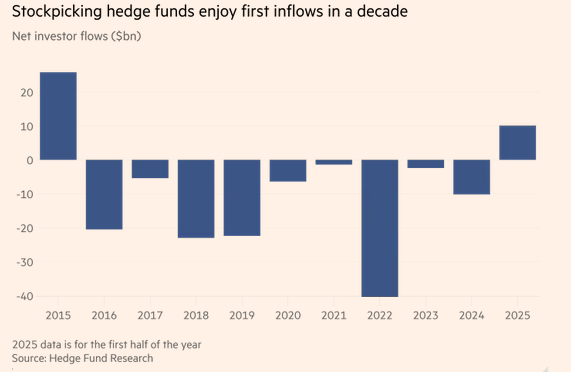

1. Stock Picking Long/Short Hedge Funds First Inflows in 10 Years.

https://www.ft.com/content/293d5329-2ff2-46e5-a6f9-4109d43fde2b

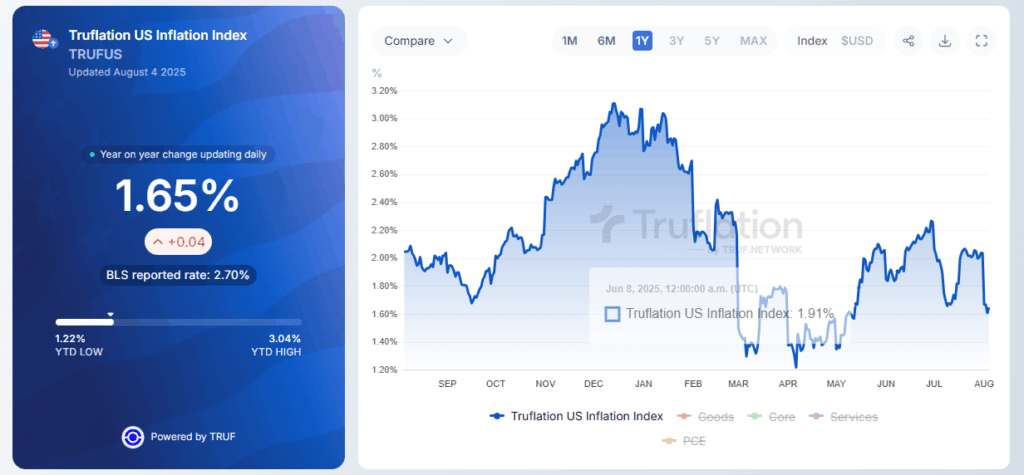

2. Real-Time Inflation 1.65%

https://truflation.com/marketplace/us-inflation-rate

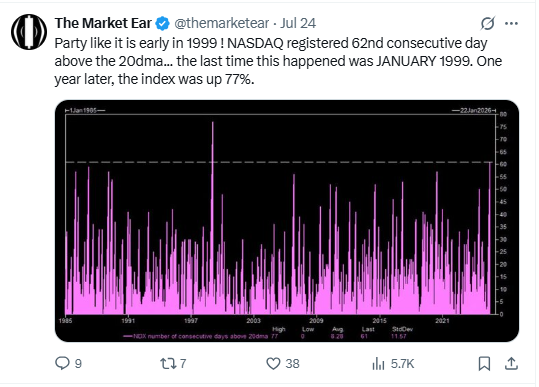

3. What May Be Scaring The Fed? Level of Speculation?

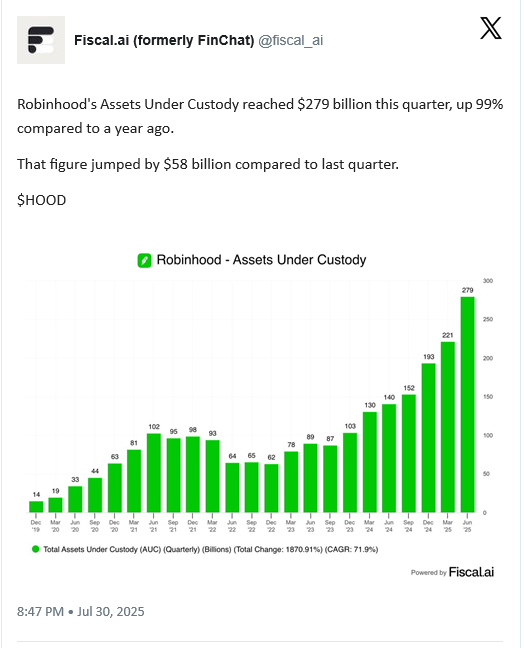

4. Level of Speculation? HOOD Assets Under Custody +100% Year Over Year.

From Howie Lindzon letter https://www.howardlindzon.com/

5. Prof G Newsletter—If the Magnificent 7 were a country, it would have the third-largest GDP, behind the U.S. and China.

