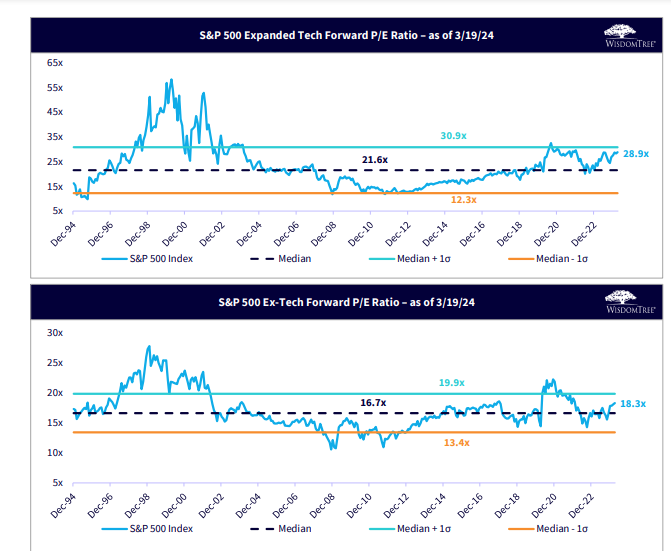

1. Tech vs. the Rest Forward P/E Ratio …28.9x vs. 18.3x

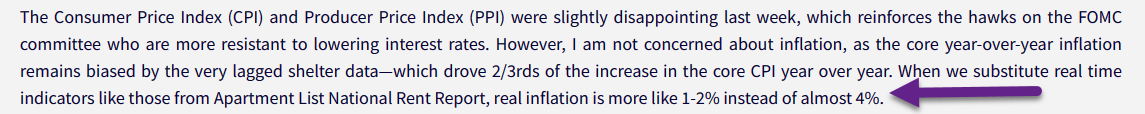

Jeremy Schwartz Wisdom Tree

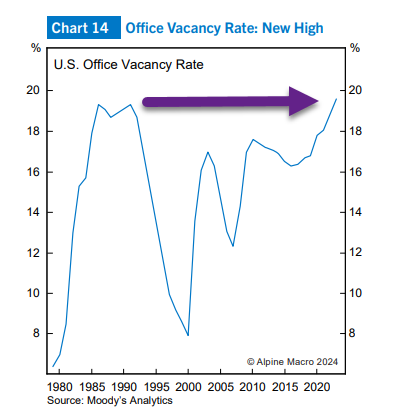

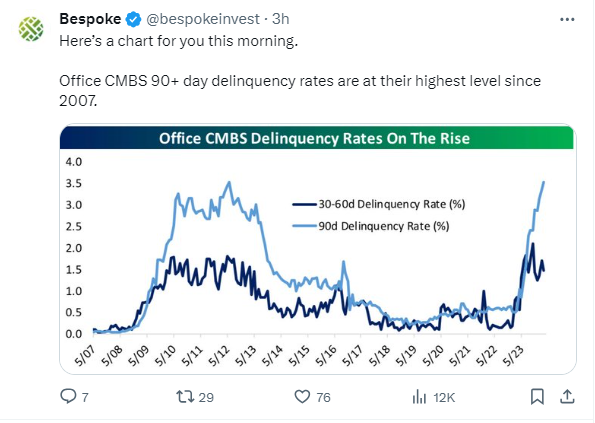

