1. July Equity Inflows Surpass Previous Record by 50%

Zero Hedge- The public buys the most at the top and the least at the bottom.

Like it or not, retail investors, aka the public, are often called dumb money. Take it for what it’s worth, as the saying was made by professionals or so-called smart money.

Bob’s rule is logical as the public is usually more susceptible to psychological factors. Greed often gets the best of us. Think about how hard it is to sell a stock when it’s up 50%. At such times, investors are loathe to sell it because greed accentuates our FOMO (fear of missing out) on additional profits.

Smart money is equally susceptible to greed, but they often have risk management guidelines that limit their risk-taking ability.

Fear works similarly. An adage on Wall Street says investors are the only type of consumers that do not want to buy when prices go on sale. The fear of even lower prices is powerful, especially in larger routs when valuations make sense again.

Currently, retail investors are having a field day. Per JP Morgan, courtesy of Zero Hedge:

“The estimated retail investor net flow into US equities and ETFs from this methodology has been hovering at a very high $700mn per day pace in recent weeks (including the week ending July 30th). As a result, the monthly net flow for the month of July rose to a new record high of $15bn, surpassing the previous record high of $10bn in June by 50%!”

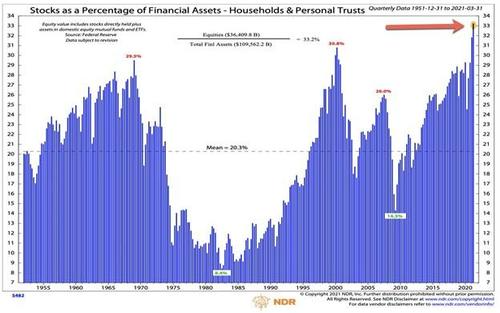

The graph below shows the public has more invested in this market than any time in at least 70 years!

Read Full Article on Bob Farrell’s Rules

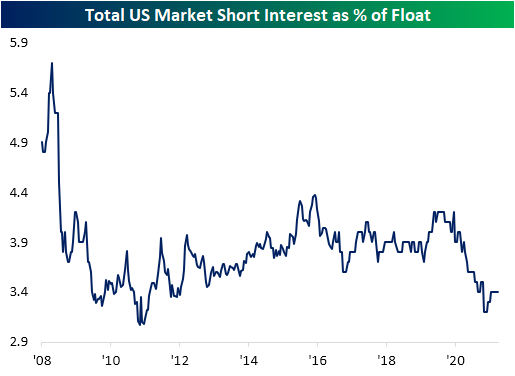

2. At the Same Time Short Interest at Record Lows.

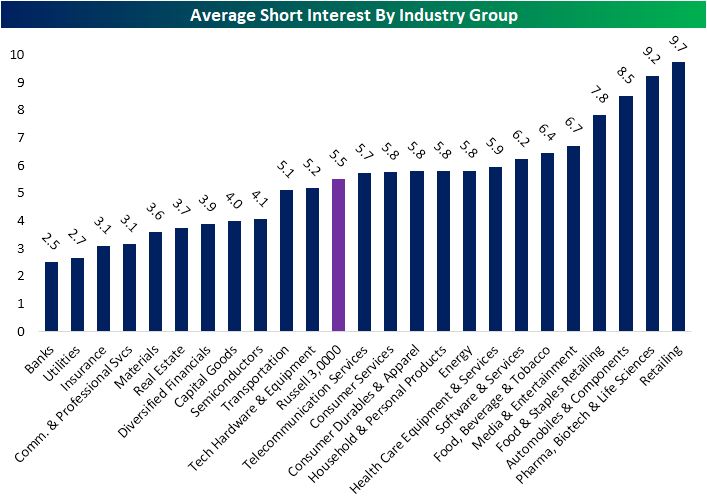

Bespoke-Taking a look at what are currently the most heavily shorted stocks in the Russell 3,000, retailers take the top spot with the average stock having a 9.7% short interest as a percent of float. Pharmaceutical, Biotech, and Life Science stocks are the only other industry in which the average stock has a short interest above 9%. Autos in addition to Food & Staples Retailing are the other two sectors with notably elevated short interest. Conversely, Banks, Utilities, Insurance, and Commercial and Professional Services have a relatively low short interest versus the Russell 3,000 average of 5.5%.

