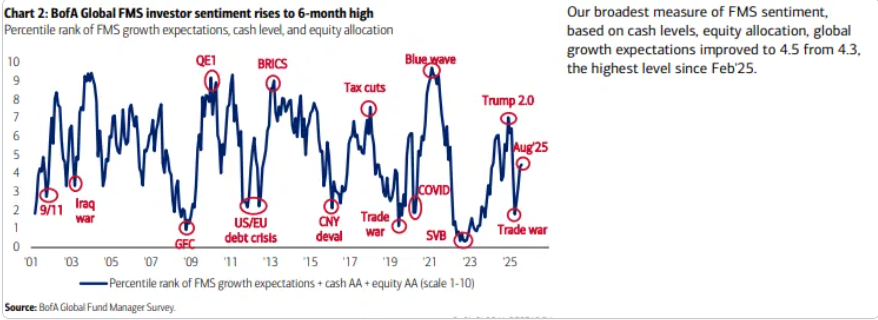

1. Sentiment Rising But Not Near Previous Tops.

https://business.bofa.com/en-us/content/market-strategies-insights.html

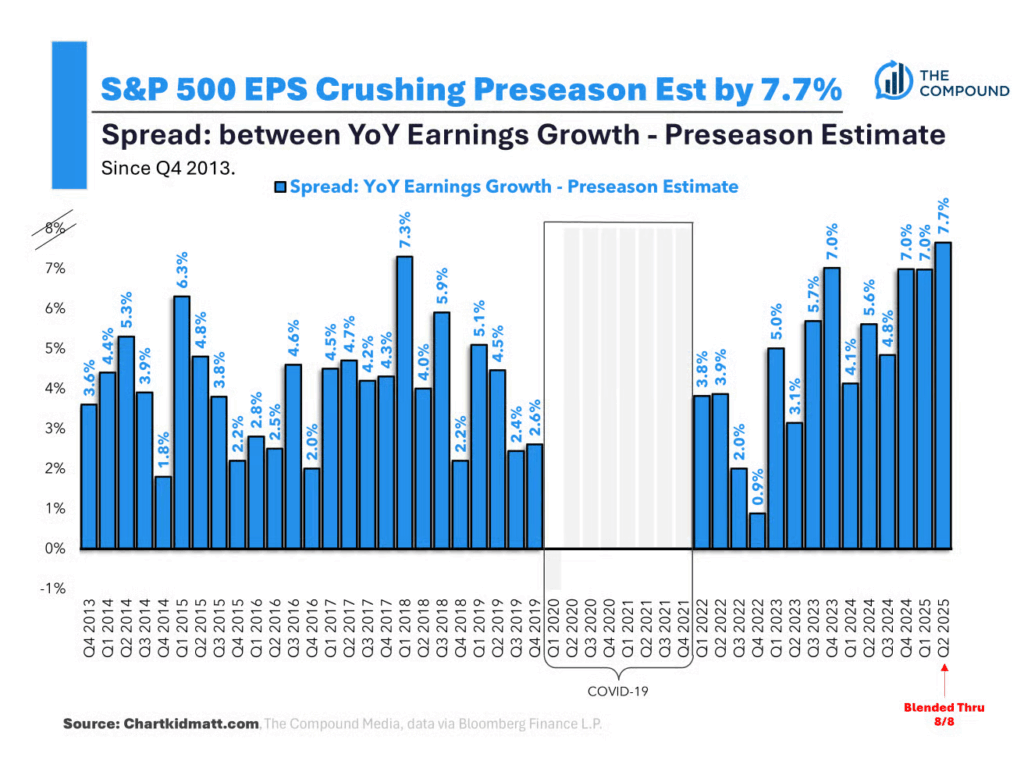

2. Earnings Surprises Quadruple Preseason Estimates.

Earnings surprise. “Q2 earnings are nearly quadrupling preseason estimates.”

