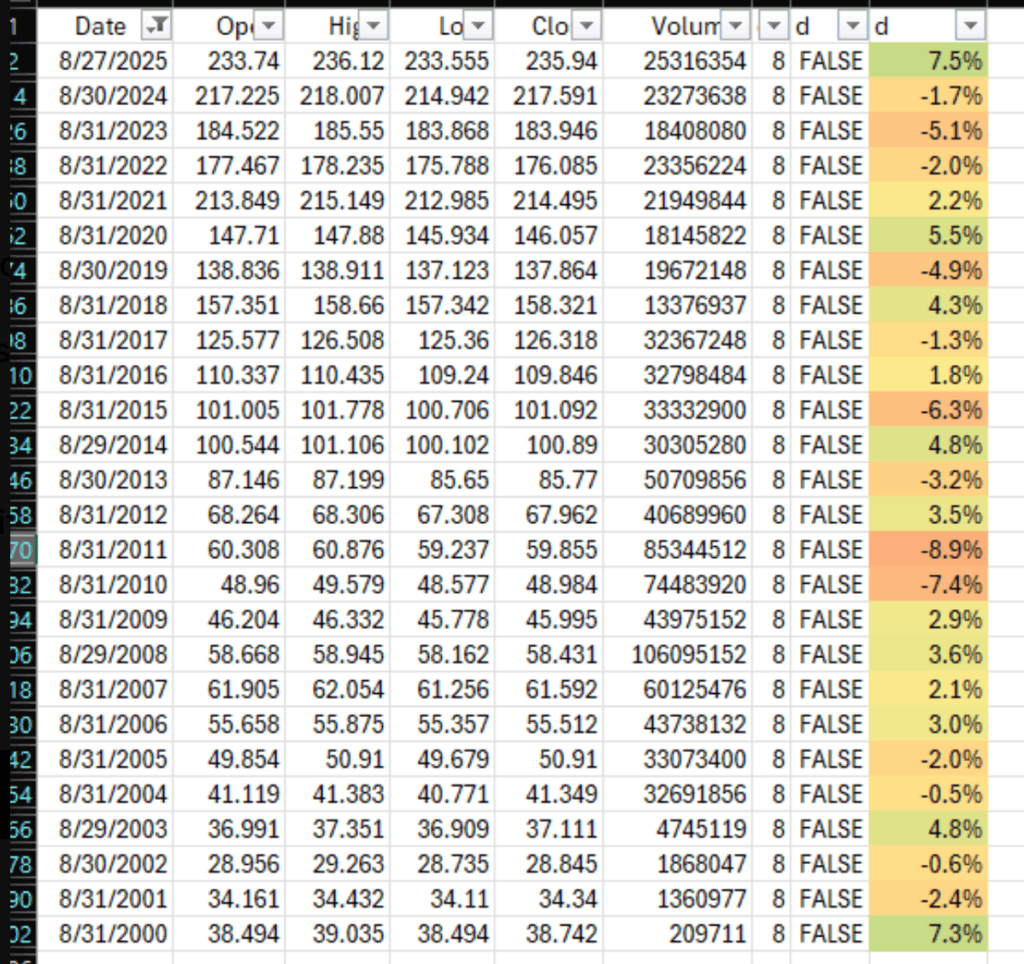

1. Largest Top 10 U.S. Stocks vs. World-Prof G Markets

Prof G Markets

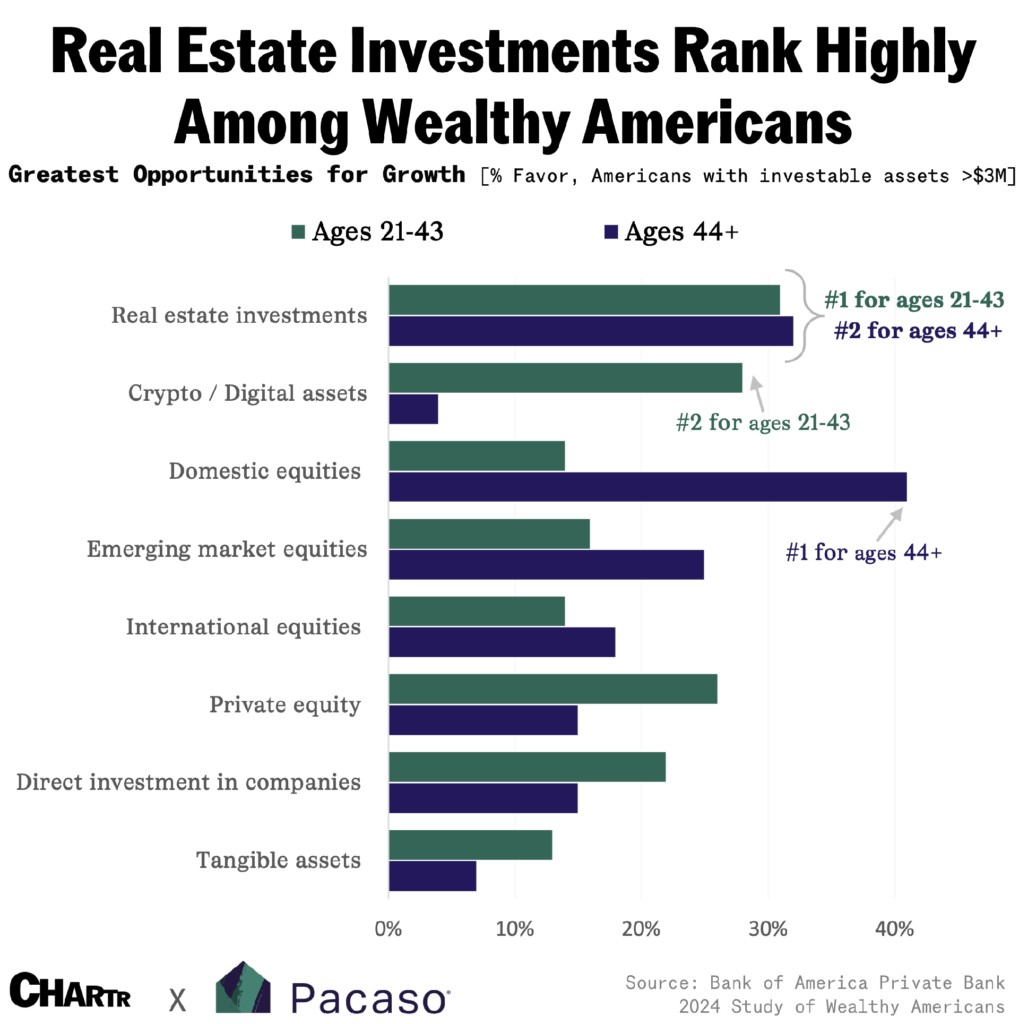

