1. Not the Sign of a Top…AAII Bull/Bear Sentiment Survey Just Had 15 Straight Weeks of Negative Readings…5th Longest Streak Ever. Historically Bullish

What is AAII Sentiment Survey?

Dorsey Wright Nasdaq

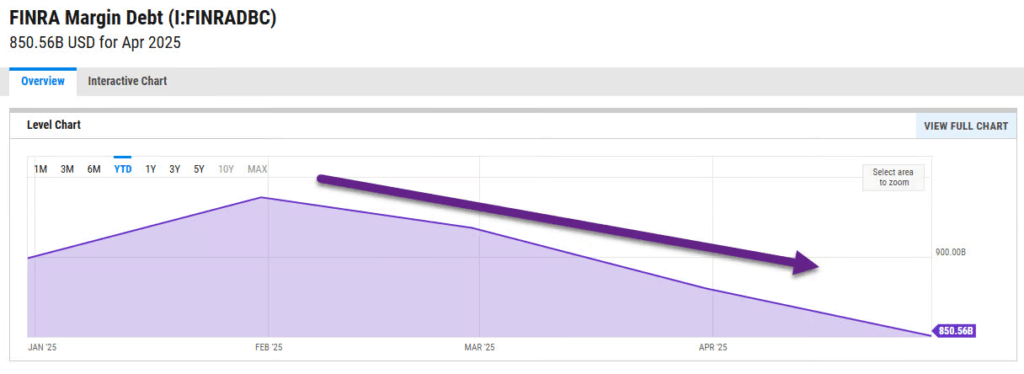

2. Not the Sign of a Top…Margin Debt Skyrockets Near Tops in Markets…Going Down in 2025

YCharts

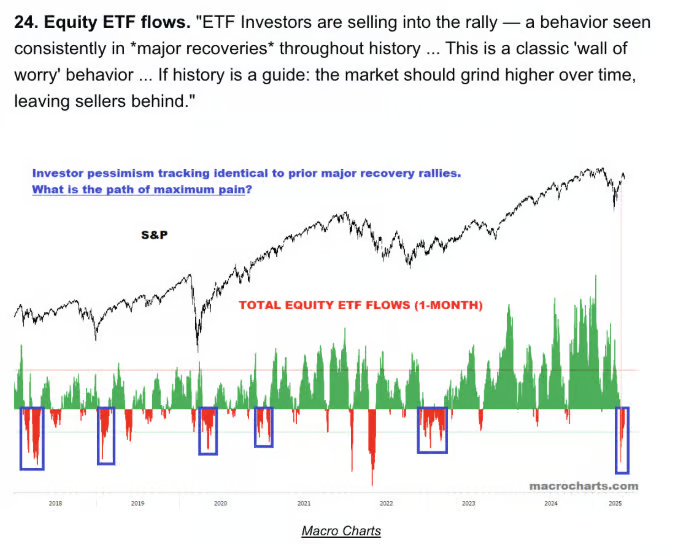

3. Not the Sign of a Top…Investors Bought the Dip Now Selling Rally

Macro Charts

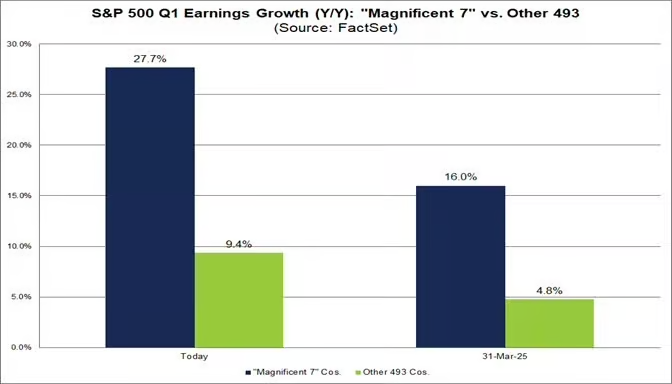

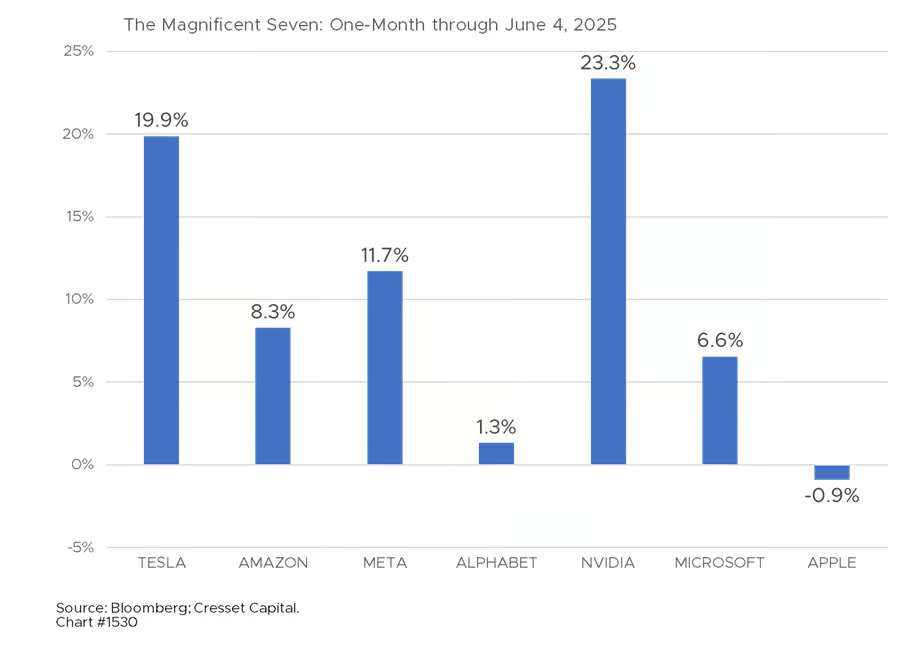

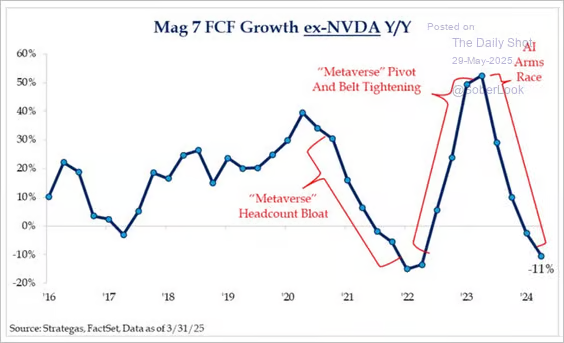

4. MAG 7 Spending Huge of AI Capex Sending Free Cash Flow (FCF) Down

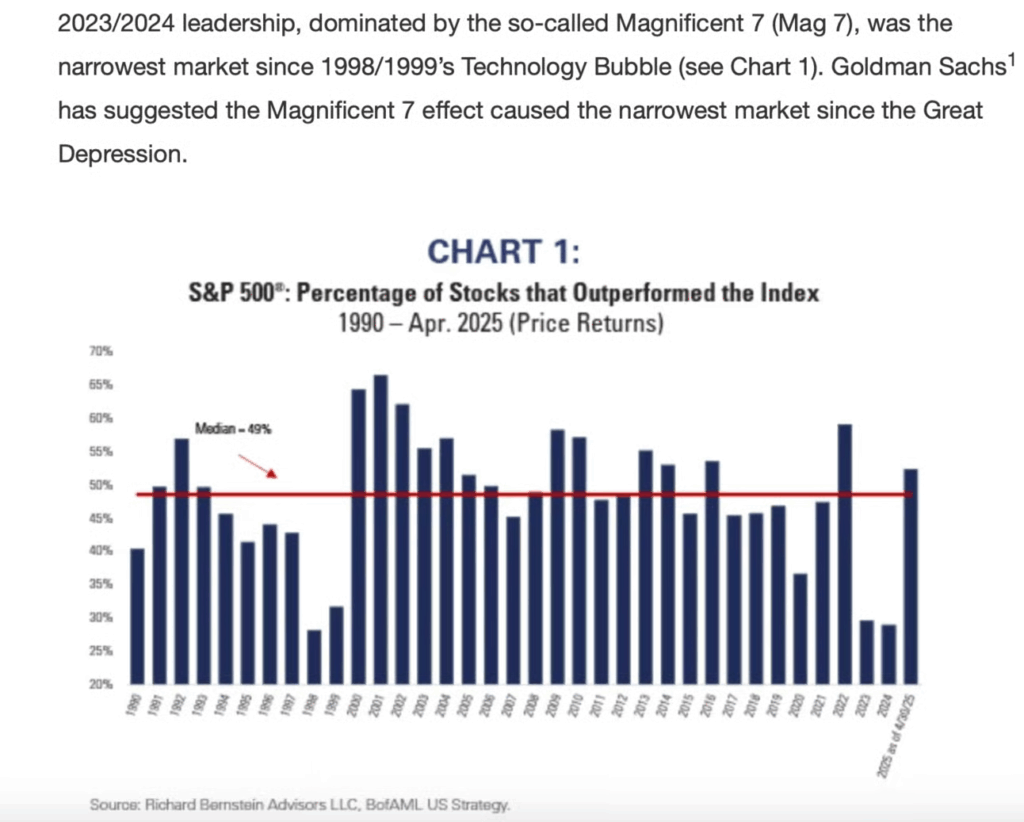

Equities: Excluding NVIDIA, the Magnificent 7’s year-over-year free cash flow growth has turned negative. The sharp rebound in 2023 was driven by cost-cutting and headcount reductions following the “metaverse” bloat, but that tailwind has faded as AI-driven CapEx ramps up, pressuring cash flows once more.