https://www.bespokepremium.com/interactive/posts/think-big-blog/shorted-names-cool-into-the-summer

3. Why Tech Leads? Margins 2x Broad S&P

4. Zillow Stock -50% from Highs in Middle of Housing Boom

| Property listing websites have long been hot property themselves as getting people to browse pictures of homes they can, or (even better) can’t afford, has turned out to be a hugely lucrative venture. The business model for property sites is usually pretty straightforward, with some combination of advertising, marketing and commission fees keeping the website lights on. For years, those kinds of services turned Zillow into a billion dollar business, and the largest property site in the US. Then, a few years ago, Zillow decided it wanted to get into a new line of business — house flipping. Huge scale house flipping Armed with more data than probably any other institution has ever had on homes in the US, Zillow began buying homes in 2018, hoping to make modest renovations and sell the houses on later for a higher price — a classic house flipping technique more common with individuals who have watched too many home renovating TV shows. Last week Zillow gave an update on its home flipping side hustle, revealing that they had bought more than 3,800 homes in the last 3 months, as well as detailing what they spent, and made, on a typical transaction. According to Zillow the company spent an average of $322k on each home, spent $10k renovating it, $16k on selling, marketing and holding costs and sold each home for $370k — profiting just over $20k per home. So if Zillow wants to buy your house, ask for a bit more. www.chartr.com |

5. Global Inflation Rates.

https://twitter.com/charliebilello Charlie Bilello

6. Volumes of Goods Shipped by Truck, Car and Rail Return to Pre-Pandemic.

Cass Freight Index: U.S. freight volumes return to pre-pandemic levels in July, costs go higher-CNBC

Frank Holland@IN/FRANK-HOLLAND-B9657883/@FRANKCNBC

KEY POINTS

- The Cass Freight Index for July shows volumes of goods being shipped by road and rail in North America returning to pre-pandemic levels.

- However, the cost of shipping remains elevated, the report says.

- Freight shipment volumes were only 0.5% higher than in July 2019 but 15.6% higher than in the same period last year. Shipments declined 3% from June.

The Cass Freight Index for July released Thursday shows volumes of goods being shipped by truck, car and rail in North America returning to pre-pandemic levels, but the cost of shipping remains elevated.

Freight shipment volumes were only 0.5% higher than in July 2019 but 15.6% higher than in the same period last year. Shipments declined 3% from June.

Cass Freight Index

| July 2021 | Year-over-year chg | 2-year stacked chg | Month-to-month chg | Month-to-month chg (SA) | |

| Shipments | 1.177 | 15.6% | 0.5% | −3.1% | −3.1% |

| Expenditures | 3.510 | 43.1% | 22.7% | −5.9% | −4.8% |

| Truckload Linehaul Index | 147.200 | 13.4% | 6.9% | −0.8% | N/A |

Source: Cass Information Systems

7. Half of Infrastructure Bill Upgrading Transportation.

Liz Ann Sonders-Schwab

https://twitter.com/LizAnnSonders

8. Largest 3 U.S. Cities See Population Decreases.

Marketwatch-The largest three cities in the U.S., New York City, Los Angeles and Chicago, all had population decreases from 2019-2020, according to early Census projections.

Largest U.S. cities decline in population while smaller metrosgrowPhoenix grew 18% in the last 10 yearsPercent change of population estimatesSource: U.S. Census Bureau

https://www.marketwatch.com/story/if-working-from-home-becomes-more-permanent-migration-trends-will-shift-economists-say-11628087671?mod=home-page

9. WSJ-Crypto Hackers Stole More Than $600 Million From DeFi Network, Then Gave Some of It Back

Heist is one of the largest cryptocurrency thefts to date, on par with breaches at Coincheck in 2018 and Mt. Gox in 2014

By

Anna Hirtenstein

Hackers stole cryptocurrencies worth more than $600 million from Poly Network, a decentralized finance, or DeFi, platform, in one of the largest crypto heists of recent years. In a surprise turn, whoever stole the money then returned over one-third of the pilfered assets.

Poly Network, which uses digital assets for lending and other financial transactions, disclosed the hack in a series of Twitter posts Tuesday. Blockchain security company SlowMist estimated that the stolen cryptocurrencies were worth over $610 million at the time.

