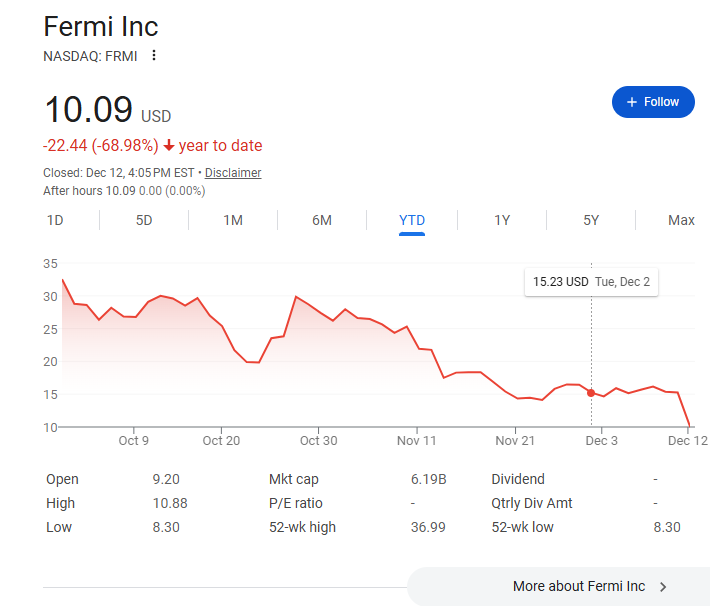

1. Tech Earnings Still Rising

Earnings contribution. And finally, the Tech sector’s contribution to S&P 500 operating earnings is expected to rise above 30% by Q4’26.