Matt Cerminaro – Chart Kid Matt

https://www.dailychartbook.com

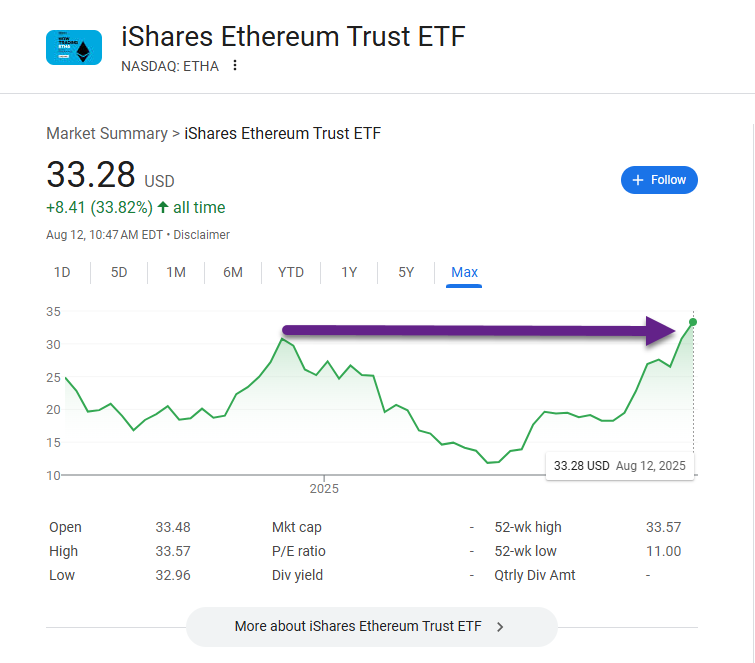

3. ETHE Ethereum ETF All-Time Highs.

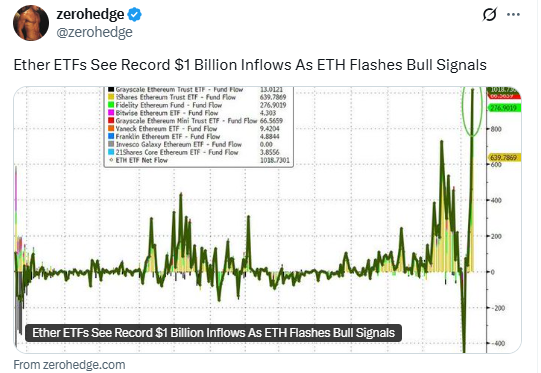

4. Ether Sees $1B Inflows to ETFs

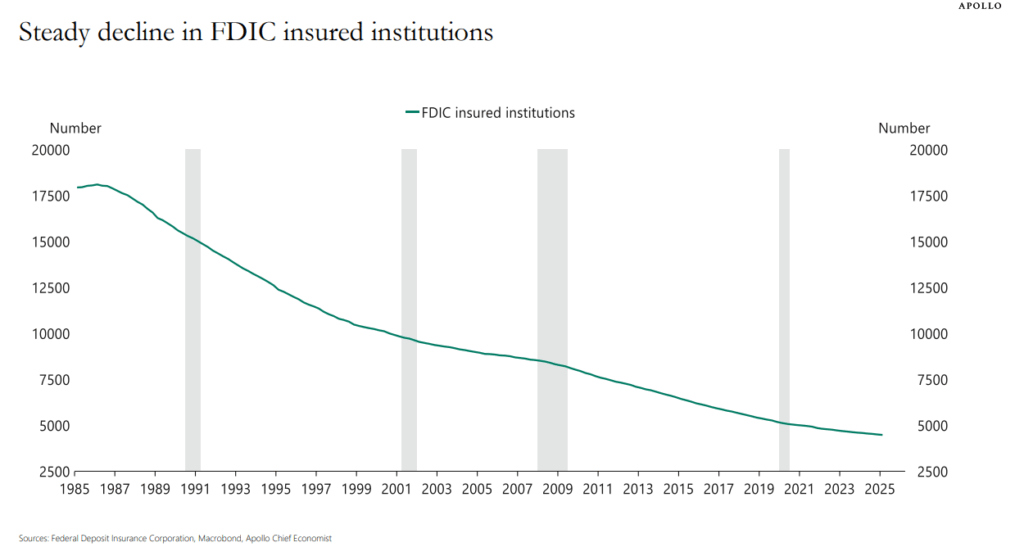

5. Banks Playing a Smaller and Smaller Role-Torsten Slok Apollo

https://www.apolloacademy.com/the-daily-spark/

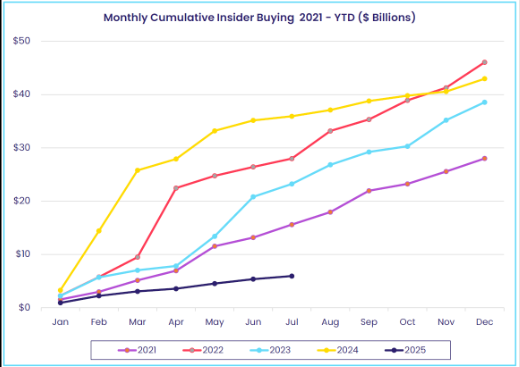

6. Insider Buying Another Look vs. Last 5 Years.

Dave Lutz Jones Trading But Insider buying has plunged this year, with corporate executives showing more caution than the broader investor pool who have driven markets to record highs, Bloomberg reports. Insider purchases totaled just $6 billion in 2025 through July, the slowest pace in eight years, according to data from EPFR Global.