2. Private Equity/Alts Charts from Michael Batnick

The Irrelevant Investor

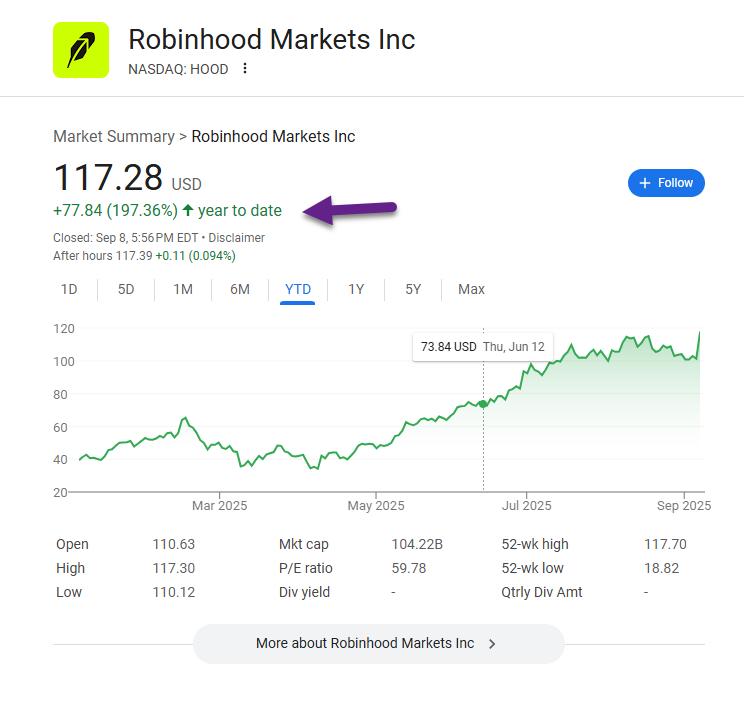

3. RobinHood +197% 2025…New Highs