S&P Global

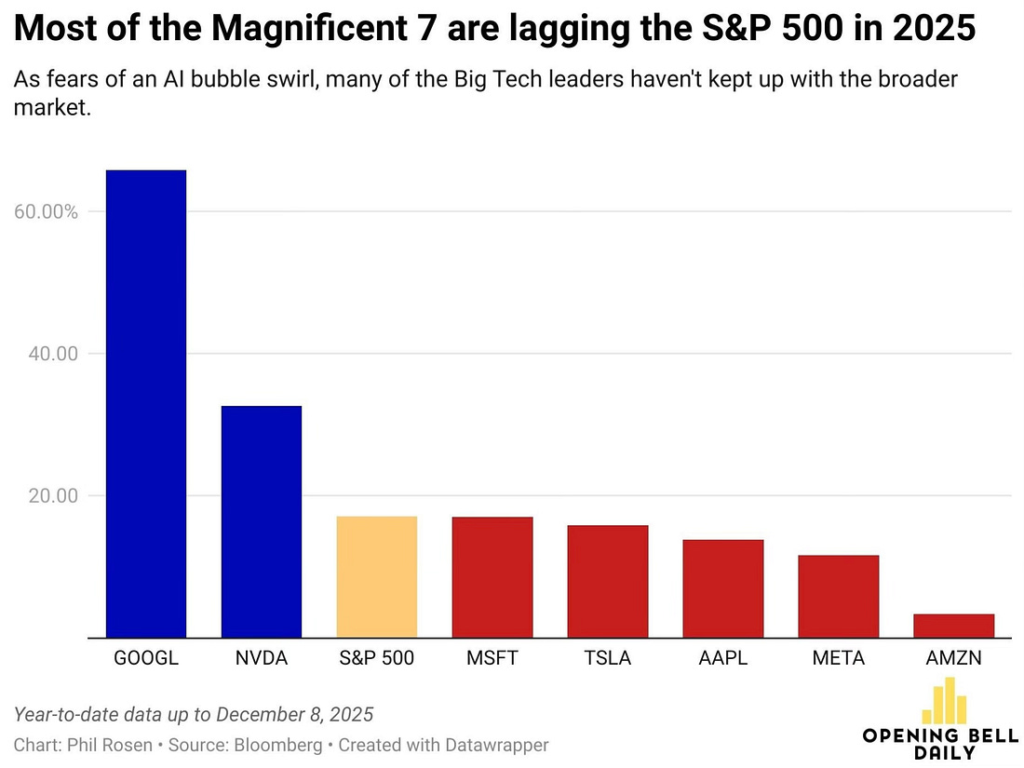

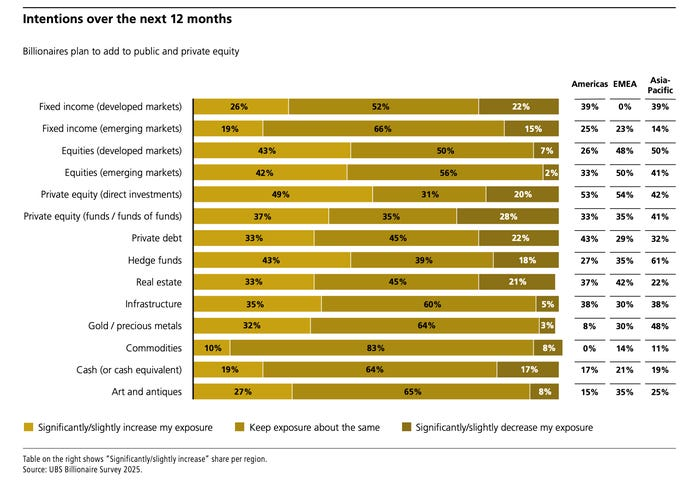

2. S&P Sector Performance Since October 8th

Bespoke Investment Group While the S&P 500 hasn’t really gone anywhere, sector performance has been disparate. Communication Services and Health Care are both up over 6%, and another three sectors have outperformed the S&P 500 gain of 0.3%. At the other end of the spectrum, Utilities is down over 5%, but right behind it, Technology has declined 3%. The fact that Technology, which makes up over a third of the S&P 500, has declined over 3%, and the market has treaded water, indicates a broadening of performance. It also illustrates how hard it is for the market to make headway without Technology participating.

Bespoke Premium

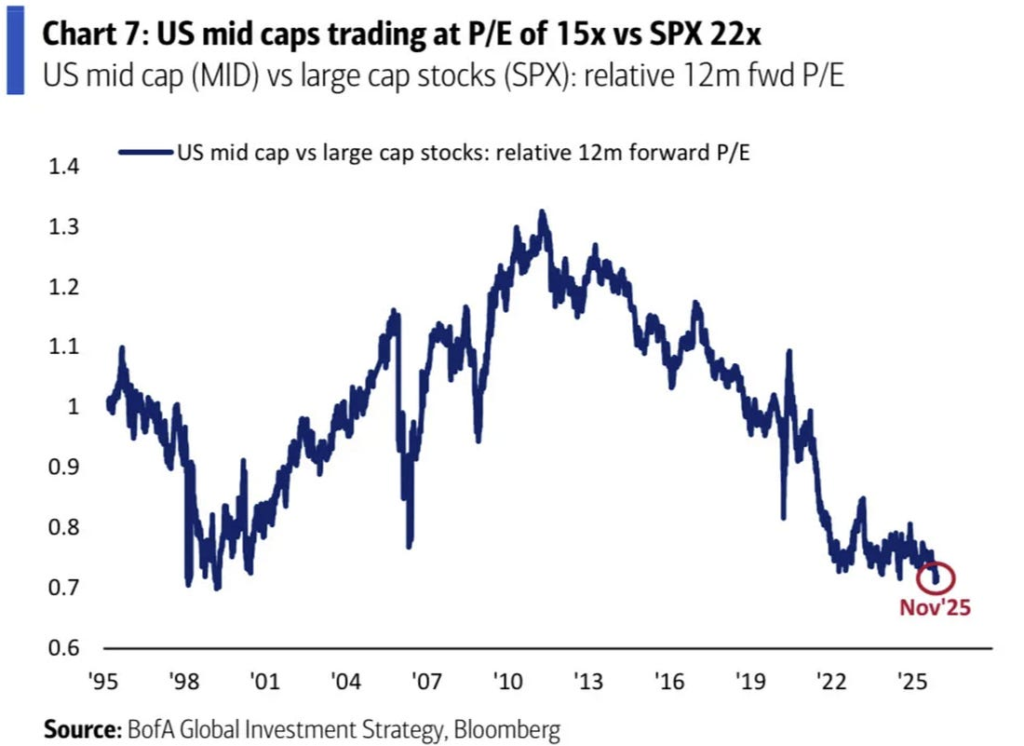

3. U.S. Mid Cap Stocks vs. S&P 500 Record Cheap…Below 1998 Record Lows.

Substack David Marlin

From @Callum Thomas (Weekly S&P500 #ChartStorm)