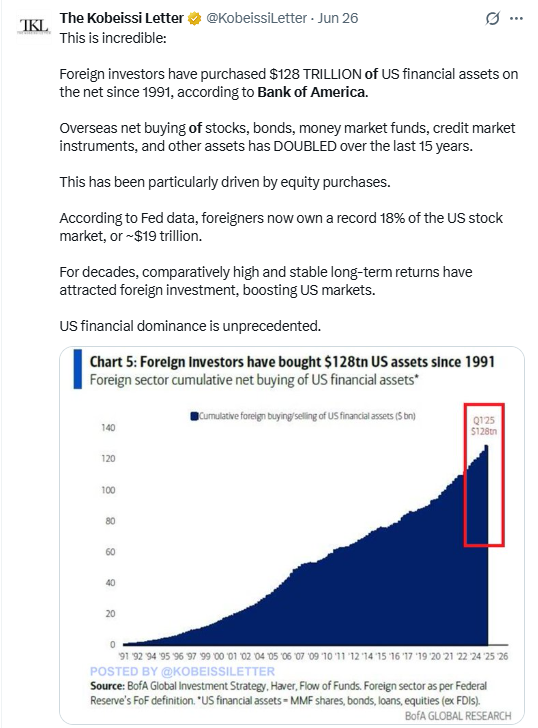

7. Overseas Buying of U.S. Assets Has Doubled in Last 15 Years.

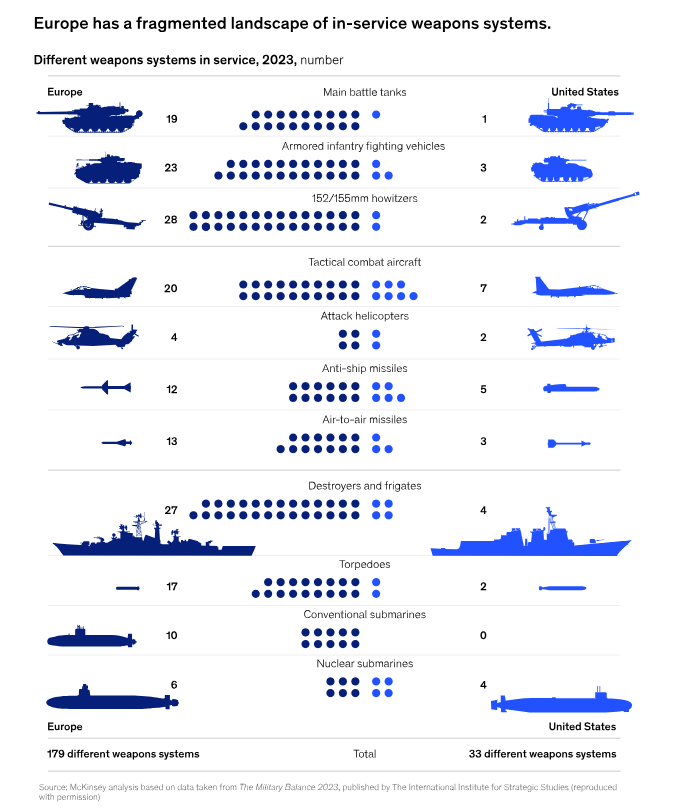

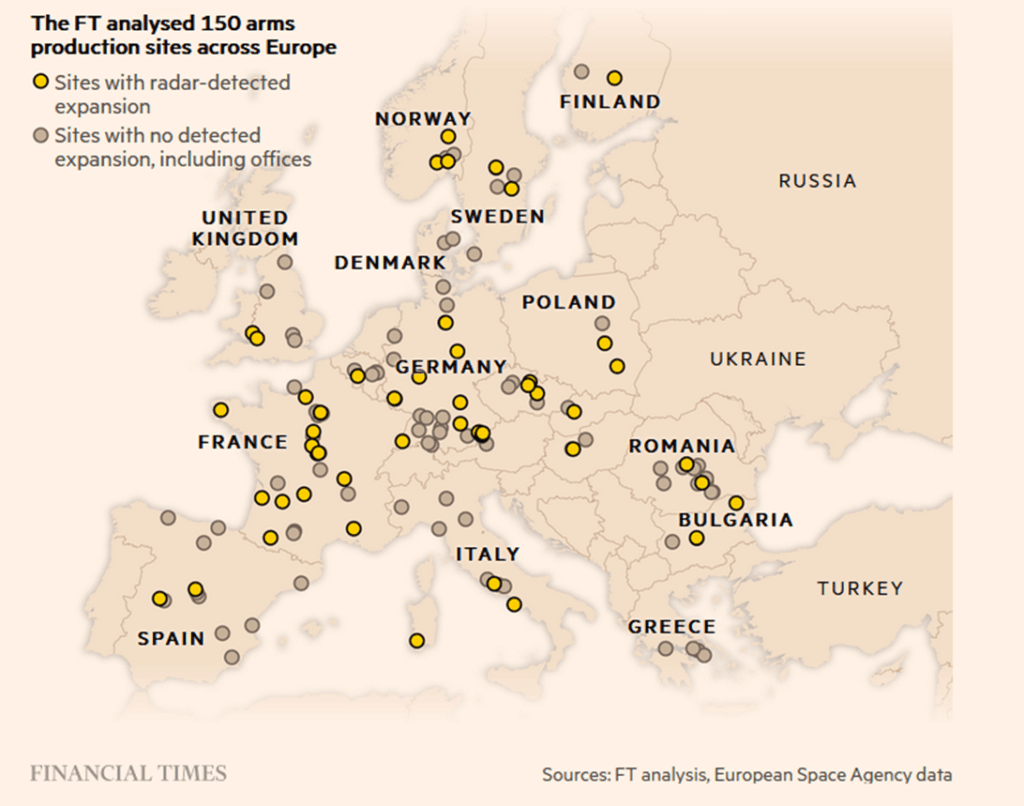

8. 179 Weapons Systems Supplying Europe Military vs. 33 for U.S.

Barrons The result is a hodgepodge of 179 weapons systems supplying European militaries, compared with 33 in the U.S., where the top four contractors soak up more than half of Pentagon procurement, according to Morningstar research. “Joint procurement will be the key to expanding Europe’s defense base,” Muharremi says. https://www.barrons.com/articles/europes-defense-stocks-cool-2-buck-trend-1dc8e6c2?mod=past_editions

9. Arms Production Across Europe

https://www.ft.com/content/ce617187-43ed-4bec-aebf-b1b346c4cfb1

10. Top 60 finance and investing blogs in 2025

Looking for the best finance blogs to follow in 2025? Whether you’re a retail investor, finance professional, or just curious about markets, this curated list of 60 top finance and investing blogs offers deep insights across macro, stocks, tech, and more. These blogs are carefully selected for their originality, consistency, and thought leadership — from hedge fund managers to fintech insiders. Updated regularly by Snippet Finance.

You can find the whole list in the Content Hub where it is regularly updated. There, the blogs are categorized, you can rate them, and add any you think we missed.

Want bite-sized insights from these blogs? Subscribe to Snippet Finance and get curated highlights twice a week.

To discover the 60 best finance and investing blogs, keep reading. Note these are not in order of best to worst but simply the 60 best.

1. Net Interest

Category: Financials

Smooth, insightful, and effortless writing on everything and anything related to the financial sector.

2. Bits about Money

Category: Financials

Go deep on the most important financial topics.

3. This Week in Fintech

Category: Financials

Don’t miss a beat in fintech.

4. Rupak’s Substack

Category: Financials

An insider’s view, from plumbing to hedge funds.

5. Bps and Pieces

Category: Curation

A trial of papers, from industry and academia, on how to invest better across asset classes.

6. Hamilton Lane – Weekly Research Briefing

Category: Curation

A tour of the markets every week.

7. The Big Picture

Category: Curation

The original – look out for the 10 links.

8. Not Boring

Category: Tech

The bright side of tech and crypto.

9. The Generalist

Category: Tech

Come for the future, stay for the community.

10. Digits to Dollars

Category: Tech

Leave the semiconductor sector to the experts.

https://snippet.finance/top-60-finance-and-investing-blogs-in-2025/ from Abnormal Returns Blog www.abnormalreturns.com