2. Office Market 90 Day Delinquency Rate

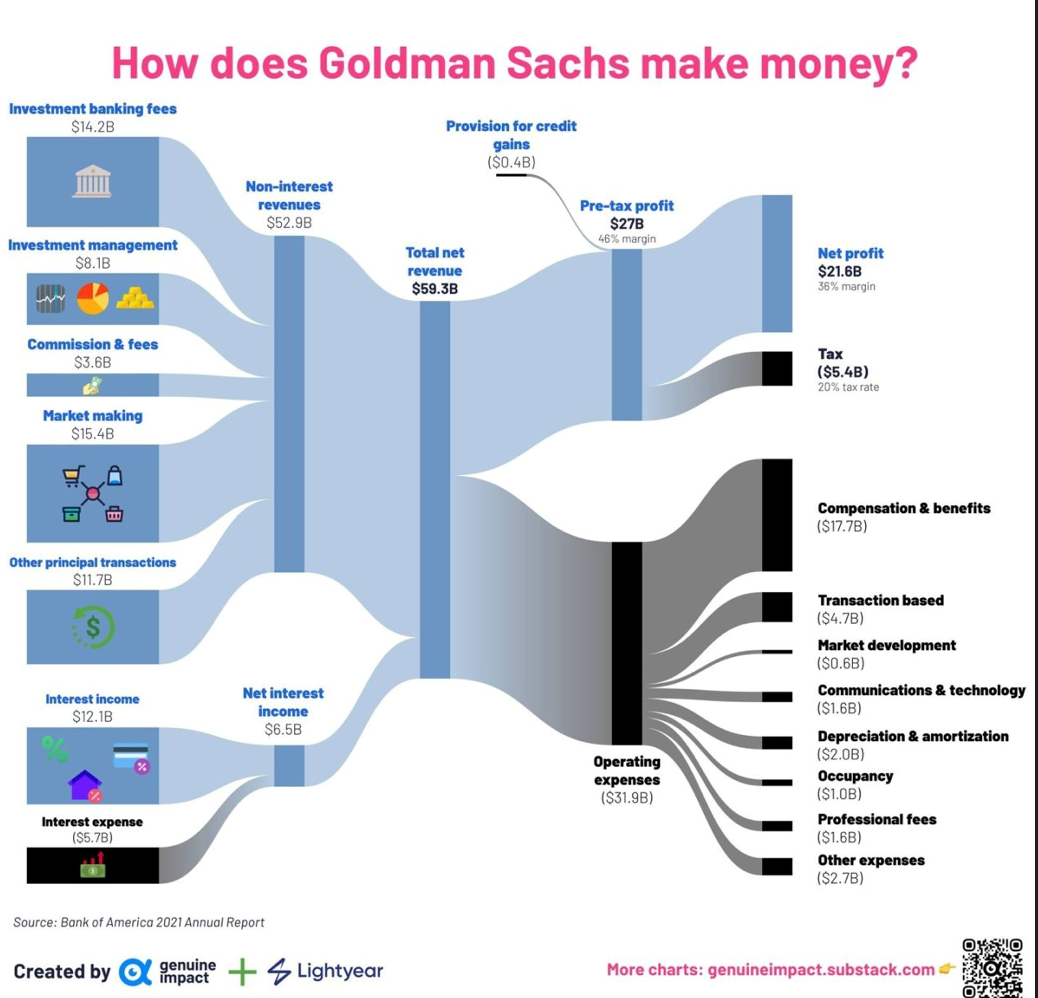

3. How Does Goldman Sachs Make Money?

Wall Street Oasis https://www.linkedin.com/company/wall-street-oasis/

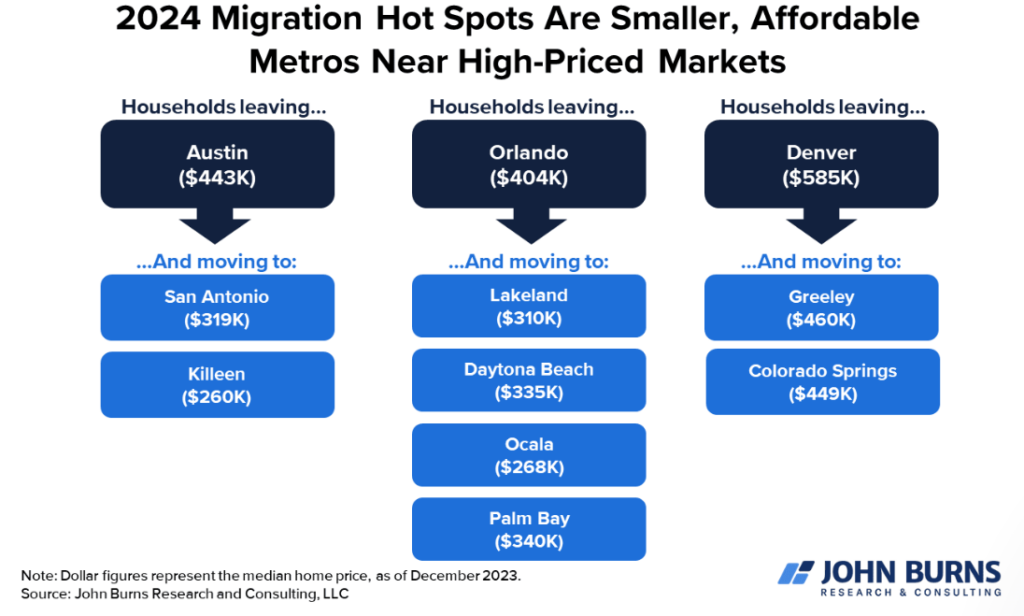

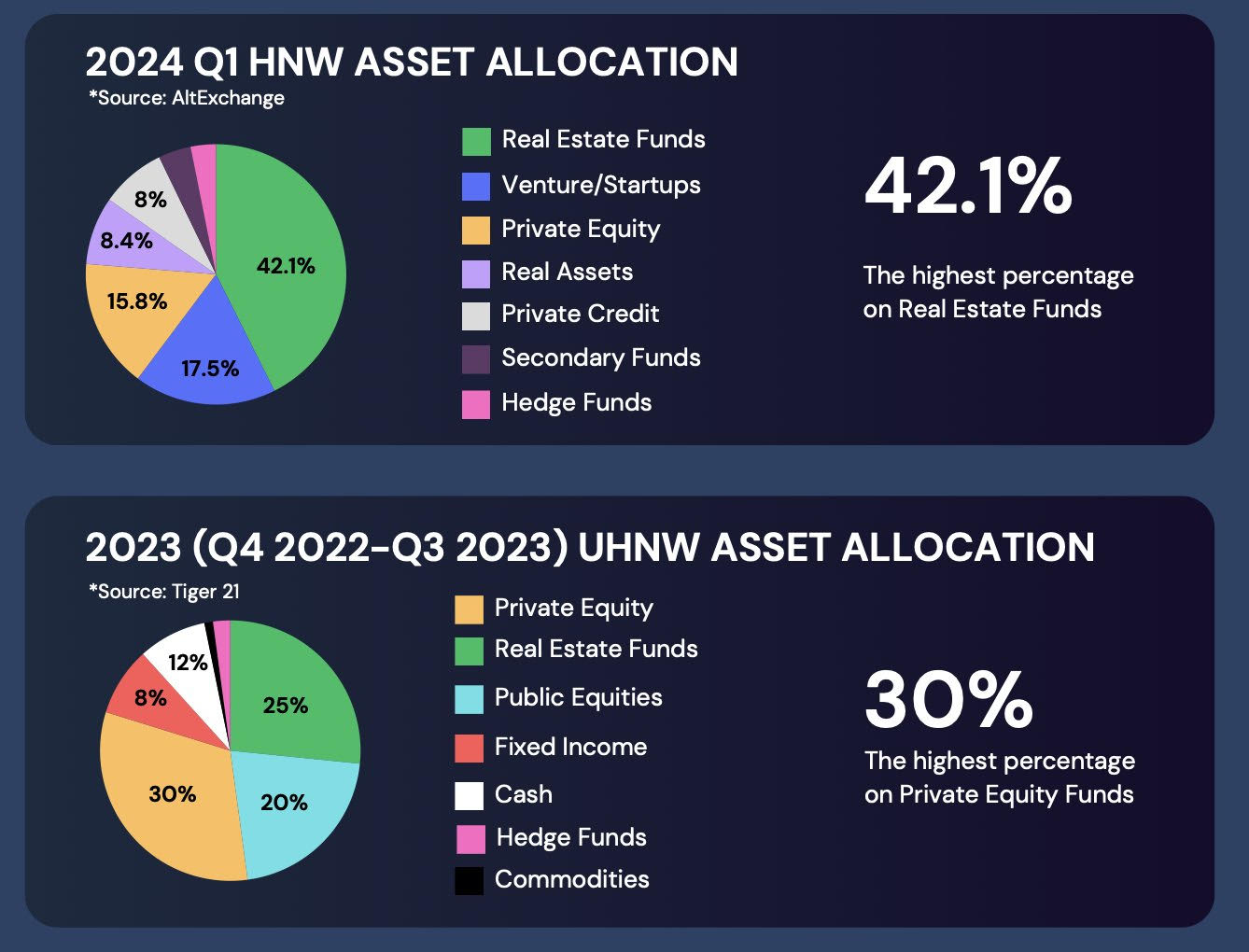

