Happy Thanksgiving!

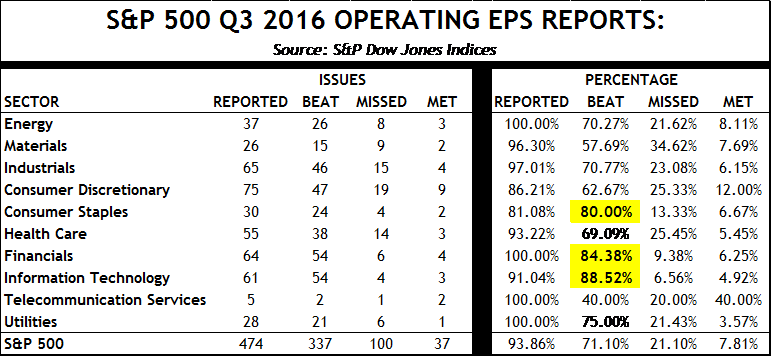

1.Earnings Wrap Up….71% of S&P Beats Earnings.

S&P EPS UP 14% Y/Y IN Q3

FINANCIALS, TECH AND STAPLES EXCEEDING STREET ESTIMATES:As of last Friday, 474 of the S&P 500 Index companies have reported Q3 earnings, of which 337 have beaten earnings (71.10%) and 100 have missed (21.10%), albeit on lowered estimates. Furthermore, 70 out of 108 companies beat on sales. Thus far, 54 out of the 64 Financials that reported earnings and 54 of the 61 Tech firms that reported earnings have beaten estimates.

Rich Farr, Chief Market Strategist Jim McGovern, Market Strategist info@bluestonecm.com

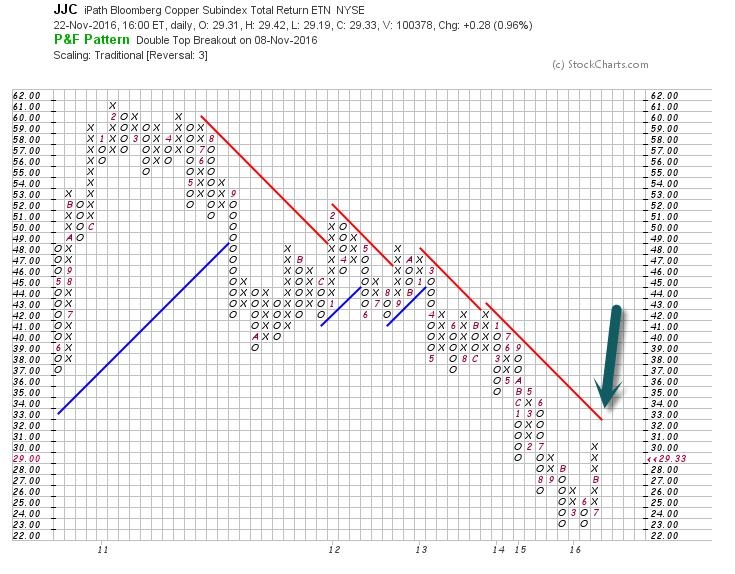

2.Global Growth? Copper up 25% Since October.

JJC Copper ETF 50day thru 200day to upside on big volume.

JJC—See Red Line on Chart…Trend line going back to 2011.

3.Shiller PE Ratio by Month.

DESCRIPTION Shiller PE ratio for the S&P 500. Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10 FAQ. Data courtesy of Robert Shiller from his book, Irrational Exuberance .

The cyclically adjusted price-to-earnings ratio, commonly known as CAPE,[1] Shiller P/E, or P/E 10 ratio,[2] is a valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation.[3] As such, it is principally used to assess likely future returns from equities over timescales of 10 to 20 years, with higher than average CAPE values implying lower than average long-term annual average returns. It is not intended as an indicator of impending market crashes, although high CAPE values have been associated with such events.[4]

https://www.quandl.com/data/MULTPL/SHILLER_PE_RATIO_MONTH-Shiller-PE-Ratio-by-Month

Larry Swedroe Article that CAPE ratio in need of new context.

http://www.etf.com/sections/index-investor-corner/swedroe-ratio-need-context?nopaging=1