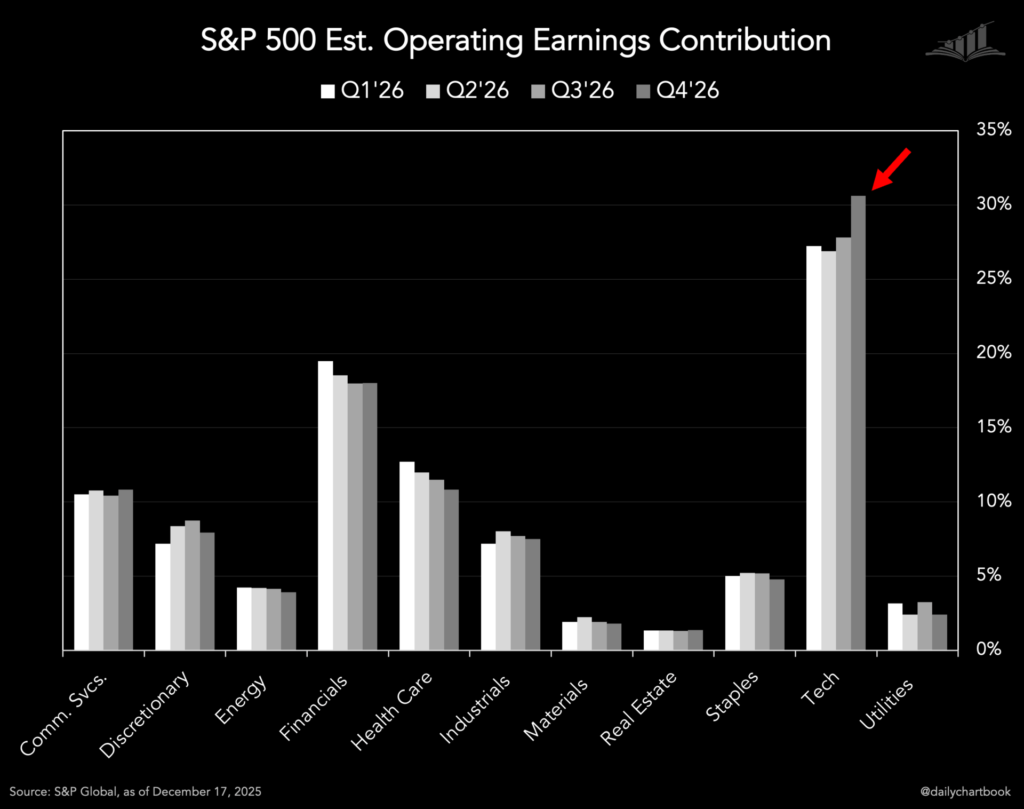

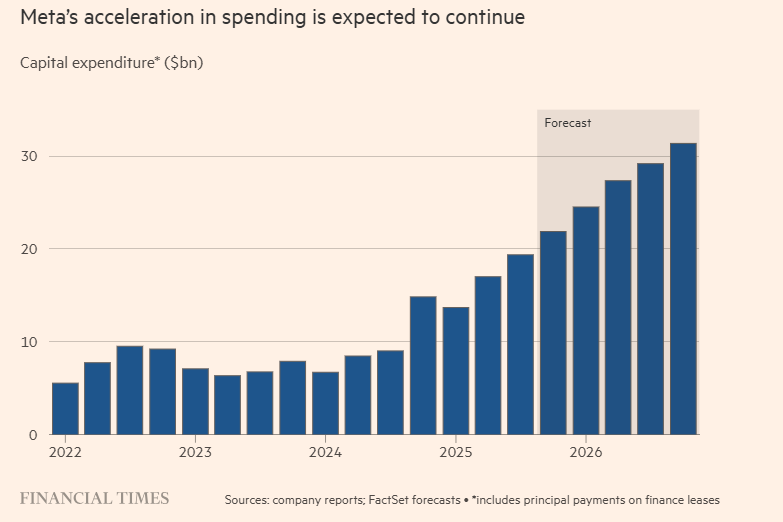

4. META Cap-Ex Acceleration Projected to Continue.

FT

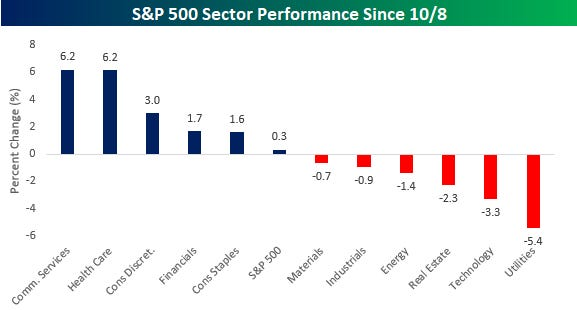

5. META +10% YTD vs. MAG 7 ETF +23%

Google Finance

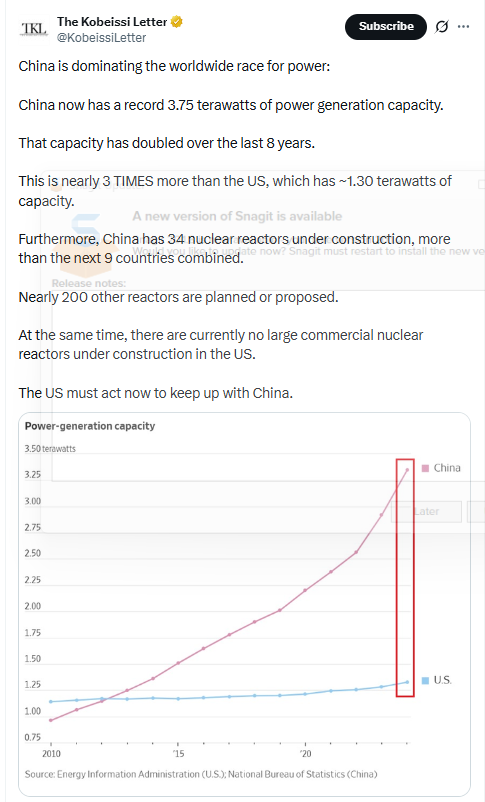

6. China Has Doubled Its Power Capacity in 8 Years.

KobeissiLetter

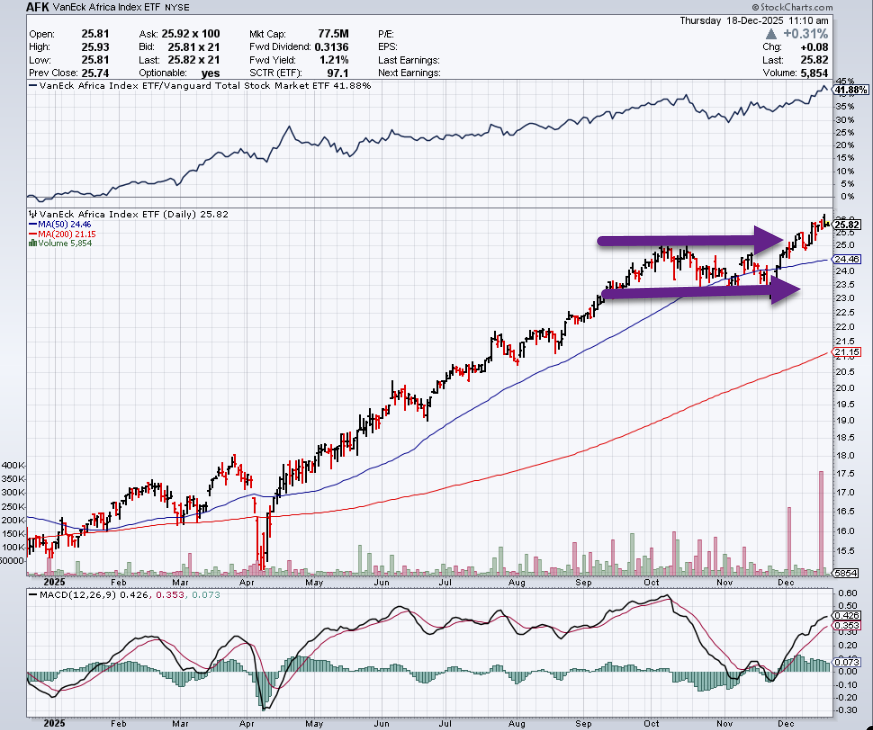

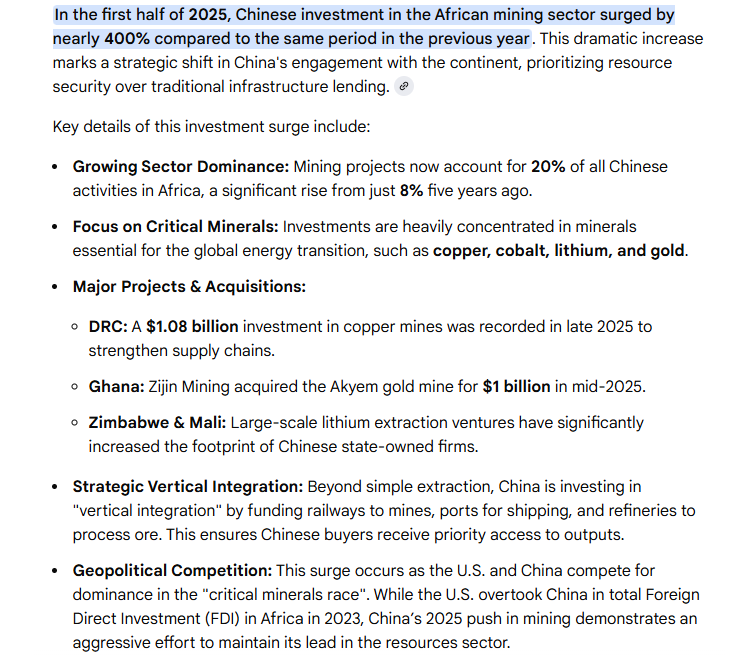

7. Chinese Investment in African Mining +400% in One Year.

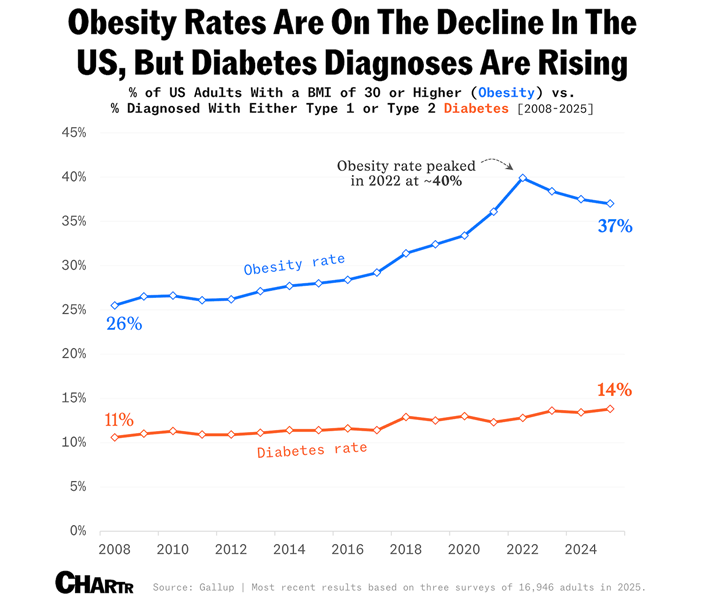

8. Obesity Rates Declining.

Chartr

9. TikTok’s Long-Awaited Sale Has Finally Arrived. Here’s What to Know

The agreement has been years in the making.

BY AVA LEVINSON, NEWS WRITER

After years of false starts, TikTok announced a deal to sell its U.S. assets to a group of mostly American investors under a new venture. The move isn’t yet finalized, but it means the app would continue to function within the country.

CEO Shou Chew sent a memo to employees on December 18, according to CNN.