4. The Biggest Alternative Allocation for Wealth Americans is Real Estate

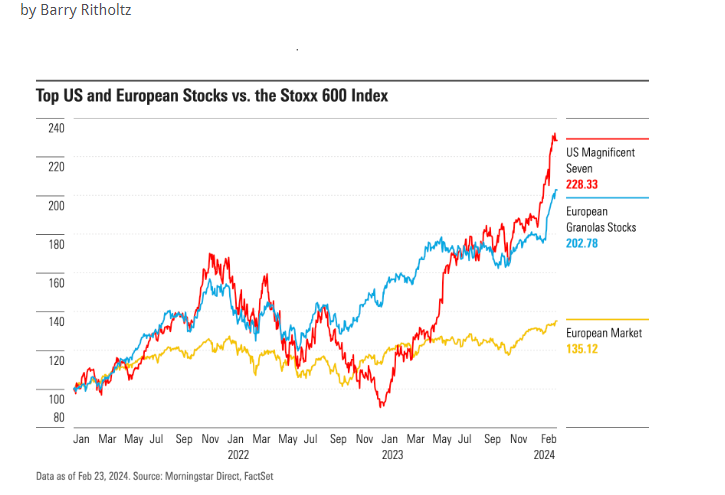

From Barry Ritholtz The Big Picture Blog

Wealthy investments in alternatives include some VC, PE, and hedge funds, but the bulk is in real estate

