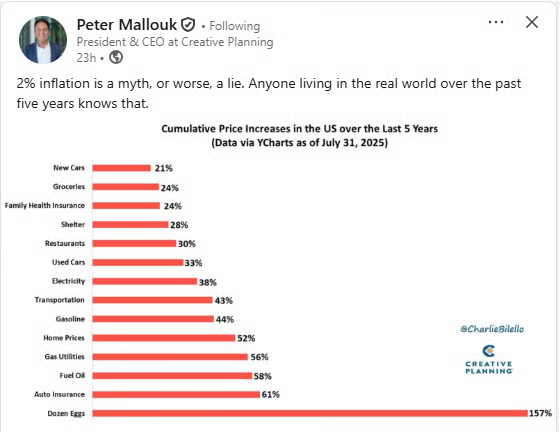

1. 70% of S&P 500 Trading Above 200 Day Moving Average.

That shouldn’t be a surprise when for the first time this year, more than 70% of the S&P 500 stock are above the 200-day.

Source: Willie Delwiche

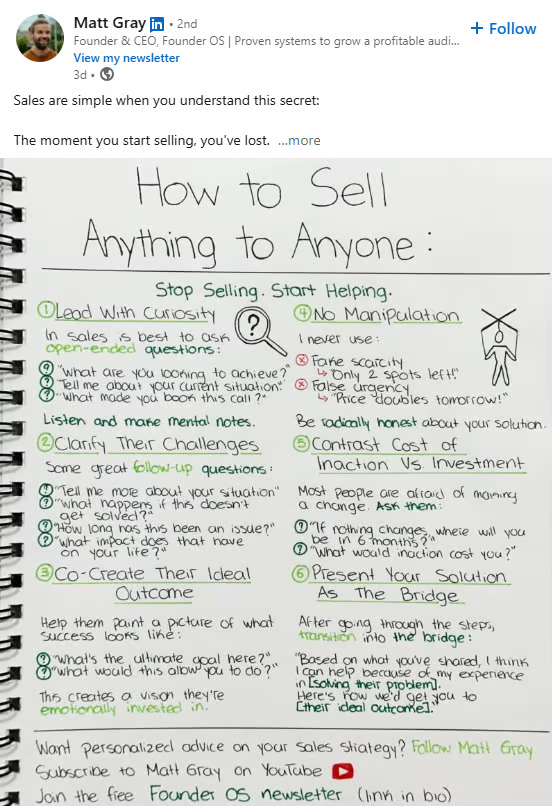

2. S&P Forward P/E Ratios by Sector.

https://www.barrons.com/articles/stock-market-outlook-f25a09ec?mod=past_editions

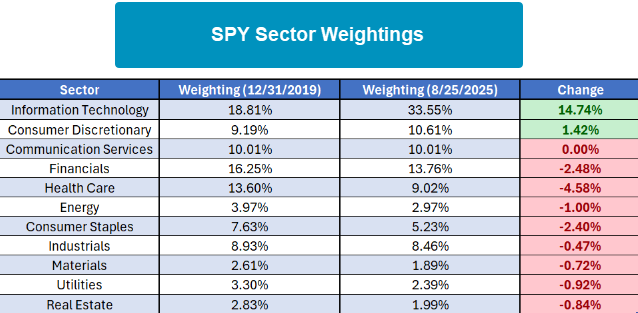

3. 2019-2025….9 of 11 Sector Market Caps Shrunk.

https://www.nasdaq.com/solutions/global-indexes/nasdaq-dorsey-wright/research-analysis-platform