https://www.profgmarkets.com/subscribe

5. The Best Stock Market Days Occur During Major Declines.

NYT By Jeff Sommer

https://www.nytimes.com/2025/08/01/business/stock-market-best-worst-days-investing.html

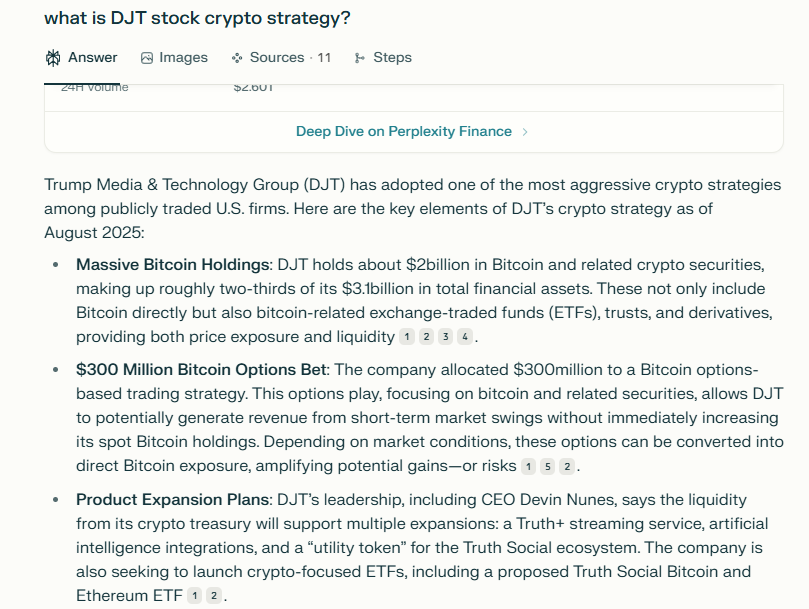

6. DJT Stock Goes Full Crypto ….No Big Bounce Yet.

7. More Money Raised by Crypto Treasury Stocks than IPOs in 2025

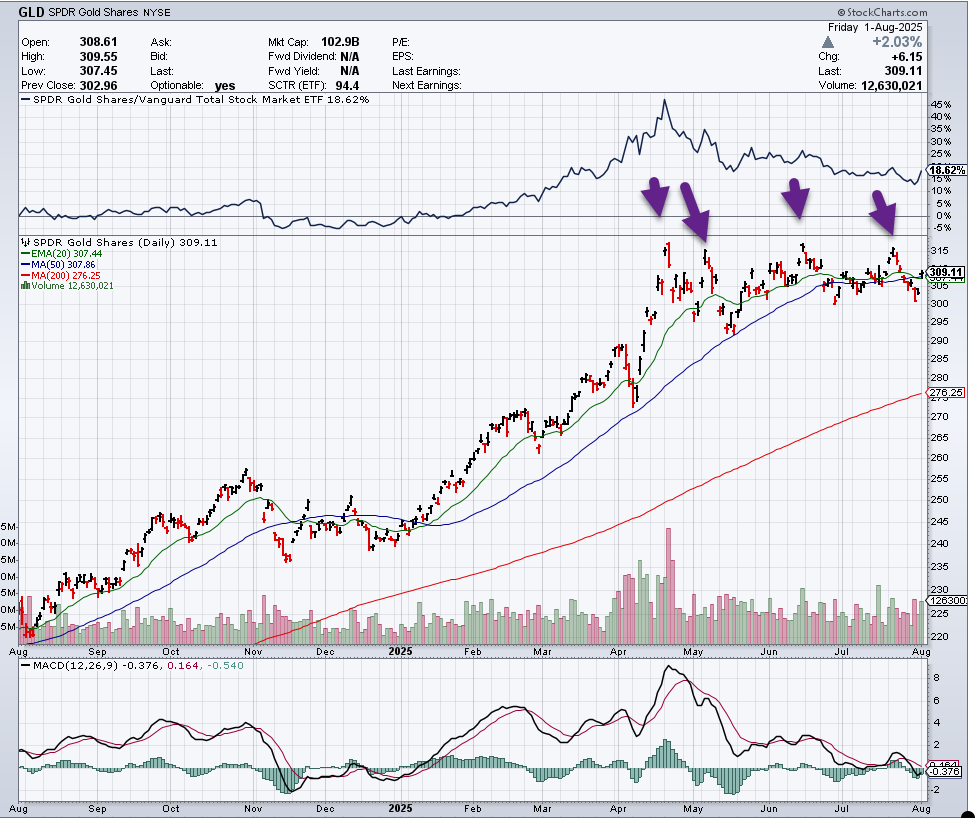

8. GOLD 4 Shots at New Highs…Not Yet.

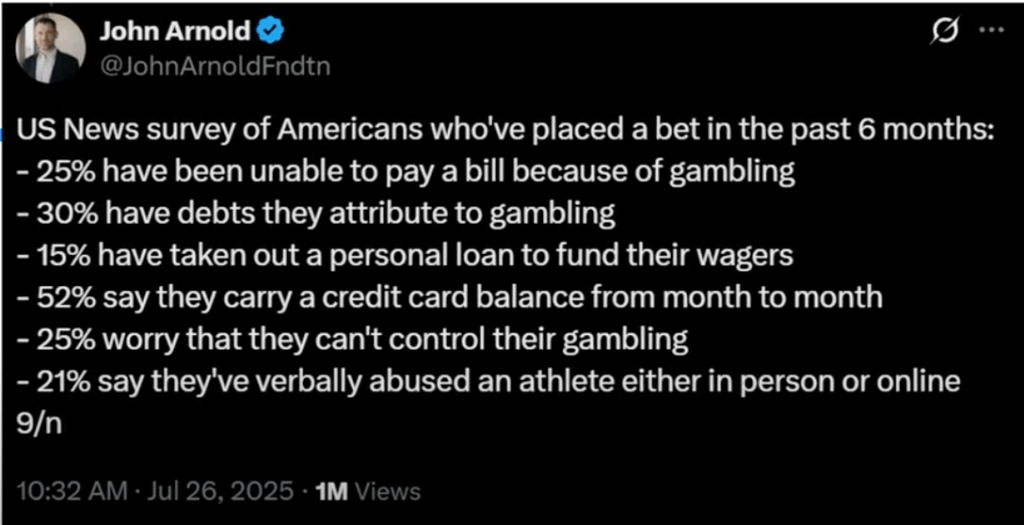

9. The Downside of Betting Culture.

10. Technology/Venture Take on American Crime

Venture Investors Warm to Public-Safety and Law-Enforcement Tech

Startups are selling software to help solve crimes or free 911 dispatchers from nonemergency calls, among other things. This year they’ve raised $990 million, nearly double 2024’s total.

A crime scene unit in Brooklyn. Venture investors are increasingly backing startups whose software can help in government services, including law enforcement. Photo: Kyle Mazza/Zuma Press

Venture capitalists have made a flurry of bets on public-safety and law-enforcement technology startups this year, the latest sign of a shifting appetite toward companies that rely on government revenue.

Venture firms, including industry leaders Sequoia Capital and Andreessen Horowitz, have invested in tech ranging from artificial-intelligence voice chatbots that handle nonemergency 911 calls to analytics software that helps detectives solve cold cases. The deals propelled the sector’s overall U.S. funding haul to $990 million this year through July 9, nearly double the amount raised for all of last year, according to data firm Crunchbase.

Venture Capital

Venture Capital news, analysis and insights from WSJ’s global team of reporters and editors.

Investors and entrepreneurs have long viewed plodding government sales cycles as incompatible with the hypergrowth many startups seek. But that’s changing. As AI supercharges the startups’ tech and lowers the cost of developing new products, founders say public-safety agencies are more eager and amenable to doing business with them.

Investors, in turn, are warming to young companies that rely on government sales. The recent success of defense-tech startups—many of them powered by AI—has demonstrated that startups with government-reliant revenue models can make it.

“The ‘Why now’ is AI,” said Nihal Mehta, co-founder and general partner of Eniac Ventures.

Eniac Ventures invested in San Francisco-based Hyper, which launched publicly this month and offers voice AI technology for nonemergency 911 calls. Voice AI has improved to the point where it can be used by police departments, Mehta said, which could save them money and free up human dispatchers to handle more critical calls.

“Historically this sector has had antiquated technology, and police departments were hard to sell into,” said David George, a general partner at Andreessen Horowitz. “That has tipped relatively fast.”