Source: @dollarsanddata

https://ritholtz.com/2024/03/sunday-reads-363/

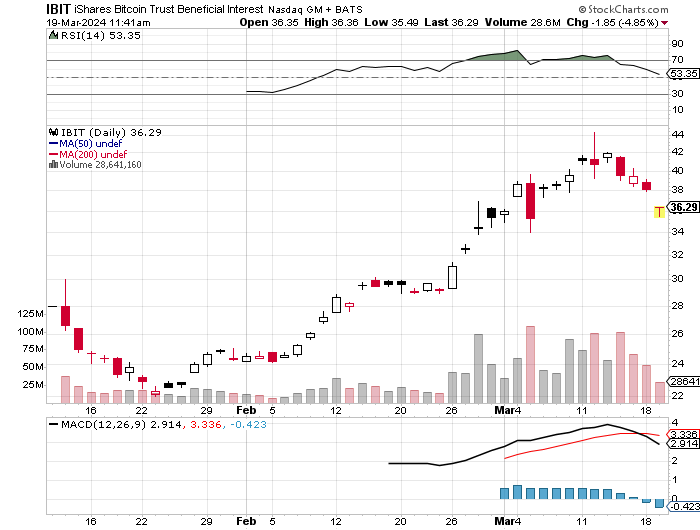

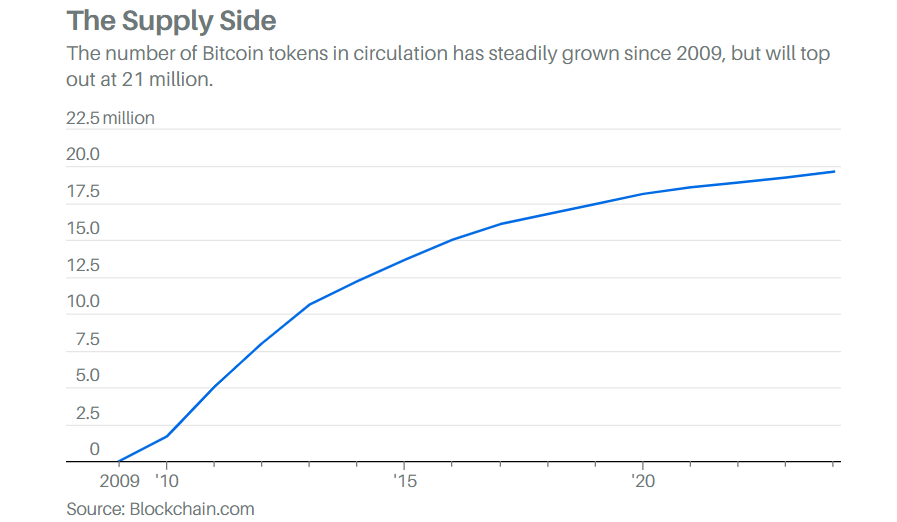

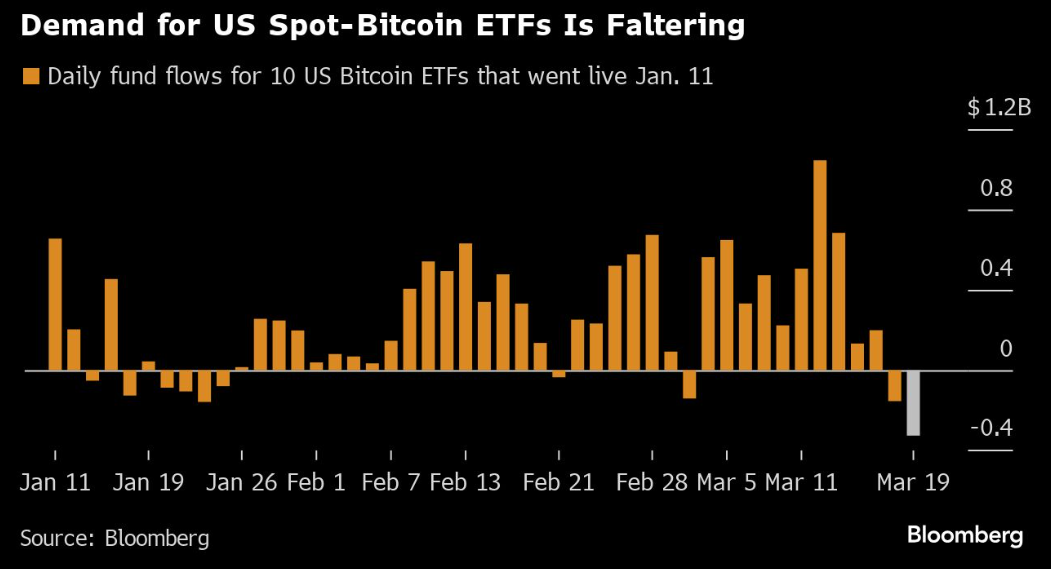

5. Demand for Bitcoin ETF Reverses Overnight

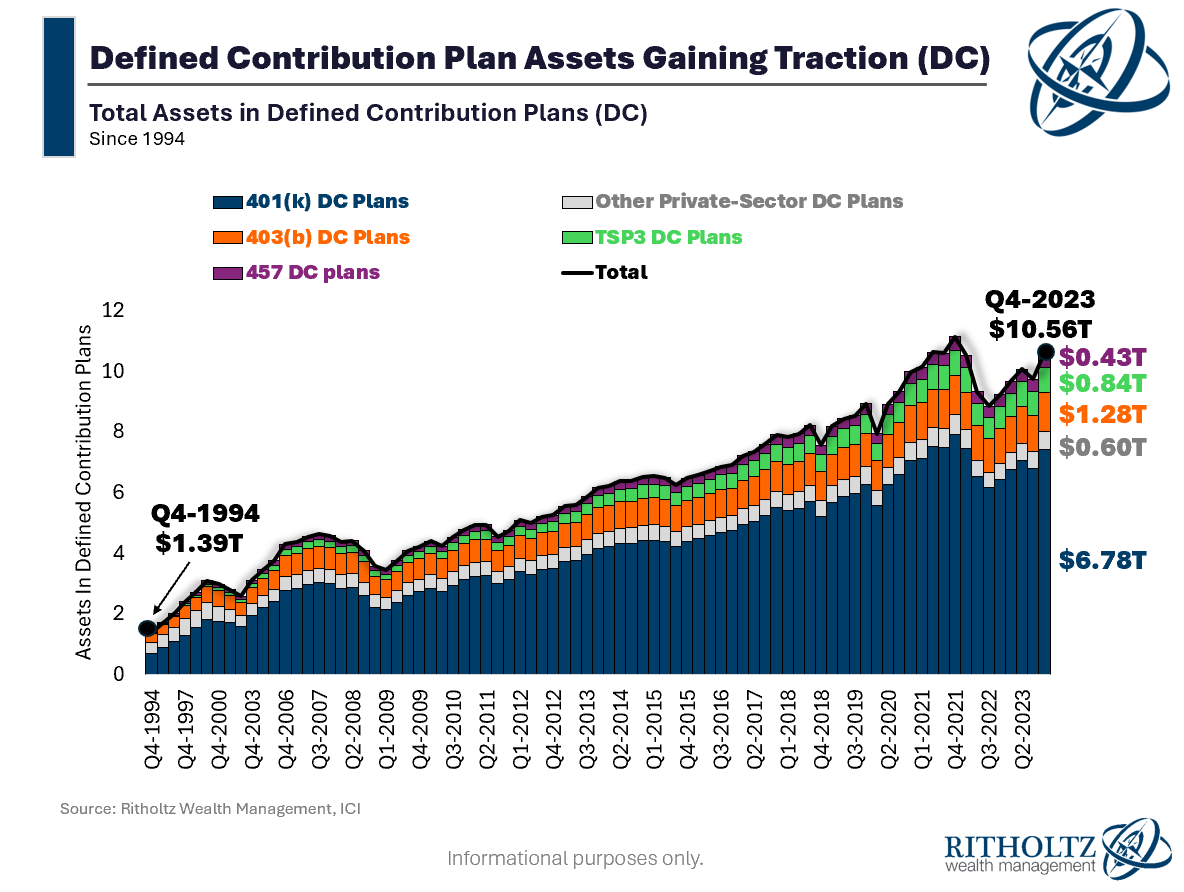

6. $10.56 Trillion in 401k Like Plans and It Keeps Coming Every 2 Weeks