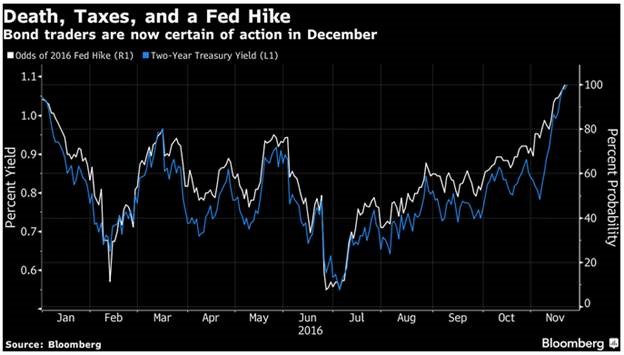

4.Market Implied Odds of Fed Rate Hike at December Meeting Just Hit 100%.

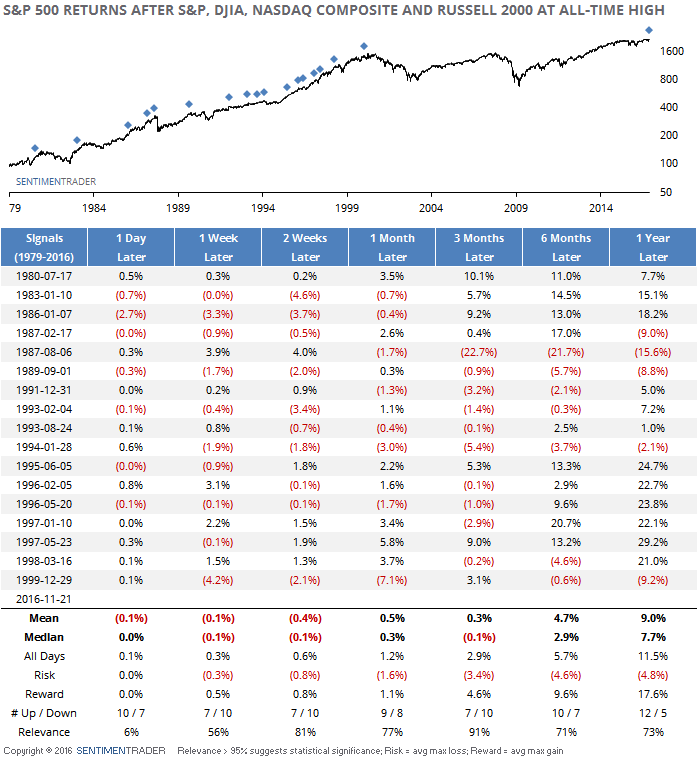

5.When the Big Four Hit All-Time Highs Together…What Happens?

When the “big four” make new all-time highs together. Actually a negative average return 3 months later.

Found at

www.abnormalreturns.com

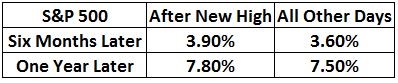

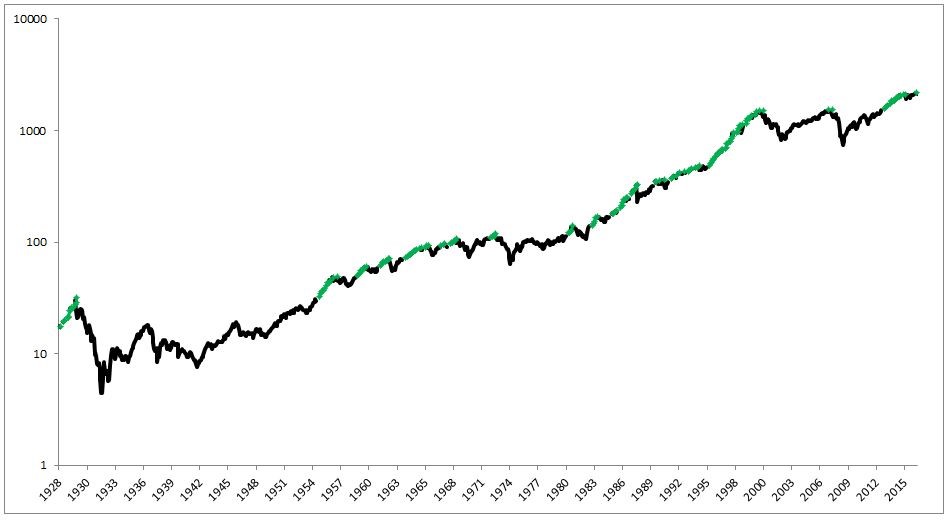

6.How About 6 months and One Year Out.

