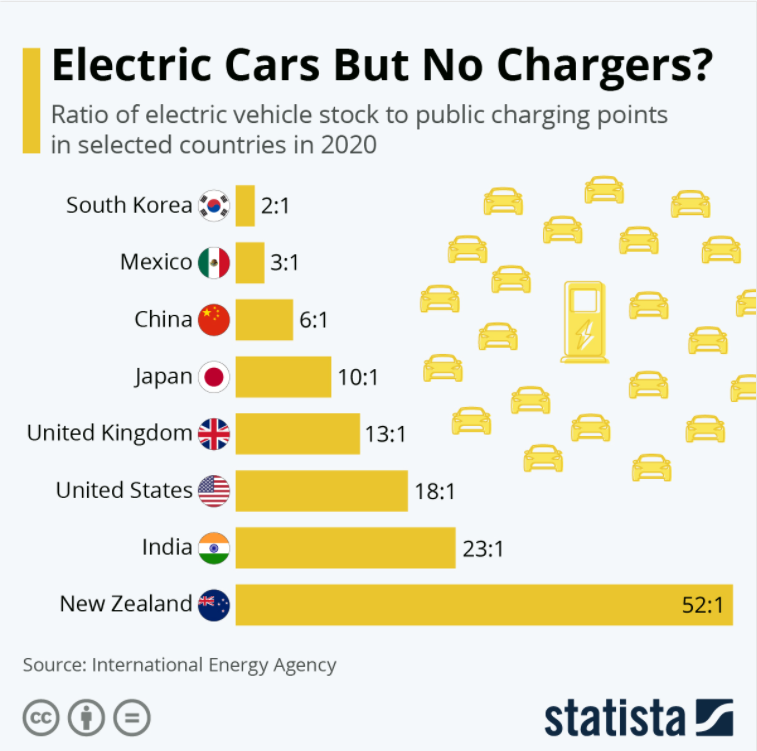

9.Electric Cars But No Chargers?

https://www.statista.com/chart/26325/ratio-electric-vehicles-to-public-charging-points/

10.The 5 Ethics of Life You Need to Know About

I recently read the 5 Ethics of Life from The Wise You. I believe these 5 principles offer a great deal of wisdom for living a very successful life.

1. Listen Before You Speak

Every successful person I have ever worked with has developed the ability to listen.

I was directing a basketball clinic in New York and went to dinner with a high school coach and the legendary UCLA coach, John Wooden. Coach Wooden’s UCLA teams won 7 NCAA National Basketball Tournaments in a row and 10 in the last 12 years he coached. I don’t think either of these feats will ever be eclipsed.

If you had been at that dinner and you thought speaking was the key to intelligence, you would have thought the high school coach was John Wooden and Coach Wooden the high school coach. The high school coach did most of the talking and one of, if not the best, team coach in the history of American sport did most of the listening.

My daughter, Colleen, is a lawyer who worked exclusively in the Hedge Fund industry. She often had to negotiate contracts where a great deal of money was on the table. So, everyday when she opened her computer, she read this quote, “I won’t learn anything today by talking; but I will learn today by listening.”

2. Earn Before You Spend.

I worked at a university where budgets were quite tight. When we needed more dollars in our athletic individual sport budgets or to expand something for all our sports, we were often told to earn or fundraise the money needed. I was involved with both these areas as I was the basketball coach and the athletic director/chair.

To better serve our student-athletes we needed to expand our weight room. Many of the athletes we recruited were from high schools where the weight rooms were bigger and better than what we had at our university. To accomplish this expansion, we had to raise the money. We reached our goal through the initiation of a golf outing that continues to serve athletics today.

The same problem existed with our basketball budget. Our budget was inadequate to serve our players the way they deserved to be served. Once again, we had to earn the money before we could spend it. So, we started a clinic for Chicago area coaches. The clinic enhanced our budget by 38%.

It would have been nice to be given the money for these two necessities, but by earning the money before we could spend it, we were very judicious in our spending.

