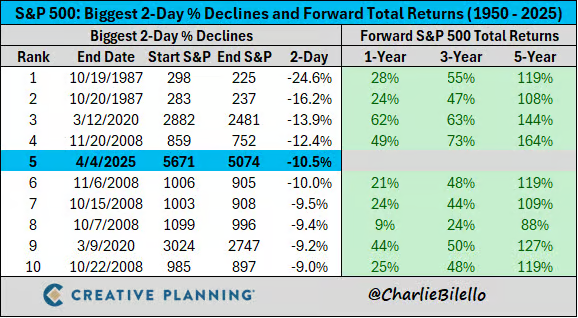

1. S&P Biggest 2 Day Decline Since 1950—What Does History Say?

Charlie Bilello

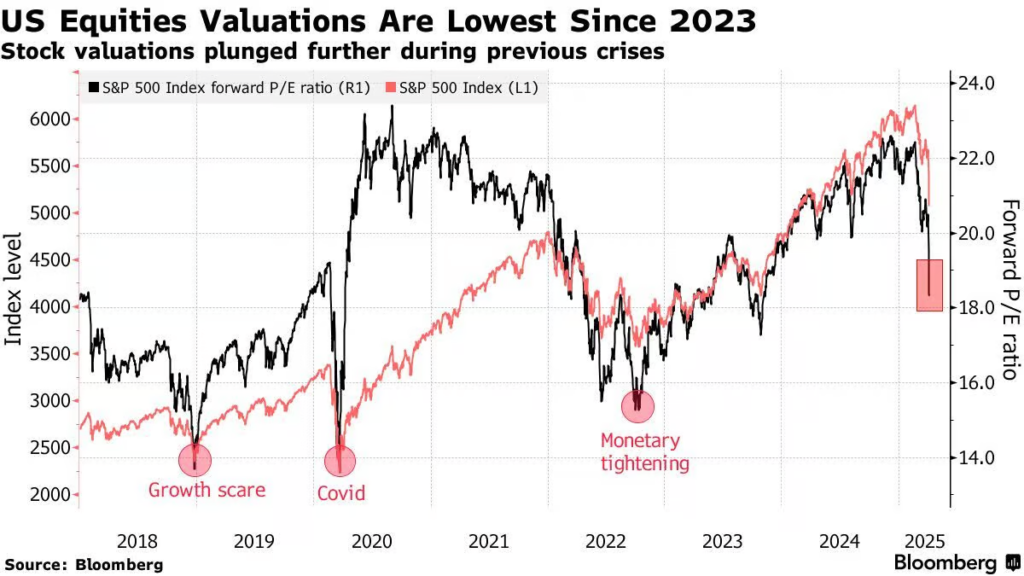

2. Forward P/E Correcting Fast…Ex-Mag 7 Closer to 15

Bloomberg

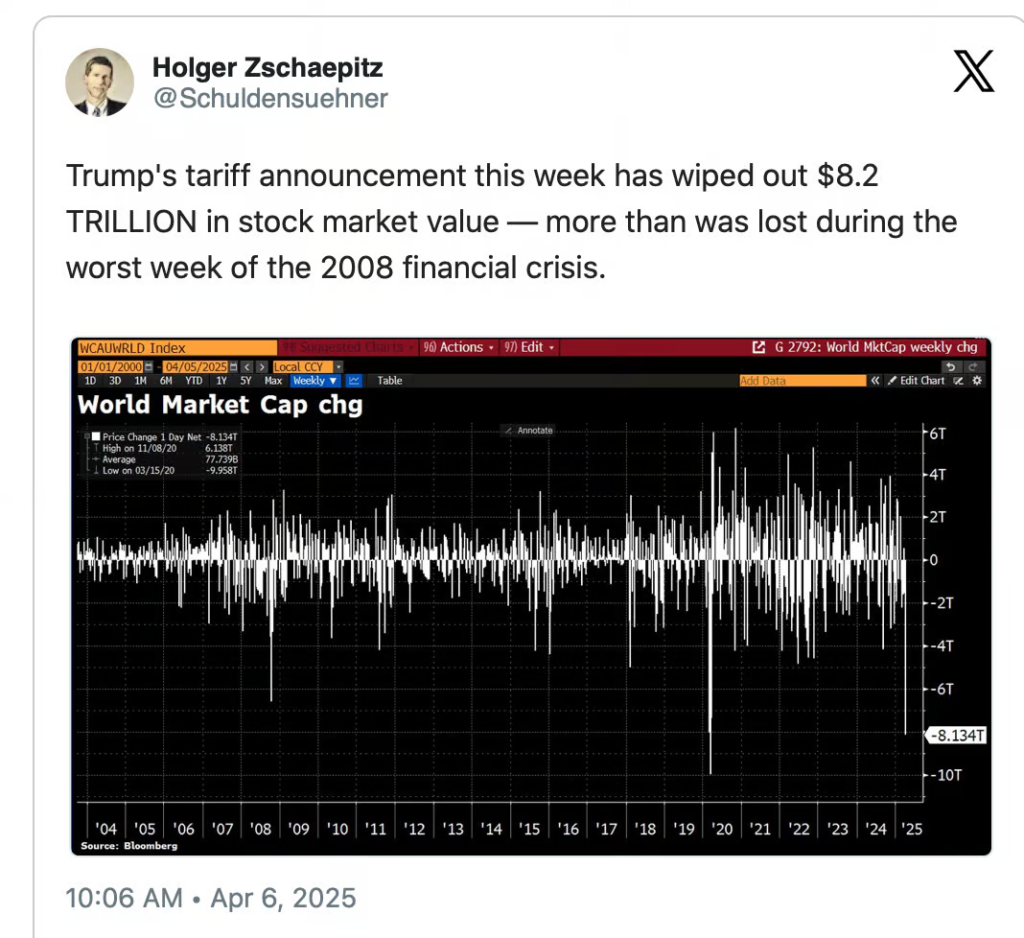

3. Last Week Higher Dollar Amount was Lost than 2008 Crisis

StockCharts

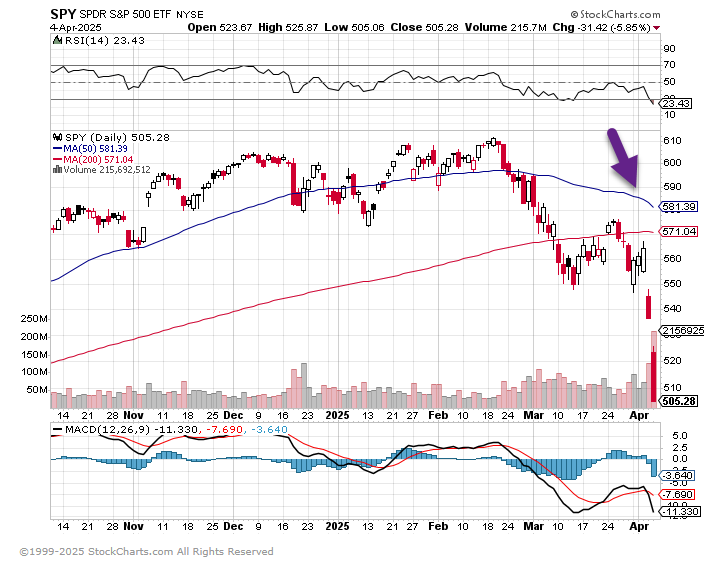

4. S&P 50day Still Above 200day…Break Today?

StockCharts

