1. Start with a Couple Small ETFs That Doubled Off Corona Bottom

NERD ETF Chart-Esports and Digital Entertainment

NERD ETF Chart-Esports and Digital Entertainment

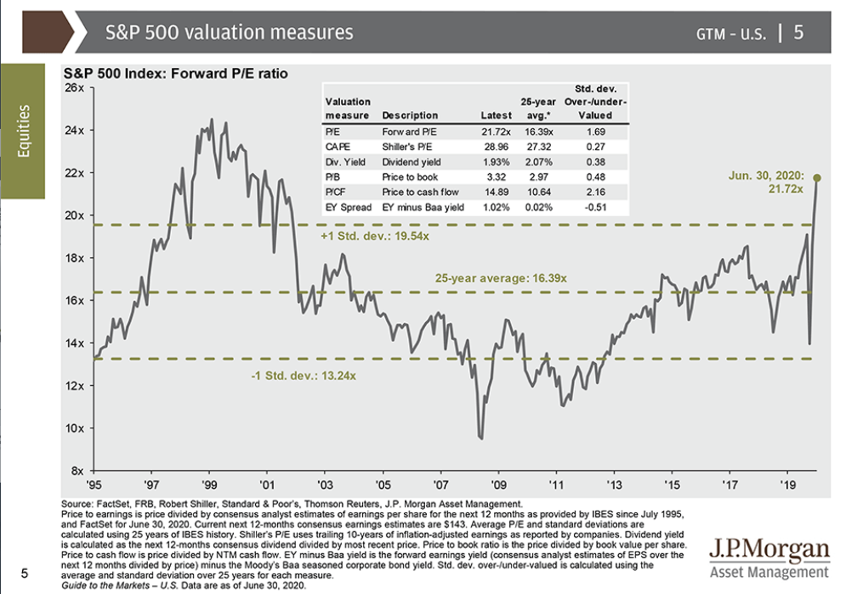

S&P Above 1 Std. Deviation Expensive

Buffett puts some cash to work with buy of Dominion.

Posted June 29, 2020 by Joshua M Brown

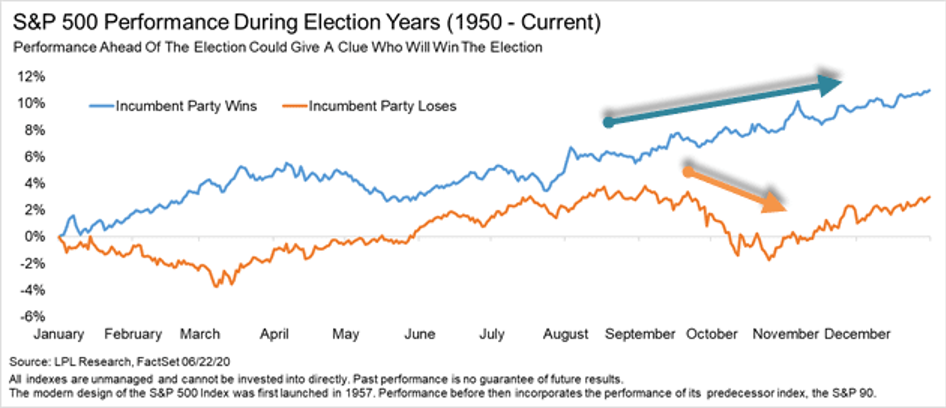

Ryan Detrick from LPL Financial made my Chart o’ the Day today…