1. Copper Breakout…+13% One Day

StockCharts

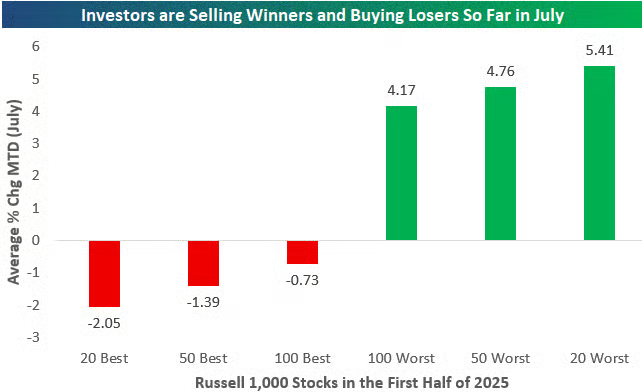

2. Investor Rotation Out of Winners to Start the Month

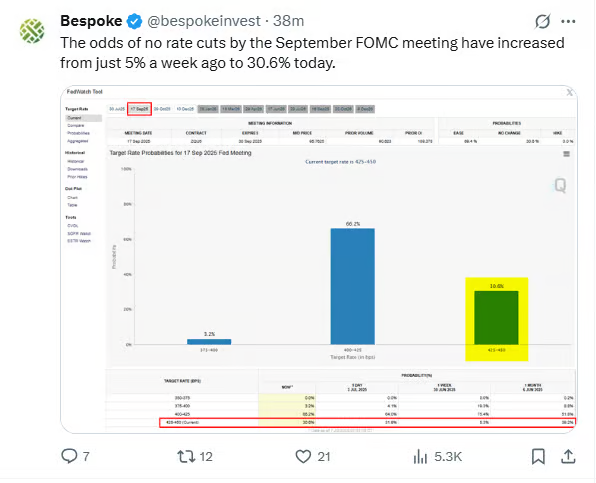

Bespoke Investments-The chart below highlights a sharp reversal in investor behavior so far this month, with a clear rotation out of the first-half winners and into the biggest losers. Looking at average month-to-date returns for Russell 1,000 stocks, the 20 best-performing names from the first half are down an average of 2.05%, while the top 50 and 100 from the first half are also in negative territory this month. In contrast, the worst performers from the first half are seeing a surge in buying interest: the 20 worst names are up an average of 5.41% MTD, followed by the 50 worst at 4.76%, and the 100 worst at 4.17%. This pattern reflects classic mean reversion trading, where investors rotate into beaten-down names in hopes of a rebound, while locking in profits on stocks that have already had big runs. It also suggests that investors are bottom-fishing in laggards in search for value or speculative bounce plays. Whether this is a short-term rebalancing or the start of a more sustained shift in market leadership remains to be seen, but it’s interesting that we saw similar pullbacks in first-half market leaders in July 2023 and July 2024 as well.