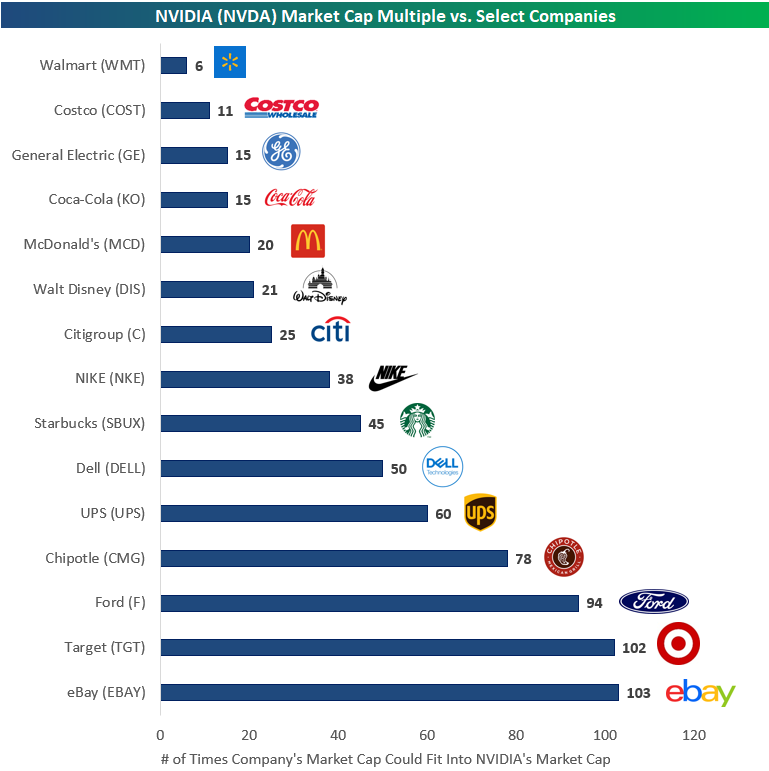

4. Putting NVDA Valuation in Perspective.

Bespoke Investment Group If you thought comparing NVIDIA to entire countries was wild, our next chart shows just how far ahead it is of some of America’s most iconic companies. With a market cap north of $4 trillion, NVIDIA is worth 6 Walmarts (WMT), 11 Costcos (COST), 20 McDonald’s (MCD), or 25 Citigroups (C). Taking it further, it could swallow 38 Nikes (NKE), 45 Starbucks (SBUX), or 50 Dells (DELL). At the extreme end, NVIDIA’s value equals about 60 UPS (UPS), 78 Chipotles (CMG), 94 Fords (F), 102 Targets (TGT), or 103 eBays (EBAY). Put simply, NVIDIA’s market cap isn’t just massive, it’s in a league of its own, making even household corporate giants look like small caps by comparison.

Bespoke https://www.bespokepremium.com

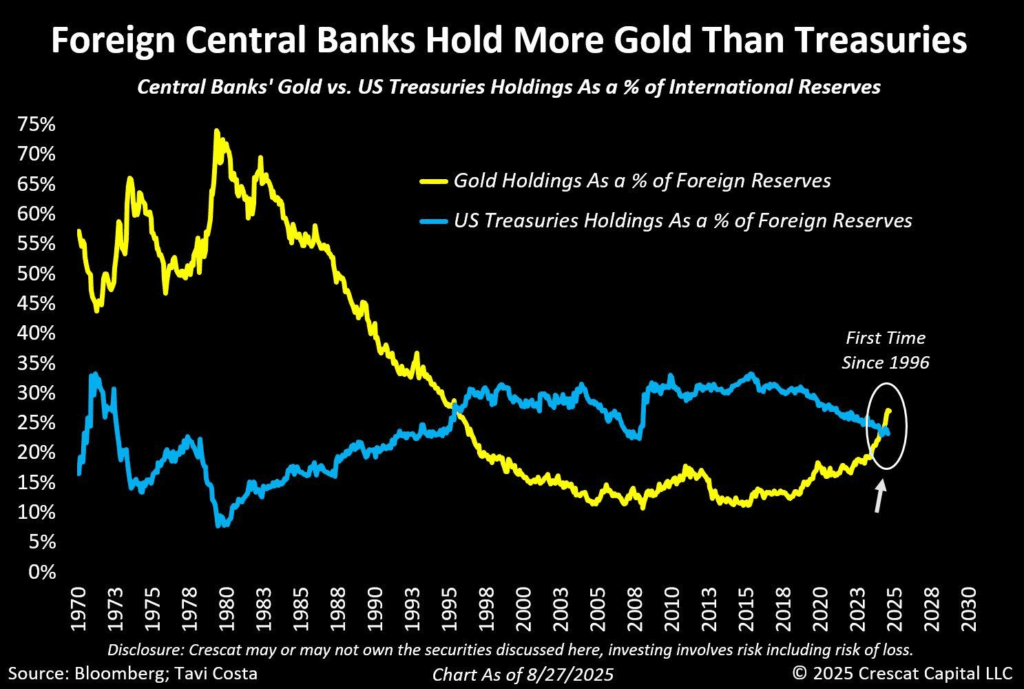

5. Foreign Central Banks Hold More Gold Than U.S. Treasuries.

Central banks vs. gold. “Foreign central banks now officially hold more gold than US Treasuries — for the first time since 1996.”