The hackers made away with digital currencies including ether and tokens backed by bitcoin, as well as tether, a coin designed to mimic the value of the U.S. dollar, and the Shiba Inu coin, a novelty spinoff of the joke cryptocurrency dogecoin inspired by the Shiba Inu breed of dog.

Poly Network said Wednesday that assets worth around $260 million have been returned.

In a series of lengthy question-and-answer posts about the heist on a blockchain account used to hijack the funds, the purported hacker or hackers claimed that they were always planning to return the funds.

“I am not very interested in money! I know it hurts when people are attacked, but shouldn’t they learn something from those hacks?” one of the posts said. The hacker or hackers said they were negotiating with the Poly Network team and that they “would like to give them tips on how to secure their networks.”

The Poly Network hack is on par in size with infamous breaches at Coincheck in 2018 and Mt. Gox in 2014, where digital assets valued at around $550 million and $400 million, respectively, went missing. The incident highlights the risks of trading in the unregulated market, where theft, fraud and scams are common.

https://www.wsj.com/articles/poly-network-hackers-steal-more-than-600-million-in-cryptocurrency-11628691400?mod=itp_wsj&ru=yahoo

10. The 7-Step Approach to Effortless Self-Regulation

Research on effortless self-regulation is reviewed.

THE BASICS

To reach important goals, we often exert a lot of effort.

For instance, to get good grades, lose weight, stay sober, or save money, we exert much effort to resist the temptations of watching TV, spending time with friends, eating delicious fatty food and sugary treats, drinking alcoholicbeverages, doing online shopping, etc.

But what if there was an easier way?

An article by Ludwig and colleagues, published in the November 2020 issue of Perspectives on Psychological Science, discusses such effortless self-regulation strategies.

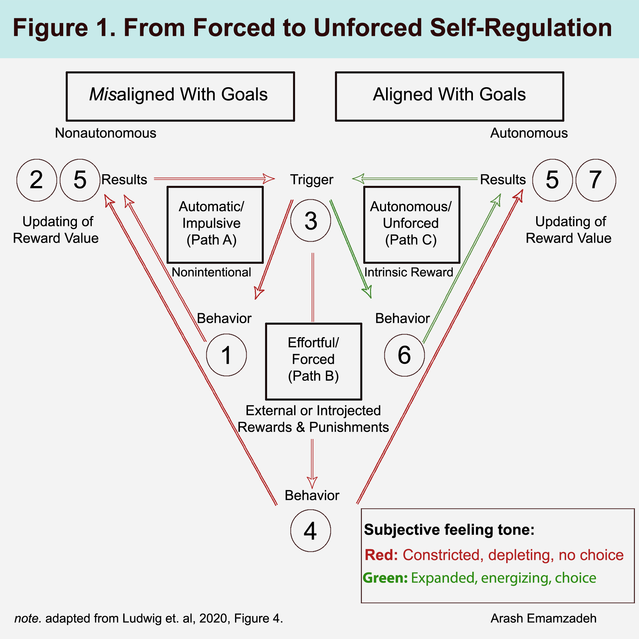

This post summarizes the article’s suggestions about how to use effortless self-regulation strategies at seven points in the enactment of any behavior (see Figure 1).

1. Goal-incongruent behavior.

At Point 1, the individual notices that some behavior contradicts an important goal; for example, eating out conflicts with the need to save money. Since behaviors often become automatic, such awareness is an important step in creating change.

Intervention: At random times throughout the day, pause. Then, ask yourself, “What am I doing and why?”

2. Outcome of the goal-incongruent behavior.

Moving from Point 1 to Point 2, one will need to mindfully consider the results of that automatic and impulsive behavior. After consciously evaluating the consequences of the behavior, the net result might be positive, neutral, or negative. For instance, the temporary pleasures of eating junk food are perhaps not worth the weight gain, stomach ache, and feelings of guilt and regret. If so, the updated reward value of the behavior will now reflect this negative value.

article continues after advertisement

Over time, being mindful of the behavior’s outcome is akin to collecting data showing the automatic behavior is not as rewarding as previously assumed. Awareness of this negative value will eventually give rise to unpleasant feelings of dissonance and discomfort.