5. Crude Oil Fell -13.6% in 2 Days, THU and FRI

StockCharts

6. Ten Year Treasury Moved Back Above 4% Last Night

CNBC

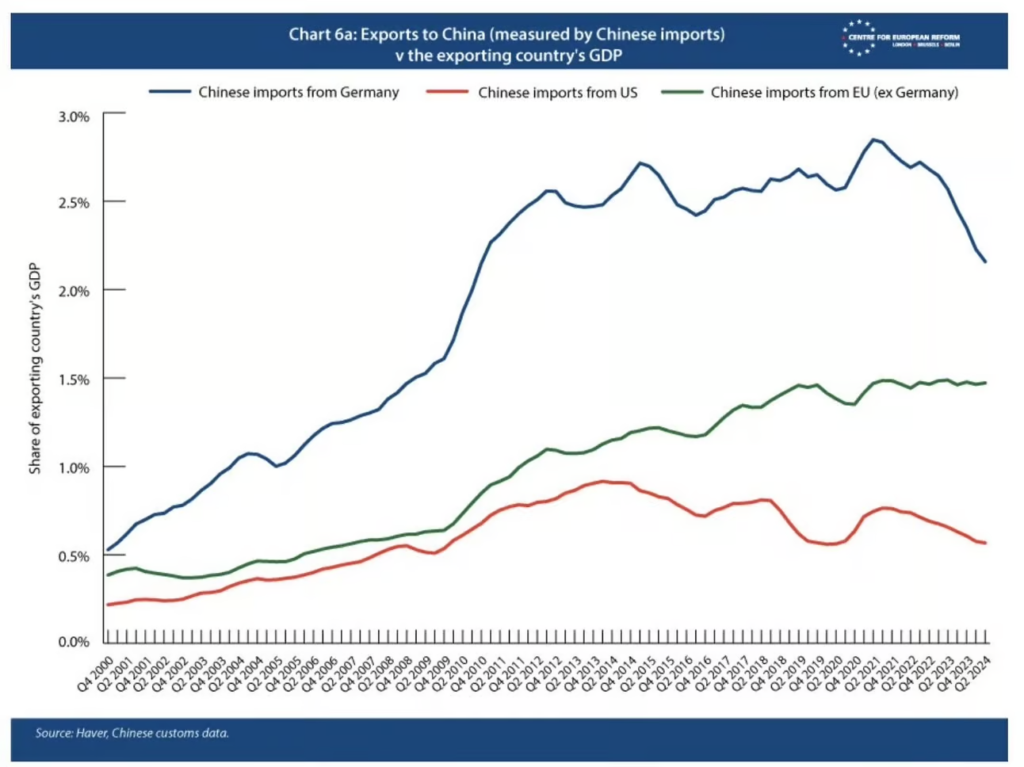

7. China Tariffs…U.S. Does Not Export Much to China

Markets are freaking out about China retaliating hard against the United States, with a 34% tariff on all US goods. But in economic terms, this isn’t such a big deal: China barely imports from the US in the first place.