Irrelevant Investor Blog @michaelbatnick

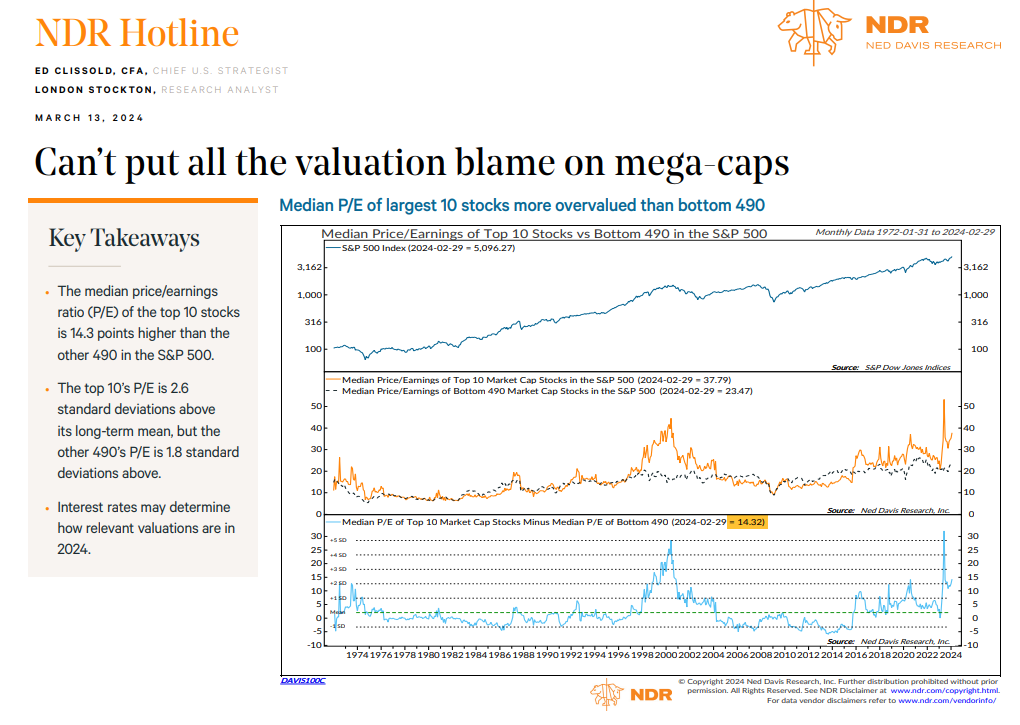

A tidal wave of money is pouring into the market with every paycheck millions of Americans receive. At the end of the 4th quarter, there was $10.56 trillion in Defined Contribution Plans. I don’t think it matters much* whether this money goes into actively managed mutual funds or index funds. The fact that it’s coming in, in this size, every two weeks come hell or high water, is absolutely having an impact on the price of stocks. Specifically, the price relative to whichever underlying fundamental metric you prefer to measure.

Why Are U.S. Stocks So Expensive?

