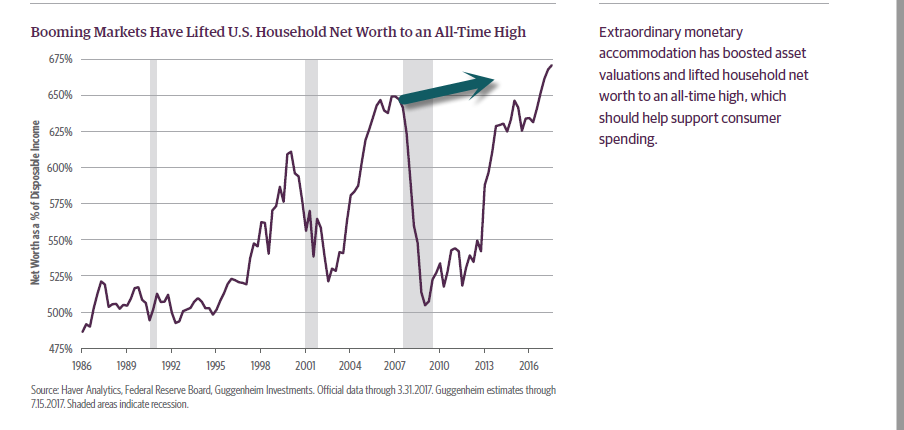

1.U.S. Households Net Worth to an All-Time High.

https://www.guggenheimpartners.com/cmspages/getfile.aspx?guid=8db18c30-ea6a-4b35-9e5f-cc00f7bba3df

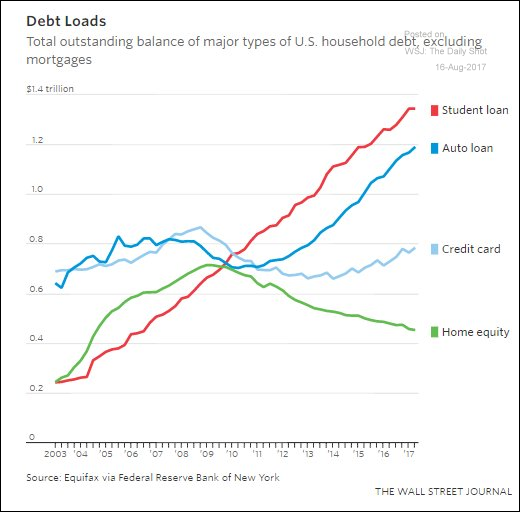

2.Post-Crisis Picture of Household Debt

The United States: This chart shows how consumer debt balances were impacted by the Great Recession.

Source: @WSJecon, @josephncohen; Read full article

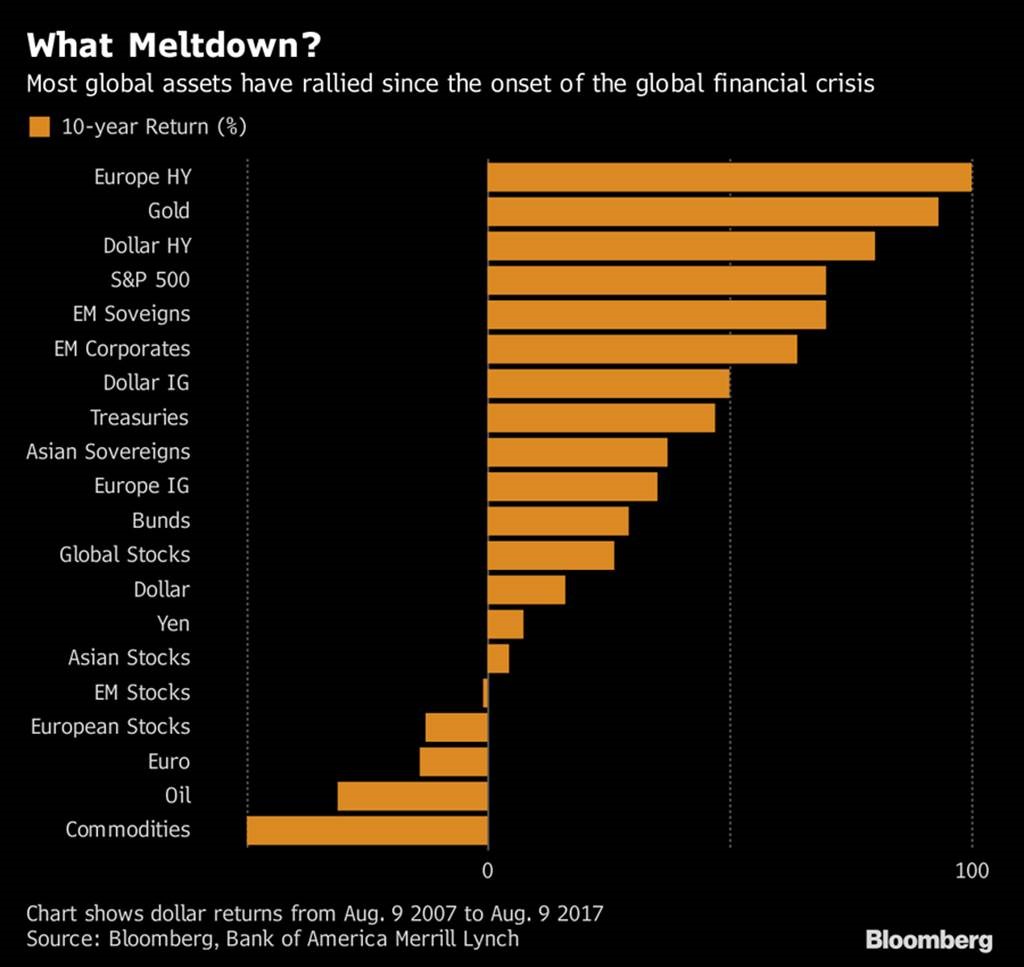

3.Euro High Yield Bonds Highest Return Since Financial Crisis??

European junk bonds posted highest returns after financial crisis

Investors who bought high-yield corporate debt made 100% on their money over the last 10 years

Aug 15, 2017 @ 12:41 pm

If you’d bought European high-yield bonds the day the global financial crisis erupted, closed your eyes and held onto them through the unprecedented events of the following decade, you would now be sitting on a 100 percent return.

On the other hand, if you’d put your money in most major commodities, other than gold, you would have lost 50 percent. The euro and European stocks would have handed you a loss, but most bond markets, U.S. stocks and the dollar would have been a good bet.

Bond markets subsidized by the world’s largest central banks with asset-purchase programs that swelled to almost $14 trillion may help explain why debt to Europe’s most leveraged companies came out on top. With European Central Bank President Mario Draghi promising to do “whatever it takes” to hold together the euro zone, investors were emboldened to lend to the riskiest companies while yields on government debt turned negative.

4.S.Korea only a Blip Down on N.Korean Threats….2017 EWY (s.Korea)+25% vs. S&P +9%

S.Korea ETF not much of a pullback

S.Korea vs. S&P

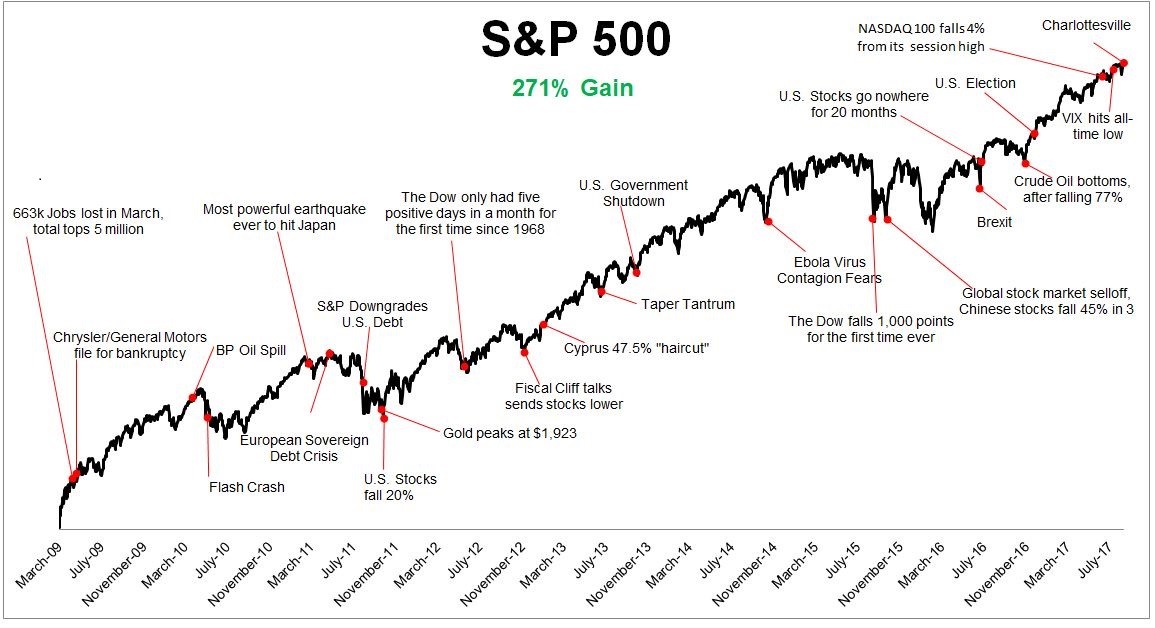

5.Great Snapshot of Stocks Resiliency in this Bull Run.