Bespoke

3. JOBY Electric Flying Taxis–$8B Market Cap

The Irrelevant Investor

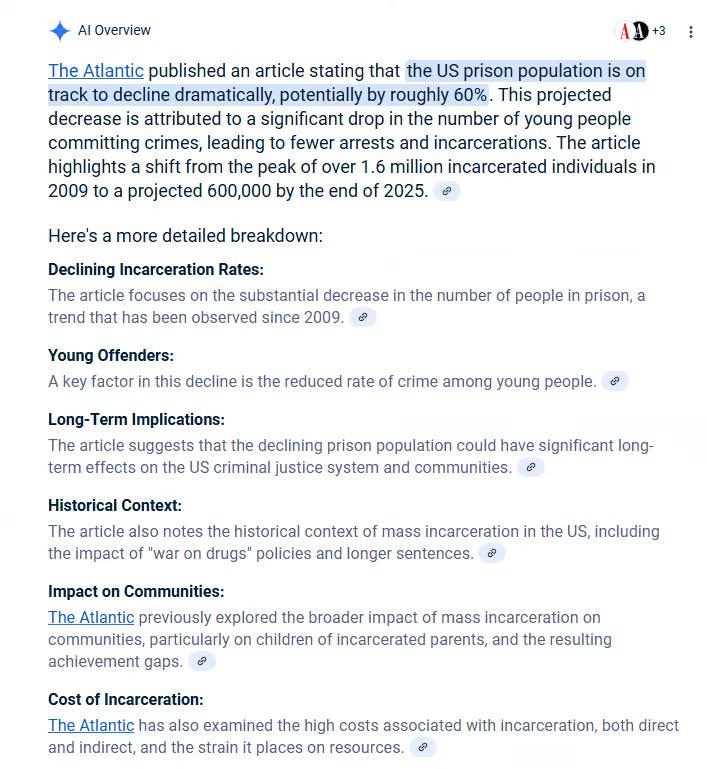

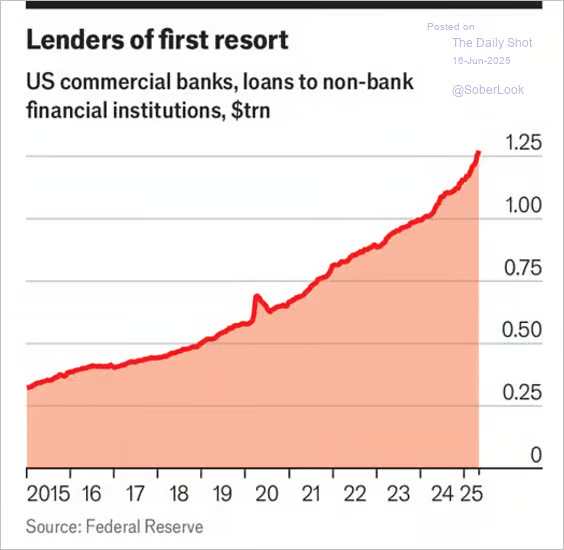

4. Banks Lending to Private Lenders that Lend to Businesses????

Credit: Loans from US commercial banks to non-bank financial institutions have more than doubled since 2020, now exceeding $1.25 trillion. This sharp rise underscores the deepening entanglement between traditional banks and shadow banking, amplifying systemic risk.