Source: @KevRGordon, @StrategasRP Daily Shot Brief

5. Dollar Chart Turning Back Down…Chart to Watch 2025

StocKCharts

6. Weak U.S. Dollar Key to International Equities Reversion to Mean Trade

Capital Group

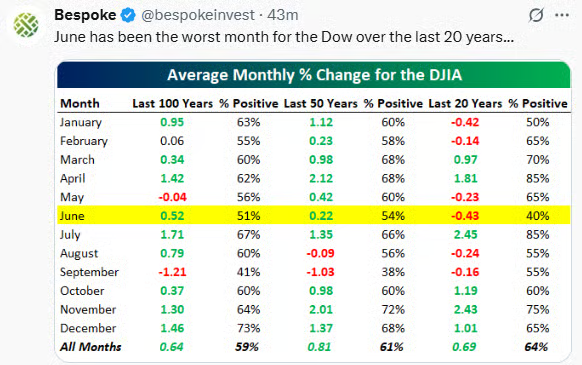

7. June Bearish Month

Bespoke

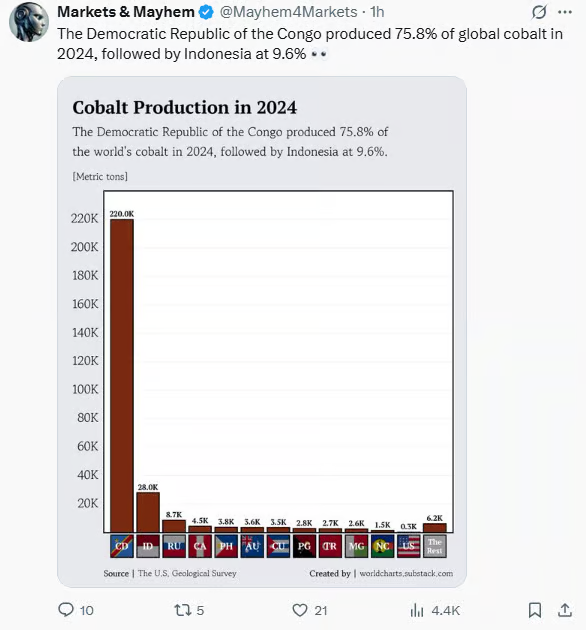

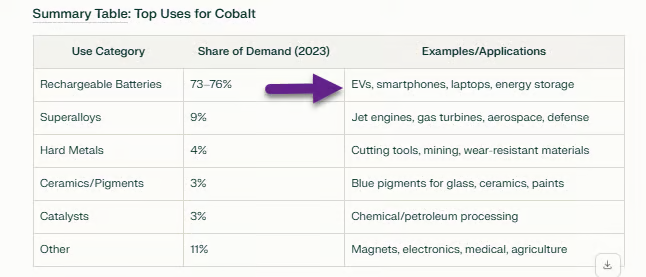

8. The Democratic Republic of Congo Produces 76% of World Cobalt

Markets & Mayhem

Perplexity

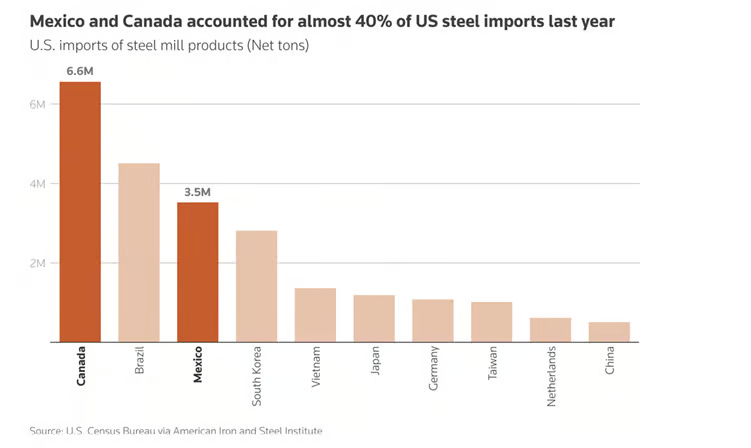

9. Mexico and Canada 40% of US Steel Imports Last Year

Reuters

10. Ten Science-Based Tools for a More Peaceful Mind

Learn about a few simple strategies for cultivating a peaceful mind.