This is the ‘wall of worry’ that stocks have climbed to rally 271% since 2009

By Sue Chang

Stocks have not been this resilient since 1965

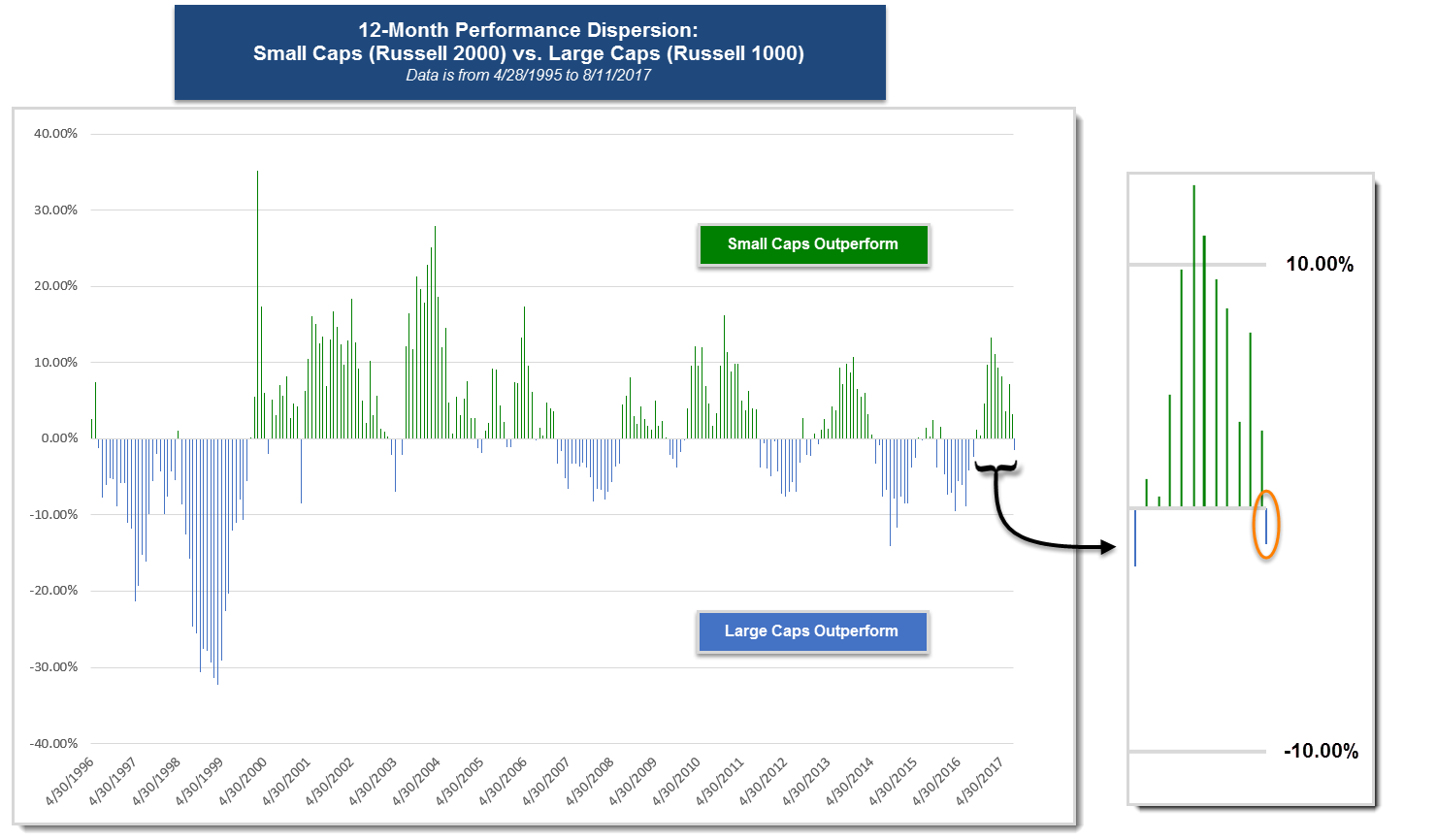

6.Follow Up to my Comments Earlier in the Week Regarding 2017 Large Cap Dominance.