Robinhood Markets Inc

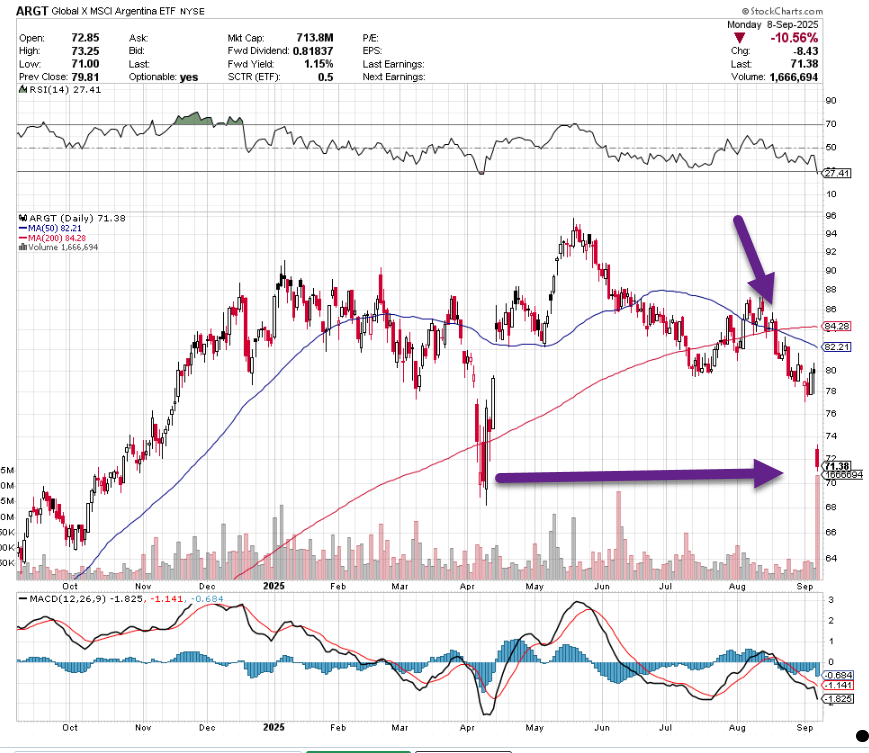

4. Election Setback in Argentina…ETF Pulls Back to April Lows

50day thru 200day to downside.

