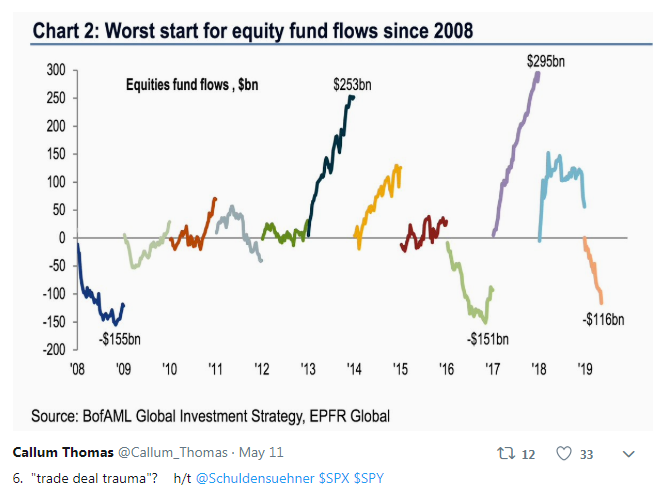

1.Most Hated Bull Market Ever…Worst Start for Equity Fund Flows Since 2008

Not usually the action at top of bull market…$116B Out of Equities

https://twitter.com/i/moments/1127307062789042176 Continue reading

https://twitter.com/i/moments/1127307062789042176 Continue reading

From Dave Lutz at Jones.

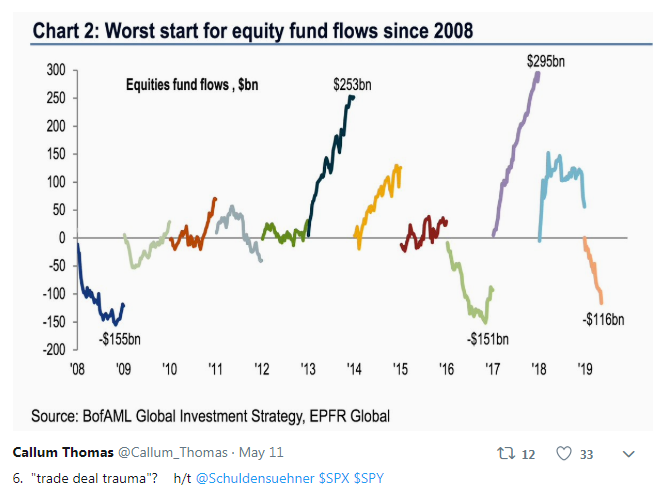

“The fact that inversion occurred with futures expiration still over two weeks away gives us confidence that this move isn’t just noise (the front of the curve can be volatile near futures expiration) but is actually showing a demand for protection in the market,” said Vinay Viswanathan, an equity derivatives strategist at Macro Risk Advisors – There was record volume in TVIX, the 2x VIX ETF, yesterday

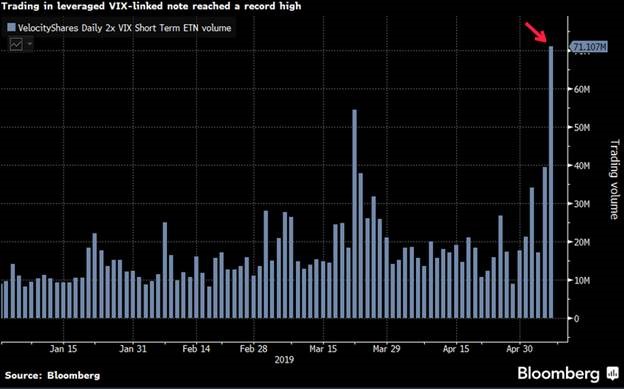

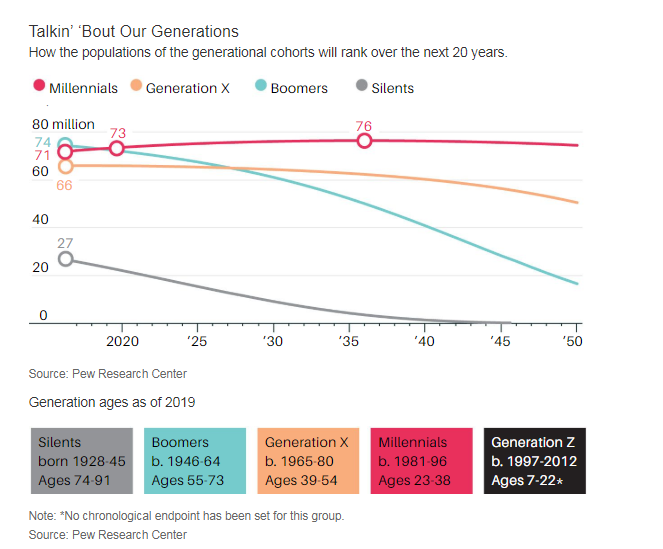

Millennial spending will account for 25% of total U.S. retail sales in 2020,

or $1.4 trillion annually.

Source: Accenture

5 Stocks to Ride the Coming Wave of Millennial Spending

Daren Fonda

https://www.ishares.com/us/products/239737/ishares-global-100-etf

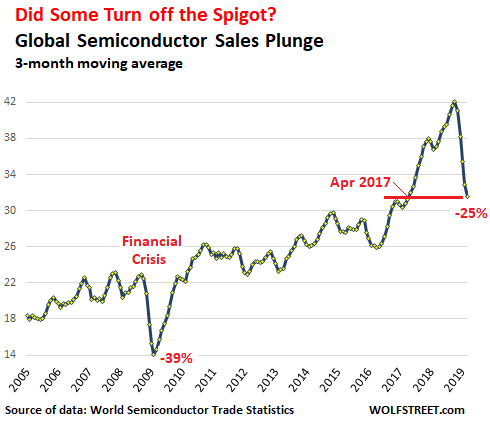

by Wolf Richter • Apr 30, 2019 • 73 Comments • Email to a friend

According to chip makers, the plunge isn’t over yet. Now hoping it won’t turn into the mess as in 2001 when the last tech bubble became the dotcom bust.

Global semiconductor sales dropped 15.5% in the first quarter, from the fourth quarter last year, to $96.8 billion, the World Semiconductor Trade Statistics (WSTS) organization reported Monday afternoon. The three-month moving average in March has now plunged 25% from the three-month moving average at the peak last October, the deepest plunge since the Financial Crisis:

Demand was down across all regional markets: The global 15.5% drop in sales from Q4 2018 to Q1 2019 split up regionally this way – and the problem isn’t just China: