Category Archives: Daily Top Ten

Topley’s Top Ten – May 14, 2020

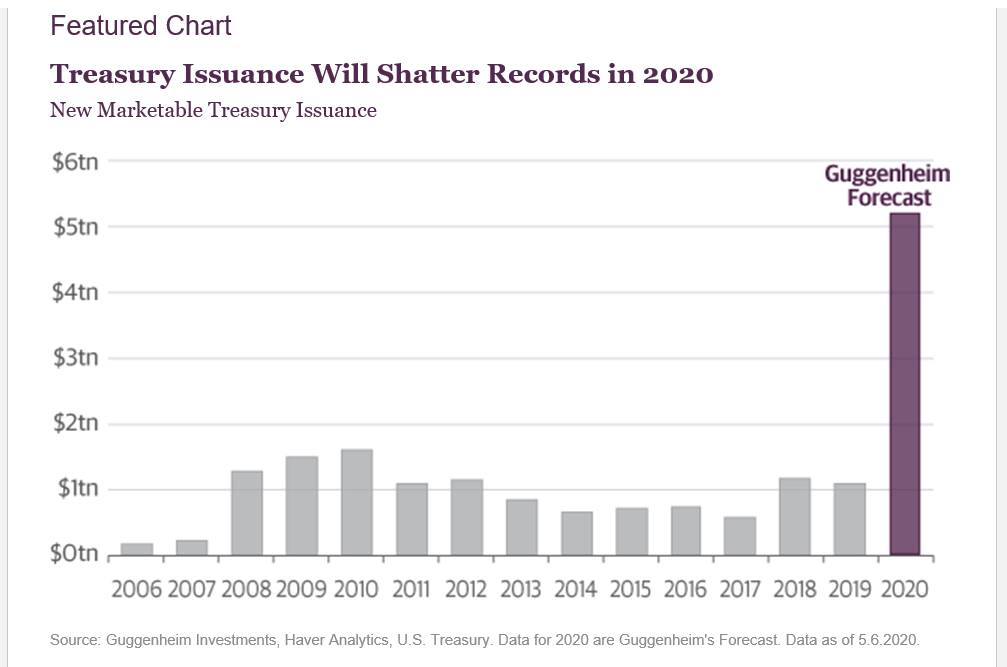

1.Sector and Industry Returns Since 2/19/20

Bespoke-Some Stocks Moving Above February Highs

Wed, May 13, 2020

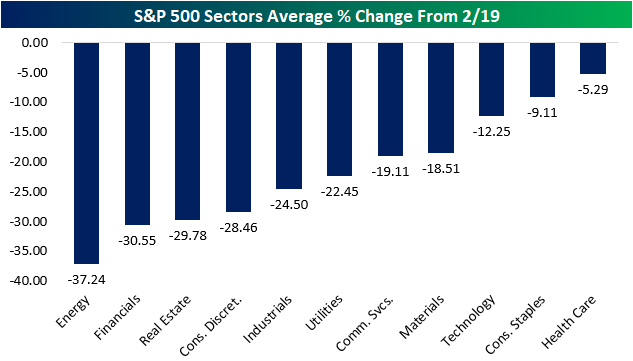

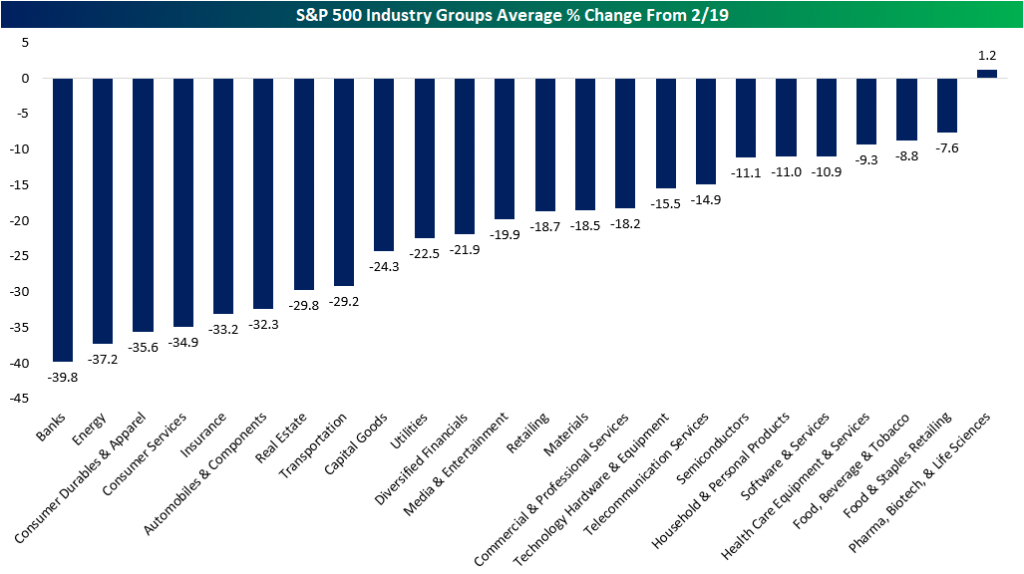

In last night’s Closer, we noted that as of yesterday’s close, the S&P 500 (SPY) sat over 15% away from its 2/19 all time high. But as for the index’s individual stocks, about 12.4% have retaken their 2/19 levels. As shown in the chart below, Health Care sector stocks on average are the closest at 5.29% below their levels on 2/19. Consumer Staples are the only other stocks that are less than 10% away from those levels on an average basis. Conversely, Energy, Financials, and Real Estate have the furthest to go, all down around 30% or more.

Meanwhile taking a look across industries, there is only one group of stocks that’s currently above its 2/19 levels on an average basis: Pharmaceuticals, Biotechnology, & Life Sciences. While stocks of that industry have pushed above by 1.2% on average, the other groups are not even close with the next closest to doing so being Food & Staples Retailing at 7.6% below 2/19 levels. In addition to Food & Staples Retailing, Food, Beverage, & Tobacco, and Health Care Equipment & Services are the only others that are even within 10% away. On the other end of the spectrum, Banks, Energy, and Consumer Durables & Apparel are down the most.

Topley’s Top Ten – May 11, 2020

Topley’s Top Ten – May 7, 2020

1.S&P Forward P/E Multiple Above 20

It is difficult to think about the E in the P/E ratio when the economy is shut down and half of blue-chip companies don’t want to provide guidance on full-year earnings because of all the uncertainty. The Fed probably doesn’t worry much about if the forward multiple is 18, 20, or 25, their clear goal is to support markets at least as long as we are in lockdown and maybe until the unemployment rate has moved into the single digits again. With this backdrop the chart below isn’t particularly helpful if one wants to understand if stocks are going up or down from here. For more see also here and here, and also here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

Topley’s Top Ten – May 6, 2020

1.The Buffet Indicator Up to Date Q1 2020.

The Latest Data-With the Q1 GDP Advance Estimate, we now have an updated look at the popular “Buffett Indicator” — the ratio of corporate equities to GDP. The current reading is 156.3%, up from 156.0% the previous quarter.

Advisor Perspectives

Continue reading