StockCharts

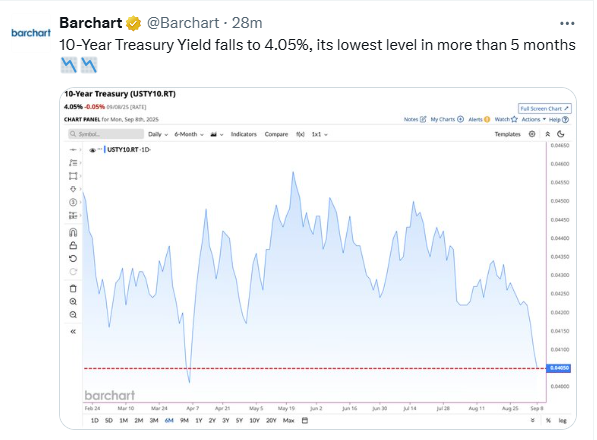

5. 10-Year Treasury Chart Approaching 4% Levels

Barchart

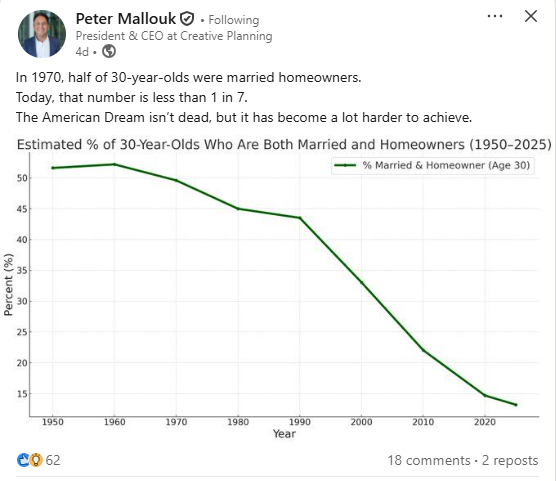

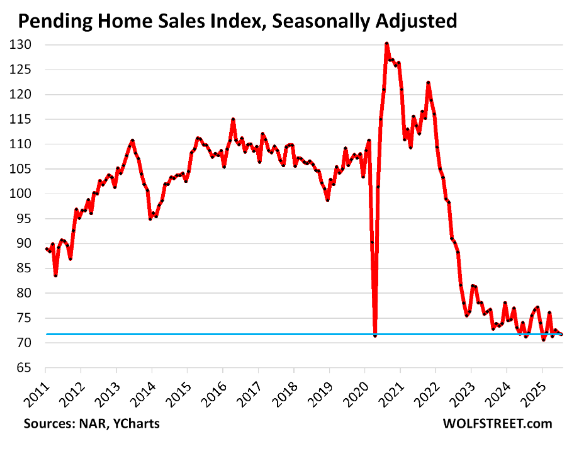

6. Housing Needs Lower Rates….Three Years of Pending Sales Index Down

Wolf Street-Demand in the housing market sagged further: Pending home sales dropped by 0.4% in July from June, seasonally adjusted. They have now spent nearly three years crawling along, or setting, record lows, according to data going back to 2010 from the National Association of Realtors today (historic data in the chart via YCharts):

Buyers Strike

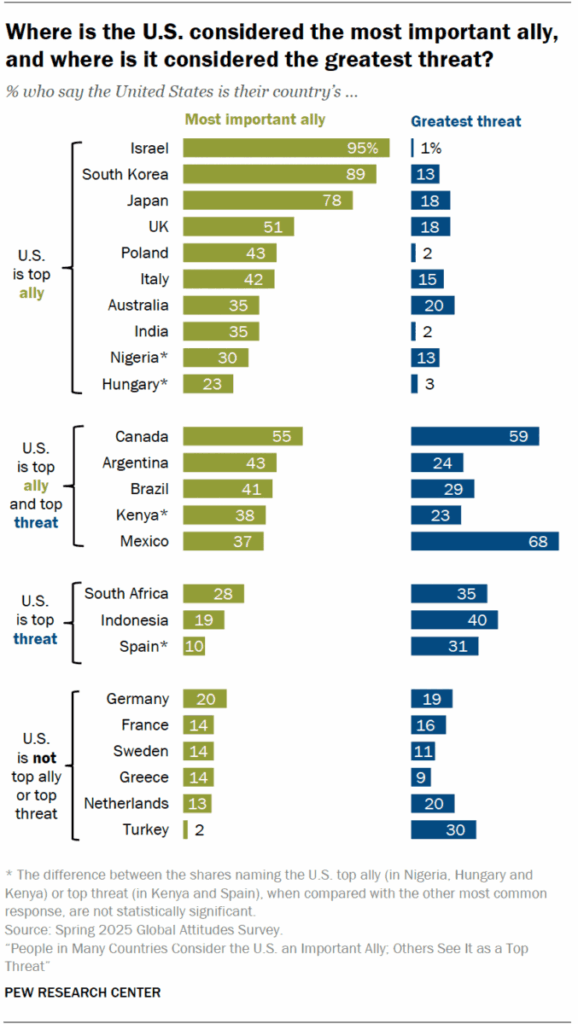

7. U.S. Most Important Ally vs. Threat

People in Many Countries Consider the U.S. an Important Ally; Others See It as a Top Threat

The Big Picture Blog

8. 90% of Americans Largest Asset is Social Security

Americans’ Most Valuable Asset Isn’t Stocks or a Home. It’s Social Security.

For the vast majority of people, the stream of promised retirement checks is worth more than anything else, our columnist says. By Jeff Sommer

Jeff Sommer writes Strategies, a weekly column on markets, finance and the economy. Social Security is the most valuable thing most Americans have.

I don’t mean this in an abstract sense. In purely financial terms, the Social Security check that you are getting now or have a right to receive when you are older is your most valuable financial asset.

That statement is true for nearly everyone except those in the top 10 percent of the wealth distribution in the United States. And for people right in the middle, Social Security amounts to roughly one-third of their total wealth, on average, according to an eye-opening study by the nonpartisan Congressional Budget Office.

For poorer people, Social Security isn’t just the most valuable asset they’ve got. It can be absolutely crucial — the difference in old age between destitution and a bare modicum of survival. And it helps people with disabilities and children as well as older Americans. Social Security lifts more people out of poverty than any government program, according to a separate study by an independent research institute the Center on Budget and Policy Priorities.

Anything this important ought to receive far more attention and respect than it has been getting. Instead, Social Security is a neglected responsibility of the political classes — a precious 90-year-old legacy that has been allowed to fall into disrepair.

Consider this: If Social Security is your most valuable asset — and it is, for nine out of 10 households, according to the budget office — protecting Social Security ranks among the most important things that will help you financially.

https://www.nytimes.com/2025/09/05/business/social-security-wealth-benefits.html

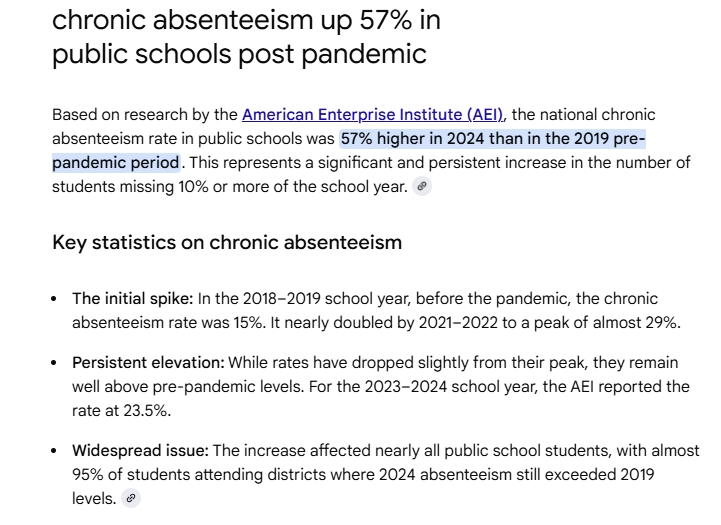

9. Chronic Absenteeism in Schools Post-Covid World

Google AI Search

10. Write it down, write it down, write it down

September 8 Update: On the importance of “writing it down,” + AI and education, and more.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A quick PSA: 1) several of you have sent me some very cool leads / intros of different creators / entrepreneurs to chat with, thank you I love you all. 2) I do read all of my email replies and try to respond to as many as I can, so if you have someone you think I should meet, def shoot me a note!

Write it down, write it down, write it down.

As a “non-technical” San Francisco resident (a slur used by software engineers and programmers to describe normies like me who weren’t building React apps pre-ChatGPT) during an AI boom, I think it’s important to ramp up my knowledge base on how all of these AI tools work under the hood. This would, of course, make me better at my job as an investor, but it’s also a hubris thing. It annoys me when I’m interested in a thing, or I use it a lot, and I don’t really know it works.