7. Chipotle 50 to 1 Stock Split …

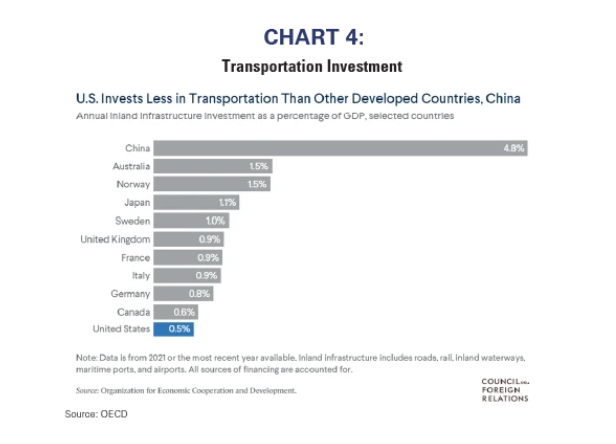

8. U.S. Transportation Investments

RBA Advisors

US Industrial Renaissance: It’s a matter of national security (rbadvisors.com)

9. Reddit IPO

FINANCE

The site that fueled memestock mania goes public

Today’s the day you can finally own stock in Reddit, the only social media platform where you can both stage a Wall Street coup and join a community for people who love stapling bread to trees.

The 19-year-old company, listed on the New York Stock Exchange as RDDT as of today, is selling 22 million shares priced at $34 each, valuing Reddit at $6.4 billion.

But that’s pretty much the only conventional thing about this IPO, which is being bet against by some of the very people who make the site what it is, prompting Reddit to warn of potential volatility.

Here’s what’s going on:

- In a nod to the platform’s reliance on user-generated content, Reddit set aside 1.76 million shares for certain US-based highly active users and volunteer community moderators.

- Many Redditors have not only passed on the IPO—they’re getting ready to dance on its grave. The 15-million-member r/wallstreetbets subreddit, which briefly turned GameStop to gold in 2021, is filled with talk of shorting RDDT and watching it “absolutely plummet.”

- Any Redditors who did buy before the bell won’t have to wait the typically mandatory six months before selling, so they could cash in on initial surges.

Growing pains

Last year Reddit CEO Steve Huffman said it was time to “behave like an adult company.” But the untameable beast that is the Reddit community hasn’t always been on board with Huffman’s efforts to make the site profitable…like when thousands of moderators protest-shuttered their communities after Huffman announced that third-party developers would have to pay for site access.

Now that it has a fiduciary duty to make its shareholders richer…Reddit has to figure out how to turn a profit without enraging users. But in a move that will probably anger many of them anyway, Reddit is looking to diversify its main revenue stream (ads) by letting companies train their AI models on user-generated content. It just signed a $60 million/year data licensing contract with Google, but the FTC is probing the deal.—ML

https://www.morningbrew.com/daily

10. You Can’t Succeed In Life Without This Skill

The Daily Stoic

Preparation is important.

Planning is important.

Reflection is important.

I mean, I wrote a whole book called, Stillness is the Key, because it’s true. And I was just saying earlier this month that I needed to slow down and take better care of myself because I was pushing too hard. And I just read and loved Cal Newport’s new book Slow Productivity (we had a great conversation on The Daily Stoic podcast, listen here).

At the same time, I also just hung up two signs at The Daily Stoic offices and in the backstock of The Painted Porch that say “A Sense of Urgency.” It’s something I cribbed from the kitchens of Thomas Keller, the creator of Per Se.

He wanted his staff to understand that they weren’t waiting on customers…the customers were quite literally waiting for them. Sure, making great food takes time and it can’t be rushed…but it also can’t be slow-walked.

I’m a ‘sense of urgency’ guy. I always have been.

As I was working on a draft of this article, one of my former employees sent me a short piece about the concept of “clock speed,” which in the world of computing refers to how quickly something can execute instructions. “Something you are very good at,” this former employee (and now friend) wrote. “You keep the tempo/momentum very high and if there is ever a bottleneck somewhere (decision or input), you process that as soon as physically possible. You return the ball very quickly.”

It’s funny that he said “return the ball” because that’s something I used to say a lot. I’d say look, we don’t control how long other people take to do things, but we do control how long we take. We want to hit the ball back into their court—I’d rather be waiting for them than them be waiting for us.

I started using a different metaphor more recently. When someone tells me that it’s going to take six weeks for our bindery to make another run of the leatherbound Daily Stoic, I want to “start the clock” as soon as possible. Meaning, I’m not pleased if I hear it took 2 weeks to make the decision about how many to order, or that somebody was slow in processing an invoice. I don’t control how long it takes to make stuff, but I do control when the clock starts on it.

The project is going to take six months? Start the clock. You’re going to need a reply from someone else? Start the clock (by sending the email). It will likely take a while for the bid to come back? Start the clock (by requesting it). It’s going to take 40 years for your retirement accounts to compound with enough interest to retire? Start the clock (by making the deposits). It’s going to take 10,000 hours to master something? Start the clock (by doing the work and the study).