This Is Not Bearish

Posted November 22, 2016 by Michael Batnick

The S&P 500 just made an all-time high for the 11th time this year, and the 1134th time since 1928. Today, the Dow Jones Industrial Average crossed 19,000 for the first time ever. The natural inclination is that now might not be the best time to put new money to work. The data doesn’t support this, at least not in the short term.

The table below shows that average returns six months and one year following an all-time high has been stronger compared with all other days.

Taking a longer-term view, 18% of all months have closed at a new all-time high. You can see them represented below by the green dots. New highs are nothing to fear, in fact they are the cornerstone of every great bull market.

The people that use all-time highs to scare you are the same people who told you that the 27% selloff in the Russell 2000 earlier this year was the canary in the coalmine. Small-cap stocks are now at all-time highs and 40% off their February lows. The main takeaway is this; it’s true that every nasty bear market we’ve ever had followed an all-time high, but all time highs on their own is not a harbinger of bad things to come.

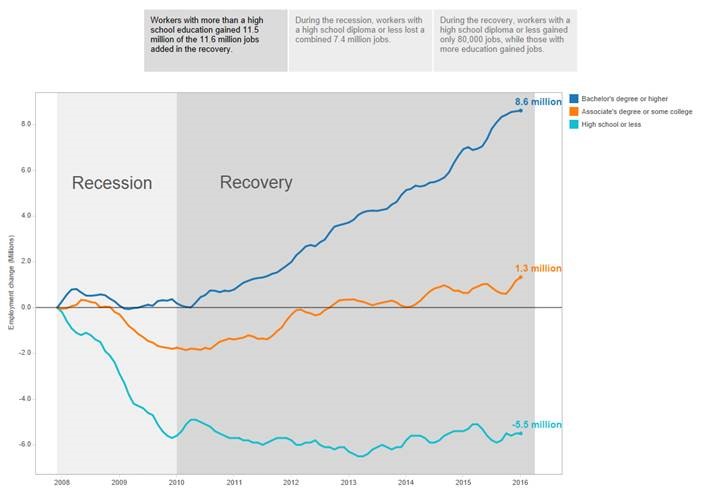

7.Populism, Elections and Economy in One Chart…..Workers with More than a High School Education Gained 11.5m of the 11.6m Jobs Added in this Recovery.

Job Change in Recession and Recovery

November 23, 2016 6:30am by Barry Ritholtz

Source: Georgetown University

http://ritholtz.com/2016/11/americas-divided-recovery-job-change-recession-recovery/

8.Read of Day…..World’s Largest Allocators Tackle Social, Environmental Issues

A study of 50 institutional investors found asset owners are increasingly confronting challenges beyond securities returns.

Investors including PGGM, the New York State Common Retirement Fund, and the California State Teachers Retirement System (CalSTRS) are leveraging their funds to address global systemic risks, according to a report by the Investor Responsibility Research Center Institute (IRRCi).

The study examined how 50 asset owners and managers have increasingly factored challenges such as financial system sustainability, climate change, and human rights issues into portfolio-level investment decisions.

“Investors are intentionally confronting global environmental, social, and financial systems challenges in a way that makes financial sense,” said John Lukomnik, executive director at IRRCi.

According to the report, both asset owners and managers most commonly addressed these risks by integrating ESG factors directly into their investment processes. Additionally, more asset owners than managers sought to create long-term value through this systemic lens while more asset managers saw opportunities in impact investing than allocators.

Furthermore, the desire to reduce risk and gain financial returns drove both asset owners and managers alike in seeking to impact global challenges through their investments, the report said.

New York’s pension, for instance, has focused on social issues such as affordable housing, local business development, and diversity. Last year, the fund worked with Goldman Sachs to create a low-carbon equity index fund to which it has allocated $2 billion.

Likewise, CalSTRS allocated $2.5 billion to an MSCI low-carbon index fund this past July. CalSTRS has also worked with sustainability non-profit Ceres to question 45 fossil fuel companies about their strategic plans given various energy and climate scenarios.

PGGM, the second-largest pension manager in the Netherlands, has allocated a multibillion dollar portion of its assets to a “solutions” portfolio focused on climate change, food security, health care, human rights, and financial system stability, among other issues.