From Nasdaq Dorsey Wright

So far during 2017 Large Caps have outperformed Small Caps as the Russell 1000 Index RUI has gained 9.85%, compared to the 1.92% by the Russell 2000 Index RUT (thru 8/15/2017). This is a bit of a switch from last year as Small Caps were the dominate market cap group and the Russell 2000 gained 19.48%, compared to 9.70% by the Russell 1000. To examine this relationship further we compiled the 12-month rolling returns for the Russell 1000 and 2000 indices beginning in April of 1996. In the graph below, the columns colored green are periods in which Small Caps outperform Large Caps, while columns colored blue indicate outperformance by Large Caps over Small Caps (or underperformance by Small Caps compared to Large Caps). In the pop-up to the right of the graph notice that the most recent rolling 12-month period was one in which Large Caps outperformed by roughly 1.5%. This is the first time since August of 2016 that Large has outperformed Small. In the bullet points below we have provide some additional interesting observations.

Observations:

- During the study period, Small Caps have outperformed Large Caps 56% of the time.

- Within the past 10 years there haven’t been many instances, other than two, where Large Caps have outperformed by more than 10% in a given rolling 12-month period. Conversely, Small Caps have outperformed Large Caps by more than 10% in 7 rolling 12-month periods.

- Looking back through the late-1990s and there were 22 rolling 12-month periods in which Large Caps outperformed Small Caps by more than 10%. Meanwhile, from 2000 to 2005, Small Caps had 27 rolling 12-month periods in which they outperformed Large Caps by more than 10%.

7.Alibaba Good Numbers….1 Yr. Outperformance vs. FANG Stocks.

BABA big outperformance versus tech giants

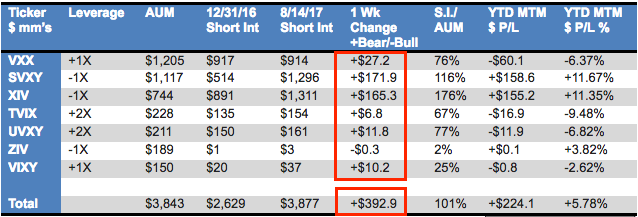

8. Traders have added $393 million in bearish VIX exposure over the past week

Traders are doubling down on one of the market’s hottest trades

Traders are doubling down on volatility bearishness. Scott Olson/Getty

You’d think last Thursday’s stock market shock would have investors betting on more price swings.

The opposite has happened.

Traders are instead using the 44% single-day spike in the CBOE Volatility Index — or VIX — as a reason to pile into wagers that the measure will come back down.

Using exchange-traded notes, they’ve made their exposure $393 million more bearish on the VIX over the past week, according to data compiled by financial analytics firm S3 Partners. In other words, they’re betting that stocks will revert back to the listless, sideways trading that’s characterized so much of the action in 2017.

One place traders are looking is the VelocityShares Daily Inverse VIX Short-Term ETN, which amounts to a direct short bet on the fear gauge. It’s surged a whopping 81% year-to-date, and investors have added roughly $165 million of exposure over the past week.

These traders are “looking for the VIX index to continue declining from its recent year-to-date high and settle back nearer its 10.79 July/August average,” Ihor Dusaniwsky, managing director of predictive analytics at S3, wrote in a client note.

Traders have added $393 million in bearish VIX exposure over the past week. S3 Partners

http://www.businessinsider.com/vix-short-volatility-bets-traders-doubling-down-2017-8

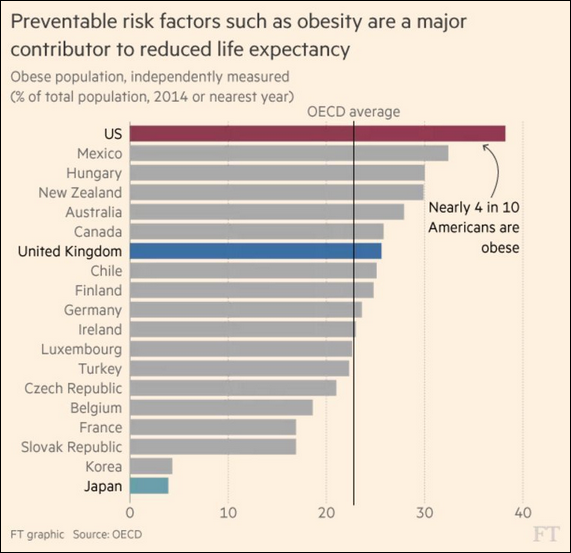

9.Almost 4 in 10 Americans are Obese.