It struck me that this has become a kind of dividing line between success and failure within my team. Those who haven’t worked out haven’t been able to start the clock or return the ball very quickly. It’s not just my team—it’s a source of frustration that fills the letters and dispatches of just about every great general, admiral, and leader throughout history.

In the American Civil War, General George McClellan, for instance, seemed utterly incapable of getting to the fight quickly, to the complete exasperation of everyone who worked with him. There’s even a story about Lincoln coming to meet with McClellan for a meeting but McClellan blew him off because he wanted to go to bed (he thought it could wait until the next day). Only after repeated prods from Lincoln—by “sharp sticks,” one of his secretaries said—did McClellan finally begin to move against Lee in 1862, taking nine days to cross the Potomac. “He’s got the slows,” Lincoln said in frustration. Joking to his wife after visiting the general in the field, Lincoln poked fun at his parked commander. “We are about to be photographed [if] we can sit still long enough,” he said. “I feel General M. should have no problem.”

McClellan was a brilliant soldier. But groaning under the weight of his baggage train, his conservatism, his entitlements, his paranoia, and his precaution, he was constitutionally unable to do things quickly, to act urgently, to care about the people waiting on him. He seemed to not understand how much the country was waiting on him, how much it was depending on him sending the message that the North was in the war to win it. Deep down, maybe he didn’t actually want to win the war–at least not early–hoping that a negotiated end might preserve slavery.

Lincoln’s big mistake, honestly, was not firing him sooner. You could say Lincoln had the slows himself there–or was in denial–about what needed to be done. Replacing McClellan was not easy and he had to cycle through a number of replacements, but if Lincoln had started the clock sooner, who knows how much sooner the war would have ended.

Not that I’m not saying you need to rush everything, I’m really not.

There’s another Civil War general I like, General George Thomas. Thomas was hardly known for his speed. His nickname, in fact, was “Old Slow Trot,” which he had earned for the discipline he enforced as a cavalry commander. But it really wasn’t that he was slow; he was deliberate. After all, a trot is not a walk.

Some people thought he was too slow and maybe sometimes he was. Thomas found himself at odds with Grant for not moving fast enough against General Hood’s army at Nashville, taking such an exasperatingly long time to get moving on Grant’s order to “attack at once” that Grant moved to personally relieve him.

Grant thought that Thomas wasn’t hurrying, that he was dragging his feet. In fact, he was fully committed–unlike McClellan–to attacking, he just wanted to ensure he succeeded when he did so. Having prepared properly, supplied adequately, and trained effectively, he waited for the right moment and then attacked with all deliberate speed. Thomas annihilated his enemy in the Battle of Nashville in December 1864, one of the great victories of the war. (His other nickname was the “Rock of Chickamauga,” for standing fast against a massive enemy attack that would have easily broken a fair-weather general like George McClellan.)

There is an old Latin expression that I think captures the balance here nicely: Festina lente. Make haste slowly. A sense of urgency…with a purpose. Energy plus moderation. Measured exertion. Eagerness, with control. It is about getting things done, properly and consistently.

Seneca once said that the thing all fools have in common is that they’re always getting ready to start. But the thing about clocks is that they are running even when we aren’t. If someone says it’s going to take six weeks to manufacture something, that’s the minimum. It will take longer if you delay getting started, also if you’re slow to respond to emails, or if you don’t start working on your plans to receive that shipment when it’s done. If you don’t have a sense of urgency about what you do, you’ll miss opportunities for efficiency and for effectiveness.

You aren’t someone who will work well on my team, or really, any great team.

So it’s worth asking:

Are you someone who reliably returns the ball? Are you someone whom colleagues and clients can count on to be there when they need you? Or will they have to prod? Will they have to beg? Will they have to repeat, again and again, the urgency of the situation?

Are you always getting ready to start or are you in the habit of starting the clock?

Do you have “the slows” or do you have a sense of urgency?

Where are you slowing things down, where could your clock speed be better?

Your success hinges on your answer. On your ability to effectively manage time. On your capacity to initiate projects, address tasks, expedite processes.

We don’t control the clock, but we control when it begins ticking on our projects and pursuits. Every moment of hesitation delays the outcome and diminishes the potential for success.

Don’t be a fool. Don’t be the person always getting ready to start. Instead, always be starting the clock.

https://ryanholiday.net/you-cant-succeed-in-life-without-this-skill/