Key points

- The body’s stress response includes sympathetic nervous system activation and the release of stress hormones.

- A relatively simple way to start calming the mind is by using visualization.

- Research shows spending time in the wilderness, a park, or even your front yard may benefit your well-being.

Via Psychology Today: A peaceful mind may be defined as a state of calmness or tranquility that is free from worry, ruminative thoughts, or other types of busy, frenetic thoughts. Oftentimes, we spend too much time thinking—thinking about what’s to come in the future, what’s happened in the past, or even what’s going on right now. When we do this, we make it difficult for our minds to calm in ways that are good for our well-being (learn more about your well-being with this well-being quiz).

There is much research on how we can decrease our distressing thoughts and calm the body. For example, we know that the body’s stress response includes sympathetic nervous system activation and the release of hormones like cortisol, norepinephrine, and epinephrine (Charmandari, Tsigos, & Chrousos, 2005). All of these make us feel wired, and this makes it difficult to have a peaceful mind. That’s why some of the techniques we’ll discuss below target the body directly. Once we help the body calm down, the mind can more easily follow.

- Visualization: A relatively simple way to start calming the mind is by using visualization. To try it, simply imagine yourself in a peaceful place. While visualizing yourself in this place, try to look at the world around you. What do you see, hear, and smell? If you can get your mind to imagine you’re in a place that makes you feel peaceful, your brain and body actually react as if you are in that place (Quoidbach, Wood, & Hansenne, 2009).

- Doing things you enjoy: Sometimes we get stuck in a clouded mind when our lives are dull, stagnant, or uninspiring. That’s why doing things you enjoy may help put your mind at ease. Doing fun things can help stimulate your mind so that when you are relaxing, your mind can fully rest.

- Going for a swim: Another way to calm the body is to activate the parasympathetic nervous system. Interestingly, immersing the body in cold water helps activate this system (Mourot et al., 2008). So if you’re feeling your mind racing, go for a swim in cold water or even take a cold shower.

- Getting outside: Perhaps one of the best ways to put your mind at peace is to get outside. Research shows that spending time in the wilderness, a park, or even your front yard may be beneficial for your well-being (Ulrich & Parsons, 1992). The outdoors offers so many different things that can help soothe the mind—fresh air, sunlight, and breathing in the scent of trees are all good for our health. Try to spend at least 15 minutes outside each day.

- Meditation: Meditation is a commonly used strategy when we want a more peaceful mind. The goal with meditation is to clear the mind of thoughts and just be present, often focusing on the breath.

- Listening to music: One study showed that listening to peaceful, relaxing music can reduce cortisol, a key stress hormone (Khalfa et al., 2003). In particular, binaural beats (i.e., when two tones with slightly different frequencies are played to each ear) seem to be beneficial and can even help improve performance (Garcia-Argibay, Santed, & Reales, 2019). Given the research, listening to soothing music may be another simple way to put the mind at peace.

- Practicing yoga: Yoga can actually reduce cortisol, a key stress hormone (Thirthalli et al., 2013). It’s not entirely clear why, but it might be because yoga involves deep breathing and concentration that prevents us from ruminating on our worries. Doing yoga regularly can be a great way to create a more peaceful mind and a healthier body.

- Using mantras: Using mantras may be another way to create a more peaceful mind. Mantras are types of chanting that are often used as part of Eastern meditation techniques. Early research suggested that mantras may be beneficial for well-being. Studies show that mantras can result in short-term decreases in stress and depression (Wolf & Abell, 2003).

- Using massage: Massage is another technique that may be helpful. One study showed that 10, 30-minute massages over five weeks led to a lower cortisol response (Field, 2005). Soothing physical touch does indeed seem to relax us. Whether it’s human-to-human interaction or getting aches and pains out of our bodies, massage can be a useful trick for calming the mind and body.

- Deep breathing: Deep, controlled breathing has been shown to activate the parasympathetic nervous system. This system is key in helping us de-stress, and it is the counterbalance to the sympathetic nervous system—our fight or flight system. Deep breathing also can quickly reduce anxiety and promote a greater sense of calm (Zope & Zope, 2013). By taking a few deep breaths, we begin to tell our body that things are safe, and the systems that are overactive can begin to mellow.