Other examples cited in the report include the Ireland Strategic Investment Fund, which invests in enterprises “designed to support economic activity and employment in Ireland,” and the Caisse de dépôt de Québec, which has invested in Montreal’s public transportation system, as well as downtown office buildings and hotels.

“A lot of work is left to be done to better understand the complex relationship between systems and portfolios,” said William Burckart, who co-authored the report. “But, this study demonstrates that institutional investors, whether implicitly or explicitly, understand that the world is becoming increasingly interconnected.”

The full report is available here.

http://www.ai-cio.com/channel/RISK-MANAGEMENT/World-s-Largest-Allocators-Tackle-Social,-Environmental-Issues/

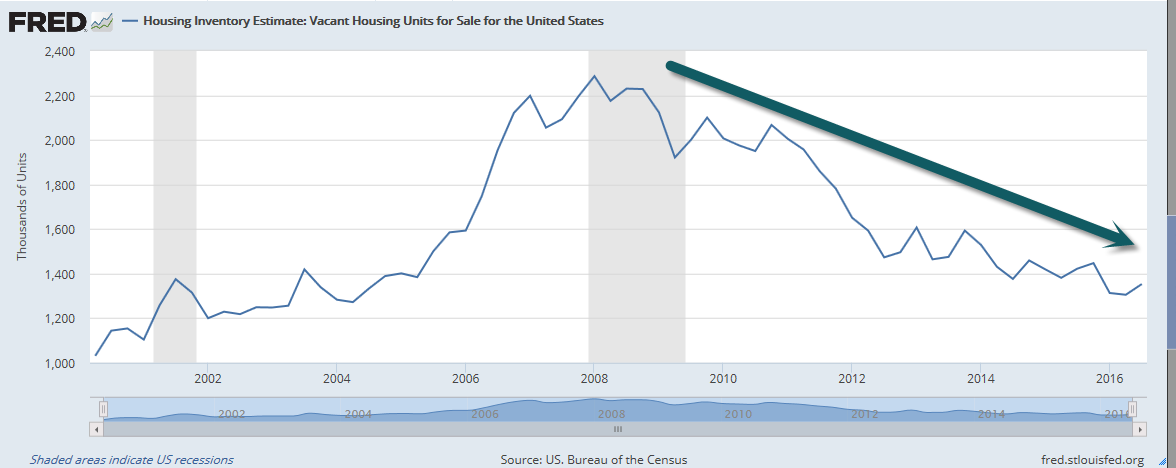

9.Existing Home Sales Highest Since Feb. 2007.

Inventory for Sale Back to 2002 Levels.

10.The Antidote to Envy

How to value the life you have and do something with it.

Posted Sep 21, 2016

Recently, I discovered Womankind, a beautiful, thoughtful, and elegant new magazine published in Australia and available worldwide. The graceful editor, Antonia Case, inquired if I might write an essay for the most recent volume. Issue #9 was published in July 2016 and is now on the shelves in the United States. Learn more about Womankind. So here it is, The Antidote to Envy.

Source: cco public domain

If I had a choice when it comes to vice, I’d pick any of the seven classics save the vice of envy. At least the other six have a connection to goodness, at least some of the time. Just think of the delicious indulgence of a lazy weekend or surrender to a decadent dessert; the juicy satisfaction of a lustful fantasy or the thrill of pride. Even a passionate fight has something good to recommend it. But to my mind, envy is the deadliest of the seven deadlies, and in a category all its own. Envy turns us against ourselves and others. It disturbs peace of mind, fueling shameand guilt. At its root, envy is felt to be so fundamentally bad because it highlights what is lacking and hates goodness itself.

Consciously, envy is so painful because it is based in a feeling of deprivation. We look at our neighbors and long for what they have, imagining their lives to be so much more beautiful, happy, and satisfying than our own. While an age-old phantom, Shakespeare’s green-eyed monster has been unleashed on steroids in our modern culture. Capitalism has cleverly engineered longing and desire, says The Vagina Monologues’ playwright Eve Ensler[i], tantalizing us with offers of what we might have or who we might become in the future rather than embracing the good of what we have and are today. It is no surprise, then, that envy leaves a trail of depression, anxiety, low self-esteem, poor body image, and perfectionism, just to name a few of its troubling effects.