Chartbook

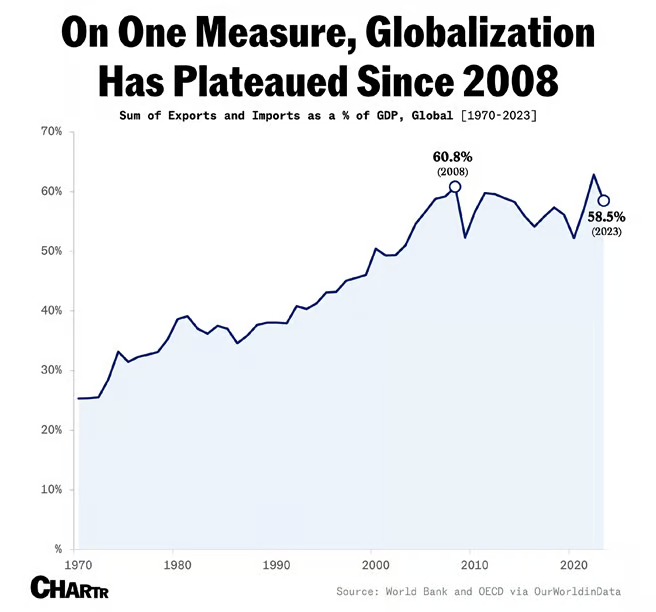

8. The Top in Globalization was in Motion

StockCharts

9. Another Contra Indicator?

Hedge funds capitulate, investors brace for margin calls in market rout.

Summary:

- Some hedge funds offload all stocks as selloff widens

- Prime brokers say leverage falling, more selling coming

- Sales triggered by margin calls rise in South Korea

Via Reuters: Some hedge funds say they are offloading all or most of their holdings of stocks as U.S. President Donald Trump’s trade war wipes out trillions of dollars of market value and forces them to curtail trading using borrowed cash.

In the three trading days following Trump’s announcement of broad reciprocal tariffs on almost all countries, stock markets across the world have plummeted, and bonds have become both a haven and a bet on rate cuts by the Federal Reserve, turning on their head market assumptions before Trump took office.

The selloff on Wall Street has been vicious as investors that bet on U.S. exceptionalism and economic might stampede out of its markets.

The benchmark S&P 500 index (.SPX), opens new tab fell 10.5% over two days and lost about $5 trillion in market value. China’s CSI300 (.CSI300), opens new tab blue-chip index fell more than 5% on Monday, while the pan-European STOXX index (.STOXX), opens new tab is down nearly 12% from its March 3 all-time closing high and in correction territory.

William Xin, chairman of hedge fund Spring Mountain Pu Jiang Investment Management based in Shanghai, said he had liquidated all of his stock positions as the current geopolitical landscape is messy, and the risk of a global recession is rising.

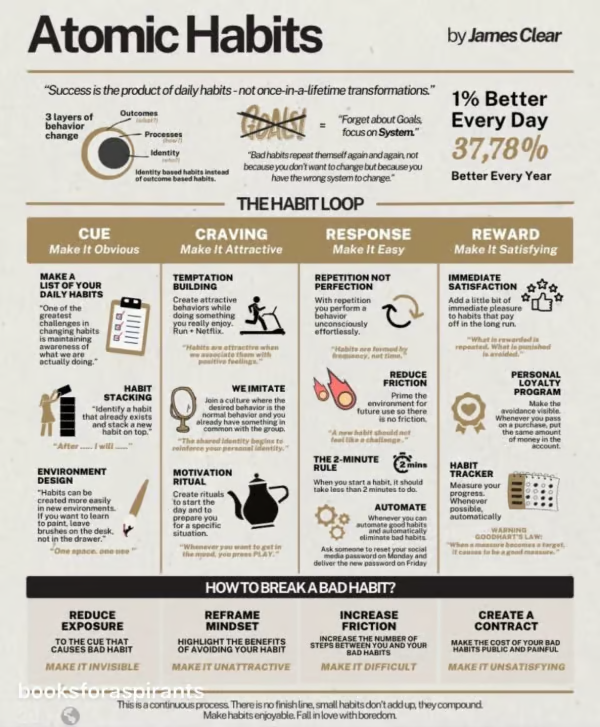

10. Atomic Habits Chart

James Clear