Of course, some goal-congruent behaviors (e.g., exercising early in the morning) are not inherently more pleasurable than goal-incongruent behaviors (e.g., eating junk food). However, goal-congruent behaviors are associated with goal-related positive feelings (e.g., feeling fit, proud, confident, in control), which significantly increase these behaviors’ reward value.

Intervention: Perform your usual behavior (e.g., eating unhealthy food) mindfully, noting your feelings and the consequences of the behavior.

3. Triggers of the goal-incongruent behavior.

Notice the triggers (Point 3). Take the example of stress eating: When a trigger is encountered—a hurtful comment, an emotion like fear or anger, or sensory stimuli like the smell of fried food—one can use the updated reward value (Point 2) to consider alternative behaviors that might be more rewarding.

Intervention: Explore potential triggers.

4. Forced restraints of the behavior.

After realizing that some unhealthy behaviors are less rewarding than assumed, people often try to reduce them using effortfultactics.

In fact, triggers (Point 3) provoke not only automatic behaviors (e.g., stresseating) through Path A to Point 1, but also provoke forceful regulation attempts (e.g., using pure willpower) through Path B to Point 4. Forcibly stopping oneself, however, will not reduce the desire. Sometimes it makes it stronger.

Intervention: As you forcefully engage in or refrain from engaging in some automatic action, observe your unpleasant subjective experience (e.g., of effort, frustration, struggle).

5. Outcomes of forced restraints of the behavior.

Moving from Point 4, we see two consequences of the same forceful self-regulation, as represented by Point 5 on the left and on the right:

- A. Left Point 5: Negative results (e.g., the resistance to forcing oneself to exercise).

- B. Right Point 5: Positive results (e.g., the benefits of exercise itself).

Typically, the negatives of forceful self-regulation outweigh the positives: Forceful self-regulation is associated with frustration and resistance, and worse yet, it is only a temporary solution because the undesired behavior often recurs as soon as self-control weakens.

Such awareness can update the value of the effortful emotion regulationstrategy used to control unhealthy or dysfunctional behavior. So, one learns that forceful regulation (even if temporarily necessary) is not very rewarding or effective in the long term.

Intervention: Attend to your subjective experience of using forceful self-regulation. How successful is the forceful strategy?

6. Exploring new autonomous behaviors.

Realizing that behaviors incongruent with one’s goal (Path A) and effortful strategies of controlling those behaviors (Path B) both have lower than expected reward value, one might begin to explore behaviors that are unforced (i.e. autonomous) and more intrinsically rewarding. See Path C, Point 6.

At this step, people can experience the freedom of choice to experiment (e.g., try three instead of four scoops of ice cream), try alternative behaviors (replace the last scoop with delicious fruits), or change the goal itself (eat right to feel healthier instead of to look better).

Intervention: Make a note of the type and frequency of effortless and autonomous goal-congruent behaviors you have been exploring recently.

7. The outcome of a new, effortless behavior.

Point 7 (Path C) concerns the realization of the consequences of the new autonomous and unforced behavior and updating its reward value.

For example, you may notice a sense of pride, self-confidence, inner sense of calm, or additional energy after behaving autonomously (e.g., consciously choosingrather than forcing yourself to go for a run, save money, or eat healthily).

article continues after advertisement

Autonomous behaviors are rewarding because they help us achieve valued goals, are associated with freedom and a sense of agency, and are energizing and effortless.

When self-regulation is autonomously motivated (Path C)—in contrast to forceful self-control (i.e. reacting only to reward/punishment)—no single behavior is considered “the right one.” This means many options become available to help us achieve our goal. And we can act with full awareness of what we find naturally satisfying and valuable.

Intervention: To strengthen your new behavioral pattern through repeated updating of its reward value, pay attention to how you feel during and after trying a new autonomous behavior.

Takeaway

Through mindful observation of your automatic behaviors and effortful (but ultimately unsuccessful) attempts at controlling these behaviors, you will find yourself slowly engaging in more autonomous behaviors and using effortless self-regulation strategies. Perhaps doing so is one key to success.

About the Author

Arash Emamzadeh attended the University of British Columbia in Canada, where he studied genetics and psychology. He has also done graduate work in clinical psychology and neuropsychology in U.S.

https://www.psychologytoday.com/us/blog/finding-new-home/202101/the-7-step-approach-effortless-self-regulation?collection=1132444