At root, envy spoils our sense of goodness about ourselves. We feel inadequate. We feel small. We feel unworthy. For women judging ourselves by the ideals of modern society, we find ourselves longing for a better figure, a nicer house, a more appealing partner, more money, more professional success, more talented children, and the list goes on. To make matters worse, under the sway of envy, we feel surrounded by those who seem to have it all and the happiness that we imagine goes with it. Faced with the pressure of such comparisons, what are we to do?

To be honest, most of us take the easy way out: we try to feel better about ourselves by spoiling the good in others. I think this is the real reason why envy is felt to be so deadly. It is one thing to long for what we do not have, but it is something far worse to attack the goodness in others. On a small scale, this dark underbelly of envy is the source of gossip, pettiness, complaining, and all manner of mean-girl maneuvers. On a larger scale, it is the source of political gridlock, terrorism, and imperialism, just to name a few. The quick and easy way out of the pain of envy is to attack what is good even if it means ruining it for everyone.

Source: cco public domain

Tearing down is so much easier than building up. It takes years for a business to build a good reputation and one bad Yelp review to tarnish it. Building a house takes grit, perseverance, resources, and time. A single match can destroy it in a matter of minutes. The same is true for people. A rumor can ruin a career or a marriage; an unflattering photo on Facebook, someone’s good name. Negativity is very powerful, and enviousattacks make swift work.

But, of course, no one wins with this way of managing envy. No one feels good, nothing constructive is accomplished, and the vicious cycle of deprivation turning to spite keeps going round and round. The antidote to envy can only be found in playing the long game: you must grow yourself by building on the good you already have.

In my book, Wisdom from the Couch, I share a story told about a concert featuring the world-famous violinist, Itzhak Perlman. Stricken with polio as a child, Perlman wears braces on both legs and walks with two crutches. At this concert, he tenaciously made his stage entrance without any assistance. The audience sat in awe and sympathy, watching him painfully enter and then cross the stage to his chair. One had the sense that the man had overcome enormous odds.

That night like all other concert nights, Perlman tucked his violin under his chin and nodded at the conductor to begin. As he got into the piece—some versions of the story say he was just a few bars in and others say he was well into it—one of the strings of his violin broke. It was a snap so obvious that it couldn’t be missed. Everyone thought that, surely, the momentum of the piece would be ruined, as he would have to stop to replace the string or borrow another violin, no easy task for even an able bodied man.

Source: cco public domain

After stopping the orchestra, the conductor looked over to see what Perlman wished to do. To everyone’s surprise, Perlman raised a single finger to the conductor, a sign to wait just a moment. He closed his eyes, clearly gathering his thoughts. Then he opened them, looked at the conductor, and signaled him to go on. The orchestra took the conductor’s cue, and off they went again as if they hadn’t missed a beat. Only now, Perlman was playing on three strings.

Many people believe that this story must be a legend because it is impossible to play a symphonic work on violin with just three strings. But if anyone could, Itzhak Perlman could, right? One can imagine him working his way through the music around the missing string, compensating, adjusting, and improvising. It couldn’t have been the same piece, of course. But it was brilliant, passionate, and beautiful. For the audience bearing witness to such a marvel, it was even better than what they had come to hear.

A local newspaper reported that when Perlman finished playing, the audience sat in stunned silence before leaping to their feet with an extraordinary outburst of applause. It was also reported that after the audience quieted down, Perlman wiped the sweat from his brow and said, “You know, sometimes it is the artist’s task to find out how much music you can still make with what you have left.”

I don’t know whether or not this story actually happened, but I know that, in the psychological sense, it is true. The truth of the story is that Itzhak Perlman is showing us more than his attitude toward music; he is showing us his attitude toward life. He knows the undeniable truth that no matter how hard he may work, he will never have it all. There will always be something missing—whether it is a string on the violin or the ability to walk with ease. But just as there always will be something missing, there always will be something left. Perlman decided to take the attitude that what is left is good and it is enough.

Like a parable, this story can have a big impact if we have eyes to see and ears to hear. We will all face adversities in life of one kind or another, some big and some small. And we all know what it means to be lacking something, because that is the human condition. Envy tells us that someone, somewhere has it all—but it just isn’t true. It is everyone’s challenge in life to do something with whatever they have, and the best way to do that is to see the good, be thankful for it, and do something useful with it.

Like it! Share it! Tweet it!

A version of this essay was published in Womankind, Issue #9, July 2016, and is used here with permission.

For more cool stuff, check out my website at www.drjenniferkunst.com