My method for speed-running this knowledge acquisition has increasingly been to build things using the technology that I’m interested in. Pre-AI coding assistants, this would have been difficult to do without a programming background, but now with Claude Code / Cursor / ChatGPT, you really can “just do things.”

My most recent interest was learning how to fine-tune a model. You hear about “fine-tuning” and “training” models all the time, but what does that actually mean? Like, what are you, the “fine-tuner,” actually doing? So I decided to fine-tune one of OpenAI’s models by training it on all of my travel blogs to create an chat model that can generate “Jack Raines-style travel blogs” on a whim.

The whole process only took a few hours, and after taking it live, I took another hour or two to document the whole process for future record.

I’ve always been a big proponent of “writing is thinking,” and I have always thought process documentation was important, which shouldn’t be a surprise considering that I am a writer. But I think the importance of slowing down and writing out your thoughts and processes has increased 10x now that AI tools are so prevalent.

Why?

Because knowledge acquisition used to be an automatic consequence of doing or researching anything, but thanks to AI, the end result the the knowledge formerly created by reaching the end result have become decoupled. Writing is the forcing function to ensure that you actually retain knowledge from AI-enabled projects.

Pre-ChatGPT, it was pretty difficult to reach your end result or ideal output without learning how the thing you’re trying to build, or the idea you’re trying to research, works along the way. Three years ago, if you wanted to create a simple python tool that allowed you to forward emails to a particular address and receive Spanish translations of those emails a few seconds later (I spun this up a few weeks ago), you would have had to understand the logic of the code itself and be very intentional about the software stack you used to connect all of the pieces for it to work. Your intuition was being refined the entire time you were building the thing.

Now? You can hack the whole thing together in a few hours with coding assistants without having any idea how the backend that you just built “works.” The result? You have a functional tool, but your actual “learnings” from building that tool are minimal. If you spend an hour or two after building the tool to document your process, however, you’ll retain much more knowledge of “how” you built the whole thing, which will allow you to move faster and more purposefully on future projects, and if you take the time to read through the script(s) and analyze what the code is actually doing, your intuition about coding logic will improve. Again, pre-AI, your intuition was strengthened simply by doing the work. But now that you can streamline 90% of the labor, you have to be intentional about the learning.

The same is true for anything “research-y.” Say I’m digging into the marine robotics space as diligence for a couple of investment opportunities. I could almost-certainly offload most of the cognitive load of the “research” to a Gemini deep research report, and read through a thorough, well-written, AI-generated report after. The problem is that your fully-AI-generated report will be logically sound, and while reading it will obviously inform you about your topic of interest, reading without writing won’t reveal to you all of the things you don’t know.

The process of writing about a topic makes the holes in your knowledge base immediately obvious because you’ll be stopped mid-sentence when you’re working through an idea as you encounter an information gap. Those information gaps inform the direction of your research, and you accumulate more and more knowledge as you seek to fill those information gaps. You have to do the writing yourself to retain the lion’s share of the ideas, and more importantly, to strengthen your intuition over time.

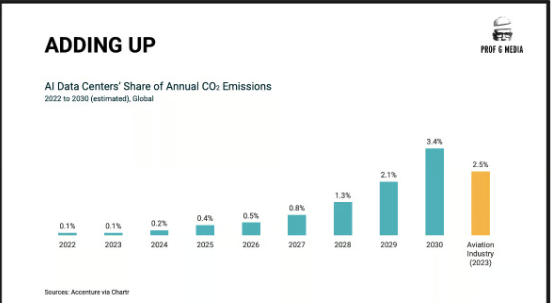

Writing is also powerful reinforcement learning: ideas stick with you better when you write them out and read them. That’s not to say that we shouldn’t use AI assistants. Claude Code is fantastic, and my ChatGPT usage is absolutely contributing to global warming. But if you aren’t retaining the knowledge related to your work, AI isn’t giving you leverage. It’s turning you into a commodity.

https://www.youngmoney.co/p/write-it-down-write-it-down-write From Abnormal Returns Blog www.abnormalreturns.com