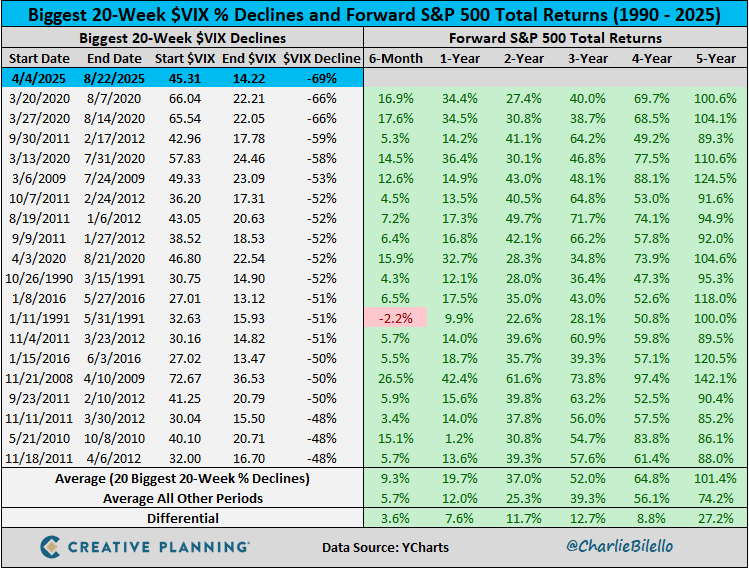

6. Volatility has been Crushed, with the $VIX Showing its Biggest 20-week Decline in History.

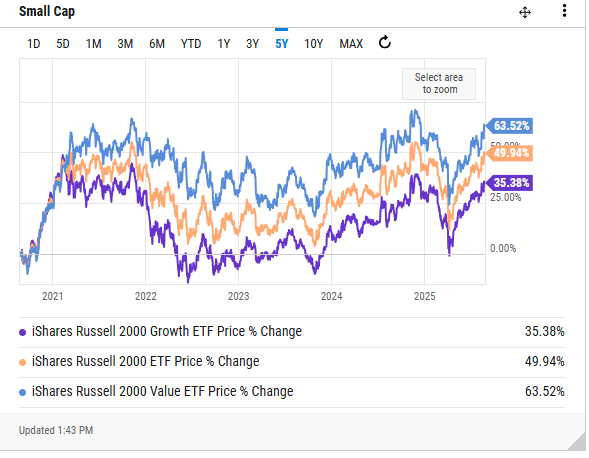

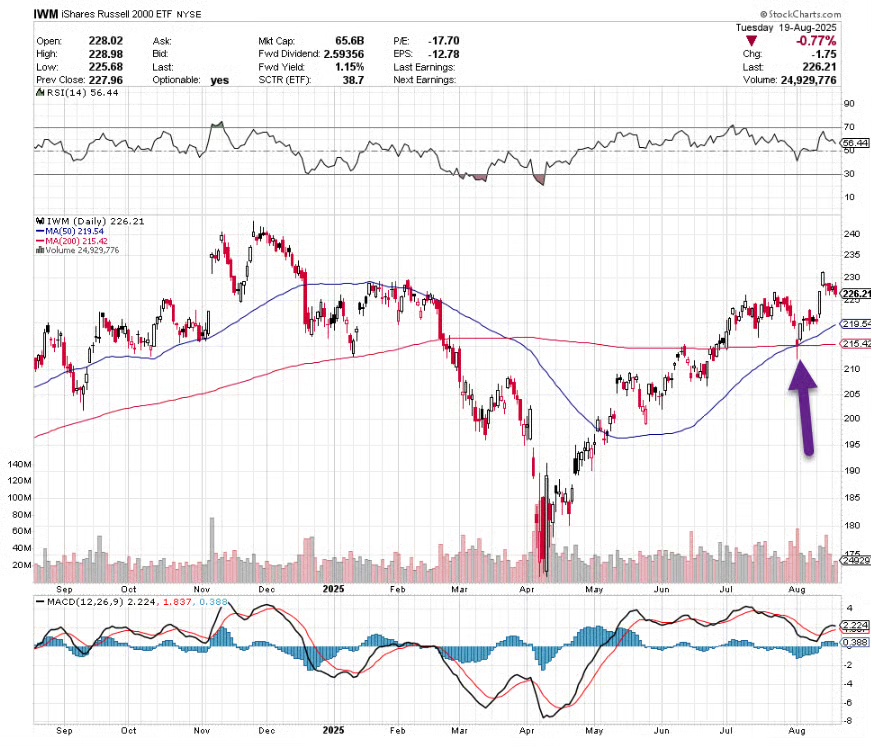

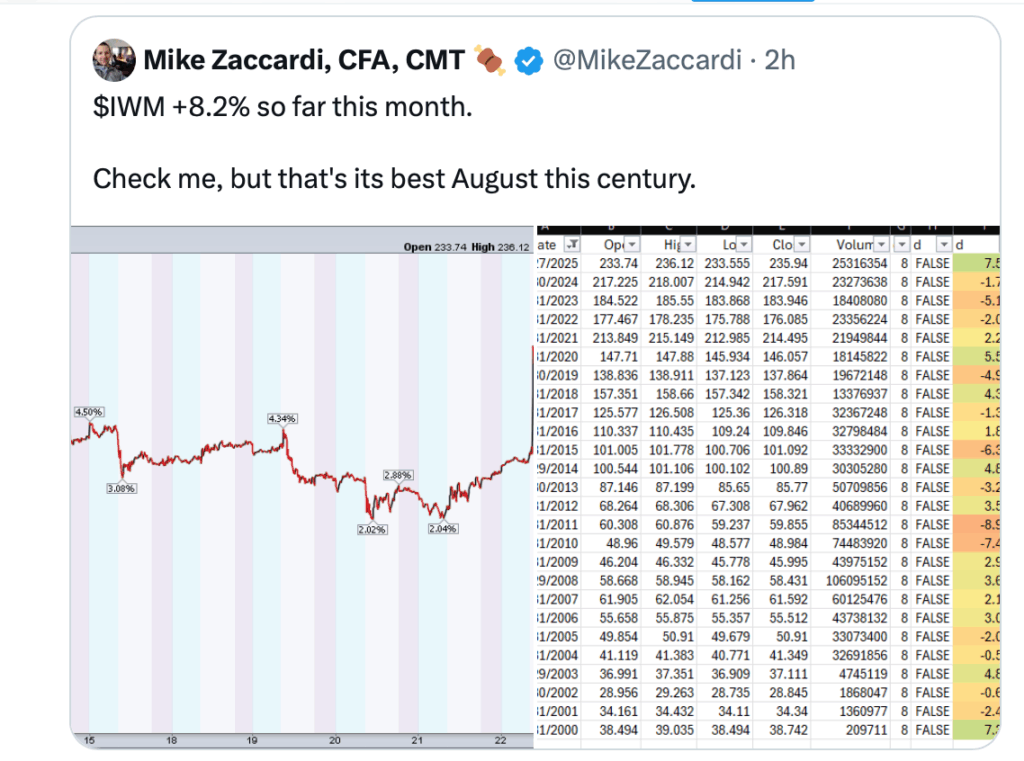

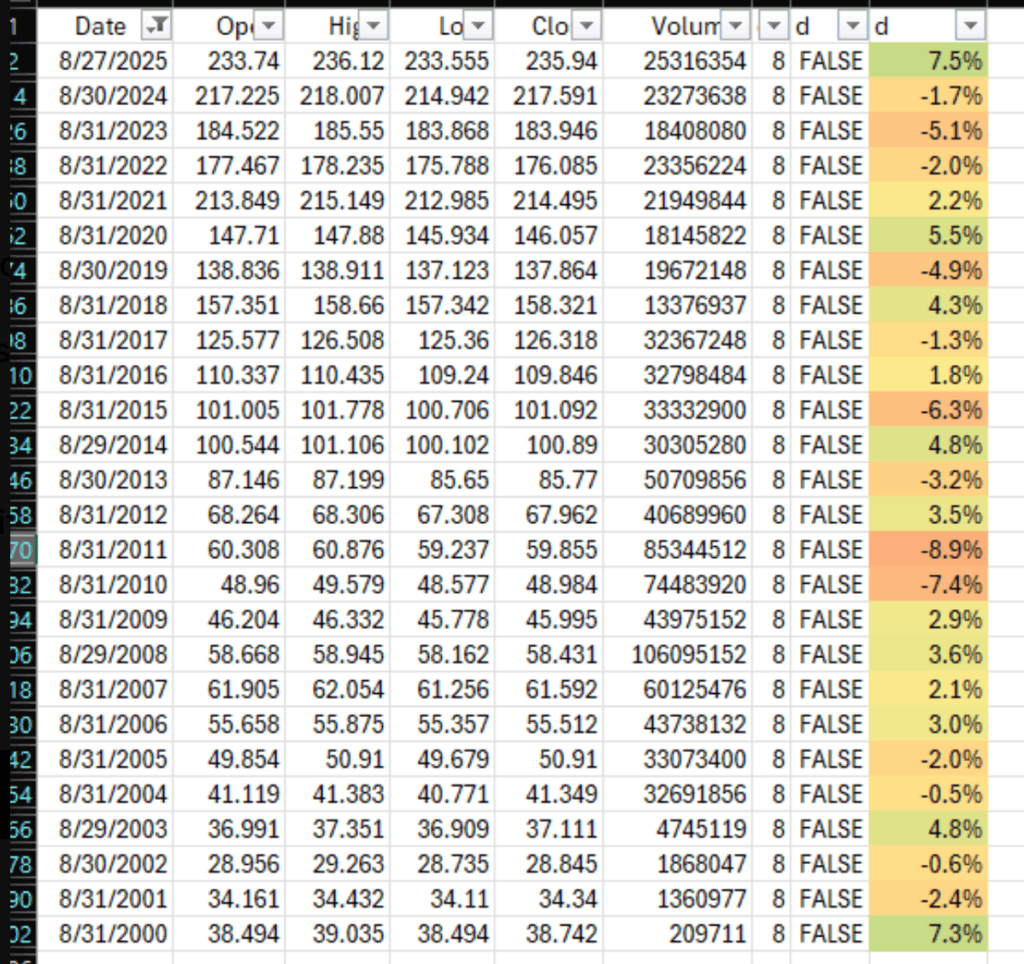

7. IWM Small Cap Best August in 100 Years.

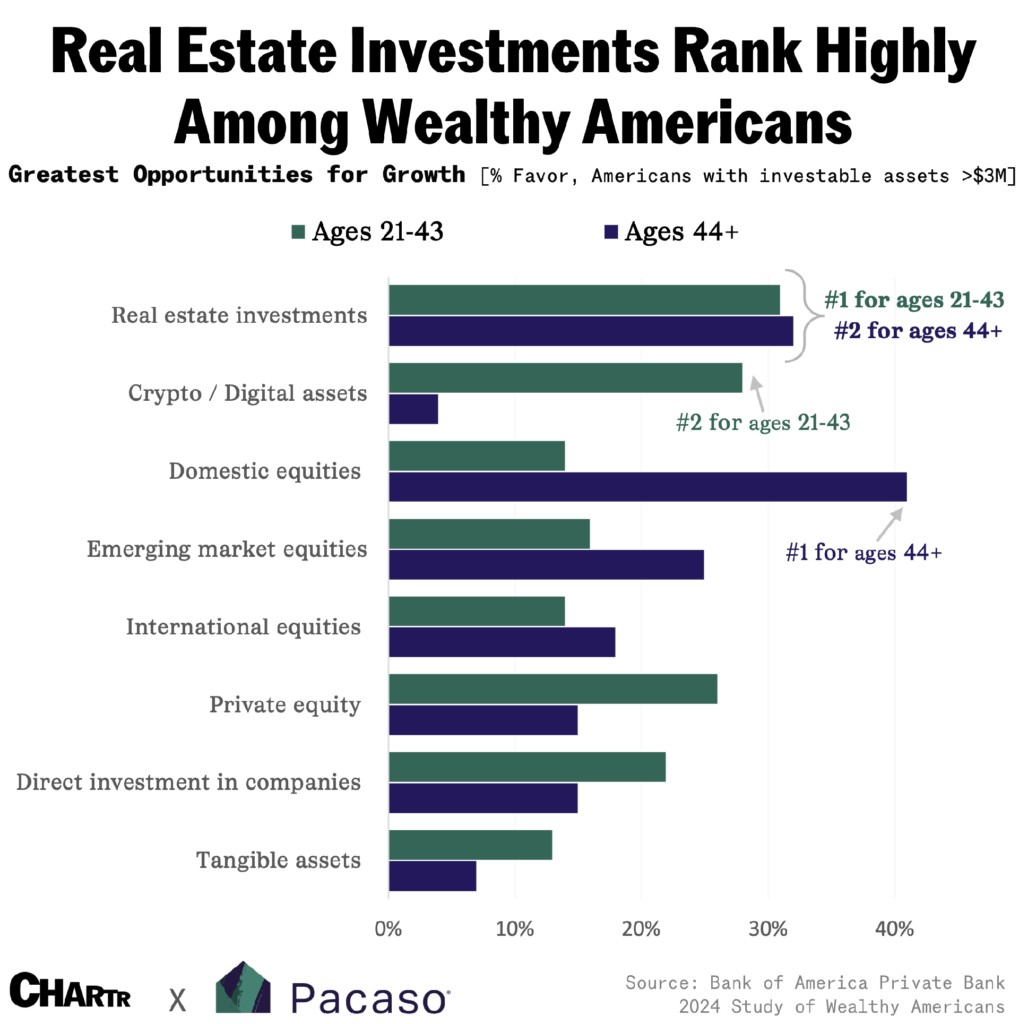

8. Real Estate Still Ranks High as Investment for 21-44 Year Old

While crypto has been popular for wealthy Americans, real estate continued to hold greater appeal. And it’s the smart real estate entrepreneurs that know where to disrupt.

Take the $1.3T vacation home market1, where houses have traditionally been too expensive or too much hassle. After selling his own company to Zillow for $120M, Austin Allison applied his proptech expertise to create Pacaso: a co-ownership platform for luxury vacation homes.