Source: The Economist Read full article via Daily Shot Brief

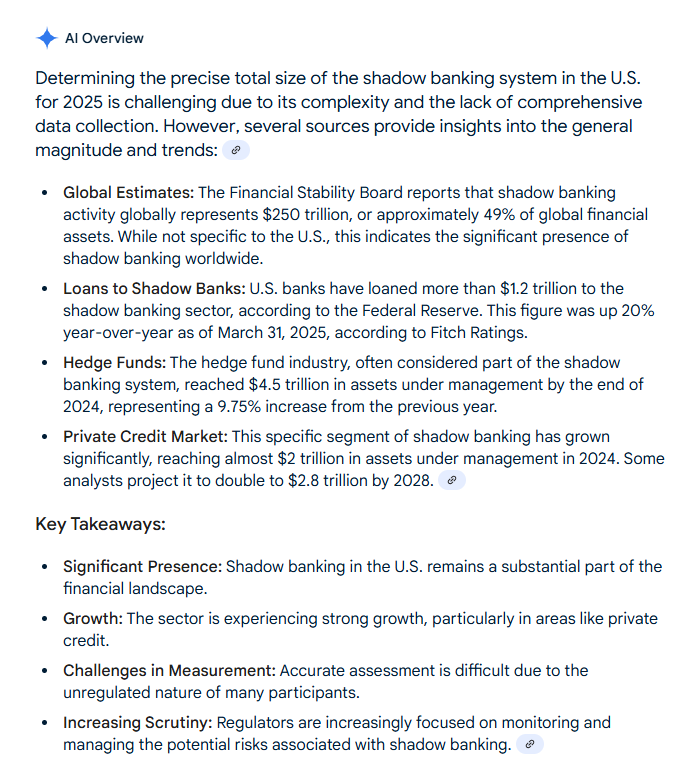

5. Shadow Banking System

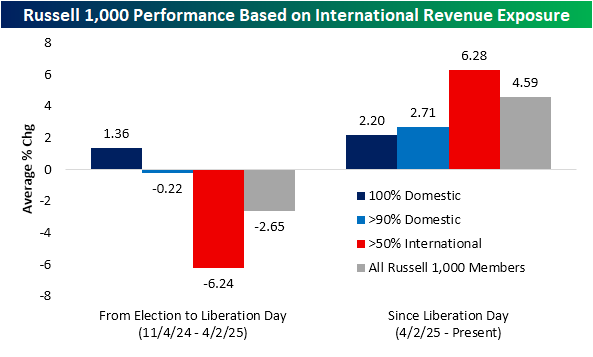

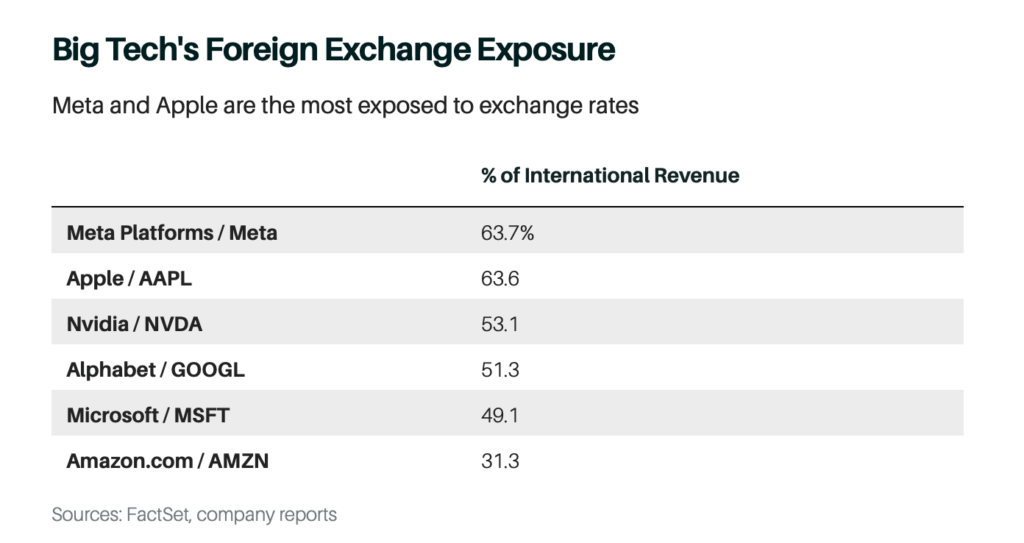

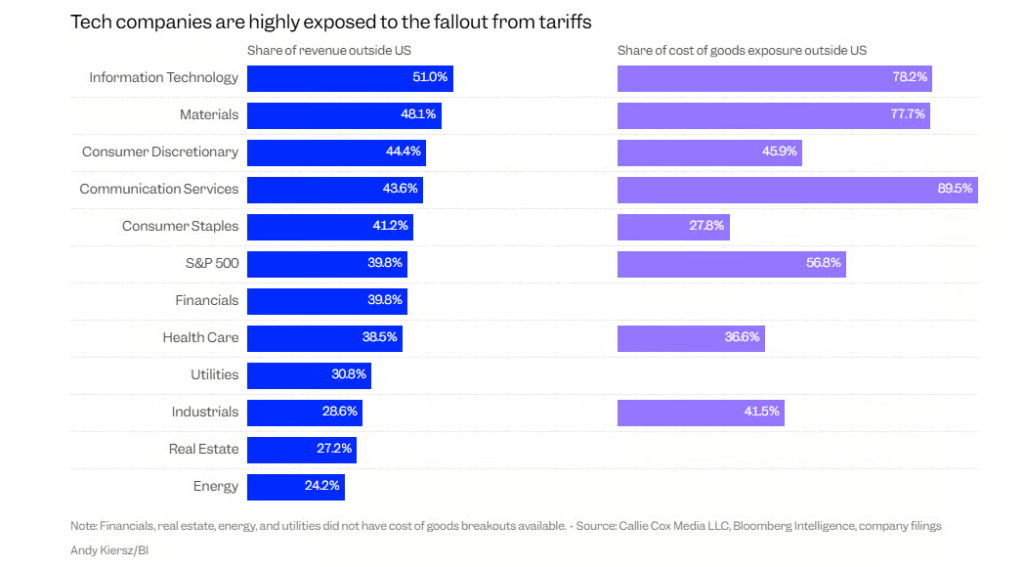

6. Weak Dollar Could Help Offset Some of Tech Stocks Exposure to Tariffs

Business Insider

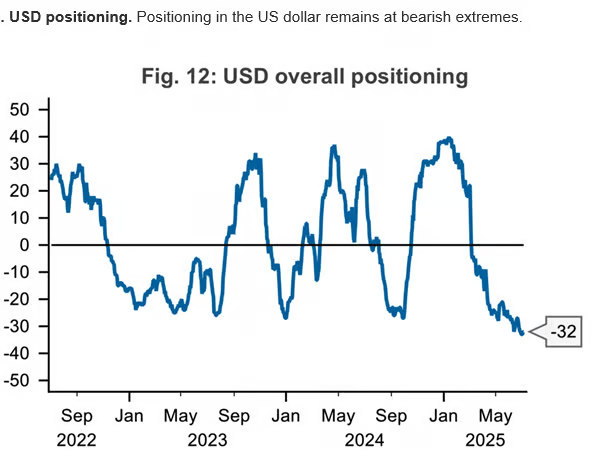

7. U.S. Dollar Positioning Extreme Bearishness

Daily Chart Book

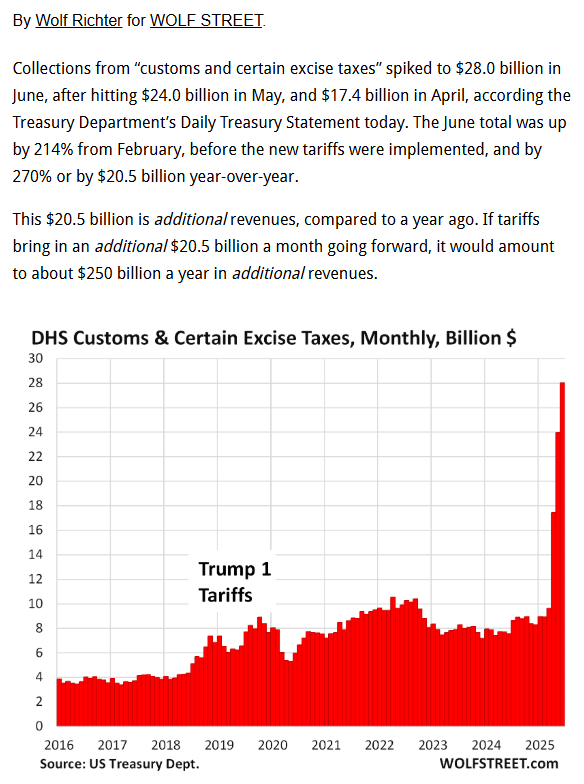

8. At Current Rate, Tariffs Would Add $250B Per Year to Revenue

Wolf Street

9. Another Russian Minister Kaput

BBC: Russian minister sacked by Putin found dead.

Russia’s Investigative Committee says former Russian transport minister Roman Starovoit has been found dead, apparently with a self-inflicted gunshot wound.

He was dismissed earlier on Monday by President Vladimir Putin.

No reason for Starovoit’s dismissal was given and deputy transport minister Andrei Nikitin was announced as his replacement shortly after.

The Investigative Committee said it was working to establish the circumstances of the incident.

Starovoit was appointed minister of transport in May 2024.

Before that, Starovoit had served as governor of the Kursk region for almost six years, until he became the transport minister.

The region was partly seized by Ukrainian troops in August last year in a surprise offensive. Moscow only recently managed to drive out the Ukrainian forces, although in late June, Kyiv said that it was still holding a small area of territory inside Russia.

Starovoit’s successor, Aleksey Smirnov, was only in post for a short while. He was arrested in April and was later accused of embezzling funds that had been allocated for the building of fortifications on the border with Ukraine.

According to Russian outlet Kommersant, Starovoit was about to be brought in as a defendant in the same case.

It is unclear when, exactly, he died.