“To succeed in life, you need three things: a wishbone, a backbone and a funny bone.” – Reba

3. Think Before You Write.

I believe I learned two valuable lessons from two good friends on thinking before writing.

My first lesson came from a very successful businessman. His advice was that it was okay to write about something you were angry about. However, don’t send it that day. His wisdom was to read it the next morning when you had cooled off, tear it up, and then rewrite it.

My second important lesson was directed to the writing segment of thinking before you write. A successful college administrator taught me this. As a leader you often have a colleague come to you with an idea he is excited about. If you begin talking about it at that moment, that conversation may end up taking two hours of your day.

Instead of talking about it when he/she brings their idea to you, tell them to put it in writing, bring it back to you, and the two of you will discuss it. This philosophy makes them think before they write. Their new concept(s) will be more concise and more organized when they come to the discussion.

One other thought about people interrupting your day with their ideas. A professor at Notre Dame said he complained for 25 years that he could get little done at work because of all the interruptions. Then in his 26th year, he realized the interruptions were his work.

Leaders must listen to the interruptions because they are important to the people bringing them. However, you benefit both them and you when you tell them to think, then write.

4. Try Before You Quit.

Thomas Edison is said to have failed in 10,000 experiments before he founded electricity. He must have had a strong FQ – Failure Quotient. He could and did fail often but he had the resiliency to keep getting back up.

Abraham Lincoln, considered by many to be one of, if not the best, president in American history, lost the great majority of all the elections he ran in before being elected president. Like Edison, he had a strong FQ.

The movie, RUDY, may be the best example of combining trying with a strong FQ that I have seen in my lifetime. I know Rudy Ruettiger quite well and the movie accurately portrays the many obstacles he had to overcome to get admitted to Notre Dame and to become a walk-on with the football team. I am positive he was the only person in his life who believed he could accomplish either dream!

It is easy to quit; it is tough to try, most especially when the odds are not in your favor.

The title of the Reverend Robert Schuller’s outstanding book represents the most important concept in trying – Tough Times Don’t Last but Tough People Do.

5. Live Before You Die.

I was fortunate to be asked to present basketball camps and clinics in some European countries. These events presented great opportunities for me to live before I died.

This travel offered me a great learning experience. One of the best parts of these trips was how educational they were. They brought me to places I never would have seen in my lifetime were it not for basketball.

In Belgium coaches took me to Ardennes where one of the most important battles in World War II was fought, The Battle of the Bulge. After the Allied Forces won this battle, the Germans retreated for the rest of the war. I will never forget looking at the pillars which listed all the states where American soldiers who were killed in that battle lived.

In Ireland I saw the beauty of the Ring of Kerry and the extraordinary Cliffs of Moher, but it was the warmth and the incredible hospitality of the Irish people that I remember most.

In Austria the coaches brought me to a concentration camp. Although I had read a great deal about the holocaust, I was not prepared at all for what I saw. It was the most eerie feeling I have ever had in my life. It is unbelievable that the Nazis could even think of, let alone do, the atrocities that were done in that camp and camps throughout Europe.

In Greece I went to the Acropolis. There are no tall buildings in Athens because from ever building the Acropolis must be seen. It was a long walk to the top, so I asked the coaches how did the workers carry all the marble to the top of the hill when they were building before the life of Christ? Their answer was – SLOWLY!

When we traveled with our team throughout the United States, we tried to have our players live before they died. They had the opportunity to go to Cooperstown in New York: Fenway Park in Boston; the Grand Ole Opry in Nashville; the Mormon Tabernacle Choir in Salt Lake City; Juarez, Mexico while playing in El Paso; skiing in Colorado; and the Golden Gate Bridge in San Francisco to name a few. Our trips were much more than basketball.

Final Thoughts

These 5 Ethics or principles can lead to a most successful life:

- Listen. Before You Speak.

- Earn. Before You Spend.

- Think. Before You Write.

- Try. Before You Quit.

- Live. Before You Die.

https://addicted2success.com/