Since inception, the company has generated $1B+ worth of luxury home transactions and service fees across 2,000+ owners. Well-known VCs have already invested — and until 9/18, Pacaso is offering everyday investors the chance to share in their growth at $2.90/share.2

9. Scientists find musical link to boosting brain function for life

By CHRIS MELORE, US ASSISTANT SCIENCE EDITOR

Learning to play a musical instrument can protect your brain from aging, building up a defense against cognitive decline that lasts a lifetime.

Researchers from Canada and China discovered older adults who had spent years playing music were better at understanding speech in noisy environments, like a crowded room, compared to those who didn’t play music.

Their brains worked more like younger people’s brains, needing less energy to focus than older non-musicians’ brains had to use to make up for age-related mental declines.

Playing music was found to build up a person’s ‘cognitive reserve,’ which is like a backup system in the brain.

This reserve helps the brain stay efficient and work more like a younger brain, even as someone grows older.

Years of music training strengthened connections between brain areas that handle hearing, movement, and speech, making it easier to process sounds in tough situations, like when it’s hard to single out one voice in a crowd.

Researchers said their findings debunked the idea that older brains always need to work harder to compensate for aging.

Instead, regularly practicing an instrument for about 12 hours a week, regardless of how well you play, can build up a ‘reserve’ that keeps the brain from having the think too hard unnecessarily.

10. Tiny Thoughts Shane Parish

Luck writes the first chapter, but your actions write the rest.

**

Something I try to teach the kids is the concept of ‘one more.’

One more rep.

One more step.

One more minute.

One more revision.

One more practice test.

It’s so easy to stop, but most of the value comes from one more.

***

School often teaches that correct answers are obvious. Reality is the opposite.

We drill kids on facts that seem obvious once known, never mentioning that almost all of them were buried behind a door of ‘that doesn’t make sense.’ Gravity baffled us for millennia. We didn’t think hand washing mattered, even the idea of germs causing sickness sounded insane.

Every breakthrough started as heresy. But we teach kids to flee from the very feeling that precedes discovery.