The head of the State Duma Defence Committee, Andrei Kartapolov, told Russian outlet RTVI that his death occurred “quite a while ago”.

Earlier on Monday, before Starovoit’s death was announced, Kremlin spokesman Dmitry Peskov was pressed by reporters on whether the dismissal meant Putin had lost trust in Starovoit over the events in Kursk.

“A loss of trust is mentioned if there is a loss of trust. Such wording was not used [in the Kremlin decree],” Peskov replied.

10. Match Your Exercise to Personality

If your exercise routine has hit a summer slump, it may be because your workouts aren’t suited to your personality, new research suggests.

Personality traits can influence which physical activities people enjoy, as well as how often and how much benefit they get from exercise, according to a study published Tuesday in the journal Frontiers in Psychology.

About 31% of adults fall short of the recommended 150 minutes of moderately intense physical activity per week, highlighting the need for tailored exercise programs to get people motivated, scientists at University College London said.

“Understanding personality factors in designing and recommending physical activity programs is likely to be very important in determining how successful a program is, and whether people will stick with it and become fitter,” senior author Paul Burgess, a professor at the UCL Institute of Cognitive Neuroscience, said in a news release.

The researchers recruited 132 adults, who underwent baseline fitness testing before they were split into two groups.

For eight weeks, one group was asked to follow a home fitness regimen that included strength training and cycling workouts of varying intensity. Those in the control group were provided with stretching exercises but otherwise continued their typical lifestyles.

It’s expected that introverts would gravitate toward solo workouts and extroverts would shine in group fitness classes, but the study showed some surprises.

To participate, the volunteers filled out questionnaires that measured the so-called Big Five personality traits:

Agreeableness

Conscientiousness

Extraversion

Neuroticism

Openness

The more extroverted participants did enjoy high-intensity interval training (HIIT) workouts and aerobic fitness lab testing.

However, people who scored high on extraversion were less likely to complete follow-up testing, so only 86 participants overall completed the study. In addition, extroverts didn’t have greater fitness improvements.

“Extroverts often prefer team sports or group fitness classes, and they get energy from fellow exercisers,” Dr. Blaise Aguirre, a child and adolescent psychiatrist at McLean Hospital in Arlington, Massachusetts, said in an email. “On the other hand, others who are more conscientious would be drawn to structured, schedule-based activities — say, a specific class at a gym where a specific and predictable routine is followed — and this is because this fits their organized, goal-oriented nature.”

People who scored higher on neuroticism — that is, a tendency to be moody or anxious — liked low-intensity exercise sessions at home as opposed to being supervised in the lab. They were also less likely to self-monitor their heart rates.

“People who are very anxious might avoid challenging forms of exercise or ones that involve others for fear of embarrassment, and because of this gravitate toward solo or less intense activities,” wrote Aguirre, who wasn’t involved in the study.

An important finding for people with anxiety: Participants with high neuroticism in the exercise group were the only ones who showed decreased stress, the authors noted.

At baseline, the participants who were more conscientious demonstrated better physical fitness and worked out more hours per week. That trait wasn’t a predictor of how much someone enjoyed exercising, though.

Participants who scored high in openness were less likely to enjoy the HIIT workouts and threshold rides — or cycling to boost aerobic power — which involved varying intensities. But they were likelier to complete follow-up testing.

People who are high in openness might be willing to experiment and seek out novel or varied routines, Aguirre said in email. “For instance, if they typically go to the gym and like to jog, they may be open to trying dance, hiking or some new fitness trends.”

The trait of agreeableness predicted more enjoyment of an “easy, long” bike ride, the study found.

Which workouts work for my personality?

The link between personality and physical activity goes both ways, Aguirre said.

“In as much as your personality shapes your exercise routine, exercise can shape personality in return, in that it can also help reinforce positive traits (like being more disciplined and more sociable) and reduce negative ones (like anxiety or emotional instability),” he said.

Whether you’re looking to refresh your exercise regimen or starting from scratch, Aguirre recommends keeping these tips in mind:

Know yourself and your nature.

Choose activities that match your traits.

Start small and build consistency.

Seek support if needed.

Be patient with yourself.

“There is no one-size-fits-all approach,” he said.