Food for Thought: Obesity around the world.

Source: @FT, @PlanMaestro

10.How to Manage Your Emotions

The life lesson we should have been taught at school

Posted Aug 14, 2017

We all suffer from emotional overreactions. In the heat of the moment we say something to a person we love without stopping to consider the shockwaves. Or we blast off an email and wonder why we didn’t sleep on it before pressing ‘Send’. Our emotions spill over and, by the time they recede, the damage is done.

There’s no denying that this kind of behavior is on the rise. In the public domain, barely a day passes without newspapers splashing the story that a comment, tweet or email has caused an uproar. Demands are made for heads to roll, and responses range from retractions (‘I apologise unreservedly for my lack of judgement …’) to defiance (‘This is a ridiculous case of political correctness…’). And then the next story breaks.

The converse situation is that we feel gripped by fear or anxiety and fail to seize the moment to speak up or act according to our values. The consequences of freezing can be just as deleterious, and sometimes more so, than overreacting. Either way, managing our emotions is a tricky business.

When we look back on these situations our stock explanation is, ‘My emotions got the better of me’. But this raises a serious question: am I in charge of my emotions, or are they in charge of me? Nobody asked me this question at school, or told me the answer. Consequently I stumbled into the adult world with a royal flush of emotions – ranging from joy and excitement to fear and anger – without a manual for how to live with them.

The truth is that we’ve ended up with a tangled mess of advice in this area. Much of the prevailing literature tells us to squash negative emotions and replace them with positive ones. Other experts tell us this is tantamount to putting icing on dog food and calling it cake. So which, if any, is right?

To navigate through this emotional battleground, some important distinctions need to be made:

- We cannot turn emotions on and off like a tap. They will come and go whether we like it or not. Once this is clear in your mind, you can stop waiting for unwanted emotions to go away. The idea that we can banish them is unhelpful and doesn’t hold up to scrutiny; they are part-and-parcel of the human experience. Besides, the more we strive to live according to our values and commitments, the more our emotions will rise up to challenge us.

- Emotions aren’t positive or negative. The human brainis wired to categorize things as positive or negative, and is particularly alert to threats. This made good evolutionary sense for our ancestors, who learned to react to external threats for the purposes of survival. As humans developed language, we employed the same process of classification to our internal state, including our emotions. Thus we see joy as positive, and therefore welcome, and fear as negative and unwelcome. However, this creates new problems. On the basis that ‘what we resist persists’, suppressing emotions that we perceive to be negative only tightens their grip. So what’s the alternative? If we can experience the full range of human emotions without attaching positive and negative labels to them, the result can be hugely liberating. Take Dame Judi Dench as an example, who has won one Oscar, two Golden Globes and 10 BAFTA awards. She says that the more she acts the more frightened she becomes. In contrast to thousands of aspiring performers who are waiting for the day when they’ll overcome their fear, she treats it as a companion rather than an enemy. This is not to say that she finds her fear comfortable, but she makes no attempt to resist it, and therefore it doesn’t define her. ‘I have the fear,’ she says. ‘I wouldn’t be without it.’ Perhaps this is why her on-screen characters brim with humanity.

- You are not your emotions. Emotions are, by their very nature, strong. However, it’s important to get clear that you are not your emotions. You are a person with values and commitments who happens to have emotions that are triggered on a regular and ongoing basis. This point might seem semantic, but it isn’t. When we become fused to our emotions – thinking that ‘they’ and ‘we’ are one and the same thing – we are effectively hijacked by them. If you can notice emotions without becoming them, they no longer determine your behavior.

- We always have a choice. A thought or feeling in itself doesn’t prevent you from taking any action. It’s easy to think, ‘I’m frightened and can’t speak’, but this is a trick of the mind. It would be more accurate and authentic to say, ‘I’m frightened and I’m choosing not to speak.’ Being able to observe our emotions – even when they feel overwhelmingly powerful – creates a space in which we can reference our commitments and values. While we cannot always choose our emotions, we can choose our response to them. This gets to the heart of responsibility, and responsibility is probably the closest thing to a superpower that human beings possess.

For more in depth information, see my books ‘Blamestorming: Why Conversations Go Wrong and How to Fix Them,’ and ‘Work storming: Why Conversations at Work Go Wrong and How to Fix Them’. Both are published by Watkins.

To subscribe to future blogs, visit http://www.robkendall.co.uk

Follow me on Twitter@Rob_Kendall

https://www.psychologytoday.com/blog/blamestorming/201708/how-manage-your-emotions