“We have signed agreements with investors regarding a new TikTok U.S. joint venture, enabling over 170 million Americans to continue discovering a world of endless possibilities as part of a vital global community,” said Chew.

Going forward, nearly half of the new entity, TikTok USDS Joint Venture LLC, will be controlled by investors including Oracle, Silver Lake and MGX. Current ByteDance investor affiliates will own around 30 percent, and ByteDance itself will control just under 20 percent.

Featured Video

The Smartland Initiative – MEDC – Webinar

The venture will be held accountable for “retraining the content recommendation algorithm on U.S. user data to ensure the content feed is free from outside manipulation,” as reported by Axios.

U.S. Government Orders

Trump has long been demanding that ByteDance sell its U.S. entity, with his first related executive order issued in 2020. In 2024 a law passed banning the app unless it was sold, but Trump continued to extend enforcement to give time for sale negotiations.

He said in September that the administration and China had agreed to hand over control of the app to mostly American investors.

When the deal is finalized, it “will operate as an independent entity with authority over U.S. data protection, algorithm security, content moderation and software assurance, while TikTok global’s U.S. entities will manage global product interoperability and certain commercial activities, including e-commerce, advertising, and marketing,” the memo said.

RTO Mandate

Another announcement from TikTok came yesterday, when the company told U.S. employees they’d be returning to in-person work five days a week by the end of next year, staffers told Business Insider. The rule will span several large sectors, and one employee predicts much of the company’s U.S. staff will be included in the regulation.

But that could change if TikTok finalizes the sale of its U.S. cohort. The deal is currently set to close by January 22, with approval from the Chinese government.

10. The Decline of Reading

The Financial Times has a chart about the percentage of teenagers who read in their leisure time:

Ben Carlson Blog